Implementation of Transportation in Amazon.com Incs Supply Chain

Introduction

Currently, supply chain sector faces numerous challenges that include need to adopt rapid technological advancements, conform to strict regulations, increasing cost, complexity due to multiple channels to market, consumer demands, volatility in the industry, and risks associated with transportation and distribution of goods. The novel coronavirus pandemic has exacerbated the challenges further putting more pressure on already fragile system. In attempt to circumvent these challenges, the business entities particularly big multinational companies are forced to have innovate to overcome the challenges. For Amazon.com Inc., innovation touching on adoption of such approaches as implementation of warehouse management system, big data and Blockchain in distribution networks, streamlining distribution networks, and outsourcing transportation are seen as ideal roadmap to addressing the challenges encountered. This essay investigate gaps in Amazon Inc.’s supply chain system towards meeting its global demands and consumers needs then addresses such approaches as outsourcing and leveraging technology primarily in transportation sector as solution to the gaps. Business dissertation help is vital in exploring all these innovative strategies further.

Background of the Company

Jeff Bezos founded Amazon.com Inc. in 1994 as a book selling company. It has expanded gradually into an e-commerce business entity- online retainer, with subsidiaries in manufacturing of electronic book readers, and web services providers (Kristensen et al., 2017). The company headquartered in Settle, US, has operations set up across the global including European headquarters in Luxembourg City, Hydarabad India, Toyko- Japan, and Cape Town in South Africa. The company’s growth path has seen it morphed from a small entity in Bezo’s garage in Bellevue, Washington, expanding to being among the Big Five companies in the US if not the world, ranked among Google, Facebook, Apple, and Microsoft. Despite increasing competition and changing dynamics that include complexity in distribution networks, more segmented, consumer demands and preferences, and changing consumers’ attitudes at a global in the online retail market, the company has maintained its global growth with revenues going up by 38% to $386 billion in 2020 (Statista, 2021).

Fundamental to the company’s performance and growth rate lies in its consumer-centric culture where, as emphasised by Jeff Bezos “Our vision is to be earth's most customer-centric company; to build a place where people can come to find and discover anything they might want to buy online” has been centre to its expansion and growth plan (Smith and Linden, 2017). The organisation culture of putting the customer first in business operations has seen the company adopting innovative systems at both delivery and supply sector of the product chain. For instance, in addition to including the consumers’ feedback on delivery network seeking on areas and ways of improving services experience, the company promises delivering products within a few hours at a lower cost.

Looking for further insights on Strategies for Amazon Inc? Click here.

Amazon Supply chain

The growth is forecasted to grow positive as the company continue to streamline its distribution channel particularly the last-mile delivery –last point in supply chain before the product reaches the customer. However, according to Kohan (2020), it continuous growth is not only linked to consumer-focused culture but also owed to distribution channels, which makes up the numerous supply chain systems and distribution stores across the global. As pointed by Hahn et al. (2018) and Melnyk & Stanton (2017), its supply chain system plays an integral role in the company performance. Rodrigue (2020) highlighted that dynamic consumer demands coupled with heighten competitions, online retailers face challenges of aligning its operations towards distributional-based consumption built around transcending geographical expansion, market coverage, and functional specialisations. In the e-commerce business sphere, a new physicality of freight distributions that incorporates distribution channels, modes, and purpose-designed facilities supporting efficiency and effectiveness in service delivery (Esper et al., 2020). For amazon, it emphasis on leveraging innovation and technology in improving and smoothening supply chain system while also pushing the cost of operations down. However, putting up this structural facilities by itself expensive. Additionally, other factors that had a significant impact on the distribution channels, disrupting the retail sector, include digitalisation, new locations, sourcing and development of distribution strategies, and economies of scale (Rodrigue, 2020).

Increasingly, online retainers are realising the importance of end-to-end visibility of supply chain for overall performance and success. Technology enabling tracing and tracking to monitor progress has been core to pressures of efficiently and meeting satisfactorily the consumer needs (Bányai, 2017). The growing challenges faced by transportation units such as tighter delivery windows, shorter lead times, rising freight costs, globalisation, environmental conservation awareness, increasing frequency and smaller shipments, and human drivers shortages (Allen, 2017). For Amazon, an efficient transportation management system is central to its consumer-centric ideology and low cost delivery services.

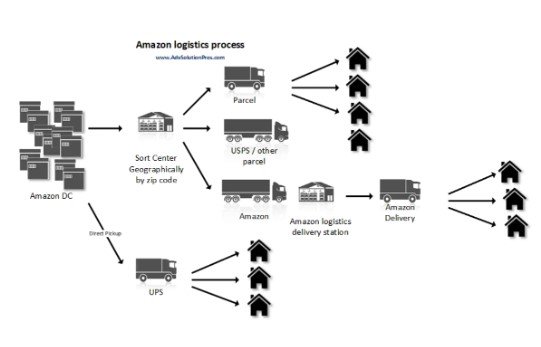

As pointed by Buchman (2018), the biggest differentiating factors for the company from the competitors are its delivery model that includes a Prime Now option that delivers a product within two hours, and two-day prime delivery. In the US, the company has its own delivery services involve in transporting goods from one warehouse to another and hub centres then also using in-house last mile delivery systems. Additionally, the company has a development partnership with such companies as FedEx and UPS leveraging the existing routes and infrastructure particularly in relative remote and rural areas (Avelar, 2020). The company trucking fleet launched in 2005 is used transport goods from one fulfilment centre to another. In addition, the company has 32 Boeing 767-300s aircrafts (Prime Air) used primarily for prime services shipping goods between hubs. With support of tracking and monitoring technology, the company controls the shipment of goods across the supply chain that includes procuring, shipping, distributing, and delivering to consumers. Despite having one of the most elaborate supply chain system, the company faces challenges in distribution network that include increasing consumer demands for efficiency, rising fuel cost, environmental concerns and conservation calls, commoditization of transportation resulting to being price-driven, technological advancement, and increasing regulations that include compliance, safety, and driving hours. It is worth noting that transportation challenges faced does not end with having fleets and infrastructural capacity to support shipment and delivery of goods within a given regions, but also incorporate the human resource management. Although the company may opt to outsource the entire transportation services to address challenges on a particular region, in some countries, the employment laws and regulations may be stringent

Implementation of transportation –making changes

Currently, the company has three inventory networks. First, retail inventory in which the company owns and fulfilled or purchased from vendors. Secondly, fulfilment by Amazon (FBA) including inventory owned by third –party sellers but then fulfilled by Amazon. Lastly, marketplace inventory that is owned by third-party sellers. As of September 2020, the company had 175 operating fulfilment centres, 105 Prime Now Hubs, 84 sorting centres, and 61 delivery stations under its global outbound distribution network. Fulfilment centres act as warehouses where the company takes in the inventory from the suppliers and manufacturers then shipped out to consumers. The Prime Now Hubs are much smaller and aimed to serve specific consumer base within an urban area. Whereas, sortation centres are middle-mile point used in sorting merchandise before being shipped to distribution centres. Lastly, the last-mile handles preparation and delivery of the orders to the customers.

Increasingly, the company is shifting away from conventional logistics delivery networks and depending more on the in-house systems. In order to meet its consumes’ oriented service delivery as well as adhering to the time-bounded delivery business model, the company’s in-house systems is seen as a remedy to circumvent the challenges which came with relying on traditional logistics networks. According to Banker and Reiser (2018), the company needed to make the delivery services efficient and effective through streamlining and expanding the services delivery platforms. However, according to Bharadwaj (2019), setting up a complete in-house network with supporting systems and infrastructure to cover all its global distributions channels would be very expensive and unattainable in short-term hence, reasons for the company to continue relying on conventional ways in addition to adding new channels.

Implementing Technology

For the company, the solutions posed by outsourcing transportation come in the form of adopting an on-premise software solution. The Blockchain and big data technology integrating the locations and movement of goods at all time will provide a real-time data accessible to the organisation and its outsourced parties, regardless of the time or location. It can integrated both warehouse management system and transportation management systems tracking and trace all the goods movements whether stored in the warehouses (fulfilment centres) or in transit (Gossler et al., 2020). Additionally, with the help of its Amazon Web Service (AWS) services, the company can leverage predictive analysis in order to optimise and make forecast of the consumer demands and supply chain system (Happonen, and Siljander, 2020). In predictive analysis, the company would be in a position to know in advance the goods and its respective quantities consumers in a particular area. These anticipatory measures ensure the availability of productive at a notice time and hence reducing fulfilment time. If a customer’s orders a common product, it will be shipped directly from the company’s hub then delivered within a shorter timeframe.

In implementation of the transportation systems supported by big data- and Blockchain- driven, and by extension, distribution network, the company has to develop supporting infrastructure that incorporate warehouse management and tracking systems. Combining the two approaches, predictive analysis and outsource transportation services will have significantly impact on overall company’s efficiency, consumer-centric ideology, and logistics cost (Zhu et al., 2017). In light of increasing fuel prices and public awareness of environmental impact, the company need to integrate such strategies in order to cut shipping cost and travelling distance. The autonomous tracking and data sharing through intelligent vehicle evaluating road conditions is another approach of improving fuel efficiency (Monios, and Bergqvist, 2020). The technique currently used by FedEx involves integrating tracking autonomously all its logistics and using data from its fleets aimed at optimising the routes. Amazon can borrow this mechanism in addressing the transportation challenges it faces.

International Suppliers

The goods flow from the company’s inbound handling facilities to the several hub centres scattered across the country with several truck trailers particularly in the US. However, the challenges of extending the in-house transportation networks and facilities incorporating the distribution networks into a different market forces the company to have a third party as an outsource transportation and delivery entity. Unlike in shipping stage, where the company has held reversed rights particularly goods from China to the US aimed not only streamlining the service but also cost-cutting by removing intermediaries, in land transportation is essentially governed by different laws ranging from consumer attitudes, demands, socio-economic factors, government policies, religious beliefs, and environmental awareness (Sreedevi, and Saranga, 2017; Melacini et al., 2018). In European Union, in additional to difference in culture and daily norms, the legislation implemented that include data protection, employment rights and laws, cross-border movement, and environmental conservation across the nation countries in the region from the those in the US impose number of challenges to the company. Additionally, as pointed by Chen et al. (2021), the changing business dynamics to more consumer-centric, digitalisation of both businesses and societies, and regulations is putting more pressure on the transportation and logistics. These challenges linked to demand for a quality delivery services, remaining competitive, and forced to innovate in attempt to optimising its operations and services.

In transporting goods, the company’s inbound systems involves goods arriving from respective seller then being split at the cross-deck centres to be handled by fulfilment posts. Amazon has two inbound handling model. First, a seller manages own inbound flows and, secondly, the company handle to cost by collecting the goods via airfreight (Sun et al. 2020; Rodrigue, 2020). In addition to its internal air and truck fleets handling deliveries, the company has outsourced some of transporting services to third entities as FedEx and UPS for both last transportation and mile deliver.

Although Amazon is rumoured to be thinking about launching ‘logistics as a service’ in attempt to address the challenges faced primarily on the delivery sector of the supply chain by leveraging its experiences and infrastructure. According to Odnokonnaya (2017), the swelling networks and increasing packages enables the company to expand to new routes rather than dealing with third parties such as UPS and FedEx. Currently, the feasibility of the approach remains just an idea and not yet explored for success implementation. However, if it is launched and implemented successfully, these would meaning instead of outsourcing delivery services to third parties, the company would have its subsidiary and an entity sharing core organisational values and ideals in handling deliveries particularly last miles services (Shen, and Chen, 2020). With this approach, handling the deliveries in host country (the US) and countries with established delivery infrastructure and near similar sociocultural, consumers’ attitudes, and business environment, which initially poised considerable challenges to the company would have been addressed.

However, its viability in an international market with different social, political, consumer expectations and behaviour, and environmental awareness might poise another challenge. Entry into a new market as logistics and transportation entity but subsidiary or department of Amazon might result in drawing a negative reaction and perceptions towards the company. Some might view it as seek to dominate and take over the entire process from purchasing, inventory, warehousing, delivery, customer services, and customer relation (Wan et al., 2019). Importantly, it poses the question on aligning its organisational model to the local values, ideals, behaviour, expectation, and regulations while meeting satisfactorily the consumers’ demands and needs

Challenges of outsourcing

The outsourcing approach towards addressing the challenges faced by the company requires having a robust inventory visibility, tracking, and management systems. Although a third party may offer infrastructure capacity and resource required to complete the last mine deliveries as well as transportation to fulfilment centres, it critical foe the company to maintain understanding and control of the business inventory (Wasilewski, 2019). For instance, outsourcing to last mile delivery to an Indian company in India will not only offer a capacity but because of better understanding of local customs, logistics, culture, norms, and beliefs, it will have a more operating competence on input and outcomes. However, Amazon has to retained detailed, real-time visibility of inventory at both transits and delivery centres. As highlighted by Happonen & Siljander (2020) and Rahman et al. (2019), the decentralisation of transportation and logistics services to local entities require proper tracking and management of inventory from the warehouses, stores, and locations, which pose considerable challenges to distributed connected systems. Without these, the logistics challenges on faced by the company will ultimately morph to poor deliver services and dissatisfaction among the customers.

Improving Absorptive Mechanism

The contractual agreements with third parties handling supply chain especially in new markets ensures the company liabilities and engagement are secured legally. In 2019, the company remodelled its supply partnerships where it would deal directly with wholesale suppliers rather than vendors. The approach aim at ensuring the vendor shift to third party where delivery the suppliers would link with a third party delivery agent to collect and deliver packages to customers. Over the same period, the company launched as ventured into delivery packages for non-customers. However, the company was forced to suspend the approach due to challenges arising handling and delivery from its own customers. According to Grothaus (2020), the Amazon Shipping approach poised significant problems in meeting its own consumers’ demands while ensuring high satisfaction rates across the consumer base.

Managing international suppliers

Internationally, Amazon has taken number of strategies aimed at confirming the local markets. For instance, in EU region, the company established European Fulfilment Network (EFN) service countries that include UK, Germany, France, Italy, and Netherlands. It should be noted that the region have a free movement of goods and services within, prior to Brexit, that means setting up a distribution and managed directly by the company require understanding the operations and systems of various players that include suppliers, consumers, and regulators. Alternatively, having partnership agreement with established logistics and transportation companies such as DHL with deep understanding of the regions include cultural aspects, behaviours, and socio-economic attributes as respective country in the region as well as capacity to handle delivery services efficiently and effectively would ultimately enhance the Amazon performance. Building from the argument by Sigala & Wakolbinger (2019) and Gossler et al. (2020), partnership with established players in the international market is crucial and offers a company capacity to circumvent the challenges around difference in socio-cultural, political, environment, and competition aspects in addition to reducing financial burden and legal obligations of aligning with regulations. As pointed by Bertalero et al. (2020), the reasons the company has been pushing for in-house distribution networks that include transportation and delivery systems are majorly increasing shipping cost as well as streamlining the services. Internationally, building distribution networks that include having core facilities such as warehousing, hubs, and transportation and delivery fleets can be quite expensive negating the whole idea of cutting shipping cost and cheap services for consumers.

Conclusion

In addressing the transportation channels in its distribution network, one approach the company can take is setting up and establishing elaborate and innovative in house distribution channels but building such a massive network requires enormous investment. Although the agility, innovation, and customer-focused approach the company has pioneered is possible in a smaller scale but expansion into a global entity requires a different strategy particularly is search for advancing consumer-focused service delivery. Therefore, the second approach in addressing the challenges wound incorporate outsourcing transportation in some channels. In such markets as European where the regulations, consumer expectations, culture, and environmental concerns differ from those in the US, the company can outsource the logistics and transportation to established companies such as DHL rather than trying to build and streamline its own networks. Outsourcing means the company losses it core aspect in the distribution channels, having control of movement speed, but can leverage technology to track and monitor the product. As mentioned before, Amazon supply chain strategy broken down includes warehousing, delivery, technology, and manufacturing. The warehouses (fulfilment centres) ensures the products are easily accessible through availability in particular regions or coordinate with other centres and hub making sure accessibility of products. In situating the fulfilment centres near urban centres and populous areas then supported by hubs means the company will have less travelling distance in delivery process. Hence, improving delivery efficiency will also cut transportation cost.

References

Allen, G., 2017. Transportation Network Optimization in the Amazon Effect Era. [online] Material Handling and Logistics. Available at:

Avelar, P., 2021. Talking about the Amazon logistics network | Advanced Solutions. [online] Advanced Solutions. Available at:

Banker, S. and Reiser, C., 2018. The Amazon Supply Chain: The Most Innovative in the World? - Logistics Viewpoints. [online] Logistics Viewpoints. Available at:

Bányai, T., 2017. Supply chain optimization of outsourced blending technologies. Journal of Applied Economic Sciences (JAES), 12(50), pp.960-976.

Beliën, J., Boute, R., Creemers, S., De Bruecker, P., Gijsbrechts, J., Padilla Tinoco, S.V. and Verheyen, W., 2017. Collaborative shipping: logistics in the sharing economy. ORMS Today, 44(2), pp.20-23.

Bertalero, G., Rosa, A. and Dalla Chiara, B., 2020. Analysis of outsourcing conditions for freight transport and logistics among manufacturing companies: insights from a review of data and a field investigation. Transportation Research Procedia, 45, pp.459-466.

Bharadwaj, S., 2019. The Engineering Behind A Successful Supply Chain Management Strategy: An Insight Into Amazon. Com. International Journal of Scientific and Technology Research, 8(10), pp.281-286.

Buchman, E., 2018. The Rise of Amazon Logistics. [online] Transport Topics. Available at:

Chen, Y., Xiong, H. and Chen, Y.J., 2021. Should traditional retailers function as pre-warehouses of online retailers?. International Journal of Production Research, 59(5), pp.1476-1495.

Esper, T.L., Castillo, V.E., Ren, K., Sodero, A., Wan, X., Croxton, K.L., Knemeyer, A.M., DeNunzio, S., Zinn, W. and Goldsby, T.J., 2020. Everything Old is New Again: The Age of Consumer‐Centric Supply Chain Management.

Gossler, T., Wakolbinger, T. and Burkart, C., 2020. Outsourcing in humanitarian logistics–status quo and future directions. International Journal of Physical Distribution & Logistics Management.

Gossler, T., Wakolbinger, T. and Burkart, C., 2020. Outsourcing in humanitarian logistics–status quo and future directions. International Journal of Physical Distribution & Logistics Management.

Hahn, Y., Kim, D. and Youn, M.K., 2018. A Brief Analysis of Amazon and Distribution Strategy. The Journal of Distribution Science, 16(4), pp.17-20.

Happonen, A. and Siljander, V., 2020. Gainsharing in logistics outsourcing: trust leads to success in the digital era. International Journal of Collaborative Enterprise, 6(2), pp.150-175.

Kohan, S., 2021. Amazon’s Net Profit Soars 84% With Sales Hitting $386 Billion. [online] Forbes. Available at:

Kristensen, M., Penner, J., Nguyen, A., Moy, J. and Lam, S., 2017. Company Synopsis for: Amazon. com, Inc.

Melacini, M., Perotti, S., Rasini, M. and Tappia, E., 2018. E-fulfilment and distribution in omni-channel retailing: a systematic literature review. International Journal of Physical Distribution & Logistics Management.

Melnyk, S.A. and Stanton, D.J., 2017. The customer-centric supply chain. Supply Chain Management Review, 20(12), pp.28-39.

Monios, J. and Bergqvist, R., 2020. Logistics and the networked society: A conceptual framework for smart network business models using electric autonomous vehicles (EAVs). Technological Forecasting and Social Change, 151, p.119824.

Odnokonnaya, M., 2017. Logistics Outsourcing: Current state of the market of outsourcing logistics services.

Rahman, S., Ahsan, K., Yang, L. and Odgers, J., 2019. An investigation into critical challenges for multinational third-party logistics providers operating in China. Journal of Business Research, 103, pp.607-619.

Rodrigue, J.P., 2020. The distribution network of Amazon and the footprint of freight digitalization. Journal of transport geography, 88, p.102825.

Rodrigue, J.P., 2020. The distribution network of Amazon and the footprint of freight digitalization. Journal of transport geography, 88, p.102825.

Rodrigue, J.P., 2020. The distribution network of Amazon and the footprint of freight digitalization. Journal of transport geography, 88, p.102825.

Shen, B. and Chen, C., 2020. Quality management in outsourced global fashion supply chains: an exploratory case study. Production Planning & Control, 31(9), pp.757-769.

Sigala, I.F. and Wakolbinger, T., 2019. Outsourcing of humanitarian logistics to commercial logistics service providers. Journal of Humanitarian Logistics and Supply Chain Management.

Smith, B. and Linden, G., 2017. Two decades of recommender systems at Amazon. com. Ieee internet computing, 21(3), pp.12-18.

Sreedevi, R. and Saranga, H., 2017. Uncertainty and supply chain risk: The moderating role of supply chain flexibility in risk mitigation. International Journal of Production Economics, 193, pp.332-342.

Statista, 2021. Topic: Amazon. [online] Statista. Available at:

Sun, L., Lyu, G., Yu, Y. and Teo, C.P., 2020. Fulfillment by Amazon versus fulfillment by seller: An interpretable risk‐adjusted fulfillment model. Naval Research Logistics (NRL), 67(8), pp.627-645.

Wan, Q., Yuan, Y. and Lai, F., 2019. Disentangling the driving factors of logistics outsourcing: a configurational perspective. Journal of Enterprise Information Management.

Wasilewski, A., 2019, April. Integration Challenges for Outsourcing of Logistics Processes in E-Commerce. In Asian Conference on Intelligent Information and Database Systems (pp. 363-372). Springer, Cham.

Zhu, W., Ng, S.C., Wang, Z. and Zhao, X., 2017. The role of outsourcing management process in improving the effectiveness of logistics outsourcing. International Journal of Production Economics, 188, pp.29-40.

Looking for further insights on Impacts of the COVID-19 Pandemic on Organisational Culture? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts