Economic Analysis of Tesco PLC

Introduction

The corresponding study would be involving the economic analysis of the selected organization for this purpose, which would be the Tesco PLC. Furthermore, this study would be delving into the analytical assessment of the macro-economic environmental context of the selected organization, the market exposure of the company as well as the pertaining effects of the same and the cost vulnerabilities to which the organization has been subjected to which could be ascertained from the comparison of the performance of Tesco PLC with the comparable competing organizations in the respective market scenario. The general information regarding the Tesco PLC highlights the company being a public limited company which is situated within the United Kingdom and had been incorporated and registered under the Companies Act 1985 with the registration number of 445790. The registered office of Tesco is situated at Tesco House, Delamare Road, Cheshunt, Hertfordshire, EN8 9SL, UK. According to Coe, Lee and Wood (2017) the company primarily performs the activities of retail functionalities within the UK, Hungary, Poland, the Republic of Ireland, the Czech Republic, Slovakia, Turkey, Thailand, South Korea, Malaysia, USA, Japan, India and China.

Market presence of the Tesco PLC

According to Coe and Wrigley (2017), Tesco PLC is the largest grocery retailing organization within the UK with 28% of market possession in terms of sales volume generated by 2646 sales outlets as well as 490 gasoline filling facilities belonging to Tesco Retail, situated throughout the UK. Tesco also has 25 distribution centres located at different parts of the country. Apart from these, the retail convenience line of business named One Stop has in excess of 700 shops throughout Wales, England and Scotland. The Tesco Group also provides insurance services and retail banking facilities through the subsidiary Tesco Bank which generated the revenue of £1051m and an operating profit of £149m during the financial year of 2017/18 and this outlined a growth of 3.9% in the revenue scale and 93.5% in the operating profit measures in comparison to 2016/17 when the revenue incurrence had been that of £ 1012m and the operating profit was £ 77m. Such statistical evidence is meant to corroborate and lend credence to the presumption of Tesco PLC being the leading retail organisation at the UK which outlines, partially, the success achieved by the organisation under consideration in terms of the macro-economic environment. Furthermore, the joint venture of O2 and Tesco PLC has resulted into the telecommunication operative Tesco Mobile which currently provides services to 5 million customers throughout UK through virtual mobile networks.

Tesco PLC has benefited from the diversification efforts of stores as well as product and market ranges. According to Byrom and Medway (2018), the store diversification involves the following:

◊ Tesco Metro ◊ Tesco Extra ◊Tesco Express ◊One stop ◊Tesco Homeplus ◊Tesco Superstores

Structure of Tesco market offerings

Furthermore, the product range diversification of Tesco has involved the establishment of mobile phone networks, financial services, music download services, DVD rentals, school uniforms, home ware and cotton trading internationally. According to Corbet and McMullan (2018) the company is considered to be the largest job opportunity provider within the EU through creating 743000 jobs so far. Significantly, the company has achieved a slew of international awards such as the following:

1: The Grocer’s Own Label Food and Drink Awards 2: The Grocer of the Year 3: ‘Waste Not Want Not‘ Award 4: Best Grocer Award (2018). 5: British’s Favourite Supermarket

The technological innovation introduced by Tesco has been, according to Dobson, Kim and Lan (2016) the utilisation of the RFID enabled systems of barcode identification for the accurate counting of the products in an automated manner. Advancements in the M-commerce as well as in the development of the latest mobile application have contributed in the formulation of a simplified model of business. One beneficial outcome has been the reduction of cost incurrence and optimisation of waste management systems. One critical strength of Tesco has been the introduction of own label product offerings. This has been oriented towards the strategy of enhancement of greater close proximity to the existing and prospectus customers through development of diversified formats of shopping such as metros, superstores, expresses and convenience stores. This strategy has been particularly followed at the UK. Furthermore, the own label products of Tesco have also permitted the company to consecutively improve customer service prospects and ensure the highest levels of satisfaction amongst the customers and to enhance and broaden the appeal of the brand value of the company through the finest ranges of product offerings so that the most diversified ranges of consumers could be catered to. The objective of the company in this context has been to strengthen the profit earnings. Evans and Mason (2018) have stated that the advantage of being the first mover was gained by Tesco through the launching of Tesco.com which has contributed in establishment of the channel through which finance generation and non-edible product sales have been performed. This has positively contributed in the growth of the market share. Furthermore, functions such as supplier management, global distribution network management and stock control mechanisms have been strengthened by innovative IT applications. The following are the benefits achieved by Tesco through implementation of greater effective IT applications such as Dunhumby and Tesco Clubcarddata: Continue your journey with our comprehensive guide to Economic Analysis of Tesco PLC.

1: Greater innovation management on the levels of retail service propagation. 2: Greater sharing of knowledge. 3: Curtailing of decision formulation time. 4: Greater consumer profile understanding. 5: Accurate shaping of product offerings. 6: Development of greater ranges of products and services through better information accumulation on different customer segments. 7: Greater analysis of shopping profiles by customers to develop more effective promotional strategies.

Tesco strategic business approach

According to Fernie and Sparks, (2018), the culmination of such macro-economic endeavours, on part of Tesco, has brought forth the four fold strategic approach to further the business fortune of the retailer. The components of such a strategic approach are as the following:

1: Making the shopping experience of the customers as effortless as possible. 2: Price adjustment to the measures where the offered products could become effectively affordable. 3: Enhanced provisioning of product choices and service options to the customers through multiplicity of sales outlets such as large and small stores, supermarkets and online shopping facilities. 4: Introduction of value and simplicity to the predominantly complicated market structures through streamlining of operations while attempting to minimise operating costs.

According to Filimonau and Gherbin (2017), the approach of Tesco, to compete in the global and UK markets as a discounter, has required the company to underpin the sales related strategic functionalities with the attitude of becoming the provider of services and goods with the lowest amount of permissible costs. The delivery of low cost model based goods and services has been oriented towards gaining of competitive leverage in the markets through the betterment of customer relationship management, formatting of stores and management of supply chains through the utilisation of justin-time supply and distribution networks.

Financial performance of Tesco

According to Haddock-Millar and Rigby (2015), the payout ratio of Tesco PLC in the form of the earning proportion delivered to the shareholders as dividends had been inconsistent throughout the period of 2008-2014. The statistical calculations are as the following:

It could be determined from the above table that the period of 2010-2012 had demonstrated the effects of the strategic failure on part of Tesco in implementation of the price reduction regarding certain products which had culminated in the decline in the aggregate demand of offered products since the consumers did not have the surety of the quality which they sought in the product offerings. In this context, Holland, Lindop and Zainudin (2016) have observed the inventory and pricing costs incurred during this period to be sunk costs. This involved the future costs and probable comparative revenue generation and the outcome was that the output (value added) and the total fixed cost remained the same, however, the variable total cost had to be readjusted which resulted in the lesser percentage of dividends being delivered to the shareholders. According to Laffy and Walters (2016), this decline had been followed by the considerable increase in the sharing of dividends which peaked during 2013 at almost 78% of the earning proportion in spite of the fact that earnings per share by Tesco had been decreasing during the financial year of 2013/14. Ma, Ding and Hong (2010) have observed that this trend signified the attempt by the company executive management to salvage the reputation of the company through earning the trust of the shareholders by delivering greater percentages till the financial scandal of 2014/15 when the Tesco executives inflated the profit margins and the detrimental outcome was 75% reduction of the dividend sharing. The ensuing crisis had also resulted in Tesco halting delivery of dividends for the years 2015-2017. According to Merrill and Batrouney (2019), the existing financial leverage involves the explanation of the debt amount which, any company such as the Tesco PLC, requires to finance over the total revenue capital. In this context, the chronological statistical calculations concerning the financial leverage of the Tesco PLC within the period of 2008-2015 are as the following:

As could be comprehended from the above table, the peak of the financial leverage prior to 2015 was in the year of 2010 with 3.34% of the total revenue capital. The interim years demonstrated the steady decline in the trend till the financial year of 2017-18 when the financial leverage extent had again surmounted the new height of 5.96% when the fraud had been already committed by previous Tesco executives. During this period of interim years, the sales volumes, assets and the equity of the shares registered variable growth with intermittent declines. According to Nguyen et al (2017), this period required Tesco PLC to increase standing debt to address all of the damages caused. Thus, the retailer required regaining of consumer loyalty through initiation of different projects and international expansion. According to Pantano and Gandini (2018), the resultant strategy of Tesco capitalised on the achievement of business objectives through which the value maximisation for stakeholders could be achieved. As per the research of Pijper (2016), the strategic growth of Tesco had been predominantly organic during the period of 2008-2014 through the utilisation of skills and knowledge which the company developed to better identify the customer profiles, to develop additionally effective supply chain management, to formulate new product ideas and to format the stores and localise the product offerings. Two significant joint business ventures during 2008 could be mentioned in this regard, with Royal Bank of Scotland for development of the Tesco Personal Finance and with Samsung for the purpose of establishment of effective business models in the targeted markets at South Korea. As a direct outcome, the sales and profit volumes in 2008, region wise, registered a significant growth as has been demonstrated in the following figure:

According to Robson and Pitt (2018), the financial year of 2011-12 had been particularly profitable for the Tesco shareholders since Tesco group revenue earnings was registered £64,539m which had been a marked increase from the £56034m from the previous financial year. This resulted in the underlying diluted earnings of 37.41p on a per share basis and per share dividend had been 14.76p with the group profit before tax being £3.8bn. Such improvement in the market performance of the Tesco PLC could be contextualised from the macroeconomic perspectives. According to Sadler and Evans (2016), being in the leading position as the grocery retailer as well as the supermarket within the UK, the sales and revenue extents of the Tesco currently supersede those of the competing market rivals within the UK with the possession of 27.3% of the retail market space in total. This capability scenario is further reinforced through the internationalisation of the organisational sales prospects which has resulted in the establishment of 6966 stores worldwide by 2018 which has been an 85.71% increment from the 3751 global stores in 2008. According to Singh (2019), this progressive expansion has been an outcome of gradual transformation of the financial profile of the global retailing business. The capital intensive nature of the retail expansion process had been catalysed by the rising valuation of multiple target acquisition prospects to overcome previously attained ranges of cost sensitivities on part of the consumers. The detrimental effect of this had to be suffered by Tesco through exacerbation of costs as this entailed additional capital investment for establishment of supporting Information Technology as well as logistics management infrastructure. Apart from these, the global retail market has become increasingly Oligopolistic since a limited number of retail MNEs have been dominating the markets throughout the international scenario and Tesco is an integral component of this Oligopolistic structure. According to Shi et al (2018), supplementary financial sources were utilised through cash generation from the domestic UK markets in addition to the acquisition of funds from the financial institutions in the forms of equity and debt. According to Son et al (2018), for instance, the HIT acquisition at Poland was funded by Tesco not through debt incurrence but through trading capital (£ 386 m), primarily through the capital derived from appropriately performing domestic markets at UK.

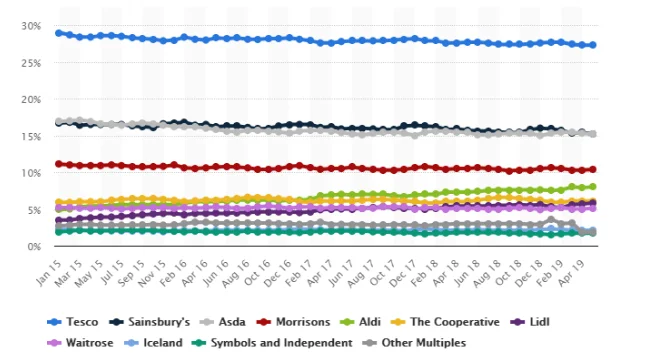

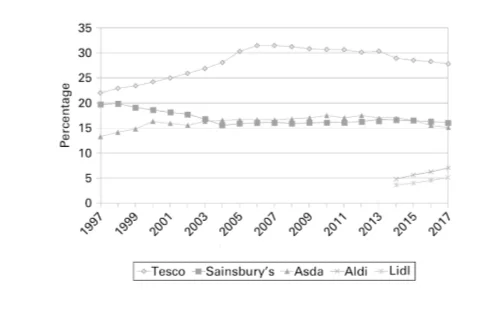

Tesco market performance in comparison to competitors

According to SPARKS (2018), after Carrefour and Wal-Mart, Tesco could be considered to be the third largest global retailer organisation, however, the majority of the annual sales generation of Tesco (80%) comes from the UK. However, in terms of the total sales area, the global presence (91298000 sq.ft.) has superseded that of the available selling floor space at the UK (50521000 sq.ft.). According to Strom (2015), this has transpired into the generation of 30% of the total group revenues of the company including the non-food product categories such as from the electronic to the beauty products.

According to Tench and Topić (2017), Tesco has been intending to withstand the economic tribulations in the coming years through utilisation of a variety of sources including medium and long term capital debts, retained profits, public issues with comparatively higher benchmark retention prices, introduction of commercial papers and bank leases and borrowings. Another method of overcoming cost vulnerability for Tesco has been to divert the cash flows which have been generated by the current assets towards reinvestment into or acquisition of new assets. Wood, Wrigley and Coe, (2016) have observed that the reinvestment is primarily oriented towards enhancement of the value of Tesco shareholder returns. The medium as well as long term capital is primarily utilised for the purchasing of fixed assets such as machinery and real estate and maintenance of the stores.

Financial performance management of Tesco in terms of fiscal vulnerability pre-emption

For Tesco, the financial metrics of profitability ratios over the years have been reflective of the cost and fiscal vulnerability of the company as well as the organisational financial performance regarding earning generation in relation to the operating costs, assets, revenue and equity of shareholders. This is of prime significance since this outlines the asset utilisation efficacy and stakeholder value enhancement by Tesco over a certain period of time as well as indicating the fiscal underperformances of the company regarding expansion of sales propositions which could negatively impact the pricing strategy employed by the retailer. One example has been previously stated to be the 2015 scandal of overstatement of profits which involved losses of £ 5.378 bn. This had culminated in the cumulative negative incurrence of all of the metrics of the profitability ratio. Since then, the restructuring of Tesco has ensured slight recovery from such a disadvantageous position. The comparative profitability ratio analysis is amply demonstrative of the underperformance of Tesco and Woods (2008) has delineated the disruptive effects of discount retailers such as Aldi and Lidl to be responsible for this. According to Wrigley et al (2019), the Weighted Average Cost of Capital (WACC) (6.7%) had been higher to the ROIC (3.74%) for Tesco (2017). The potential financial position improvement prospects of Tesco for the future are as the following:

1: Cutting of 25% prices in 380 products for competitive pricing purposes. 2: Further sales of unprofitable businesses such as the South Korean stores and Homeplus with generation of £ 4bn additionally as well as disposal of 95% share holdings of the Kipa (Turkish retail industry) to generate cash proceeds of £30 million, resulting in the £100 mn reimbursement of total external debt. The emphasis would be to expand the material value for the shareholder investment and strengthening of balance sheets. 3: Better competitive discounting of products through diversion of funds slated for promotional contribution to lower the offered prices in stores. This could effectively provide a financial buffer to the retailer to endure future economic shocks since this would optimise the working capital through lowering of initial investments.

Conclusion

The completion of the joint venture between Tesco and Booker Group (Bg) for £ 30 bn in 2018 has permitted Tesco to utilise the stores of Budgens, Londis and Premier (owned by BG) and this has catapulted Tesco shares 5.7%. Tesco would have to look forward now to formulate the leading food business in Europe through utilisation of a diversified range of wholesaling and retail resources gained from this joint venture since BG is the largest food wholesaler group in UK.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts