Impact of Mergers on Acquirer Shareholders

1. Introduction

1.1 Motivation

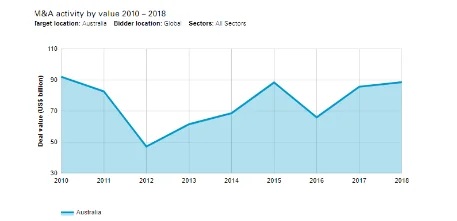

Mergers and Acquisitions (M & A) activity is the most critical aspect of the modern economic environment. In the context of the contemporary business environment, a carefully designed and executed acquisition process can establish a substantial value for the merging firm by advancing the operational efficiency. A business entity can take different benefits and other synergistic gains that could be correlated with a combination of various business activities. However, a bad acquisition decision could hamper the overall efficiency of companies (Faff, Gunasekarage & Shams, 2017). Therefore, this study has tried to examine the implications of Mergers and Acquisitions on the returns of acquirer shareholders. For determining the acquirer shareholder returns, investors consider different variables and determinants to examine organisational efficiency and profitability that include revenues, stock prices, profit growth, and abnormal stock return. In the context of the Australian economic environment, the approach of M & A has played an important role in shaping the Australian economy after the financial crisis. This is because weak economic growth leads to several difficulties to Australian companies to maintain stable growth along with profitability in highly competitive market trends. Therefore, the concept of Mergers and Acquisitions has gained significant popularity in the last five years to improve the overall organisation efficiency (Hossain, Heaney and Yu, 2018). It plays an important role to influence optimum utilisation of resources. In the last three years, Australian companies have maintained significant growth in the Mergers & Acquisitions. The assessment of Mergers and Acquisitions trends in Australia, the total value of M & A deals has reached AU$123.1 Billion in 2018 as compared to AU$119.1 Billion of 2017. In 2017, the total number of M & A deals was reached to 618 as compared to 583 of last year (Australia M&A and PE activity hit new heights in 2018, 2019). Therefore, this investigation tries to examine different elements of the Mergers and Acquisitions process.

1.2 Aim

The aim of the present investigation is “To Evaluate the Returns to Acquirer Shareholders in M&A in Australia”.

1.3 Objectives

As per the study aim, the first objective of investigation is to evaluate different motives of Mergers & Acquisitions. Furthermore, the examination of key determinants of M & A to maximise the shareholder’s wealth has been identified as second objective. In the third objective, the study is focused to determine the relationship between M & A and acquirer shareholder’s returns in Australia

1.4 Research Questions

The study tries to answer questions such as what are the different motives of Mergers & Acquisitions, what are the important determinants of M & A to maximise the shareholder’s wealth; and how does M & A influence acquirer shareholder’s returns in Australia?

1.5 Contribution and Summary of Findings

The rationale behind the selection of the present study is that there have been several studies carried out on the importance and growth of M & A activities. In this context, Rani, Yadav, and Jain (2015) stated that M & A helps companies to stimulate organisational growth and efficiency. Moreover, the increase in the level of market competition is being emerged as an important driver of M & A. However, previous studies have identified some deficiencies in the assessment of the impact of M & A on the acquirer shareholder’s returns. Therefore, this study is going to investigate the acquirer’s abnormal stock returns for examining the implications of Mergers & Acquisitions. In the context of the present investigation, performance study has paid significant attention to the semi-strong market efficiency that shows that the share price of an organisation is significantly influenced by the new information that reaches the market. Therefore, any changes in the fundamental value of a company should immediately be reflected in the share price of the acquirer firm (Hassan & et al., 2018). Therefore, the findings of the present investigation would play an important role to determine the relationship between the Mergers and Acquisitions of an organisation and share prices of acquirers companies.

1.5 Study Structure

The present follows a systematic structure to complete the whole study appropriately. The first chapter “Introduction” has determined the background with research gaols. It presents a brief overview of the whole investigation. The second chapter “Literature Review” carries out a systematic assessment of past studies and views of different authors about the subject matter. This part presents an in-depth understanding of the different aspects of Mergers and Acquisitions. The third section “Research Methodology” examines the appropriateness of different research approaches and methods with reference to study goals which have been applied by study to attain study objectives. The next section presents the ‘Findings’ of the present study by applying different approaches to data analysis. The fifth section “Discussion” evaluates study finding which has been acquired from different sources. The last stage determines the conclusion of the whole investigation.

2. Literature Review

2.1 Mergers & Acquisitions Motives

The investigation of Florio, Ferraris, and Vandone (2018) has found that the primary motive of M & A is to maximise the shareholder’s wealth by maximising the market value of an organisation for its owners with efficient financial management. In the context of the acquirer’s standpoint, an organisation can add the value in the acquisition process when the acquisition of the target company exceeds the cost of acquisition. In this regard, high-speed growth and synergy have identified important motives of M & A. Pathak (2016) asserted that M & A plays an important role to manage different types of uncertainties along with the slow internal expansion. Therefore, companies are tried to manage different opportunities to stimulate sales growth that results in an improvement in the profitability of companies. Therefore, an increase in the profitability of the acquirer’s firm adds value for shareholders. Chen & et al. (2020) stated that Synergy could be termed as an important motive of Mergers and Acquisitions. It is termed as the ability of a corporate combination of two firms in order to become more profitable. This concept is worked on the net acquisition value as per the two elements that are termed as operational synergy and financial synergy. Operating synergy is incorporated to attain the objective of revenue enhancements and cost reductions that could be managed through the horizontal or vertical merger. This is because sources for revenue enhancement direct influence the firm’s valuation process (impact of Mergers and Acquisitions on the operating performance and shareholders’ wealth – analysis, 2015). On the contrary, cost reduction is identified as one of the important element at the economies of scale to highlight the efficiency of M & A deals. Yang & et al. (2019) argued that financial synergy had found a very effective approach to reduce the cost of capital. Therefore, shareholders can find an increment in the value of the firm with reference to tax benefits and excess cash through which an organisation can manage its investment in high return projects. It helps firms to manage financial distress.

Dig deeper into Trends and Success Factors in Mergers and Acquisitions with our selection of articles.

Diversification is also considered as an important motive of Mergers and Acquisitions. Humphery‐Jenner & et al. (2017) asserted that the diversification of business operations plays an important role to maintain organisational sustainability. In this context, companies can expand business operations by buying other firms rather than growing the firm through internal operational expansion. The diversification of the acquirer’s business increases operational efficiency and creates new earning opportunities that could encourage the shareholder’s wealth in a positive manner and reduce the risk of investment. In the context of other economic motivation, agency theory supports companies to attain the objectives of diversification. It can be managed by horizontal integration and vertical integration. Li & et al. (2018) stated that horizontal integration enhances an organisation’s value when a Mergers and Acquisitions are taken place among rivals that would find a great tool to increase the market share. It also affects the market power of the firm. The assessment of Alhenawi & Stilwell (2017) has determined that the market structure is categorised into two extreme forms under the economic theory. In one context, a pure competition where each seller plays the role of a price taker, and it cannot influence the market price of different products and services. On the other side, monopoly (market power) creates a market environment where only one seller is identified in the market that has the substantial power to influence the price of different products and services in the attainment of profit goals of the company. On the contrary, Agarwal & Kwan (2017) argued that vertical integration is focused on performing merger or acquisition between companies that are having a buyer-seller relationship. There are various motives for vertical integration identified that include assurance of a dependable source of supply, quality maintenance, along with timely delivery considerations that could lead to a positive relationship with shareholder’s wealth.

The investigation of Segal & et al. (2019) has found that the hubris hypothesis is also considered as an important motive of Mergers and Acquisitions. According to the hubris hypothesis, managers have their motive to acquire other companies. It affects the firm’s valuation process that could influence the shareholder’s wealth in both a positive and negative manner.

2.2 M & A Performance Study or Valuation

The study of Faff & et al. (2019) has identified that shareholder’s wealth creation is being addressed as the primary goal of management. An organisation considers several strategies to examine the post-M & A performance that include the assessment of turnover and profit growth, evaluation of relative firm’s value, review of short and long term stock performance. In addition to that, abnormal stock return and post-M&S incremental cash flow. In this context, the study of Faff & et al. (2019) has found that acquiring firms experienced a significant increase in the stock prices of the company. Therefore, it can be stated that Mergers and Acquisitions plays an important role in increasing the shareholder’s wealth. It plays an important role to influence the firm’s value.

2.3 Determinants of the Firm’s M & A Deals

The investigation of Faff & et al. (2017) has found that the size of the target firm influences the acquirer’s value. This is because it leads to a direct impact on the returns of shareholders. This is because larger acquirers have found lower announcement returns as a reason for higher agency costs. Apart from that, larger targets have addressed lower announcement returns due to a lower proportion of premiums. Furthermore, Hossain & et al. (2018) stated that the method of payment is an important tool that encourages market-based up and downs. Therefore, it plays a critical role in determining the acquiring firm`s stock return. In this context, the investigation of Rani & et al. (2015) has found that the market will react positively when M&A deals are completed with cash payment as compare to other deals that are signed with a mixture of cash and shares (equity). In this context, the approach of the signalling hypothesis suggested that an acquirer firm that issue equity to manage the payment of M&A deal believes that its stocks are overvalued, and it would influence the overall value of the firm. In other words, the market suggests that the equity capital that is being offered is more overvalued as compared to the target assets that would be acquired in the Mergers and Acquisitions deal. Therefore, an announcement of an M&A deal with asymmetric information along with the stock payment option will influence the organisation to convey valuable information to the market (Impact of Domestic M&A on Acquirer Shareholder`s Equity: Evidence from Oslo Stock Exchange, 2017. This approach could result in a lower CAR because different market indicators are re-evaluating the acquiring firm with reference to contemporary market trends. Hassan, Ghauri & Mayrhofer (2018) argued that the signalling hypothesis also suggests that M&A deals with cash payment options show the financial strength of the acquirer company. Moreover, this approach also influences the acquirer’s firm to manage the company’s investment in positive net present value projects.

The investigation of Florio & et al. (2018) has found that an overvalued acquirer is mainly adopted the option of stock as the method of payment method because management believes that this approach can influence a negative share price correction that could be carried out by the market. Moreover, shareholders would find the reduction in acquirer share’s value when its overvalued equity is converted to low-value equity with appropriate correction. Furthermore, empirical studies have supported the concept in which mispricing has emerged as an important motive when acquirers consider equity as the most reliable method of payment (Pathak, 2016). It could be considered an important reason so as the market “punish” this specific transaction. Therefore, shareholder finds a reduction in returns. Yang & et al. (2019) asserted that the size of the bidding, along with the target firms lead a significant impact on the acquisition returns. In this context, the bidder (target firm) size is significantly influenced by its market capitalisation. Kansal & Chandani (2014) asserted that bidder announcement returns are not influenced by the bidder size in some cases because several factors of the business environment affect the market capitalisation and goodwill of a firm. Popli & Sinha (2014) stated that managers in smaller firms require closer monitoring as a result of higher ownership concentration that may affect the acquirer’s return in Mergers and Acquisitions. In addition, managers of larger firms may be more focused on hubris approach, and it plays an important role in determining the social relationship between managers. Therefore, top management in the business entity would face fewer obstacles and issues in assessing appropriate sources of finance to complete M & D deals. Chang, Chang & Wang (2014) asserted that the larger targets also provide lower acquisition returns for the target firm’s shareholders. This is because the larger targets find a low proportion of the takeover premiums. According to the study of Yılmaz & Tanyeri (2016), firm valuation/investment opportunities are also considered as important determinants of Mergers & Acquisitions. This is because the valuations of the merging firms play an important role to influence the acquisition returns. In this context, the approach of Tobin’s Q has identified as an important measure of firm valuation. This tool approximates the value of the firm by adding the market value of equity capital within in the book value of assets and deducting the book value of common equity which is divided by the book value of assets. The investigation of Parola, Ellis & Golden (2015) has found that high Q bidders or firms find higher returns during the Mergers and Acquisitions. On the other side of Tobin’s Q, the book-to-market ratio (B/M) can be considered as an alternative approach to firm valuation. B/M is mainly incorporated by dividing the book value of equity from the market value of equity.

Xu (2017) asserted that the bidder and short-run target returns are positively correlated with the book-to-market ratios of the particular organisation. Bidder (target) stock price run-up is being considered an important determinant, and it is acquired by making appropriate adjustments in buy-and-hold stock return within a certain pre-announcement trading period. Moreover, it could be associated with the 200 trading days that will be ended 6 days before the final announcement. In the context, the study of Kansal & Chandani (2014) has found a negative relationship between bidder returns and bidder stock price accumulation. Similarly, target returns are not linked up with the target stock price run-up within the firm valuation process. According to Popli & Sinha (2014), the cross-border acquisition is also considered as an important determinant of M & A process. Therefore, the returns to merging firms are highly correlated by the cross-border status of the M & A deal. Chang & Wang (2014) examined the merger and expansion trends in multinational companies and found that multinational corporations that have expanded their business operations into new overseas markets for the first time have recorded positive returns. However, Yılmaz & Tanyeri (2016) argued that that cross-border acquisition generates lower returns than domestic acquisitions. This kind of situation is mainly faced by US and UK acquirers. Therefore, the economic position of a country leaves a direct impact on the acquirer’s return in the process of cross-border acquisition. In the context of cross-border deals, the investigation of Parola, Ellis & Golden (2015) has found that the acquirer finds a positive return within a cross-border public acquisition process when the shareholder’s protection in the target firm country is very low. However, acquirers assess negative returns when the target firm country has determined different policies and regulations for the protection of shareholders. Moreover, acquirer returns are also associated with the quality of accounting standards. This is because a country with a high degree of accounting standards would facilitate better returns to acquirer firm.

3. Research Methodology

3.1 Introduction

Research methodology determines a basic structure through which a researcher can properly manage the whole investigation (Mackey & Gass, 2015). In the context of the present investigation, the study is aimed to evaluate the returns to acquirer shareholders in M&A in Australia. Therefore, the key elements of research methodology are listed below:

3.2 Research Design

A research design provides a basic overview to manage a study systematically as per the nature of the investigation. There are mainly two types of research designs considered by researchers that include exploratory and descriptive. The exploratory research design is mainly applied by the researcher to carry out qualitative analysis to discover some new ideas and thoughts. However, the descriptive research design is used to explore and explain the situation, which is influenced by the different variables (Flick, 2015). The present study has tried to evaluate the impact of Mergers & Acquisitions on the shareholder of acquirer returns. Therefore, the report has selected that descriptive research design. The main reason behind the selection of descriptive research design is that it has provided a structured approach so as the study has gained significant success in order to determine the relationship among different variables related to Mergers and Acquisitions. Moreover, the study has considered secondary data to carry out statistical analysis. In this context, a descriptive research design has followed a rigid structure, so that the study found that a rigid structure has assisted the report to examine a variety of statistical data related to Mergers & Acquisitions trends in Australia. On the contrary, Kumar (2019) asserted that the exploratory research design offers great results when a researcher follows an unstructured approach with greater flexibility. Therefore, the exploratory research design is found very useful to carry out the qualitative study, but it has not found suitable for analysing the quantitative data.

3.3 Data Collection

The reliability of study outcomes is significantly influenced by the method of data collection along with sources of information. In this context, researchers mainly considered primary or secondary or both sources of information. The primary data collection is applied to assess the perception of people or target respondents about the particular subject matter. It includes face-to-face conversation, questionnaire filling, personal interviews, and others. However, the secondary sources of information include past studies, online articles, books, and journals (Little & Rubin, 2019). This investigation has focused on evaluating the implications of Mergers & Acquisitions on the acquirer’s returns so as the report has considered secondary sources of data. The consideration of secondary data has assisted to generate an in-depth understanding of Mergers and Acquisitions trends, motives, and other related determinants. Moreover, the report has considered Mergers & Acquisitions reports to acquire appropriate statistical data related to Mergers & Acquisitions trends in different industries of Australia (Mackey & Gass, 2015). In this process, M & A data associated with SDC platinum has been acquired through Thomson. Furthermore, the study has also acquired data related to stock return from an international data stream or Bloomberg.

3.4 Sample Selection

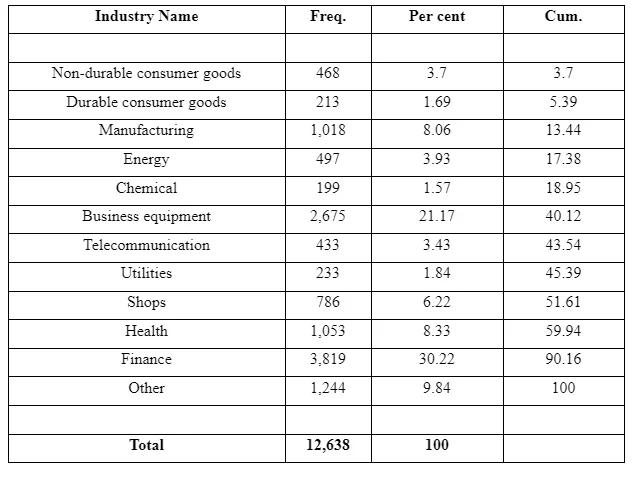

In the context of the present investigation, data related to M & A trends in Australia from the period of 1980-2020 has been taken. The total number of observation is 12,638. Moreover, the data is associated with twelve different industries like energy, durable goods and many more. Furthermore, the study has also considered the data related to different variables like market capitalisation, size of companies, and others.

3.5 Data Analysis and Description of Study Process

The study has considered quantitative data that have been collected from different secondary sources about the Mergers and Acquisitions Trends in Australia in different years. Therefore, this investigation has applied different tools statistical analysis to determine the relationship among different variables. In this context, the study has applied descriptive statistics for assessing a summary of available data related to Mergers and Acquisitions in different time duration and different sectors as well as the role of different variables on the acquirer returns. It seems a great tool to measure the mean, mode, median, and other elements of central tendency (Flick, 2015). Moreover, it has provided a brief description of data sets. Furthermore, this investigation has applied a t-test for determining the significant difference in different variables. For analysing the data, univariate tests have been performed in the study to identify the difference in the acquirer’s return within M & A acquisition of public and non-public companies. This test has assisted the study to examine the variation in the acquirer’s returns within M & A process in different types of companies. Apart from that, the multivariate regression is also considered by the study to determine the impact of an independent variable on the dependent variable (acquirer’s return).

Kumar (2019) stated that multivariate regression had found a great tool to measure the degree at which more than one independent variable (predictors) and more than one dependent variable (responses) are linearly related. It seems a great tool to carry out statistical analysis to generate appropriate study findings. Therefore, the study has formulated a below-mentioned equation with reference to multivariate regression model:

XI (Acquirer’s return) = ß0 + ß1*car0101 + ß2*mktcap + ß3*q + ß4*lvb + ß5*amihudliq + ß6*roa + ß7*size + ß8*public + ß9*allcash + ß10*tender + ß11*hostile + ß12*compete + ß13*toehold + ß14*lockup + ß15*moe + ß16*same2sic + ß17*yearad + ß18*indname12

3.5 Ethical Consideration

The study has considered different strategies to complete the whole study as per the different ethical norms. The present investigation is worked on secondary data and has maintained the authenticity and reliability of secondary data. Furthermore, the study has also provided appropriate references for all resources of secondary data which have been considered by the study to carry out a literature review (Little & Rubin, 2019). Apart from that, this study has also maintained different legal norms of data safety and privacy to maintain the confidentiality of personal data of different individuals who are involved in the present study. All these practices assist help to complete the whole study ethically.

4. Findings

4.1 Descriptive Statistics

The above table is showing in the Mergers & Acquisitions trends from the period of 1980 to 2018. In this context, the total number of deals is 12,638. Further assessment of the above results has determined that the maximum number of M & A deals was incorporated in 1997. However, the period of 1980 was reported the lowest number of M & A deals.

The above table is showing the Mergers & Acquisitions trends in different industries. In the context of the present investigation, the study has considered different sectors to generate appropriate study outcomes. The assessment of the above data determines that Finance and Business Equipment Industries have recorded top positions in Mergers & Acquisitions that have maintained a proportion of 30.22% and 21.17% respectively within total deals.

As per the above table, the report has considered different variables to examine different observations for generating appropriate study findings. The mean value observation related to independent variable of Car(-1.+1) is 0.0044955, Market Capitalisation is 4398.097, Q is 2.0477, LVB is .19519, ROA is 0.13412, Size is .29648, Public is .42530, All cash payment is .28493, Tender is 0.07319, Hostile is 0.01780, Compete is 0.03228, Total holding is 0.03766, Lockup is 0.0064, MOE is 0.0045 and Same2sic is .625415.

In the present investigation, the total value of observations is 12,638 in which the total number of non-public companies is 7,263 and of public companies is 5,375. Similarly, the mean value of the non-public company and public company is respectively 0.144918 and -.0090121, showing that mean for non-public is higher as compared to public companies.

4.2 T-test (Univeriate Test)

The above table shows the result of the t-test to determine the difference in the acquirer’s return in a public and non-public company. With reference to t-test, t(12636)=13.5715; t=0.000. Furthermore, the mean value of the non-public and public firm is less than the alpha value of 0.05. Therefore, the relationship between the two variables is statistically significant. Therefore, the evaluation of data has found a statistically significant difference in the acquirer’s return of pubic and non-public organisation within the Mergers & Acquisitions process. Acquirer’s return of non-public companies is significantly higher as compared to public companies.

5. Discussion

The present study is focused on evaluating the returns of the acquirer firm’s owner within the Mergers and Acquisitions process. In this context, the assessment of findings of different authors has determined the similar results in which the motives of Mergers and Acquisitions have addressed as key drivers of acquirer returns. It includes operational synergies, financial synergies, business expansion, diversification and many more. In the context, the investigation of Florio, Ferraris, and Vandone (2018) has found that agency theory supports companies to attain the objectives of diversification because companies can enhance their market share with consideration of horizontal integration and vertical integration. It influences the company’s market share along with acquirer returns. Therefore, companies are expanding their business operations with the help of mergers and expansion. In the context of the firm’s valuation, the assessment of the acquirer’s return in the M & A of pubic and non-public organisations has found that shareholders present their distinct reactions with reference to the nature of the target firm (Hassan & et al., 2018). In this regard, Pathak (2016) asserted that acquiring firms experienced a significant increase in the stock prices of the company. Furthermore, a detailed assessment of the financial outcomes of different companies has determined that the market would react positively to an M&A announcement. The comparison of different results and findings has determined that mergers and acquisitions play an important role in influencing the shareholder’s wealth in either a positive or negative manner. Therefore, acquirer returns in Mergers and Acquisitions are influenced by several variables. The present study has carried out statistical analysis and found that different independent variables associated with the Mergers & Acquisitions process such as the size of the organisation, market capitalisation, method of payment and several other directly influence dependent variables or acquirer return. In this context, Chen & et al. (2020) stated that the size of the target firm plays a key role to influence the acquirer’s value. It leads to a direct impact on the returns of shareholders. Moreover, it has found that the market will react positively when M&A deals have been accomplished in cash. In this context, the usage signalling hypothesis has found that if an acquirer firm overvalued its stock due to payment of M & A through the equity that could enhance the overall value of the firm.

With reference to statistical analysis, the study has found similarities in the findings of both quantitative analysis and literature review in which acquirer returns in M & A are correlated with different situational factors. In this context, Chen & et al. (2020) stated that there is a significant increment identified in the acquirer returns within the multinational corporations that have expanded their business operations into new markets for the first time. On the other hand, the cross-border acquisitions provide lower returns as compared to domestic acquisitions among the US and UK acquirers. Therefore, different factors of the external business environment and the economic position of a country leave a direct impact on the acquirer returns.

6. Conclusion

6.1 Summary of the Paper

The present investigation has concluded that the return of acquirer’s investors within Mergers & Acquisitions deals is significantly influenced by different business conditions or environments that could be either positive or negative. In this context, the report has worked on different objectives such as identification of the motives of M & A, assessment of key determinants, and evaluation of the relationship between M & A and acquirer shareholder’s returns in Australia. In this context, the evaluation of past studies and views of different authors that an organisation considers different motives of M & A such as expansion, diversification, synergies and many more. This study has concluded that acquirer returns could be influenced by M & A motives in either a positive or negative manner. The present study has determined that the nature of the target firm is also influenced the acquirer returns in which the assessment of statistical data has recorded a significant difference in acquirer returns for public and non-public companies. In this context, an organisation’s valuation in the Mergers & Acquisitions process leads a direct impact on the market value of the acquirer along with the returns of shareholders. Further assessment of key determinants of Mergers & Acquisitions has determined the positive relationship between acquirer returns and M & A trends in Australia. In this context, different variables such as market capitalisation, size, payment process, and others leave a direct impact on the acquirer returns.

6.2 Limitations

There are some limitations identified in the present study. First of all, this study has paid extra attention to secondary sources of information so as the study is failed to assess fresh information about the subject matter with reference to views of different individuals through primary data collection. Secondly, the present investigation has considered a variety of secondary data and statistical data so as the effectiveness of study outcome is limited with the quality of data.

6.3 Further research avenues

The present investigation has identified the positive correlation between M & A and acquirer’s returns. Therefore, further studies can be performed to assess the benefits of Mergers and Acquisitions for acquirer firm so as the report would be able to explore different outcomes of the corporate acquisition. Apart from this, future study can be carried out to evaluate different factors of the business environment within the Mergers and Acquisitions process.

7. Reference

Agarwal, N., & Kwan, P. (2017). Pricing mergers & acquisitions using agent-based modeling. Economics, Management & Financial Markets, 12(1), 55.

Alhenawi, Y., & Stilwell, M. (2017). Value creation & the probability of success in Mergers & Acquisitions transactions. Review of Quantitative Finance & Accounting, 49(4), 1041-1085.

Chang, S. I., Chang, I. C., & Wang, T. (2014). Information systems integration after Mergers and Acquisitions. Industrial Management & Data Systems.

Chen, F., Ramaya, K., & Wu, W. (2020). The wealth effects of Mergers & Acquisitions announcements on bondholders: New evidence from the over-the-counter market. Journal of Economics & Business, 107, 105862.

Faff, R. W., Gunasekarage, A., & Shams, S. (2017). Takeover Competition & Acquisition Choices in Australia. Available at SSRN 2914935.

Faff, R., Prasadh, S., & Shams, S. (2019). Mergers & Acquisitions research in the Asia-Pacific region: A review of the evidence & future directions. Research in International Business & Finance, 50, 267-278.

Flick, U. (2015). Introducing research methodology: A beginner's guide to doing a research project. Sage.

Florio, M., Ferraris, M., & V&one, D. (2018). Motives of mergers & acquisitions by state-owned enterprises. International Journal of Public Sector Management.

Hassan, I., Ghauri, P. N., & Mayrhofer, U. (2018). Mergers & Acquisitions motives & outcome assessment. Thunderbird International Business Review, 60(4), 709-718.

Hossain, M. M., Heaney, R., & Yu, J. (2018). The information content of director trading: Evidence from acquisition announcements in Australia. Global Finance Journal, 100448.

Humphery‐Jenner, M., Sautner, Z., & Suchard, J. A. (2017). Cross‐border mergers & acquisitions: The role of private equity firms. Strategic Management Journal, 38(8), 1688-1700.

Kansal, S., & Chandani, A. (2014). Effective management of change during Mergers and Acquisitions. Procedia Economics and Finance, 11(3), 208-217.

Li, K., Qiu, B., & Shen, R. (2018). Organisation capital & mergers & acquisitions. Journal of Financial & Quantitative Analysis, 53(4), 1871-1909.

Mackey, A., & Gass, S. M. (2015). Second language research: Methodology and design. Routledge.

Parola, H. R., Ellis, K. M., & Golden, P. (2015). Performance effects of top management team gender diversity during the Mergers and Acquisitions process. Management Decision.

Popli, M., & Sinha, A. K. (2014). Determinants of early movers in cross-border Mergers and Acquisitions wave in an emerging market: A study of Indian firms. Asia Pacific Journal of Management, 31(4), 1075-1099.

Rani, N., Yadav, S. S., & Jain, P. K. (2015). Impact of mergers & acquisitions on shareholders’ wealth in the short run: An event study approach. Vikalpa, 40(3), 293-312.

Segal, S., Guthrie, J., & Dumay, J. (2019). An Australian case study of stakeholder relationships in a Mergers & Acquisitions process. Advances in Mergers & Acquisitions (Advances in Mergers & Acquisitions, Volume 18). Emerald Publishing Limited, 65-81.

Xu, J. (2017). Growing through the Mergers and Acquisitions. Journal of Economic Dynamics and Control, 80, 54-74.

Yang, B. & et.al. (2019). Can financial media sentiment predict Mergers & Acquisitions performance?. Economic Modelling, 80, 121-129.

Yılmaz, I. S., & Tanyeri, B. (2016). Global Mergers and Acquisitions (M&A) activity: 1992–2011. Finance Research Letters, 17, 110-117.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts