Market Entry Strategies for SMEs

Introduction

International marketing is subject to various driving factors. The slowing growth rate in the developed markets that include European zones and United States of America (US) has limited the entry and expansion in these markets. Despite slowing down, these markets remain a major trading environment for businesses seeking to either expand of enter new markets. Globalisation in business perspectives, as defined by Stahl et al. (2017), infers businesses having operations in a different environment other than their country of origin. With this, come a different operating environment culturally, laws and regulations, consumer behaviour, purchasing pattern and power, and socio-cultural attributes. Accordingly, Boussebaa (2020) highlight that setting up operations in a different market entails considerations of more than opportunity but also the perception of consumers towards one’s products. Within the scope of this assessment, the discussion is rooted on decision for a London based SME to entry into Chinese market. The market focus is Ultra- Heat-Treated milk (UHT) for children aged from age 3 and 11 years. In this case, entry into Chinese market to tap the UHT milk market require taking into account the socio-cultural aspects of the Chinese market, the laws and regulations of operating the country, ease of entry and competition, the potential perception and reception of the product by the market, and consumer purchasing behaviour and pattern. Building from the argument posed by Karami and Tang (2019), the key questions the SME need to answer include ‘How easy for a UK company to enter the Chinese market? What are the entrant barriers? How competitive is the Chinese UHT milk market compared to the UK? Is the Chinese government have a direct influence on determination of the market operations? What is the perception of the Chinese customers on the UK products? Based on this, the company would make informed decision on whether to proceed with entry plans or not. This report outlines the assessed the potential challenges and environment in which a business entity must operating within to be success in an international market. In attempt to gain insight into the elements, the assessment utilise the appraisal tools for entry into an international market, decision barring entry into an international market, as well as analysis of both the UK and Chinese UHT milk markets.

Chinese Dairy Market

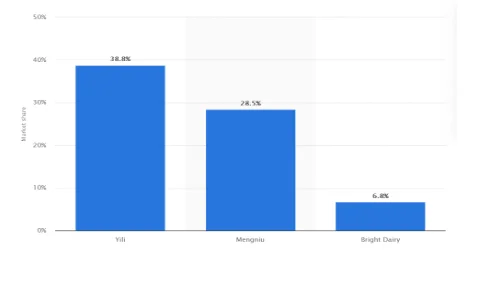

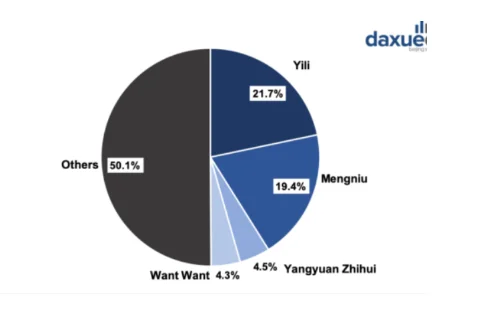

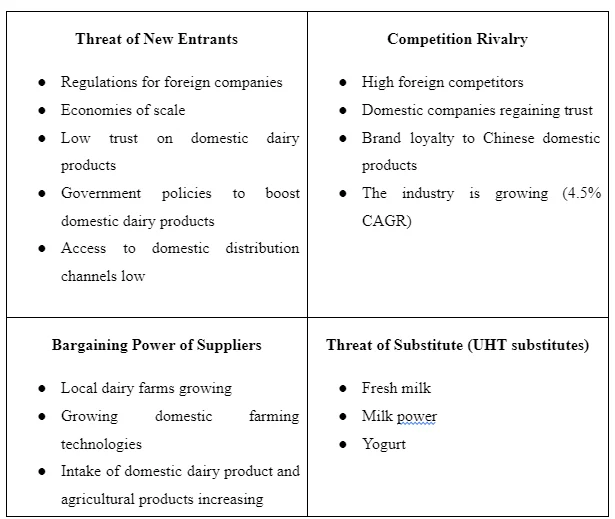

In the first quarter of 2019, Inner Mongolia Yili had a 38.8% of the UHT milk market share in China then followed by Mengniu with a 28.5% market share and Bright Dairy (6.8%). The three company held a 74% of the market share. In addition to the UHT milk, the Chinese milk market consists of fresh liquid milk, powdered milk, and concentrated milk. However, soya milk is also slowing making its ways into the market. Following the 2008 melamine scandal that rocked the Chinese milk industry, the market has slowing grow while also allowing foreign companies to gain market share over the time. The scandal that involved deliberate addition of melamine to diluted raw milk intended to boost the protein content (Gossner et al., 2009), raised a serious safety issue. Six deaths were reported and more than 300,000 Chinese and young children who had consumed melamine-added milk were diagnosed with Kidney and Urinary tract effects. Huang (2018) reported that despite measures put in place to guarantee safety and zero additive by local companies, parents remain sceptical and do not trust local milk. The incident involving some of the largest dairy producers in the country the include Sanlu Group, damage the reputation of Chinese food industry while devastating the domestic dairy industry. Following the incident, several foods regulations aimed at curtailing malpractice in the industry were passed into law. In 2020, the milk consumption per capital increased to 28 kilograms and is estimated to reach 41 kilograms/capita by 2030. Although the domestic companies is regaining trust aided by regulations in place, report show that public confidence on the domestic Chinese dairy products remain low with statistics indicating market share as high as 80% is taken by foreign companies. In attempt to boost the market share of domestic products, the government recently instituted a stringent regulation banning imports of dairy products by and from unregistered overseas companies (Huang, 2015). In 2018, the UHT milk registered 25% CAGR in sales and account for 60% of Chinese milk market share. During the pandemic period, the consumption of milk products increased as consumers sought for enhance their immunity. This, according to PRNewswire (2020), saw a significant increase in sales of cheese products, UHT, and low-temperature fresh milk. Other. As of 2020, Yili and Mengniu remained the biggest companies measured in terms of market size (approximately 40%).

The rising household income, a growth of 4.5% annually since 2015, has increased consumer purchasing power. The government enactment and implementation of two-child policy (liberation from 1-child policy) show a potential population growth with being children in near future. The industry show an annual growth of 4.5% to $68 billion (IBISWorld, 2018). Technological advancement has also shaped the agricultural in the country, production aspect, marketing, and quality monitoring and assurance (GMA, 2020). The milk consumption is expected grow by 13% while whole milk powders by 40% by 2025. Unlike in the UK, Chinese consumers have a habit of purchasing milk in small qualities. The lack of confidence on domestic dairy products saw an increase in imports by 14.80% in 2018 (PRNewswire, 2019). Consumer demand for healthy, high quality, and safe dairy products- safety first that include in packaging (paperboard for UHT) as it helps preserve the quality. The Political, Economic, Social, and Technical outlines factors, which influence the market of a product in a given market, in this case, UHT milk in Chinese market. According to Fredenburgh (2020), Chinese domestic companies show interest of collaborating with foreign companies particularly those from the UK because of being renowned for quality and reliability.

Contemporary challenges faced in entry

As pointed by Nikitina and Lapiņa (2019), contemporary businesses operate in a complex environment. Multifaceted nature of the operations is tired down to the rapid changes experienced in the current market place, socio-economic disparities across different countries, difference in policies and laws, differences in purchasing behaviour and power, and religious beliefs. Ideally, consumer behaviour transcends individual needs and wants but also includes capability of an individual to purchase, willingness to purchase, religious beliefs, influence of social and cultural tiers, and set rules by either government or religious doctrine (Boone et al., 2018; Nikitina & Lapiņa, 2019). The disparities in dimensions as such factors as power distance, individualism, and indulgence are other core determining factors to a business success in a different international market. Ștefănescu (2018) illustrated that all these factors culminate to ease of doing business in a said country. For instance, Chinese market being in Asia continent would have a huge difference in term of market determining factors (consumer perception, preferences, purchasing pattern and power, and influence of society or beliefs on buying) compared to the UK market.

Hofstede Cultural Dimensions

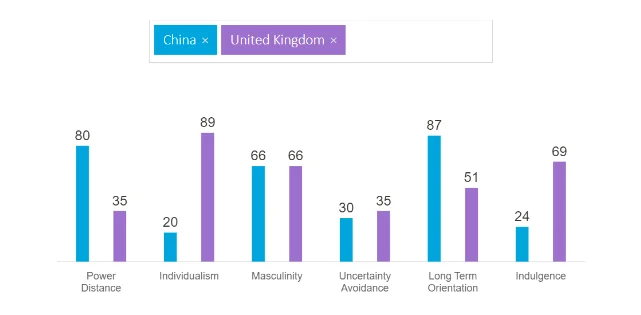

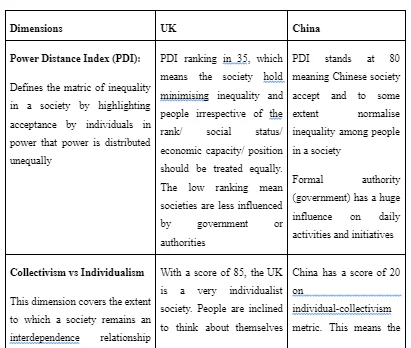

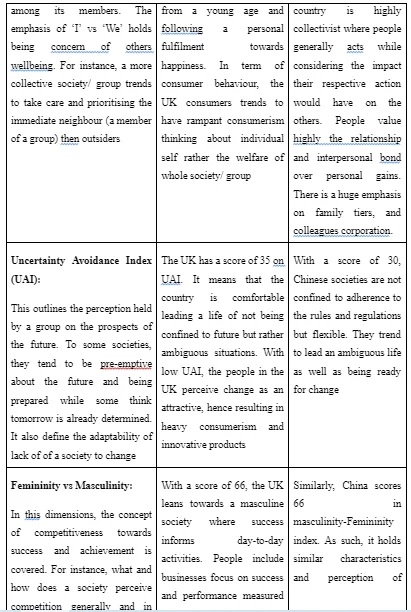

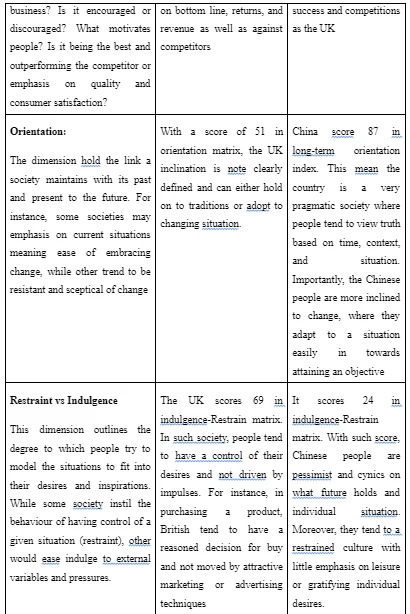

Using Hofstede Cultural dimension, one can understand the cultural difference between the UK and Chinese markets. This would aid in discerning ways in which the UHT milk would perform in the Chinese market compared to the home country, the UK. The framework developed by Geert Hofstede, it has five main dimensions namely power, gender, identify, uncertainty, indulgence, and time. Collectively, as illustrated by Beugelsdijk and Welzel (2018), it portrays the influence different cultures ingrained on societies have on the decision making and perception held. It further outlines the relationship between values and behaviour portrayed within the dimensions used in measured. For instance, understanding the preferences of UHT milk by the Chinese market segment (3-11 years) in comparison to their counterpart in the UK would follow a structured framework of the two countries. The table below shows a comparison of the UK to Chinese market in relation to UHT milk for 3-11 years customer market. Dimensions outlined by Hofstede framework guide the comparison.

From figure 1 and Table 2, one can argue that Chinese and UK societies hold distinct features, which defines the characteristics of consumers in each market. For UK, the consumers’ trends to be driven by individual desires and taste of a product while Chinese consumers included to social variables and accepted norms. For being individualistic, the British market would have a more consumer-oriented behaviour compared to their counterparts, Chinese, in buying a product. Additionally, the value Chinese people have on family and colleague relationship more than outsiders result view the foreign companies sceptically while also prioritising the Chinese products. Based on this, the consumers from the two countries have unique and distinct consumer behaviours, which ultimately affect the performance of a UK SME company in the Chinese market.

Porters Five Forces Analysis

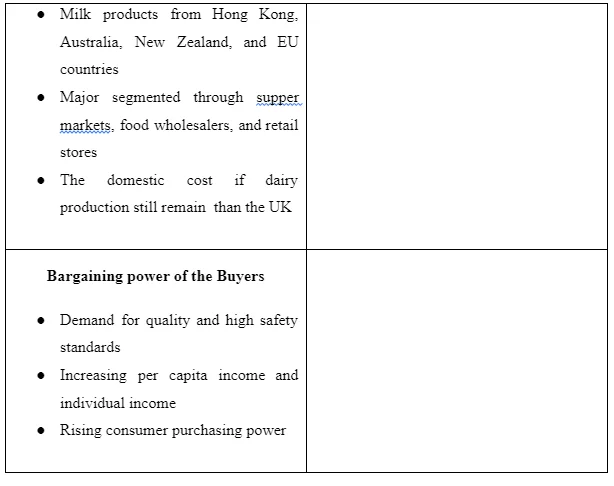

In 1979, Michael Porter’s came with a model used for analysing business competition. The model commonly referred to as Porter’s Five Forces Framework outlines competitive intensity as well as attractiveness of a given market. The forces that include threat of new entrants, substitution, rivalry among the competing companies, bargaining power of suppliers, and that of the consumer makes up the fundamental attributes that define ‘structural-conduct-performance’ paradigm of an organisation performance in a given market. As pointed by RFE, the framework is important in making a strategic decision that is rooted on competitive factors in a market. For instance, the ease of a business entity to entry a new market. The success of entering into the Chinese market by UK SME focusing on the ‘UHT milk children aged 3-11 years’ is can be determined by measuring the competition, suppliers, consumers, and suppliers in the market. In 2018, the Chinese organic dairy market reached a value of USD 860 million and is expected Compound Annual Growth Rate to be 15% (CAGR) to be worth 2.014 billion by 2024. The market is segmented based on provinces that include Jiangsu, Shandong, Henan, and Zhejiang Provinces. The distribution channels include direct sales, convenience stores, grocery, online retailers, and discount stores.

Conclusion

Entry into international market requires a business to have a strategies entry plan. Complexity of the contemporary international market characterised consumer demands, preferences, diversity in culture and social norms, economic disparity, difference in regulations and policies between host and home country, are culminated by the changing business environment such technological advancement and consumer purchasing behaviour. Successful entry into Chinese market by UK SME demand consideration of political, environmental, socio-economic, and technology aspects of the host country then comparing to the home country. Using Hofstede cultural dimensions, Chinese and the UK cultural aspects differ in number of ways such as social beliefs, power disparities, orientation, indulgence, and individualism. These differences inform the customer-purchasing pattern and behaviour. The cultural differences Supplier chain management in additional to social norms and beliefs limits internationalisation of SME into Chinese market. Using Porters Five Forces, the Chinese market show a huge potential for companies emphasising on quality, reliability, and transparency. This comes following the melamine scandal that faced the domestic dairy industry and eroding the Chinese confidence on the domestic dairy products. Although the government, in addition to making developing a conducive environment for business growth, it instituted regulations aimed at boosting the domestic dairy products, the foreign companies still perform better. However, this regulations structured to be ‘toughest possible punishment’ and ‘strictest possible oversight and accountability’ and formulation and enactment of ‘the strictest food safety law in history’ cutting across the production, marketing, and consumption are will ultimately curtail entry into the Chinese market and also considered a threat in long-term for foreign companies.

References

Beugelsdijk, S. and Welzel, C., 2018. Dimensions and dynamics of national culture: Synthesizing Hofstede with Inglehart. Journal of Cross-Cultural Psychology, 49(10), pp.1469-1505.

Boussebaa, M., 2020. From cultural differences to cultural globalization: towards a new research agenda in cross-cultural management studies. Critical perspectives on international business.

Gossner, C.M.E., Schlundt, J., Ben Embarek, P., Hird, S., Lo-Fo-Wong, D., Beltran, J.J.O., Teoh, K.N. and Tritscher, A., 2009. The melamine incident: implications for international food and feed safety. Environmental health perspectives, 117(12), pp.1803-1808.

Karami, M. and Tang, J., 2019. Entrepreneurial orientation and SME international performance: The mediating role of networking capability and experiential learning. International Small Business Journal, 37(2), pp.105-124.

Nikitina, T. and Lapiņa, I., 2019. Creating and managing knowledge towards managerial competence development in contemporary business environment. Knowledge Management Research & Practice, 17(1), pp.96-107.

Stahl, G.K., Miska, C., Lee, H.J. and De Luque, M.S., 2017. The upside of cultural differences. Cross Cultural & Strategic Management.

Ștefănescu, R., 2018. Aspects Concerning The Competition Of Business Operators In The Contemporary Business Environment. Annals of Spiru Haret University. Economic Series, 18(3), pp.69-80.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts