Conflicts in Investment Banking

Introduction

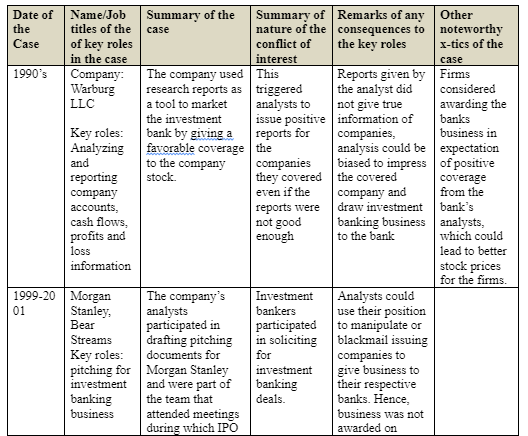

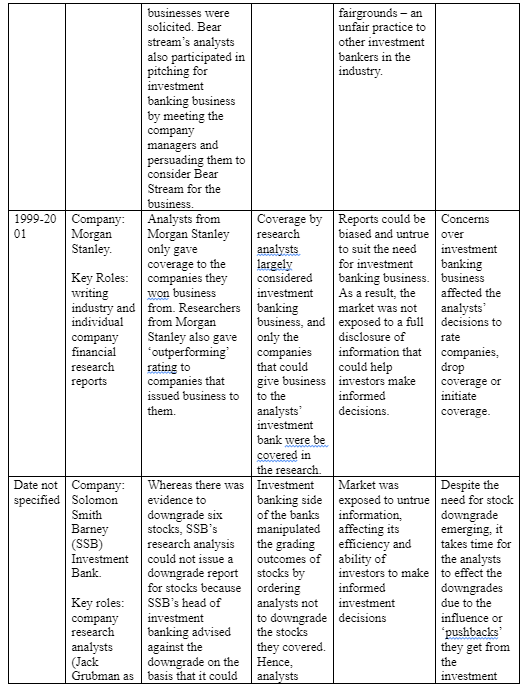

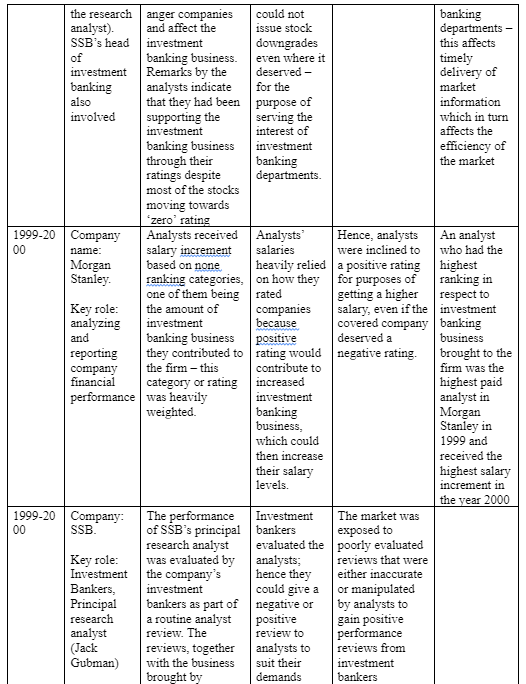

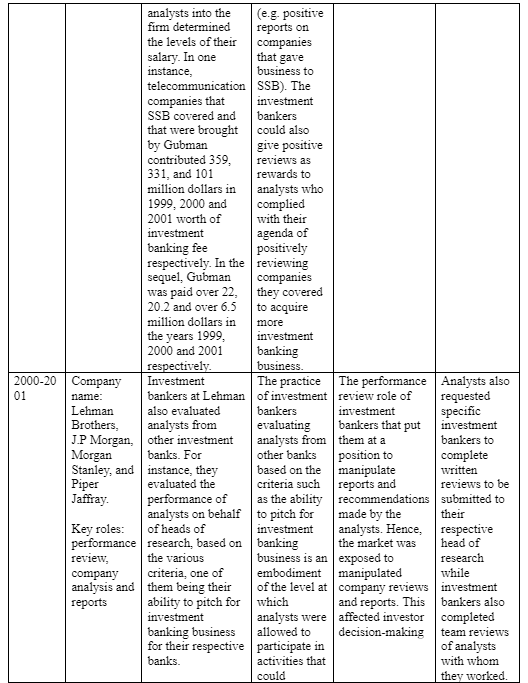

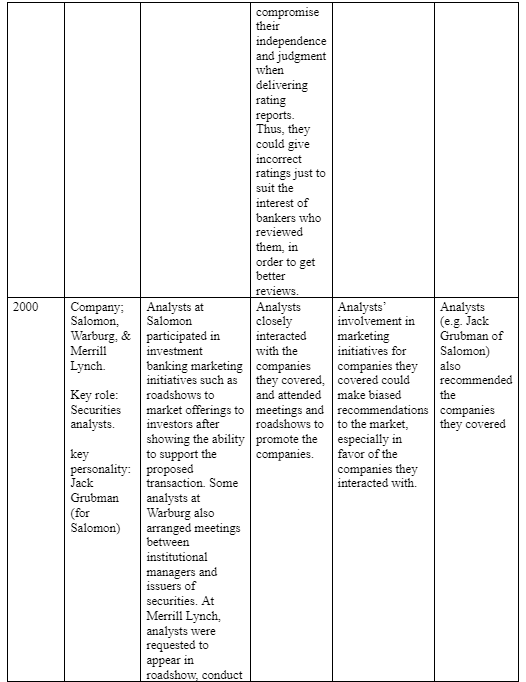

Conflict of interest among investment bankers and research analysts has been a major factor affecting market efficiency in the United States of America’s securities market. With specific reference to Fisher (2005) and the SEC (2003) this paper will summarize the conflicts of interest so far documented. Secondly, the paper will identify and discuss the conflicts of interests addressed by the reforms mentioned in the SEC document.

Section A: A summary of Conflict of Interests

Section B: Reforms Made By the SEC to Address the Emerging Conflict Of Interest

The reforms introduced by the SEC addressed various conflicts of interests highlighted in the above section. For instance, analysts gave positive company reports and reviews to attract business for the investment banking departments (Fisher 2005). The SEC addressed this conflict of interest by introducing a policy which ensured that the mangers of research departments could now make decisions to terminate coverage of specific companies, and investment bankers were no longer allowed to make any decisions regarding the coverage of specific companies (SEC 2003).

As aforementioned, analysts could participate in soliciting for investment banking business by attending roadshows and pitching meetings. To address this conflict of interest, the SEC introduced a policy that barred analysts from participating in investment banking business solicitations, including roadshows and pitches (SEC 2003).

According to Fisher (2005), analysts could only cover companies they won investment businesses from. This conflict of interest was enabled by the continuous interaction and communication between the research and analysis departments and the investment banking departments of the banks. To address this conflict of interest, the SEC introduced a policy that sought to physically separate the investment banking and the research departments of the institutions to limit the flow of information between the two departments. Moreover, the firms were required to create firewalls that restricted interaction between the research and the investment departments unless under special circumstances (SEC 2003).

Dig deeper into Interest Rate Arbitrage with our selection of articles.

Finally, the analysts’ salaries were determined by the volume of investment banking business they brought into the firms Fisher 2005. This compromised their integrity to give fair and unbiased research reports and company coverage. To address this conflict of interest, the SEC issued a directive that the analyst compensation should not be based indirectly or directly on the investment banking revenues they contributed. Moreover, analysts’ performance was reviewed by investments bankers, and a key criterion was how much investment banking business they contributed. In response, the SEC established a policy that investment bankers should not evaluate analysts’ performance (SEC 2003).

Looking for further insights on Impact of Financial Crisis on the Banking Sector of the UK? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts