A Portfolio Management Analysis

INTRODUCTION

Risk assessment is being identified as a critical task while performing the portfolio management that has a considerable impact on the selection process of an appropriate investment portfolio that offers excellent returns (Nicolas and May, 2017). This investigation evaluates the relationship between risk and returns regarding share prices of 10 companies. It also determines that relationship between risk and returns along with the limitation of the portfolio management approach, which can be vital for investors seeking in place to optimize their investments. For students who are grappling with complex concepts such as risk assessment and portfolio management, seeking finance dissertation help can offer the most valuable guidance in navigating through the intricacies of this particular field.

TASK

Dig deeper into A Journey Towards Becoming a Portfolio Manager with our selection of articles.

In the context of share portfolio management, risk and return both are interrelated concept and influencing each other because an individual investor could find high returns along with considerable risk in loss of investment. On the other hand, low-risk investment and portfolio also reduce the earnings of an investor. There are significant variations identified in the risk factors based on the nature of the investment. 1. Direct Relationship between Risk and Return (A) High Risk - High Return: This type of relationship occurs in such conditions if the investor will take more risk for availing higher returns. For example, an individual has invested one million that indicates the risk of loss of one million dollars. Suppose, an individual has earned 10% return then he could enhance its risk factor by investing more funds in assessing better earning capabilities (Paquin, Gauthie and Morin, 2016). (B) Low Risk - Low Return: In the context of a direct relationship, another condition occurs when an investor decreases investment that shows a reduction in the risk of loss and his return will also decrease during the period of reduction in investment. 2. Negative Relationship between Risk and Return (A) High-Risk Low Return: Sometimes, an investor is increasing the investment amount for assessing higher return, but with an increased return, some investors have found low returns as a result of the distinct nature of the investment project. Therefore, there is no benefit for increasing the volume of investment within low return projects (Pompian, 2016).

For example, There are 1,00,000 lotteries available in the market through which an individual will earn the prize. If an individual has bought 50% of total lotteries or 75% of lotteries, then the value of earning will reduce because increase in the risk. (B) Low-Risk High Return: There are some projects in which if an individual invest low amount but that particular individual would be able to earn a higher return. For example, Investment in government projects. If an individual gets government based investment options, then he will get a higher return by taking the small risk of loss (Ampatzoglou and et al., 2015). Role of diversification for reduces risk in the context of share portfolios In the context of portfolio management, the approach of diversification plays a critical role in lowering the risk factor. The primary principle of investment is managing the investment within the diversified portfolio. This approach assures the investor in which investor can spread his capital amongst different investments that could avoid the reliant upon a single investment for different goals of return (Chandra, 2017). The critical benefit of diversification is that it assists investors in reducing the risk factor within the investment portfolio.

Looking for further insights on Understanding Asset and Liability Management? Click here.

Three key advantages of diversification include:

- Minimising the risk of loss – if one investment performs poorly over a certain period, but other investments perform great during the period then investor finds a reduction in the risk of potential losses within the investment portfolio. The volume risk is significantly higher than one type of investment (Wu, Wermers and Zechner, 2016).

- Preserving capital – An individual investor has to manage different situation during its life span. Therefore, the approach of diversification helps an individual for the preservation of his capital which is close to retirement.

- Generating returns – Diversification assures returns becomes some stocks are not performing well in a conventional manner, but a diversified portfolio is going to offer overall positive returns (Chourmouziadis and Chatzoglou, 2016). Assessment of different risk factors helps investors to evaluate the impact of risk. Investors mainly face two main types of risk while taking an appropriate investment decision. The first type of risk is called un-diversifiable that is also termed as a systematic or market risk. This type of risk is related to every company and investment options. Some common causes in particular risk are inflation rates, political instability, exchange rates, war along with the interest rates (Pandey, 2015). This type of risk is not paying special attention to the particular company or industry so as it is very critical for managing the risk factor by diversification. However, this type of risk factor has to be managed by investors in every investment. The second type of risk is categorised in diversifiable. This risk is also termed as an unsystematic risk that is related to a company, industry, market and economy and the diversification of share portfolio can reduce the level of risk. The most common sources of unsystematic risk are related to the business risk along with the financial risk that could be influenced by various internal and external factors (Nicolas and May, 2017). Business owners could manage these risk factors by changing business strategies. 5. Discussing the practical limitations of the model of portfolio management In the context of portfolio management, the Capital Assets Pricing Model (CAPM) has been considered for examining the appropriateness of projects. There are some limitations addressed within the Capital Assets Pricing Model (CAPM):

- Risk-Free Rate (Rf): This model is mainly worked on the commonly accepted rate. This rate is used as the Rf. This model uses this rate as per the yield earned on the short-term government securities. The main issue with this rate is that the yield is changing regularly and creating volatility (Le, 2016). Therefore, it is very critical for an evaluator for use an appropriate risk-free rate because there is significant fluctuation addressed within the risk-free rate that could hamper overall risk-return assessment within portfolio management.

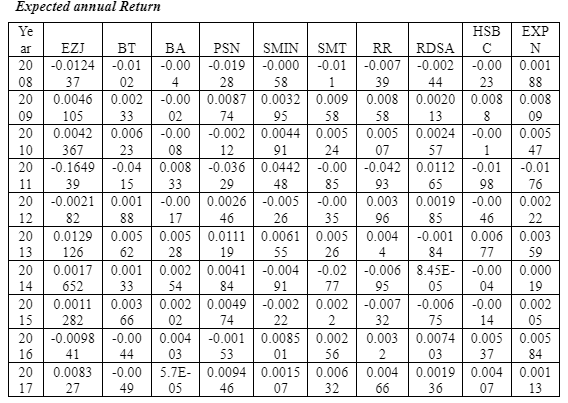

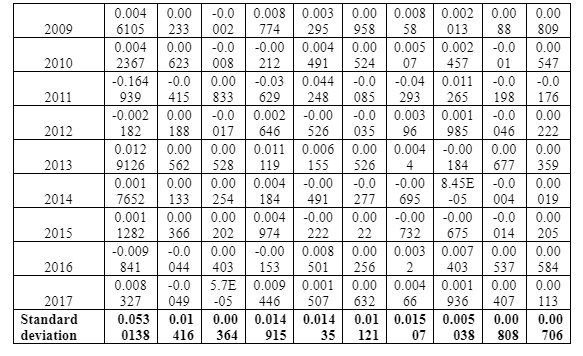

- Return on the Market (Rm): In the process of portfolio assessment, the return of the market can be calculated by conducting the sum of the capital gains along with the value of dividends related to a particular market. A problem arises when the market is offering a negative return at any point in time (Paquin, Gauthie and Morin, 2016). This resulted that a long-term market return is utilised for managing the smooth return in investment. Another issue is that these returns are predicted about previous year records and it may not be representative of future market returns. Therefore, it is very critical for the CAPM model in order to make an appropriate prediction about future returns. This aspect has limited the effectiveness of the CAPM model during portfolio management.

- Ability to Borrow at a Risk-Free Rate: CAPM is worked on the four major assumptions that have been found unrealistic and inappropriate during the real-world picture (Pompian, 2016). According to these assumptions, investors can borrow and offer funds for lending at a specific risk-free rate which is unattainable in real business and market conditions. This is because an individual investor is not able to borrow and lend funds at a similar rate. Therefore, the minimum required return line must be lower than the returns which have been calculated by the particular model. Therefore, this approach has limited the effectiveness of rate of returns because these rates have not considered the real market conditions (Ampatzoglou and et al., 2015).

- Determination of Project Proxy Beta: In the process of portfolio risk assessment, portfolio manager that is using CAPM to assess an investment should have to identify the value of beta reflective as per the requirement of the investment proposal. Therefore, the portfolio manager has to consider a proxy beta. However, it is challenging to determine the beta values with an appropriate manner, and it could have a massive impact on the reliability of the outcome. Therefore, it can be stated that beta value is playing an essential role in analysing the effectiveness of portfolio (Chandra, 2017).

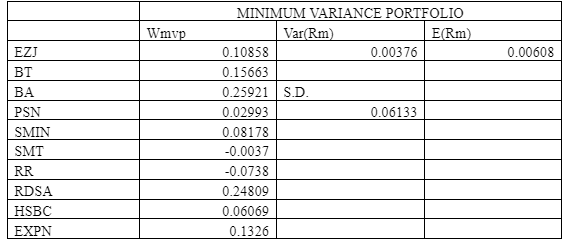

The volatility of the tangency portfolio is identified as a unique approach for assessment of the level of variance analysis within returns of a portfolio. The approach is focused on determining the average earning and risk factors that could influence the earning capabilities of the portfolio. On the other hand, Value At Risk of a portfolio is calculated not only by measuring or estimating return and volatility of individual assets but also assessing correlations between them (Wu, Wermers and Zechner, 2016). With the growing number and diversity of positions that have been identified in the existing portfolio, there are some increments identified within the level of difficulties. Therefore, it can be stated that the approach of Volatility of the tangency is not suitable for calculating the Value at Risk of the same portfolio when there are changes that occurred during the period. In addition to that, it does not consider market forces and situational changes for determining the value of the portfolio.

CONCLUSION

As per the above assessment, it is concluded that the assessment of financial risk is a very critical task in portfolio management because it requires consideration several factors such as market risk, growth factors and others. CAPM tool provides significant assistance for evaluating the reliability of share portfolio, but dependence on assumption has limited the effectiveness of the CAPM model. This report has concluded that diversification of portfolio supports to an investor for lowering the risk of loss within the total investment.

REFERENCE

- Ampatzoglou, A., Ampatzoglou, A., Chatzigeorgiou, A., and Avgeriou, P. (2015). The financial aspect of managing technical debt: A systematic literature review. Information and Software Technology, 64, 52-73.

- Chandra, P. (2017). Investment analysis and portfolio management. McGraw-Hill Education. Chen, J. M. (2017). Econophysical Models of Finance: Baryonic Beta Dynamics and Beyond. Available at SSRN 3059436.

- Chourmouziadis, K., and Chatzoglou, P. D. (2016). An intelligent short term stock trading fuzzy system for assisting investors in portfolio management. Expert Systems with Applications, 43, 298-311. Le, T. (2016). Forecasting with CAPM.

- Nicolas, S., and May, P. V. (2017). Building an effective compliance risk assessment programme for a financial institution. Journal of Securities Operations and Custody, 9(3), 215-224. Pandey, I. M. (2015). Essentials of Financial Management, 4th Edtion. Vikas publishing house.

- Paquin, J. P., Gauthier, C., and Morin, P. P. (2016). The downside risk of project portfolios: The impact of capital investment projects and the value of project efficiency and project risk management programmes. International Journal of Project Management, 34(8), 1460-1470.

- Pompian, M. (2016). Risk profiling through a behavioral finance lens. CFA Institute Research Foundation. Wu, Y., Wermers, R., and Zechner, J. (2016). Managerial rents vs. shareholder value in delegated portfolio management: The case of closed-end funds. The Review of Financial Studies, 29(12), 3428-3470.

Looking for further insights on A Case Study on Drax Power Station Project? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts