Innovation's Role in Business Success

Introduction

The primary focus of concurrent business practices is the development most profitable products and services as well as ensuring the obtainment of suitable market leverage in the hyper competitive scenario. Further objectives are indicative of enabling the various ancillary businesses to be developed on the basis of such products and services so that consumer management could be most effectively and efficiently performed in favour of the respective organisations. To this effect, the corresponding study would be formulated on two different segments. The first one would be concentrating upon the demonstration of understanding regarding differential measures of technology and innovation to outline the progress of a selected business organisation. The second one would involve demonstration of practical illustrations regarding impacts of innovation and technology on sales, operations and profits of the selected business entity. This process would involve evaluation of the significance of Corporate Social Responsibility of the organisation under consideration.

Task One

According to Hamilton and Webster (2018), innovation could be understood as the successful implementation of any novel ideation in the fields of commerce or management to enable any institution/business entity to enhance operational efficacy. Prajogo (2016) has emphasised on the distinctive divergence of innovation, as a process, from that of invention. The three factors of technology, inventions and research are the core constituents of any form of innovation and multiplicity of models of innovation could be identified in terms of development of organisational policies to encourage innovative creativity within the products and services generation processes of such organisations.

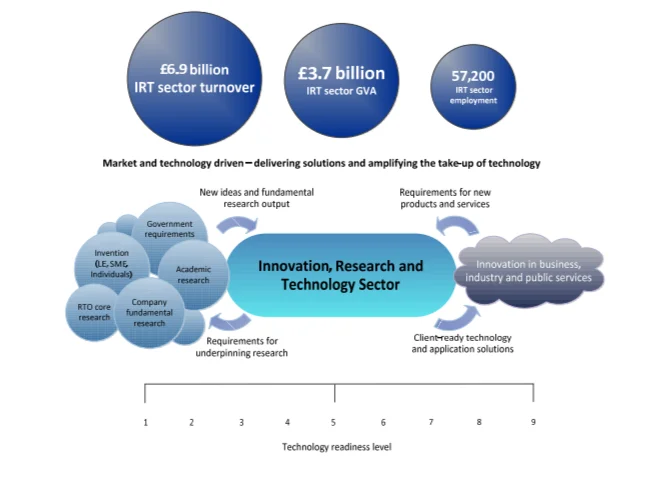

On the other hand, according to Gaganis, Pasiouras and Voulgari (2019), technological innovation influences organisational functionalities to profoundly disrupt existing market spectrums. The objective of technological innovation is to change the relative significance of resources and to challenge the learning capabilities of organisational human resources. Calabrese et al (2018) have argued that objective of any technological innovation is to fundamentally alter the competitive basis on which any business organisation, such as Cineworld, would be required to function. In this context, Akhmetshin et al (2017) have pointed out that during the financial year of 2016-2017, the Innovation, Research and Training (IRT) sectors had supported the contribution of a gross value addition of £7.6 billion to the UK GDP, through supply chain management improvement based indirect and direct impacts. According to Erasmus, Strydom and Rudansky-Kloppers(2016), the gross value addition multiplier of the sector is 2.08 which entails that for every £1 million generated by economic activities through the IRT structure at UK, the amount of £1.08 million is created additionally through the betterment in management of supply chains and through positive impacts on wage based consumptions. As per the research of Vasilev et al (2017), during the financial year of 2017-2018, the estimated measure of direct employment generation by the IRT sector had been 57200. Dey (2019) has outlined this number to be comparable to the complete staff numbers of the Russell Group of Universities at UK. Furthermore, the direct support extended by IRT sectors within the UK has managed to impact 140100 personnel in terms of employment generation through the financial years of 2016-2019. The impact has been evident through the indirect, induced and direct channels of operations. Abdullahi and Zainol, (2016) have observed that the employment multiplier of the IRT sector within UK has been 2.4 during the same time period. This could be illustrated as for each 100 personnel provided employment within this sector or associated processes, it could be estimated that an additional 140 personnel are provided employment at differential sections of UK economy which have been supported by the IRT sector contributions. This has been measured by Vom Brocke and Mendling (2018) to be 1 in every 230 jobs in UK. In terms of support to total employment within UK, according to Visnjic, Wiengarten and Neely (2016), during the 2013-2017 time period, the IRT sector has achieved measure of success which could be effectively compared to the total number of employment at Milton Keynes.

Furthermore, the research of Santos et al (2018) outlined that UK IRT sectors have been estimated to have generated £2.9 billion to the existing tax receipts during the 2013-2017 time period. Such an amount has been estimated by Laasch and Conaway (2017) to be adequate to remit wages of at least 41000 doctors, 111000 nursing attendants and 89000 teaching stuff. In addition to the standardised metrics based economic contribution, UK innovation sectors have also generated adequate commercial benefits for the associated clientele. Such benefits are inclusive of the Spillover benefits involving all of the dimensions of the greater economy. From the perspectives of Long, Iñigo and Blok (2020), it could be ascertained that if the current measure of IRT efforts pertaining to the R&D activities of innovation could be maintained, then, on the basis of standardised assumptions, the return to the clientele within UK would be tantamount to £3.5 billion per annum. The Spillover return would be £6.3 billion on a yearly basis. In this context, Pilav-Velić and Marjanovic (2016) have observed that benefits generated by the IRT contributions could progress further on the basis of the characteristics of such sectors since IRT functionality in networking for provisioning of adequate facilities of clustering of businesses, could encourage various industrial and tertiary sector fields through which greater R&D could be undertaken. Such developments could enable and enhance the Spillover and private return factors to expand over the process of performed R&D.

Zhang, Zhao and Xu (2016) have outlined that Innovation sector based turnover within the UK has been £6.9 billion (estimated), within the period of 2013-2017. In totality, the IRT sector has supported, through indirect, direct and induced impacts, an estimated measure of £7.6 billion within the UK in terms of value addition to the national economy within the same time period mentioned previously. Furthermore, Teplov, Albats and Podmetina (2019) have concluded that the UK IRT sector has ensured a productivity level of at least £64,100 of gross value addition per annum on a per employee basis. This entails a 45% greater value than that of the UK average during 2013-2017. According to Obeidat et al (2017), this value measure is also greater than the UK architectural service sector (£53,000), the sector of market research and polling of public opinion (£50,400), the scientific research sector (£46,500) and the sector of technical testing and analysis (£40,300). Finally, González-Benito, Muñoz-Gallego and García-Zamora (2016) have researched that the prevalent estimation is the Innovation and Research sector within UK has contributed to the enhancement of productivity in the measure of 3% per annum since 2009 in the real terms with inflation adjusted. This could be juxtaposed with the fact that during the same period highlighted previously, the real productivity throughout the national economy was essentially flat. Möller and Halinen (2017) have opined that, as far as the factor of technological application for the development of business prospects and market operations could be concerned, Cineworld, has utilised computer software and hardware applications and processes for the purpose of adjusting to external effects of technological developments.

Task Two

Company overview

The selected organisation has been the Cineworld PLC which had been established during 1995 and currently is considered to be the second largest chain of cinema globally with 9518 screens at 790 sites within 11 different countries (UK, USA, Canada, Ireland, Poland, Romania, Israel, Hungary, Czechia, Bulgaria and Slovakia). The primary brands of the organisation are Regal (USA), Cineworld (UK) Picturehouse (Ireland), Cinema City (throughout the European Union) and Yes Planet (at Israel). The cinemas of the company offer an extensive range of venues for private and corporate events where the digital projection facilities offered by Cineworld PLC involve displays with every media format including PowerPoint Presentations and feature films. According Aarikka-Stenroos et al (2016) the Cineworld Group, during 2018, had formulated a technological partnership with Arts Alliance Media (AAM) software to Regal Cinemas for the purpose of effective centralisation of in excess to 9500 screens. The Cineworld Group currently utilises Theatre Management Systems (TMS) which is supplied by AAM as well as Screenwriting software services and 3rd line technical assistance to the assets of Cineworld at both European sectors as well as in Israel. Furthermore, AAM is providing Cineworld with the Producer Circuit Management Systems (CMS) which has enabled the company under consideration to establish centralised control over 900 additional screens within UK circuit from the head office of the company. Furthermore, Yermack (2017) has researched that, following the recent acquisition of Regal Cinemas at the USA, Cineworld has formulated the decision of implementing automation services within their scheduling and content management services and for this purpose, AAM would be providing the company with Screenwriter updated versions. This would be implemented throughout the 7361 screens of the Regal cinema circuit within USA so as to expand the coverage base of the producers to the most optimised measures.

The outcomes of such investment in technology and innovation management have been identified by Veldman and Willmott (2016) in the following manner:

1: Opening of 31 Screen X as well as 30 4DX screens throughout different operational zones globally.

2: Achievement of considerable operating savings on the investments of development of 2000 laser projectors with next generational technologies.

3: Enhancement of online sales of tickets.

Task Three

According to Price et al (2018), the functionality of corporate governance could be illustrated as the system of rules, policies, regulations, practices and processes through which any business organisation could control and direct operational assets and their utilisation. Katmon and Al Farooque (2017) have opined that the objective of corporate governance is essentially the balancing of company interests with the interests of organisational stakeholders including the shareholders, customers, suppliers, senior managerial executives, financiers and the existing government regulatory authorities. Akbar et al (2016) have stated that corporate governance processes also assists respective organisations to obtain organisational objectives. To this purpose, the corporate governance processes encompass every sphere of operational management including action planning and internal control mechanisms as well as performance measure management. Corporate governance also influences the processes of corporate disclosures. According to Zalata and Roberts (2016), the concept of Corporate Social Responsibility (CSR) could be considered as a self-regulating model of businesses which could assist any business organisation to factor in the element of social accountability encompassing stakeholders and the general customer populace. CSR could be applied by different organisations to manage the impact of the company on the various aspects of operational functioning encompassing the environmental, economic and social perspectives. In case of Cineworld, Kumar and Oberoi (2019) have outlined that CSR based engagements in the ordinary business discourses could ensure that any organisation could operate in certain manners through which both the concurrent environment and society could be contributed to in the most positive manner.

From the research perspectives of Braggion and Giannetti (2019), European business organisations have primarily focused on the decision formulation aspects associated with the functionalities of organisational Board of Directors (BOD). This corporate governance approach is primarily associated with the representation of interests of shareholders in the companies. European organisations task their BOD with the responsibility to formulate important decisions encompassing corporate human resource appointments, management of compensation of executives and recommendations of dividend policies. According to Driver and Thompson (2018), board obligations could often stretch beyond the measures of financial optimisation which could entail situations when shareholder resolutions could outline the necessity for certain environmental, financial, procedural or social concerns to be prioritised.

CSR pyramid of Archie Carroll

According to Ntim (2018), the CSR pyramid of Archie Carroll consists of a framework which could explain the manner and the rationale of organisational operations pertaining to social responsibility management. This pyramidal structure highlights four distinctive yet inter-related categories of organisational responsibilities. These are the following:

1: Economic Responsibility

2: Legal Responsibility

3: Ethical Responsibility

4: Philanthropic Responsibility

The base of this pyramid is formulated on profit only. This foundation, as per the observations of Crane, Matten and Spence (2019), is vital in terms of meeting all of the regulations and responsibilities for any company such as the Cineworld PLC so that all of the demands of the organisational shareholders could be met.

Economic Responsibilities

In terms of economic responsibilities, as has been outlined by Grayson and Hodges (2017), Cineworld PLC only issues one class of share capital as ordinary shares. All of the shares which formulate parts of the ordinary share capital could provide the shareholders to have identical values such as the right to cast one vote in the restructuring of management echelons of the company. The details of share capitals and subsequent changes in the same could be demonstrated through annual financial statements of the company. According to Wang et al (2016), the objective is to garner as much sustainable profitability as possible to ensure the long term survival of the business. Liang and Renneboog (2017) have detailed the core focus of the economic CSR based responsibilities of Cineworld as sustaining the extent of capital expenditure for the purpose of enhancement of organisational business prospects, leveraging of competitive positioning abilities, greater dividend generation for existing shareholders and other stakeholders and maintaining the achieved extent of growth capital generation in the form of post-tax deduction profit.

Ethical responsibility

Albuquerque, Koskinen and Zhang (2019) have emphasised on the ethical policies of recruitment, employment and development of operational staff by the Executive Management echelons of Cineworld to be reflective of the ethical CSR management practices. The process involves the dual factors of work experiences and qualifications regardless of marital status, race, gender, ethnicity, religion or nationality. Furthermore, Ali, Frynas and Mahmood (2017) have highlighted that the policy of Cineworld PLC Group has been to accord complete and fair consideration to employment applications from people with different disabilities since the organisation espouses the specific abilities and aptitudes of such personnel. Cineworld PLC accords effective consideration to the staff to continue their employment in spite of their complications such as physical difficulties. Such considerations involve providing promotions to the disabled staff to relevant and reasonable positions and arrangement of appropriate training opportunities. According to El Ghoul, Guedhami and Kim (2017), the company prioritises the health, development and welfare of the organisational employees. A number of policies are implemented and maintained by the organisation with the intent of recruitment, attracting, development and retention of selected employees. The rationale underscoring such policies has been that he continuation of education, development and training within the organisational employees could ensure future success of Cineworld through pooling of necessary human resource talent.

Philanthropic responsibilities

According to Shaukat, Qiu and Trojanowski (2016), the obligations of workforce engagement are influenced by the details of engagement of Directors with the employees. Such engagement is premised upon employee interest management and the associated impact on the decisions formulated by the Company under consideration. In this context, Demirag (2018) has specified that enhanced stakeholders engagement, encompassing the customers, suppliers and financiers of the company, has been the area of focus concerning the effort by the Directors to foster better commercial relationships in favour of the financial prospects of the company.

Legal Responsibility

The ordinary shareholders have been entitled for the reception of Company reports related to accounts of the organisations. This entitlement is also extended to attend the general meetings of Cineworld. According to Hamilton and Webster (2018) no restrictions or limitations are imposed on holdings of ordinary shares and no prior approval regarding transferring shares of the organisation is also required. However, prior approval is required for a person with an interest in 0.25% of the capital share issued. Such share capital is required to be held in certified forms and such a shareholder has to comply with any served disclosure notice in terms of responding with the required information concerning the generation of interests ins such issued share capital.

Conclusion

At the conclusive stage, it could be observed that Cineworld invests extensively in management of operations in the most consistent manner in accordance to the existing legal requirements and regulations of the UK governments. Meeting of stakeholder obligations is prioritised. Furthermore, the company utilises technological innovation to perform in the manner which could be consistent with market dimensions.

Reference List

Aarikka-Stenroos, L., Peltola, T., Rikkiev, A. and Saari, U., 2016. Multiple facets of innovation and business ecosystem research: the foci, methods and future agenda. In ISPIM Conference Proceedings (p. 1). The International Society for Professional Innovation Management (ISPIM).

Abdullahi, A.I. and Zainol, F.A., 2016. The impact of socio-cultural business environment on entrepreneurial intention: A conceptual approach. International Journal of Academic Research in Business and Social Sciences, 6(2), pp.80-94.

Akbar, S., Poletti-Hughes, J., El-Faitouri, R. and Shah, S.Z.A., 2016. More on the relationship between corporate governance and firm performance in the UK: Evidence from the application of generalized method of moments estimation. Research in International Business and Finance, 38, pp.417-429.

Akhmetshin, E., Danchikov, E., Polyanskaya, T., Plaskova, N., Prodanova, N. and Zhiltsov, S., 2017. Analysis of innovation activity of enterprises in modern business environment. Journal of Advanced Research in Law and Economics, 8(8 (30)), pp.2311-2323.

Albuquerque, R., Koskinen, Y. and Zhang, C., 2019. Corporate social responsibility and firm risk: Theory and empirical evidence. Management Science, 65(10), pp.4451-4469.

Ali, W., Frynas, J.G. and Mahmood, Z., 2017. Determinants of corporate social responsibility (CSR) disclosure in developed and developing countries: A literature review. Corporate Social Responsibility and Environmental Management, 24(4), pp.273-294.

Calabrese, M., Iandolo, F., Caputo, F. and Sarno, D., 2018. From mechanical to cognitive view: The changes of decision making in business environment. In Social Dynamics in a Systems Perspective (pp. 223-240). Springer, Cham.

Crane, A., Matten, D. and Spence, L. eds., 2019. Corporate social responsibility: Readings and cases in a global context. Routledge.

Demirag, I. ed., 2018. Corporate social responsibility, accountability and governance: Global perspectives. Routledge.

El Ghoul, S., Guedhami, O. and Kim, Y., 2017. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies, 48(3), pp.360-385.

Gaganis, C., Pasiouras, F. and Voulgari, F., 2019. Culture, business environment and SMEs' profitability: Evidence from European Countries. Economic Modelling, 78, pp.275-292.

González-Benito, Ó., Muñoz-Gallego, P.A. and García-Zamora, E., 2016. Role of collaboration in innovation success: differences for large and small businesses. Journal of Business Economics and Management, 17(4), pp.645-662.

Grayson, D. and Hodges, A., 2017. Corporate social opportunity!: Seven steps to make corporate social responsibility work for your business. Routledge.

Katmon, N. and Al Farooque, O., 2017. Exploring the impact of internal corporate governance on the relation between disclosure quality and earnings management in the UK listed companies. Journal of Business Ethics, 142(2), pp.345-367.

Kumar, R. and Oberoi, S.S., 2019. Cash Richness and Propensity to Acquire–An Empirical Examination Based on Largest Deals. International Journal of Economics and Financial Issues, 9(4), p.74.

Laasch, O. and Conaway, R., 2017. Responsible business: The textbook for management learning, competence and innovation. Routledge.

Long, T.B., Iñigo, E. and Blok, V., 2020. Responsible management of innovation in business. The research handbook of responsible management. Cheltenham: Edward Elgar.

Möller, K. and Halinen, A., 2017. Managing business and innovation networks—From strategic nets to business fields and ecosystems. Industrial Marketing Management, 67, pp.5-22.

Ntim, C.G., 2018. Defining Corporate Governance: Shareholder Versus Stakeholder Models. Ntim, CG (2018). Defining Corporate Governance: Shareholder versus Stakeholder Models’, in “Global Encyclopedia of Public Administration, Public Policy and Governance”, Springer, USA.

Obeidat, B.Y., Tarhini, A., Masa'deh, R.E. and Aqqad, N.O., 2017. The impact of intellectual capital on innovation via the mediating role of knowledge management: a structural equation modelling approach. International Journal of Knowledge Management Studies, 8(3-4), pp.273-298.

Pilav-Velić, A. and Marjanovic, O., 2016. Integrating open innovation and business process innovation: Insights from a large-scale study on a transition economy. Information & Management, 53(3), pp.398-408.

Price, M., Harvey, C., Maclean, M. and Campbell, D., 2018. From Cadbury to Kay: discourse, intertextuality and the evolution of UK corporate governance. Accounting, Auditing & Accountability Journal.

Santos, G., Afonseca, J., Lopes, N., Félix, M.J. and Murmura, F., 2018. Critical success factors in the management of ideas as an essential component of innovation and business excellence. International Journal of Quality and Service Sciences.

Teplov, R., Albats, E. and Podmetina, D., 2019. What does open innovation mean? Business versus academic perceptions. International Journal of Innovation Management, 23(01), p.1950002.

Visnjic, I., Wiengarten, F. and Neely, A., 2016. Only the brave: Product innovation, service business model innovation, and their impact on performance. Journal of Product Innovation Management, 33(1), pp.36-52.

Vom Brocke, J. and Mendling, J., 2018. Business process management cases. Digital Innovation and Business Transformation in Practice. Berlin et al.: Springer.

Wang, H., Tong, L., Takeuchi, R. and George, G., 2016. Corporate social responsibility: An overview and new research directions: Thematic issue on corporate social responsibility.

Yermack, D., 2017. Corporate governance and blockchains. Review of Finance, 21(1), pp.7-31.

Zalata, A. and Roberts, C., 2016. Internal corporate governance and classification shifting practices: An analysis of UK corporate behavior. Journal of Accounting, Auditing & Finance, 31(1), pp.51-78.

Zhang, Y., Zhao, S. and Xu, X., 2016. Business model innovation: an integrated approach based on elements and functions. Information Technology and Management, 17(3), pp.303-310.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts