A Case Study on Pg Company

Introduction

Organizations of all sizes possess an incentive for cost reduction so that they can manage to remain competitive and at the same time increase profits. Companies that provide goods for sale, production costs are a significant aspect in pricing as well as comprehensive performance. P&G Company has been accumulating an exponential production cost but saving very little. Thus it is vital for the organization to cut the cost incurred in production and increase its savings that are dormant at 400 million US dollars. Therefore, P&G need to put in place system that continuously monitors for additional savings, partnered agencies to begin bidding more. For students who are researching strategies for cost reduction and business efficiency, seeking professional guidance and business dissertation help can provide them with the most valuable insights and methodologies in place to implement in real-world scenarios.

1.1 Background Information

Proctor and Gamble Company is an American multinational consumer goods corporation that was founded back in the year 1837 by two founders William Procter a British American and James Gamble an Irish American. It basically specializes in the production of a wide range of cleaning agents as well as hygiene and personal care products. The leading producer of household products in the US has its operation running in at least eighty nations across the globe and markets its brand of three hundred to more than a hundred and sixty countries. Its products fall into eight categories, which are; home care, family care, baby care, fabric care, healthcare, beverages, snacks, and beauty care in which they generate revenue of more than one billion US dollars on annual basis. The company’s commitment to maintain its position, as the leading organization in its market, P&G has become one of the most belligerent marketers and biggest advertisers in the globe.

1.2 Methodology of the Study

The study on the reduction on production cost by P&G Company is by application of qualitative research method for the exploratory study. The study aims at acquiring a comprehension of the cost of production P&G Co. incurs on each Fiscal Year (FY) by exploring on company’s documents and Annual Reports.

2.0 Findings and Analysis

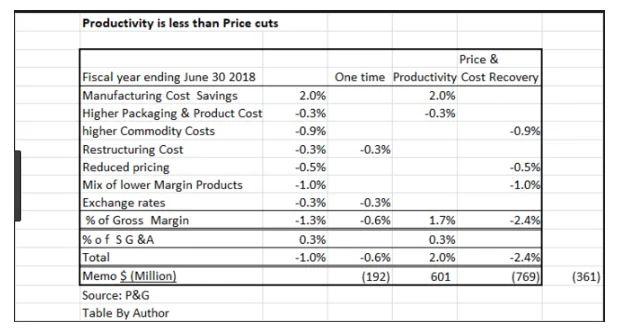

2.1 Source of High Production Cost

P&G market environment is competitive with local, global and regional competitors. In several industries and market segments, in which the company sells its products, it competes against other branded products and retailers’ private-labeled brands. In addition, several of the product segments in which the company competes are differentiated by price tiers which as premium, super-premium, value-tier, and mid-tier products. Despite a well-constructed and positioned in the market and industry segment in which it operates, in most cases holding a leadership or an essential market share position, the company cannot evade its varying costs of production. So far the efforts the company has made in saving on production ranges at 2% of the net production cost as indicated in the table below;

Cervantes, Monica, Kayla Crimson, Carina Figueroa, Alexander Hess, and Emmanuel Martinez. "GM 105–12: Procter & Gamble Company’s 2015 Strategic Audit." (2015).

Krishnaswamy, S., 2017. Sources of Sustainable competitive Advantage: A Study & Industry Outlook. St. Theresa Journal of Humanities and Social Sciences, 3(1).

Agarwal, D.N.R., 2018. Significance Of Swadeshi Products: A Study On Cosmetic Products. International Journal Of Scientific Research, 6(6).

Muthanga, J., 2017. The" Procter & Gamble Company". Consumer behavior in the tissue and towel business.

2.2 Profitability/Efficiency Ratios Analysis

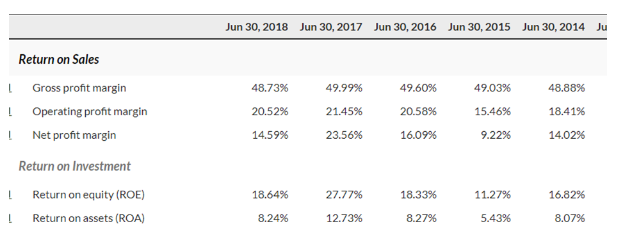

P&G is known for being a multi-line Consumer Goods Company comprised of the individual brands that range from health, beauty, feminine and family care, home care and fabric, as well as grooming to baby. However, what attracts most is the company’s capacity to maintain significant profits and performance efficiency. Based on details extracted from stockanalysis.net, the following details are valid.

Considerable ratios related to the efficiency and profitability of P&G include operating profit margin, gross profit margin and net profit margin.

Kaya, O. and Urek, B., 2016. A mixed integer nonlinear programming model and heuristic solutions for location, inventory and pricing decisions in a closed loop supply chain. Computers & Operations Research, 65, pp.93-103. Schlegelmilch, B.B., 2016. Creating Global Product and Service Offerings. In Global Marketing Strategy (pp. 83-103). Springer, Cham.

Gross profit margin: This indicates the percentage of the available revenue meant to cover the operating as well as other expenditures. P&G gross profit margin, according to Stockanalysis-on.net (2018), is said to have increased from the year 2016 to 2017, with a significant deterioration witnessed from the year 2017-2018 (Stockanalysisnet-on.net 2018).

Gross profit and gross profit margin performance of P&G, adopted from Stockanalysis-on.net (2018)

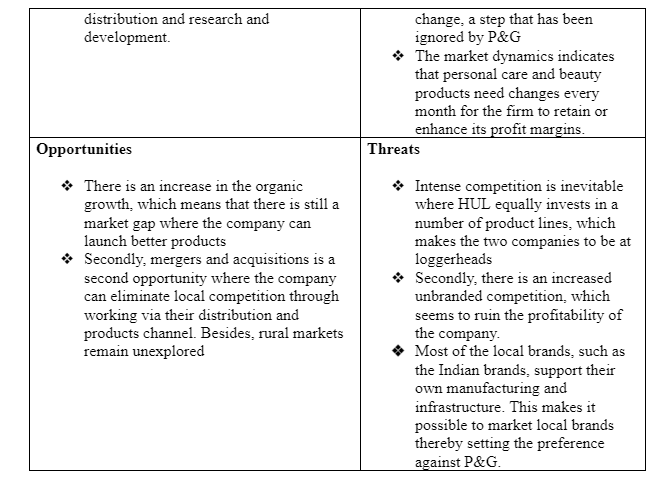

3.0 Proposed Strategies to reduce the costs

Various observations have made as regards the performance of P&G in the market, both in the local and foreign markets. First observation is that the company is realizing deteriorating profit and efficiency ratios, which means that it is spending more to balance same profit margins. Secondly, the company is spending more to ensure that its brands are the leading ones as a result of marketing efforts (Kaya and Urek 2016). Lastly, a reduction of brands in the market means that P&G is making attempts of reducing challenges that come with managing a wide range of products. Based on this, various strategies can be proposed to bring down the production costs.

First, the company should adopt the open sourcing strategy instead of sticking to the agencies. The CEO David Taylor once indicated that the company has plans in place that would see P&G reduce expenditures by around $400 million before the 30th June 2021. This comes along with a possible saving of $750 million for the three fiscal years (Schlegelmilch 2016). Adoption of open sourcing strategy will see the agencies compere and therefore expunging some of them from the supply chain (Kaya and Urek 2016). In addition, the company should foster brand consolidation, a program or a strategy that will divest some of the brands. The program will be accompanied by a three-pronged strategy that constitutes supply chain optimization, lowering the marketing expenses and working on new local facilities across the developing markets.

4.0 Conclusion

To sum up, P&G has been one of the best performing companies around the world. However, recent deteriorations in terms of performance have attracted different attentions. Based on the profitability/efficiency ratios, I am convinced that that the company is enjoying a decreasing profit margin when comparisons are made between 2016-2017 and 2017-2018. Similar observations are made when exploring the weaknesses and the threats the company is recently facing. The change has seen the company calling for strategies that will help it reduce the production costs. I believe that the introduction of the three-pronged strategy was meant to impact development of facilities in developing markets, lowered marketing expenses and an optimized supply chain. Such changes would put the company back to its performing ways and therefore realize better profit margins.

Dig deeper into A case study on Maxonique Brow and Nail Bar with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts