Johnson & Johnson Consumer EMEA Operations

Brief description of the case study

Johnson & Johnson Consumer business organization has been used as a case study in this essay. The organization operates in Europe, Middle East, and Africa. It is an operating company within Johnson & Johnson, which is a broad-based healthcare company with a global operating model across pharmaceuticals, medical devices, and consumer healthcare. The organization is noted to have a global turnover of ca. $76.5 Billion Dollars, 134,000 employees and a market capitalization of ca. $360 Billion Dollars (Johnson & Johnson, 2017). The Johnson & Johnson Consumer EMEA (Europe, Middle East & Africa) organization is headquartered between Zug, Switzerland and Maidenhead in the United Kingdom. The business has a turnover of $3.6BN and has a broad operational base between regional and Global functions from manufacturing (mostly third party), supply chain, quality, regulatory, medical affairs, legal, finance, procurement, IT, commercial and marketing. Its operating model is largely financially, and target driven, whereby, it has 6 operational clusters across the region led by Area Managing Directors. The clusters have a full operational board with a sale and marketing head, reporting directly and others cross functional leaders in finance, supply chain, regulatory, quality and medical affairs reporting with a dotted line and into their regional function leaders. The main products produced by the Johnson & Johnson Consumer business organization are branded consumer healthcare, which are split into the following categories: Over the Counter (OTC) medicines or self-care, baby, beauty, skincare and feminine hygiene. The company’s notable global brands are Nicorette, Band-Aid, Johnson’s baby, Aveeno, Clean & Clear, Johnson’s adult, Neutrogena, le petit Marseilles, Listerine and Tylenol. The organization’s customer base is predominantly the mass-market retail channels, with a large pharmacy, wholesale business, discounter business, and increasingly E-commerce. The organization provides a mix of manufactured goods and increasingly services that are internal and external, such as supply chain, distribution, marketing, data, and category management services. Johnson & Johnson Consumer business has a 130-year history based on the original brands that were pioneered by the founding family. The EMEA organization was founded on the Baby and skincare business but more recently in 2007, the company acquired the consumer brands from Pfizer. This expanded the portfolio of brands and established a footprint in the pharmacy business as well as in the more profitable OTC or selfcare medicines. A significant innovative plan that is necessary for development in Johnson & Johnson consumer organization should focus on baby care business. Factually, baby care business is one of the foundational brands within the organization and the brand name is shared by the organization, from the founding Johnson family. Johnson’s Baby is a global brand leader with a broad portfolio of baby cleansing and moisturizing products that have served the needs of many generations of mothers, as part of the cleansing ritual to care and nurture precious babies around the world. Johnson’s Baby remains the number 1 baby-cleansing brand in EMEA with ca. 20.1% value market share in every year (Nielsen share report, 2018). Whilst the Baby brand and category are critical to the business as they share the corporation’s name, they allow the organization to connect with families and recruit parents into the portfolio of brands. However, it is noted that Johnson’s Baby brand has been consistently declining in revenue and profitability for the last eight years.

Marketing Plan for the strategic innovation

The product innovation idea involves a transformation of the Johnson’s Baby brand with a modernization and brand restage. This will include the product range, the aesthetics and forms, the branding and connectivity with insight driven baby care regimes that translate from the products to the in-store environment and provide parents with a gentle, caring, and modern solution to care for their precious babies. As such, this section will provide the marketing plan for the baby care business, an innovative plan that is necessary for the development in Johnson & Johnson Consumer organization. These are as provided below:

Mission statement for the innovation

For nearly 125 years, Johnson & Johnson consumer organization has had a mission to create the gentlest baby products in the world. The company intends to harness that experience and science, in order to provide parents with an effective yet gentle solution to care, nurture, and nourishment of precious babies. As such, the company will ensure that its products are made from the safest and minimal ingredients and that the quality of our products will continue to be unsurpassed. Moreover, the company will also ensure that consumers can find the products they desire, wherever its convenient and at a fair price. High quality standards will be regarded as paramount in all of the company’s products and the services Additionally, sufficient and significant information will be provide to parents and healthcare professionals.

Looking for further insights on Balance Between Customized Experiences And Consumer? Click here.

Objectives for the innovation

To increase Retailer influence and in-store presence through modernizing the Johnson’s Baby brand, in order to grow and drive retailer influence to lead the category offline and online

To generate stronger, more competitive claims about efficacy and gentleness on babies and the environment

To deliver profit through a significant price increase & share growth to increase the value of the brand and provide value to the category with retailers, leveraging this to enhance the in-store presence with greater share of shelf and in-store presence

To drive the market share growth to arrest the decline and recover share in all markets

Marketing audit for the innovation

Market for the innovation

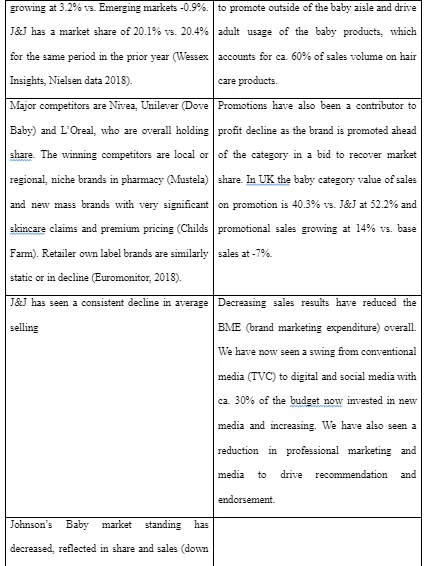

Brands & Price positioning

The brands that are winning in the baby toiletries category across EMEA are typically for sensitive skin, with strong claims and sensitive or limited ingredients. Are mainstream or are widely available in high distribution and command a premium price. In stark contrast JOHNSONS® is synonymous with fragrances and extra ingredients (FT. Com, 2018). Is widely available and in high distribution but does not current command a premium price.

Marketing objectives for the innovation

The new products should have significantly improved aesthetics, look and feel, the range should be less complex and easier for parents to be able to understand which products are right for their babies based on their stage of development. The ingredient reduction and improved formulations should be communicated and position the JOHNSONS® Baby brand alongside the premium and safe brands that are driving growth in the category. The pricing should deliver a net sales increase, assuming volume, elasticity and impacts of 8.9% (Nielsen price and promotion analytics, UK, Spain & Saudi Arabia, 2017). The brand should have clearly defined pricing tiers from the base, better and premium ranges that allow the consumers to understand the benefits and pay the appropriate price for the added value brand benefit. The base tier should also maintain the ability for the JOHNSONS® continue to be price competitive versus the lower priced retailer brand labels. Promotions must adhere to the Global guidelines based on the location in store, price discount levels provided (J&J Baby guidelines, 2018) and the brand should not be promoted above the category promotional intensity as per the monthly promotional effectiveness tracking report (J&J revenue growth management tracker, July 2018). The distribution should reflect the shopper understanding and channel missions (J&J Baby Guidelines, 2018). We should have a channel strategy that features the appropriate sizes and packs, the discounter range should be the smaller sizes that allow us to meet the fixed price points of a pound or Euro and the online or ecommerce business should feature the multi packs or large sizes that make it economically viable to cover the cost of distribution. We need to expand our distribution in ecommerce and range distribution by 5% points in discounters, whilst maintaining our weighted and numeric distribution % across the region. The media mix should reflect the channels and level of investment as per the media mix analysis (Nielsen media mix modelling analysis, 2018). There should be an appropriate balance as per your local country guidelines and the percentage of marketing to net trade sales should not exceed 13.5%.

Marketing mix for the innovation (4PS)

The marketing mix to be discussed in this section is categorized into four sub-segments, including a discussion of the product, place, price, and promotions. These are as provided below:

Product

The Johnson’s baby care products have a set of characteristics, which make consumers to identify them easily in the market. It is evident that the products give babies smooth skins, protects them from rashes, and ranges from different sizes, thereby, implying that the products target individuals of all social classes (Slater et al., (2014). Moreover, the products are classified into various product levels, whilst their core remain the same. There are the core products (for example, Johnson’s powder), the basic products (baby powder), the expected product (smell), the augmented product (blossoms), and the potential product (Johnson’s baby products do not have any side effects) (Nijssen, 2017).

Place

Johnson’s baby products are sold in medical stores, and in many fancy, as well as grocery stores, especially near children care hospitals. Apart from these, they are available in pharmacies in all hospitals, especially the government hospitals, for easy accessibility for the consumers. Generally, it is evident that Johnson’s baby products are widely distributed in approximately 10,000 hospitals, and 150,000 registered medical shop (Slater et al., 2014).

Price

Pricing of Johnson’s baby products varies, according to the sizes of the products that a consumer desires and also, based on different variants. Apart from selling certain baby products solely, Johnson &Johnson Company sells specific products with gift packs, which may include ear buds, or baby shampoo amongst others. It is notable that the products in such cases are often lowly priced (McDonald & Wilson, 2016).

Promotions

Johnson’s baby products are promoted in all mediums that are readily available for promotion. The company purposes to apply different forms of promotion strategies whilst promoting in different channels of advertising. Some of the mediums of promotion include the print media, television, IMC, and the digital media (McDONALD, 2016).

Budget estimation for the innovation

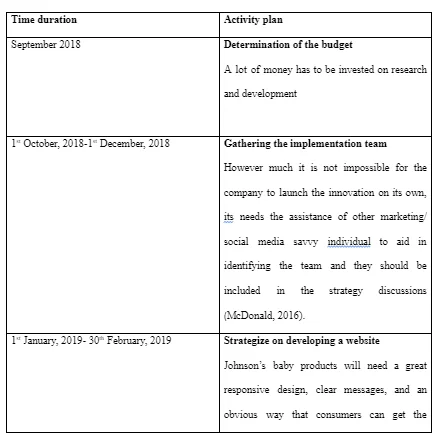

Outline of a 12-month implementation plan for the innovation

There are significant steps that will be required for the Johnson’s baby innovative plan to be implemented fully. This is as presented below:

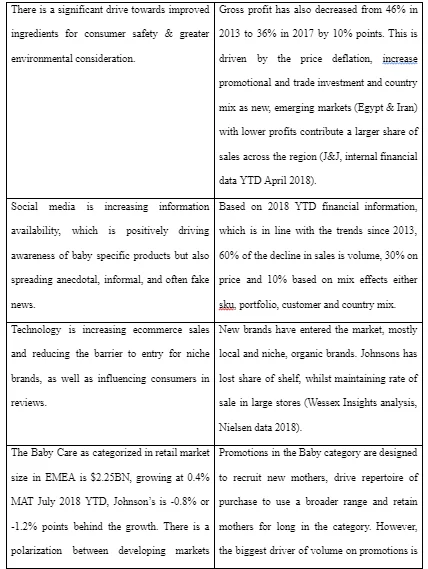

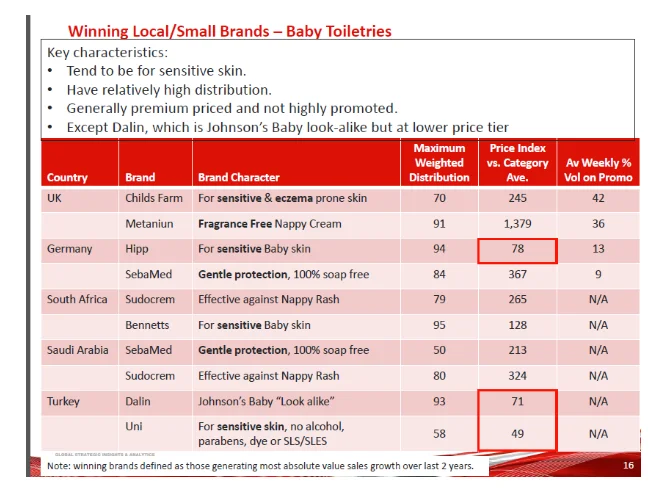

Executive Summary of SWOT Analysis

The relative growth of baby care products within the overall health and beauty categories across Europe, Middle East & Africa has been low. Despite the region’s relative affluence, in absolute value terms it only contributed 2% of the global sales gain over 2011-2016 (Euromonitor, 2018). The low absolute growth in the region was largely caused by the market value contraction of major markets. The market value stagnation in the region mirrored the flat population growth of the under 12 years old age group. This makes it less attractive to retailers as it is not growth accretive compared to other categories.

Baby wipes saw fast value growth not just due to the convenience aspect but also the variety of purposes for which these products can be used, besides cleaning the baby. For example, consumers use them to remove make-up, as well as stain from clothes or clean the surroundings where the baby is eating or playing. Baby wipes is also a lower profit category for Johnson & Johnson (Johnson & Johnson, 2018).

More growth is being driven by medicated brands in skin treatment and diaper / nappy rash, largely through recommendation in the pharmacy channel. These brands tend to have more robust claims, that provide greater efficacy and command a price premium. They are however cannibalizing the volume from existing major players e.g. Johnson & Johnson and not driving incremental growth in the category.

High category sophistication and channel diversity is driving greater awareness of baby specific brands. However, the commoditization is at an equal or faster pace meaning that innovation and more premiumization is critical to continue to continue to stay ahead and drive value growth. The category in-store within traditional large retailers is not engaging mums beyond functional hygiene and cleansing. Mum’s also have access to increasing amounts of information and are becoming very aware of ingredients and looking for natural or chemical free products.

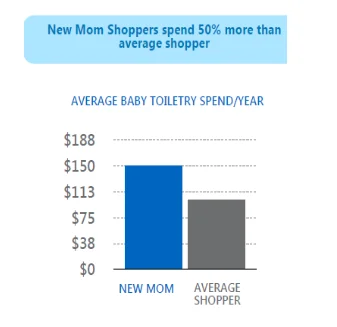

JOHNSON’S® and other major brands have been losing share and relevance as more new brands have been introduced to the market and are struggling to compete (Wheeler & Omair, 2016). This means that the strength of the J&J business to drive innovation is diminished as the brand is losing revenue and in store share and visibility. Thus, losing relevance and diminishing their ability to influence the large traditional retailers, who are also looking for incremental value and innovation to drive price inflation. Mothers are very valuable to retailers as their average basket spend is ca. 40% higher than the average shopper (Johnson & Johnson, 2018)

The Johnson’s brand is losing relevance as it’s not had a major redesign in 43 years. The brand is squeezing on price and differentiation by private label and marginalized by niche brands and new modern small brands with very strong efficacy claims (Johnson & Johnson, 2018).

Executive summary of PESTEL Analysis

There has been a significant amount of new legislation surrounding product ingredients, including formaldehyde-releasing chemicals and a long-chained paraben (U.S. Food & Drug Administration, 2018). This has proved a significant challenge for Johnson & Johnson and the JOHNSONS® Baby brand. Firstly the complexity in keeping pace with the regulation changes, maintaining compliant and safe products through production and supply changes and most importantly maintaining equity and confidence with parents (Eisend, 2015). The economic factors are many and each one has a very specific impact on the J&J Consumer baby care business. The brand profitability and organizational profitability were significantly affected by the BREXIT announcement. The sterling pound (GBP) dropped from a range of ca. 1.35-1.45 to 1.15 or an equivalent of 18% decrease based on the median prior range versus the EURO (EUR) (XE.COM, September 5th, 2018). This meant that to maintain gross profit in the UK company, the organization had to implement a significant cost increase to the retailers. Not all of which was passed on to the consumers and thus affected the retailer profitability and didn’t fully offset the cost increase for J&J.

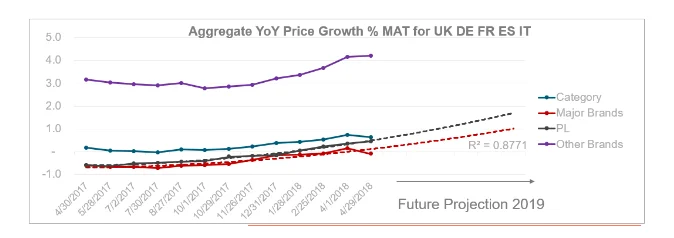

Secondly, there is little retail price inflation, thereby, implying that the traditional large retailers are unable to increase their prices to consumers, due to competition from discounters & Ecommerce increasing competition (Nielsen, 2018).

little inflation there is, is mostly being driven by “other” brands which are non-major multinationals or niche brands. This means that JOHNSON’S® Baby is now less profitable, losing share and relevance from the retailers and the consumers perspective. The demographic impact of low birth rates (Euromonitor Passport, baby & child specific products, 2017) means there is a diminishing consumer base that is also driving low to flat category volume growth. Whilst there is a faster growth in some developing markets (Euromonitor, 2017), the local brands are growing due to having a lower cost of goods and retail price, which is restrictive in terms of requiring local manufacturing to avoid import duties and expensive raw material costs. Social media is driving far greater awareness of the value of baby specific products, which is a driver of growth. However, social media also facilitates the spread of information from around the World, often with very little formal substance which can dramatically drive positive or negative sentiment about a brand (Baker & Saren, 2016). Technology is reducing the barriers to entry for niche brands, which was formerly a competitive advantage for major brands. Reviews and ratings, can dramatically affect the consumption and equity as well as drive negative or positive perceptions about the brands. Data availability and improved processing skills is also allowing Global and regional retailers to assess the difference in pricing across the countries and challenge suppliers to harmonize pricing or developing alternative sourcing strategies that further erode supplier (J&J) profitability (Day, 2014; cited in Homburg et al., 2017). There is a far greater awareness of the impact of the products we consumer on the environment, this is driving a push to improve formulations and reduce the impact of product packaging and transportation costs. Further increasing the J&J product cost base and eroding profitability (Johnson & Johnson internal financial cost data, 2018). The legal impacts are a combination of legislation that allows free flow of products across Europe and allows customers to capitalize on pricing variations. Historical pricing, currency and the various economic factors determine these different costs of living drive. There has also been significant litigation against Johnson & Johnson, that means that the organization has become more risk averse in terms of claims that are made on product efficacy compared with some of the smaller, niche brands (Independent.co.uk, 2018).

References

Baker, M. J., & Saren, M. (Eds.). (2016). Marketing theory: a student text. Sage.

Day, G. S. (2014). An outside-in approach to resource-based theories. Journal of the Academy of Marketing Science, 42(1), 27-28.

Eisend, M. (2015). Have we progressed marketing knowledge? A meta-meta-analysis of effect sizes in marketing research. Journal of Marketing, 79(3), 23-40.

Homburg, C., Jozić, D., & Kuehnl, C. (2017). Customer experience management: toward implementing an evolving marketing concept. Journal of the Academy of Marketing Science, 45(3), 377-401.

Hsu, M. W. (2016). An Analysis of Intention to Use in Innovative Product Development Model through TAM Model. Eurasia Journal of Mathematics, Science & Technology Education, 12(3).

McDONALD, M. A. L. C. O. L. M. (2016). Strategic marketing planning: theory and practice. In The marketing book (pp. 108-142). Routledge.

Slater, S. F., Mohr, J. J., & Sengupta, S. (2014). Radical product innovation capability: Literature review, synthesis, and illustrative research propositions. Journal of Product Innovation Management, 31(3), 552-566.

Wheeler, S. C., & Omair, A. (2016). Potential growth areas for implicit theories research. Journal of consumer psychology, 26(1), 137-141.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts