Applied Islamic Banking and Insurance

Financial principles which are governed and regulated as per the Sharia law, also known as Islamic Law, are termed as Islamic Finance. This report provides a critical analysis of study done by Perves (2015) on compliance and regulatory frameworks of Islamic Banking and Takaful (Islamic Insurance).

According to the authors, the Sharia consists of a number of prohibitions and regulations, along with prescriptions regarding the practice of finance dissertation help. These prohibitions generally tend to include the likes of receiving or paying interest (also known as ‘riba’), gambling or speculating, being associated with industries that are considered to be ‘haram’ such as those involved in alcohol, pork, pornography, weapons or even conventional banking (Hassan & Salman, 2017). On the other hand, Islamic Banking consists of many obligations as well. For instance, obligations like almsgiving, also known as ‘zakat’, which is also one of the five pillars of Islam, fair sharing of economic profits and losses and productive use of money, are some of the key obligations listed in Islamic finance and Sharia law (Salman, 2015).

The authors selected to perform this study from the perspective of Bangladesh, mainly because of the fact that the first Islamic bank was established in the country in 1983 – Islami Bank Bangladesh Limited (IBBL) (Perves, 2015). Ever since then, Islamic finance has gained significant prominence, growth, and development. In addition to this, Bangladesh is among one of those countries where the significance of Islamic finance is extremely prominent. Authors have proved this with the fact that the Islamic Financial Services Board has awarded the top category of ‘systemic importance’ to Islamic Banking industry in Kuwait, Malaysia, UAE and Bangladesh (Mihajat, 2018).

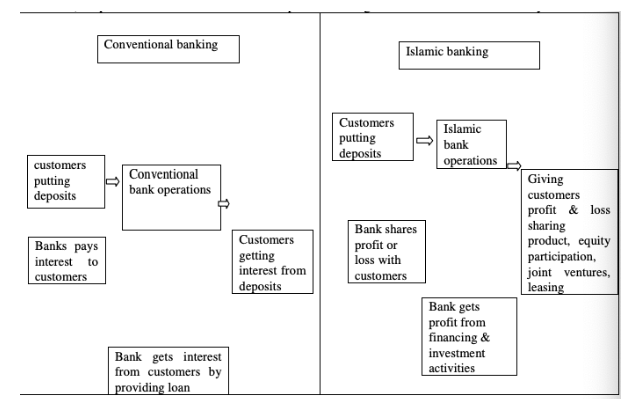

Perves (2015) defined Islamic bank as a company which works according to the Islamic Banking business and its aims and operations do not consist of any element which is prohibitied by the religion of Islam. They used the definition of Islamic Banking as per the Islamic Banking Act of Malaysia. (Chowdhury & Shaker, 2015) described Islamic banking as a normative concept and stated that any banking system that follows the value system and ethos of Islam can be termed as Islamic Bank. The authors described the differences in conventional and Islamic banking through the following figure.

Looking for further insights on Moral Hazard In Insurance? Click here.

According to the author, one of the key and differentiating factor of Islamic banking is its Profit-and-Loss Sharing (PLS) paradigm. Even though Ayedh (2019) states that there are not many differences between Islamic and conventional banking, but Perves (2015) argued this by stating that there are many points of differences between the two banking systems. While in conventional banking the individual or group is responsible for the profit or loss they incurr, but in Islamic banking it is distributed among all the people associated with the banking system. According to NuHtay & Hamat (2015), conventional banking is more profit oriented, while Islamic banking is largely based on morals and ethos that are best for the society. Furthermore, the religion of Islam does not provide any seperation between mosque and state; therefore whatever rules are mentioned by the mosque, the government also has to follow them and vice versa. This is a very good exmaple of Sharia law being implemented in every day lives of the people (Dahnoun & Alqudwa, 2018). Thus, it can be said that any person who does not follow Islam or does not comply with Islam cannot associate with an Islamic bank. Followers of Islam, i.e., Muslims, are prohibited from indulging in activities such as gambling, speculation, prostitution, sale of alcohol, pork, tobacco and other such items. Thus, if any person is found to be involved in such acts, they cannot associate with any of the Islamic banks (Khan, 2018).

Take a deeper dive into The pros and cons of Banking industry with our additional resources.

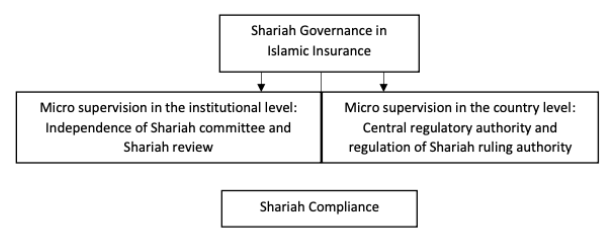

Sharia governance is a major part of Islamic banking institutions. According to Salman (2017), governance can be defined as a system of guiding, monitoring and controlling different institutions and organisations. Thus, the role of Sharia Governance Framework (SGF) is of great importance in functioning of Islamic banks. Figure 2 shows different aspects of Sharia Governance and Supervision.

The implementation of Sharia principles helps in ensuring that all activities performed by an insurance organisation comply with the Islamic law and therefore be able to protect interests of its stakeholders, customers and other such organisations and individuals (Hassan & Salman, 2017). It is because of this very reason; it is imperative for Islamic insurance companies to strongly and effectively follow guidelines and standards mentioned in the Sharia law (Perves, 2015). Furthermore, these should be strongly and closely monitored by the Sharia Supervisory Board (SSB), management and other such regulatory authorities (Dahnoun & Alqudwa, 2018).

There are four principles on which Islamic Corporate Governance is significantly dependent. One such principle is ‘tawhid’ which is done through the harmony of knowledge through collaborate and integrative means to different interrelating environmental features (Salman, 2015). It is crucial to note here that these principles should be used and managed in accordance with the rules of Shariah, which in turn is largely based on Al-Quran and Sunnah.

Perves (2015) in their study stated that in Bangladesh, one of the main areas of the Islamic financial markets that requires attention is the Islamic capital market as well as its instruments like Sukuk. It has proved to be one of the main fund-raising tools for companies and governments around the world. In this context, the Bangladeshi government is focusing on introducing Sukuk as instrument for effectively managing liquidity in Islamic banks. Further in this regard, the Islamic Treasury bill is waiting for approval from the government before it is issued to the market. In similar manner, equity market of Bangladesh is still smaller in relation to its regional neighbours (Chowdhury & Shaker, 2015).

One of the two main stock exchanges of Bangladesh is The Dhaka Stock Exchange, while the other one is the Chittagong Stock Exchange. The Dhaka Stock Exchange, in January of 2014, had made plans for listing an Islamic equity index that would focusing on tracking Shariah compliant stocks. The combined market capitalisation of listed firms on the Dhaka Stock Exchange in October 2013 was valued that BDT 2.5 trillion or USD 32.6 billion (Perves, 2015). This can be compared with that of the valuation of National Stock Exchange of India, which was valued at USD 1 trillion, the Stock Exchange of Thailand which was valued at USD 394.8 billion and Karachi Stock Exchange which was valued at USD 48.7 billion (Perves, 2015).

Perves (2015) further emphasised that there are still numerous challenges present in Islamic Banking systems in Bangladesh. In this regard, one of the key challenges is not being able to successfully develop an interest-free mechanism to place their funds for a short-term. Another major challenge is with regard to the risks involved in profit-sharing is very high. This is so high that almost all of the Islamic banks operating in the country are using such financing techniques that provide them with fixed assured returns (Khan, 2018).

Short term trade investments made by vast majority of Islamic banks is one of the main issues related with Islamic banking. In this regard, these banks havily rely on Bai Mujjal/Murabaha to be able to perform effectively and efficiently. There are two main reasons behind this. The first reason is that these banks mainly focus on short-term financing of trade transactions for which Bai Mujjal/Murabaha seems to be among more of the convenient tools as compared to the systems of profit-loss sharing (Alam & Hossain, 2019). The second reason is that these banks compete with the banks operations of which are heavily depedent on the use of internet, also known as the internet banks. Due to this reason, these banks tend to be extremely anxious to earn as much as they can on their investments, so that they can give interests to their investment account holders which can be compared with the prevailing rates of interest.

Engaging in Bai-Muajjal/Murabaha transactions as ‘mark-up’ can help in enhancing overall efficiency and effectiveness of the Islamic banks. These can further be fixed in such a manner that can provide with assured returns (Salman, 2015). It is one of the main reasons for reluctance showed by Islamic banks while investing under the Mudaraba or Musharaka, which are also considered as the true Islamic financial mechanisms. Many Islamic scholars believe that replacing interest by a device such as ‘mark-up’ can present change only in the name, rather than presenting any substantial change (Chowdhury & Shaker, 2015). Furthermore, this new system will not be any different from the interest-based system, especially with regards to equity. Prohibition of interest in Islam is aimed at stimulating and promoting the overall production, which is also the main aspect of achieving high and significant growth (Khan, 2018). This is apart from the equity considerations. Such benefits can be obtained only if and when the interest system is completely removed and is replaced by a more fundamentally different system such as the profit-loss sharing system.

The study of Perves (2015) utilised the qualitative approach. This means the author provided only qualitative data and did not rely on using any quantitative measures for analysing the data. Even though use of this approach provided valuable informaiton about the research topic, however, if quantitative measures would have been used, it would have helped the readers in building a better and sound understanding of the data sets (Othman, 2017). This way the overall efficiency and effectiveness of the study itself could have been improved by a significant margin. However, Othman (2017) also used similar approach only. The author relied on using past data, i.e., literature review to invetigate the research topic and develop a sound understanding of the subject matter.

The tawhid and shura based tactic describes the epistemological basis of Islamic corporate governance which seems to be unclear and confusing to adopt and implement in the current conventional practices of corporate governance. In ascertaining the Shariah in the corporation, the SSB plays a significant role in monitoring and ensuring the Shariah rules and regulations within the activities of the organization (Alam & Hossain, 2019). Besides, the shareholders can play an important role by participating in the decision-making process and the policy making of the institution to protect the rights and interest of all stakeholders rather than maximizing the institution’s profit.

The other stakeholders, as well as the community perform their roles to provide joint collaboration and to safeguard the interest of as a whole and to motivate for the social welfare. All of the procedures are performed through maintaining the principles of justice to accomplish the ultimate objective of the Islamic corporate governance accompanying the private and social goals. (Khan, 2018) has defined SG system as “a set of institutional and organizational structures and process through which the Islamic financial institutions ensure that there is effective independent oversight of Shariah compliance over the issuance of relevant Shariah pronouncements, dissemination of information, and an internal Shariah compliance review”.

This framework has incorporated the objectives, strategical issues, economic incentives and traditional rules and regulations of the institutions. The study of Perves (2015) utilised the qualitative approach. This means the author provided only qualitative data and did not rely on using any quantitative measures for analysing the data. Even though use of this approach provided valuable informaiton about the research topic, however, if quantitative measures would have been used, it would have helped the readers in building a better and sound understanding of the data sets (Othman, 2017). This way the overall efficiency and effectiveness of the study itself could have been improved by a significant margin. However, Othman (2017) also used similar approach only. The author relied on using past data, i.e., literature review to invetigate the research topic and develop a sound understanding of the subject matter.

The body of shura is an executing body formed by the board of directors, management, shareholders, employees, and customers might assure the efficiency of the organizations and influence in the decision making of the corporation (Salman, 2015). Moreover, it’s a large challenge for the scholars how to solve this problem by maintaining these rules and regulations of Islamic Shariah.

REFERENCES

Alam, K., & Hossain, S. (2019). Shariah governance practices and regulatory problems of Islamic insurance companies in Bangladesh. International Journal of Academic Research in Business and Social Sciences, 9(1), 109-124.

Ayedh, A. M. (2019). The integration of Shariah compliance in information system of Islamic financial institutions: Qualitative evidence of Malaysia. Qualitative Research in Financial Markets.

Chowdhury, N., & Shaker, F. (2015). Shariah governance framework of the islamic banks in Malaysia. International Journal of Management Sciences and Business Research, 4(10).

Dahnoun, M., & Alqudwa, B. (2018). Islamic insurance: an alternative to conventional insurance. American Journal of Humanities & Islamic Studies, 1(1).

Hassan, R., & Salman, S. A. (2017). Guiding principles in developing Shari’ah governance framework for Islamic capital market. International Journal of Economic Research, 14(6), 27-38.

Khan, I. (2018). A narrative on Islamic insurance in Bangladesh: Problems and prospects. International Journal of Ethics and Systems .

Mihajat, M. I. (2018). Shari’a Governance Framework in Islamic Banking in Oman: Issues and Challenges. In The Name of Allah, The most Beneficent, The most Merciful, 73.

NuHtay, S. N., & Hamat, M. (2015). Takaful (Islamic insurance): historical, Shari’ah and operational perspectives. International Business Management, 9(1), 65-69.

Othman, M. B. (2017). Development and Shari'ah issues of the Takaful industry in Malaysia - Effects of the Regulatory Framework on the Implementation and Growth. Journal of Finance and Banking Review, 2(1), 38-43.

Perves, M. M. (2015). Legal and Regulatory Framework in Islamic Banking System: Bangladesh Perspective. European Journal of Business and Management, 7(21), 179-188.

Salman, S. A. (2015). Takaful (Islamic insurance): when we started and where We are now. International Journal of Economics, Finance and Management Sciences, 3(5/2), 7-15.

Salman, S. A. (2017). Viability of introducing takaful (Islamic insurance) in India: Views of politicians. Banking & Finance Law Review, 32(2), 389.

Dig deeper into Analyzing Financial Time Series Data with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts