Corporate Social Responsibility, And Business Ethics

Introduction

Flip, a company established and headquartered in Netherlands, is a smartphone business entity operating the United Kingdom (UK), Netherlands, and Belgium. Its ‘Enjoy World Everywhere’ mission is reflected in its expansion and plans to venture into new markets across the global in the next six years. Moreover, its slogan of ‘Just Relax’ combined with its mission has been the fundamental in its expansion and provision consumer-oriented services and products, including business dissertation help. Flip Company bases its business activities at relaxation and enjoyment of life by its consumers and striving to spread the same everywhere, across the global. The company is founded on the three core values; Connecting the world, Affordable phones for everyone, and high reliability. However, achieving this goals need formulating a framework that handles competition and foster expansion and growth. Fundamental to this is consideration of, first, market segmentation involving grouping potential consumers based on their needs and preferences. Secondly, targeted consumers through recognising that different consumers, in different regions and socioeconomic levels have different needs then developing a strategy to handle each target market. Thirdly, positioning of the company in a market informed by products and service to be different from competitions either by quality or cost but driven by consumer.

Consumer-oriented services and products coupled with culture of quality has been core in its success rate evident by customer satisfaction and expansion rate. This report aims to critically analysis and underpin the strategic management (International Strategic Management), Corporate Social Responsibility (CSR), and Business Ethics as fostered by Flip Company. The report is sub-divided into two sections; first focusing on the strategic management that include Flip’s strategic positioning (organizational culture and structure, service and products quality, consumer satisfaction, and pricing), while the second part entails its sustainability commitment supported by the business shared values, empowering stakeholders (consumers, employees, and shareholders) and environmental protection. Currently, the company is ranked at 8th position driven by employees’ productivity with key productivity index (KPI) of 65%, consumer satisfaction, and product quality.

The company’s six year expansion plan include entry into other European markets that include German, France, and Monaco by 2020, Asia market (China, Japan, and India) by 2021 as a third round expansion plan, round 4 involves venturing into the American market that includes USA, Canada, Brazil, and Surinam by year 2022. The fifth and sixth expansion plan encompasses entry into the Pacifics market (Singapore, Malaysia, Indonesia, and Australia) by 2023 and Africa and the Middle East by 2024 respectively.

Section 1: International Strategic Management

1.1: Flip Strategic positioning

Continue your journey with our comprehensive guide to Corporate Social Responsibility.

In order to map out the Flip company competiveness and its competitive advantage, it is essential to understand its position in the market, through combing through the strategic positioning. The smartphone industry in which the Flip Company is operating is a crowded business environment and highly competitive. As posed by Srivastava et al. (2001) and Aghazadeh (2015), in marketing and business strategy, market-based view in regarded to a business entity is position in relation to other players in the market. Thus giving an imagery or identity of a brand or product against the competitors. The strategic positioning model below highlights the company’s positioning as well as strategy.

Dig deeper into Business Ethics and Responsible Management with our selection of articles.

1.2: Porter’s Generic positioning model

Commonly referred to as Porter’s generic strategies, are strategic techniques adopted by business entities in attempt to penetrate new markets and sustainability after penetration while driven by need to garner strongest advantage over the competitors. As illustrated by Moon et al. (2014) and Ormanidhi & Stringa (2008), the positioning model is structured by a aim of a company to attract targeted consumers in the industry it operates in and setting itself in a position it can maintain the attracted consumers (its position). Ideally, a company’s position in relation to other players in the industry is based on the strength of the products offered, employees-consumer relation (largely driven by workers training), or marketing campaign (Ohara et al., 2015). Business ideals of profit, growth, and sustainability in largely grounded on the idea of effectively combating and handling threats but importantly foreseeing opportunities. The concept of positioning gives a business entity key and ways of marketing its existing products or creating new products/market aimed on expanding its operations and subsequently profitability or at least maintaining its market share through dealing with competitors, new products, or changing consumer preference. Business putting itself at a position where it can address consumers’ need has to reach out to existing and potential consumer. Prominently, this is done through pricing, placing, product quality and differentiation, and promotions. In essence, as pointed by Ormanidhi & Stringa (2008) the more intense the positioning strategy, the more the outcome, measured by market share, profit, revenue, consumer satisfaction, and reputation, of marketing strategy. Banker et al. (2011) contended that a marketing strategy followed by a business could either break or uplift it the next level, in terms of business success. As such, in case of Flip, an elaborate business strategy has capability of elevating its marketing, expansion, and growth goals such that buyers’ could not just know about the products the business offers but be in a position to purchase.

Michael Porter argued that a company’s strength lies on its positioning in the market and cost advantage over the competitors (Ormanidhi, and Stringa, 2008). As such, according to Banker et al. (2011), these strengths are moulded into three strategies; namely: cost leadership, focus, and differentiation. The threat helps the firm establish its identify informed by the services and products its offer while differentiating itself from other products in the market. Using Banker et al. (2011) assertion, the company should be in a position that set its identity from the purchaser’s eyes while noting that a framework followed should be guided by requirements and motivations of the consumers but not limited to market needs but driven by actions and products of the competitors.

In the perspective of the Flip, its competitive advantage is guided by porter’s five-force model (bargaining power of buyers, threat of substitute products, bargaining power of suppliers, threat of new entrants, and rivalry in the industry) evaluating various segments collectively housing its entry and sustainability in the new market. Nevertheless, before formulating a strategy, following questions have to put to mind; first, “what are the company’s consumers really buy?” secondly, “how is the company’s products different from others available in the market?” and thirdly, “what markets the products and services offered different from others in the market?”

For instance, consumer focus segment in current market (Netherlands) and projected market to enter (Belgium).

The segment capture the consumers bargaining power who can pressurise the company to improve the quality of service, lower product pricing, or better consumer services. According to Porter (2008), consumer bargaining power is subject to low switching cost to other available products in the market. Smartphone market global is saturated by almost similar products as well as information on the quality and cost, hence consumers can easy switch from one product to another with little cost to bare. As such, small compromise on the product by the company can result in significance loss in market share. Since, in Belgium, there are five competitors, the company can either change the pricing structure lowering with respect to competitors or increase its products quality. Although going by Gersbach and Haller (2009), description of buyers personalities, where they can be placed into different group depended on the individual driving factors towards the product that include the highly motivated, the casual lookers, the bargain hunters, and serious buyers.

Therefore, in a given scenario, a company need to first identify its consumer bases before adopting any given strategy. For instance, the company can structure its pricing strategy to include a discount (reducing the cost of number of smartphones purchased). In 2024, in attempt to boost the sales, new smartphone model was introduced and the purchasing cost restructure reducing the price of 5 smartphones by 75%. The strategy matched the quality and the pricing category to the buyers’ preferences. Moreover, in addition to the company intensifying the e-marketing such as search engine optimization (SEO) and price per click as a way of reaching out the young buyers, it identified global offline promotion campaigns. This is evidently with the budgeting into marketing cost and research and development, which increased from € 3,055,000.00 in 2021 to € 26,075,000 in 2023 and € 29,775,000 in 2024, similarly, the development budget rose from € 0.00 in 2022 to € 375,000 in 2023 and € 375,000 in 2024

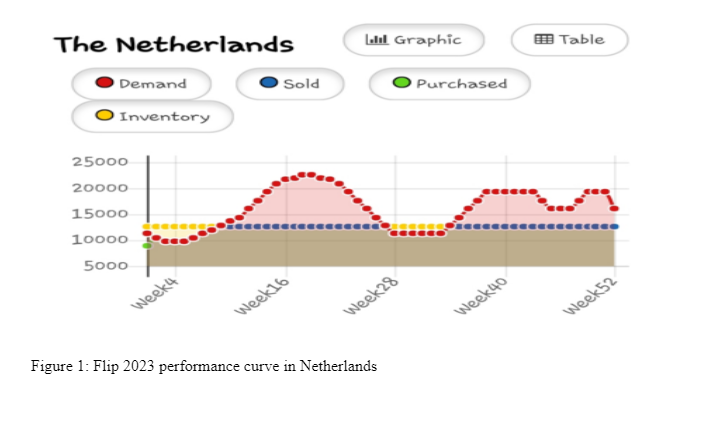

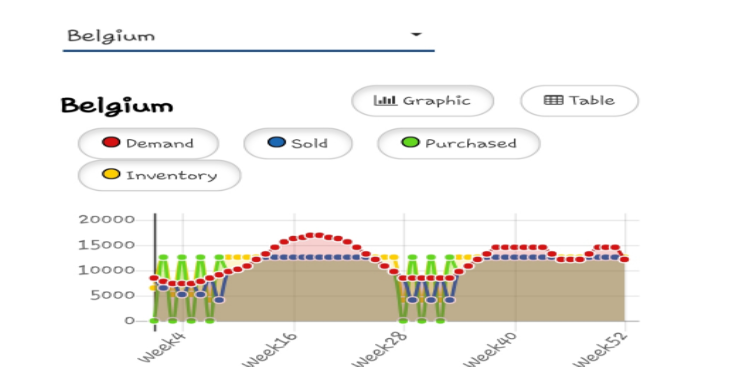

Increasing funds into the research and development ensuring the quality of the product rivalled the products from the competitors in the market. Similarly, increasing the marketing through direct target focus segment under consumer-oriented campaigns (SEO and price per click) as well as letting individual country develop marketing strategies geared towards targeted consumers rather than generalised approach (Shih et al., 2013; Brenes et al., 2014). This reduced the marketing channel clouting while locking the consumers (Hahn, and Powers, 2010). As such, the change in strategy saw rise demands in Netherlands as well as Belgium in 2023 (shown in figure 1 and 2 below).

1.3: Competitors’ rivalry Netherlands/ Belgium

As indicated by Porter, rivalry in an industry in determined by other business entities in the field offering similar products within the same quality and pricing as well as employee-consumer relation (Dobbs, 2012). Based on assertion made by Takata (2016), the company need to combat competition by identifying potential consumers and subsequently their preference and need, then working towards satisfying their needs.

As such, exerting pressure on each other that might lead to reduced market share and profit margins. Flip, is currently faced 8 competitors in Netherlands with such companies as ZEXCEL and MY PHONE leading the market with 22.18% and 14.11% respectively (figure 3). Therefore, the competitors’ rivalry very high with Flip having approximately 12% market share in 2019 and around 2% in 2020 and 2021.

Although over the same period, between 2019 and 2022, the company saw a drop in the sales trends in 2019 and 2020 then gradual increase between 2020 and 2022 to over 600 million products sold (figure 4).

David et al. (2017) postulated that adopting a defensive strategy as a marketing tool aids a business entity in retaining valuable customers who might switch to competitors’ products. According to Karakaya and Yannopoulos (2010), in an industry where competitors exist, each company must protect its product, brand, market share, profitability, and growth expectations in order to maintain competitive advantage as well as developing reputation. Ideally, there exist several strategies a company can deploy in attempt to outmanoeuvre its competitors and reduce financial risks. According to Ebrahim et al. (2018) and Giannoulis et al. (2013), a company has little control on the consumers’ product and service preferences but can mould its products and services to satisfy consumers’ needs and wants.

In a defensive approach, a company can attack the competitors weakening its products, hence market share, or highlight the risks faced and subsequently strategies on ways of protecting its brand. Building from Karakaya & Yannopoulos (2010) and Martín-Herrán et al. (2012) assertion on the defensive marketing technique, Flip can continuously improve its product and services through investing more on quality, conducting product proliferation, and intensifying marketing. Between 2021 and 2023, Flip successful defended its market share evident by increased both market share and sales within the same period after a drop in 2019-2020 (Figure 3 and 4).

Suppliers’ bargaining power: Generally, the suppliers’ bargaining power is low because the company owned the research and development (R&D) process and licensing, which determines the smartphone quality and feature (Nair et al., 2011). However, dependence on the supplier of the smartphone components and value adding is high due to the number of competitors in the market. The company need to agree with manufacturers on supply agreement as well as manufacture quality.

Entry barriers: According to Geroski and Jacquemin (2013) and as evident Flip’s entry, smartphone market is easy to enter by new companies as profit is high, consumer loyalty is very low and rapid change in consumer preferences and demand. Flip low in market leadership and economies of scale might face stiff competition from new entrants into Netherland market because its positioning (Koller et al., 2011; Chen, and Pearcy, 2010). New strategies are paramount such as improving consumer satisfaction and product quality though increase in profit ultimately attracts more competitors into the industry.

Threat of substitutes: Smartphones face can be substituted with wearables devices and tablets but in this case, simulating the Flip performance scenario, the substitutes were not considered hence that threat of substitutes was low.

1.4: Focused choice

1.4.1: Competitive advantage

In a competitive business environment, businesses have to focus on employed number of strategies in order to gain an upper hand over the competitors. Rothaermel (2017) highlighted four primary methods that include differentiation, strategic alliances, defensive strategies, and cost leadership. According to Johnson (2016), a company can offer same product in terms of quality and features with the competitors but at a lower cost, in the form of cost leadership. The strategy demands a company to formulate a way in which to produce same products (quality) as the competitors but a lower production cost such as perfection of production methods and utilization of resources (employees and materials) hence lower cost (Valipour et al., 2012; Chen, and Pearcy, 2010). For Flip, investment into R&D projects and machines means the effectiveness of production and quality of the products can be enhanced. However, the company needed to determine what the competitors offer (products, pricing, and quality) in the field.

The Bowman strategy clock aided in analysing its position such as cost leadership, products differentiation, and strategy focus (Hsieh, and Chen, 2011; Shakhshir, 2014). The focus of the company is offering quality product at a moderate cost choosing to ensure the consumers have value of their money. This is evident by focus on the increase investment onto the R&D aimed at being a leader in quality matching the consumers’ value of quality products while considering the cost. The focus strategy was to match the quality at a lower cost under ‘hybrid technique’. The low sales between 2019 and 2021 prompted increase in products quality, development of new flagship products, and enhancing its marketing strategy. For instance, increasing the research (investing fully on the necessary machines and research progress) leads to reduction of the purchasing cost of the products by 20%. That explains shooting increase in sales in 2022 and 2023 following increases in previous years respectively.

1.5: Strategic direction

Johnson (2016) highlighted that business growth is driven by its directional strategy that include utilization of resources full to expand its operations and grow. One of the approach involves increasing the output, increasing efficiency, speed of production and delivery, and minimizing wastage (Wheelen and Hunger, 2011; Picazo-Tadeo et al., 2012). Another incorporates increasing the company’s assets and liabilities through loans, grants, and equity. Flip employed organic development strategy where it focused on maximizing its capabilities and resources such as reinvesting from sale, streamlining the production process, and enhancing the R&D process (hiring more R&D researchers to increase speed of the process, and products quality and features) and delivery system (IDC). Using Ansoff Matrix, where it provides a framework for a company to formulate its growth strategy, Flip can shape its future through market penetration, product development, market development, and product diversification.

1.5.1: Market penetration

The company used predominantly the market penetration strategy aimed at increasing its market size. Ansoff et al. (2018) illustrated that market penetration is can be driven by selling more products to existing customer base or finding new consumer base in existing markets. First, Flip invested more into product development through R&D to reach out to consumers with preference of high quality products but at a low cost. Secondly, it increasing its e-marketing strategy by investing more into social networks (Facebook, Instagram) and online linked business network to enhance its advertisement such as website (SEO), using extended optimization to improve the company’s website ranking on search engines, and price per click, where it paid € 0.5 per click for each potential customer who click the company’s advertisement. The e-marketing aimed at attracting more visitors to its website.

Thirdly, Flip increased its offline promotion campaign through increasing its global campaign budget. The idea was the more the funding of campaigns the high advertising outreach such as branding sports teams and advertising during live games (sporting fields). In order to reach a wide potential consumer and attain intended campaign effect, Flip invested EUR 2.5 million in campaigns, which included sponsoring sports cups and global TV shows.

1.5.2: Market development

The company, entered new markets (the Americans, Africa, Middle East, and Pacific) as a strategy to expand its market size and consumer base. Its international organizational structure is sub-divided with each division having own expertise and responsibilities for instance the Asia market had its own operation chief (Shaw, 2012). The approach was seen as ideal in dealing with different preference and perception of consumers in different region due to difference in culture and lifestyle. Expansion into Monaco and France came at a time the company needed to expand and take Netherlands’ consumer preference to other European nations. The expansion was not as successful as expected due to different consumers’ sensitive to cost and preference to quality. However, entry into the Pacific (Malaysia, Indonesia, and Singapore) saw skyrocketing in sales. This is attributable to the pricing and quality segmentation as consumer in the region.

1.5.3: Product development:

Flip has invested heavily into R&D to enhance its product quality as well as enhancing employee performance and productivity through emphasising on the training and mentoring programmes (Hassanien and Dale 2012). The scorecard demonstrate the companies commitment into learning and training programmes where it has invested heavily into R&D machines and personnel, having in place mandatory internal courses, ensuring employees are aware of the respective local laws and company policies. Balancing between product cost and reliability of the product is crucial especially given that investing more on research means increasing both quality and product pricing. By increasing the research by 33%, the company increases its product reliability to 90% from initial 85%.

Moreover, it sets awareness on privacy and data leakages, and significance and ways of using social media taking into consideration local laws, lifestyle, and beliefs. KPI measurement of education level of the staff was 65%.

Flip has in place on-boarding program that allows new employees to familiarise with both organizational culture, employees, structures, and policies, hence ensuring coordination and commitment among team members. In attempt to heighten the employee performance and productivity, the company set EUR 1000 for employees to spend on external training while also allocating 0.1FTE per employee for training purpose. As employees’ motivation, loyalty, and commitment, the company share 0.1% of the profit with the employees in additional to 1% annual remuneration to its entire workforce (REF). The company reward individual employee and team’s performance by giving a bonus of 1.5% of the salary for going above a target while those who met their target receive 1%.

Section 2: Challenges in International Business

Conducting business internationally comes with number of challenges and controversies. Operating in different country means facing different political, socio-economic, and environmental. According to Yang (2012) and Gokmen and Ozturk (2012), biggest challenges faced by international businesses include structure of the companies, foreign laws and regulations, right shipping methods, communication between branches as well as with headquarters, political risk, and difference in culture, beliefs, and lifestyle. However, the Flip organizational values are connectivity, affordably, and reliability was key on its expansion strategy.

2.1: Creating shared values

According to Porter and Kramer (2019), it is fundamental for any business entity to connect with its existing and potential consumers, employees, as well as other stakeholders (shareholders and distributors) by having commonness such as reliable and affordable products. Through creating shared value (CSV), a business entering into new market need to incorporate its core business activities with corporate social responsibility (CSR) towards solving social challenges within a community in which it operates in (Beschorner, 2014; Porter and Kramer, 2019). According to Michelini and Fiorentino (2012), CSV should be linked to a business core activities, manufacture, and distribution of smartphone in the case of Flip, in order to maximize both the values held a community and profit for the company.

The company’s global policy incorporate recruiting talented employees across the global then introducing them to their colleges through on-boarding program to familiarise with organization’s policies, ideals, values, and structures. The company recognised local unemployment rate hence implementing a program to take in local employees as part of social moral commitment such given society (Porter et al., 2011). Based on the social contract theory, outlining that businesses undertake their respective activities by following unwritten agreement with a community it operates in hence business activities is beneficial to the society (Eckerd, and Hill, 2012; Wilburn, K. and Wilburn, R., 2011). Therefore, the company uplifted the livelihood of community as a payback. Moreover, Flip, as a company, ensures all its employees are aware and comply with local laws, customs, and align with beliefs in addition to local consumer relation. The mandatory coaching program ensures they learn about risk and dealing with consumer complaints and questions.

2.2: Shared values with consumers

Flip uphold the assertion held by Eckhardt et al. (2010) pointing out that consumers are fundamental and most influential stakeholders in any business entity. According to Lussier and Halabi (2010), consumers determine the success or failure of a business by affecting directly or indirectly profits margin. Therefore, De Mooij (2019) argued that any business need to model its activities and operations as well as culture and values around consumers’ needs, preferences, and values. Flip adopted a consumer-to-business (C2B) business model, as evident by its values and slogan, (just relax) where the consumers through their preferences and needs, create values and then business them around its operations. As such, model of affordability and reliability ensures consumer drives the pricing segment and quality.

Additionally, the company takes serious consumer privacy and data protection. It ensures all its employees are conversant with local laws and regulations pertaining data protection and privacy by training them on compliance and data privacy. In order to capture the concerns and needs of all its consumers as well as other potential consumers, the company adopted a regional-based management systems where the head of the region such as the Pacific or the Middle East can formulate strategies aligned to respective consumers’ preferences and needs rather European counterparts. Lastly, the company fundamentally relied on the data from consumers that include preferred model, quality, pricing, and engagement through mapping consumer satisfaction index (feedback and suggestion) in strategies and making decision on future of the company.

On the other hand, the company had to making decision on marketing strategy that balanced the moral aspects of society making sure the consumers are not manipulated while formulating an approach to attract and reach out to as many potential consumer as possible. Based on the green marketing approach, Flip emphasised on environmental sustainability while avoiding greenwashing while avoiding waste that would harm the environment and subsequently, through effects of climate change, the society.

2.3: Empowering people

2.3.1: Talent attraction

As mentioned before, an organization’s workforce is instrumental to its success, performance, growth, and sustainability. However, Beck and Boulton (2012) illustrated that an effective workforce comprising of the committed and talented employees push an organization to another level. According to Meyer et al. (2012) employee commitment informed by surpassing given targets and lack of lateness and absenteeism have a serious consequence on team and individual performance. Bryant and Allen (2013) described a talented employee as characterised by commitment to the given tasks, roles, and targets and occasional going a step beyond tasks description. For Flip to meets its objectives of ‘connecting the world everywhere’, it must have talented team committed to and sharing same values. Currently, the organization has 26 full time employees working at the headquarters to coordinate and monitor global orders and shipments as well as handling customers’ complaints, queries, and concerns.

2.3.1: Talent retention

In order to maximum productivity and performance of each employee, the company sets maximum work load for each but if the pre-set value is surpassed, freelancers that include contractors and gig-employees are hired to reduce the workload and burnout. Flip commits EUR 85,000 per year although comes at a cost of less productivity and commitment to the organizational values and objectives.

Deery and Jago (2015) elaborated that retaining committed and highly productivity employees must always be a priority to an organization for its sustainability and continuous growth. There are number of ways in which management can adopt to prevent such talented and committed employees from leaving, especially leaving for attractive competitors, that include remuneration, bonuses, motivations, promotions, gifts, and opportunities for individual and career growth. Flip, as a business entity, is committed to retaining such talented employees through setting 1% of the salary as remuneration, 1.5% on those exceeding, 1% to those met the target performance respectively. The firm further shares 0.1% of the profit with the workforce. Additionally, each employee is given time (0.1FTE) and EUR 1000 for external training as a form of enhancing and acquiring knowledge and skills (Stahl et al., 2012; Schiemann, 2014). The effort placed towards advancing education and skills acquisition by workforce as seen education level of staff at 65%. The company has adopted the Purchase a Human Capital Management (HCM) support system aimed at increasing employee loyalty and productivity (Kucharcikova et al., 2016).

3.0 Guiding principles

Coupled with the organization’s slogan and values of reliability, affordability, and connectivity, it is driven by ideals of ensuring individual interest and needs are meet not just full but beyond expectation. Therefore, it adopts the anthropocentric perspective that centres its activities and operations to revolve around consumer needs. Furthermore, the company is committed to quality products and satisfactory consumer relations, which has seen increased investment into R&D over the years. Increasing the effectiveness of R&D researchers and machines, and other employees by emphasising on learning and training ensures moving towards those values and objectives. Moreover, the company contracted IDC, an Amsterdam, Netherlands based company to handle its supply chain system. IDC is well known for its efficiency, flexibility, high delivery speed, and low carbon emission as well as delivering globally. The company is paid EUR 32.50 ppu and a turnover bonus of 10%.

Thirdly, it takes commitment into environmental concerns seriously by ensuring sustainable operations, environmental-friendly products, low carbon footprint supply chain system, and commitment to global environment protection agreements.

Conclusion

Flip business model of reliability, connectivity, and affordability is structure to capture consumer’s needs and preference in smartphone industry. Entry into new market, development of new market, or expanding on existing one are some of the business expansion strategies adopted by Flip aimed at its growth and sustainability over the six-year period. Additionally, recognising significance of organizations structure and culture encompassed through values, beliefs, and consumer-business relations, it strategize through enhancing employee’s performance and productivity (talent recruitment, motivation, and retention), increasing product quality, heightening efficiency of delivery and production system, and developing consumer-centric approaches. Additionally, shared values between consumer and the company has propelled it develop approach geared towards consumer preference and social needs as well as environmental protection. As highlight above, Flip, as a business entity need to consider consumers as important and integral parts of their respective business model that includes using consumer feedback and suggestion in policy formulation.

References

- Aghazadeh, H., 2015. Strategic marketing management: Achieving superior business performance through intelligent marketing strategy. Procedia-Social and Behavioral Sciences, 207, pp.125-134.

- Ansoff, H.I., Kipley, D., Lewis, A.O., Helm-Stevens, R. and Ansoff, R., 2018. Implanting strategic management. Springer.

- Banker, R.D., Hu, N., Pavlou, P.A. and Luftman, J., 2011. CIO reporting structure, strategic positioning, and firm performance. MIS quarterly, pp.487-504.

- Beck, A.J. and Boulton, M.L., 2012. Building an effective workforce: a systematic review of public health workforce literature. American journal of preventive medicine, 42(5), pp.S6-S16.

- Beschorner, T., 2014. Creating shared value: The one-trick pony approach. Business Ethics Journal Review, 1(17), pp.106-112.

- Brenes, E.R., Montoya, D. and Ciravegna, L., 2014. Differentiation strategies in emerging markets: The case of Latin American agribusinesses. Journal of Business Research, 67(5), pp.847-855.

- Bryant, P.C. and Allen, D.G., 2013. Compensation, benefits and employee turnover: HR strategies for retaining top talent. Compensation & Benefits Review, 45(3), pp.171-175.

- Chen, Y. and Pearcy, J., 2010. Dynamic pricing: when to entice brand switching and when to reward consumer loyalty. The RAND Journal of Economics, 41(4), pp.674-685.

- David, M.E., David, F.R. and David, F.R., 2017. The quantitative strategic planning matrix: a new marketing tool. Journal of strategic Marketing, 25(4), pp.342-352.

- De Mooij, M., 2019. Consumer behavior and culture: Consequences for global marketing and advertising. SAGE Publications Limited.

- Deery, M. and Jago, L., 2015. Revisiting talent management, work-life balance and retention strategies. International Journal of Contemporary Hospitality Management, 27(3), pp.453-472.

- Dobbs, M.E., 2012. Porter's five forces in practice: templates for firm and case analysis. In Competition Forum (Vol. 10, No. 1, p. 22). American Society for Competitiveness.

- Ebrahim, R., Ghoneim, A., Irani, Z. and Fan, Y., 2016. A brand preference and repurchase intention model: the role of consumer experience. Journal of Marketing Management, 32(13-14), pp.1230-1259.

- Eckerd, S. and Hill, J.A., 2012. The buyer-supplier social contract: information sharing as a deterrent to unethical behaviors. International Journal of Operations & Production Management, 32(2), pp.238-255.

- Eckhardt, G.M., Belk, R. and Devinney, T.M., 2010. Why don't consumers consume ethically?. Journal of Consumer Behaviour, 9(6), pp.426-436.

- Geroski, P.G. and Jacquemin, A., 2013. Barriers to entry and strategic competition. Routledge.

- Gersbach, H. and Haller, H., 2009. Bargaining power and equilibrium consumption. Social Choice and Welfare, 33(4), p.665.

- Giannoulis, C., Svee, E.O. and Zdravkovic, J., 2013. Capturing consumer preference in system requirements through business strategy. International Journal of Information System Modeling and Design (IJISMD), 4(4), pp.1-26.

- Gokmen, A. and Ozturk, A.T., 2012. Issues of business ethics in domestic and international businesses: A critical study. International Journal of Business Administration, 3(5), p.82.

- Gwiazda, A., 2013. System Approach Concept as Teaching Tool of Strategic Management Fundamentals. Education of Economists & Managers/Edukacja Ekonomistow i Menedzerow, 27(1).

- Hahn, W. and Powers, T.L., 2010. Strategic plan quality, implementation capability, and firm performance. Academy of Strategic Management Journal, 9(1), p.63.

- Hassanien, A. and Dale, C., 2012. Drivers and barriers of new product development and innovation in event venues: A multiple case study. Journal of Facilities Management, 10(1), pp.75-92.

- Hsieh, Y.H. and Chen, H.M., 2011. Strategic fit among business competitive strategy, human resource strategy, and reward system. Academy of Strategic Management Journal, 10(2), p.11.

- Karakaya, F. and Yannopoulos, P., 2010. Defensive strategy framework in global markets: A mental models approach. European Journal of Marketing, 44(7/8), pp.1077-1100.

Take a deeper dive into Corporate Responsibility: sustainable business with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts