Credit Card Debt in Australia: A Growing Concern

Chapter 1. Australian Credit Card Debt Default

Fact

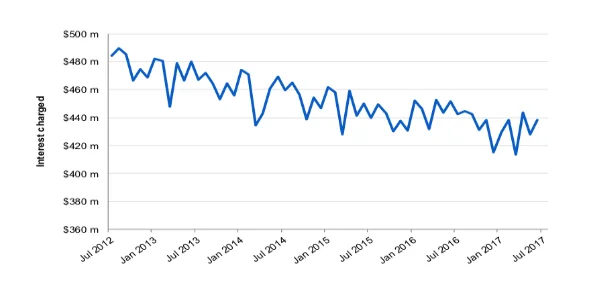

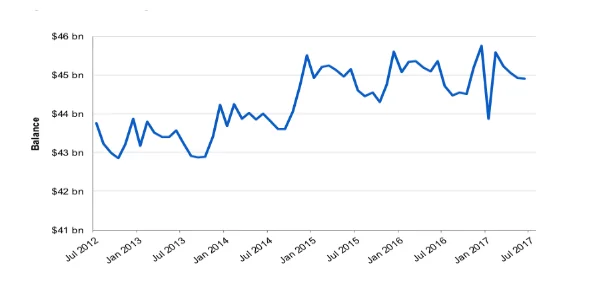

Recent rising financialisation issue in Australian household economy might be an increasing risk of credit card debt default. It has been warning from 2018 by news media, such as ABC news channel that worry Australian consumer owned AUD $ 45 billion credit card debt, which is assumed that it needs 17 years to repay the whole amounts, if it dived for every Australian credit card (CC) users, AUD$ 2,000 per each card users. According to Finder.com.au credit market report, there are 16,694,597 credit cards that have been using in the Australian economy. The figure has been increased by adding more 8,298 cards only in 2017, which means every Australian adult have 0.9 credit card. Compare with famous financialisation issue in Australia, house price bubble, (ABC News, 2019) which CC debt is new economic issue that rising in social concern. However, from financialisation study by orthodox economists, the increase of credit card usage would be one of the typical transformations in financialisation transformation in household consumption pattern. Lapavitsas (2009) lies that, financialisation tends to transform bank’s business model from loan to industry to household throughout their consumer loan service. Additionally, credit card would be common financial product for the purpose. In Australian economy, credit card debt default (CCDD) would be raising an economic and social issue because among the usage of credit card, as a consumer loan-based input in economy has obviously been increasing like below Reserve Bank of Australia graph.

Another economical reason why CCDD would be an issue, not only each household perspective but also aggregate demand perspective, that is securitisation for the default that would be only covered partially in out of total expected amounts because still 95 percentage of assets back security is mortgage back security rather than CCDD security (Reserve Bank of Australia. 2018). Even Australian Government authority, Australian Securities and Investment Commission (ASIC), published report, “credit card Lending in Australia” for alarming the serious economic threat is coming in Australian economy (ASIC. 2019). From the Australian Securities and Investment Commission (ASIC) report, 580 lies that one out of six Australian consumers (18%) are struggling with credit card debts. Outstanding balances of total credit card debts are AUD $ 45 billion, including credit card interests of AUD $ 31.7 million.

It is debatable because the Australian CCDD risk is hired by visible economic phenomena, house market bubble in household economy area. There are two reasons why academically CCDD is interesting. In theoretical approach, it is debatable that first, credit card usage, itself can be explained in mainstream consumption theories as a reasonable temporary income source in Milton Freedman’s permanent income hypothesis or it would be proper solution in Liquidity constrain hypothesis. Additionally, all CCDD responsibility would be a consumer’s non-rational decision-making process or due to financial literacy in mental accounting perspective. In industrial strategy approach, a conflict between profit interest of Australian credit card industry, increasing membership and loan more credit for generate more profit, and managing user’s default possibility for protecting CC user’s serious financial damage, applying more strike financial credit rating process to new member when they apply card or continue warning service for the cc repayment default prevention would be a debatable in this project.

Australian credit card industry

Before modern types of credit card service were provided, there were similar financial service that have been existed. From the 19th century to the 1930’s similar financial items compare with nowadays credit card, such as charge coin, have been used. For example, charge coin, which looks like a coin, but there are hole, logo of the service entity and account number that would record by hand writing every time the client used it for charging price of purchasing, where it had been used in hotel and some departmental store. It is usually linked with own charge coin account in the department or hotel like credit card. Next item was ‘charge-plate’, which was looks similar compare with charge coin but did not have a hole but client’s name and signature for prevention of mistaken identity. Credit card services started in the United States from early 1950’s. At the beginning, Market leader were Diner Club Cards that first independent payment company in the world. The business model of Diner Club Card was self-sufficient service for traveling and entertainment for their member, including credit payment service mainly for client’s business diner. However, already, the number of cardholders reached 20,000 in 1951. After that, many credits card service was established by American financial companies, such as American Express Company to establish American Express Card in 1958, Interbank Card Association to establish Master Card in 1966 and so on until now American credit card company leads international credit card service market. From the technological innovations since 1960’s, credit card transformations have been increased over the years.

In Australia, before 1974 only store card has been used. Australian credit card usage has been started from establishment of credit card services in Australian Merchant Bank, Bankcard. It is business model that was a joint effort by Australian bank (finder b 2019). It hits in 1976 with 1,054,000 Bankcard holders and almost 49,000 participating merchants. And also, Bankcard started to run ATM from 1977. Hence, the card service extended to whole Australia. Until the shrinkage of the market share in 2006, Bankcard was main credit card company that dominated the Australian credit card market in the peak of 1984 (finder b 2019). Early 1980’s was the period that forging credit card started to join the Australian credit card market (finder b 2019). Foreign international credit card (CC) companies, such as Visa and Master card signed co-branch agreement with the Bankcard from 1980. And then the agreements were dissolving the 1983. And after launching Electronic funds transfer at point of sale (ESTPOS), system in same year. In 1984, Visa and Master card are properly launched in Australia, and it was a turning point in Australian credit card market, occupied by foreign card companies and its market share (finder b 2019). Without influenced of local credit card corporation’s closing in 2007, Australian credit card market has been extending. According to finder.com.au report 2019, the growth is influenced by invention of Mobil phone service that is based on application, and invention of Internet banking system. Especially Australian electric payment bill payment system like BPAY, launched in 1997, was one of the causes of the growth. Recent trend in Australian CC is careless payment system that includes withdraw of money only by slim client’s card in wallet or using electric device, like smart phone, to pay instead via ‘wallet apps (finder b 2109). From Reserve Bank of Australia Payment Board Annual report (Reserve Bank of Australia 2018 a), Credit card transaction per capita has been increased.

Australian credit card industry has been extended. Merchant banks extended their business partners not only by involving the banks but also airplane company like Qantas or supermarket for example Woolworth (credit card compare 2019). According to finder.com.au state of the credit card market report 2018 pointing 8 current Australian credit cards trends, which are; First, introductory offers, which means Card Company can offer some special condition to new cardholder, such as bonus sign-up point, or 0 percent interest. The dealing would be offered to new client, if the new client signs up in certain date. Second one would be a Dual Credit Card service, which means two different cards would share same one account. For example, American express card accompanies another company’s card like visa card option and is designed to maximise your reward points. That is the reason why the service is popular among reward seekers. Simply, user pay only one annual fee for this type of account, although its usually on the high side. Third one is as a mentioned before contactless payment system. Credit card authorised only tapping card on devices instead of swiping card. Fourth trend would be no charge to foreign transformation fee cards. The service became a popular with using frequent flyer cards and travel credit cards, for instance, cheap local airplane card that did not charge extra foreign transaction fee or currency conversion fee for swiping abroad. Fourth would be the fact about annual fee, which is, there has been a widening division in sentiment towards annual fees, with many premium cards charging higher annual fees for their perks, matched by a growing consumer interest in cards promising no annual fee for life. Fifth one would be development of CC security technologies. One of example might be credit card features now include two steps protocols, which are chip-and-Pin verification technology or online verification system that use in one-time password sent to user’s mobile phone that must be keyed on before online transaction takes a place. Also, Card Company are monitoring all users’ irregular, and suspicious transaction for covering user’s protective zero liability policies. Sixth trend would be about online payment service. Recent Australian CC companies evolved online payment service with internet banking and mobile phone, and payment gate way, like Paypal and SecurePay and eWay are using more secure way to pay. Final Credit card trend would be increased of credit card debt with a rise of Card usage. Again, from ASIC CC debt clock, the average debt per credit card holder stands at around A$ 4,300, which will be cist A$2,139 in interest over 5 years at 18% p.a

Household Consumption and CCDD rate

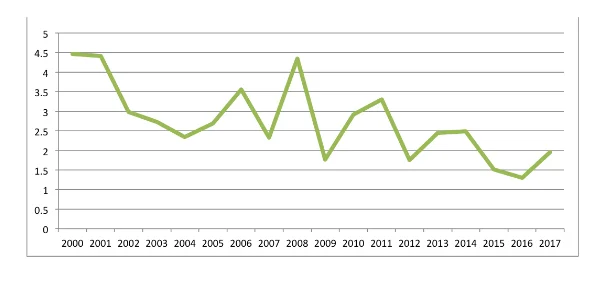

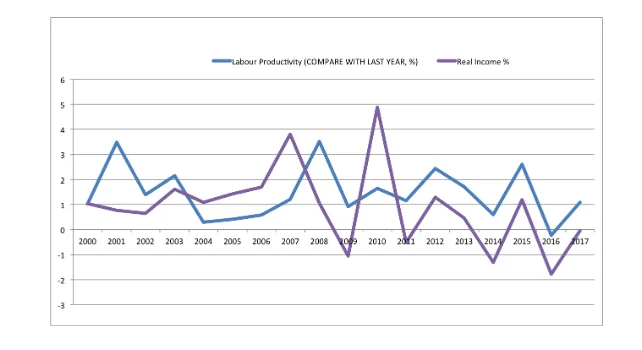

For understanding about the CCDD case, it is necessary to measure national statistical figures, such as real income change, Price of commodities during Australian financialisation era, level of CCDD approximately from 2000 to 2017, the ASIC report 580 covered. In a household account, the research should start with debit side, which are mainly income and expensive. It means average Australian household’s income would be research for the period that ASIC 580 report covered, that 2012 to 2017 (AISC 2019). Real income refers to the income of an individual or group after taking into consideration the effects of inflation on purchasing power. Hence, this project would adopt the formula that proportion of nominal income increases divided by consumer price index (Investopedia. 2019). Graph below illustrate labour compensation change, per last year. It explains after Global Financial Crisis (GFC), there were big fluctuations and from 2011 to 2017, trend would be slowly reduced. Compare with 2008 in 2009 labour compensation reduced until 1%, it is definitely affected by GFC. And in 2010, compare with 2009, labour compensation is rapidly increased by 8% that explains the Australian economy is recovered by Government supporting in economy. But after GFC labour compensation staying under 3%, even in 2016, it was minus (OECD Data a 2019).

However, for calculating real income, there must be less inflation change for answering the real income figure. The graph below illustrates Australia inflation rate, consumer price index, which shows that, only 2008 had a high inflation (approximately 4.3 %) and lest of period was lower than 3.3 % except early 2000’s (OECD Data b 2019).

As a result, it is logical to find the real income that less inflation percentage from labour compensation changes. And the real income should be compared with productivity, like graph below. If proportion to change real income is lower than productivity, it means Australian received fewer amounts then they really contributed to Australian economy. From the graph, it is obvious that, after GFC, except 2010, the year that Australian Government used quantitative easing for managing 2008 GFC, always real income was lower than labour productivity increase. It means under the assumption that, Australian household spent same expenditure, household have been supper to liquidity constraint, ignore with household equity side.

Furthermore, from OECD Australian Data, the household spending has not been decreased, it rather increases from $690,568 million to $1,044,303 million after GFC.

For spending the increased amounts of household expenditure with depressed real income, it would be logical to conjecture that, there was some extra financial source in Australian household consumption. And also, as per the Australian Reserve Bank data below, the Credit Card transaction has been increased. It means Australian used CC as a finical source to cover their liquidity constraint.

It should be concern that, as ASIC report 580-pointed 18 percent of consumers were CCDD, it does not mean the consumer had an uncontrollable consumption behaviour necessary. It needs more research, but there must be research about the list of the spending for finding correlation between the CCDD and liquidity constraint for purchasing life necessary. It is also arguable that, how much the CCDD would realise, they are defaulting CC debt. Because, in conventional consumption theory, like mental accounting lies that human being some time confused to understand their spending and pick up one example, credit card usage that consumer did not realised they are spending their money because the form of the money is not same as a currency or coin. It is digitalised currency in plastic card, as a result the theory explains CC consumer tend to spend more than necessary. But how about the CCDD spend more than they are able to pay back, because their real income is not enough, another word, the household did not have an enough purchasing power for maintain their consumption. Another issue would change in credit side of Australian household’s balance sheet in the ASIC REPORT 580, The graph below describes the Australian Household Debt ratio (OECD Data c 2019). From 2000 Australian household get more debt in their disposable income. The increased household debt illustrates that, Australian household balance sheet liability side has been increased with many possible explanations for example took home loan for purchasing house or CC debt increased because of the rise in consumption. From second graph below, Household spending, which is increased constantly, it is more logical that role of debt in Australian household would be significant (OECD Data d 2019). It means that, under the assumption household borrowed mainly for purchasing home and consume with credit card. There is high possibility that Australian household have a debt default (216 % of disposable income in 2019), if there is economic shock like recession, causing relatively high household liability appear in balance sheet.

Concern with CCDD, from ASIC report 580, the Australian authority suggested Balance Transfer. But without compensation increase, it would not be ultimate solution but temporary expedient only for the household. Even the offer period household would be free from payment, but there would be no difference that fact household has to pay the principle and interest, which is strongly related with their income level. Except the fact that, the balance transfer has a many possibility that fails because of CC debtor’s moral hazard, such as still using card even the offer period and not reduce consumption with many excuses. However, in bank industry, the balance transfer would be the best solution for the high CCDD risk, because still CC corporations are able to receive card interest, which is profit in CC corporations balance sheet. It could not receive, If CC user went to bankruptcy. From the situation, this project will ask it would be appropriate that household CCDD would be caused by only household over consumption. And the balance transfer would be the solution without real income increase in the circumstance that household real income would be final source to pay back.

Australian Securitisation Mark

History of securitisation can be tracked until the 1970’s United States. Government National Mortgage Association (GNMA), also called Ginnie Mae, issued first mortgage back security in secondly market (Barnett 1997). And soon Private Corporation that charted by US government, Fannie Mae followed the issuing mortgage back security and first issued collateralised mortgage obligation (CMO), which is more complicated, but solving repayment risk of mortgage back security in 1983 (Barnett 1997). Todays, Real Estate Mortgage Investment Conduit (REMIC), which is established by US Congress by the Tax Reform Act 1985, facilitate all the most of issuance of the CMO. First assets backed security (ABS) has been issued by Sperry Lease Finance Corporation in 1985. In Australia, the American securitization funding technique mainly performed by Banks (Bailey and Davies, 2004). The Australian Securitisation has been dramatically evolved from the middle of the 1990s to the middle of 2000s. During the period, outstanding assets and liabilities increased approximately A$ 10 billion in 1995 to A$ 160 billion in 2004. The kind of assets that securitised had been widely extended (Bailey and Davies, 2004). The assets back securities have been issued to the local market and offshore market. According to Bailey and Davies (2004), since 2000, assets back bond was occupied over 50 percent of bond that issued. Issue of securities by another type of assets like commercial mortgage or trade receivable and so on are increased more rapidly as compared with residential mortgage back securities. From Bailey and Davies (2004), it is hard to explain the growth only with housing finance in Australia. According to McCabe (2010), there were several reasons to use security in the bank and other financial institutions. “The process of selling the loans to a third party, rather than retaining them on their balance sheets, enables them to: manage their credit risk while continuing to maintain a relationship with the borrower; free-up regulatory capital, so that it can be used more productively; and diversify their funding sources thereby enabling them to raise funds to finance new lending” (McCabe 2010). However, the market proportion of credit card back security is only two percent, compare with back mortgage security, 98 percent (RESERVE BANK OF AUSTRALIA. 2018 c)

However, in 2008 GFC became a chance to think about the potential risk of assets back secularity. Kevin Davis (2009) suggested four points that attributed 2008 GFC (Davis 2009). First of all, the major point is the rapid growth of high leveraged financial products. It is arguably because the high leverage products are sustainable only when the investors have confidence and the value of the assets that have to increase for supporting the loan. The second reason was the growth of liquidity creation technique which the lenders were believed their risk would not be significant. Next one was shadow banking system, including hedge funds that is supported to build complex financial instruments, which spread out the risk to the global financial market. Finally, it was the lack of risk information about the financial system for the public. It causes too many institutions to suspend credit in GFC, because of the inability to assess the risk positions of potential counterparties. As a result, they are compounding the crisis through the lack of liquidity in the market (Davis 2009). Fortunately, the Australian Government is immediately involved the GFC for solving. According to Davis (2009), Reserve Bank of Australia injected liquidity to the market and guaranteed deposit and bank. Also, the government made an infrastructure project for easing 2008 GFC, and Australian securitisation market has been hit hard during the period because of the avenue for a bond issue. And the small lenders who were a force to leave security market, causing a return of high street bank, that changed the market position, only fewer participants would lend mortgage and another form of credit. David (2009) lie that, it is reasonable in post-GFC; the lender who left the securitisation market that should be returned to allow for increasing market competition. From experience, it is obvious that, the volatility of the security market is high, especially when the real economy stumbles. Due to the conservative environment of the Australian financial industry, still maintaining strong Keynesian style government involving policy implement in the market, 2008 GFC has been efficiently managed. However, it does not mean that, the Australian security market is perfectly safe from such an economic disaster. This is due to the concern that, the Australian security market size is not significant as compared to the leading financial market in the world, ranking 16 only (World Federation of Exchange. 2018), but again it does not mean the character of the commodity is stable. Still, assets back security is suspicious item as a debt derivative that Borrows (2002) mentioned.

From the research GFC case, it is obvious that, the Australian CC industry has a not perfect, but still a safer default hedging system, Australian securitisation market. Ironically the risk hedging system might be a cause to influence and to push their business model to their CC clients with reasonable confidence, because the industry has a back door. In CCDD’s perspective, Australian Security market, not only Australian case but also almost of financialised economy block, which are running a similar hedging system that would be good example for illustrating credit card industry, which is not designed for client concern but for interest of industry, in debt default risk hedging perspective. Furthermore, from the historical experience, it is possible that Australian financial authorities involved economy throughout quantitative easing, it is logical that, if there are significant issues in the securitisation market, it will cause to spend Australian Tax payer’s money for protecting CC industry and securitisation market investors but not Tax payers, themselves who are defaulted. For detecting the business model of Australian CC industry to balanced treatment to both entities, CC corporations and clients that facing possibility of CCDD, it is necessary to observe another entity, which is CCDD hedging system for CC user.

Australia Bankruptcy Act 1966

First for understanding, the credit card user’s CC debt default and after process, it is necessary to understand Australian credit report bureau. Credit Bureau or credit report agency is non-government organisation that collects client’s personal financial information, holds and distributes the client’s personal credit history to loan provider or to other clients. There are six credit-reporting agencies (CRA) in Australia, which are CreditorWatch, Compuscan, illion, Experian, Tasmanian Collection Service, Equifax. Each CRG would provide a little bit different type of reports for the same client, because each private CRA use different information source, concern in different aspect for writing credit report. For instance, Equifax, which is the largest credit reporting agency in Australia and provides personal and business credit reports in country wide. Another CRAs like illion and Tasmenia Collection Service are also providing Debt collection service for client. It is possible to order a free copy in 10 days and credit alert services are also available (EQUIFAX. 2019). The credit report would be changed if the client believes that, there are inaccuracy information in the copy. The credit-reporting agency (CRA) report would use when the client applies for loan or even credit card. The CRA records three different way to late payment, which are first Late payment, second, Default, and finally, Serious credit infringement. According to Finder, Payments are considered ‘late’ if they are more than 14 days past the due date and can stay on CRA report for up to two years. When the client makes a late payment, client’s creditor will often charge to client a late fee and client’s interest rate may increase, depending on the terms of client’s credit card agreement. Defaults on the other hand are more severe. Client’s default on client’s credit card if the client misses a payment or payments of more than $150 by more than 60 days and this can stay on client’s credit report for a total of five years (finder c). A serious credit infringement occurs when client owe a debt to a credit provider and have not responded to them or contacted them in six months or more. This can stay on client’s credit report for seven years, which can seriously affect client’s ability to take out a new credit card or loan in the future. If the client makes the owed payment, it will revert to a default (finder c).

In extreme case, Australian credit card debt defaulter would be applied Bankruptcy process. According to the Australian Bankruptcy Act, 1966 individual concern about personal bankruptcy would be bankruptcy for three years and one day. However, according to parliament; the registration process should be one year and not three (INHEBLACK. 2018). Moreover, the individual’s name will be permanently listed on the National Personal Insolvency Index (NPII), which is accessible to anyone online, including bank, and employer. The bankrupt individual will be forced to sell some assets to pay back the debt and be requested to get permission when you travel overseas. The individual’s income will charge from the top on a certain amount for paying back the debt (Australian Government AFSA 2015). Preventing personal Bankruptcy, as a result of Credit card default, has bred forth a new type of financial products including debt consolidation loan or the transfer of lower interest charge credit card. Michael Janda maintained that, the new debt consolidates loan, which could not be the first solution, but it is famous since the financial product provides commission to bank employee like the manager who confirmed the loan contract (ABC NEWS 2016). Due to the new loan, the rate of bankruptcy has been reduced by A$ 5 billion in Australian credit card balance from 2012 to 2016. It is evident that, the financial industry temporary delayed their debt default moment because, for debtor perspective, the new product would not reduce debt payment amount. On the contrast, even transfer to lower charge card or little interest of debt consolidation loan; still, a debt obligation is maintained that lies card user that is the final charger.

Government Authority’s Analysis

It would be reasonable that Australian Government’s perspective to understand the credit card debt default case. One of the efficient ways to get the information that would be analysed Australian Government body’s official report, such as Australian Securities and Investment commits (AISC) 580 report: Credit card lending in Australia. It was published in 2018. The report researched Australian credit card usage from 2012 to 2017 concerning with credit card Debt issue in government perspective (ASIC. 2019). First, according to ASIC 580, Since 2012, the National Consumer Credit Protection Act 2009 (National Credit Act) has contained additional requirements for credit cards intended to address some of issues. First issue is Credit card product design and long-term debt—Consumers can carry large balances on their cards for extended periods at high interest rates, including balances that they have no prospect of repaying in the short- to-medium term (or that may cause financial harm in the future if their circumstances change). Second issue is Credit card marketing and increasing debt levels—Some features of credit cards offered to consumers, such as high interest rates or balance transfers, can lead to many consumers carrying more debt over time. Finally, Credit card selection—Consumers can face challenges by selecting credit cards suited to their actual behaviours, in that:

Behavioural biases may affect product selection and use, causing consumers to choose a credit card because of certain features (e.g. interest-free periods and balance transfer offers) rather than a card that aligns with their behaviours, resulting in additional costs; and

Differences in credit card features and terms can be difficult for consumers to assess.

Secondly, the report covers three entities, CC companies called debt provider, Australian CC user, Government solution for the CC debt crisis, and AISC’s suggestion for the case, blueprint of CC industry reform plan. Secondly, ASIC 580 report focused three areas, which are consumer outcome, Balance transfers, and effectiveness of key reform. Consumer outcome means debt outcomes from credit card productions over time with particular attention to consumers, who are in arrears, carry debt at a high interest rate for a long period, or repeatedly make low repayments. Balance transfers covered that, when and how balance transfers are used, how Australian CC users are repaid and their effects on aggregate credit limit and debt levels over time. Effectiveness of key reforms part illustrated that additional requirement for credit cards

Disclosures intended to help consumers choose credit cards and encourage them to make larger repayments; and

Requirements standardising how repayments are allocated to outstanding balances.

For research and published the report, twelve credit providers covered the vast majority of the credit card market participated in our review (ASIC. 2019).

In Consumer outcome part (pp24~43), ASIC 580 used word ‘Problematic Debt’. Report itself agreed that there is no typical definition of the problematic. But it gives a process to develop their own definition of the problematic debt. First there are three scenarios; (a) Failure to make minimum repayments. (b) Significant long-term debt, and (c) Small repayments. From the three scenarios, ASIC developed four problematic debt indicators, with additional condition to filter out, such as (a) occasional variations in behaviour that do not detract from the overall risk of harm; and (b) practices that may not cause problems, such as regularly carrying a large balance at no cost. From the ASIC 580 report, defined four different indicators depend on CC holder’s debt situation across all their CC account. The debt indicators are;

Severe delinquency--- The account has been written off or is in the worst state of delinquency that the relevant credit provider report to ASIC.

Serious delinquency---The account has been 60 days (or more) overdue in the previous 12 months.

Persistent debt---The average balance of the credit card is 90% of the credit limit over the previous 12 months and interest has been charged.

Repeated low repayments---The consumer has made eight or more repayments on the account at or below 3% of the credit limit and interest has been charged over the previous 12 months.

The report continues to disclose the problematic CC debt indicators in whole Australian economy.

First, in 2017, 18.5% of consumers, more than 1.9 million people out of 24,641,661 in total population satisfied one or more of the problematic debt indicators. From the report p27, 178,351 consumers (1.7%) are in Severe delinquency, 369,997 consumers (5%) are in serious delinquency, 930,335 consumers (10.8%) are in Persistent debt indicator, and 435,079 consumers (8.5%) would be in Repeated low repayments situation in 2017.

Secondly, the report is concerned about another three consumer features, which are;

Number of the cards the consumer hold

Age of the consumer

The consumer credit providers

Number of cards that the population hold is first, one cardholder were 14.2% consumers, compare with three cardholders, 31.8%. in low repayment consumer group, the correlation between the number of cards and the proportion of consumers potentially displaying problems was greatest (one card holder 5.4%, five card holder 31.8%, and six of more card holders 42.6%). The age of the consumer is younger where the consumers had a higher overall incidence of problematic debt. 21.2% of consumers aged 18-29 satisfied one of our indicators, compared to 10.8% of consumers aged 65 and over. However, the distribution of consumers across the different indicators is varied significantly by age. According to the report, Greater proportions of young consumers were in delinquency: 3.3% of consumers aged 18–29 were in severe delinquency. For consumers making repeated low repayments, the distribution was relatively uniform across age categories, with a slightly higher proportion of consumers aged 45–64 in this category. Report lies that some variation in the incidence of problematic debt is based on who provided the credit card. This variation could be driven by many factors, including differences in:

(i) Portfolios (e.g. providers with younger portfolios may have higher rates of delinquency);

(ii) Lending practices; and

(iii) Providers’ responses to problematic debt.

The report discloses their research about credit provider. ASIC research to credit provider to ask three questions, which are;

(i) Prompts to make larger repayments when consumers have made low repayments for an extended period;

(ii) The availability and promotion of structured payment plans (which may help address some of the concerns about issues that arise out of the amount of flexibility a credit card can provide, and the low minimum payments required); and

(iii) Reminders about repayments, including overdue repayments.

The ASIC lies that ‘Few credit providers have taken proactive measure to address ongoing problems other that delinquency. Consumers, who are in persistent debt or repeatedly making low repayments, may be profitable; this means there may be limited incentives for providers to act”. It means ASIC released that, relationship between credit provider and credit card holder would have a different economic position. And then the report continues with ‘Some providers have started to take proactive measures to deal with persistent debt, repeated low repayments and cards that do not suit consumers.’ From the part, it is possible to assume that Australian credit card corporations catch the level of significance in the situations and reacted to prevent extreme mass default case for protecting their profit even it partially, which will mention later in this article. The Report pointing several actions that credit provider did. First one would be monitoring client’s portfolios for cards that do not suit consumers and if it is possible to cancel the card that did not used. Or some case industry is involved to change credit card for reducing default for certain consumer. From the report common indicators that industry used for monitoring were;

(i) High credit limit use and exceeding the credit limit due to interest charges;

(ii) Making repayments at or near the contractual minimum for a consecutive number of months;

(iii) The way the card is used (e.g. cash advances or payments on payday loans);

(iv) Holding an inactive credit card; and

(v) Issues with other products (e.g. financial hardship or delinquency).

The report lies that credit provider also concern to properly contact throughout text message, emails, online notifications, letter, and phone calls, the client who match with their criteria and suggest changing to alternative financial products. From same providers, the report lie that they achieved a 93% activation rate on the new cards. Another reaction that credit provider offer is structured payment plans for CC user who are not in hardship, to help them to reduce their balance or repay a large purchase by instalments. The report listed conditions that involved with the plans;

(i) A lower interest rate than the purchase rate;

(ii) A fixed repayment term of between three and 36 months;

(iii) Customer selection of the structured payment amount, either a large purchase or part of the customer’s credit card balance; and

(iv) A set monthly repayment amount based on the other features of the plan.

The ASIC report 580 suggested ‘Balance transfer” (pp46~65) as a one of the solutions of the CC debt threat to consumer in the report. From the first, AISC official site define that, “A balance transfer is a way of moving some or all of your credit card balance from one card to another. The debt you move to the new card attracts a lower interest rate (or even no interest) for a certain period, called the promotional or honeymoon period” (ASIC's Moneysmart. 2019). The ASIC report 580 also warning that, the balance transfer would be a serious debt trap, if CC user fails to pay off the transferred balance in the promotional period; keep the card the balance was transferred from; and make new purchases on one or more of the credit cards. It referenced by Australian Parliament report “Interest rates and informed choice in the Australian credit card market/16 December 2015”. However, the ASIC report 580 explores three points of the balance transfers (BT), which are;

(i) When and how balances are transferred;

(ii) Why consumers transfer balances; and

(iii) Whether consumers repay transferred balances and what happens to their total credit card debt during and after the promotional period (i.e. if the ‘debt trap’ risk exists).

The ASIC repot 580 overviewed that number of Balances transfers, account of money that is able to transfer to new balance, reason that BT occur, debt outcome and BT, and research about cancelling the old credit card in empirical survey. The ASIC report 580 mentioned that” in 2017, just over 1 million had a balance transferred onto them at some stage; this is equivalent to 7.6% of all open accounts. Including cards that were cancelled by June 2017, the total proportion of all cards with a transferred balance at some stage was 8.3%”. “Our data linking exercise suggested that these 1,068,053 credit cards are owned by almost 800,000 people. Approximately 187,000 (23.5%) of these people owned more than one credit card with a transferred balance”. “The breakdown of these consumers by age (as at 30 June 2017) and the number of cards owned. It indicates that consumers aged 30–49 were more likely than other consumers to own one card or multiple cards with a transferred balance”. The ASIC report 580 described the amount on money that transferred. From 2012 to 2017, A$12.4 billion transferred. Half of transferred amount were smaller than A$ 10,000, the most common amount is between A$0 to A$4,999. “Younger consumers were relatively more likely to transfer a smaller balance, and less likely to transfer a balance over $10,000”. The ASIC report (p51) also illustrated that why consumer the BT occur. ASIC found that main reason for transferring balance was reducing credit card debt. “The most common reason given by consumers for choosing to transfer a balance was to manage debt that was getting out of hand (43%). Other reasons included making a transfer to manage a one-off expense (22%), due to a change in personal circumstances (20%), receiving unexpected bills (18%) or due to a change in income (15%)”. “But also, most people that chose to transfer a balance did not consider alternative debt solutions (59%). Those that did considered personal loans (46%), selling personal belongings (28%), asking to borrow from others (23%), payday loans (22%) or mortgage extensions (17%)”.

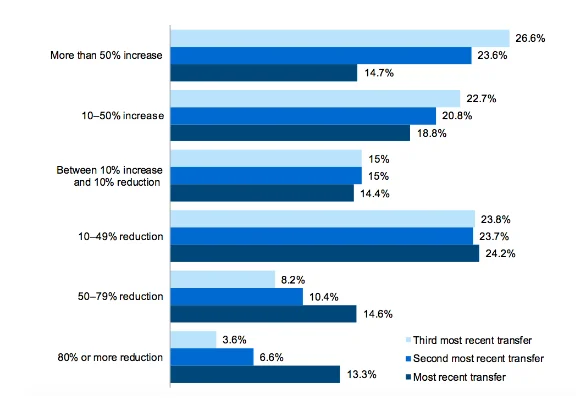

The ASIC repot 580 disclosed relationship between BT and the debt outcome. (pp 52~63). First, minority of consumer increased debt during the BT promotional period. For the group, the BT would be a debt trap does not chance to reduce or clean CC debt. The report is divided into two groups of the BT groups, that have a BT account once and multiple times. First, consumer who transferred one balance case, based on the data, 53.1% of consumers reduced their total credit card debt by 10% or more, including 8% of consumers who reduced the debt by 100% and a further 11% who reduced the debt by 80% or more.

For a substantial minority of consumers (31.6%), their total credit card debt increased by 10% or more during the promotional period. Of particular concern is the 15.7% of consumers whose credit card debt increased by more than 50%. This reinforces the Senate Inquiry recommendations about engaging with consumers who are not repaying a balance and ensuring consumers have access to consumer-tested reminders about the end of promotional period. Secondly, consumer who transferred more than one balance case, in general terms, consumers who transferred more than one balance were less likely to reduce their total credit card debt and more likely to increase their total credit card debt during promotional periods

Consumers achieved relatively better outcomes on later balance transfers. On the most recent balance transfer, 33.5% increased their debt by 10% or more and 52.1% decreased their debt by 10% or more. These results are close to, but slightly worse than, the outcomes for consumers who only transferred one balance. By comparison, on the previous balance transfer, 44.4% increased their debt by 10% or more and 40.6% decreased their debt by 10% or more. For consumers where data for three balance transfers was available, those outcomes were worse again on the earliest transfer. We compared how these consumers’ debt changed during their latest balance transfer and their most recent previous one. 47% of consumers achieved a ‘better’ outcome, either because they reduced more of their debt on the latest transfer than they had on their previous transfer, or because their debt increased less. 25% of these consumers achieved a worse outcome. In order to sum up, consumers who transfer balance more than one account shows more high problematic debt. Consumers who transfer two or more account illustrated highest problematic debt ratio in the report, which is 36.1%, and next would be transfer their balance in one account, which is 34.1 %. For the result, it is logical to assume that, consumer who own high debt transfer balance more than one accounts. The ASIC 580 repot discovered many consumers use their CC after transferring balance. It has been found that, a majority of consumers (53.8%) used the credit card with the transferred balance. This included 21.8% of consumers with interest charges exceeding $5 in less than six months of the promotional period, and 32.1% with interest charges in six or more months. When ASIC lowered the threshold to $1, we found that, 63.8% of consumers had used the card with the transferred balance. This was broadly in line with ASIC’s consumer research, of people who completed our survey, 65% told that they had made additional purchases on the card. Some people who took part in one-on-one interviews indicated that this was affecting their ability to pay down the debt. It means owning CC debt might cause by another factor like household liquidity constraint rather than consumer’s moral hazard. But CC corporation perspective, in a big picture, the BT was a process to reduce the debatable debt in their account, and the process did not significantly reduce their business profit, CC interest charge, which will occur if consumers go to bankruptcy. And also, in consumer perspective, due to maintain consuming life necessary, they still used CC, which means consumer had to borrow money for even payback debt.

It is very controversial that Australian government body mentioned BT with CCDD, rather than more deeply research the reason the CC debt defaulter borrowed money more than they can pay back and give advice to Government or treasury. Only the academic explanation in the report, that represent ASIC’s view about the issue was Economic Behaviour perspective, like mental accenting approach. It is not appropriate because using the conventional economic theory that against common assumption the conventional economy accepted, that economic participators are rational being. And suggest some financial method that officially warning there is possibility to seriously fail to solve the CC debt defaulter in official Government advice, but still CC corporations are able to generate profits.

Research Question

From the recent ASIC report 580, it is obvious that Australian household significantly depend on consumption by consumer loan, including credit card. It is commonly illustrating that Financialisation caused to transform financial service between bank and household in general. According to Lapavitsas (2009) social reserve, which used to be free in former financialisation era, like education, health service, housing, retirement, and real wage increase, became a some sort of debt service, such as, government running student loan program, private health insurance system, mortgage program and house loan product by bank, mandatory superannuation program which are based on market system, and generalisation of credit card usage for maintain household consumption level. It has been examined that, Australian credit card industry has been successfully extended with its risk hedging mechanism, including consumer credit rating system and securitisation market, and debt post scriptum industry. With fixed real income growth, compare with labour productivity from 2000, CC would be a financial product that maintain ordinal Australian’s consumption pattern. Without concern about income quintile multiplier, CC service is showing high accessibility to all the households. However, approximately less 20 percentage of Australian consumer failed to control their CC spending.

Theoretical explanation about household consumption has been also changed. Until financialisation era, conventional economy consumption theory would assume rational economic participator as a consumer. However, until 1980’s conventional consumption theories concern more about financial source to maintain constant spending for explaining Kuznet’s puzzle, which illustrated that US long term consumption pattern tend to show constant consumption rather than consumption changing that affecting by household income fluctuation, that Keynes explain in general theory. Behaviour economic perspective, which still describe as a rational decision maker, has been adopted for early 1930’s fisher’s consumption theory but main concern was a theoretical subsidiary to prove the Kuznet puzzle. However, in financialisation era, from early 1980’s in advanced economy, conventional consumption theories start to mention about liquidity constraint problem in household consumption. Tobin was one of the pioneers to suggest that financial product would be a proper solution but trend on conventional consumption theories would move to focusing consumer behaviour research rather than Keynesian style Macroeconomic subject matter, liquidity constraint. It is important, to be concerned about the theoretical trend, especially for changing of economic entities form rational decision maker to non-rational decision maker by focusing that, the consumer is able to deny fundamental reason why liquidity constraint occurred, and easily avoid the responsibility had to use consumer credit in first stage. Also, it is real irony that conventional economy changes character of consumer for focusing individual’s personal mistake rather than systemic. 2017 Nobel prize winner Richard Talyer explains credit card usage with his mental accounting theory, that human being has a limitation to make a rational decision by its own psychological nature. However, it would be interesting question that how much of the Australian credit card debt default would be caused by card user’s moral hazard or mental accounting? If answer would be mainly Australian CC Debt Defaulter realised that they will go to bankruptcy, it means mental accounting should avoid in the argument, and research why they had to have a liquidity constraint, cause of CC use. So, consumption theory would return to traditional point before 1980’s wvwn in credit card arguing. However, if result would be Australian CC Debt Defaulter did not realise their true financial point until bankrupt, then politics should use industrial policy that reduce CC usage, which will affect to card industry’s profit as a consumer protection perspective. And register more generous personal bankruptcy act, because it is not conscious negligence.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts