Analysis of Factors Shaping Demand and Supply in the UK Private Rental Housing Market

Introduction

The recent system of private rental housing searches have been raising in demand in UK is because there is an improvement in the life expectancy rates of people and also there are a growing number of demands of one-person households. Studies says that there are nearly about 1.8 million households are there on the English local authority housing in registers. There is a significant level of overcrowding in the social and private housing stocks. This assignment here will look after the whole process and factors affecting the demands and supplies of the private rental houses in UK. offers the most valuable insights into the economics dissertation help you seek. In first part below there will be a discussion on the factors that help in determining the changes in the prices of private rental housing of UK. These changes will be presented using various demand and supply graphs. In the second part the focus will be on the government or economic policies that influence the demand and supply of private rental houses in UK.

Task1. Identification of the factors to determine the price of private rental houses in UK using supply and demand analysis graphs.

The housing stocks of UK basically includes the local authority rental and privately rented accommodation, privately occupied and owned apartments and houses, and those properties which are managed by the other housing associations.

Types of households in UK

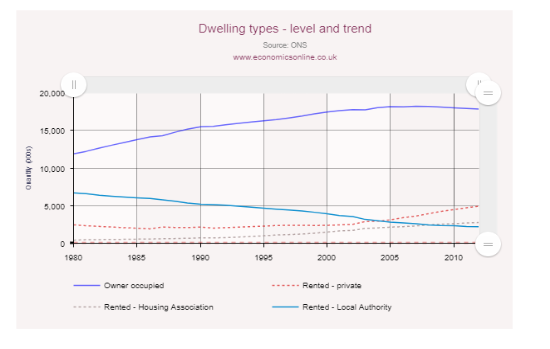

The time of early 20th century have showed that at that time there was less than 10per cent of the houses which were owner-occupied but this trend drastically changed in the 21st century. The 10 per cent number had risen to nearly about 62 per cent which is just above the EU average (economicsonline.co.uk, 2021). The figure below will significantly show the decline of the local authority housing demands whereas private housing demands have raised associated with various schemes.

Privately owned properties

The private owned houses in UK are either of leasehold or freehold types. Freehold type of ownership is that where the land is basically owned as well as the property on that land is also without any interruption. On the other hand, leasehold property means that the land and the property on that are not owned by the person who is using the property. In leasehold type the owner buys the normal rights of that property and land for usage purpose for a specific period of time duration (ft.com, 2016). The time duration granted is usually over 100 years when the lease is initially granted to the owner for use.

Privately rented properties

In this system, the landlord allows to rent his property out to someone else with the help of a short term or long term agreement of tenancy. This terminal is usually decided as a period of six months. Although these term periods can either be changed or can timely be renewed also. This six months period can be more than that also in some cases. The tenants who are rented those properties against that allowance pay a monthly or full period rent till the rental agreement exists (gov.uk, 2020). After renewal the rents can be increased also by the original owner of that property with a discussion with the tenant.

Local authority/local government rented property

This is also a type of property lease where the local authority rents the properties which are under the government to the tenants. These types of tenancy can be either weekly or monthly against the fixed amount of rent. This rent amount is commonly subsidised below the commercial market rates of UK (gov.uk, 2020). The properties are usually allocated to the tenants or individuals according to their needs. Most of the UK authorities don’t have the sufficient number of properties to meet the demands of all the people that’s why there is a long list of awaited tenants for getting houses under the government of UK.

Approved Mortgages

Mortgage is that property where the majority of all the freehold along with the leasehold housing properties is bought by the aid of the long term loans. The mortgage properties can be for any period of time duration amongst all the most common time duration is of 25 years of period (investopedia.com, 2019). The repayments of these mortgages generally include two primary elements- one is repayment of that loan which can be named as capital and the other element is the repayment of the interest which is levied on that loan.

Housing association property

These properties are very much affordable sometimes in case of the part-ownership and part-rental agreements. The part-ownership is that agreement where the ownership of that housing property is distributed among members who are more than one. It is not a single handed ownership property type (investopedia.com, 2020). The part-rental ownership is where the ownership of the property is enjoyed partly by more than one member. All the members included uses the property according their agreed part times.

Existing properties and new built houses

As per the largest mortgage lender of UK, the Nationwide Building Society, around only 5 per cent of the transactions are involved in the purchase of the newly built properties. Instead the left 95 per cent of the transactions are involved in the purchase of either modern property which is built after 1945 or in old properties which is built before the start of the Second World War (ons.gov.uk, 2018). One of the primary key factors is the relative dearth of new properties that drives the UK property price trends in upwards direction.

Demand of private houses

Price determinant

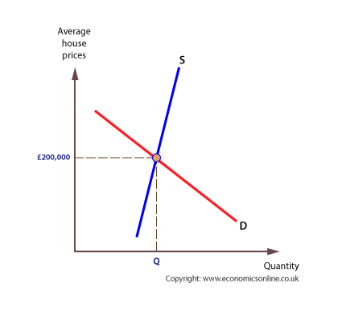

The demand of the private housing is basically determined by many factors, one of them is the house prices. There is an inverse relationship between the demand and the prices of these houses (ons.gov.uk, 2019). This inverse relation can be explained referencing to the income and the substitute effect. When the prices are high the real incomes of people will fall and the demand will ultimately reduce. When the prices are lower, the individuals will encourage buying more houses because then their real income also rises.

Non-price determinants

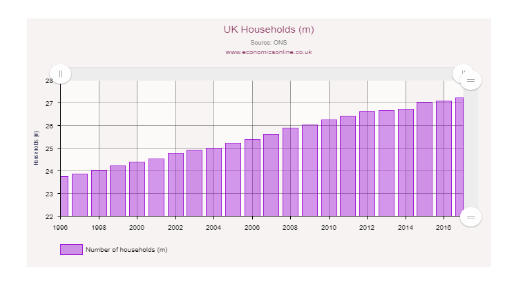

Population is a determinant upon which the total demand of properties is dependant. As the population sizes differently and changes with time, the structure of the housing demands changes (theguardian.com, 2017).

Household income level is another determinant where the changes in the national income and its distribution put significant effect on the property demands.

Social trends and the lifestyle of people like the preferences of late marriages alter the pattern of the demands of houses and the total demand also (economicsonline.co.uk, 2021).

Changes in the Interest rates defines the ability of individuals to fix the amount if the repayment of the mortgaged properties. Many borrowers having fixed mortgage rates could not take the lower rate advantages.

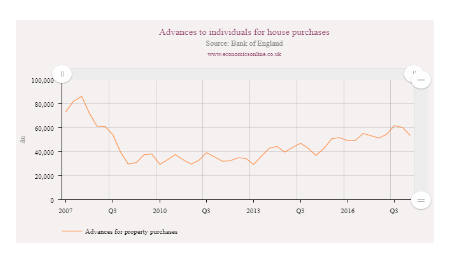

Availability of credit is important determinant since it supplies the credit fall with the reduced demands of houses.

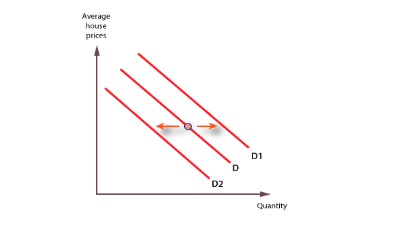

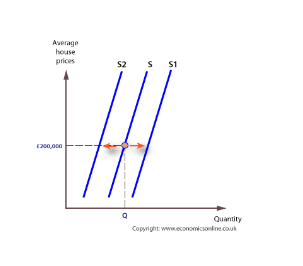

The changes in the demand are another important determinant that underlies the demand of houses which will shift the demand curve to either left or right.

Supply of private houses

Price determinant

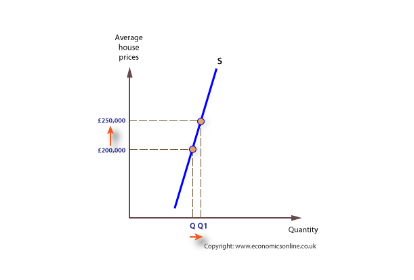

The supply of private houses is somehow privately determined due to the house prices along with the number of the other underlying determinants. The relation between the price and supply of houses is positive where the supply is high with the higher prices (gov.uk, 2020).

Non-price determinants

Cost is an important determinant since the changes in the costs of new built houses depends on the costs of raw materials and labour costs.

Government laws ad legislations also affects the housing supply long with the subsidies that are given to the house builders encourages the supply or availability of the houses (theguardian.com, 2017).

Technologies such as the application of new methods of building houses like pre-fabrication are determinants of the housing supply in UK. The use of new materials in house building increases the speed and hence increases the property supply also.

Shift in the supply is an underlying determinant which changes the supply curve. This determinant is tended to increase the property supplies elasticity where the market is cheaper at ends (ons.gov.uk, 2018).

Equilibrium house prices

As the time passes, the demand of houses in UK has continuously risen whether the supply of houses in UK has remained unchanged and stable. Prices of the houses reflect both the factors of demand and supply in all the markets. The equilibrium price occurs at that price where the current demand of houses matches the current supply availability of the houses (investopedia.com, 2020). In short run equilibrium, supply is relatively inelastic which increases the demands.

Task2. Identification and explanation of governmental/economic policies that is used to influence the demand for private rental housing in UK.

There are a lot of economic or government policies which affect the demands of the private housing system in UK and influence the supply of the same. The affordable housing policies includes the social rented, intermediate and affordable price rented housing and these provides the specified and eligible household needs and these are not met by the market of UK (theguardian.com, 2017). These factors imply on the newly built properties or the private sector rented properties which are purchased for usage as a kind of affordable houses. The housing cost in the UK market is not always high in numbers in absolute terms but sometimes it’s relative to the income of people also. When conventionally measured the term housing affordability is stated as the median price of house with the median income. The UK market, if considered as a whole, is somewhat less unaffordable with a multiple of about 5.0 (ons.gov.uk, 2019). The really extremely high prices of the UK houses also affected the homeownership attainment.

The housing tax policy such as the central government grants for the local authorities and the council taxes influences the changing trends in the demand of private houses in UK. These type of grants are locally distributed to the local authorities on the basis of needs according to some of the complicated formulas which takes the accounts ton numerous characteristics of the local residents and authorities (investopedia.com, 2020). The local authorities face issues in most of the cases here the cost of providing sufficient infrastructure along with the local public services for the new built residential developments.

Looking for further insights on An In-depth Exploration of Political Economy? Click here.

Stamp duty land taxes are the real estate taxes transactions levied on the property and land agreements which was initially introduced in the 1950s in UK (gov.uk, 2020). These stamp duty taxes drives the wedge between the price paid by the buyer and the price which is obtained by the seller.

The interest rates on the land and properties are levied on variable rates. The higher the rates will be the less the property becomes affordable and in this situation the demand curve will shift from the existing place to the left side of that. The interest rate which was previously at an average level of about 4.5 per cent that started to fall drastically in the year 2008 and reached at their lowest level which created a record (economicsonline.co.uk, 2021). The average variable rate of the mortgage from the banks and the building societies somehow fell to 3.8 per cent in the year 2009 and with that the continuous fall in the graph started and reaches to nearly around 2.4 per cent within early 2018 (ft.com, 2016.).

The UK government introduced the scheme of Home Information Packs (HIPS) in the year 2007 which is an attempt for speeding up the house buying process. However the critics on this argued that this might add a new level or layer of bureaucracy in the market which is already over-regulated. The requirement of this is further provided to the packs which were eventually scrapped in the year 2010 (ons.gov.uk, 2018). Conversely the relaxation regulations introduced by the UK government encouraged more building of new houses so that the supply of all the people can be met by the government. Previously there were very strict regulations on the requirements for planning permission in the building of new houses which may deter the house builders.

The rights of the tenants under the UK government is that the deposit of the house needs to be returned at the time when the tenancy ends except in case of some other circumstances it can be kept protected (investopedia.com, 2019). It is very much important that the tenant must check the Energy Performance Certificate of that property which one is going to own. The written agreement is a must if there is a fixed term tenancy which is more than 3 years. The tenant can claim that they want an undisturbed, safe, good state of repaired property which sometimes costs excessive high in charges.

The urban housing policies of UK are mainly classified into tenures among which the main tenures are such as local authority housing, registered social landlords, private rented housing and owner occupation. The local authority housing is those houses which are provided by the government by providing those houses to the people which are owned by the UK government (gov.uk, 2020). The registered social landlords are those who have registered themselves under the UK government as the housing providing mediators who act as substitutes for the government who cannot meet the required house needs of people. The area based policies of the UK government is often concentrated on mainly the deprived areas within the cities and works with joint or either partnership that draws together the whole range of house providing agencies and community work. The urban housing policies are mainly focused on the economic development which includes the local economic activities, employment policies and the income generation policies too (theguardian.com, 2017). The geographical issues are specifically concerned with the spatial relationships of the city life, transport and planning, the urban infrastructure and the environment obviously.

Conclusion

The writing in this assignment presented the overall view of the private housing in UK. And its policies laws, rules and regulation and also the factors and determinant of demand and supply of the private housing system in UK. The above writing stares that housing stocks of UK includes the local authority rental and privately rented accommodation, privately occupied and owned apartments and houses. There are various types of housing facilities in UK such as privately owned properties, privately rented properties, local authority/local government rented property, approved Mortgages, housing association property and Existing properties and new built houses. There are two types of determinants that affects the housing in UK one of them is the price changing and other includes other elements like social trends, government laws, availability of houses and many others. Finally it can be concluded that if the prices are high the demands will reduced and if the prices of households are at an average level then it can be affordable.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts