India's Electric Bicycle Market Growth

Introduction

India has been experiencing a consistent growth trend in the electric two wheeler vehicle market segment throughout the previous decade. Currently, the market characteristics are considered to be indicative of the associated market segment having become highly lucrative in terms of the possibility of achievement of rapid growth concerning electric bicycles. The market highlights the prospects which are integral to the relative extensive economic growth pace of the country in general. In this context, the corresponding research study would be deliberating about a specific case study concerning the selected product of the electric bicycle brand of Hercules HiVolt which is manufactured by the BSA Motors. Furthermore, the case study based research would be delving into the analysis of the objectives of the study, evaluation of the commercial trends in India concerning the electric two wheeler based markets, the assessment of the services which are provided by such developed products such as Hercules HiVolt and, further, the study would be selecting a specific country where electric bicycle utilisation would be prevalent. This country specific example would be focused upon to highlight the various salient points such as the timeline of market acceptance and popularity achievement by such a product in the selected country and the average per annum sales measures within such a country specific market. Furthermore, the study would be also entailing the manufacturing base of such an Indian product and would be researching about the companies which are engaged in production of such an electric bicycle within India.

Product specifications

evfuture.com (2019) has demonstrated that the electric bicycle of Hercules HiVolt has been an electric two wheeler model which had been launched by the Hercules bicycles manufacturer. This product had been equipped with a multiplicity of components which are as the following:

1: 180 W DC Motor of brush category,

2:12V 12Ah,

3: Charger indicator equipped controllers,

4:@LA battery

5:220VC chargers

6:1.0A chargers with 50Hz extent

7: Thumb throttle managed speed brake cut assembly.

8: PU saddles.

9: V-brakes.

10: Central tripod based stands.

Furthermore, velocrushindia.com (2019) has been deliberative about the facts that Hercules HiVolt bicycle is further equipped with the option of low fatigue inducing commuting speed of 24 Kmph and this top speed could be maintained through the considerate riding distance of up to 30 kms while the bicycle could be operating on a singular charge. The product differentiation point could be outlined to be the relatively modest operating cost of 10 paise/km and the reliability as well as comparatively less maintenance requirement for the bicycle.

It could be identified, through evfuture.com (2019), that the Hercules HiVolt could be utilised a viable alternative for the urban commuters and for the adventure sports enthusiasts as well who could prefer to undertake long journeys in such environmentally friendly vehicles. The product is projected as an eco-friendly and smart alternative which could meet the commutation requirements of the customers which much efficiency. The categories of commuters who could find this electric bicycle to be especially effective in terms of urban cycling could be identified as core bicycling enthusiasts, teenagers and adults as well. Thus, the customer range encompasses most of the age groups. Furthermore, on the PAS mode, the vehicle could consistently provide a 40 kms range with a powerful and comfortable experience for the driver. The vehicle could negotiate complex terrains, such as those in the cross country commutation, owning to the ruggedness of construction and the urban roads as well with utmost measure of efficiency.

Market specifications

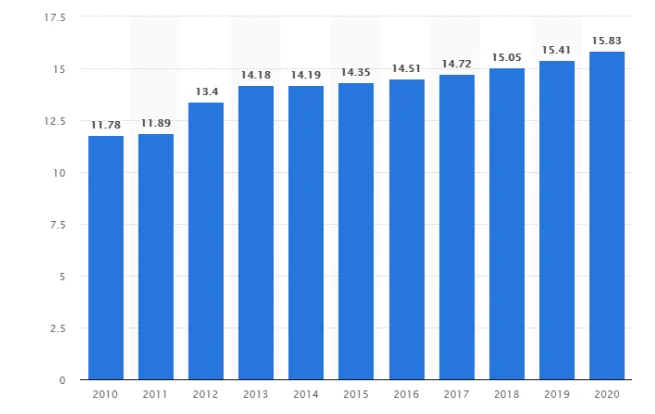

As has been observed by Mohanty and Kotak (2017) electricity driven two wheeler vehicle market of India had been $27 million of value during the financial year of 2017-18 and the current forecast of growth of the market in terms of the Compound Annual Growth Rate (CAGR) till the financial year 2023-24 would be that of 41% on a per annum basis. This is slated to expand the current value of electricity driven two wheeler vehicle market of India up to $ 200 million. As has been observed by Valera and Agarwal (2019), this is an implicit indication that the current environmental awareness based policies of the Indian government have been emphatically put to effect to curb the growth of levels of air pollution throughout the country. Such government policies could be acknowledged to be the recurrent government incentive schemes which have been repeatedly put forward in the previous 5 years for the curtailment of the carbon footprints of different vehicles and the most effective method in this context could be identified as the greater utility of electricity driven vehicles in terms of the manufacture of their main frames, chassis and their individual components within India, by Indian corporate organisations such as the BSA motors (Faisal, 2017). Furthermore, the various other factors which have consistently assisted in the expansion of the Indian electric two wheeler vehicle market, could be identified as growth in the dealership and distributorship networks, greater expansion of the online based sales and purchase domains and the expanding affordability of electricity driven two wheelers, such as the electric bicycles, which could be churned out by the automobile manufacturing organisations both at India and abroad.The boost in demand in the global market, involving the electric bicycles, has been palpable as well.

Company profile

The research of Mohanty and Kotak (2017) has brought forth that the BSA Motors had been established by The Murugappa Group in the year 1949 in collaboration with the UK based Tube Investments of India Ltd (TII) which was, erstwhile, was known as the Tube Investment Cycles. The TIC had been the engineering arm of the Murugappa Group of companies. The Murugappa Group holds the cumulative worth of $ 3.03 billion and the headquarters of the company are situated at Chennai, India. In is a business conglomerate with focused business interests in primarily the metal forming, engineering, finance, bicycles manufacturing, abrasives, fertilizers, general insurance, bio-products, sugar plantations and real estate & property development. 29 limited enterprises are subsidiaries of The Murugappa Group. The bicycle manufacturing facilities are currently disseminated across 13 Indian states. The significance of the business initiatives of The Murugappa Group is the successful forging of business venture alliances with various global enterprises such as Mitsui Sumitomo, China Engineering & Exploration Bureau and Groupe Chimique Tunisien. The current total employee strength of The Murugappa Group is 32000 personnel. With the passage of time, the TII had transitioned from a primarily bicycle designing and manufacturing enterprise to the foremost expert in terms of mobility management in the Indian market context. Salmeron-Manzano and Manzano-Agugliaro (2018) have outlined that the organisation had been best known for the various flagship brands of bicycles including the Hercules HiVolt and Montra. Within the Indian market context, the contribution of the BSA Motors has been the practical formulation and perfection of each and every category of bicycle which had seen introduction at different market regions of India as well as to the market segments situated abroad. Such categories included the first MTB, the first bicycle with different gears, the Shox model, the initial bicycle meant for female riders only, the first bicycle meant to be utilised by children exclusively, the initial light roadster brand, the initial bicycle formulated entirely from carbon-fibre and finally, the first cycling café to be introduced within India. The Hercules brand related products, such as the initial bicycle model had been rolled out during the year 1951. This introduction was later followed with the brands such as Phillips (1959), BSA (1964) and Montra (2011).Currently, the organisation under consideration operates bicycles production plants at Noida, Nasik and Chennai. Furthermore, the company also operates central warehousing and storage facilities at various provincial capitals and cities of industrial significance such as Durgapur, Patna, Guwahati and Cuttack. These urban centres also house the regional offices of the company through which the majority of the nationwide dealer network, comprised off in excess of 2500 primary dealers and distributors, are directed and controlled. The BSA Motors further utilises the services of more than 10000 secondary dealers. As per the observations of De La Iglesia et al (2018), TI Cycles field an extensive range of bicycle models, however, the first electrical bicycle concept had been brought forward by the introduction of Hercules Hivolt. The underlying product objective was the reduction of pollution and energy efficiency improvement within the offered product ranges. These organisational perspectives had been translated into the introduction of battery which could effectively last longer than previously available power sources in a comparative manner, introduction of special features such as thumb throttles which could be proven to be convenient for the riders even under sever conditions. The imperative of capturing the international market for such a product has brought forth the application of new colour schemes such as separate colour schemes for both boys and girls. Furthermore, quality improvement concerning the battery and controller sections has been focused on most significantly (Digalwar and Giridhar, 2015).

As has been observed by Hyvönen, Repo and Lammi (2016), the global market for electricity driven bicycles had been estimated to have been valued at the worth of $ 6900 million during the financial year 2017-18. The current forecast of growth in the global market segment of such electric vehicles consists of the projected expansion to the gross worth of $8410 million by the end of the 2025-26 financial year (Ahmad, Alam and Shahidehpour, 2017). This would be entailing the Compound Annual Growth Rate of 2.5% throughout the period of the forecast. The global production estimate during the financial year of 2016-17, involving the numbers of electric bicycles produced throughout the world, was 33 million approximately. Salmeron-Manzano and Manzano-Agugliaro (2018) have observed that the average price range of the electricity driven bicycles globally, had commenced from $ 202 and this highlighted a gross margin of about 18%. In terms of the current sales estimates, a profound yet gradual increment in the prices of the electric bicycles such as the Hercules HiVolt, on the global scale during the previous few years, was achieved.

External factors influencing the sales of electric bicycles globally

The general inclination towards utilisation as well as perpetuation of the renewable energy sources in terms of transportation industrial power sources, on the global scale, has translated into the greater measure of government support policies at, the various national spheres, to encourage such technologies such as electricity driven vehicles and such trends have been responsible for the definitive expansion in the general utilisation and purchase of electric bicycles. Furthermore, the stringent rules and regulations which, have been increasingly formulated by the different national governments for the protection of the environment from increased carbon footprints emanated through the utilisation of non-renewable energy sources, have also ensured the market demand expansion of electric personal transports such as the electric bicycles. Increment in environmental concerns has been instrumental in creating the most positive impacts on the electric bicycle sales volumes (Altenburg, Schamp, and Chaudhary, 2015). Furthermore, the popularity of the electric vehicles has also expanded from variegated factors such as greater investment in the research and development services by companies such as the BSA Motors, the development of new and greater innovative components of such bicycles such as higher performance and efficiency based batteries and greater resilience of the vehicle frames which are now completely constructed from composite materials such as carbon fibres. Lin, Wells and Sovacool (2017) have specified that the additional rationale of growth in popularity in of electric bicycles at countries such as China and other countries of the Asia Pacific region have been the development of the public charging infrastructure and the rental ride services associated with the electric bicycles at such countries. The fuelling of the growth prospects of electric bicycles at both the global market segments and at the various Asia Pacific regional and national markets has been successful through the positioning of such products primarily as an environmentally friendly substitute to the existing fossil fuel driven personal transport two wheeler vehicles such as motorbikes and scooters. Such outcomes have been crucial regarding the decision of manufacturing organisations such as the BSA Motors to undertake concerted effort in projecting the electric bicycles as vehicles which could not only curtail the prevalence of air pollution, but, also, could effectively contribute to the reduction of greenhouse gas based environmentally detrimental effects. Within the anticipated period of the next 5 years, as has been evidently demonstrated by the research of Altenburg, Schamp and Chaudhary (2015), the domination of the global market for the electricity driven two wheelers would be undertaken by the Asia Pacific regional markets in terms of generation of the most extensive gross amount of sales on a per annum basis. In this context, the majority of the contribution in terms of expansion of the individual formats of electricity driven two wheeler vehicle markets has been generated by the countries of China and India. Ou et al (2018) have outlined that the most extensive market space, from the perspective of any national economy context, for two wheeler vehicles, could be found at China alone. The potential of China to maintain relatively large consumption measures of such bicycles, has ensured that sales figures would be kept at the necessary benchmark threshold for the market to be sustained and expanded consequently. China also influences the growth in the global market for such specific vehicles with the considerably greater numbers of imports and exports of electric bicycles and other electric personal transport vehicles than the other countries who utilise and engage in the sales and purchasing of such products.

Demand measure of electric bicycles within a particular national perspective

Chen and Midler (2016) have brought forth the research which has indicated the particular categories of electric bicycles which have comparatively greater demand value within the Chinese markets. These could be identified as exclusively pedal assisted, power on demand with pedal assistance and exclusively power on demand based bicycle brands. As has been observed by Lin and Wu (2018), the legislative provisions of China actually hyphenates the electric bicycles from those of the electricity powered similar vehicles such as mopeds and others. The operations and certifications of such electric bicycles are subjects to stringent legal stipulations. The research of Yan et al (2018) had outlined that the electric bicycle market within the Chinese market experienced a persistent growth measure of 3.94% (CAGR) throughout the period of 2014-2019. As have been specified by Helveston et al (2015), the most notable vendor companies which are currently operating within the regional markets of China in terms of supply and retail sales management of the different electric bicycle brands are as the following:

1: Derby Cycle

2: Jiangsu Xinri

3:Yadea Technology Group

4: Zhejiang Luyuan

5:EZee Kinetics

6:Geoby

7:Giant Bicycles

8:JiangsuAima

10:Stromer Bicycles

11: Yamaha Motor

Sales progress and market operations perspectives

Sachs et al (2016) have determined that the focus of such vendors has been the provisioning of scalable and tailored products and components of the finalised products such as the electric vehicles for utilisation even within contested climatic environments. In terms of supply management, these vendors are also overtly oriented towards the management of productivity, curtailing the different strands of the task execution chain services which could save additional time and cost for the particular vendors and, most significantly, towards the reduction of human intensive communication and delivery networks for the purpose of reduction of the required human resource slab so as to save the gross service cost incurrence. The driver of the market expansion prospects at China, for the branded electric two wheelers such as the Hercules HiVolt, has been the increasing disposable income of the general Chinese households and the relatively high concern towards reduction of the considerably alarming status of environmental pollution which has gripped China for the previous two decades due to extensive industrialisation and stupendous expansion of the utilisation of fossil fuel based power and transportation sectors within the country. Zhang et al (2017) have been of the opinion that the prevalent market challenge which affects the current Chinese market for the electric bicycles, could be identified as, the relative premature stage of the underlining technology itself. As have been specified by Ouyang, Zhang and Ou (2018), the current policy which could be outlined to have taken shape within the Chinese national perspective, concerning the electric bicycle based markets, is the greater emphasis on progressive electrification based achievement of cleaner technology by the general transportation services, including the personal transport mechanisms which have preceded the changes of other, industrial transportation segments of the market, in embracing electricity driven vehicle technology. However, some gaps have remained concerning the development of the local capability to manage the supply chain based tribulations within the high demand based Chinese regional markets. One particular reason of such gaps could be outlined as the increasing number of unorganised sector based operatives who have been entering the primary markets of electric bicycles within China after the global recession of 2008-09. In this context, Li et al (2016) have suggested that from the localised perspective, a specific solution could be envisaged as the greater localisation of technology, in terms of component manufacturing and greater emphasis on the decentralised approach concerning the further development of the organisational supply chains by the existing unorganised sector based manufacturing companies which have been operating within China.

Sales conditions within China

Furthermore, within the Chinese national, provincial and regional markets, the segmentation of the targeted market spaces is performed through the product type of the electric bicycle. There are primarily two major segments of such market spaces which are currently in existence within the Chinese general bicycle market. These are the lead-acid battery driven electric bicycles and the Lithiam Ion battery equipped Hercules HiVolt. Apart from these, the market based sales processes further segmentise the existing Chinese market space in terms of the product under consideration into two segments namely the direct sales based market and the dealership based distribution oriented market. This second format of the market segmentation, in terms of sales generation, is primarily prevalent at the markets of the Asia Pacific region. In China alone, the majority of the customers purchasing the Hercules HiVolt product, generally express their preferences in favour of dealership based indirect sales through maintaining of product distribution capabilities of the commercial applications such as the Hercules HiVolt.

Zhou et al (2015) have brought forth the case of Yadea Group Holdings, which is the largest Chinese manufacturer for electric scooters and also one of the largest retailers of imported electric bicycles such as the Hercules HiVolt, concerning the envisioning of rebranding the existing product ranges of electric vehicles, including the electric bicycles, by such a company, for the purpose of greater sales generation scope realisation in the current Chinese and overseas market scenarios. The objective is to reposition the existing products as glitzy and technically advanced so as to persuade the potential customers to become convinced to even accept major price forms (addition to the existing prices in the measure of 50% increment) in terms of purchasing such products. Zhang et al (2017) have determined that the current plans of the e-bike and electric bicycle market operatives, including the manufacturers, vendors and importers, within China, pertain to the dozens of new brands of electric bicycles within the Chinese territorial and overseas market. According to Zhang et al (2017), the consortium of Hong Kong listed e-bike companies have planned the launch of such vehicles which could be priced at $ 1455 or at 10000 yuan correspondingly. The current market forecast on which such price range planning has been premised could be considered to be indicative of the affirmation concerning the inclination of affluent consumers, on the global scale, to purchase electric two wheelers. According to Lin and Wu (2018), the average price of Hercules HiVoltage within the Chinese markets has been registered at 2000 yuan on a per annum basis within the duration of 2015-2019 financial years. Such price and sales contexts have been further explained by Chen and Midler (2016) to be indicative of the technological shift of the automotive industry towards consummate electrification. Thus, the growth potential of the electric bicycles is extensive, not least because of increasing awareness of the global population of the different environmental tribulations and the associated necessity to ensure environmental protection. To this effect, the expansion of the environmentally friendly and non-polluting automobile and semi-automatic vehicles, such as the electric bicycles, has gained credence not only regionally, but at the global level as well. Helveston et al (2015) have instituted the research undertaking which has brought forward the details of the Indian market concerning the electric bicycle sales and current commercial utilisation extent. In this context, the Indian market at the current financial year could be considered to be the second largest globally for the two wheeler electric vehicles, after China. According to Xiqiao and Zhou (2017), the financial year 2018-19 had registered the sales of in excess of 21 million two wheeler vehicles of different denominations. However, only 126000 two wheelers out of the entire sold products had been those of the electrically driven segments, including the bicycles. This was a considerable growth (129.9%) in terms of the sales performance of the electric two bicycle market within the current economic context.

Hercules HiVolt manufacturing situation in India

As has been determined by the research of Vidhi and Shrivastava (2018), various major manufacturing organisations are currently operating within India, apart from the BSA Motors, which have invested consequentially in the Hercules HiVolt component manufacturing. These could be identified as the Hero Electric Vehicles Pvt, Ltd, Electrotherm (India) Ltd, Lohia Auto Industries, Ampere Vehicles Pvt Ltd, the NDS Eco Motors Private Limited, Tork Motors Private Limited and the Tunwal E-Bike India PVT LTD. These companies generally contribute to the efforts of the BSA Motors, which is a subsidiary of the TI Cycles of India, which, is a bicycle manufacturing unit of the Tube Investments of India Ltd, through their key resource development teams and working mechanisms so as to sustain their profitable dealership and third party manufacturing processes. The ultimate objective is to boost the customer reach of the companies. Within the Indian market context, Alamelu, Anushan and Selvabaskar (2015) have observed, the different manufacturing organisations of electric vehicles generally emphasise upon the factors of quality and comfort. However, the most significant aspect concerns the performance parameters of the motor of such vehicles. The power ratings are mostly multifarious and vary as per the available motor constituents and the metropolises within which these motors could be utilised since different urban centres in India hold different limitations of maximum speed. The staring point of such varying power ratings is 200W. Certain electricity driven bicycles come under the exemption category regarding the power output which could be less than that of 250W and this entails a maximum speed which is sufficiently less than that of 25kmph. The electric bicycles which have greater power ratings could support greater weight transport with comparative effortlessness. However, greater battery consumption is a consistent challenge which hampers the higher power rating engines. Lesser than 250 W power rating output could drain the batteries with greater duration and this affects the efficient load bearing capacity of the respective vehicles (Khan et al. 2018).

Notable electric bicycle products of Indian manufacturing organisations

One of the major manufacturing organisations of electric bicycles in India is the Elektron Inc. which, produces the Elektron Hybrid Bicycle m368. This organisation is based at Chandigarh, India. The first product of this company was launched during the year of 2016. The m368 is constituted by components formulated by the lightweight Aluminium alloy 6061. The specific features of the product are, as the following:

1: Theft proof emplacement of the battery and power transmission segment within the main frame of the bicycle.

2: Front lights are preinstalled.

3: Mudguards, reflectors and horns are also installed within the primary instillation phase.

4: Additional accessory management expenditure is not required.

5: Emplacement of double walled rims composed out of Aluminium alloy.

6: The dispensation of the front suspension comprises of Aluminium based 60mm coil spring.

7: Maximum speed (factoring in the load bearing capacity to the optimum extent with undulated surface speed maintenance element) is 25 kmph.

8: Pedals are wide and are formulated by griping alloys.

9: Equipped with the ODO meter and the LED battery meters.

10: Price range is 33999 INR (inclusive of all of the taxes).

11: The utilised motor is of 250 Watt power output category with 35 NM torque.

12: Effective cross distance operational envelopment is 35 kms to 70 kms.

13: Effective battery charge retention duration is 4-5 hours (depending upon the utilisation ratio).

Another major electric bicycle manufacturing organisation within the Indian market context is the PURE EV company. This organisation was formulated by the alumni of IIT Hyderabad. The company currently has invested extensive efforts in terms of introduction of innovative products within the electric bicycles and two wheeler segments of the existing alternative technology driven market. The company constitutes the necessary facilities for research and development as well as testing of the manufactured vehicles which are produced by the in-house assembly lines of the company. Hung, Jaewon and Lim (2017) have highlighted the flagship products of the company as the following:

1: Effective integration of the battery and mechanical components controller through the precision stream lining of the main chassis.

2: Vehicle construction component has been the 26 ”double wall alloy.

3: Utilisation of the 36V 250W rear brushless geared motor.

4: Utilisation of further cutting edge mechanical components as the 7-speed derailleur rear wheel Shimano.

5: The application of latest braking framework components such as the Disc Brake TEKTRO brand (F/R)

6: Tire dimensions are 26×2.35 Tyres

7: Hand twist throttle and clutch.

8: The frontal suspension is the XC 30.

9: Pedal assistance accessories such as magnetic intelligent pedal assistant system.

10: The maximum weight dimension is that of 23 kgs which includes the combined weight of the battery, the gearbox and the associated electrical components as well.

In terms of the price range variation, velocrushindia.com (2019) has outlined that PURE EV electric bicycles generally are offered at the benchmark retention price of 31,499 INR (inclusive of all of the taxes). This price specification involves the sales application of the Etron model of the PURE EV product inventory. Furthermore, the price range of PURE EV Epluto is 71999 INR. Furthermore, the ETrance model is offered at the price range of 51999 INR and the cost of the Egnite is that of 47499 INR.

The third electric bicycle manufacturer of premium significance within India is the Coppernicus which is headquartered at Bangalore (alternatively pronounced as Bengaluru). The brand value of Coppernicus T3 E-bike is meant to redefine the commutation method of urban India with particular solutions which could further inspire interest in the direction of electric vehicle purchases. velocrushindia.com (2019) has brought forth the particular characteristics of the T3 E-bike. These are as the following:

1: The durable yet lightweight frame of the vehicle formulated by the 6061 Aluminium alloy.

2: Utilisation of high tensile, deep drawing, high carbon CRCA strips for the manufacturing of the chassis.

3: Utilisation of special hydraulic disc brakes.

4: Emplacement of sensors to cut-off the electronic motors in terms of safety management.

5: SR Suntour suspension systems with a travel of 100mm.

6: RD Shadow+ technology coupled with the Shimano ZEE shifters with has the provision of 10 different gears.

Another significant electric bicycle brand within India has been the Hero electric bicycle product of Hero Electric Avior. This bicycle has been made available in dual variants, namely the AMX and AFX. AMX variant is meant to be sold to male customers and the price is 19290 INR while the AFX is meant to be purchased by female customers with 18990 INR. The manufacturing organisation, Hero Electric had been established by the Hero MotoCorp and now, it is a subsidiary of the parent company and specialises in the manufacturing of high performance and durable quality electric two wheeler vehicles. Throughout India, the company under consideration holds showrooms at more than 100 cities with 500 associated dealerships. The dual versions of Avior have been provided with special engine assembly configuration which consists of nothing extra other than the battery integrated with the transmission mechanism. Furthermore, the application of automatic CVT transmission gearboxes has been further assistive in terms of management of the weight factor (motoroids.com, 2014).

Apart from these, the particular characteristics of the Hero Electric Avior are as the following:

1: Utilisation of the advanced, 4 stoke, single cylinder, air cooled engine within the AMX and AFX variants.

2: Utilisation of a specific SOHC which can displace 124 cc.

3: Achievement of a maximised power output of 8.62 PS.

4: Infusion of a 5 speed chain drive within the automatic transmission system and utilisation of a manual transmission system with a further 6 speed chain drive.

5: Integration of separate battery packs for the tail lamps.

As one of the leading electric two wheeler manufacturing organisations in India, the Hero Electric stands to capture the attention of various customer ranges such as the young professionals, teenagers, urban commuters and the cycling enthusiasts and corporate personnel who could be either young or physically efficient to ride the electric vehicles such as the Avoir.

Conclusion

The preceding case study based research has been deliberative regarding undertaking a holistic approach to analyse the existing market performance scenario of different electric bicycles brands within India as well as measuring the national and global prospects regarding the future of such products. To this effect, the study has formulated a critical appraisal regarding the manufacturing and endorsement of electric bicycles within India by various companies with special emphasis on the average price extents, the specificities of the production models and the brand value of the individual products. The study has looked into the manufacturing effort, invested by Indian companies, concerning the manufacturing of such electric bicycles, either in completion or in partial measures.

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts