Strategic Analysis of Novartis

Introduction

Novartis is a multinational pharmaceutical company that is located in Switzerland. It is established in the year 1996. It is analyzed to be one of the largest pharmaceutical companies in terms of capitalization of the market and the total amount of sales. The different lists of drugs that are manufacture in it are mesylate, cyclosporine, diclofenac, and many others. It ranked second in the access to medicine index which indicates how the company is ready to produce products at the accurate time to the world's poor. The actual earning that was reported for the company in the year 2018 is about US$12.6 Billion. The annual revenue of the company is about US$53.2 billion. The actual value of the market capitalization of the company is over US$209.7 billion. The total employee of a company that is reported in the year 2018 is about 129,924. It has a better employment rate as compared to other Pharmaceutical sectors. The Ciba-Geigy merged with that of Sandoz and created the pharmaceutical-based organization Novartis. For those who are delving into the pharmaceutical sector, seeking business dissertation help in understanding industry dynamics and key players such as Novartis can provide valuable insights into market trends and strategies for success.

The study will evaluate the strategic analysis of Novartis using various methods and tools. The strategic analysis will be evaluated using various tools like PESTLE, Porter's five force analysis, and many others. The study will also discuss the competitive advantage of the organization and the opportunities as well as the weakness that exists or occur in the operation of the organization. It will also discuss the comparison between a similar organization as well as the recommendation that will be discussed which the organization Novartis can use from similar organization operations.

Discussion

Task 1

PESTEL Analysis

The PESTLE Analysis is one of the useful that can be used to analyze the strategic and competitive environmental analysis of the organization. The PESTLE analysis of the Novartis is summarized as below

Political: The political factor plays one of the essential roles that can impact the performance or the profitability of Novartis. As the company is operating in the drug manufacturing sector therefore it exposes itself to the different types of the political environment or the political risks. It is essential for Novartis to identify the following political factors before investing in a particular market. The factors like Risk of military invasion and political stability must be considered before investing a considerable amount of money into any market. The other factors like the level of corruption and intellectual property protection especially in the regulation of the Healthcare sector must be analyzed by Novartis. The tax rate and the incentives are also an essential factor that must be analyzed as it plays important factors in the market. The wage legislation and the trade regulation as well as tariff-related to healthcare are also one of the important factors that are having a political impact on the operations of the Novartis (Capacci-daniel et al. 2016). The Political factor also includes the factors like Legal framework for the contract and the pricing regulations are also having a political impact on the business of Novartis. The Anti-drug law related to that of the manufacturing of Drugs also plays a major role in creating a political impact on the business of the organization. It is found that Novartis has achieved an accurate level of stability in that of the political environment by participating in the public affairs operations held in Switzerland, Washington DC, and Belgium within the Novartis Global public Affairs department.

Economic: It can be said that the economic crisis has a major impact on the business of Novartis as well as the trust of the society towards the organization. The crisis as according to the people might create factors like scandals, Bankruptcy, and other types of unethical practices. Globalization can also impact the business of Novartis if there is a lack of adaptation in the organization as what is being declared. There are various macro-environment factors like interest rate, foreign exchange, and the actual rate of the economic cycle. The factors which must be considered by the Novartis while analyzing the economic impact on the organization are Discretionary rate, Economic growth rate in the operating market, and education level in the economy.

Social: It is found that now the customers are not much aware of the accurate ethical guidelines related to the right pharmaceutical products which result in creating only problems and also higher expenditure of resolution at the end. The customers also started giving priority to the products which help in overcoming the current health issues with less involvement of expenditures and also proper prescription. Thus this change in the perspective of customers can enhance the quality of the products which are being developed by the organization Novartis. The class-structure as well as the attitude of consumers towards the health and environment also plays a key role in putting social impact on the business of Novartis.

Technological: Technology is one of the crucial factors that can have a massive impact on the success of healthcare organizations like Novartis. The organization Novartis has included some of the advanced technologies like big data and IoT to improve the performance of the business. This helps in the secure storage of customer data and also performing the visualization of data as well as filtering the actual customer at the proper time. Therefore it creates some effects on the value chain structure of Novartis and also impacts the customer satisfaction rate (Coelho, 2019).

Environmental: It is essential for every firm to understand the environmental standard that can put an impact on the operation of it in the market. The factors that must be considered or can put an impact on the business or operation of Novartis are weather, climate change, Air and water pollution regulation in the manufacturing of Drugs, and the waste management in the Healthcare sector like Novartis. However it is found that the organization Novartis supports the green environment and thus improves its waste management as well as also supports the recycling of products.

Legal: There are various legal factors that must be considered by Novartis while operating in the market like Health and Safety Law, Data Protection Law, Anti-trust Law while manufacturing Drugs, Copyright patient, or the intellectual property law. It also includes employment law as well as the Discrimination Law to support the employees and staff of the organization. However, Novartis abides and follows all the rules as suggested by employees and there is no case of discrimination between staff, and also the drugs are prepared follows all the legal activities and regulations (fernfortuniversity.com, 2020).

Competitive Advantage

Novartis has a large number of competitive advantages as compared to other healthcare sectors in terms of operations. There are many competitors of Novartis which exist in the market like Pfizer, Roche, Johnson & Johnson and many others and the competitive advantage over these companies are

Novartis has a large database of suppliers all over the world which proves that it has stronger supply chain management as compared to other competitors.

As reported in the year 2017 there is a total of 125,161 employees working in the company Novartis and it shows that it has a better employment rate as compared to other competitors. But it is less than Johnson and Johnson because of a lack of training and development.

The patent of drugs provides a better competitive advantage and also it increases the customer percentage for Novartis. Thus it also helps the organization to give tough competition in the market. However the patent is valid only for a shorter period of time and rivals can take advantage of it.

The high expansion in the global market allows company Novartis to have more competitive power than that of other healthcare industries.

Porter's 5 Force Analysis

Porter's five force analysis provides better analysis in terms of competitors, consumer, and the supplier of the organization. Porter's five force analysis of the Novartis is been defined as below

The barrier to Entry: It is essential for the company that enters the pharmaceutical industry to have optimal research and development as well as a patent for the products in order to get success in the market. The capital that is required for the research and development is considered to be very high and thus it is one of the threats for the industry to enter into the market. The limitation in the patent for a new company creates difficulty for the new entrants in the market to gain a competitive advantage. Thus the factor is found to have a low impact on the competitive advantage as well as the operations of Novartis.

Power of Buyer: As the number of buyers for Novartis is scattered throughout the world and therefore there is less probability of bargaining from the organization for customers. The product of Novartis is also protected by the patents and therefore the buyers do not have much choice that can create an impact on the pricing of products. The power of buyers is therefore analyzed to be low on operations of Novartis.

Power of Supplier: Novartis has a large database of suppliers all over the world as lots of them have registered in Novartis's Portal. Thus Novartis has the capability to switch suppliers without much impact on cost and also it is not at all easy for the supplier to increase the price. Thus the power of suppliers is considered to have a low impact on the business of Novartis.

Threats of Substitute: As the products of Novartis are protected with the patents and that is offered to customer, hence there is no such replacement of the products that can be developed by the competitors in the market. However it can be concluded that as the patent exists only for a shorter period of time, therefore there are high chances that the competitors can take advantage of it and introduces the substitute of it. Henceforth, the threats of substitutes have a medium impact on the performance of the business (Vinayavekhin et al. 2020).

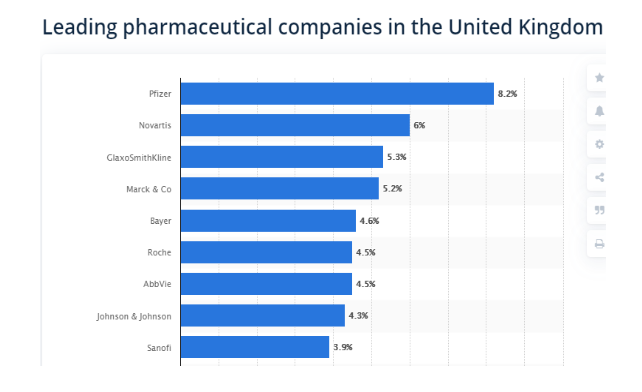

Competitive Rivalry: There is a high impact on the competitors in the operation of Novartis. There are many companies like GSK, Pfizer which has already lead the industry with the continuous development of products. The market share of various healthcare sectors is also high as compared to that of Novartis.

SAFe Discussion

Suitability: The company Novartis is suitable for the environment in which most of the healthcare sector is working. The products that are produced or manufactured through it are suitable for the customer as it has patent protection. Even it proves at the time of the rise in health issues and epidemic issues the company through reliable research has produced some of the effective medicine.

Feasibility: Novartis offers flexibility policy within the organization which allows the worker to get the facilities like work from home and also allows the staff to work in their own way without any restrictions. The company has a sufficient number of resources as well as the employee which helps in increasing the success rate of it. Therefore the employees as per the analysis are satisfied with the working environment and also every one of them is valued and respected with the benefits and incentives for the hard work. It results in increasing the manpower of the company which impacts the feasibility within it (novartis.com, 2020).

Acceptability: Novartis has a good value of profitability because of a higher number of customers and also large manufacturing of drugs. There is a high demand for drugs from Novartis and because of this reason the company has a better cost-benefit advantage as compared to the other competitors. The Net Income of the company Novartis is increasing yearly and it provides a better position in the market. [Referred to Appendix 2]

Task 2

Opportunities and Challenges

The various opportunities that exist in the business of Novartis are listed as below

Increase in the number of customer from Online channel

The decrease in the cost of transportation as because of the lower shipping prices helps the company to boost profitability and increasing market share

Lower rate of inflation helps to bring more stability of Novartis in the market.

Stable free cash flow allows the company to invest in the adjacent segments of the market.

The challenges that exist in the business of Novartis are

Change in customer behavior from the online channel can be one of the weaknesses to the existing supply chain of Novartis.

The marketing of the products is not that effective as even the sales rate is higher but the positioning of the market is not accurate or optimal and that leads to the decrease in marketing advantage over competitors.

The Novartis spend less amount of money on training and development of staff as compared to the other competitors, thus it brings a higher attrition rate in the workforce.

Now there are some of the improvements which can be done on the operation of Novartis to get a better result like the company must spend a higher amount of money on training and development of employees. The marketing of the company must include some of the advanced concepts and they need to expand their marketing globally to increase target reach. The increase in the number of customers through online channels puts an impact on operations of Novartis but it must focus on the existing supply chain also as it can increase the productivity of the organization (novartis.com, 2020). [Referred to Appendix 1]

Comparison of a similar organization

The comparison between Novartis and similar organization that exists in the market are

Annual Revenue: The annual revenue of Johnson & Johnson is about $82.1Billion and that of Novartis is $53.2Billion. Thus Johnson & Johnson is having more annual revenue as compared to that of Novartis (Tan, 2017).

Number of Employees: According to the analysis of the year 2018, the total number of employees working in Johnson & Johnson is about 1, 34,000 and that of Novartis is 125,161. Thus, the number of employees working in Johnson & Johnson is also more than Novartis.

Market Shares: The market share of Novartis is about 6% in the United Kingdom and that of Johnson & Johnson is 4.3%. Therefore, this provides a better opportunity for Novartis as compared to Johnson & Johnson.

A number of operating locations: Johnson & Johnson is operating in more than 60 countries and also having more than 260 different companies. The products of Novartis are located in 155 different countries all over the world. Thus expansion rate of Novartis is more than Johnson & Johnson (jnj.com, 2020).

Recommendation

Novartis has excelled in implementing different healthcare services but there is a little recommendation that can be useful for the operations of it. Novartis needs to focus more on the management of resources. It must identify the actual rate of the resource wastage and where they can use it perfectly. The company like Johnson and Johnson is having better employee rate and that helps in increasing the average revenue. Thus, Novartis must think about employees and start investing accurate amount in the training and development of staff. The company Novartis also needs to analyze Porter's five force analysis to identify the competitive weakness as well as the economic stability of market before entering or investing into new market.

Conclusion

Novartis is one of the recommended sectors that deal with the manufacturing of drugs. The company is having better competitive advantage as compared to other sectors as because of optimal marketing position and the high market share. However it is having less revenue as compared to that of the Johnson and Johnson. Thus the company needs to focused more on the employee training and development and also to expand the marketing strategy all over the world.

Reference List

Capacci-daniel, C., Delacruz, M., Gong, B., Jain, A., Lu, Y. and Zhang, L., Novartis AG, 2016. Compounds for the treatment of conditions associated with DGAT1 activity. U.S. Patent 9,242,971.

Coelho, A.C.F.D.S., 2019. A valuation of the pharmaceutical company Novartis AG (Doctoral dissertation).

Tan, L., 2017. Financial Situation Assessment of the Johnson & Johnson Company.

Vinayavekhin, S. and Phaal, R., 2020. Improving Synergy in Strategic Planning: Enablers and Synchronisation Assessment Framework (SAF). International Journal of Innovation and Technology Management.

Appendices

Appendix 1: Business Model of Novartis

Appendix 2: Novartis Background

Looking for further insights on Strategic Analysis of IKEA: Resources, Capabilities? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts