Business Life Cycle

EXECUTIVE SUMMARY

Analysing business environment of the organisation is very crucial, particularly when seeking business dissertation help. Conducting such analysis can be very useful for the firm, as it can help in getting a better understanding about its overall environment, as well as its operations. On the basis of such information, the company can modify its operations, in order to enhance its performance and thereby achieve its goals and objectives. There are several strengths of Kelan Solutions. One of the key strengths is that it has a very good history of operations in the market.

In this regard, the company has performed very well over the years which has helped it to gain a superior position in the market, with the help of which it has been able to attract the customers with far more ease and effectiveness. One of the biggest opportunities for the company has arrived in the form of a global pandemic – the COVID19. Thus, it can be said that the company should focus on developing its marketing function in such a manner that it can reach out to large number of customers and develop a healthy and strong relations with them. There are a number of threats prevailing in the current market. It will be imperative for Klean Solutions to identify these threats and develop a plan to overcome them so that the operations are not adversely affected. COVID-19 is one of the key threats for the company. During this pandemic, world governments have imposed hard lockdown in their countries in order to control and stop the spread of the virus. Due to this reason, supply chains of companies have been broken down.

The pandemic has introduced new opportunities as hand-washing and individual cleanliness have been promoted as the best proportions of halting the spread of the infection. Interest for handwash and sanitizers has along these lines flooded, relieving the misfortunes made during the lockdown. The organization is mulling over a major agreement with West Hertfordshire Hospitals NHS Trust for the standard inventory of hand sanitiser and handwash for the following five years. Net present value (NPV) is the distinction between the current estimation of money inflows and the current estimation of money outpourings throughout some stretch of time. Restitution period, or "compensation strategy," is a less complex option in contrast to NPV. The restitution strategy ascertains what amount of time it will require for the first speculation to be reimbursed. A disadvantage is that this strategy neglects to represent the time estimation of cash.

ANALYSIS OF THE CURRENT BUSINESS

Analysing business environment of the organisation is very crucial. Conducting such analysis can be very useful for the firm, as it can help in getting a better understanding about its overall environment, as well as its operations (Strobl and Kronenberg, 2016). On the basis of such information, the company can modify its operations, in order to enhance its performance and thereby achieve its goals and objectives. The soap and detergent manufacturing industry is very competitive in nature. Due to this reason, it is all the more important for the firms in this sector to analyse their businesses (Jabłoński and Jabłoński, 2016). Such information can be vital for an organisation such as Klean Solutions to analyse its business operations and functioning. Access to such information can lay down the foundation for the company to achieve success and fulfil its goals and targets. In the following paragraphs, a thorough analysis of the company through a SWOT analysis and financial statement analysis has been carried out. In addition, it also provides a conclusion and recommendations so that the firm can focus on enhancing its overall operations and thereby achieve its goals and targets.

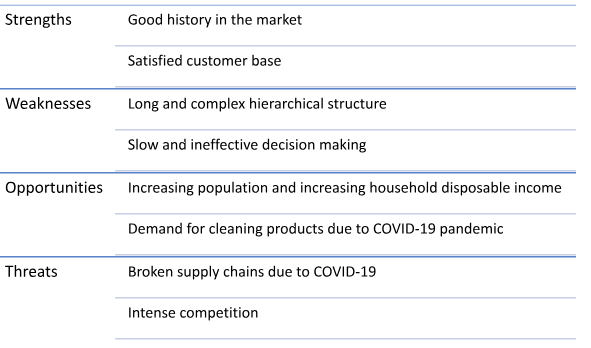

SWOT Analysis

Strengths

There are several strengths of Kelan Solutions. One of the key strengths is that it has a very good history of operations in the market (Matejun and Mikoláš, 2017). In this regard, the company has performed very well over the years which has helped it to gain a superior position in the market, with the help of which it has been able to attract the customers with far more ease and effectiveness. This has again helped the company in performing better and satisfy the customers, thereby fulfilling its goals and targets. Revenue growth over the years has presented the opportunity for more expansion. This can be supported through the fact that the company was able to launch two new retail outlets in the year 2018 (Kesidou and Carter, 2018), while in 2019 a third outlet was launched. This shows the year-on-year growth achieved by the company.

Weaknesses

A major weakness of the company is that it has a very long and complex hierarchical structure. Due to this reason the decision-making process gets adversely affected and thus the overall performance of the firm as well (Dowell et. al, 2015). This weakness influences ability of the company to achieve its goals and targets. Such a situation also weakens overall position of firm in the market.

Opportunities

One of the biggest opportunities for the company has arrived in the form of a global pandemic – the COVID19. This virus outbreak has taken over the world by storm as every country is suffering from it. The pandemic is an opportunity for the company mainly due to the reason that it allows the firm to sell more cleaning products, as the people are demanding for cleaning solutions, so that they can be save themselves from the virus (Leotta and Ruggeri, 2020). Thus, it can be said that the company should focus on developing its marketing function in such a manner that it can reach out to large number of customers and develop a healthy and strong relations with them. This will help in attracting more customers and thereby selling their products with ease. Therefore, it can be said that the company will be able to enhance its overall performance and achieve its goals and targets (Perkins and Khoo-Lattimore, 2020).

Another significant opportunity for the company comes in the form of growing population and rising real household disposable income. Since the population is increasing then it means that there are more customers for the company to cater to and sell its products. Further, rising disposable income indicates that the people can afford high-quality and premium priced products, thereby driving sales figures of the company and enhancing its overall performance (Manda et. al, 2015). To avail this opportunity and make the most out of it, the firm should focus on enhancing the quality of its products, work on its prices to keep them as competitive as possible and also improve its positioning in the market among the target customers. This way the firm will be able to enhance its overall performance and operations (Paschen, 2017).

Threats

There are a number of threats prevailing in the current market. It will be imperative for Klean Solutions to identify these threats and develop a plan to overcome them so that the operations are not adversely affected. COVID-19 is one of the key threats for the company (Muzellec and Lambkin, 2015). During this pandemic, world governments have imposed hard lockdown in their countries in order to control and stop the spread of the virus. Due to this reason, supply chains of companies have been broken down. This has also adversely affected operations of many firms across different channels and sectors (Barbieri and Santos, 2020). Thus, it will be imperative for the company to determine a way to rebuild its supply chains and also to develop a system through which its operations can be effectively managed, so that it can achieve its goals and targets.

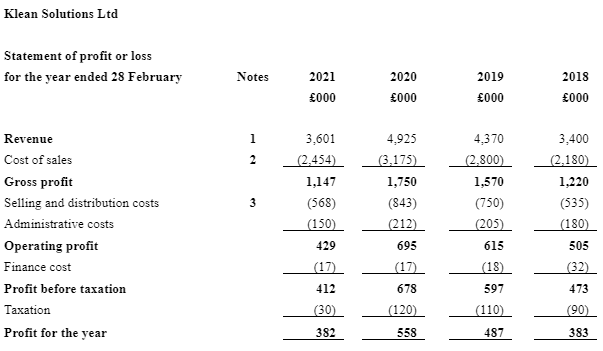

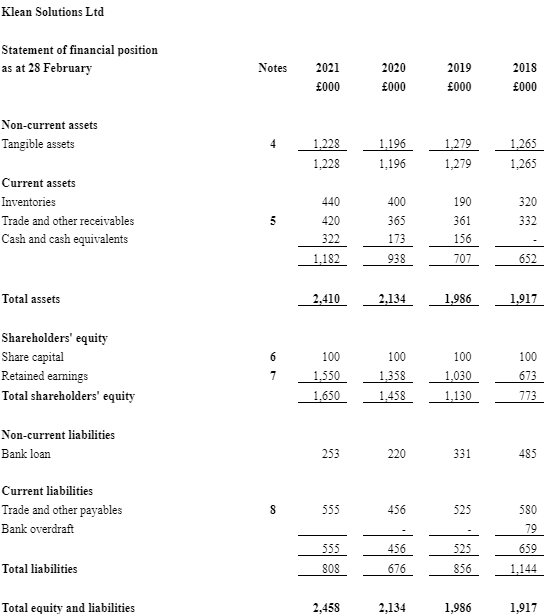

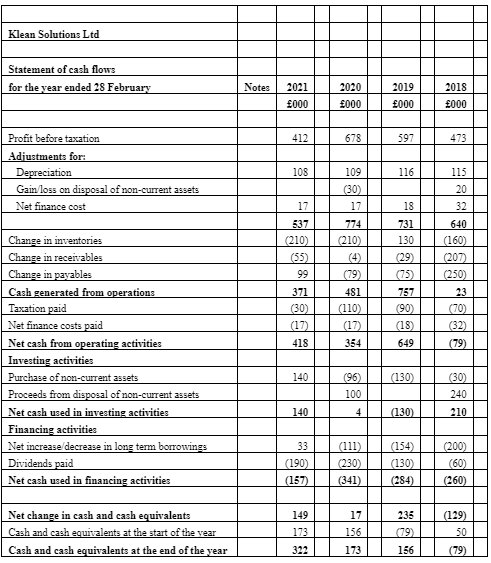

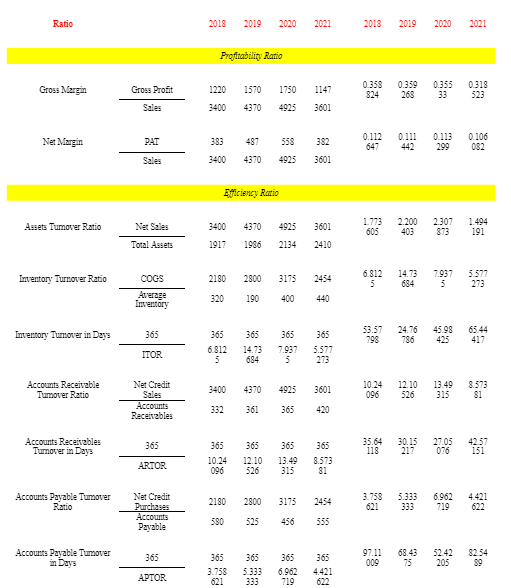

Financial Statement Analysis

As per the financial analysis, the gross profit margin of the company was around 35% between 2018 and 2020. However, it was reduced to 31% in 2021. Same pattern was observed in net profit margin, which was around 11% in 2018 and reduced to 10.6% in 2021. The decline in the company’s profit margins was because of company’s fall in revenue. Further, the efficiency ratios show poor credit management of the company. Over the years, there is increase in receivable period and decline in payable period. Due this this, there are higher chances of negative working capital and cash shortage. Also, the inventory turnover ratio deteriorates over the period of time, showing that company was finding it difficult to sale its products in the market. The reason behind decline in sales could be company’s inability to meet the satisfaction and needs of the consumers. Or it may not have employed its assets properly, so that those assets are not performed optimally.

Conclusion and Recommendations

On basis of the above discussion, it can be said that the company should focus on re-developing and strengthening its supplier network, as it would help the organisation to reach out to its customers and deliver the products to them. In the wake of the COVID-19 pandemic, business operations have been severely negatively influenced. Undertaking such a task will help the company to not only perform better but also fulfil its goals and targets. Since the population is increasing then it means that there are more customers for the company to cater to and sell its products. Further, rising disposable income indicates that the people can afford high-quality and premium priced products, thereby driving sales figures of the company and enhancing its overall performance. To avail this opportunity and make the most out of it, the firm should focus on enhancing the quality of its products, work on its prices to keep them as competitive as possible and also improve its positioning in the market among the target customers. This way the firm will be able to enhance its overall performance and operations.

ANALYSIS OF NEW BUSINESS OPPORTUNITY

The pandemic has introduced new freedoms as hand-washing and individual cleanliness have been promoted as the best proportions of halting the spread of the infection. Interest for handwash and sanitizers has in this manner flooded, alleviating the misfortunes made during the lockdown (Friis and Sorensen, 2015). The organization is pondering a major agreement with West Hertfordshire Hospitals NHS Trust for the customary stock of hand sanitiser and handwash for the following five years.

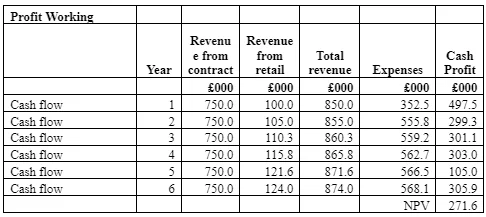

The costs are assessed at 65% of absolute income every year. Furthermore, there will be a need to contribute 20% of the underlying speculation as working capital in the primary year. This will be totally recuperated in the fifth year of the agreement (Hoffmann et. al, 2020). Toward the end of the five-year contract, incomes are relied upon to be acquired from retail alone for a long time to come. It is along these lines judicious to downsize the yearly development pace of retail income from 5% to 2% from the beginning of year 6. Thusly, the complete benefits in year 6 will be comprised of retail income (with a 2% development from year 5 retail income), less gradual costs which will stay at 65% of absolute income for the year. In view of this current year, benefit, the remaining/terminal estimation of the task (post-charge) is assessed to be £358,500 (Tschiggerl et. al, (2018).

DCF (NPV) Technique

Net present value (NPV) is the contrast between the current estimation of money inflows and the current estimation of money surges throughout some stretch of time. NPV is utilized in capital planning and venture wanting to dissect the benefit of a projected speculation or task (Manda et. al, 2016). A positive net present worth demonstrates that the projected profit created by an undertaking or speculation - in present dollars - surpasses the expected expenses, additionally in present dollars. It is expected that a speculation with a positive NPV will be beneficial, and a venture with a negative NPV will bring about a total deficit. This idea is the reason for the Net Present Value Rule, which directs that lone speculations with positive NPV esteems ought to be thought of (Hillen and Lavarda, 2020). Cash in the present is worth more than a similar sum later on because of swelling and to income from elective ventures that could be made during the interceding time. As such, a dollar acquired later on will not be worth however much one procured in the present. The rebate rate component of the NPV equation is an approach to represent this. In the present case, the NPV for the project is coming out to be positive, showing that it will be beneficial for the company to go with the new project.

Limitations and Assumptions of DCF

Measuring a firms’ profitability with NPV depends intensely on suspicions and assessments, so there can be generous space for blunder. Assessed factors incorporate speculation costs, rebate rate, and projected returns. An undertaking may frequently require unexpected uses to make headway or may require extra uses at the venture's end. Compensation period, or "recompense strategy," is a less difficult option in contrast to NPV (Campbell et. al, 2016). The recompense strategy computes what amount of time it will require for the first venture to be reimbursed. A downside is that this strategy neglects to represent the time estimation of cash. Hence, recompense periods determined for longer ventures have a more prominent potential for mistake (Paschen, 2017). Also, the compensation time frame is carefully restricted to the measure of time needed to acquire back beginning speculation costs. It is conceivable that the venture's pace of return could encounter sharp developments. Examinations utilizing restitution periods don't represent the drawn-out productivity of elective ventures (Dowell et. al, 2015).

Risks and Uncertainties

The cost of capital is the pace of return necessitated that makes a venture advantageous. It decides if the profit from the venture merits the danger. At the point when an organization settles on whether to make a speculation, it needs to set a suitable expense of capital. On the off chance that it points excessively high, it might decide a venture does not merit the hazard and have a botched chance (Kesidou and Carter, 2018). Alternately, if the expense of capital is excessively low, it could be settling on speculation choices that are not beneficial. At the point when a speculation does not have an ensured return it tends to be hard to decide the incomes from that venture. This can now and again be the situation for organizations that put resources into new gear or choices dependent on business development. An organization can assess the sort of incomes these venture choices may have, however there is an opportunity they could be off by a huge rate (Jabłoński and Jabłoński, 2016).

Conclusion and Recommendations

The pandemic has introduced new freedoms as hand-washing and individual cleanliness have been promoted as the best proportions of halting the spread of the infection. Interest for handwash and sanitizers has in this manner flooded, alleviating the misfortunes made during the lockdown. The organization is thinking about a major agreement with West Hertfordshire Hospitals NHS Trust for the customary stock of hand sanitiser and handwash for the following five years. A positive net present worth demonstrates that the projected profit created by an undertaking or speculation - in present dollars - surpasses the expected expenses, additionally in present dollars. It is expected that a speculation with a positive NPV will be beneficial, and a venture with a negative NPV will bring about a total deficit. This idea is the reason for the Net Present Value Rule, which directs that lone speculations with positive NPV esteems ought to be thought of.

Cash in the present is worth more than a similar sum later on because of swelling and to income from elective ventures that could be made during the interceding time. As such, a dollar acquired later on will not be worth however much one procured in the present. The rebate rate component of the NPV equation is an approach to represent this. Measuring a firms’ profitability with NPV depends intensely on suspicions and assessments, so there can be generous space for blunder. Assessed factors incorporate speculation costs, rebate rate, and projected returns. An undertaking may frequently require unexpected uses to make headway or may require extra uses at the venture's end. Compensation period, or "recompense strategy," is a less difficult option in contrast to NPV.

The recompense strategy computes what amount of time it will require for the first venture to be reimbursed. A downside is that this strategy neglects to represent the time estimation of cash. Hence, recompense periods determined for longer ventures have a more prominent potential for mistake. Also, the compensation time frame is carefully restricted to the measure of time needed to acquire back beginning speculation costs.

REFERENCES

Barbieri, R., and Santos, D. F. L. (2020). Sustainable business models and eco-innovation: A life cycle assessment. Journal of Cleaner Production, 266, 121954.

Campbell, J. D. et. al., (2016). Asset management excellence: optimizing equipment life-cycle decisions. CRC Press.

Dowell, D. et. al., (2015). The changing importance of affective trust and cognitive trust across the relationship lifecycle: A study of business-to-business relationships. Industrial Marketing Management, 44, 119-130.

Friis, J. D. and Sorensen, K. A. M. (2015). Business model or strategy: what comes first? A lifecycle perspective in the Scandinavian software industry. Problems and perspectives in management, (13, Iss. 2 (contin.)), 161-169.

Hillen, C., and Lavarda, C. E. F. (2020). Budget and life cycle in family business in succession process. Revista Contabilidade and Finanças, 31(83), 212-227.

Hoffmann, B. S. et. al., (2020). Life cycle assessment of innovative circular business models for modern cloth diapers. Journal of Cleaner Production, 249, 119364.

Jabłoński, A., and Jabłoński, M., (2016). Research on business models in their life cycle. Sustainability, 8(5), 430.

Kesidou, E., and Carter, S., (2018). Entrepreneurial leadership: an exploratory study of attitudinal and behavioral patterns over the business life-cycle. International review of entrepreneurship, 16(1).

Leotta, A. and Ruggeri, D., (2020). An Overview of Family Business. Profiles, Definitions and the Main Challenges of the Business Life Cycle. Management Controlling and Governance of Family Businesses, 7-28.

Manda, B. K. et. al., (2015). Prospective life cycle assessment of an antibacterial T-shirt and supporting business decisions to create value. Resources, Conservation and Recycling, 103, 47-57.

Manda, B. K. et. al., (2016). Value creation with life cycle assessment: an approach to contextualize the application of life cycle assessment in chemical companies to create sustainable value. Journal of Cleaner Production, 126, 337-351.

Matejun, M., and Mikoláš, Z., (2017). Small business life cycle: statics and dynamics (SandD) model. Engineering Management in Production and Services, 9(4), 48-58.

Muzellec, L. and Lambkin, M. (2015). Two-sided Internet platforms: A business model lifecycle perspective. Industrial Marketing Management, 45, 139-150.

Paschen, J., (2017). Choose wisely: Crowdfunding through the stages of the startup life cycle. Business Horizons, 60(2), 179-188.

Perkins, R., and Khoo-Lattimore, C., (2020). Friend or foe: Challenges to collaboration success at different lifecycle stages for regional small tourism firms in Australia. Tourism and Hospitality Research, 20(2), 184-197.

Strobl, A., and Kronenberg, C., (2016). Entrepreneurial networks across the business life cycle: the case of Alpine hospitality entrepreneurs. International Journal of Contemporary Hospitality Management.

Tschiggerl, K. et. al., (2018). Considering environmental impacts of energy storage technologies: A life cycle assessment of power-to-gas business models. Energy, 160, 1091-1100.

APPNDIX

SWOT Analysis

Financial Statements

Confirmation Statement

Financial Ratios

Investment Appraisal Calculations

Take a deeper dive into Business functions and its environment with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts