Tesla's Strategic Business Roadmap

Introduction

Business strategy is referred to the combined decisions taken and the action executed by the organisation to fulfil their business objectives and goals in order to ensure a competitive position in the industry. The strategies act as the backbone of the organisation as it shows them the map to be followed to achieve the desired business goals. In this report, the macro and micro environment analysis of Tesla is to be discussed to understand the way it has affected the company’s business strategies. The strategies capabilities of Tesla are also to be discussed. Later, the different strategic decisions taken by Tesla are to be explained and justification of appropriate growth strategies adopted by the company is to be provided. Lastly, a strategic management plan is to be formulated for Tesla to inform the way they are to progress further.

Task 1

LO1 Analysing the impact and influence of macro-environment on Tesla and its business strategies (P1, M1, D1)

Analysis of Mission, Vision and Objectives of Tesla:

The mission of Tesla is to accelerate the transition of the world into sustainable transport (tesla.com, 2019c). The acceleration component of the mission indicates that Tesla has established its role of pushing the industry use advanced technologies in forming sustainable products which operate in renewable energy. This aspect is beneficial for Tesla as it is going to help them in saving the earth's limited resources for the future. Moreover, using renewable sources of energy to operate Tesla's products would mean they would ensure the sustainability of their products in the market as they are never going to run out of energy and reduce operating costs ensuring products to be delivered in lower cost. The transition of the world aspect in Tesla's mission means that they are putting their emphasis on operating the global market. This aspect is beneficial for Tesla because it would help them to gain increased finances through foreign exchange and explore wider talents from different regions to improve their business. The vision of Tesla is to create them as the most compelling automobile organisation of the 21st century by driving the transition of the world to use electric vehicles (tesla.com, 2019c). The compelling aspects are beneficial for Tesla as it is going to help them show excellence in business, in turn, assisting to overthrow other competitors in the market. Tesla's driving the world to use electric car aspect in vision is also beneficial for the company as it would lead them to use advanced technology in lowering the pollution and ensure the sustainability of earth's resources resulting to act in conserving the earth that is the most concerned topic of the 21st century.

Tesla’s primary objectives are:

The generation of increase in demand for Tesla's electric is effective for them in saving the earth's resources and the use of advanced technologies to provide sustainable products to consumers. The environment-friendly products make consumers attracted to buy them as they feel they are acting to save the environment (Mathur et al. 2018). Thus, this objective is going to help Tesla increase their customer base. The long-term brand awareness and improving corporate reputation help an organisation to become a familiar name in the industry who is trusted by many consumers for buying products from them (Shahid et al. 2017). Thus, this objective is effective for Tesla in attracting new customers that would lead them to improve their sales and earn increased financial resources from the market. The development of customer loyalty is important for the company as loyal customers trust the brand and boys from them, in turn, boosting the company to earn revenue. Further, the loyal customer through word-of-mouth helps the company attract more new customers (Izogo and Ogba, 2015). Thus, the last objective is beneficial for Tesla in maintain steady flow of customers to earn potential revenue from the market.

Continue your journey with our comprehensive guide to Innovation with Business Goals.

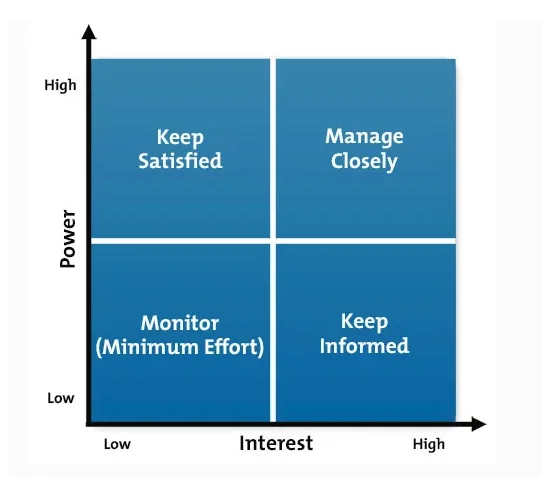

Stakeholder Matrix of Tesla:

The stakeholder matrix is being used by the organisation to understand the way they are to shape their business in attracting customers and be in competitive advantageous position in the market (Mathivathanan et al. 2018).

According to Stakeholder matrix, there are four positions for the stakeholders within a company:

High power and High interested people: These natures of stakeholders are to be keenly managed as they are key buyers of products of the company who regularly invest to have improved services and goods ensuring flow of finances and continuous sales of product in the market (Kuzmin and Khilukha, 2016). At this position, Tesla attracts the stakeholders who are luxurious in nature with keen interest in buying high-performing cars to meet their everyday and luxurious needs. Tesla to keep this nature of stakeholders attracted develops high performing cars with the implementation of improved and innovative automobile technologies without considering much about the cost. This is because these natures of luxurious customers focus more on the value of the product rather cost.

High power, Less interested: These nature of stakeholders are required to be keep satisfied through innovation in products (Mathiyazhagan et al. 2018). Tesla keeps this nature of stakeholders satisfied and attracted by delivering fancy luxurious cars with innovative improvements in car models without bothering on complex features to be implemented like the previous stakeholders who are high power and high-interest individual.

Low power, high interest: These natures of stakeholders are not luxurious in nature but show interest to buy innovative products and in doing business with them the company require to keep them informed about their products (Bouzon et al. 2018). Tesla keeps these natures of stakeholders attracted by informing them on regular basis about their new products and tries to create innovative cars for them with lower prices.

Looking for further insights on Tesla Inc.: Transitioning Toward Sustainable Energy? Click here.

Low power, less interested: Tesla keeps this nature of stakeholders attracted to their products by closely monitoring their needs and communicating with them regarding their car manufactured in such a way so that they do not get bored.

The macro-environment of Tesla can be analysed by using PESTEL Analysis tool to understand the way it is affecting Tesla and its business strategies.

PESTEL Analysis

The Automotive Investment Organisation (AIO) is providing incentives for foreign companies to expand their business (Gov, 2018). Tesla is an American organisation with mission and vision to operate globally is using the AIO to expand in the UK to fulfil its mission for the world's transition to electric cars. The plug-in grants for the low emission automobiles in the UK would help the hybrid and electric vehicle manufacturer to lower the price of their automobile products (Gov, 2018). This aspect has positively affected Tesla to reduce the price of their products in the UK and attract more customers as their current strategy is to produce an increased number of hybrid and electric vehicles. The UK automobile industry is reported to make total turnover of £82 billion in 2018 which is more than the previous year in 2017 when their turnover was £77.5 billion (Smmt, 2018; Smmt, 2017). This indicates that the UK automobile industry is growing financially. As asserted by Honjo et al. (2018), the industry that has a growing turnover is effective for the companies where they require operating. This is because their operation in the flourishing market would ensure them proper earning of finances for their company. Thus, the UK automobile industry being at a flourishing stage is being used by Tesla to effectively perform and incur more finances for their company for fulfilling their vision of being the compelling car company in the 21st century. The social condition of the UK is seen to be in a luxurious stage which is evident as 1 in 65 people in the country is reported to be a millionaire (the guardian, 2015; Smmt, 2018). Tesla manufactures luxury vehicles which are priced at premium amount (teslarati, 2018). Thus, the increased economic efficiency of the UK is being used by Tesla to manufacture compelling cars with high prices and luxurious facilities to meet its vision of capturing the global market in the 21st century. In the UK, infrastructure for manufacturing electric vehicles has grown by 46% (baringa, 2019). Thus, Tesla has planned to use the UK market so that by using advanced technologies from the market they can fulfil their vision to develop compelling cars that run efficiently on electric. As argued by Calvo et al. (2015), importing of resources to manufacture goods leads the organisation to create increased cost of their products. This is because while importing they have to pay customs duty and other charges that add to the total cost of manufacture of the product. In case of Tesla, in the UK the company have opportunity to avail improved technology in building their cars without need of importing resources that are going to help them lower the price of their products, in turn, being able to attract wide range of customers. The UK government is seen to be allocating pollution taxes for vehicles that emit increased amount of CO2 (Gov, 2017). In case of Tesla, most of the automobiles manufactured execute low emission and they are presently diverting to become an electric car manufacturing company. Thus, the taxes levied are going to benefit Tesla in ensuring lower management cost of their cars as they mainly executes low emission and this would influence the environment-friendly customers to buy their products increasing the customer community for Tesla in the UK. However, the UK government has implemented tax for low-emission vehicles (metro.co.uk, 2017). This is going to influence the car consumers of Tesla to pay increased finances in managing their vehicles while operating in the UK. Tesla to operate legally in the UK requires ensuring they follow the Companies Act 1998 and other corporate laws. This is because violation of laws leads companies to face lawsuits that negatively affect their name in the industry making consumers lose trust over the company, in turn, avoiding to buy from them (Götz et al. 2016). In respect to pollution laws in the UK such as Pollution Prevention and Control Act 1999 and Clean Air Act 1993, Tesla requires to ensure their cars follows the guidelines to ensure they contribute effectively in reducing the pollution in the country.

LO2 Assessing Tesla’s internal environment and their strategic capabilities (P2, M2, D1)

In order to analyse the internal environment of Tesla, the SWOT analysis tool is to be used.

SWOT Analysis

Analysis:

Tesla is seen to have a unique brand position in the market where they are changing the way people are driving by manufacturing luxury electric and automatic-driving vehicles (Forbes, 2015). It acts as strength for the company as unique brand positioning has helped them dominating the electric vehicles market by providing luxurious self-driving automobiles to attracting new consumers towards them. The sales figures for Tesla shows that in 2015 their sales increased by 27% whereas in 2016 it jumped to get increased by 59% after the launch of their Model X (Tesla, 2018). This indicates that the products of Tesla are in high demand in the market and offering them the ability to incur increased finances to be used in expansion of the organisation. Thus, the increasing sales figure act as strength for the organisation to help them have money to effectively operate in the industry. In 2019, Tesla is reported to be best brand and automobile group for selling plug-in electric cars (CNBC, 2019). This indicates that Tesla is one of the leading brands in the industry which is preferred by many consumers for buying automobiles making it strength for the company as it is going to increase their demand in the market. Tesla is seen to burning through cash as they have largely invested most of their finances for the research and development purpose to develop transformative technology for their automobiles. Moreover, Tesla is investing in a lavish manner for its factory in Nevada which is going to manufacture lithium cell batteries for the organisation (Tesla, 2019). This burning through cash is acting as weakness for Tesla as it is leading them faces negative free cash flow and earnings that is making them being unable to have finances required to resolve its debts. In 2016, it is reported that the debt of Tesla has been raised to $1.5 billion in terms of long-term debt and leases for capital which is 72% of their total capital and it has led them to have just $1.4 billion in hand (CNBC, 2019; ft.com, 2019). Thus, it indicates that the huge debt of Tesla is making them financially weak to be able to have proper cash flow to make investment for future growth. Tesla’s Model 3 is reported to be one of the cheapest models that have been launched (Forbes, 2018). This indicates that Tesla has the opportunity to reach to increased number of customers making them able to get increased investment from the new customers. Tesla is working on reducing the cost of their automobiles so that they can be able to attract more wide range of customers. It is evident as Tesla is reported to be building a Gigafactory where they are going to produce batteries for vehicles at lower cost which may 30% less than the present cost (Tesla, 2019). This initiative is going to act as an opportunity for Tesla as through the process they would be able to attract increased number of customers as well as improve sales to collect increased finances for the company. Tesla is going to face financial threat which would make them unable to properly invest for their ambition product ramp in the future. This is because as in 2016 they have $1.5 billion hands which are much lower than the total amount of fiancés required to be invested in the ramp (CNBC, 2019; teslarati, 2018). Thus, this aspect act as threat as the company to fulfil the required amount of finances would wither debt finances or execute equity offering that is going to hinder their financial stability. The increased competition in the electric vehicles market is also going to act as threat for Tesla and its competitors would offer cars at half prices. It is evident as the VolkswagenMEB Entry is reported to be priced at half the Model X of Tesla that is still regarded as one of the cheapest cars of the company with price of $4,600 (Tesla, 2019; drivingelectric, 2019). This is going to make it vulnerable for Tesla to lose its customer base to its competitors which would make them face lower competitive advantage and incur less revenue from the market their sales would be affected. The strategic capabilities of Tesla are to be identified through VIRO framework to understand which strategy of the company is able to create better competitive advantage in the market.

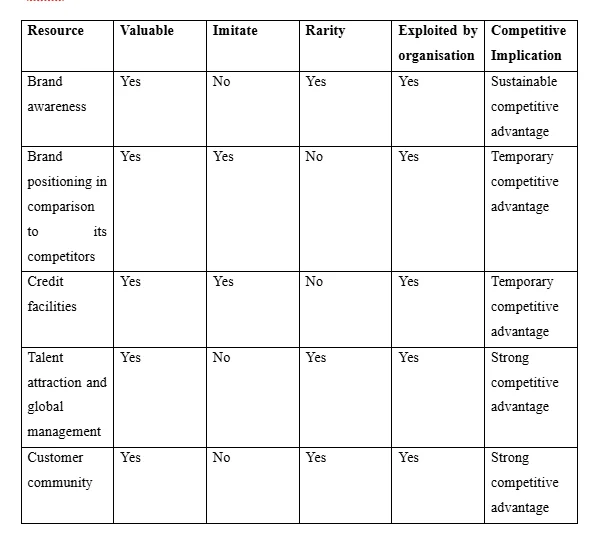

VIRO Framework

VIRO Analysis

The least expensive car in Tesla with price of $4,600 is Tesla Model 3 but one of its competitors that is Volkswagen is seen to be making entry of MEB which is going to be cheaper electric car with pricing that is half of Tesla 3. Moreover, Byton is another key competitor of Tesla who is manufacturing M-Byte that is an electric car with battery longevity that of Tesla Model 3 (Tesla, 2019; drivingelectric, 2019; byton, 2019). The facts indicate that though brand positioning of Tesla products is made in a valuable way yet they are able to be intimidated by its competitors and are not rare in nature. This also indicates that the brand positioning of the electric automobiles by Tesla in the market is going to bring temporary competitive advantage as their products can be intimated and manufactured with less price to be provided to its customers to make them get attracted to its competitors. Tesla is seen to be using sinnovative way of advertisement where the target consumers are informed through videos about the special features of the new automobile products of the company and the way they are manufactured to increase awareness regarding their products (teslarati, 2014). This has created effective brand awareness regarding their products which are difficult to be imitated by its competitors. Thus, brand awareness of Tesla is going to bring sustainable competitive advantage as it is rare for its competitors to develop the level of awareness at the preset Tesla has in the automobile market. The credit facilities of Tesla indicate that in 2018 they have incurred US$ 21.461 billion as revenue which is more than the previous year (annualreports, 2018). In comparison, Volkswagen which is one of the competitions of Tesla has incurred US$26.485 billion as revenue in 2018 (volkswagenag, 2018). The figures indicate that the credit facilities of Tesla are though valuable in nature but they can be intimated as seen in the case of Volkswagen who has incurred more credit than Tesla. This informs that in respect to credit facility Tesla has temporary competitive advantage as they are not rare in nature and not difficult for its competitors to outsmart them. The customer community of Tesla is quite valuable as 90% of customers are seen to remain loyal to the company (Forbes, 2019). Moreover, the customer community of Tesla is difficult to be imitated as most of the customers are immensely deducted to buy from the company due to its innovative and high-quality products that fruitfully satisfies their needs compared to other competitors of Tesla in the market (Forbes, 2019). This informs that the customer community of Tesla is going to bring strong competitive advantage for the company as they are rare and difficult to be imitated to make them switch to buy from others. The talent attraction and global management of Tesla are seen to valuable in nature as they execute successful innovation in their products to supply them globally by attracting effective talent to work for the organisation (teslarati, 2018). The way they attract talent and manages business globally is hard to be imitated and rare in nature due to which it is going to bring strong competitive advantage for the organisation.

Strategic Capabilities of Tesla:

The strategic capabilities are referred to the ability of the business for harnessing their skills to gain competitive advantage in the market. Tesla’s strategic capabilities are:

Innovative CEO

Unique and futuristic designs of electric cars

The innovative CEO who is Elon Musk of Tesla is one of the strategic capabilities of the organisation because the organisation can use the person to frame innovative and upgraded design of cars that has never been present in the industry to meet all needs of customers. Moreover, the unique and futuristic designs is another beneficial strategic capability of Tesla as it is going to help them develop and manufacture innovative automobiles that would provide improved satisfaction to the existing consumers in the market making them prefer to buy from them (Dana, 2018).

Mc Kinsey 7S model:

The Mc Kinsey 7S indicates the way key seven elements in the business are aligned for increasing the effectiveness of the organisation in the market (Ahmadjian and Schaede, 2015).

Strategy: Tesla’s strategy is to accelerate the world to make transition to use electric cars for ensuring to use sustainable energy (tesla, com, 2019). The strategy is effective for Tesla as it would boost their image as an environment-friendly organisation making consumers avail them as buying from Tesla would show their contribution to save the environment which is one of their social responsibilities. Tesla also has the strategy to keep the price of their products to minimum (tesla, com, 2019). This is an effective strategy to attract wide range of consumers from different classes in the society as economic prices would attract the middle class individuals to avail Tesla’s products as it would be within their financial ability (tesla, com, 2019).

Structure: Tesla operates its business by following divisional organisational where there are various ranges of divisions in the company such as energy, software, engineering and production and others (tesla, com, 2019). The benefit of divisional organisational structure is that it assists the company to be self-sufficient by promoting work in form of teams where various staffs with different level of expertises share innovative ideas to decide the way final product is to be developed and manufactured (O’Gorman and Curran, 2017). Thus, the divisional structure is effective for Tesla to develop innovative products in a collaboratively way with the implementation of different experts ideas.

System: Tesla uses various systems for its long-term prospects such as customer relationship system, team development and management system, business intelligence system, employee management system and others (tesla, com, 2019). These are effective for Tesla’s business in keeping the employees satisfied, skilled and motivated to work with effort and efficiency as well as keep customers motivated towards them.

Style: The leader of Tesla uses the transformational leadership style in leading the organisation (tesla, com, 2019). It is evident as the leader which is Elon Musk in Tesla encourages, inspire as well as motivate the employees to share ideas and develop collaborative working environment to meet the goals of the organisation. The transformative leadership style is effective for Tesla as it helps in the formation of an effective vision for the company in a collaborative way and promotes enthusiasm and motivates employees to work efficiently, in turn, improving performance of the company.

Staff: The staffs within Tesla are recruited through internal and external recruitment policy based on their talents and educational qualities to ensure they work in an efficient manner and they are provided reward and career opportunities along with growth in the organisation. This is effective for Tesla to retain staffs as the rewards and fair recruitment policy makes the employees feel valued.

Skills: Tesla provides training to its employees to improve their skills which are effective to help the organisation progress. This is because improved skilled through training lower the skill gap helping employees to make less error and executes work in a proper manner (Tesla, com, 2019).

Shared Values: The shared value of Tesla is to attain sustainability through innovation (tesla, com, 2019). This is because innovation helps the products of the organisation to be continuously changed to meet the changing needs of the customers which ensure their sustainability in the market as the meeting needs through innovation provides satisfaction to customers.

Task 2

LO3 Evaluating and applying outcomes of Porter's Five Forces model with respect to the market performance of Tesla (P3, M3, D1)

Porter’s Five Forces Model

Bargaining power of buyers: The switching cost for the customers of Tesla is high which means they would experience high variety in price while purchasing products similar to Tesla from the competitors of the organisation. This is evident as Tesla’s cheapest car Model 3 costs £38,900 whereas the similar model of Kia e-Niro cost £33,000 and Hyundai Kona cost £30,000 (thisismoney.co.uk, 2019). However, the presence of substitutes of Tesla’s used technologies and efficiencies provided in their products in the market is moderate (teslarati, 2019). It is evident as Kia e-Niro has lower performance than Tesla and Hyundai Kona is just wider apart in performance and efficiency than Tesla’s Model 3 (thisismoney.co.uk, 2019). This indicates that the bargaining power of the buyers of Tesla is comparatively weak as they cannot force Tesla to bargain with them as they have less scope and opportunity in the market to get similar products at lower prices.

Bargaining power of suppliers: The forward integration is referred to the business strategy used by suppliers to include vertical integration where the business activities are expanded through other parties to control the direct distribution of products by the organisation. In case of Tesla, the suppliers have lower forward integration level which is evident as few of the Tesla products are sold through third-parties and mostly are supplied by the company directly to the customers (teslamotors, 2019). This indicates that the suppliers have moderate to weak power to bargain with Tesla as the company is less dependent on them and solely manages most of the supply of their products in the market.

The threat of substitutes: Tesla produces wide ranges of products with the best innovative technologies to ensure high-quality services are provided to the consumers who use their products. This is evident as the unique design designs of the cars with highly efficient motors, performance, quality of the battery, wheel options and others present in Tesla are unable to be designed and manufactured by other existing and new companies (CNBC, 2019). At present, in the industry, there is less scope to develop product substitutes against the existing automobile and energy efficient products at the same cost manufactured by Tesla. Thus, the threat of substitute is weak for Tesla as there is moderate availability of substitute products in the market in comparison to their existing products.

Threat of New entry: The business of Tesla is difficult to be completed with due to their highly innovative and diversified brand image with premium pricing, high cost of brand development and popularity of Elon Musk who is the head of the organisation (Tesla, 2019). Moreover, the new entrant to compete with Tesla require huge amount of finances to establish their business which may not be possible for them as the required investor would not be available to invest in a new business. Moreover, new entrants require licence, distribution channels, insurance and others to operate their business which is not easy for them to obtain in the new industry (Ly and Shimizu, 2018). Thus, the threat of new entry is acting as a weak force for the business of Tesla as the new entrants do not have much upfront investment to meet Tesla’s quality of products. Moreover, they also require huge time and effort in establishing the image at the present Tesla has in the market during Tesla would scale heights due to which threat of new entrant is low.

Competitive Rivalry: Tesla is seen to operate in the electric vehicle industry where the competition is seen to have developed in an intense way. This is because there are more existing firms such as the Volkswagen, Jaguar, BMW and others who are developing various nature of energy efficient and electric automobiles that are similar to Tesla (Tesla, 2019, teslarati, 2018). In this aspect, Tesla is going to face increased competitive rivalry as more companies are trying to develop new products and develop rival strategies for Tesla so that they can outsmart the existing products manufactured by Tesla to attain competitive advantage in the market.

Strategic implication of the competitive force analysis:

Tesla is seen to have partnered with Dailmer in 2009 who has invested $50 million in the company and provided them a contract for their drive train technology (reuters.com, 2014). Moreover, Panasonic partnered with Tesla and has invested $30 million for co-development of battery and together they have opened the factor in Nevada (teslarati.com, 2019f). Tesla has also collaborated with Toyota who invested $50 million and sold their United Motors manufacturing firm to help increase and manage the manufacturing of Model S units (thedrive.com, 2017). The mentioned collaboration has been done by Tesla so that they can improve the quality and production of car models with the help of others and be in a higher competitive advantageous position in comparison to its rivals. This would lower the force of competitive rivalry for Tesla with the help of collaboration with other companies they would make their products in such a unique way that no other competitors can overthrow them in the market.

Ansoff Matrix

The strategic decisions are related to the entire environment in which a company is operating, the entire resources as well as its entire people (Wegner and Mozzato, A2019). As per Porter's Five Forces analysis, the only strong force that is affecting the competitive position of Tesla is competitive rivalry. In order to devise different strategic decision for Tesla in this respect, the Ansoff matrix is to be used. Ansoff matrix is referred to a strategic management tool which offers framework for the organisation to devise strategies regarding their future growth (Rapley, 2017). The Ansoff matrix informs four growth strategies that can be used by the organisation which are market penetration, product development, market development and product differentiation (Gurcaylilar-Yenidogan and Aksoy, 2018). The market penetration is the primary strategy that is to be used by Tesla in which they are going to intensify their sales in the present market in the global context. This is to be done so that Tesla can minimise the competitive rivalry by increasing their competitive advantage in the market through increased market share developed by earning increased revenue due to expansion of their company and sales. The product development is the second strategy that is to be used by Tesla for increasing their growth in the market according to which new automobiles that use environment-friendly technology are to be manufactured for increasing their sales. The development of new products as per the demands in the market helps them to attract more consumers (Chiang et al. 2016). Thus, Tesla by developing different products of electric vehicles that are environment-friendly in nature would help them to increase their consumer community by drawing customers from their competitors, in turn, improving their competitive position in the market. The market development strategy is to be used by Tesla in expanding to new markets to enter markets of new countries where they are still not delivering products. It is to be done with the intention to increase their global exposure to be in a competitive and leading position with respect to its competitors. The product differentiation strategy is to be developed by Tesla to enter new market domain such as one of their target is to create new battery products for non-automotive application (Tesla, 2018). This is to be done by them with the intention to expand their business in diverse market areas to earn increased revenue to be in a competitive advantageous position in the industry in comparison to its competitors.

Balanced Scorecard of Tesla

The improved revenue growth of Tesla indicates that the company is performing at an immense rate in the market through the sales of its products and services (annualreports, 2018). In respect to the customer, Tesla is also seen to have higher score in the market as they are seen to provide updates and innovated technology in cars that are meeting the needs and demands of their customers in an effective way. The high resale value of products makes the customer feel valued in buying products as they can ensure that after selling the products they can get good returns for their investment thus offering value for their money (Hess and Andiola, 2017). Therefore, Tesla high resale value for its products is effective way to improve their customer base. The low-cost manufacturing helps to keep the price of the products low (Asif and Singh, 2017). Thus, the low manufacturing cost of automobiles for Tesla is valuable for their company scorecard as they can provide improved cars to customers at lower prices making them able to buy their products without thinking about bothering as would have faced in case of huge financial investment. Tesla spends more percentage of finances compared to key competitors like BMW and others in developing improved innovation in their cars (tesla.com, 2019). This indicates that they are more concerned in making innovation and learn new implementations to be made in their products to remain at a high score in the market. It is evident as innovation drives in building better products that in turn attracts more customers increasing the sales figure of the company.

LO4 Applying models, theories and concepts for understand and interpreting strategic decision for Tesla (P4, M4, D1)

P4 Applying a range of theories, concepts and models, interpret and devise strategic planning for a given organisation.

Porter’s generic strategies:

Porter’s generic strategies allow the company to identify essential strategies to be used by them to ensure competitive advantage in the market (Bertozzi et al. 2017). Tesla follows the board differentiation strategy to build its competitive advantage in the market. The differentiation strategy informs that the company are to develop and manufacture its products in such a way so that its features and quality are more attractive in nature compared to the competitors (tesla.com, 2019). In case of Tesla, it is seen that they use high-standard and advanced environment-friendly technologies to manufacture its products that are totally different and innovative in nature compared to its competitors which is evident as they have earned various patents for their technology. Patents are offered to owner making them legally able to use, sell, make and import the invention ideas (tesla.com, 2014). Thus, this informs that Tesla’s products are unique in nature and they differentiate in such a way so that it is better and improved in nature than the existing designs and manufacturing ideas being used by its competitors.

Strategic Plan:

Executive Summary

The strategic report is framed to inform about the way Tesla is going to work to meet the strategic objectives set for next 5 years. In the process, it is understood that Tesla has strength of unique brand positioning and opportunity of innovation as analysed through SWOT Analysis tool. The vision, mission and objectives along with the strategic goals for next five years are mentioned. The industry analysis is done through Porter’s five force model and competitor analysis is done which informs that Tesla is facing competitive rivalry as key issues but its production of high performance cars compared to competitors is acting in favour to help them remain in the competitive advantageous position in the industry. The value chain analysis of Tesla to meet the mentioned goals is done through Porter’s value chain analysis.

Elevator Pitch

The annual revenue of Tesla was $22.59 billion as counted on March 31, 2019, and it is found to be 81.17% increase from the previous year (annualreports, 2018). This indicates that Tesla is able to gain effective finances from the market through sales which inform that Tesla is growing and capturing the market for automobiles and energy at an immense rate. Tesla mainly operates in the automobile and energy industry as well as has expanded its operation in manufacturing spacecrafts and solar panels (tesla.com, 2018). This indicates that Tesla is focussing on variety of products to develop and expand their organisation.

Vision and Mission of Tesla

Mission: The mission of Tesla is to accelerate the transition of the world into sustainable transport (tesla.com, 2019c).

Vision: The vision of Tesla is to create them as the most compelling automobile organisation of the 21st century by driving the transition of the world to use electric vehicles (tesla.com, 2019c).

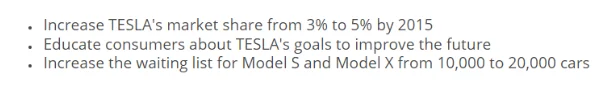

Objectives of Tesla:

Primary Objectives:

Secondary Objectives:

Overarching Objectives:

SWOT Analysis:

Analysis:

The unique brand positioning of Tesla is strength as it is going to help them in persuading sales of its products. This is because unique brand positioning promotes visibility of the company in the market which acts as top-of-mind-recall to create prospects for the company to shut other competitors due to preference of the consumers to buy the unique products (Adin et al. 2015). The robust growth in sales of Tesla acts as it strength because it informs that their products have increased demand in the market which indicates they have opportunity to increase their company size through increased sales of their products. The burning through the cash and high debts is acting as weakness for Tesla because it is going to create financial crisis within the company to operate its business (ft.com, 2019). However, to resolve this weakness Tesla is seen to have the opportunity of creating effective innovation in their products to create new and innovative products to be supplied to customers to increase sales in the market, in turn, helping them incur better finances to cope with debt and improve their financial performance. Further, Tesla’s initiative to reduce cost in manufacturing and other related activities is going to help them save finances to meet their debts, in turn, would assist the company to revive from their financial crisis. The increased competition is a potential threat faced by Tesla in operating the business (electrek, 2019). In order to resolve this, they have to use their strength of unique brand positioning and opportunity of making innovation in their products. This is because it would lead Tesla’s products to stand out in the market and have increased demands making more customers buy them over other products that are developed by its competitors helping them have a competitive advantage. Moreover, Tesla while making innovation require to ensure proper research is done regarding the competitors so that they have information about the way to innovate and make changes in their products so that it stands out in the market and create demand for them over competitors.

Goals for the next 5 years:

First year goals:

To increase the present sales by 10% compared to its competitors

To improve and increase the production of their Model 3 car to meet the demand

Second year goals:

To increase the sales by 20% compared to its competitors

To allow same day repairs of their cars

To develop self-driving cars that can change lanes automatically

Third-year gaols:

To improve the auto-piloting technology for their cars

Fourth year goals:

To be the key manufacturer and supplier of electric cars in the market

Fifth year goals:

To improves sales by 23% compared to its competitors

To increase revenue collection by 90%

Key performance indicators of Tesla:

Improved profit margin and increased sales growth

Improve sales per employee

Talented employees

Innovative technology use in manufacturing cars

Target Customers:

The Ansoff Matrix of Tesla indicates that key target customers of the company are individuals who belong from higher social-class and luxurious customers.

Industry Analysis:

The industry analysis is to be done by using Porter’s Five forces model to understand the way present prevailing situation within the industry. Tesla mainly operates in the automobile and energy industry.

Bargaining power of buyers: The switching cost for the buyers is low in the electric car industry which indicates they have low bargaining power (Forbes, 2015; thisismoney.co.uk, 2019). This is because low switching cost means there is less difference in the cost of products from one company to another making buyer unable to bargain. This acts as an advantage for Tesla to attract and persuade potential; customers to buy their products as the extent of performance and technology their automobiles model are providing it is hard for any buyers to ignore them.

Bargaining power of suppliers: The bargaining power suppliers are not be bothered by Tesla as they personally supply their cars through manufacturing outlets and showrooms without accessing any external supplier to supply their manufactured car in the market. Moreover, there are increased suppliers of electric car parts and Tesla personally has their own manufacturing unit and battery manufacturing factory making bargaining power of supplier weak for Tesla.

The threat of substitutes: In electric car industry, the threat of substitute is weak for Tesla. This is because they are producing updates and innovative products as well as offering technology and survives features that holistically fulfilling needs and demands of customers (CNBC, 2019). This acts as advantage for Tesla to ensure smooth operation of their business in the industry as they have low threat of being substituted.

Threat of New entry: In electric car industry, the threat of new entry moderate. This is because the extent of investment and improved technology a new company would require staying in the industry would be unbearable for them to perform at par with Tesla (Ly and Shimizu, 2018). In this respect, Tesla has the opportunity to use their skills to rule the electric car industry without fearing threat of new entrants as the new companies cannot develop their business to the extent Tesla is performing at the moment.

Competitive Rivalry: The competitive rivalry in the electric car industry is high. This is evident as almost all automobile companies such as Ford, General Motors, BMW and others have participated in the industry and manufacturing electric vehicles (Tesla, 2019, teslarati, 2018). However, in case of Tesla it is seen that the performance of their electric cars in no match to any of the models produced by its competitors even though they are lower in price. This indicates that Tesla though is going to face increased competitive rivalry due to existing competitors in the electric car industry but their quality and performance of cars are going to offer them advantage to remain in an upper position compared to its competitors. Competitive Analysis

BMW:

Strength:

Valuable brand with global operation

Improved driving experience

Perfect engineering

Weakness

Increasing debts

Poor brand portfolio

In relation to strength, Tesla also has effective global operation like BMW and offer better performance of their cars to its customers while driving. However, Tesla have effective brand portfolio in the market making it better than BMW as it is the aspect in which the company lags.

Volkswagen:

Strength:

Effective diversification strategy

Widest brand portfolio

Weakness

High recall rate in US market

Less competence in battery driven cars

In relation to strength, Tesla also has effective brand portfolio and greater diversification strategy to operate in the global market. However, they still do not have much recall rate and the resale values of their products are more. Tesla has effective competence in building battery driven cars and electric cars making it to have better efficiency than Volkswagen to operate efficiently in the electric car industry.

Strategies and Tactics:

Tesla is required to lower their unnecessary expenses and implement finances to improve their manufacturing unit to make it efficient to increase the manufacture of their Model S as per rising demand in market. In order to intensify the sales, Tesla is going to ask for feedback from the customers in details for each of their existing products in the market. This is because feedback from the customers helps the organisation to understand the specific needs and demands of them which are to be focussed to change the present product nature to increase sales (Chernev, 2018). Thus, Tesla through the strategy of having feedback from the customers would be able to understand the way the present product are to be modified and change to improve their performance in the market to increase their sales figures. In order to create innovation in Tesla’s electric vehicles improved functioning of their research and development department is be made. In this process, the tactical actions to be taken by them is that new talents is to be added in the research and development team so that they can identify through improved skills the nature of attributes to be added in their electric vehicles to make them more demanding in the market in comparison to its competitors.

Justification and Recommended growth platform and strategies for Tesla

Tesla is going to use market penetration strategy as one of the growth decision for the organisation in which they are going to intensify the offering of their products in the market to expand their business. This is because from SWOT analysis it is found that the company is facing a huge debt and thus they do not have enough finances to enter new market. In order to execute this, Tesla is going to use support product development and diversification strategy so that new and innovative products can be offered in the existing market to attract more customers to expand their market operation. This is going to lead Tesla to improve its research and development department where new ideas to present their existing products in new form are to be developed to successfully ensure market expansion.

Team

Automobile engineers

Electric car engineers

Mechanical engineers

Sales managers and sales executive

Product Support Engineer

Software Engineer

Senior Financial Analyst

Product Service Engineers

Operations Plan

Porter’s Value Chain analysis is the strategy that is used for analysing the internal activities of the organisation (Koc and Bozdag, 2017).

Inbound logistics: Tesla inbound logistics include storage of raw materials that are required for building electric cars. In this respect, Tesla stores wide range of resources such as scare materials (steel, cobalt, aluminium, nickel, cooper, etc), lithium battery, electric appliances and others. These resources are required in manufacturing cars to meet the demands in the market and in turn promote sales of the company.

Operations: Tesla would operate its car manufacturing from its facility units in California, Netherlands, Fremont and others.

Outbound Logistics: Tesla is going to use shipping transportation in supply and distributing their vehicles globally so that their target sales can be achieved.

Marketing and Sales: Tesla is going to focus on word-of-mouth and advertisement to market and sell its products to reach the determine revenue percentage at the end of the year.

Service: Tesla is going to improve their customer services and increase automobile servicing agents and employees to reach the goal of automobile repairing within one day.

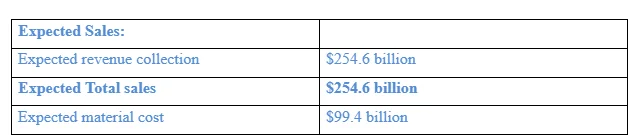

Financial Projection

For 1st year:

Conclusion

The above discussion informs that the political, technological, economic and social environment in the UK automobile industry is supporting the growth of Tesla. Tesla presently has huge debt as one of their weakness to grow and increased competition is acting threat for their business but they have the strength of unique brand positioning and opportunity of innovation and cost reduction to cope with the threat and weakness. Porter's Five Forces analysis informs that competitive rivalry is the only force that is acting in strong way to hinder Tesla’s competitive advantage in the market. However, Tesla high performing cars are able to create advantage for them to cope with the competitive rivalry to be at an advantageous position in the industry. In this relation, the strategic development plan of Tesla is framed where the key objective is to intensify sales of the organisation in the existing market to collect increased revenue and profits as well as introduce better electric vehicles to improve their position in the market to gain competitive advantage.

References

Adina, C., Gabriela, C. and Roxana-Denisa, S., 2015. Country-of-origin effects on perceived brand positioning. Procedia Economics and Finance, 23, pp.422-427.

Ahmadjian, C.L. and Schaede, U., 2015. The impact of Japan on Western management. The Routledge Companion to Cross-Cultural Management, p.49.

Ansoff, H.I., Kipley, D., Lewis, A.O., Helm-Stevens, R. and Ansoff, R., 2018. Implanting strategic management. Springer.

Asif, A. and Singh, R., 2017. Further cost reduction of battery manufacturing. Batteries, 3(2), p.17.

Bertozzi, F., Ali, C.M. and Gul, F.A., 2017. Porter’s Five Generic Strategies; A Case Study from the Hospitality Industry. International Journal For Research In Mechanical & Civil Engineering (ISSN: 2208-2727), 3(2), pp.09-23.

Chanthawong, A. and Dhakal, S., 2016. Stakeholders' perceptions on challenges and opportunities for biodiesel and bioethanol policy development in Thailand. Energy Policy, 91, pp.189-206.

Chiang, Y.M., Chen, W.L. and Ho, C.H., 2016. Application of analytic network process and two-dimensional matrix evaluating decision for design strategy. Computers & Industrial Engineering, 98, pp.237-245.

Götz, G., Herold, D. and Paha, J., 2016. Results of a survey in germany, austria, and switzerland on how to prevent violations of competition laws. In Competition Law Compliance Programmes (pp. 37-58). Springer, Cham.

Honjo, Y., Doi, N. and Kudo, Y., 2018. The Turnover of Market Leaders in Growing and Declining Industries: Evidence from Japan. Journal of Industry, Competition and Trade, 18(2), pp.121-138.

Kuzmin, O. and Khilukha, O., 2016. Regulation of stakeholders' interests in corporate governance through negotiations. Економічний часопис-ХХІ, (161), pp.56-60.

Ly, K.C. and Shimizu, K., 2018. Funding liquidity risk and internal markets in multi-bank holding companies: Diversification or internalization?. International Review of Financial Analysis, 57, pp.77-89.

Mathur, S., Valecha, R.R. and Khanna, V., 2018. A Study on the Impact of Green Marketing on Consumer Buying Behavior in Automobile Industry. International Journal for Advance Research and Development, 3(1), pp.286-290.

Wegner, D. and Mozzato, A.R., 2019. Shall we cooperate, or shall we compete? How network learning episodes influence strategic decisions in strategic networks. Int. J. Management and Enterprise Development, 18(3), pp.171-188.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts