Accounting Equations, Stock Exchange Listing, Stakeholders

Task 1

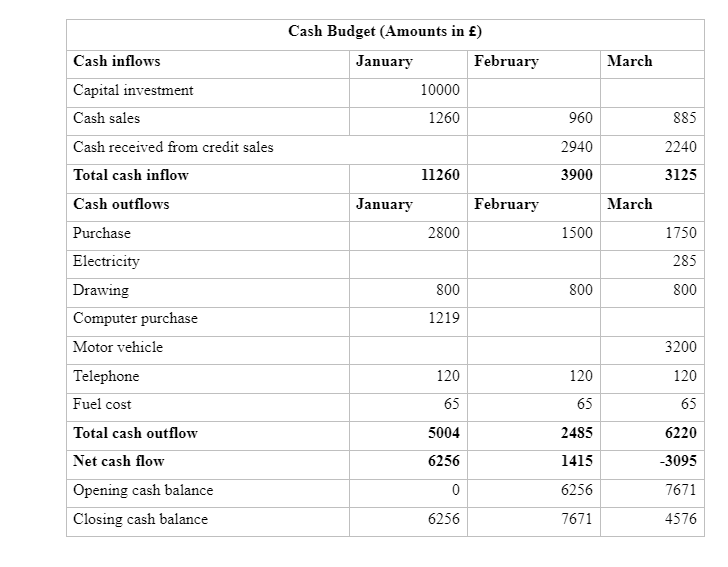

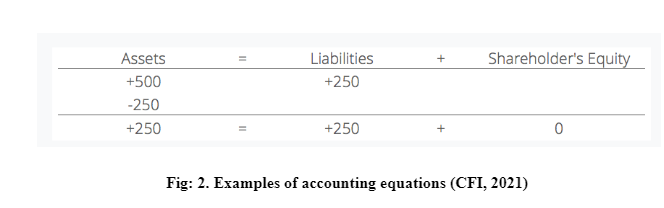

The following table demonstrates the cash budget for three months ending 31st March 2022

From the cash budget, it can be observed that the net cash flow is expected as £6256 at the beginning of the quarter, and at the ending of the quarter, the net cash flow is -£3095. The closing cash balance is expected as £6256 in January and is expected to become £4576 at the end of 31st March 2022.

Task 2

2.1. What is Accounting Equation and explain why the accounting equation will always work? Also, provide an example with your explanation.

A crucial aspect of financial statements is the accounting equation, which is a basic accounting concept. According to the accounting equation, a company's overall properties match the number of its liabilities and stakeholders' equity. This calculation forms the foundation of double-entry accounting and stresses the design of the balance sheet. Double-entry accounting is one in which each transaction impacts both ends of the accounting equation. An associated debt or shareholder's equity account must be updated for any change to an asset account (CFI, 2021). However, when conducting journal entries, it's crucial to remember the accounting equation (Fernando, 2021). Furthermore, the accounting equation can be used to determine if a company's business activities are correctly recorded in its accounting records.

The accounting formula has always been in proportion and works beautifully when a company adopts the double-entry method to keep accurate records, which means that the both the left hand side and right hand side of the equation can be equivalent. Since every business deal has an influence on at minimum one of a company's financial statements, the balance must be managed. When a firm takes money out of the bank, for instance, its assets grow and its obligations grow in lockstep. Accordingly, when a corporation buys merchandise for cash, one asset rises and another falls in value. In this scenario, the accounting system is called double-entry accounting or bookkeeping since each transaction affects two or more accounts (Averkamp, 2021). Furthermore, it will be easier to comprehend the foundations of accounting if individuals take the time to master the accounting equation and identify the dual side of every transaction. However, if a person is unclear which accounts will be impacted by a transaction, it might be beneficial to consider about only one of the accounts that might be affected, such as cash, then use the accounting equation understanding to figure out another one. Meanwhile, anything occurs, the accounting equation will always be balanced as a result of the transaction (ACCA, 2021).

Looking for further insights on Budgetary Control? Click here.

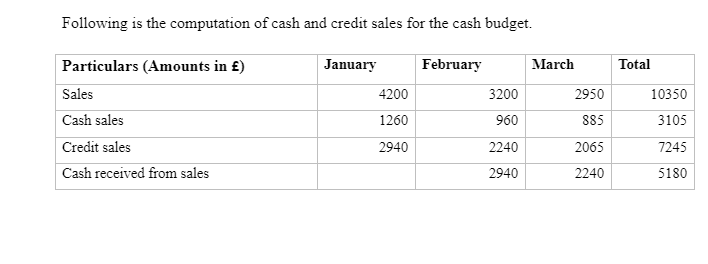

Each side of an equation must have the same net impact for every transaction. The following are some transaction instances and how they impact the accounting equation.

Ex. 1

Cash Purchase of a Machine:

Company XYZ wants to buy a $500 machine with cash alone. A debit to Machinery (+$500) and a credit to Cash (-$500) would arise as a consequence of this transaction. The following would be the net impact on the accounting equation:

This transaction has no impact on the liabilities or shareholder's equity on the right side of the equation since it solely affects the assets (CFI, 2021)

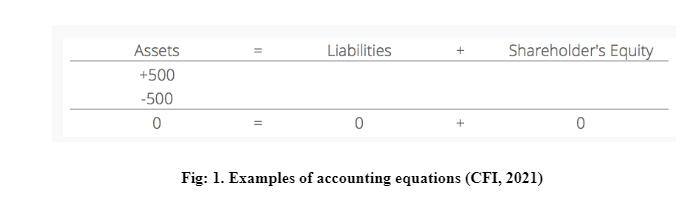

Ex. 2

Cash and Credit Purchases of a Machine:

Company XYZ wants to buy $500 equipment, but it has only $250 in its bank account. The corporation is permitted to acquire this equipment with a $250 down payment, but it must pay the remaining balance to the maker. Equipment would be debited (+$500), Accounts Payable would be credited (+$250), and Cash would be credited (-$250). The following would be the net impact on the accounting equation:

Each end of the accounting equation rises by $250 as a result of this transaction (CFI, 2021).

]2.2. What benefits might a company gain from having its shares listed on a stock exchange?

It has been revealed that an exchange seems to be a corporation that operates a marketplace for the trading of shares, currencies, bonds, futures, and derivatives, among other things. At specified hours of the working day, sellers and buyers meet on a market to trade financial products. The stock exchange, on the other hand, is a facility that allows corporations to trade their stocks. Before a company may deal on the stock market, it has to be registered first. The exchange makes thing easier to issue and redeem securities (Priya, 2019).

Accordingly, a publicly traded corporation is one whose stock is listed upon the regulated stock market. The exchange's listing rules must be strictly followed by such firms. A minimum income level and the quantity of stock exchange-listed shares may also be included. Typically, such businesses would launch an IPO (Initial Public Offering) to offer their stock to the general public. As a result, they are given money. Following that, the stock market will list such businesses and allow them to trade their stocks. The supply and demand for the shares determine the value of the stocks (Priya, 2019). Meanwhile, companies that are publicly traded get publicity, improved control, and more responsibility, among other benefits. Aside from that, the stock exchange has some advantages.

One of the major advantages of a firm being registered with the stock market is because it has a greater public presence. Moreover, they are also more prominent and easily identified than other companies. This enables such businesses to acquire new consumers and clients. According to surveys, one of the greatest impediments to a company's growth is a shortage of inexpensive financing. Companies that are registered on a stock exchange, on the other hand, may readily raise money by issuing more shares to investors for the process of purchasing them. The funds obtained will be put to good use in the company's expansion. Typically, publicly traded firms are not reliant on venture financing. Venture investors frequently insist on having some degree of control over a privately owned firm in exchange for purchasing shares. Because the individuals who buy shares in a publicly listed firm have limited rights that are available to stakeholders, stock markets allow corporations to keep more control and independence (Shaji, 2021). As a consequence of the registration, liquidity has grown, permitting owners to fully appreciate the potential of their investments. It enables investors to buy and sell in the company's shares, joint control, as well as reap the benefits of any gain in the company's worth. Furthermore, as an outcome of the registration, the entire functioning of the firm becomes more open and effective. The top management team of a publicly listed corporation are accountable to the firm's investors. As mandated by the Bond Indenture, companies those are listed should also ensure timely compliance through providing data and transparency to the Market and other stakeholders. (MSE, 2021). Furthermore, when a firm goes out publically, the expense of acquiring funds via bank loans is decreased. As they get accessibility to more capital and their accounting records are more available owing to auditing laws, banks perceive general publically traded enterprises to be less hazardous than privately held corporations. (Blissett, 2019).

2.3. Who do you think might be considered to be stakeholders in a large, listed company like Marks and Spenser?

Shareholders are those who have the ability to affect or have been influenced by the aims of the company. (Freeman, 2010). Any individual, group, or organization that has a stake in a company's attention, assets, or result, or who is influenced by that outcome, is referred to as a stakeholder.

In this context, based on the study, Marks and Spencer is a well-known British retailer that sells greater quality, cheap costing food, clothing, and household products to millions of people all over the world. It operates on two continents such as, UK and the rest of the world. The commerce and franchising operations in the United Kingdom include the UK division. Marks & Spencer owns businesses in Asia and Europe, along with global franchised ventures, all of which fall under the Global section. On 28th of September 1884, Michael Marks and Thomas Spencer founded the business, which is headquartered in London, England. (Forbes, 2020). Meanwhile, workers, consumers, shareholders, and financiers, as well as vendors, local communities, the authorities, and pressure organizations, are all can be stakeholders for Marks and Spencer. Several of these stakeholders might be from within the company, while others are from outside (Bryson, 1995).

Furthermore, Marks & Spencer employs around seventy thousand people that work for the corporation in order to improve their living situations (Marks and Spencer Annual Report, 2019). Pay equity, work satisfaction, rewards, a nice working environment, and harassment prevention are all things that employees will desire. As they are active in the day-to-day activities, employees have a direct impact on the company's earnings. As part of their employee engagement strategy, Marks and Spencer has its internal hotlines and conducts programs that require staff involvement. Consequently, customers are important stakeholders for Marks & Spencer as they're the ones who purchase the company's goods. Consumers want companies to offer the best items at the minimum feasible price, and they may be willing to partner with a firm that can assist them in accomplishing this aim. In order to make a profit, companies must provide services or products to clients. Consumers as well as other businesses could be consumers in this situation. Marks and Spencer keep track of how well their items are selling and can foresee client wants based on sales data. Customers may be contacted, surveys can be conducted to learn about consumer wants and preferences, and input can be given to consumers via their Retail Customer Support. Consequently, suppliers are entities that provide the organisation with commodities. Marks and Spencer's vendors are spread around the globe, and they demand secure agreements along with competitive prices for their items & services. The proportional size of suppliers and the quantity of providers available define their effect. Furthermore, shareholders as well as investors are businesses or individuals who have made a financial investment inside the farm by acquiring stock or putting money to the firm during challenging times. They are concerned regarding the company's long-term viability and revenue. Investors will exert weight on management to change tactics whenever things not going properly so that the firm can stay productive. Marks and Spencer has yearly conferences, meetings featuring big creditors, SRI indices, and data queries as a means of keeping investors and shareholders informed. (GraduateWay, 2018).

2.4. Is the profit that a business makes a reliable indicator of its cash balances? What are the

differences between Profit and Cash?

Cash flow is the total amount of cash and cash alternatives, including such bonds, that a corporation generates or spends during a certain timeframe. The cash reserves of a company determines its range, in this sense, the more the money available and the lower the money consumption percentage, the more manoeuvring room a company has and, in most situations, the higher their value. Cash flow and revenue are not synonymous. Cash flow is the amount of money that comes in and out of the business. Profit, on the other side, is the amount that remains after most of the company's expenses have been removed from total revenue (Schwarz, 2020). A financial report consists of three parts: a net profit, a cash balance, and a balance sheet. However, the net profit and the cash balance exhibit different sorts of information. The net income represents how such gains or losses spreads across the organisation, whereas the net profit reflects the company's success via sales, costs, and revenues. They are, nevertheless, inextricably linked in the meantime. As it begins with earnings statement's net earnings or losses and then displays how well the business collects cash, the statement of financial position cannot function without the earnings statement (Tarver, 2021). However, the terms "profitable" and "positive cash flow transactions" are not comparable. It is important to note that simply because a company being profitable doesn't mean it's making money. In this context, consider the case of a manufacturing corporation that is experiencing poor product demand and intends to liquidate 50% of its plant equipment. The buyer would pay cash for the outdated equipment, but the company would end up losing money on the deal since it rather prefer use the materials to produce products and earn an operating income. (Segal, 2021). Therefore, profit cannot be considered a trustworthy predictor of a company’s cash balance.

Furthermore, the differential between corporate working capital and earnings or net profit may determine whether or not a corporation succeeds. Profits appear nice on paper and can assist with funding, but cash flow is more crucial in keeping a firm afloat during difficult times. The liquidity of a company is represented by cash flows. The capacity to spend and invest money is referred to as liquidity. Profitability, on the other hand, depicts a company's income versus costs, and some of these expenditures are not paid in cash. However, profits are affected by inventory and cost of sales, but not usually cash due to the sheer timing of costs (Murray, 2021). Although the financial structure is highly based on GAAP norms, the working capital process differs significantly from them on a regular basis. Accordingly, net income is calculated using declared revenues and known costs, while profit is calculated using cash receipts and cash payments under the Cashflow system. Furthermore, the accounting approach is unrelated to capital planning, whereas capital budgeting is determined by cash flow. Regardless of the fact that some businesses earn money whilst remaining cash-negative, others generate revenue despite remaining financially unviable. Companies, on the other hand, needed money on a regular basis and can function irrespective of whether they are struggling financially. In the meanwhile, it is sufficient to state that revenue is

necessary for a firm's  expansion. A publicly traded firm's share price will drop if it does not produce a profit over time, making potential investors wary of investing into the firm. Furthermore, capital is a critical component for a corporation's near-term existence. (CFI, 2021).

expansion. A publicly traded firm's share price will drop if it does not produce a profit over time, making potential investors wary of investing into the firm. Furthermore, capital is a critical component for a corporation's near-term existence. (CFI, 2021).

References

ACCA (2021). The accounting equation. [online] www.accaglobal.com. Available at: https://www.accaglobal.com/ie/en/student/exam-support-resources/foundation-level-study-resources/fa1/technical-articles/accounting-equation.html [Accessed 11 Nov. 2021].

Averkamp, H. (2021). Accounting Equation (Explanation). [online] AccountingCoach.com. Available at: https://www.accountingcoach.com/accounting-equation/explanation [Accessed 11 Nov. 2021].

Blissett, L. (2019). Benefits of the Stock Exchange. [online] Zacks.com. Available at: https://finance.zacks.com/benefits-stock-exchange-6013.html [Accessed 11 Nov. 2021].

Bryson, J. M., 1995. Strategic Planning for Public and Non-profit Organization. Revised

Cambridge University Press.

CFI (2021a). Accounting Equation The basis of accounting. [online] Corporate Finance Institute. Available at: https://corporatefinanceinstitute.com/resources/knowledge/accounting/accounting-equation/ [Accessed 11 Nov. 2021].

CFI (2021b). Profit vs Cash. [online] Corporate Finance Institute. Available at: https://corporatefinanceinstitute.com/resources/knowledge/finance/profit-vs-cash/ [Accessed 11 Nov. 2021].

ed. San Francisco: Jossey-Bass.

Fernando, J. (2021). Accounting Equation. [online] Investopedia. Available at: https://www.investopedia.com/terms/a/accounting-equation.asp [Accessed 11 Nov. 2021].

Forbes (2021). Marks & Spencer. [online] Forbes. Available at: https://www.forbes.com/companies/marks-spencer/?sh=49386f8b7de1 [Accessed 11 Nov. 2021].

GraduateWay. (2018). Stakeholders Influence in Marks and Spencer. [Online]. Available at: https://graduateway.com/stakeholder/[Accessed: 11 Nov. 2021].

Marks and Spencer Annual Report (2019). Marks and Spencer. [online] M&S. Available at: https://corporate.marksandspencer.com/ [Accessed 11 Nov. 2021].

MSE (2021). Benefits of Listing / Going Public. [online] www.msei.in. Available at: https://www.msei.in/corporates/benefits-of-listing [Accessed 11 Nov. 2021].

Murray, J. (2021). Understanding Business Profit vs. Cash Flow. [online] The Balance Small Business. Available at: https://www.thebalancesmb.com/how-your-business-make-a-profit-and-have-no-cash-4067910 [Accessed 11 Nov. 2021].

Priya, K. (2019). Top 10 Benefits of Listing Company on Stock Exchange. [online] Swarit Advisors. Available at: https://swaritadvisors.com/learning/top-10-benefits-of-listing-companies-on-a-stock-exchange/ [Accessed 11 Nov. 2021].

Schwarz, L. (2020). Cash Flow Analysis: Basics, Benefits and How to Do It. [online] Oracle NetSuite. Available at: https://www.netsuite.com/portal/resource/articles/financial-management/cash-flow-analysis.shtml [Accessed 11 Nov. 2021].

Segal, T. (2021). Corporate Cash Flow: Understanding the Essentials. [online] Investopedia. Available at: https://www.investopedia.com/investing/read-corporate-cash-flow-statement/ [Accessed 11 Nov. 2021].

Shaji, A.M. (2021). Explaining Benefits of Listing a Company on the Stock Exchange. [online] Enterslice. Available at: https://enterslice.com/learning/benefits-of-listing-a-company-on-the-stock-exchange/ [Accessed 11 Nov. 2021].

Tarver, E. (2021). Cash Flow Statement vs. Income Statement: What’s the Difference? [online] Investopedia. Available at: https://www.investopedia.com/ask/answers/031215/what-difference-between-cash-flow-statement-and-income-statement.asp#citation-1 [Accessed 11 Nov. 2021].

Take a deeper dive into Accounting and Finance with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts