Foreign Direct Investment: A Global Perspective

1. Introduction

In the recent era of globalisation, the government, researchers, and multinational corporate firms are interested in conducting research in Foreign Direct Investment (FDI) as it has direct impact on the economic growth and social development in both the host and countries and developing countries. The countries are gaining proper access to natural resources and market in developing countries by raising fund through FDI. FDI is defined as an investment for maximising the interest of the entrepreneurs to establish the business, where the activities are functioning outside of the economy from which the investors can invest internationally. It is measured in USD and it is also considered as share of GDP to analyse the important of FDI in the economy for ensuring growth and social development (UNCTAD, 2018).

In the emerging economies, the investors and policy makers attracted nearly half of the FDI in the year of 2010 and it is considered as beneficial for the host countries as well as the multinational corporate firms to achieve success in near future. The FDI is also effective for the organisations who are seeking to invest more in the business for achieving success by establishing in their business operational activities. For the host countries, the rising FDI is considered as contributing factors as it helps to create jobs in the economy as well as introduce new technology, enhance innovation and creativity as well as make the labour force more efficient for performing their task proficiently. In this regard, the multinational corporate businesses are also beneficial or such rising amount of FDI were the entrepreneurs and the companies enhance the market performance and provide the investors to access their market for utilising natural resources and low-cost labour force for establishing the businesses (UNCATD, 2011).

In the context of FDI, the BRIC economies are the attractive destinations for increasing FDI, and it plays an important role in the world economy for the natural resources in Brazil and Russia, as well as young population of India and China who are proficient to perform better and achieve future success. The investors are looking for large population so that they can access large consumer base in the market as well as large market size for operating their business, on the basis of that the it is possible to achieve success for future. The description of BRIC is proposed by Goldman Sachs in 2010 which indicates the emerging economics where the countries Russia and Brazil will dominate the supply the raw materials where the countries China and India are key to deliver a hug amount of final manufactured goods and services.

FDI is hereby beneficial for the investors to access a huge market and attract the customers at the market for economic growth and in this context, the BRIC countries are successful to increase savings and national Income as well as create jobs in the economy, reduce the issues of the unemployment and introduce new technology, and make the labour force more skilled successfully. Rapid economic growth in the BRIC nations through FDI can be possible with significant determinants of FDI inflows which further motivate the investors for enhancing more investment for future. The structure of the paper includes different sections where the chapter two is literature review with the determinants of FDI and gaps in literature. The third section includes different variables and data collected through hypothesis and section four will illustrate the data and analyse the collected information strategically to evaluate the above-mentioned research topic. Section five is about graphical analysis and the next section which is section six is related to research methodology. The seventh section is empirical results and miss specification test and finally the conclusion will be illustrated after proper data collection and analysis.

2. Literature review

The literature review section of the research is beneficial to identify suitable secondary sources of information and represent the information for developing own understanding and improving knowledge and skill successfully. The major determinants of FDI across different countries will be represented through which the researcher can develop proper knowledge and in-depth analysis ion the research topic. The data and information are varying across different countries and in this regard the theoretical approach and economic approach are effective for empirical research. In the context of classical mode of the determinants of FDI, there is OLI-framework. According to the OLI framework, internationalisation theory states that the structure of the organisations is important and good organisational structure is providing a scope to develop good working practice, manage proper organisational culture and strong governance in the firms, proper location and ensure internationalisation that play a crucial role to engage with the society and expand their business internationally (Dunning, 1973; Edwards, 1990; Singh, and Kwang, 1995). Schneider and fry (1985) stated that, econometric approach is effective o understand the economic and political factors. There are multiple sources through which it is possible to gather proper information and data such as IMF report, business letters, world development report and UIV statistical yearbook. Schneider and fry (1985) concluded that, politico-economic model is effective to consider the joint effects of economic and political factors that have crucial impacts on the FDI inflows in the host countries. Duran (1999) utilised a unique approach by using panela and time series data for estimating and analysing the driving forces of FDI inflows across different geographical areas. The data set is from 1970 to 1995 focusing on Latin America and the Caribbean areas. The study found that, there are different factors that have important effects on the FDI inflows such as growth rate of the domestic countries, saving pattern of the customers, sunk cost, country’s solvency and macroeconomic stability as well as domestic savings, openness to fairness and foreign trade and market size (Nunes and Oscategui, 2006; Sahoo, 2006; Nonnenberg and Mendonca, 2004). These are the major factors that are encouraging the FDI inflows in the host countries. According to the study by Duran (1999), the market size and openness to international trade are the most significant factors affecting the FDI inflows.

In addition to these, Bevan and Estrin (2000) researched on FDI inflows and it explored that, there are serious flows between market and transition economies, according to Loree and Guisinger (1995), the are different determinants related to political or economic in the united states during the year of 1972 and 1982. Sing and Jun (1995) investigated the developing economies to identify the economic condition and the business operational condition, political; risk factors in the country and macroeconomic variables that influence FDI flows in the host countries. According to Bevan and Estrin (2000), FDI inflows in the host countries are determined by the numbers of factors, such as market size of the economy, internal growth, industrial development, foreign resources, corruption level of the country and government balance in the private and public sectors development as these are important factors for the investors to consider during investing their capital in the host countries (Sahoo, 2006). The determinants of FDI in the developing countries depend on the government initiatives taken place in the countries as well as there are many macroeconomic factors that encourage more FDI inflows in the host countries. In the contrast, according to Schneider and fry (1985), the political and economic determinants are crucial for influencing the foreign investors to attract more investment. The research analysis utilise different database such as world bank’s WDI’s, OMF’s IFS, Ipeadata and Euromoney through which it is possible to acknowledge the determinants of the FDI in the developing countries and according to the study, the major factors or the determinants in the developing nations to attract FDI are such as size and growth in the market, foreign capital in the host countries, labour qualification and skilled workforces in the economy, performance of the stock market as well as exchange market and technological upgradation so that the investors can avoid their risk and invest safely to earn high return on their investment (Borensztein, De Gregorio and Lee, 1998; Chakrabarti, 2001; Dunning, 1981).

Nunes and Oscategui (2006) also carried out same research which is also effective to understand the determinants of FDI inflows in the different geographical areas. The analysis and researches show that, the FDI inflows depends on the macroeconomic policies and government practice sin the economy, market size and consumer base in the economy, trade openness and the scope for international trade and availability of important drivers of FDI so that the investors can get high return on investment for the period of 1975 to 2003 (Duran 1999; Onyeiwa and Shrestha 2004; Vijayakumar et al, 2010; Ranjan and Agrawal, 2011; Akpan et al, 2014). Through a panel co-integration test, Sahoo (2006) identified that, there is long run equilibrium relationship with potential determinants where the host countries can attract more foreign investors through improving the key determinants. The major factors affecting FDI inflows in the Russia, brazil, India and China and South Africa are analysed through panel data analysis by Vijayakumar, Sridharan and Rao (2010) during the period of 1975 to 2007. Ranjan and Agrawal (2011) researched through random effect model and ordinary least square (OLS) approach on annual data set for the period 1975-2009 to understand the key determinants of FDI inflows in the host countries. As per the investigation, it has been explored that, the factors such as labour cost, market size, growth prospects, macroeconomic stability, trade openness and infrastructure facilities are considered as independent variables and the FDI inflows is the dependent variable (Onyeiwa and Shrestha, 2004). Through this study, it is also possible to demonstrate that, the independent factors affect the FDI inflows in the BRIC nations. In addition to these, as per the study by Vijayakumar et al. (2010), currency evaluation and labour force are also effective factors contributing in FDI inflows. As per the world bank analysis, the market size, infrastructural facilities in the host countries and labour cost are the major determinants to attract the foreign investors for raising FDI in the developing countries (Edward, 1999). The macro economic factors such as political stability, government laws and legislation and contribution of the government are effective factors that have crucial impacts on the FDI inflows where the investors are looking for stable environment and good fiscal and monetary policies, where the investors can get support from the government of the BRIC nations for more investment (Duran, 1999; Bevan and Estrin, 2000; Nunes Oscategui, 2006; Sahoo, 2006; Vijayakumar et al, 2010; Akpan et al, 2014).

2.1 Gap in literature

There are many studies considered in the literature review, which analyse the determinants of FDI and the results are depending on the choice of economy, variable undertaken during research, different analysis like panel data and empirical research and time period methodology which are effective to develop the research successfully. The aim of the paper is to identify the key determinants of the FDI inflows and in this regard, it is necessary to introduce the variables with limited empirical studies to find and examine the significance of each of the factors for attracting more foreign investors. In addition to these, focusing on present time period is necessary for understanding the present situation in comparison to the previous literature. There are no such present literatures in this literature review which is the main gap in literature.

3. Determinants of variables of FDI

3.1 Trade openness

Trade openness is one of the important variables of FDI inflows on the developing countries in which capital flows between the economies are beneficial for the developing countries for which the Gross Domestic Products (GDP) of the emerging economies can be enhanced in future (Onyeiwa and Shrestha 2010). In addition to this, the export and important of the capitals goods and services as well as trade to GDP ratio also increases for such trade openness where it is expected that the international trade activities as well as increasing the National Income (NI) of the country can be improved in future (Obstfeld, 1984).

H1: Greater trade volume and unrestricted trade policies and practice boost FDI in the hosting economies.

3.2 Market size

Market size is another key determinant of FDI where the large market size of the host countries is beneficial for the investors to access a large volume of the customers as well as it can ensure greater capital inflows as compared to smaller market size (Dasgupta and Ratha, 2000). For potential consumption and greater activities of purchase and sales and trade, it is possible to increase capital inflows through FDI in the large market size as compared to small market size in the host countries. The market size can be calculated through GDP and GDP per capital income and it is expected to have positive correlation between large market size and high capital inflows through FDI (Calvo, Leiderman, and Reinhart, 1996).

H2: The larger market size of the host country indicates more FDI to be attracted.

3.3 Real interest rate

The real interest rate is another important determinant of FD in which it indicates the level of risk within the host country. High interest rate creates a greater margin between the domestic interest rate and the world interest rate, and it attracts the investors to invest in the host countries and it further contributes in raising capital inflows through FDI. In addition to these, due to instability and political risks, sometimes, the interest rate of the host countries becomes lower and it further deteriorates the FDI flows in long run, where the investors do not want to invest a higher volume due to low irate of interest. Hereby, the relationship between the interest rate and the capital inflows through FDI is positive (Nonnenberg and Mendonca, 2004).

H3: High real interest rate reflects stability and certainty to attract more FDI through influencing the investors with high rate of interest.

3.4 Macroeconomic stability

Macroeconomic stability is also another important factor to analyse the FDI amount as it has direct impacts on the inflation rate of the host countries. Appropriate fiscal and monetary policies are effective to stabilise the inflation rate of the country and it further ensures that there is possible to attract the investors for FDI and reduce the uncertainty in the economy. A country with instability is experiencing volatility and disincentive for FDI. The relationship in this context between the macros economic condition and FDI is considered to be positive where stable economic condition influence and encourage more FDI in the host countries (Duran, 1999; Jadhav, 2012).

H4: A country with absence of volatility and presence of stable macroeconomic condition with appropriate fiscal and monetary policies attract more FDI inflows in the host countries successfully.

3.5 Technological capabilities

Another effective ad crucial factor in influencing FDI is technological capabilities of the host countries in which high capabilities attract more FDI in the host countries. Flow of FDI is greater where the technological capabilities is high by ensuring technological innovation and creativity (Kokko, 1994). In this economic condition, the investors are attracted to invest more FDI of increasing capital inflows to gain better return on investment. As a result, there is positive relationship between the technical capabilities and the FDI inflows where the investor tries to invest in such an economy where there is technological upgradation and the human resources are capable of enhancing technical innovation and creativity for achieving success sin near future. Efficiency of the employees in the host countries and continuous improvement in the performance of the employees to ensure technical innovation further attract the investors for more capital inflows (Bornstein, Gregorio and lee, 1998).

H5: high efficiency and modern technology to the host countries attract more FDI.

3.6 Currency valuation

The currency valuation also has crucial impacts on the FDI flows where the strength of the domestic currency of the host country further defines that the firm is able to improve their purchasing power to perform in the market. Exchange rate risk with depreciation of the currency in the host country increases the purchasing power of the investing firm in the hoist country. In this regard, value of the currency is calculated through effective exchange rate which is defined as the weightage average of country’s currency selected of a significant basket of goods and services adjusted for inflation. Therefore, negative relationship is built between FDI inflows and the currency valuation.

H6: A rise free exchange rate and a greater purchasing power raises the attractiveness of the host country to increase FDI inflows to the foreign investors.

The hypothesis of the research is such as,

H1: Greater trade volume and unrestricted trade policies and practice boost FDI in the hosting economies.

H2: The larger market size of the host country indicates more FDI to be attracted.

H3: High real interest rate reflects stability and certainty to attract more FDI through influencing the investors with high rate of interest.

H4: A country with absence of volatility and presence of stable macroeconomic condition with appropriate fiscal and monetary policies attract more FDI inflows in the host countries successfully.

H5: High efficiency and modern technology o the host countries attract more FDI.

H6: A rise in free exchange rate and a greater purchasing power raises the attractiveness of the host country to increase FDI inflows to the foreign investors.

4. Data collection and analysis

In this section of data collection and analysis, it is possible for the researcher to represent the collected data in a systematic way as well as acknowledge the significance of each of the variables that has crucial impacts on the FDI inflows. In addition to this, through this chapter, it is also possible for the researcher to use descriptive statistics, graphs and charts for representing he data and obtain the valid and relevant result after appropriate analysis of the gathered data and information.

4.1 Gathered data

The data are collected from the secondary sources of information such as World Bank’s Development Indicator (WDI) and Eikon and the frequency of the database are covered 1997-2017 for the BRIC nations. For all the four nations, Brazil, Russia, India and China are FDI inflows in terms of USD and the independent variables are chosen according to the relevant variables.

The above table 1 denotes the variables of the specified model with their respective measures, abbreviation and the sources of the data. In order to measure the technological capabilities, the index is developed by using the internet users in the countries and the mobile smartphone users to capture the economy’s access to the internet and the connectivity to the world. The logarithms are taken place for removing the possibility of non-normality in the distribution and it allows elasticity interpretations. In addition to this, logarithm with the base of 10 is utilised and in this regard the facts real interest rate and the inflation rate are inefficient to be calculated as these are in negative values and for logarithm to be performed, it is necessary to have positive values. The data base is gathered initially through the cross-sectional format and for estimation purpose, he pooled data and panel data set are utilised for lest square estimation.

4.2 Descriptive statistics

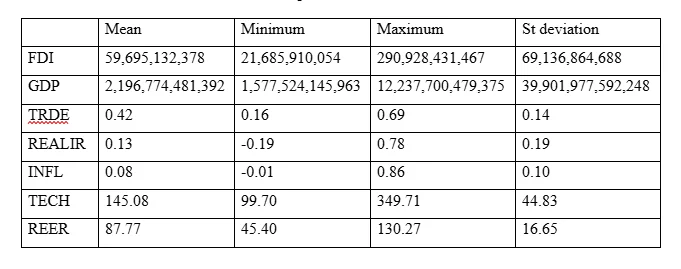

The table 2 describes the descriptive statistics for all the variables in the data set and it is being calculated by using the raw data and information for interpretation of the data. The mean FDI inflows to the BRIC nations for the period of 1997-2017 is approximately $59 bn and the maximum FDI inflows is $290 bn which the receive by China in the year of 2013. It refers that, the country China is considered as maximum amount of FDI inflows in 2017 where the total values or the FDI inflows are £12.24trn and the minimum GDP value is about 2.19trn.

All Variables have 84 observations

In addition to these, the mean TRADE-GDP ratio is 42.67% which indicates that, the FDI inflows not only depends on the trade, but there are other factors that influence the foreign investors to raise their investment in the BRIC nations. Additionally, the standard deviation of inflation rate is high where there is significant dispersion, but as per the data revealed through the research, it can be seen that, in Russia, there is 85.74% inflation rate and the country China is facing negative inflation rate of -1.41% in 1999. On the other hand, the real interest rate is also relatively at its high standard deviation values where the maximum and minimum real interest rate values are 77.61% and -18.95% respectively. Moreover, the mean of the real effective exchange rate is 87.77% and lastly her is technology index which has a mean of 145.08 with maximum and minimum value of 349.71 and 99.70 respectively, that in turn reveals a large range.

4.3 Correlation analysis

The paper shows that, there are significant numbers of variables that have crucial impacts on the dependent variable which is FDI inflows in the BRIC nations and it is important to be concerned about the risk of multicollinearity in the independent variables, when the variables are in the systematic way, it is called collinearity and the estimation becomes highly; sensitive to the addition or removal of the observations with collinear variables.

The table 3 shows the correlation matrix between six independent variables aim the model and it illustrates that there is interdependence between the variables. The correlation matrix shows that the LGDP and LTRADE are high correlated pairs and there is high correlation between LTRADE and REALIR. The respective values are such as 0.66 and -0.81. It is advantageous for the researcher to use panel estimation technique which eliminates the collinearity problems (Hill, Griffiths, and Lim, 2012).

5. Graphical Analysis

Graphical representation of the data findings is effective to develop proper conclusion about the findings and understand the relationship between the independent variables and the dependent variables successfully. In this regard, through the graphs, it is possible to acknowledge the positive or negative relationship between the FDI inflows and the other independent variables in the BRIC nations within the time frame of 1997 to 2017. Figure 1 to 7 provides clear graphical representation about the determinants of the FDI inflows along with the dependent variables.

The above figure 1 describes the log of FDI net inflows and the data is for the BRIC nations where it seems to increase until the recent years whereas the LFDI flattens and declines for Russia in the year of 2015.

The figure 2 indicates that, the log of GDP illustrated for the BRIC nations which shows that there is strong trend of upward shift for all the nations where it is very similar to the FDI inflows in the nations but for Brazil and Russia it is declining.

The above figure 3 refers the log of trade GDP ratio which shows varying levels of the trade openness of the BRIC nations which further indicates that, for all the countries, trade openness has been increased throughout the years of 1997 to 2017. Moreover, during 2000, the LTRADE was declining for Russia and also for China and India and ion 2004, the LTRADE in Brazil has been increased and pealing at 1.47 before falling of ad increasing again.

Figure 4 represents the annual inflation rate and it shows that all the countries are demonstrating relatively stable inflation rate at the similar level. It further indicates that there is significant spike in the data for Russia in the period of 1998-2001 where the inflation rate has been raised at 85.57% in the year of 1997.

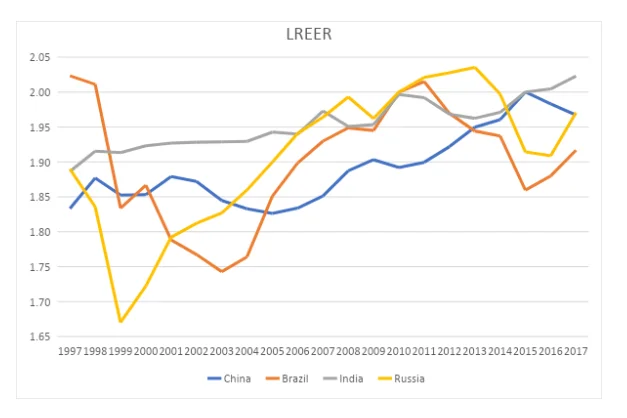

Figure 5 indicates the LREER which illustrates that there is volatility in the behaviour in the BRIC nations showing a period of upturn and downturn. China was also fluctuating before steady growth in 2004. India shows stable performance despite of fluctuation.

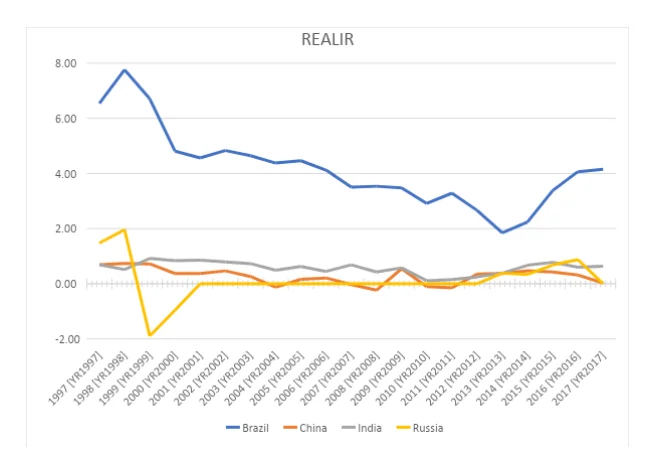

The real interest rate is illustrated by the above figure 6 which refers that there is relatively stable interest rate for China and India whereas Russia seems to fluctuate, and the country Brazil has longest real interest rate level in the period.

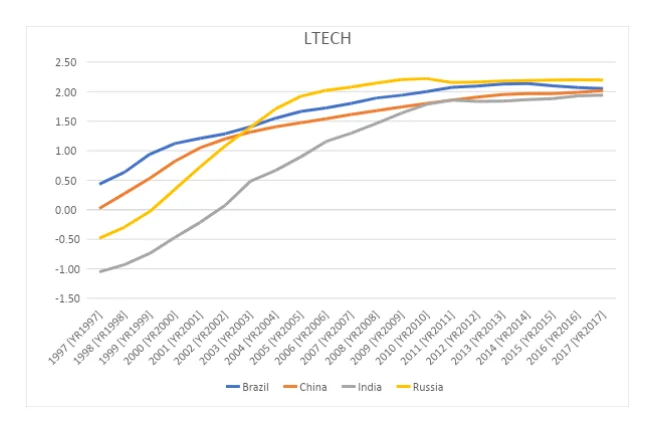

LTECH has illustrated by the above figure 7 which shows that, over the period of time, there is increasing trend of technology in all the four countries. Russia’s technological index rises rapidly as compared to the other nations Brazil, China and India before falling to converge with Brazil, China and India.

6. Methodology

There are wide range of analysing the research topic on the basis of collected data and information such as multiple regression, panel data and other statistical models like random effects, foxed effect and pooled least square methods. In this regard, multiple regression model is one of the effective ways to present results in more holistic and generic ways. Panel data estimation is also effective o capture the dynamic behaviour and obtain more meaning through evaluation and estimation of reliable information and gathered data. The Hausman specification test is beneficial for fixed and random effect estimators to utilise the statistical models for better outcome. This particular paper utilises the least square method as it helps to provide consistent and efficient estimates of the relevant parameters (Vijayakumar et al, 2010). The OLS assumes that, there is no difference between the cross sections data, and it is common across all the cross sections data. Hereby, the pooled least square method does not involve in testing across fixed or random effects method. In addition to these, the in the random effect method, the number of cross sections is greater than the independent variable, which can raise difficulties to draw conclusion after proper analysis of this paper. Hereby, the least square method is suitable for conducting this research paper in which it considered the cross-section data and information, independent variables and model specification for analysing the collected data and analyse the hypothesis well by the statistical model.

Model specification:

The independent variables are the determinants of the FDI inflows, and the dependent variable is the flow of FDI.

LFDIit = α + β1LGDPit + β2LTRADEit +β3INFLit + β4LREERit + β5REALIRit + β6LTECHit + eit

Where,

LFDIit Is the log of Foreign Direct Investment net inflows for country i at time t that demonstrating FDI inflows (Vijaya Kumar et al., 2010).

LGDPit is the log of Gross Domestic Product in current US$ for country i at time t, indicating market size.

LTRADEit is the log of the value of Trade as % of GDP for country i at time t, representing trade openness

INFLit is the inflation rate as an annual % for consumer prices for country i at time t, representing macro-economic stability.

LREERit is the log of Real Effective Exchange Rate for country i at time t, reflecting currency valuation

REALIRit is the Real Interest Rate as an annual % for country i at time t, indicating real interest rate.

LTECHit is the log of technology index for country i at time t, representing technological capability.

For the selected country, the simple technology index is constructed as,

Yjt = Xjt/Xjt-1*100

Where

Xjt is the value of the jth indicator at time t for each country.

Yjt is summed up and divided by two to obtain the technology index in percent for each country I (TECHi), which is represented as:

TECHit = ∑2iYit/2

eit is the error term over time t for country i.

7. Empirical results

7.1 Significant determinants of FDI

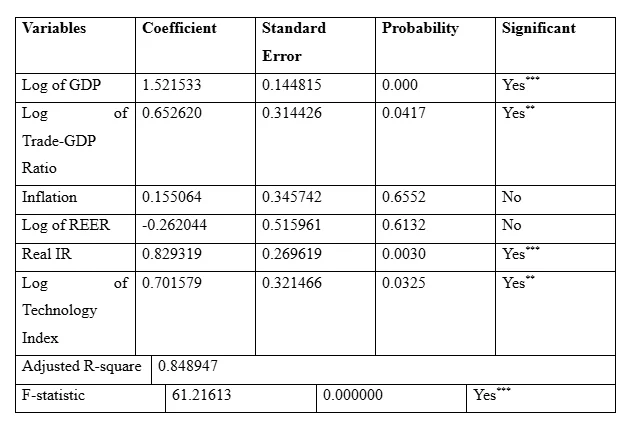

The fourth table below shows that, from regression that run on Eviews; the probability suggests that, four out of six determinants of FDI in the four nations are significant. The hog of GDP and the real interest rate is at its significant level 1%, whereas the log of the trade-GDP ratio and the log of Technological index are significantly different from zero at the 5% level of significance. Additionally, the adjusted R-squared takes a value of 0.85 which indicates that there is 85% of variability in the log of FDI et inflows around the four countries. The regression has an F-statistic value of 61.21 with a very small corresponding p-value, hence the null hypothesis is rejected and the alternative hypothesis are accepted representing that, the independent variables all together are significant in this study which have crucial impacts on the FDI inflows in all the BRIC nations.

***, **, *, represent significance at the 1%, 5%, 10% significance levels, respectively.

The coefficients of LGDP and LTRADE support the hypothesis is effective to conclude that, there is high significance of the market size and the trade openness on the FDI inflows in the BRIC nations. The coefficient for market size and trade openness indicate that at a 1% increase in the variables leads to a 1.52% and 0.65% increase in the FDI net inflows, respectively (Ranjan and Agrawal, 2011). LGDP has high significant on FDI as compared to the LTRADE and it indicates that the GDP growth plays a crucial role to attract the foreign investors in the BRIC nations. The coefficients for the inflation rate are positive with the values if 0.16 with statistically significant value at 10%, indicating that there is impacts of inflation rate on the FDI inflows in the BRIC nations (Vijayakumar et al., 2010). Akpan et al. (2014) obtained that, the inflation rate and other macroeconomic stability has lesser role in making the decision of foreign investment in the BRIC nations by the foreign investors. The coefficient value of LREER is -0.26 indicating that there is 0.26 decrease in the LFDI of the LREER is increased by 1%. Hereby, there is negative relationship between the FDI and the currency value and the result shows that the REER is insignificant determinant of the FDI inflows. The real interest rate is significant at 1% level indicating that there is coefficient value of 0.83 suggesting that the real interest rate raises the FDI inflows by 0.83% in the BRIC nations. Onyeiwu and Shrestha (2004) who find the real interest rate is significant determinant of FDI inflows where the BRIC nations can attract the investors positively through rising real interest rate of the country (Onyeiwu and Shrestha, 2004). LTECH is significant at its level 5% indicating that, the coefficient value is 0.70 where for technological upgradation, the FDI inflows has been raised by 0.70%. This further represents that, the technological capabilities of the country and development though creativity and technical innovations are effective to attract more foreign investors to invest in the counties.

1= Brazil

2= Russia

3= India

4= China

Residual = Actual – Fitted

The graphical representation above, which is represented by the figure 8, is related to the residual graph in all the BRIC nations and it can be seen that, it is volatile across the 21 years. The residual is randomly scattered around Zero for the entire range of fitted value. It indicates that, the model utilised her is best fit in this study to conduct the research on FDI inflows and the key determinants of the FDI inflows. In this regard, Russia has the lowest residual value of below -4 in 2015 and with lowest amount of FDI inflows they receive. China has been very dominant receiver of the FDI with maximises amount of FDI inflows as compared to the other BRIC nations. Overall the residual graph is very volatile for Brazil, Russia and India, but, on the other hand, China has a stable residual graph throughput the years though in the past few years, it has been dropped in the level of FDI inflows.

The F test is a technique through which it is possible for the researcher to check whether the results, obtained from the regression model are significant or not and if the regression is a good fit for the data set. From the test above, it can be seen that, the probability values if 0% which is less than the significance level as per the F test which is 1%, 5% and 10% and it further indicates that, there is sufficient evidence to conclude that, the regression run in this study fits the data and it is effective to draw further conclusion to meet the aim of the research. The study ad analysis indicates that the dependent variables are affected by the independent variable and the variables considered in this study are significant explaining that there are high FDI inflows in the BRIC nations (Jadhav, 2012; Ranjan and Agrawal, 2011).

8. Conclusion

The aim of the research paper is to analyse the determinants of the FDI inflows in the countries such as Brazil, India, Russia and China for the period of 1997-2017. The paper is effective to develop proper literature review by collecting the secondary sources of information through which it is possible to improve understanding about the key determinants of FDI and it also helps to develop proper hypothesis for conducting the research efficiently. Annual panel data set from World Bank’s WDI database, Eikon empirical data are included for proper analysis by pooled least squares regression. The study indicates that, the determinants such as market size, trade openness, real interest rates and technological capability have crucial impact to increase the attractiveness of the host country for FDI inflows where the factors attract more foreign investors to invest in the host country for better outcome and high return on investment. The major limitation of the paper is short period of time for proper analysis and evaluation where the full extent of the determinants cannot be captured well. The paper further provides future opportunity to conduct more research and study about the determinants of FDI where the host countries can attract more FDI inflows by encouraging the foreign investors so that the nations under BRIC can invest more for future economic growth and social development. Future research would be effective to understand more alternative ways or determinants of the BRIC nations for increasing their attractiveness to encourage more foreign investors to raise the FDI inflows for enhancing the global impacts.

Reference List

Akpan, U. S., Isihak, S. R. and Asongu, S. A., 2014. Determinants of Foreign direct investment in fast-growing economies: a study of BRICS and MINT. African Governance and Development Institute WP/14/002,

Bevan, A. A. and Estrin, S., 2000. The Determinants of Foreign Direct Investment in Transition Economies.

Borensztein, E., De Gregorio, J. and Lee, J., 1998. How does foreign direct investment affect economic growth? Journal of International Economics, 45 (1), PP. 115-135.

Chakrabarti, A., 2001. The determinants of foreign direct investment: Sensitivity analyses of cross-country regressions. Kyklos, 54(1), pp. 89-114.

Dunning, J. H., 1981. International Production and the Multinational Enterprise. London: Publisher, Allen and Unwin.

Edwards, S., 1990. Capital flows, foreign direct investment, and debt-equity swaps in developing countries. NBER, paper No. 3497.

Jadhav, P., 2012. Determinants of foreign direct investment in BRICS economies. Analysis of economic, institutional and political factor, Procedia - Social and Behavioural Sciences, 37 pp.5 – 14

Kokko, A., 1994. Technology, market characteristics, and spill overs. Journal of Development Economics, 43(2), pp. 279-293

Loree, D. W., and Guisinger, S. E., 1995. Policy and Non-Policy Determinants of U.S. Equity Foreign Direct Investment. Journal of International Business Studies, 26(2), pp.281-299

Obstfeld, M., 1984. Capital flows, the current account, and the real exchange rate: Consequences of Liberalization and Stabilization. NBER, Paper No. 1437.

Ranjan, V. and Agrawal, G., 2011. FDI inflow determinants in BRIC countries: A panel data analysis. The International Business Research, 4(4), pp. 255.

Schneider, F., and Frey, B., 1985. Economic and political determinants of foreign direct investment. World Development, 1985, 13(2), pp.161-175.

Singh, H. and Kwang, W. J., 1995. Some new evidence on determinants of foreign direct investment in developing countries. World Bank policy research working paper, (1531).

Vijayakumar, N., Sridharan, P. and Rao, K.C.S., 2010. Determinants of FDI in BRICS Countries: A panel analysis. International Journal of Business Science.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts