Compliance And Financial Oversight

Summary report

Key findings

The issuance of 207 P-cards, in which case, in the year 2017, 10,400 transactions were made, which amounted to a total value of £874,000.

In the process of P-card issuance, it was noted that 20 applications were reviewed and found that they did not follow the right protocol for authorization.

A member of the banking team has developed an e-learning training tool for P-card users, and this has brought forth positive feedback from P-card users. However, it is suspected that the take-up for E-learning is low.

Most of the P-card users were not aware of the updating of the P-card protocol, apart from two, who were aware that it existed.

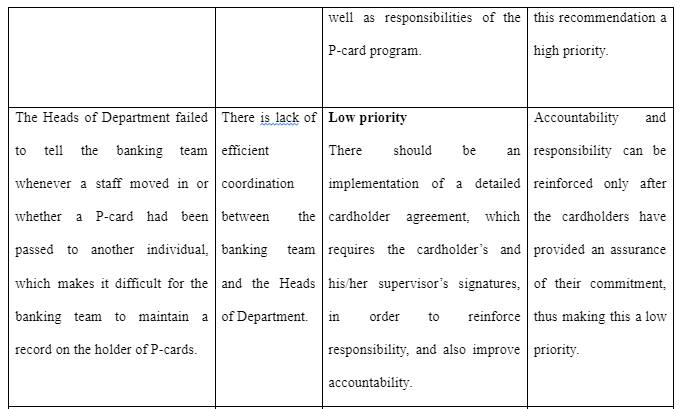

The Heads of Department failed to tell the banking team whenever a staff moved in or whether a P-card had been passed to another individual, which makes it difficult for the banking team to maintain a record on the holders of P-cards.

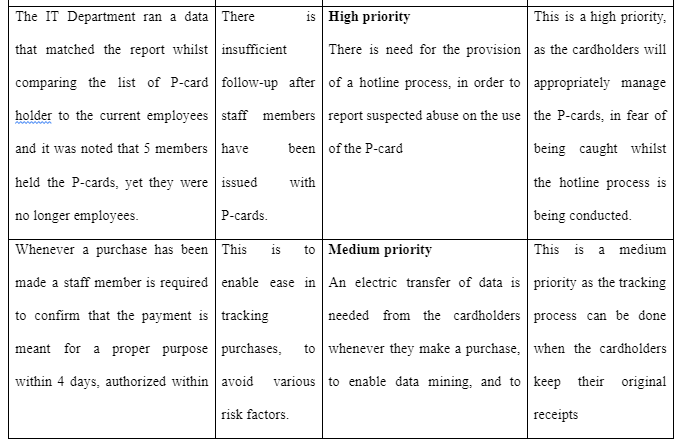

The IT Department ran a data that matched the report whilst comparing the list of P-card holder to the current employees and it was noted that 5 members held the P-cards, yet they were no longer employees.

Whenever a purchase has been made, each staff member is required to confirm that the payment is meant for a proper purpose within 4 days, authorized within 7 days by the Head of Department.

Based on the P-card protocol, cardholders are required to keep copies of their receipts for at least 6 years. However, it is clear that some cardholders do not keep copies of their receipts.

The banking team has developed a suite of compliance report that identifies suspicious activities, and when such an activity is identified, the banking team contacts the Head of Department for deeper clarification, and when there are unsatisfactory answers, the card is suspended.

Take a deeper dive into IT And Financial Services with our additional resources.

Reports indicated the following; 34% of the expenditure were confirmed by staff members, making the purchase within 4 days; 44% of the purchases were reviewed within 7 days by the Head of Department; 45 P-cards were not used in 2017; and 4 P-cards had expenditure for more than £25,000 in 2017. The amounts in the general ledger and in the financial statements have not been reconciled since March 2017. VAT rules have not been adhered

A summary of the recommendations

There is need for an establishment of a reasonable card limit program, in order to reduce either excessive or inappropriate use issue.

Ankh Morpork City Council should appoint a suitable permanent administrator, to be responsible for, and have total authority over the P-card program, thereby ensuring that all staff members follow the right authorization protocol.

E-learning training should be essential before a P-card is issued to a new member and refresher training should be offered to cardholders at least every year.

There is need for designing dedicated and detailed procedures, as well as policies. Staff members need to be updated regularly, in order to accurately reflect on the roles, as well as responsibilities of the P-card program.

There should be an implementation of a detailed cardholder agreement, which requires the cardholder’s and his/her supervisor’s signatures, in order to reinforce responsibility, and also improve accountability.

There is need for the provision of a hotline process, in order to report suspected abuse on the use of the P-card

An electric transfer of data is needed from the cardholders whenever they make a purchase, to enable data mining, and to enhance analysis, which are based on known risk factors

The cardholders should keep original receipts of their purchases whenever they make a purchase

There is need for meaningful, as well as enforced policies that govern the consequences of either misuse, fraud or abuse of the P-cards.

The P-card should be designed in a manner that minimizes possibilities of “accidental” use of the card for inappropriate purchases

Ankh Morpork City Council should designate, and also communicate various detailed roles, as well as responsibilities for transaction monitors, and reconcilers

There is need for recurring audit processes, in order to evaluate significant compliance with the P-card program policies, as well as procedures

Substantial

The banking team has developed a compliance report that identifies suspicious activities, and if found, the banking team contacts the Head of Department for clarification, whereby, if there are unsatisfactory answers, the P-card is suspended. Moreover, the e-learning tool for cardholders has presented positive feedback from the users.

Reasonable

The process of issuance is in place for right authorization, although some staff members fail to follow the right procedure. Moreover, the cardholders are required to keep receipts of their purchase for at least 6 years. However, some cardholders do not keep their purchase receipts.

Limited

There is no procedure for reconciling the amounts in the general ledger with those in the monthly statement of P-card expenditure. Moreover, Ankh Morpork City Council has failed to adhere to VAT rules for seven cases.

Presentation

This report is basically, a presentation to the Council’s Audit Committee, explaining how external auditors might seek to place reliance on internal audit

Significantly, most of the work done in the internal audit can often overlap and be connected with the work done by an external auditor, especially in specific areas that are dealing with the assessment of various control processes (Abbott et al., 2012). It is evident that whilst carrying out certain detailed work that involve the evaluation and review of an organization’s internal control framework, the internal auditor performs the procedures that are related to financial control, which are also relevant to the work in the external audit. In this regard, the external auditor may seek to rely on the work done in the internal audit, rather than opting to duplicate these procedures (Brandon, 2010).

It is worth noting that internal audit often assist external auditors in understanding an organization’s internal control system, as well as its level of compliance. This contribution of the internal audit creates a huge potential in the reduction of fees in external auditing (Desai et al., 2011). Organizations are fully interested in getting maximum benefits from the investments in internal audit. As such, they continually look for ways of controlling the external auditing fees. In this regard, organizations purpose to adopt financial incentives, thus encouraging external auditors to continually rely on seeking internal audit whilst conducting their external audit (Glover et al., 2008).

Moreover, it is also noted that there is a relative importance that relate to three factors that include competence, work performance, and also objectivity. External auditors perceive these factors to be significant whilst evaluating the strengths of the internal audit, which they need in conducting their external audit work (Saidin, 2014). In this regard, external auditors might seek to rely on the work of internal audit, to reduce workload of the external audit. Notably, external auditors often adjust the nature, as well as the extent of their audit work procedures, owing to their reliance on the work of the internal auditors. In other words, they tend to reduce the working hours when conducting external auditing, when the internal audit has shown a high competence level, as well as good work performance, and also a high level of objectivity (Munro & Stewart, 2011).

Speaking Notes

This report explains how external auditors might seek to place reliance on internal audit Most of the work done in the internal auditing often overlap and are connected to the work done by external auditors. As such, the external auditors might seek reliance on internal auditing, especially in areas that handle the assessments on various processes. Internal audit assists external auditors in understanding the organization’s internal control processes, and its level of compliance. This consequently reduces the external auditing fees, and as such, organizations focus on maximizing the investments of the internal audit whilst looking for ways of controlling the fees of conducting the external audit. Eternal auditors regard factors such as work competence, high work performance, and objectivity to be having a great importance when grading the work on internal audit. As such, they reduce the extent of their work procedures by seeking reliance on internal audit, especially if it covers the three factors.

References

- Abbott, L. J., Parker, S., & Peters, G. F. (2012). Audit fee reductions from internal audit‐provided assistance: The incremental impact of internal audit characteristics. Contemporary Accounting Research, 29(1), 94-118.

- Brandon, D. M. (2010). External auditor evaluations of outsourced internal auditors. Auditing: A Journal of Practice & Theory, 29(2), 159-173.

- Desai, N. K., Gerard, G. J., & Tripathy, A. (2011). Internal audit sourcing arrangements and reliance by external auditors. Auditing: A Journal of Practice & Theory, 30(1), 149-171.

- Glover, S. M., Prawitt, D. F., & Wood, D. A. (2008). Internal audit sourcing arrangement and the external auditor's reliance decision. Contemporary Accounting Research, 25(1), 193-213.

- Munro, L., & Stewart, J. (2011). External auditors' reliance on internal auditing: further evidence. Managerial Auditing Journal, 26(6), 464-481.

- Saidin, S. Z. (2014). Does reliance on internal auditors’ work reduced the external audit cost and external audit work?. Procedia-Social and Behavioral Sciences, 164, 641-646.

Dig deeper into Citizen-Advice Enfield: A Legacy of Charitable Service in the London Borough with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts