Discovery Insurance Company in South Africa

Introduction

Organisational structure is the system of conducting the operational activities in the workplace, where the directors, CEO, managers and the employees are cooperating with each other to achieve the organisational success sin near future and through organisational structure; it is possible for the organisations to improve the governance of the business (Gupta, 2017). Through this study, it is possible to analyse the organisational structure of the Discovery insurance company in South Africa. For students who are seeking business dissertation help, understanding the intricacies of organisational structures can provide the most valuable insights into the management practices of successful companies.

Organisational background

Discovery insurance company in South Africa is based on automobile insurance company with the primary focus on the quality and affordability of the insurance products to the diverse segment of the population. The company aims at providing quality insurance for the benefits of the customers at the affordable price so that they can straighten their customer’s base strategically. Investment on technology and infrastructural development further enhance the operational activities of the organisation where the Discovery insurance company is successful to strengthen their financial position in the insurance sector and improve the brand position in the market.

Satisfying the needs of the customers by hiring efficient and skilled workforce, technological advancement as well as innovation and creativity are effective to gain high market share in the insurance sector. The core purpose of the company is to make the people healthier and enhance and protect their lives and in this regard the vitality shared value insurance model is efficient to maximise the customer’s value successfully (Discovery Limited, 2019).

Organisational structure

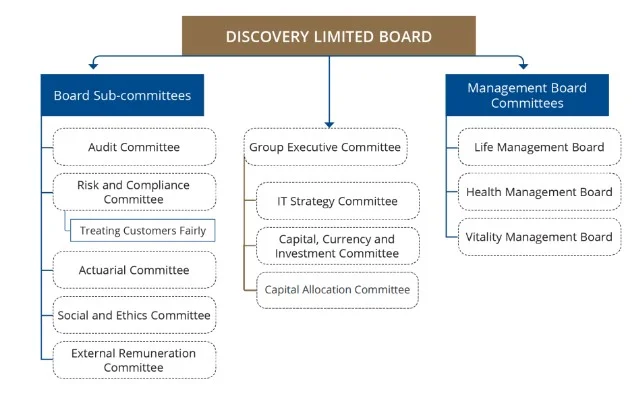

As per the organisational structure, there are three sub sections under the board of director which are board sub-committees, group executive committee and management board committees which are efficient to manage the operational activities of the firm. The board sub-committees have audit committee, risk and compliance committee, actuarial committee, external remuneration committee and social and ethics committee which are effective to manage the customers fairly. Creating the values for all the customers and provide them good return on investment are the aim of the sub-committees where the organisation is successful to achieve the organisational purpose of delivering quality insurance products and financial services at affordable price.

Organisational structure of Discovery limited

The group executive committees include Information Technology (IT) strategy committee, capital, currency and investment committees and capital allocation committee where the reallocation of the organisational resources for more investment and gaining high return on investment are managed. In these committees, the infrastructural development and technological advancement are also managed well by the engineers and technicians who are proficient to serve the customers and manage risks of investment by diversify the risks of investments in different investment scheme. The management board committee is responsible for managing the operations in insurance through life and health insurance as well as implementing vitality strategic planning to create values for the society as a whole (Discovery Limited, 2019).

Conclusion and recommendations

It can be concluded that, the organisational structure of the Discovery insurance Company is sufficient to manage the operational activities in the workplace where the skilled workforce, technicians and financial managers are able to manage the risk of investment and deliver quality insurance to the customers at affordable price. It would be efficient for the company to develop customer relationship board as well as marketing and sales department individually to retain more ling run customers in the market and strengthen their customers base as well as manage customer’s relationship by improving trust and loyalty where they can serve the customers by delivering high return on investment and creating values for all the investors.

Reference List

Gupta, P., 2017. Organisational Structure and Management: In Reference of Banking Sector. Journal of Management Science, Operations & Strategies (e ISSN 2456-9305), 1(2), pp.29-35.

Continue your exploration of Department of Accounting and Finance with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts