Significance of Accounting in Business

Introduction

Accountancy is a very crucial part of business operations. It should be properly maintained and used so that the company can achieve its goals and objectives. The function of accounting also has a very significant impact on the sustainability of the firm. It is believed that the role of accounting helps the company to achieve its targets and improve its financial performance as well (Edwards, 2013). Importance of the accounting function in an organisation can be understood through the fact that it presents a true and accurate position of the company. This way it can compete with rival firms and also satisfy the customers. In this report, different aspects of accounting have been discussed.

TASK 1

(i) Financial Accounting and its purpose

Financial accounting can be described as a specialised branch of accounting that enables the management to keep track of financial activities and transactions of the company. Essentially it records, summarises and presents these transactions in different financial statements such as balance sheets, income statement, etc. These statements then are presented to different stakeholders such as bankers, financial institutions, shareholders, government, etc. (Beatty and Liao, 2014). Many authors and experts have opined on a number of occasions that the function of financial accounting is extremely important for companies and sometimes it is even the basis of success and long-term sustainability in the market. Generally Accepted Accounting Principles (GAAP) is the standard framework of guidelines used in the context of financial accounting. The most basic yet important purposes of financial accounting are that it helps in keeping a track and summary of all the financial transactions and activities. Apart from this, the function of financial accounting also helps the management in the decision making process. Since they have access to a plethora of information regarding the operations and activities of the company, they can take effective and proper decisions (Weygandt, KIESO and Elias, 2010). These financial statements such as balance sheet, etc. are to be made on a regular basis. They are considered as external in nature because they are given to people outside of the company. Therefore, another purpose that financial accounting serves is that it helps external parties such as banking organisations, government, shareholders, etc. to assess the value of the company.

(ii) Regulations relating to financial accounting

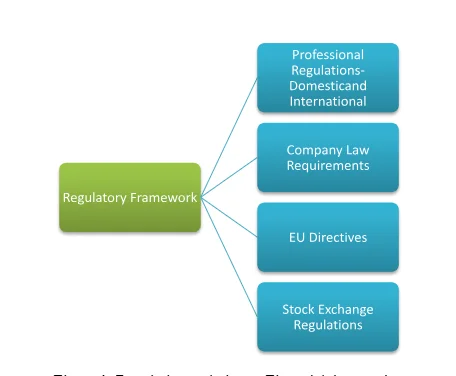

The function of financial accounting is imperative to companies, regardless of the market that they may be a part of (Gassen and Schwedler, 2010). In this regard, the authorities and experts have developed different regulations that govern the implementation and use of financial accounting. The users of financial information are many, and therefore it is crucial for the authorities that they maintain certain standards and quality in the processes of financial accounting and during the development of financial statements as well. Over the years different types of regulations have been developed to prepare the financial statements properly. Combined these are referred to as the Regulatory Framework or Generally Accepted Accounting Practices (GAAP). Although this term is very rarely mentioned in the Companies Act, it is a widely used and popular accounting standard. In the UK there are several regulations, which when combined constitutes the GAAP/Regulatory Framework as shown in Figure 1. In the 70s the UK government established the Accounting Standards Committee (ASC) to self-regulate and address the criticisms that had been levied previously on the accounting profession and function before (Modugu and Anyaduba, 2013). However, in the 90s, the ASC was replaced by the Accounting Standards Board (ASB) which was responsible for issuing accounting standards known as the Financial Reporting Standards (FRS). The International Accounting Standards Committee (IASC) was set up in 1973. The IASC issued accounting standards called International Accounting Standards (IAS). In 2001 the IASB became the standard-setting body and replaced IASC. The current structure of IASB has been shown in Figure 2.

(iii) Accounting Principles

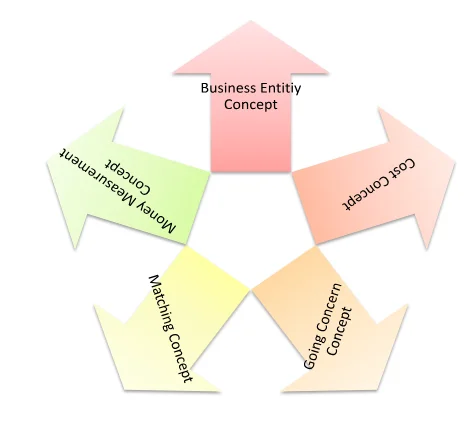

There are several aspects and concepts that have to be kept in mind by the authorities to properly develop financial statements on the basis of different standards, rules and principles of financial accounting (Premuroso, Tong and Beed, 2011). Figure 3 present 10 main accounting rules and principles related to the preparation and presentation of the different financial statements. The combination of these rules and principles can be termed as the Generally Accepted Accounting Principle. Herein the accountant has to know the difference between the business owner and the business entity. During the financial accounting process, all financial transactions and activities should be related to that of the business organisation. Further, such aspects should be clearly reflected in the financial statements as welly. In addition, these statements must consist of the transactions which are expressed in the local currency, like a pound in the UK. The cost principle further states that historical costs must be considered while developing the financial statements; this means that the principal asset amounts are not adjusted upward for inflation. Another principle which affects the development of the financial statements is that if certain information is important for any of the key stakeholders, then it must be fully disclosed. This essentially means that the financial statements should contain complete details about it. The Going Concern Principle assumes that a company will continue to exist long enough to carry out its objectives and commitments and will not liquidate in the foreseeable future (Chea, 2011). If the company's financial situation is such that the accountant believes the company will not be able to continue on, the accountant is required to disclose this assessment. The going concern principle allows the company to defer some of its prepaid expenses until future accounting periods.

Continue your exploration of The Significance of Literacy Learning in Early Years with our related content.

(iv) Conventions and Concepts

It is very important for the authorities to ensure that the financial statements are developed in accordance with the aspect of consistency. This is crucial for enhancing the efficiency and effectiveness of the financial statements and makes them more useful for the readers, i.e. the various stakeholders. In this sense, it may not be wrong to say that many authors have stated that consistency and material disclosure is the key for making the financial statements more understandable for the readers (Albrecht, Stice and Stice, 2010). There are four key accounting conventions, as shown in Figure 4. The convention of disclosure states that all material information should be properly and completely disclosed to the readers. This means that there must be consistency in terms of the information provided and shared through the financial statements. According to the convention of materiality, the statements should consist of only those aspects which are of great importance to the firm as well as its financial performance and sustainability. The convention of consistency states that the accounting practices should remain the same; they should not be changed from one period to another. The convention of conservatism ensures that the uncertainties and risks related to business operations are identified and properly understood. Figure 5 shows some of the key accounting concepts.

CLIENT 1

(i) Book of Prime Entry

One of the ways through which business transactions and activities can be recorded is through the journal entries (Beaumont, 2015). However, since businesses perform various transactions and activities on an everyday basis, it becomes very difficult to record each one of them on the ledge. Moreover, it would also make the ledge look messy. Due to this reason, each such entry is first recorded in the book of prime entry. Thus it can be said that this is the book in which all transactions and activities are initially recorded, and then they are transferred to the ledge in the form of journal entries. Books of prime entry are also known as books of original entry. These may or may not be a part of the double entry system. They are of many types; some have been shown in Figure 6. On this basis, it may not be wrong to say that the books of prime entry are critical to the overall success of the accounting function. If it is properly carried out and maintained, then it would enable the accountants and management to identify as well as analyse the accurate financial position of the company.

(ii) Double Entry System

It is a part of the accounting function or bookkeeping. This system states that each and every business transaction will involve two or more accounts. Therefore it is imperative to note that every entry must be made twice so that proper records can be developed and maintained by the authorities. It has two equal and corresponding sides which are known as debit and credit. The double entry system allows for the accounting equations to always be in balance (Gordon, 2011). By using this system, the authorities can ensure that each business activity and the transaction is properly noted and is used in a proper and effective manner. These entries are then recorded in the general ledger accounts, as the debit side must be equal to that of the credit side.

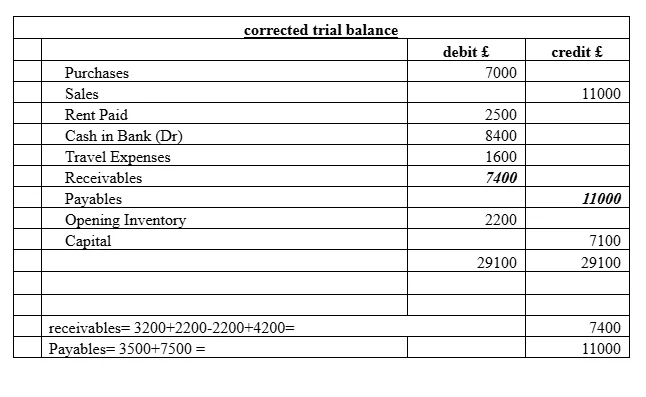

(iii) Trial Balance

CLIENT 2

(a) Statement of Profit or Loss

Also known as the income statement, the statement of profit or loss is considered as one of the key tools that present a detailed and accurate position of the company and helps the authorities in determining ways through which the firm can enhance its position and sustainability in the market. It may not be wrong to say that it is one of the most important financial statements (Crisóstomo, Freire and Vasconcellos, 2011). It provides a complete and true financial picture of the company and thus enables the stakeholders as well as the management to make well-informed decisions. It shows the revenues and expenditures made by the company during a particular time period. Thus, the statement of profit or loss also indicates how the revenues have been transformed into net income for the company. Key purpose or objective of this statement is to help managers and the investors to know about the financial performance of the company and then help them to take proper and effective decisions.

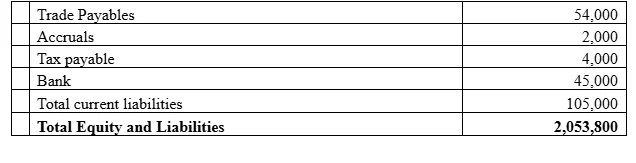

(b) Statement of Financial Position

Another name for balance sheets is the statement of financial position. It is considered as the most important financial statement as it provides details about the firm’s assets and liabilities along with their differences as well (Lovell, 2014). By reading the balance sheet, one can easily determine the financial standing of the company. It is used by shareholders, investors and managers to learn about the financial position of the firm. This way they can take appropriate decisions. For instance, investors and shareholders want to determine how their money has been used by the firm and they assess its current position by comparing the assets and liabilities. On the other hand, managers consider it as a tool with which they can compare the current financial position of the firm with past data. This helps them to take proper and effective decisions. This statement should be developed in such a manner that it reflects the basic accounting principles such as the cost, matching and full disclosure principles.

CLIENT 3

(a) Statement of Profit or Loss

(b) Statement of Financial Position

(c) Concepts of consistency and prudency

The concept of consistency states that once an accounting principle has been adopted, it should always be used. It should never be changed or modified. The only change that can be brought about here is when a new or improved version of it is developed. Through this concept, the authorities and the readers can experience a level of standard in the financial statements, which would then have a crucial role to play in enhancing their overall efficiency and effectiveness for the users (Pehlivan, 2013). On the other hand, the concept of prudency states that the amounts of revenues recognised should not be overestimated, and the expenses should not be underestimated. The authorities must be conservative in recording the amount of assets, and not underestimate liabilities. The result should be conservatively-stated financial statements. The revenue transactions must be recorded only when it is certain, and record an expense transaction or liability when it is probable (Biondi and Zambon, 2013). Another aspect of the prudence concept is that you would tend to delay recognition of a revenue transaction or an asset until you are certain of it, whereas you would tend to record expenses and liabilities at once, as long as they are probable.

(d) Purpose of Depreciation in formulating accounting statements

The main objective of the depreciation function is to match the cost of a productive asset with a useful life of more than a year, to that of the revenues generated by using the particular asset (Baber, Liang and Zhu, 2012). The concept of depreciation is considered as very important in determining the actual and accurate value of assets and thus helps the management to take appropriate decisions. Furthermore, the role of depreciation is considered to be extremely important while formulating the various accounting statements. This is because by using this concept the management is able to identify and understand the actual value of the asset and its usability for the firm. Over the years various methods and tools for calculating depreciation have been developed. Straight Line depreciation is the simplest one. Herein the expense amount is the same every year over the useful life of the asset. It best suited for calculating depreciation of heavy and big machinery which require a fixed amount in their maintenance. Following is the formula for straight-line depreciation method.

Cost-Salvage Value/Useful Life

Double-declining-balance results in larger expense in the earlier years as opposed to the later years of an asset’s useful life. The method reflects the fact that assets are more productive in its early years than in its later years. With the double-declining-balance method, the depreciation factor is 2 times that of a straight line expense method. Its formula is as follows:

Periodic Depriciation Expenses=Begining Book Value x Rate of Depriciation

Client 4

(a) Purpose of bank reconciliation statement

A bank reconciliation statement is a tool through which the management of an organisation can compare their financial records with that of the banks’. This way accurate information and knowledge about the financial position as well as the performance of the company can be determined. Thus, one of the key purposes of the bank reconciliation statement is to confirm the accuracy of balances shown in the company’s books and bank’s records. It also checks the accuracy of the entries made in the journals made by both the entities (Weygandt, KIESO and Elias, 2010). Any discrepancy would mean that either of the parties has made a mistake while recording the entries. By analysing these statements, the authorities can determine actual performance as well as the standing of the company. Therefore they can make appropriate decisions and ensure that the firm is able to achieve its goals and objectives.

(b) Areas which may cause records to vary

One of the areas in which the company records and the bank records may vary is in terms of the fees charged by the banking organisation (Beatty and Liao, 2014). Generally, banks charge a certain amount of fees from their customers to perform and record their transactions. This charge is shown in the bank reconciliation statements. This may cause the company records to be different from that of the banks’. If an item is on the books but has not yet appeared on the bank statement (outstanding checks, deposits in transit), the items are entered as an adjustment to the balance per bank statement. Outstanding checks are a deduction to the balance per bank; deposits in transit are an addition to the balance per bank.

(c) (i) Cash Book

(c) (ii) Bank Reconciliation Statement

CLIENT 5

(a) (i) Sales Ledger Control Account

This account shows the total trade debtors of the company at a given time. This means that the sales ledger control account shows the total amount of money owed to a business by its customers. By analysing these accounts receivables, the management can determine the total amount of money that the company can receive from the market, i.e. the customers. This can help the management in the understanding the position of the company in the industry and also among the key stakeholders. On the basis of this information, they can determine better ways for the company to operate and also ensure that this account is kept to as minimum as possible.

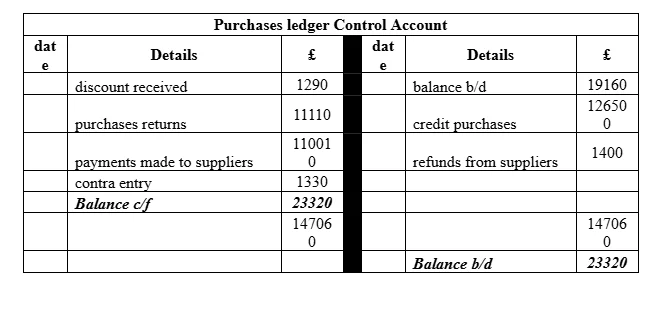

(a) (ii) Purchase Ledger Control Account

Similarly, the purchase ledger control account shows the total trade creditors of the company. This account shows the total money that the firm has yet to pay to its suppliers. Through this account, the management can learn about the total money the firm is yet to pay. This account is a part of the balance sheet and is a short-term liability (Gassen, 2014). Access to such information would help the management in determining the total money that the company has yet to pay.

CLIENT 6

(a) Suspense Account

It is a general account in the ledger which shows the amounts that are recorded only on a temporary basis (Lovell and Bebbington, 2013). It is created only because a proper account cannot be created at the time when the transaction was recorded in the books. Thus, one of the key features of this account is that it helps in preparation of trial balance. Through such account, the management can complete the trial balance, by adding the differentiating amount in the shorter side.

(b) Trial Balance

(c) Journal Entries

(d) Difference between suspense account and clearing account

One of the key differences between these accounts is the fact that suspense account is used in cases where there is an accounting problem which later on is resolved. On the other hand, a clearing account can be used for a wide variety of purposes. Suspense account has only one objective, but clearing account has several (Fülbier and Weller, 2011). The main purpose of clearing accounts is to ensure that accounts are zeroed out. Clearing accounts, generally are used for funds that are not transferred to the bank until the new year or for reversal of certain payments that need to be cleared out.

CONCLUSION

Financial accounting is that part of the business functions on which success, as well as the sustainability of the company, is dependent. It is considered as one of the crucial functions and aspects of operations of business organisations. This report focused on identifying, discussing and analysing different aspects of financial accounting, such as its purpose. The report also consisted of a discussion about different types of accounting principles.

REFERENCES

Albrecht, W., Stice, E. and Stice, J., 2010. Financial accounting. Cengage Learning.

Baber, W.R., Liang, L. and Zhu, Z., 2012. Associations between internal and external corporate governance characteristics: Implications for investigating financial accounting restatements. Accounting Horizons, 26(2), pp.219-237.

Beatty, A. and Liao, S., 2014. Financial accounting in the banking industry: A review of the empirical literature. Journal of Accounting and Economics, 58(2-3), pp.339-383.

Beaumont, S.J., 2015. An investigation of the short‐and long‐run relations between executive cash bonus payments and firm financial performance: a pitch. Accounting & Finance, 55(2), pp.337-343.

Chea, A.C., 2011. Fair value accounting: its impacts on financial reporting and how it can be enhanced to provide more clarity and reliability of information for users of financial statements. International journal of business and social science, 2(20).

Fülbier, R.U. and Weller, M., 2011. A glance at German financial accounting research between 1950 and 2005: A publication and citation analysis. Schmalenbach Business Review, 63(1), pp.2-33.

Gassen, J. and Schwedler, K., 2010. The decision usefulness of financial accounting measurement concepts: Evidence from an online survey of professional investors and their advisors. European Accounting Review, 19(3), pp.495-509.

Gassen, J., 2014. Causal inference in empirical archival financial accounting research. Accounting, Organizations and Society, 39(7), pp.535-544.

Gordon, I.M., 2011. Lessons to be learned: An examination of Canadian and US financial accounting and auditing textbooks for ethics/governance coverage. Journal of Business Ethics, 101(1), pp.29-47.

Lovell, H. and Bebbington, J., 2013. Putting carbon markets into practice: a case study of financial accounting in Europe. Environment and Planning C: Government and Policy, 31(4), pp.741-757.

Modugu, K.P. and Anyaduba, J.O., 2013. Forensic accounting and financial fraud in Nigeria: An empirical approach. International Journal of Business and Social Science, 4(7), pp.281-289.

Pehlivan, A., 2013. The effect of the time management skills of students taking a financial accounting course on their course grades and grade point averages. International Journal of Business and Social Science, 4(5).

Premuroso, R.F., Tong, L. and Beed, T.K., 2011. Does using clickers in the classroom matter to student performance and satisfaction when taking the introductory financial accounting course?. Issues in Accounting Education, 26(4), pp.701-723.

Weygandt, J.J., KIESO, D. and Elias, R.Z., 2010. Accounting principles. Issues in Accounting Education, 25(1), pp.179-180.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts