A Premium Smartphone Producer in Europe

The Future of Technology is Here

My eye a producer of smartphones that serve the European market primarily has its headquarters in the Netherlands. My eyes` vision involves the production of premium smartphones, shaping the future of technology and also the manufacture of gadgets that are highly reliable. This report does an analysis of the positioning strategies of My eye, their business ethics and CSR initiatives. For those who are seeking business dissertation help, evaluating the strategies employed by companies such as My Eye can offer the most valuable insights into the dynamics of technology-driven markets.

My eye has a very clear strategy that is developed by following six steps that involve

Having a clear strategy that involves the definition of the Mobile`s purposes within the organization

Selection of the correct mobile environments. This was achieved through the possession of a god understanding of the benefits of mobile sites in comparison to mobile applications.

Prioritization of devices achieved through the study of the patterns of usage and aimed at driving platform support.

Making the important decision on whether to outsource or own technology. My eye has been exploring ways through which it can be able to build its own offerings.

Aligning its technologies with long and short-term goals. This has been achieved through the building of a Tiered roadmap that supports the company’s strategies.

Determination of those technologies that My eye is capable of repurposing. In My eye, this has been achieved through the identification of these technologies that the company is capable of leveraging.

Positioning strategies

My eye uses a number of positioning strategies for its products, two, to be specific. One of the strategies used is positioning through the use of customer benefits. This strategy involves the use of those benefits that users get to derive from My eye`s different smartphones for instance it`s smartphones tagline that “it goes on and on” for communication of longevity. It is possible to position a brand alongside those benefits that have been ignored by competitors and which are appealing to the market segment that is targeted (Helmi, Bridson and Casidy, 2019). Outcomes that are not desirable could come about from the urge to position a brand along different characteristics and benefits, and, that would eventually, hurt any brand. For any product to be successful, it should at least promise two benefits maximum and work on creating brand franchises around the benefits (Hickman and Silva, 2018). Such focus would leave the possibility of differentiating products on the basis of those benefits that are yet to be tapped.

One of the most significant observation that has been made over the years is that consumers who have similarities that are important tend to cluster around benefits that are similar, while consumers have the tendency of clustering around different benefits which leads to segmentation of benefits (Ziaee Bigdeli and Baines, 2017) . For instance, any smartphone customers who seek reliability from the phones produced by My eye, regardless of their demographics, would be a specific benefit segment. The issue of those programs that enhance the loyalty of customers is brought to the fore by Alden and Nariswari (2017). My eye has been effectively using its free annually phone service and repair programs for their customers as a way of enhancing their value preposition and further affirming their commitment to their customers. By their nature, human beings are self-centered and that makes benefit positioning one of the most compelling and effective strategies. It is worth noting that customers prefer benefits to features and that is unless those benefits that the customers want are derived from the features.

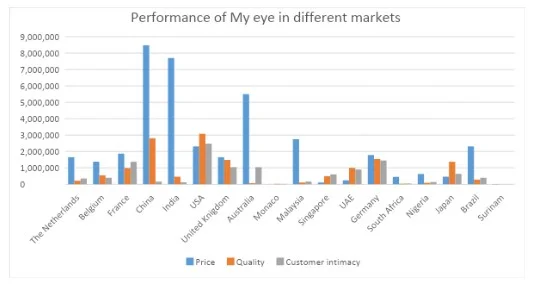

Another positioning strategy adapted by My eye smartphones is price and positioning.

Strengths

My eye has very good and strong marketing strategies in place. The marketing efforts of My eye are linked to strategies that involve positioning their products as gadgets that epitomize excellence. Continuously, the company has been leveraging technological expertise in the positioning of its products. The company has been observed to be quick to use phrases and words that describe its products as being the fastest and the best. The company`s underlying strategy is to create high value prepositions that are attached to its products. It is worth noting that their brand strategies are accompanied by visibility campaigns that are quite strong.

My eye has also put in plac some very intensive growth strategies which include; market penetration, product development, market development and diversification.

Weaknesses

My eye lacks budgetary allocations for research and development and as such has neither research nor innovation centers. This denies the company the opportunity of producing products that are innovative and that suit the needs of different customers. My eye needs to allocate higher budgets to research and development. That would ensure that they improve their processes and also produce better products.

Opportunities

My eye should work on putting in place positioning strategies in terms of provision of better quality at rates that are cheaper for the purposes of attracting more customers and even retaining existing customers. The strategies they put in place should be capable of targeting the right audiences in terms of age bracket, gender and the consumer`s lifestyle (Lagarde, 2016). Additionally. My eye should consider diversifying its operations, for instance, they can include data services that they could also market and build awareness of customers especially in the rural areas for purposes of targeting them. For purposes of experiencing the effectiveness of strategies adopted by My eye, they should work on putting in place measures that would deal with any challenges that come about, especially, in terms of promotion. It would be wise to lengthen the duration allocated to promotion of products so that messages can be delivered right on time.

Threats

As of now, competition stands as the main threat to the operations of My eye. Its main competitors are ZEXCEL, MY PHONE, PHOENIX, ORAU and BUZZBY PHONES. In such a competitive environment, a lot of effort is required to ensure that the products of My eye are able to compete effectively.

Sources of Competitive advantage

According to Aning-Dorson (2018), in every product category, there are those brands that solely with the intention of offering additional features and benefits. These brands makers charge more for them for purposes of recouping the incurred costs and for communication of their products high qualities.

The vision of My eye is to enrich life through communication. There has been a growing number of people who are connected across the globe on devices that are faster, that have greater demands on usability and speed and that offer experiences that are personalized and secure (Krishnaswamy, 2017). Every other business has its own demands and makes use of technologies for the management of operations, logistics and other types of consumer data. It is expected that come 2020, up to 50 billion connections will come about from the interactions between the environment, people and things. For effective handling of such digital floods, My eye has a commitment to ensure the provision of smartphones that are smarter, broader and more energy-efficient.

The biggest differentiator of My eye is being customer-centric and working closely with customers. Even though the company has neither research institutions nor innovation centers, plans are underway to set up to twenty such centers by 2022. That would go a long way in helping the company to create technologies that are customized for the unique needs of different individuals in addition to establishing competitive edges for the customers (Ramraika and Trivedi, 2016).

Within My eye, there is an understanding that innovation is driven by strong brands and that is evident from the company`s existing operations. If at one time, My eye is to become the first choice and best partner of telecom carriers, it would have to master current technological levels and also anticipate the future needs of customers. Some of the integral strategies for My eye include setting industry standards in addition to outsmarting current technologies.

Everywhere across the globe, one of the greatest concerns for customers is variety. My eye should accord more seriousness to the satisfaction of its customers as that goes a long way in ensuring the retention of customers, new customer development, and even increased corporation sales (Rzepka, 2017). My eye considers satisfaction to be one of the core objectives of its marketing strategies as it guides the company in planning for the future marketing of its products. Satisfaction of customers is very important and should be made to be the main focus of My eye. To retain customers on a long-term basis and to further improve on the quality of services, the measurement of the satisfaction of customers plays a critical role (Isada, 2018).

Strategic direction

For purposes of remaining competitive, My eye has developed a long-term mobile strategy that is often iterated. For higher chances of succeeding in the mobile channel. The company roots its strategies in technology that is aligned with patterns of usage, its mobile goals, its target audience and also its budget. The company has also built a phased mobile road map and continues to put effort towards leveraging its existent technologies with the intention of ensuring that projects continue moving in addition to maximizing budgets and further extension of experience that is consistent into the mobile channel. Any business that makes mobile a central part of its strategies stands to benefit from the opportunities of engaging the new customers who are connected constantly (Brodin, 2017). The extension of strategies of advertising to include mobile and the further development of cross-media campaigns has the potential of reaching the consumers of today in ways that are more effective (Chai et al., 2018).

One of the major access points for information search is smartphones, with many people from all over the world using smartphones to carry out information search today (Heizer, Render and Munson, 2016). With a smartphone from My eye, users will be able to navigate the surrounding world and also search for local information. Generally, mobile technologies have made the lives of people easier such that they are now capable of performing a wider variety of tasks and it has become somewhat hard for people to survive without smartphones. These mobile phones use a variety of transmission media like Bluetooth, Infra-red, GPS and radio wave to facilitate the transfer of data through video, text and even voice. Additionally, these mobile phones are also capable of capturing moments, web browsing social networking sites like Face-book and Instagram and also storing personal data.

It is worth noting that technologies are capable of providing competitive advantages even though such advantages are only temporary (Chaffey and Ellis-Chadwick, 2019). With the maturity of technologies they become more accessible and readily available to all and those competitive advantages that were drawn from them once, disappear.

Consumer choice

It is quite evident that it is necessary for firms to take part in the analysis of the choices of consumers and further design strategies that are appropriate for marketing and communication purposes. According to Kabue and kilika (2016), associations that are favorable come about whenever consumers are able to believe that a certain brand has benefits and attributes that are capable of satisfying their needs and also wants in ways that lead to the formation of positive attributes about a brand. The economic environment that My eye operates in is not all positive and the company needs to give its consumers value for their money for strategic imperative. Companies that deal with smartphones perceive threats in both opportunities and recession. This environment is quite similar to the great depression days when companies like Procter & Gamble and Kellog managed to outmaneuver their rivals and went on to become industry leaders (Warwick, 2017).

These are companies that were able to turn adversity into advantages in ways that were quite different. They developed value for-money strategies during the great depression. Their growth was through the delivery of services and products that enabled those consumers who were hard-hit to be more effective and even to do more with fewer resources and through that, improving their efficiency. That helped the companies to economize. Pecot and De Barnier (2017), posits that traditionally, consumers in countries that are still developing are conscious of value. There are many of these consumers who have just recently entered the consuming class and their disposable income is still limited. Even with that, the middle-class and upper class consumers also have to stretch their earnings that are also limited to cope with inflation and ever rising aspirations.

Gupta (2017), argues that any brand that customers perceive as being arrogant and beyond reach would not be capable of attracting customers and as such, all brands should always work to ensure that the services they offer are capable of emerging as offering value to customers who are ever demanding. One of the major benefits of appreciation of the buying process of consumers is that through that, it becomes possible to develop brands and further present them in ways that they are perceived as having added values over the basic commodities that brands present.

Innovation is associated with development of new services and products traditionally and with the addition of additional features and functionality to existing ones. Customers are in both cases expected by companies to pay a premium. It is observed that the idea of innovation for development of offerings that develop offerings that provide greater functionality at prices that are lower is unconventional. Smart companies in emerging markets have been observed to do just that for purposes of appealing to the greater masses of customers who are conscious of value (Cramer-Petersen et al., 2016).

That appears to be a central question that marketing practitioners and managers of brands will have to continue grappling with; the provision of more for less (Denning, 2018). As a result of trade liberalization, it’s not like there are choices given that those companies that are willing to offer their consumers with better value offer competition that is intense. Consumers only choose those businesses and products that offer them with the greatest value and as such, the key to keeping customers and winning in the long run is to have a proper understanding of the needs of the customers and their buying needs in ways that are better than competitors and delivering even more value (Bao and Lewellyn, 2017).

The relationship between choice of brand and positioning strategies brings to the fore the interplay between positioning through the choice of consumers, quality and even price. Whenever consumers are satisfied with the value they derive from the money they spend on purchasing a product, there is a high likelihood that they would feel more reinforced in their decisions whenever their adverts for brands create images that place them above their perceived price-quality orders and perceived niche. The position of a brand should be assessed through the measurement of the perceptions of consumers and also the preference for a brand in relation to different competitors.

My eye`s expansion strategies

My eye began its operations in Netherlands and expanded to Belgium, motivated by the close proximity of the two countries geographically. The operations in Belgium were generally a success. In Belgium, while smartphone models like Samsung A10 Dual Sim, Huawei Y6 and Huawei P Smart are quite popular it is worth noting that there are no smartphones that are originally manufactured there. That implies that while My eye was threatened by these existing smartphone models, they had an upper hand there because they could assemble the phones there and as such minimizing most of the costs. The assembly of phones in Belgium also gave them an added home advantage. There was a significant threat of substitute products however. It is worth noting that with Belgium’s population over 12 million, there is a high demand for smartphones. My eye produces high quality and reliable smartphones with innovative features which gives them an edge over the smartphones produced by the other competitors. Customers hold substantive powers because of their diverse preferences. My eye was however capable of watering the powers with their high quality smartphones.

My eye`s performance in Belgium’

With the success in the Belgian market, My eye further expanded its operations to France. In France, there operations were majorly successful. The French market is quite unique with high standards and is quite a hard one to conquer. My eye only managed to conquer it as a result of their production of reliable mobile phones.

My eye was however not successful in china. This is a result of the fact that it is not easy for new smartphone manufacturers to penetrate the Chinese market as a result of there being tens of other big smartphone manufacturers there. Examples of leading smartphone brands manufactured and with their headquarters in China are Huawei, Oppo, Vivo, Lenovo, OnePlus, Xiaomi, Coolpad and Meizu among others. Over 0ne billion phones are made in China annually. It is as such not as easy to penetrate the Chinese market. Another factor that made it hard to penetrate china is the ongoing China-America trade war. Of late, the war has been characterized by the placement of tarrifs and other trade barriers by the president of the United States Donald Trump on China that were intended at making China to amend the Chinese trade practices that the US deems as unfair. These tariffs and trade barriers set by the US on China make it very hard for non-Chinese companies to succeed in China.

Market penetration. The revenue growth of My eye depends on market penetration as the primary intensive strategy. Market penetration`s strategic objective is to grow the operations of My eye through growth of their revenues through the sale of current products in current markets where My eye is already in operation. My eye`s business strengths and competitive advantages aid in the combatting of the negative competitive forces from these markets. Market penetration, as an intensive strategy for growth is dependent on the effectiveness of the broad differentiation generic strategy (Koren, 2016). That is in terms of how the companies create products that are technologically innovative that are differentiated well enough for the purposes of targeting customers in the current and existing markets.

Product development.

Putting into consideration the emphasis of superiority of products, another major intensive growth strategy for My eye is product development. In this case, product developments strategic objective is the growth of businesses through the development of new products like new electronic gadgets (Grudin, 2017). Additionally, through this intensive growth strategy, My eye is able to grow its operations through iterative innovation that leads to improvement of existing products and even the development of their variants. Product developments implementation as a strategy for intensive growth is based on My eye`s differentiation competitive strategy that requires the development of products for uniqueness that differentiates businesses from their competitors.

Market development. My eye`s scale of operations makes market development another major intensive business growth strategy. The success of market development as a strategy for intensive growth is largely dependent on the value of the product and competitive advantage which in the case of My eye comes with the company`s differentiation generic strategy via technological innovations (Johnson, 2016). For instance, innovation that is effective for cutting-edge technological design would make the products of My eye even more competitive if they were rolled out in the target markets.

Diversification. My eye needs to diversify its business operations so that it can be able to maintain different channels of revenue and further spread risks across different markets and industries. The implementation of intensive growth strategies is not frequent in My eye and that is as a result of different regulatory hurdles and barriers. With My eye`s strategic objective of establishment of a business that is profitable, My eye`s diversification strategy would typically grow the company through acquisition of other farms that are smaller. The establishment of new business operations limits the minor role designation of the intensive growth strategies (Andersen and Gulbrandsen, 2018). Additionally, in the implementation of diversification, differentiation generic strategies could also be applied for strategic alignment and competitiveness among the subsidiary business operations of My eye.

Creating shared value

Driving economic success while also creating social value is a responsibility that also provides an opportunity for rethinking the ways through which My eye does its business while also driving sustainability. My eye has a strong background of corporate responsibility that is based on the belief that our society`s betterment is a responsibility that should be shared by all and is not just a job to be left to a few. There is a belief in My eye that there is an interdependency between social contribution and corporate success, and the same energy, passion and innovation culture that contributes to the success of the company could also be used to make social impacts that are positive and profound to the world.

My eye is in a position that allows them to serve considerable human populations and that gives them the perfect opportunity for improving people`s quality of life, revolutionizing business operations and strengthening global communities. What is referred to as social innovation covers more than just philanthropy and has evolved from the financial model that involved organizations just dishing out donations of money and goods to models where the corporations leverage all their assets with the intention of making social impacts. The greatest asset for My eye is their workforce which contains individuals who are both talented and enthusiastic and the company has always been aiming at making impacts that are significant. That is how the company is capable of providing innovative solutions while at the same time also helping improve those societies where they operate and live in (Lüdeke-Freund et al., 2016).

The growth of a company together with its success drives the realization of the personal value of the employees (Acquier, Valiorgue and Daudigeos, 2017). My eye has a firm belief that it has to take action to take care of its employees to ensure that they have a sense of belonging. It is also important for My eye to provide a platform where employees are able to realize their personal value. It is only through this that the company would be able to achieve development that is sustainable while also remaining full of vitality. Through the advocating of proactivity, openness and diversity, My eye should work on the development of a talent management system that promotes collaboration and also shared success between the company and its employees. The business environment faced today is more dynamic than ever before with the increased complexity of internal demands. It is necessary to open up My eye to outside talent and also explore ways of uniting the best minds of the world with purposes and goals that are common. Internally, My eye should fast-track the promotion of performers who are strong and further provide them with additional opportunities for growth. The company should also adopt different approaches for different groups of talent within the company forming an integrated structure of experts, leaders and professionals each who has views that are unique. That would go a long way in encouraging their top performers to maximize their contributions when they are in their prime, in those roles that suit them the most and in return, further, receive the greatest possible returns.

In the global business environment of today that is quite competitive, the management of talent becomes a very important source of competitive advantage that in the long run creates value for different companies (McDonnell et al., 2017). Leaders in all organizations should therefore work hard towards the attraction, hiring, development and further retaining of talent. Because leaders strongly believe that people are the only assets responsible for innovations in societies and the only path for sustaining performance is innovation. As such, the management of talent bears more advantages for companies. Additionally, it is possible to continuously review the management of talent such that companies are able to capitalize on the growth of their talented employees, find the best fit and further expand into new markets (Noe et al., 2017). As such, My eye needs to give more prominence and effort to the management of talent for purposes of optimizing the performance of their employees.

The social innovation approach of My eye is an integrated part of the company`s overall business strategy and helps them in the creation of long-term value that is beneficial to stockholders, customers, employees and even partners. The innovations broaden their understanding and perspectives on the needs of customers which goes a long way in creating a virtuous business development cycle. In the past, corporate societal engagements were viewed as business costs that were to be traded off against profitability. The interests of the society and businesses were defined in opposition to one another (Meyers et al., 2019). Businesses core function has at best been seen as neutral socially, creating wealth that can be used for paying for social well-being and at worst as destructive. Companies were always encouraged by commentators to focus on the creation of the best financial returns for their shareholders and stay out of social issues. Increasingly, however, companies have come to the realization that the creation of shared value can go a long way in benefiting their societies while also boosting their competitiveness at the same time (Porter and Kramer, 2019).

All organizations are capable of improving the quantity, quality, cost and reliability of their inputs while also acting as stewards for important natural resources while also driving social and economic development.

My eye could possibly meet the needs of the society while also serving the existing markets and accessing new ones and lowering costs through innovation. They could work on building smartphones with mobile applications that offer solutions to engage of pressing education and health problems. They could for instance, develop smartphones that have applications that monitor the health of individuals and send alerts when something is wrong or when there are emergencies.

It is also worth noting that companies never operate in isolation from their immediate surroundings. For purposes of competing and further thriving, they require local suppliers who are reliable, functioning roads infrastructure, access to talent and legal systems that are predictable. While this move towards shared value is more evolutionary than revolutionary, it represents a shift in paradigms nevertheless in the way through which companies view themselves and the roles they play in societies. With no doubt, in the next stage of evolution in the capitalist model that is quite sophisticated is the creation of shared value.

It is possible to break the creation of shared value in My eye into ten key building blocks that range from the adaptation of a vision that is clear to measurement, learning from, and performance communication. When these building blocks are brought together they build a blue print for the translation of a shared value agenda into action. The appropriate shared value approaches for different firms are usually dependent on their strategies, competitive positions and contexts. A company`s vision is one of the main building blocks for the creation of shared value. Explicit visions for companies act as engines for the creation of shared value. My eye`s slogan is “The Future of Technology is Here.” The company’s vision involves the provision of premium smartphones, shaping the future of technology and also providing gadgets that are highly reliable. For the creation of shared value, it is necessary to translate the vision into a strategy that is clear and that focuses on limited sets of opportunities that are relevant and also articulates impact goals that are measurable and also ambitious.

A robust strategy is another building block for the creation of shared value. It is in the strategy where the key issues of shared value are prioritized and also where ambitious shared value goals are set (Fraser, 2019). The development of strategies shapes and further directs the engagement of a company ensuring that the eoofrts they put are mutually reinforcing and add up to bring about change that is meaningful. Delivery is another building block. Effective delivery leverages assets and also expertise across business units and functions within companies as well as from external stakeholders and partners. This building block involves the leveraging of assets including cash, expertise, goods and influence and also the holistic management of assets. Management of performance is another building block. Management of performance seeks to measure and also learn from results, bring efforts that are successful to scale and also communicate progress. This involves the active measurement of results, external and internal communication of progress and also the bringing to scale of efforts that are successful (de los Reyes Jr et al., 2017).

My eye`s creation of shared value began with their corporate leaders making an explicit strategic decision. Companies are highly unlikely to marshal the necessary resources, focus and long-term thinking required for making impacts that are meaningful when there is no commitment from the top. The senior managers at My eye who are very engaged have been able to set the tone, and they also unleash the entire firms creativity and energy. At all times, the credibility and voice of the CEO is always an important tool for leveraging other parties who are also interested and also bringing new ones to the table.

My eye should also work towards ensuring that their strategies are tailored towards the reflection of a company`s unique positioning, competitive landscape and capabilities. Good strategies should be capable of identifying a handful of social challenges that are genuine and that are also representations of the opportunities of cost-reduction and opportunities for growth while also prioritizing processes internally instead of giving external stakeholders the opportunity of being the driving force (Kramer and Pfitzer, 2016). Through that, My eye could be able to retain control over its strategic agenda while also maximizing its chances of advancing goals that are strategic in ways that end up creating value for societies and also for businesses.

Another essential management tool for the creation of value is the setting of goals that are specific and ambitious. This focuses activities, creates momentum and also sustains it and further provides a basis for accountability both externally and internally. Goals that are properly crafted are ambitious the same way business units are not capable of outperforming without being stretched, there is a low likelihood that cautious incrementalism would spur the required innovation leaps required for making impacts that are serious. My eye, must however, also strike a balance between the clear definition of the outcomes desired and also allowing managers the necessary freedom to make decisions on how they are to be met.

It is worth noting that in the companies that are most effective in the sharing of value, social engagement is integrated into a wide variety of functions and roles and is not confined to an isolated silo and is often overseen at the board level (Nakayama, 2016). Instead of just acting s report writers and grant administrators, philanthropy and CSR personnel play orchestrating roles and they work towards the embedding of practices and also the coordination of multifunction projects within companies. My eye should consider creating the position of a chief sustainability officer who would act as a leader for their social engagement activities and who would report directly to the board. One of the responsibilities of the CSO should be to embed responsibility for sustainability goals within the relevant business units.

Energy, patience and tenacity is required in the creation of shared value (Berschorner and Hajduk, 2017). Often, company`s require many years for the full integration of the ideas into their operations. My eye has anticipated that the implementation of the strategy it developed two years ago in late 2017 will be a multiyear process. For purposes of maintenance of momentum it would be necessary to identify and further communicate successes recorded early. In majority of the cases, these types of quick wins would come about from legacy programs that are aligned with and that predate the processes for the development and further implementation of strategies. The tracking of results with the intention of keeping initiatives on track and further demonstrating progress is quite important. Often, companies are accustomed to getting data that is detailed on effectiveness in a matter of months and even weeks and that is particularly in functions like marketing and communication that oversee the different aspects of social engagement in different corporations. However, the identification of the impacts of social investments would take much longer. Typically, the process has more in common with trying to forecast a new businesses` profitability in comparison to the assessment of the reactions to new marketing campaigns.

For purposes of keeping corporate leaders and even colleagues abreast, it would be important for My eye to root its measurement in a strategy that is articulated clearly. The company would need to root its measurement against plans for implementation and goals and even adapt strategy and even do updates on the basis of new insights and new information. In the absence of such a robust framework, questions that are hard to answer would come about on the achievements of the initiative.

Conclusion

From this report it is quite clear that My eye still has a long way to go if it ever hopes to be a market leader in the production of smartphones. It is however, safe to say that the company is one the right track and with the proper tuning will be at the top in a few years to come. Their performance is a clear indication of a committed and hardworking management team to grow the company to its full potential.

References

Acquier, A., Valiorgue, B. and Daudigeos, T., 2017. Sharing the shared value: A transaction cost perspective on strategic CSR policies in global value chains. Journal of Business Ethics, 144(1), pp.139-152.

Alden, D.L. and Nariswari, A., 2017. Brand Positioning Strategies During Global Expansion: Managerial Perspectives from Emerging Market Firms. In The Customer is NOT Always Right? Marketing Orientationsin a Dynamic Business World (pp. 527-530). Springer, Cham.

Andersen, A.D. and Gulbrandsen, M., 2018. 12 Diversification into new markets. Petroleum Industry Transformations: Lessons from Norway and Beyond, p.180.

Anning-Dorson, T., 2018. Innovation and competitive advantage creation: The role of organisational leadership in service firms from emerging markets. International Marketing Review, 35(4), pp.580-600.

Bao, S.R. and Lewellyn, K.B., 2017. Ownership structure and earnings management in emerging markets—An institutionalized agency perspective. International Business Review, 26(5), pp.828-838.

Beschorner, T. and Hajduk, T., 2017. Creating Shared Value. A Fundamental Critique. In Creating Shared Value–Concepts, Experience, Criticism (pp. 27-37). Springer, Cham.

Brodin, M., 2017. Mobile Device Strategy: From a Management Point of View. Journal of Mobile Technologies, Knowledge and Society, 2017.

Chaffey, D. and Ellis-Chadwick, F., 2019. Digital marketing. Pearson UK.

Chai, S.H., Nicholson, B., Scapens, R.W. and Yang, C., 2018. Impact of Mobile Platforms on Performance Management: An Imbrication Perspective. In ECIS (p. 169).

Cramer-Petersen, C.L., Ahmed-Kristensen, S., Li, X., Rasmussen, P.J. and Nissen, G., 2016. SMART Product Innovation: a process for higher value and lower price to improve margins.

de los Reyes Jr, G., Scholz, M. and Smith, N.C., 2017. Beyond the “Win-Win” creating shared value requires ethical frameworks. California Management Review, 59(2), pp.142-167.

Denning, S., 2018. The age of agile: How smart companies are transforming the way work gets done. Amacom.

Fraser, J., 2019. Creating shared value as a business strategy for mining to advance the United Nations Sustainable Development Goals. The Extractive Industries and Society.

Grudin, J., 2017. Obstacles to participatory design in large product development organizations. In Participatory Design (pp. 99-119). CRC Press.

Gupta, V.K., 2017. Marketing Strategy: A War to Win. Journal of Management Science, Operations & Strategies, 1(1), pp.21-4.

Heizer, J., Render, B. and Munson, C., 2016. Principles of operations management: sustainability and supply chain management. Pearson Higher Ed.

Helmi, J., Bridson, K. and Casidy, R., 2019. A typology of organisational stakeholder engagement with place brand identity. Journal of Strategic Marketing, pp.1-19.

Hickman, C.R. and Silva, M.A., 2018. The Future 500: Creating Tomorrow's Organisations Today. Routledge.

Isada, F. and Isada, Y., 2018. Relationship between Competitive Advantage and Success or Failure of Overseas Expansion in Small and Medium-Sized Manufacturers. International Journal of Business and Management, 2(6), pp.23-27.

Johnson, G., 2016. Exploring strategy: text and cases. Pearson Education.

Kabue, L.W. and Kilika, J.M., 2016. Firm resources, core competencies and sustainable competitive advantage: An integrative theoretical framework. Journal of management and strategy, 7(1), pp.98-108.

Koren, D., 2016. System and method for facilitating promotion of goods and services. U.S. Patent Application 15/057,108.

Kramer, M.R. and Pfitzer, M.W., 2016. The ecosystem of shared value. Harvard Business Review, 94(10), pp.80-89.

Krishnaswamy, S., 2017. Sources of Sustainable competitive Advantage: A Study & Industry Outlook. St. Theresa Journal of Humanities and Social Sciences, 3(1).

Lagarde, C., 2016. The Role of Emerging Markets in a New Global Partnership for Growth by IMF Managing Director Christine Lagarde. Retrieved April, 28, p.2016.

Lagarde, C., 2016. The Role of Emerging Markets in a New Global Partnership for Growth by IMF Managing Director Christine Lagarde. Retrieved April, 28, p.2016.

Lüdeke-Freund, F., Massa, L., Bocken, N., Brent, A. and Musango, J., 2016. Business models for shared value. Network for Business Sustainability: South Africa.

McDonnell, A., Collings, D.G., Mellahi, K. and Schuler, R., 2017. Talent management: a systematic review and future prospects. European Journal of International Management, 11(1), pp.86-128.

Meyers, M.C., van Woerkom, M., Paauwe, J. and Dries, N., 2019. HR managers’ talent philosophies: prevalence and relationships with perceived talent management practices. The International Journal of Human Resource Management, pp.1-27.

Nakayama, D.T., 2016. Corporate Social Responsibility (CSR) and Creating Shared Value (CSV) of Smes In Japan. International Journal of Management, 7(4).

Noe, R.A., Hollenbeck, J.R., Gerhart, B. and Wright, P.M., 2017. Human resource management: Gaining a competitive advantage. New York, NY: McGraw-Hill Education.

Noe, R.A., Hollenbeck, J.R., Gerhart, B. and Wright, P.M., 2017. Human resource management: Gaining a competitive advantage. New York, NY: McGraw-Hill Education.

Pecot, F. and De Barnier, V., 2017. Strategic Management of Brand Heritage: Two Positioning Perspectives. In Marketing at the Confluence between Entertainment and Analytics (pp. 69-69). Springer, Cham.

Porter, M.E. and Kramer, M.R., 2019. Creating shared value. In Managing sustainable business (pp. 323-346). Springer, Dordrecht.

Ramraika, C.F.A. and Trivedi, P., 2016. Sources of Sustainable Competitive Advantage. Prashant, Sources of Sustainable Competitive Advantage (January 5, 2016).

Rzepka, A., 2017. Inter-organizational relations as a one of sources of competitive advantage of contemporary enterprises in the era of globalization. Procedia engineering, 174, pp.161-170.

Warwick, P., 2017. The Rise of the Global Company, Multinationals and the Making of the Modern World. Personnel Review.

Ziaee Bigdeli, A. and Baines, T., 2017. Organisational transformation towards servitization.

Continue your exploration of A Portfolio on Effective Communication and Teamwork with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts