Ethics in Business Operations

Introduction

As has been opined by Contributor (2020), the word Ethics has been derived from the Greek terminology of Ethos which outlines the elements integral to human society such as habits, customs, characters and disposition. In the institutional sense, the term denotes the fundamental moral and ethical operational values which could be brought into effect by business entities such as Boeing in terms of conducting business services. The emphasis of ethical considerations on the business processes of any organisation could be comprehended in the measure of the necessity to conduct commercial functionalities through stringently adhering to the moral and ethical norms of the society in the manner of preclusion of any violation of existing legislative provisions encompassing all of the aspects of such commercial functionalities.

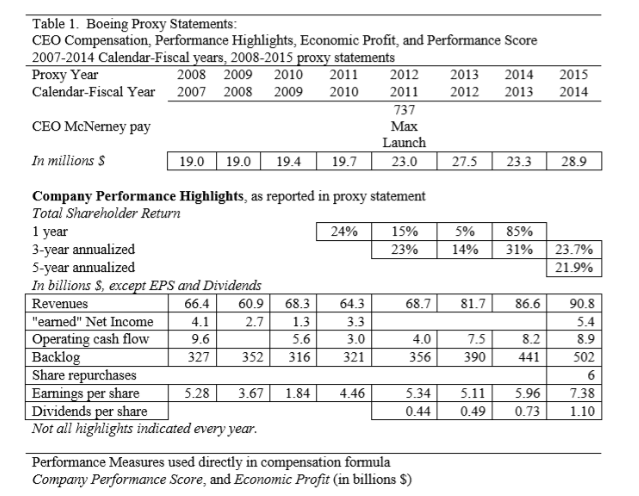

The launch of 737 by Boeing during 2011 had culminated into, in hindsight, a disastrous decision involving the serious damage which has been caused to the reputation of the company from the perspectives of ethical and public safety related considerations. The outcome has threatened the long term viability of the company. The attempt to factor in the element of risk reduction by the company in the production models of the 737 MAX had come directly into conflict with the objective of enhancement of organisational profit and company performance measures. The purpose of profit maximisation, which could be contextualised from the expansion in the pay structure of the CEO from less than $20 million in the two years which preceded 2011 to in excess of $26 million. In this context, the corresponding research study would be delving into the ethical implications of the operational measures implemented by Boeing for the puropose of commercialisation of the 737 MAX even at the cost of jeopardising the safety of aviation commuters and the flight operators. The subsequent research report would emphasise on the ethical perspectives associated with the operational functionalities of Boeing, such as instillation of the new Manoeuvring Characteristics Augmentation System (MACS), the malfunctioning of which precipitated the crash of two consecutive aircrafts (in October 2018 and in March 2019) within five months of each other, culminating in the death of 346 passengers and flight crew in total. According to Black et al (2018), the development of the Boeing 737 MAX category of aircrafts had been undertaken at a constricted budget of only $2.5 Billion and this culminated in implementation of shortcuts by the manufacturer in the format of emplacing an oversized aircraft engine on the airframe which had been at least 50 years old by the time the 737 MAX was inaugurated. Werhane (2019) has drawn attention to the 2011 annual report of the company under consideration which emphasised on the sustaining of development costs and subsequent cost overhead risks to a minimum in comparison to the requirements of development of a completely new aircraft so that the construction of 737 MAX could provide surplus resources through which greater investment in various other growth oriented projects related to the manufacturing company could be undertaken. However, as the case study has outlined, this envisioning of the development of an extensively profit making product which could provide the benefit of minimum business risk for Boeing, ended up in the disastrous experience with incalculable risks for the reputation, revenue and future growth prospects for Boeing.

Analysis

According to Fischer (2014), the impact of the two disasters on the business as well as the reputational dimensions of Boeing, not to mention the mortification of so many passengers and air crews leading to the unbearable cost in terms of human lives, could be considered to be pivotal in terms of strengthening the debate over the justification of Boeing to continue operations. Such arguments have been further illustrated by Grace and Cohen (2014) through bringing into focus the previously mentioned fact that Boeing had attempting to deflect attention away from the shortcomings in the design of the 737 MAX airframe and the hasty addition of the MACS software package to the airframes, with the supposed purpose of enabling the sensors of the aircrafts to function without any experience of technical glitches, was not communicated properly to the pilots so as not to bring into notice of such personnel the innate design complications associated with the stability framework of the 737 MAX fleet of aircrafts. According to Miller, Danny and Xu (2018), in both of the cases of accidents, including the Lion Air disaster at Indonesia involving 189 fatalities and the crash of Ethiopian Arilines at Addis Ababa with an additional 157 fatalities, the involved 737 MAX models had found to have nosedived into the ground after the MACS software suits had malfunctioned and had overridden the commands provided by the pilots in terms of stabilising the aircrafts and such technical glitches had culminated in the forceful lowering of the noses of the airframes while they were climbing after take-off.

Continue your journey with our comprehensive guide to Essential Elements of Business Operations.

Dig deeper into Resilience for Sustainable Business Operations with our selection of articles.

According to Nytimes.com (2020), the resultant impacts of these two incidents had tarnished the business reputation of Boeing on the basis of the divergence of outcomes of the contradictory statements issued by Dennis Mileunberg, Boeing CEO and the ensuing investigations launched by the Federal Aviation Administration (FAA) to determine the actual reasons behind such aviation disasters. According to Peterson (2019), Dennis Mileunberg, in the April 4th, 2019 press statement, had emphasised on the supposed fact that the MACS system had been activated when the pilots could have initiated as specific manoeuvre of their aviation platforms which could be deemed, in the aviation parlance, as an erroneous agnle of attack (climbing turn) which had conflicted with the innate programming of the MACS software suit concerning the extent to which the turning manoeuvres while climbing could be safely permissible for the 737 MAX platform. Such an emphasis has been suggested by Gormley et al (2014), to be a particular attempt towards deflection of responsibility of such disasters from aircraft design flaws committed by Boeing towards inadvertent flight characteristics handling by the pilots. However, this passing of blame attempted by Boeing CEO was proven to be an unethical endeavour by the ensuing investigation executed by the FAA, which placed the blame of these crashes on the unique aspects of the MCAS system which is neither a fly-by-wire based autopilot mechanism nor could it be operated in manual flight mode.

According to Black et al (2016), the MCAS had been implemented by Boeing so as to cover up the basic flaw in the design of the 737 MAX framework. This flaw had resulted from the attempt of the Boeing management to save billions of capital on the development costs of the envisaged completely new aircraft. The executive committee of Boeing had emphasised on the concealment of MCAS features from both the pilots and even from FAA. This unethical practice emanated from the decision by Boeing to not retire the aging 737 design and to develop the 737 MAX on the existing airframe to compete with A320 of Airbus through addition of new engines in the existent 737 airframes at much higher section of the wing since such engines were comparatively of greater thrust generation capacity than previous engines and their instillation was meant to enable the 737s to have greater flight range with sustained airspeed capabilities. The direct outcome persisted of complete alteration of the entire aerodynamics property of such airframes since these were at least 50 years old. The entire series of software, hardware, certification, design and training options were implemented by Boeing which brought forth the two previously mentioned disasters with 346 fatalities. The unethicality was centred on the attempt of the management to prioritise substantial reduction of business risks for the coming decades. Black et al (2018) have also opined that the compensation committee of Boeing effectively was convinced by the management board to factor in the risk reduction element within the projected economic profit and compensation performance score related to the company in future.

Lerbinger (2012) has observed that Boeing had described, in one of the proxy reports, the policies of compensation within the section entitled Executive Compensation – Compensation Discussion and Analysis. The justification of reduction of operational costs associated with the development of a completely new airframe has been purportedly highlighted by the company in the Performance Highlights section which encompass the standard financial accounting metircs such as order backlogs, changes in earning rates per share, pertaining cash flows and revenues. These factors, as has been observed by Ghillyer (2012) have contributed to the development of the ultimate determinant of the economic profit measure through variations in the measures of calculated company performance score for Boeing, since the organisational performance score in excess to 1.0 could indicate that Boeing could have surpassed the economic profit margin objectives for the year. De George (2011) has emphasised on the post-tax earning based net profit of capital charges as the primary measure of profit consideration for Boeing.

The above mentioned financial statement of Boeing has highlighted the large expansion of revenues for the company from 2011 onwards (from a baseline of $69 billion to the ceiling of $91billion by 2014). Such expansion in revenues and in earned profits was catalysed by the incremental sales of Boeing 737 deliveries of which increased from 3 in 2011 to 46 in 2012.

Thus, Crane et al (2019) have determined that the operational orientation towards ensuring profit maximisation and cost curtailing through deliberate developmental deprivations in the process of operationalizing the 737 MAX violated the first Fundamental Canon of the Code of Ethics of the National Society of Professional Engineers (NSPE). The preliminary findings indicated that the disasters were the outcome of the faulty sense or MACS which activated, prematurely, the counter-stall mechanism of the airframes leading to enforced downward pitch of the noses of crashed aircrafts. This has brought into effect the fact that pilots of customer airlines had not been notified in the proper manner the characteristics of the 737 MAX new models which have been equipped with the counter-stall MACS devices. The pilots of the existing 737 airframes have expressed, according to Trevino and Nelson (2016), the fact that no information has been ever shared with them by Boeing that faulty readings from singular sensors could activate the counter-stall mode of the software. Pearson (2017) have specified this to be the violation of principles related to informed consent factors and that such unethical functions from the airframe manufacturer has infringed upon the responsibility of th pilot to safeguard the lives of the passengers and the airline crews who parished in both of the crashes. The focal point of unethical practices undertaken by Boeing has been outlined by Werhane (2019) as violation of the principle of holding paramount the health and safety of the indirect stakeholders such as the passengers of customer airlines operating the new 737 models when Boeing used to charge extra for comparatively inconsequential modifications in the airframes such as emplacement of special instrument displays in the cockpit so as to warn the pilots in cases of divergent, inaccurate sensor readings. The absence of such safety devices at the cockpits of the crashed 737 complicated the process of diagnosing the malfunctioning systems for the pilots when little time was available.

Conclusion

From the ethical perspectives concerning the evaluated categories of organisational reputation, revenue systems, stakeholders and customers of Boeing, it could not be a prudent decisions to subject the company to enforced discontinuation since the organisation is one of the primere aircraft manufacturer globally with extensive customer (100 countries) and employee (65 countries) base. Discontinuation of the company would affect the entire airline industry on a global footing. Thus, it is necessary to maintain the operational functionalities of the company.

On the contrary, it is required to improve and reform the shortcomings in the management of Boeing which prioritized profit maximization at the cost of the safety of passengers of customer airlines. The company, instead of sharing the design shortcoming related data to the 737 MAX 8 pilots, attempted to preserve public trust through introduction of the counter-stall automated MACS software application to rectify structural flaws in the 737 fleet. In this context, Ferrell et al (2019) have suggested a range of crucial recommendations for Boeing to implement as in the following.

RECOMMENDATIONS

1: Company policy reconstruction

Boeing would be required to focus on to reformation of policies through which passenger safety would be provided the paramount prioritisation in terms of operational objectives.

2: Management reformation

The leadership elements of Boeing have to be sensitised towards implications of violation of industrial ethical principles concerning the preservation of passenger and customer safety. Executives have to be trained thoroughly in factoring in the public risk element while having to determine the development and introduction of new airframes or relating to modified versions of existing airframes.

3: Resolution of issues with the Federal Aviation Administration

FAA pilots would be required to test each version of flight assistance and control software which could be developed and installed by Boeing in the future airframes. The Joint Operations Evaluation Board of FAA requires to be active in terms of conducting the stimulator profile based examination of interaction in between pilots/air crews and software suits and cockpit display systems prior to completion of the certification process.

Discover additional insights on Global Operations Through E-Business by navigating to our other resources hub.

REFERENCES

D Black, E Black, T Christensen, K Gee Non-GAAP earnings for contracting and financial disclosure. Working paper Posted: 2018

Grace, D. and Cohen, S. (2014). Business ethics. Australia: Oxford University Press.

Miller, Danny and Xu, Xiaowei (2018). MBA CEOs, Short-Term Management and Performance.Journal of Business Ethics., Vol. 154.

Peterson, M. (2019). Ethics for engineers. New York: Oxford University Press.

Todd A. Gormley, David A. Matsa, Todd Milbourn (2014). CEO compensation and corporate risk: Evidence from a natural experiment. Journal of Accounting and Economics, Volume 56, Issues 2–3

Hoppe, E.A. ed., 2018. Ethical issues in aviation. Routledge.

Black, D., Black, E., Christensen, T., Gee, K., 2016. CEO compensation incentives and nonGAAP earnings disclosures. Working paper, Dartmouth College, University of Oklahoma, University of Georgia, and Stanford University.

Black, D., Black, E., Christensen, T., Gee, K., 2018. Non-GAAP earnings for contracting and financial disclosure. Working paper, Dartmouth College, University of Oklahoma, University of Georgia, and Stanford University.

Lerbinger, O., 2012. The crisis manager: Facing disasters, conflicts, and failures. Routledge.

Ghillyer, A., 2012. Business ethics now. New York, NY: McGraw-Hill.

Caldwell, C., Ichiho, R. and Anderson, V., 2017. Understanding level 5 leaders: the ethical perspectives of leadership humility. Journal of Management Development.

De George, R.T., 2011. Business ethics. Pearson Education India.

Crane, A., Matten, D., Glozer, S. and Spence, L., 2019. Business ethics: Managing corporate citizenship and sustainability in the age of globalization. Oxford University Press, USA.

Trevino, L.K. and Nelson, K.A., 2016. Managing business ethics: Straight talk about how to do it right. John Wiley & Sons.

Pearson, R., 2017. Business ethics as communication ethics: Public relations practice and the idea of dialogue. In Public relations theory (pp. 111-131). Routledge.

Werhane, P.H., 2019. The normative/descriptive distinction in methodologies of business ethics. In Systems Thinking and Moral Imagination (pp. 21-25). Springer, Cham.

Ferrell, O.C., Harrison, D.E., Ferrell, L. and Hair, J.F., 2019. Business ethics, corporate social responsibility, and brand attitudes: An exploratory study. Journal of Business Research, 95, pp.491-501.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts