Recording Business Transactions Reflective Journal

Assessment 1 Part 1

There exist some clear advantages for the establishment of a for-profit business structure. Some of these include financial rewards that are proportional to success and self-employment. The possibility of making money is the most obvious advantage of a for-profit structure (Anderson and Dees, 2017). The owner of a for-profit structure is usually at will to do what they wish with revenues that are generated above and beyond expenses. The options here include channelling some of the profits back to the company or keeping the money for personal enjoyment. Financial rewards are observed to increase as a company grows. The caveat is that the owner gets to keep the rewards and not necessarily the founders of a company in the event that investors provided capital to start a business or loan debts were acquired (Dees, 2017). For those researching or needing business dissertation help, understanding these dynamics can be crucial in analysing the practical benefits of for-profit business models.

Apart from the rewards of a financial nature, the owners of for-profit structures are normally their own bosses. The disadvantages or advantages that come with this, however, depend on the model of ownership of a business. In the case of a sole proprietorship, the liability of making a company`s unilateral decisions is usually placed on one person and the company`s finances together with those of the individual are usually one and the same thing. These individuals assume full liability in the event the company goes under. Another advantage of these for-profit structures has to do with regulation.

There are also disadvantages with for-profit structures, however. While non-profit structures are normally exempted from taxation for good reasons, for-profit structures are required to pay taxes and often, they are charged under many other mandates (Clampitt and Dekoch, 2017). This to a big extent reduces the overall bottom line that the business reports and this has the potential of affecting the overall stock value and prosperity of an organisation. Additionally, it is also widely observed that while non-profit companies attain numerous discounts and even preferential treatment, this is not the case with for-profit companies

Users of Accounting Information

The users of accounting information can generally be categorised into external and internal users. External users are broader as they include government agencies, suppliers of goods, and creditors of funds, investors, the general public, employees and customers. On the other hand, internal users include owners of a business and the management.

Accounting information is normally useful to managers for purposes of evaluating and further analysing the financial performance and position of a company. With this information, managers are normally capable of taking appropriate actions and also making decisions that are important to ensure the improvement of the performance of a business in terms of cash flows and profitability. A lot of capital is normally invested by the owners of a business into a business aiming at making profits. As a result of this, they always need financial information that is accurate so that they can know whether they have made profits or losses during particular time periods (Collier, 2015).

Looking for further insights on Surround Techniques in Studio Recording? Click here.

Ownership in the corporate form of business is normally separated from the management of a business. Investors provide capital for businesses. Accounting information is normally required by both potential and actual investors. Potential investors use this information to make decisions whether to put their money into a company while actual investors use this information to know how their money is being handled and also to know the future prospects of a company (Langfield-Smith et al., 2017).

Lenders normally require accounting information so as to assess a company`s financial position and performance and also to have reasonable assurance that they will get back their monies from those they lend. Suppliers normally require accounting information so that they can get an idea about a business’s future creditworthiness and also be able to make decisions on whether to continue providing their goods on credit. For government agencies, accounting information is normally important for the purposes of imposing taxes and regulations. Also, those employees who do not have a hand in a business’s core management normally need financial information because their future and even their present are always tied to the financial performance of the business. Better remuneration, job security and retirement benefits are ensured by the profitability and success of a business. Customers normally rely on a business to provide them with services and goods. As such they are always eager to know the financial position of a business and how it performs. With information like this, customers are able to make an assessment on whether a firm is reliable for the provision of supplies in the future.

Looking for further insights on Global Journalism Challenges? Click here.

Assessment 1 Part 2

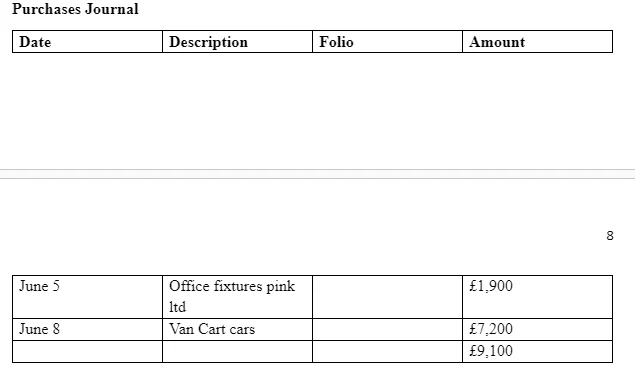

When preparing journal entries, one needs to first do an analysis of the transactions with an aim of identifying the accounts that are affected by the transaction. After that, it is necessary to ascertain the nature of the involved accounts as nominal, real or personal. One then determines the rules of debit and credit that are applicable to each of the involved accounts. Finally, it is necessary to ascertain the accounts to be credited and the accounts to be debited.

R. Locke and co. purchased a van on credit from Smith Auto Garages. The company purchased using a cheque. And as such, we debited purchases and credited creditors for the vehicle. In the event that the vehicle had been bought with cash, we would have debited purchases and credited cash at bank or cash in the hand.

When a debt becomes bad the following entries will be made: Debit bad debts account Credit debtors account with the amount owing. Debit Profit and Loss Account. Credit bad – debts account to transfer the balance on the bad – debts account to the Profit and Loss Account.

Returns outwards are goods returned to suppliers/creditors. They may be for cash purchases or for credit purchases. For cash purchases a cash refund given to the firm by the supplier, Debit the cashbook (cash at bank/hand). Credit returns outwards. For credit purchases and no refund has been made: Debit creditors. Credit returns outwards.

In recording goods taken for own use, we debit drawings and credit purchases. When recording personal expenses that have been paid for by the business, we debit the drawings and credit expense account. In some instances, the owner of a business may take over some of the assets of the business e.g. vehicle or converting business premises into living quarters or not paying into the business cash collected personally from the customers. When this happens we debit drawings and credit the relevant asset e.g. motor vehicles, premises or some building or even debtors.

Take a deeper dive into Recognition of Prior Practice Reflective Evaluation with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts