Uk Business Scenario

Introduction

Economy and employment have long been interconnected. The assignment in the current regards aims to understand the different phases of business that gives chances for employability and improve the economic condition. The assignment additionally works on understanding the possible economic problem of the UK and the way the government plans to address the same. The assignment additionally works on exploring the trend within the UK economy and the possible impact of the sum of the economic and employment growth. The assignment works on analysing the potential impact of Brexit on business, employment and economy, while working to discover the possible solutions for better conditions

2.1 Impact of different phases of business cycle on the outlook of the UK business

The term business cycle is the downward or upward movement of the GDP around the long term growth trend (Cravino and Levchenko, 2017, p. 921). The length of the business cycle is the period of time containing a single contraction or boom. In 2018, the economy within the UK is likely to exhibit a trend of growth and remains in the mature phase of economic expansion that started in 2009 after the event of great recession (Policy Exchange, 2020). The output was 16.5% above the economic activity at trough of economic recession in 2009 and 10% above the last peak in 2007. A decade later, the output was subjected to increase by 1.8% and 1.9% in 2016 (Policy Exchange, 2020). Thus, it can be conclusively stated that the trend growth rate of the UK economy remains between 1.5 to 1.9% annually (Policy Exchange, 2020). So it can be stated that the UK has been growing slightly faster than the trend rate growth in the last few years and thus may promote businesses.

As stated by Gambetti and Musso (2017, p. 764), every business is affected by business cycle and some businesses are more vulnerable to changes in their business cycle than others. For instance, a business that depends on consumer spending for profit and revenue will find that the demand for the product and services is closely related to movement within the GDP. During such a boom, such businesses enjoy the strong profit. However, during the season of recession, there is a drop in demand and profit margin. Taking an example of the real estate market, inspired the boom during the beginning of the 21st century and consumer good businesses took advantage of the same. The consumers were ready to take up personal debt in order to carry out their needed purchases. However, with the advent of a sharp economic downturn during 2008 to 2009, businesses were subjected to a loss of 10 to 30% and some even were forced to shut down (López-Salido, Stein and Zakrajšek, 2017, p. 1376). On the other hand, some businesses are actually seen to benefit from the economic downturn. As stated by Hardy and Rhodes (2017, p. 65), if products of certain businesses are perceived by the consumers as providing value for money or cheaper substitute then the consumers are likely to switch. Thus, it can be concluded that the business cycle is dependent on the economic condition of the country and is subjected to change as per the environment.

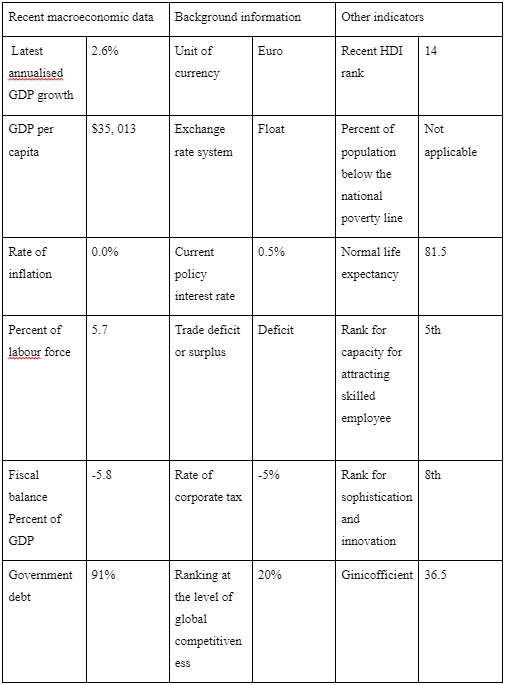

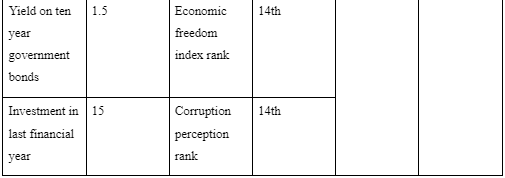

3.1 Economic problems within the UK economy and the way government plans to address them

Economic problems are an integral part of both developing and developed countries. The following are the list of structural problems faced by the UK economy:

Low budget investment: The capital spending related to share of GDP has fallen from 20% in 2007 to less than 15% in the current year (Devins, Watson and Turne, 2019, p. 398). The government has a plan pertaining to national infrastructure, but lags in the involvement in obtaining major projects. The commercial banking related services exhibits reluctance to finance business expansion plans for small and medium sized businesses. Low investment can be termed as a major issue in business

Weak productivity: Output per person employed in the UK has dropped well below the expected time of recovery. There exists a competing explanation for limited productivity growth within the UK

Structural unemployment: There has been a sustained fall within the level of UK unemployment, currently 5.7 of the total labour force. However, structural problems are highly deep seated and roughly 30% of unemployed people have been out of work for a year (Heaton, 2019, p.26). The level of youth employment tends to be on the higher side and there exists a wide variation in the level of Britain’s employment and economic issue

Structural decline in manufacturing: Albulescu (2017, p. 67), discusses about the recovery to be march of the markers; however, the evidence points towards a poor rebound within the domains of manufacturing production, investment and jobs, irrespective of notably successful in certain industrial sector, Britain continues to be highly reliant on financial services

Structural deficits in trade: The UK was subjected to one of the largest current account related deficit few years ago, the gap in 2014 was recorded to be 5% of GDP (Dhingra et al. 2016, p. 2). Export growth in the process of recovery was a bit disappointing, despite the competitive rate of exchange

Structural fiscal deficit: The advent of the coalition government was subjected to difficulty in cutting the size of the budget deficit that can be cyclically changed and remains above 5% of GDP. As influenced by McClelland (2019, p. 53), weaker than the expected revenues related to the tax can be termed as a key part to explain. However, a high rate of budget deficits clearly represents the fact that a high rate in budget deficit means the national debt continues to increase in absolute terms

Lack of competition in markets: There is a structural lack of competition in many markets. The monopoly power within the business of utilities such as gas and electricity remains a prime political and economic issue. As pointed out by Simionescu, Bilan and Mentel (2017, p. 757), fuel bills have been too slow to reduce, despite the collapse in oil prices. A real lack in competition, can work on keeping the prices high and emerge as a problem for those working on a tight budget

Structural inequality: Structural inequality can be termed as one of the most important issues in the UK. The real wages have been going down for a number of people, the actual rates of interest for pensioners savings have been negative. Thus, as influenced by Gao et al. (2019, p. 5), executive pay continues to outpace the average growth by a large amount

Problem related to housing market: The continuous supply of housing is a prime barrier in labour mobility. The problem in related to price of real estate can be a difficult thing to mobilise the labour

Poor structural funding within the public services: The demographic, social and economic pressure continue to mount the existing public services. As influenced by Stiglitz (2016, p. 134), NHS needs a major influx of funding in the next 10 to 5 years.

The overview is not exhaustive; while Britain is enjoying a phase that is a high economic scenario after a period of delayed economic growth there remains deep rooted problems that need to be addressed (Khan and Qianli, 2017, p. 26692). The conventional view in the mentioned supply side policies can be termed as an effective way of tackling structural economic issues. However, the modern economy needs a sufficiently high level of aggregate demand to make use of a high level of productive capacity that provides momentum for business for investing. Hence, it can be conclusively stated that demand side effects related to monetary and fiscal policy decisions remain critical in the mentioned debate.

Thus, it can be conclusively stated that the economic issue in the mentioned case can be termed as a critical scenario. Hence, Freeman (2018, p. 100), influenced the fact Brexit can be termed as a chance to fix the economic condition of the UK. A new era has begun in the UK and the country has entered a scene of profound structural change. Those mourning the departure of Britain from the European Union (EU) are sure this fundamental change is going to be detrimental. There remains no doubt that British economy is highly malfunctional and needs to be changed; Europe is not working either and needs to be changed. The economic growth in the UK was subjected to slow down and Brexit is partly to be blamed (Lightfoot, 2017, p. 517). The sharp depreciation of the pound relating to the referendum leading to high prices with a negative impact on the household budget. The firm invests less than would be expected, provided there is a strong global growth as the business awaits information about the possible relationship between the EU and the UK. On the other hand, high rates of growth in the form of pound led to have more demand for the British related products in the foriegn countries; which is a partial offset related to investment in the terms of investment and consumption in the UK.

In the longer run UK, needs to produce more efficiently for the life standards to keep improving the economic growth and benefit for all groups of society. Since the advent of the global financial crisis the level of employment in the UK has been increasing at a steady pace. However, it becomes important to understand the fact that the increase in average productivity per employee is stagnant (Ndou, Gumata and Ncube, 2017, p. 54). With the record of low level of unemployment and few workers from the EU coming to the UK to work. The future of the economic growth is dependent on increasing the amount of each employee can produce. Thus, it can be conclusively stated the event related to Brexit will not help in resolving the problems related to poor level of productivity. Thus, it is difficult to make use of cross border trade and employing foreign workers would create a negative impact on the health. This strain in the market is due to international competition usually enhances the firms to boost the efficiency within the firm and invest more, while immigration can help in providing the skills needed during the course of employment (Fothergill and Houston, 2016, p. 319)

5.1 Analyse the trend within the UK economy and possible impact on the economic and employment growth

The overall outlook in regards to the economic growth and the constituent parts underpins the possible fiscal events with regards to the public finance, taxation and spending. The growth in regards to the UK economy has averaged 1.3% over the last 4 quarters, this is below the potential rate of 1.4% and 1.5% growth in between 2010 to 2015 (Nabarro and Schulz, 2020). There remains no doubt that global trends are seen to play a great role in weighing down the economy surrounded by uncertainty. The aspect of uncertainty has created a broader cost on the UK economy. There remains no doubt that the UK has been affected by low levels of investment and productivity since the advent of crisis and these trends can be advanced by the referendum. Meaningful improvement in the UK demands a dynamic policy outlook coupled with strong rates of productivity. The finding in the mentioned case can be termed as follows:

UK economic weakness has been extensive than in other major economically strong countries: Growth in the UK has been poorer as compared to the G7 economies. The growth has been volatile in the second half of 2019, compared with the same period in 2018 (Nabarro and Schulz, 2020).

The level of unemployment is currently below the natural rate equilibrium, despite the realised growth remains below potential. This works on reflecting the weakness in the level of productivity and investment (Crafts, 2016, p. 262). However, the resilience within the level of employment and individual spending continues to exist. It is for the same reason growth has become driven by consumption

The private sector is particularly weakened. The business investment was subjected to a severe period of weakness outside the domain of rescission and is lowest in the G7 (Nabarro and Schulz, 2020).

The sharp divergence between the growth in private sector investment in the UK and within the other developed economies after the period of the referendum, exhibits a sustained enhancement within the economic uncertainty. This can work on enhancing the perceived risk association within the investment. The current risk in regards to the no deal Brexit can be highly damaging to the investment (Sheveleva and Tregub, p. 81).

A high rate of employment, coupled with the falling exchange rate and limited level of investment leads to rise in costs related to labour. Low level of investment now creates a scope for limited productivity and earnings in the future (Bukowski and Gowers, 2018, p. 51)

GDP is roughly within the range of 2.5% to 3% below without the advent of Brexit (Nabarro and Schulz, 2020). On the basis of pre-crisis related forecasts and the global economic performance in the last few years, one would perceive that the UK has missed a global growth that could have normally enhanced the level of investment and export

A recovery during the period of growth, demands a pronounced reduction in relation to policy uncertainty. Without suitable improvement and investment in labour productivity growth would be subjected to slow down in near future

Conclusion

In the main scenario, it can be stated that economic growth in the UK is expected to remain modest, somewhat below the long term average rate. These projects assume an orderly exit from the European Union. However, the risks are weighted to the downside over this time due to the disorderly event of Brexit as well as the possible economic crisis. The consumer spending has continued to drive economic growth, by real earnings over the last few years. However, the housing market has cooled and the investment within the business is in steady decline that is trending due to uncertainty. Employment also fell back in the last few months. Thus, it can be clearly stated that the inflation pertaining to consumer price remains around a marginal percent until the UK economy is on the clear side.

Reference list

- Albulescu, C.T., 2017. UK business cycle synchronization with Germany and the US: New evidence from time–frequency domain and structure of economic growth. Applied Economics Letters, 24(1), pp.67-71.

- Bukowski, S.I. and Gowers, R., 2018. An estimate of the impacts of the Bank of England’s quantitative easing programme on UK economic growth. Central European Review of Economics & Finance, 25(3), pp.51-65.

- Crafts, N., 2016. The impact of EU membership on UK economic performance. The Political Quarterly, 87(2), pp.262-268.

- Cravino, J. and Levchenko, A.A., 2017. Multinational firms and international business cycle transmission. The Quarterly Journal of Economics, 132(2), pp.921-962.

- Devins, D., Watson, A. and Turner, P., 2019. Evidence-Based Organizational Change in the UK Public Sector. In Evidence-Based Initiatives for Organizational Change and Development (pp. 398-404). IGI Global.

- Dhingra, S., Ottaviano, G., Sampson, T. and Van Reenen, J., 2016. The impact of Brexit on foreign investment in the UK. BREXIT 2016, 24(2).

- Fothergill, S. and Houston, D., 2016. Are big cities really the motor of UK regional economic growth?. Cambridge Journal of Regions, Economy and Society, 9(2), pp.319-334.

- Freeman, C., 2018. The role of technical change in national economic development 1. In Technological change, industrial restructuring and regional development (pp. 100-114). Routledge.

- Gambetti, L. and Musso, A., 2017. Loan supply shocks and the business cycle. Journal of Applied Econometrics, 32(4), pp.764-782.

- Gao, J., Zhu, S., O’Sullivan, N. and Sherman, M., 2019. The role of economic uncertainty in UK stock returns. Journal of Risk and Financial Management, 12(1), p.5.

- Hardy, B. and Rhodes, R.A.W., 2017. Beliefs and institutional change: the UK National Health Service. In Government Reformed (pp. 65-87). Routledge

- Heaton, J., 2019. Turning research into revenue: Generating growth from research and development can be a challenge. Julian Heaton, at Innovate UK, looks at the support available from the UK government to encourage innovation. Imaging and Machine Vision Europe, (SI), pp.26-28.

- Khan, S.A.R. and Qianli, D., 2017. Does national scale economic and environmental indicators spur logistics performance? Evidence from UK. Environmental Science and Pollution Research, 24(34), pp.26692-26705.

- Lightfoot, S., Mawdsley, E. and Szent‐Iványi, B., 2017. Brexit and UK international development policy. The Political Quarterly, 88(3), pp.517-524.

- López-Salido, D., Stein, J.C. and Zakrajšek, E., 2017. Credit-market sentiment and the business cycle. The Quarterly Journal of Economics, 132(3), pp.1373-1426.

- McClelland, D.C., 2019. The achievement motive in economic growth. In The Gap Between Rich And Poor (pp. 53-69). Routledge.

- Nabarro, B. and Schulz, C. (2020). Recent trends to the UK economy. [online] Ifs.org.uk. Available at: https://www.ifs.org.uk/publications/14420 [Accessed 17 Feb. 2020].

- Ndou, E., Gumata, N. and Ncube, M., 2017. UK Economic Policy Uncertainty Shock and the South African Economy: Inferences from the Exchange Rate, Exports and Inflation Channels. In Global Economic Uncertainties and Exchange Rate Shocks (pp. 51-72). Palgrave Macmillan, Cham.

- Policy Exchange. (2020). An outlook for the UK economy - brighter than some would think. [online] Available at: https://policyexchange.org.uk/an-outlook-for-the-uk-economy-brighter-than-some-would-think/ [Accessed 17 Feb. 2020].

- Sheveleva, E.S. and Tregub, I.V., 2017. ECONOMIC GROWTH AND FINANCIAL SECTOR DEVELOPMENT INTERRELATIONS: THE UK EXAMPLE. Экономика и социум, (3), pp.81-88.

- Simionescu, M., Bilan, Y. and Mentel, G., 2017. Economic Effects of Migration from Poland to the UK. Amfiteatru Economic, 19(46), p.757.

- Stiglitz, J.E., 2016. Inequality and economic growth. In Rethinking Capitalism (pp. 134-155).

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts