IBM and Marginal Costing Overview

Introduction

The marginal cost pricing is being described in this paper. IBM is selected to describe this cost pricing methodology here properly. These cost pricing are generally the amount cost to the manufacturer for the production of materials. The manufacturer is required to calculate the products cost price so that loss or profit on the material can be understood easily. Thus marginal costing is being described in this paper among the other costing methods so that profit margins can be understood here easily.

Business overview

Marginal costing is focused on the production of materials and the sale that is being produced. IBM is thus selected here for the same purpose to demonstrate the advantage and disadvantages of this marginal cost. IBM is based on Global business services and is situated in the US. It is a software solution organization and is highly oriented to its customer satisfaction. They are incorporated with advanced tools and technology so that can help their customers in every need and can grow their business to a great extent. They have a good market value and are also looking forward to enhancing their business across the borders. They have fought a long for getting peace for the rapid changes and revenue growth for their business. IBM is having a good acquisition strategy to grow their business. Their 44 per cent enterprise is based on this cloud managerial business model and they are focused on enhancing the marginal costing to gain good growth in their business.

Marginal costing

Marginal cost can be described as the extra cost required to equal the cost required in the production of materials. When there is a loss to organizations they generally set the marginal cost so that cost of production can be raised easily. An example can be seen of marginal cost is suppose a martial with a cost of $1.00 and its selling price is $2.00, then the organization lowers these price to $1.5 if the demand of material is low. These can help to gain the expenditure in production. The marginal cost seen here is $1.5 which is better than no sale. The marginal costing can be seen in cases where organizations are focused to sell the same products on the same price (Leung et al. 2018). These marginal costing can be a risk also if the seller couldn't pay the fixed cost. Marginal cost can be said to be direct or variable one.

The other cost such as fixed or rent or other added cost is avoided here in this marginal costing. Marginal cost is generally profitable as it adds a fixed cost to the selling price. Marginal cost is thus set so that the profit or extra income can be gained or rather proper revenue can be generated above the set price. These marginal costs are also named as variable costing or direct costing. The impact of those costing on the material can be evaluated directly (economicsdiscussion.net, 2019).

Advantages of marginal costing

Simple: It is simpler and easy to be calculated. They are mostly the same irrespective of several sales and productions. The graphs and data that are prepared are easy to be understood. Better analysis can be done by the same charts and graphs for the future of the business. The results of this marginal cost are generally easy to be understood and are useful for them (Ahn, 2017). It can be said that it is beneficial for short term decisions. The long term one are generally avoided for the case of marginal cost. These marginal costs are easy to compute and can be handled easily by the mangers.

Profitable: These are profitable to organizations in different ways. A good relationship between the output cost and the profit can be seen here in marginal costing. The other terms that can be seen to be used in this costing are direct and the indirect one which is used in the USA (Hayes, 2017). If the materials are still in stock and couldn't be sold then the marginal costs are adjusted in a certain way to gain the required profit.

Control of cost: the cost can be controlled here easily. These are generally divided into two parts naming variable and fixed one. The cost of productions is generally covered in this section and is managed with the profit that is to be gained. Impact of the profit can be seen in the graph or calculations easily. Thus the standard control and budgeting control can be easily achieved by this method here (Bauer, 2016). Generally, the finished good is managed here properly. Efforts related to increasing sales can be achieved by this method easily.

The decision making can become easy for the management and the other team members. A better result can be expected from this method. The whole contribution to the cost and sales can be seen here. Cost and sales behaviour can be achieved here easily by this marginal cost method (Rambha et al. 2018). The easy result is grasped in this case.

The contribution and key factor regarding the budgeting and planning can be discussed by this marginal costing method.

Disadvantages of marginal costing

Not suitable for long term policies: When it is computed for the long term then the cost becomes varying one for different level. It changes for various situations thus cannot be determined for long term part.

Price can be lowered: The selected price can be lowered as per the conditions. A fixed price is not there (Brown, 2016). When goods are remaining in huge amount then in those conditions these marginal costs are lowered so that some profit can be achieved instead of no sale.

Incomplete information: Incomplete information is generally achieved due to other dwindling needs and requirement of goods (Becker, 2018). Moreover, the reason for the lowering or increasing of that marginal price is not explained here properly.

Sometimes the fixed and the variable costing difference is not easy to be understood. Several of assumptions are made which doesn’t have any relation s to the truth. As if it can give unrealistic result as they may change. In marginal cost, only the variable cost are focused and thus loses its importance while capital investment (Hall, 2018). The problem is related to the variable overheads.

It is difficult to be applied in various industries. When the fixed cost is not included then the loss can be seen every year (O’Shaughnessy et al. 2018). The time factor is not described herein the marginal costing. Two jobs may take a long time for the completion and the computation of the time for each can be hard.

Limited scope is there regarding this costing and these can increase as per time. If fixed costing is ignored then it becomes hard for the capital investment. For stock and other valuations, this methodology is not acceptable sometimes. The financial statements are not able to be designed properly by this method here. The income tax is not able to accept it for the calculation purpose (Toughnickel, 2019).

IBM is said to be innovative for this marginal costing method. Their view regarding marginal costing is positive and had given good growth in their revenue and income (buscompress, 2019).

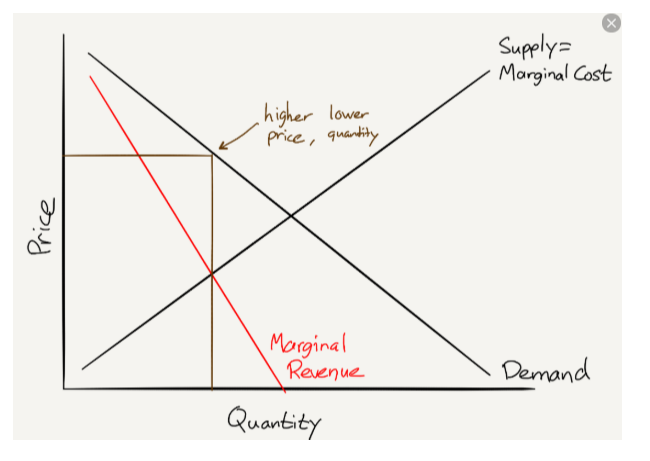

The marginal cost for IBM is shown in the graph. The higher and the lower point are seen here clearly by the graph. Direct or marginal pricing is highly initiated by IBM. This technique can help to gain good business performance and sale also (pdfs.semanticscholar, 2019).

The mark-up pricing or pricing strategy is to be followed up here in this case. The mark-up pricing strategy as suggested is the pricing strategy where the cost can be earned by equalising the retail pricing strategy. The seller generally makes good money on every product or unit of product. The volume of sale in this strategy is high in the market available. A certain percentage is being added in the cost and generally provides a good profit for the business available. Generally the selling prices are resulted by the addition of cost price and mark-up pricing strategy here in this case. The price bundling can be said as a beneficial pricing method where the product bundling or package dealing is analysed easily. In this case buyers generally buy two products for one price rather than buying all those individually. The overall sales, average sales, and profit can be incremented easily by the method of product bundling. The market demand of the product can be determined by the help of this mark-up pricing not by the product bundling.

IBM has a great strategy for the business and also a good financial method for their marketing aspect. They have a great adoption of mark-up pricing strategy and thus precede a good business aspect. IBMs financial is to gain a good business aspect and become a successful software manufacturing organization in the business sector.

Conclusion

Thus it can be concluded that marginal costing is necessary for origination to set a proper cost to gain a good profit. Here in IBM, the marginal costing is applied that can be seen by the graph also. It is also seen that these marginal costing are beneficial for the short term decision made. Few of advantages, as well as disadvantages, can be seen by this marginal costing method here. It is to be recognised that this method is an easy and useful one. It must be understood that marginal costing is just a difference between this fixed and variable costing method. The profit, as well as determination for this costing method, is easily seen in this paper. It is beneficial in decision making for management. Various financial statements can be made by this methodology here. In the case of a large amount, this method proves to be a beneficial one.

This gives additional information regarding the profit and the revenue that is required to be generated by the organizations. The capital budget risk analysis can also be done here easily. Cost management and accounting tools are generally designed by the help of this marginal costing here. The proper determination of pricing and cost management can be seen here. A case may happen when the goods are in stock and need to be sold, thus in such condition, the marginal cost is required to be brought below the expected one. This is a disadvantage but is required because it's better to gain something instead of a loss.

Looking for further insights on Global Professionalism: Big 4 Firms in Bangladesh ? Click here.

Reference List

Books

Leung, W., Windmark, F., Brodl, L. and Langner, J., 2018. A basis to estimate marginal cost for air traffic in Sweden.: Modelling of ozone, primary and secondary particles and deposition of sulfur and nitrogen.

Journals

Ahn, J. and McQuoid, A.F., 2017. Capacity constrained exporters: Identifying increasing marginal cost. Economic Inquiry, 55(3), pp.1175-1191.

Hayes, A.S., 2019. Bitcoin price and its marginal cost of production: support for a fundamental value. Applied Economics Letters, 26(7), pp.554-560.

Bauer, D. and Zanjani, G., 2016. The marginal cost of risk, risk measures, and capital allocation. Management Science, 62(5), pp.1431-1457.

Rambha, T., Boyles, S.D., Unnikrishnan, A. and Stone, P., 2018. Marginal cost pricing for system optimal traffic assignment with recourse under supply-side uncertainty. Transportation Research Part B: Methodological, 110, pp.104-121.

Brown, P.N. and Marden, J.R., 2016. The robustness of marginal-cost taxes in affine congestion games. IEEE Transactions on Automatic Control, 62(8), pp.3999-4004.

Hall, R.E., 2018. New evidence on the markup of prices over marginal costs and the role of mega-firms in the us economy (No. w24574). National Bureau of Economic Research.

Becker, N. and Farja, Y., 2018. Estimating the marginal cost of nature conservation: evidence from Israel. International Journal of Sustainable Development & World Ecology, 25(4), pp.340-350.

O’Shaughnessy, S.A., Evett, S.R., Colaizzi, P.D., Andrade, M.A., Marek, T.H., Heeren, D.M., Lamm, F.R. and LaRue, J.L., 2019. Identifying Advantages and Disadvantages of variable rate irrigation-an Updated Review. Applied Engineering in Agriculture, p.0.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts