Global Threads: Evaluating Macro Environmental Opportunities and Risks for Boohoo in China

Introduction

For an MNC to enter into a new market, it is important to analyse the macro environment, which can have a significant impact on the business. The macro-environmental factors help to determine the favourableness of the new market for the MNC to enter. Apart from that, it is also vital to identify the proper entry mode, which can be effective in the foreign nation. Based on this aspect, the report is going to analyse the macro environment of China for the entrance of a British MNC named Boohoo. It is an online fashion retail organization based in the UK. Established in the year 2006, the organization has revenue of about £580 million in the year 2018. The company is specialized in branded fashion clothing targeted for young customers with above 36000 products. The company always brings new products, with more than 100 new products dropping daily (Boohoo, 2020). However, if it enters the market of China, which has huge potential for growth for Boohoo, it first requires understanding its macro environment. Furthermore, the corporate governance codes of the nation, the sources of finance, and specific opportunities and risks for Boohoo in China also needed to be identified. In this context, seeking business dissertation help can be very beneficial for Boohoo to navigate through the complexities of entering the Chinese market smoothly.

Macro Environment Analysis

The macro-environment signifies every factor, which is a portion of a bigger society and can influence on the business of Boohoo. To understand the macro-environmental factors of China, the PEST framework is used.

PEST Analysis of China

Political Factors

The political structure of China is characterized by one party named the Chinese Communist Party, which has extreme priority and control over every function of the nation. This one-party political system gives a stable and riskless atmosphere for not only people but also businesses. However, when the economic system was deregulated from a command-based economy to a market-based economy, the authority was growingly decentralized. Presently, the central government, China, has tried to reduce the gap among diverse fields concerning developing standards, and provinces tend to give priority to local benefits rather than incorporated development of the entire nation (Chavan, 2018). Local protectionism can exert a harmful impact on the business expansion of Boohoo and deters the creation of a broad distribution network.

Take a deeper dive into Mitigating Risks with our additional resources.

Economic Factors

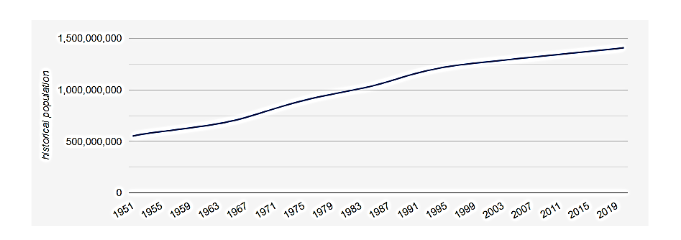

Concerning economic factors, China is regarded as one of the most potential nations throughout the globe with large GDP and a huge amount of global trade. The GDP of China is worth $13608.15 billion in the year 2018, representing about 21.95% of the global economy (see the following figure).

The economy of China has recorded the progress of about 6% in the last quarter of 2019. One key advantage for the economy of China is plenty and inexpensive labour, which can contribute to the business of Boohoo by producing clothes at low expenses. Based on this condition, judgment can be made that production in China comprising the fashion industry can maintain an optimistic perspective to prospects to a certain extent.

Take a deeper dive into UK UHT Milk to China with our additional resources.

Social Factors

While conducting business in China, social factors are extremely sensitive, which can impact on the business of Boohoo. With 1.4 billion population, the median age of people in China is 38 years, which can be regarded as a key source of income for Boohoo.

Furthermore, with the quick growth of the Chinese economy, the lifestyle of people is getting better. An increasing number of people are becoming rich with high disposable income, so showing off has become one of the keyways to live. These values will have a positive impact on the business of Boohoo. However, since China is a high context nation, individuals prefer to obtain an implied message (Lopez & Fan, 2009). Hence, for establishing a business in China, Boohoo needs to develop a strong relationship with different stakeholders.

Technological Factors

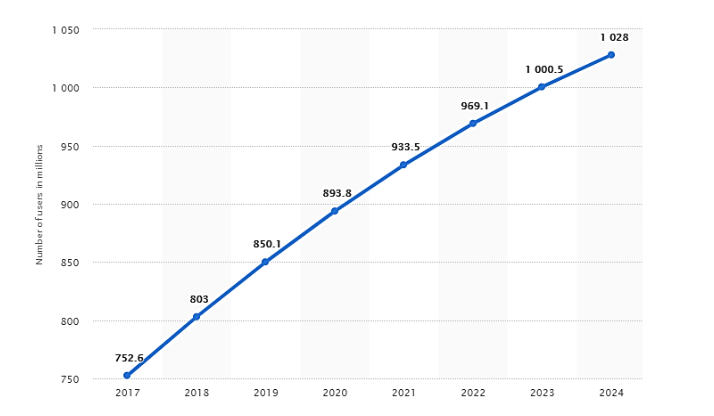

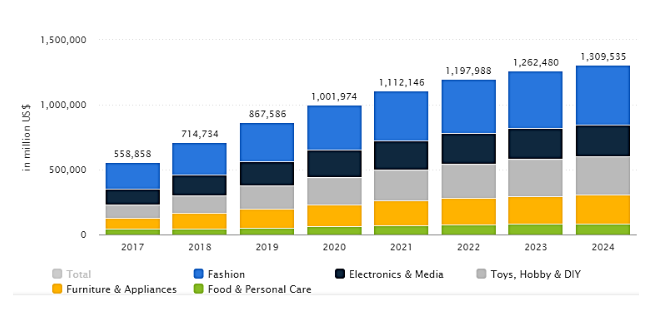

Strong technological aspects support business in China. For China, the emergence of the internet and developments in communication technology have facilitated and accelerated the information flow of new fashion trends and brands from customers to retailers, which can empower Boohoo to react rapidly with the latest impulses of customers. Furthermore, the advancement in technology. The eCommerce users in China was about 850.1 million in the year 2019, which is expected to become 1028 million by 2024 (see the following figure).

The revenue in the eCommerce fashion segment in China was recorded $303842 million in the year 2019 and is expected to reach about $464005.8 million by 2024.

This signifies increased customer demand for fashion products since the media constantly updates regarding new fashion styles. Technology has also resulted in the development of knowledge transfer and communication between organizations, which will help to benefit Boohoo by creating an effective communication network.

Entry Mode for Boohoo in China

Entry mode selection is an important aspect of the fashion retailer's market expansion. There are various factors, which can impact an organization's choice of entry mode. These factors can be evaluated by using different theories, which are described below.

Transaction cost theory: Transaction cost theory focuses on the relative effectiveness of diverse organizational structures to reduce the transaction expenditures related to conducting business in foreign nations, for instance, information search expenses and opportunism expenditures, among others (Bai & et al., 2017). According to this theory, organizations require to select entry mode with a high degree of control.

Bargaining power theory: Bargaining power theory raises the perspective that an organizational entry mode decision is subject to the relative bargaining power of the company with the host government to obtain access to the market. The key source of organizational bargaining power in this context is technological proprietorship and support to the local government. Based on this theory, an organization must select entry mode that either matches or increases the bargaining power.

Internationalization theory: Internationalisation theory observes foreign market entry as risky owing to market uncertainties, which can derive from political instability or cultural differences. Therefore, according to this theory, an organization should choose such entry mode, which has a low level of control, involving restricted resource commitment and reduction of risks.

Resource-based theory: Resource-based theory considers an organization to be an exclusive collection of tangible and intangible resources, which permit the organization to perform in a cost-efficient manner and support to organization's competitive benefit. By this theory, the organization requires to select such entry mode, which can best take advantage of its existing resources.

There are three choices for Boohoo to enter into the foreign market of China, which are:

Own subsidiaries: Opening a subsidiary company in China is regarded as the most expensive entry mode and involves a high level of control and also a high level of risk if Boohoo faces any problems in the market. In the context of the fashion segment, it is regarded as an organic growth strategy and primary method to enter but considering the differences in culture between the UK and China, this mode of entry should not be chosen by Boohoo.

Joint venture: Opening a joint venture is regarded as cooperative entry mode, which involves a moderate level of control. In this strategy, Boohoo can use the production units and knowledge of the local organizations in large and competitive markets. Considering the business environment of China, which is huge and competitive, and where it is hard for Boohoo to obtain property and to set up retail outlets directly, without knowing the market and having the proper resources, this mode of entry is perfect for Boohoo to enter into China.

Franchising: This entry strategy is based on a legal agreement between the parent company, i.e., Boohoo and a local associate, to sell the products by utilizing the brand name and established format of the parent company. This strategy involves a low level of control and requires to be used in high-risk nations, which are culturally different or have small markets with a low level of the sales forecast. Considering the market of China, which has a high prospect for sales and is politically stable, this method is also risky for Boohoo for entrance. Besides, there are inherent risks for Boohoo of losing control over the business and also dilution of brand image, while using this method to enter in the market of China (Lu & et al., 2009). Therefore, this mode of entry also should not be chosen by Boohoo to enter into the Chinese market

FDI Policies in China

For MNCs like Boohoo to enter into a new market like China, it needs to consider FDI to reorganize the production functions across borders. Host nations consider the inflow of FDI as a vital opportunity in the international market and to encourage economic improvement. Since the year 1993, China has been boasting the biggest amount of FDI inflow of every developing nation, with almost 90% of FDI is bought by Greenfield investment. FDI has played a vital part in supporting China's trade improvement and institutional restructuring. In reality, the Chinese government has already articulated a sequence of FDI policies, for example, tax incentives, tariff cuts, effective custom clearance, and online filing systems to manage investments. For instance, China has cut import tariffs on 1585 taxable products, comprising textiles, which can be beneficial for Boohoo to enter into the market. FDI in China happens through joint ventures, cooperative organizations, and wholly owned subsidiaries. Nevertheless, wholly owned subsidiaries are not allowed unless they are either implemented advanced technology and tools or exported most of their products. In the year 2001, China has eradicated trade restrictions, which are conflicting to the WTO commitments and inspired MNCs to usher in advanced technology and enhances the export quantity (Koty, 2018). Therefore, wholly owned subsidiaries swapped joint ventures as a key form of FDI in China. By the end of 2018, China had accumulated about $139.04 billion FDI, which demonstrates the entry of Boohoo in the Chinese market is favourable.

Comparison of Corporate Governance Codes between the UK and China

To enter the market China for Boohoo, it is important to understand the differences in corporate governance codes between the two nations, which is described below.

Sources of Finance in China

For stock listed organizations, there are various sources of finance available for Boohoo in China, such as internal and external sources of financing, direct and indirect financing, and equity and debt financing. For listed organizations with positive undistributed profits, an external source of financing is mostly preferred. The usage of an internal source of finance among them is quite low in China. Concerning direct or indirect financing, direct financing is mostly used by publicly listed companies in China to obtain capital. Then again, the majority of stock listed organizations in China prefer equity financing rather than debt financing. The large organizations in China demonstrate a strong preference towards allotment and issuance of new shares as a strategy for refinancing the business (Lou, 2011). Therefore, based on this, it can be stated that Boohoo can use an external and direct source of finance in terms of share capital in China as it is the most preferred financial option in that nation.

Discussion of Opportunities and Risks in China

The key opportunities for Boohoo for doing business in China are as follows:

1. The population of China is huge. Furthermore, its consumer class people are expanding rapidly. Their income is growing. The middle-income group of people in China are increasing, and accordingly, their spending is also increasing. Above 400 million people in China are currently regarded as middle-class people, and by 2022, above 550 million people will fall into this category. What Boohoo needs is customers with disposable income, which it can easily find in China.

2. In China, western brands are highly considered. Chines people are wannabe, and the desire to adore the fashion of western people. They mostly prefer western fashion, which can also bring significant opportunities for Boohoo in China.

3. Apart from that, China has a growing economy, and its labour is also inexpensive, which will be helpful for Boohoo to produce products in China at a reasonable rate.

The risks for Boohoo for doing business in China are discussed below.

1. The key risk for Boohoo in China is its different culture and language barrier. Without comprehending the culture, it is hard for Boohoo to become successful in the market of China.

2. The second important risk in China is bureaucracy and red tape. To start a business in China, there is a requirement to complete various administrative and bureaucratic procedures. This bureaucracy and red tape require a significant amount of time for company registration and obtaining approval for products.

3. Another important risk in China is Guanxi, which is termed a relationship. In China, the relationship is very important, and it requires patience to develop a strong relationship in the nation.

4. The final risk in China for Boohoo is competition. Many fashion retail companies in China are looking to enhance the product quality and variety. Therefore, Boohoo will find harsh competition in the Chinese market (Leach, 2018).

Exposure to Foreign Exchange Risk and Its Management

The MNCs which operate in China are always faced with currency risks and the devaluation of Yuan. This devaluation can have a significant impact on the profitability of Boohoo. While China has usually intended to maintain its currency competitive against other popular currencies for boosting the exports, such strategy appears to have given way to one weighted towards stopping the critical level of depreciation of Yuan, mirroring the increasing role of China as a large player in the international capital market. In the year 2015, the People's Bank of China has devalued the currency, with a 1.6% move in the managerial trading band. While officials decided to minimize the Yuan's trading band, its market exchange rate reduced by about 4.4% shortly. Hence, the exporters have faced a significant reduction in profits, while importers possibly advantaged from minimization in expenditures of business (Vrondas, 2020). Therefore, to manage the currency exchange risks, Boohoo can use different tools, such as FX options, forwards contracts, and undeliverable forwards. These tools will assist the company in controlling the currency threats and in saving itself from loss.

Conclusion and Recommendations

With the large size of the economy, China can be a great opportunity for Boohoo to enter and expand the business in a new market. Entering into the market of China can be an alluring idea, but at the same time challenging for Boohoo. The increasing middle-income group people and their preference for fashion brands will be favourable for Boohoo to grow the business. China has a massive internal consumer market; however, to exploit the market, there is a need to understand the Chinese culture. Apart from that, communication can be a great challenge for Boohoo. Therefore, it requires Chinese people to translate the language. The success in the Chinese market is subject to developing a good relationship with key stakeholders, and therefore, this should be considered by the company. In addition to this, Boohoo must also provide more consideration about maintaining the business activities and minimizing the expenditures. The success factors for Boohoo in Chain will comprise differentiation strategy, effective distribution, strong information and communication technology, quick delivery of products, and quick development of new designs and trends.

References

Bai, H. & et. al., 2017. Luxury Retailers' Entry and Expansion Strategies in China. International Journal of Retail & Distribution Management, Vol. 45, No. 11, pp. 1181-1199.

Chavan, R. B., 2018. Analysis of Fashion Industry Business Environment. Trends in Textile & Fashion Design, Vol. 2, No. 4, pp. 212-219.

Lou, X., 2011. Study on the financing methods of China's listed companies. 3rd International Conference on Information and Financial Engineering, Vol. 12, pp. 437-441.

Lu, Y. & et. al., 2009. Factors influencing international fashion retailers' entry mode choice. Journal of Fashion Marketing and Management, Vol. 15, No. 1, pp. 58-75.

Looking for further insights on Global Marketing Assignment? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts