Financial Analysis of Bonmarche Ltd

Introduction

The report is based on the financial performance of Bonmarche Limited, which is a multi-channel retailer for female apparel and accessories. The organization sells a variety of clothing with different sizes for the female customer segment by its retail outlet's portfolio. The organization was established in the year 1982 and was acquired by Peacock Group in the year 2002. Situated in the UK, Bonmarche Limited has about 3800 outlets throughout the nation and employs more than 4000 employees. The product ranges of the company comprise casual and formal apparel, outerwear, swimwear, nightwear and lingerie among others (Bloomberg, 2020). The report is going to understand the financial condition and financial health of the company through proper analysis, such as financial statement analysis and ratio analysis. Apart from that, it is also going to discuss the impact of the economy on the financial performance of Bonmarche Limited.

Impact the Economy has on Bonmarche Limited

Economic factors can have a significant impact on the business of Bonmarche Limited. Economic factors like inflation rate, interest rate, level of saving within people, currency exchange rate and financial cycle help to determine the aggregate demand and investment in the retail apparel segment. These aspects can make a business organization highly profitable or high possibility of incurring a loss. For Bonmarche Limited, the economic system which is currently operational in the retail apparel segment is like perfect competition. Many players are performing in this industry, which makes it hard for Bonmarche Limited to sell the products in the market. The rate of GDP growth in the UK also influences on how fast Bonmarche Limited is likely to grow the business in the near future. The annual economic growth in the UK has slowed to about 1.1% in the year 2019. In the year 2017 January, the GDP growth rate of the UK was about 2.2%, which has reduced to about 1.1% in January 2018 and remained the same in January 2020. That is the weakest rate of growth of the UK, due to contraction in the fixed investment and sluggish household consumption growth. This poor economic growth can also have a negative impact on the business of Bonmarche Limited as people will have low spending power and will accordingly spend less on apparel items.

The interest rate of the country will also have a certain impact on the performance of Bonmarche Limited because interest rate determines how much people are enthusiastic about borrowing and investing. The high interest rate can result in and therefore high growth of business for Bonmarche Limited. In this context, it can be stated that the UK’s interest rate has remained low for a long time. From the year 2010 to 2018, its interest rate was about 0.5%, with slightly decreased to about 0.25% in 2016 and 2017. Due to this low-interest rate, there lack investment in industrial sectors like the retail apparel industry. This has resulted in poor growth for the business of Bonmarche Limited, as people have low-level savings, which can be spent on purchasing apparel.

Apart from that, the effectiveness of financial markets in the UK can also hurt the way Bonmarche Limited can raise funds for the business at a fair rate, considering the demand and supply of the market, resulting in fluctuation in share price performance.

Financial Statement Analysis

Income Statement Performance

From the income statement of Bonmarche Limited, it can be observed that the revenue of the company was about £187.96 million, in the year 2016, which has increased to £190.07 million in 2017, but reduced to £186.1 million in 2018. This reduction of revenue of the company is accredited to the unfavourable economic condition and market situation in the UK. In a similar context, the expenses of the company were £178.27 million in 2016, which is reduced to £177.91 million in 2018. The operating profit for the company was £9.59 million in the year 2016, which has become £8.04 million in 2018 (Infront Analytics, 2020). The following table demonstrates the income statement for three years.

Balance Sheet Performance

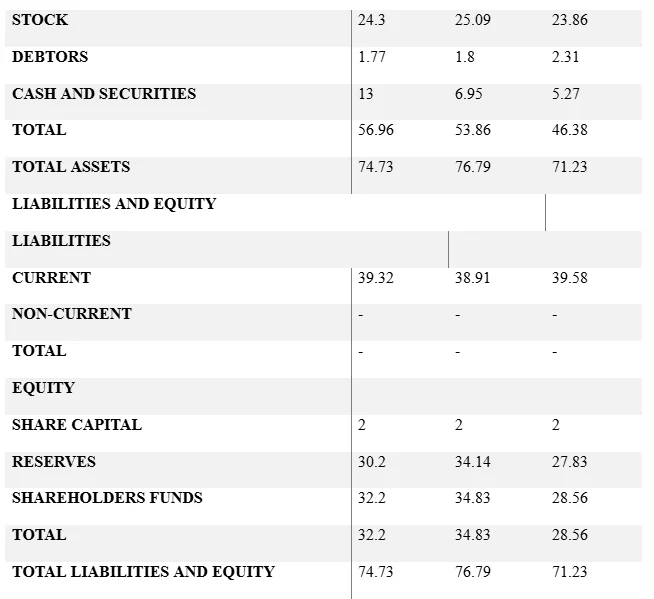

The balance sheet of the company also provides a significant indicator of the financial health of the company. From the balance sheet of Bonmarche Limited, it can be observed that the total tangible assets of the company were £14.49 million in the year 2016, which has increased to about £17.13 million in 2018. The intangible assets of the company have increased from £3.16 million in 2016 to £7.52 million. On the other hand, the current liabilities of the company were about £39.32 million in the year 2016, which has increased to £39.58 million in 2018 (Morningstar, 2020). Following is the balance sheet of Bonmarche Limited for three years.

Cash Flow Analysis

Cash flow analysis is an important measurement to understand how much cash is going in and out of the organization. Based on the cash flow statement, it can be observed that the operating cash flow of Bonmarche Limited was £13.08 million in the years 2016, which has reduced to about £10.44 million in the year 2018. This specifies that the amount of cash held by the company from operational activities has reduced. This can hurt the liquidity of the company. Furthermore, the net cash inflow of Bonmarche Limited was £5.59 million in the year 2016, which has reduced to £2.21 million in 2018 (Morningstar, 2020). The following table demonstrates the cash flow performance of the company for three years.

Financial Ratio Analysis

Profitability Ratio

The first important financial ratio measured for Bonmarche Limited is the profitability ratio. This ratio helps to evaluate the organisational capability to earn profit about sales. Five key profitability ratios have been measured in this context, which are:

Gross profit margin: Gross profit margin evaluates the financial health of Bonmarche Limited by disclosing the amount of revenue left after paying the cost of goods sold.

From the above figure, it can be observed that the gross profit margin of the company has reduced from 24.68% in the year 2016 to about 22.34% in the year 2018. This specifies that with sales of about £100, the company only left with £22.34 after paying the CGS, which must be used for covering the variable expenses of business (Investing, 2020). The trend further specifies that the capability of the company in providing products at a profitable rate has reduced.

Operating profit margin: Operating profit margin assesses the level of profit Bonmarche Limited makes on the sales, after paying all the variable expenses of business such as the wages and raw materials excluding the interest and tax.

From the above graph, it can be observed that the operating profit ratio of the company was 5% in the year 2016, which was reduced to 4.36% in the year 2018. This indicates a decreasing trend for Bonmarche Limited, specifying that the capability of the company to manage the operation effectively has reduced and therefore, its financial risks have enhanced.

Net profit margin: Net profit margin evaluates the percentage of profit earned by the organization from its revenue. It is derived after deducting all direct and indirect expenses of business; therefore, it provides information on the real capability of the organization for earning profit.

From the above figure, it can be observed that the net profit ratio of the company was 4.14% in the year 2016, which was reduced to 3.43% in 2018. This indicates sales of £100; the company is making an only profit of £3.43 after deducting all expenses. Therefore, it can be stated that the ability of the company to translate revenue into profit is reducing, which can be due to increased competition and an ineffective cost base of the company.

Return on Assets (ROA): ROA is another profitability ratio, which evaluates the net profit generated by the company by using the total assets (Goel, 2015). It demonstrates how effective the organization is in organizing the assets to generate revenue and profit.

From the graph, it can be observed that the ROA of Bonmarche Limited was 11.31% in the year 2016, which has reduced to about 8.61% in the year 2018. This signifies that with each £100 invested in assets by the company, it generates a profit of about £8.61. The low and decreasing trend of this ratio signifies that the company’s effectiveness in managing the assets to generate profit has reduced in recent times.

Return on Equity (ROE): ROE is another financial ratio, which evaluates the capability of Bonmarche Limited to earn profit from equity investments made by the shareholders (Tracy, 2012). In other words, this ratio demonstrates how much profit each Pound of shareholder’s equity of Bonmarche Limited is generated.

From the graph, it can be observed that the ROE of Bonmarche Limited was 26.15% in the year 2016, which has reduced to about 20.1% in the year 2018. This specifies that with each £100 of common shareholder’s equity, the company earns about £20.1. The decreasing trend of this ratio specifies that the effectiveness of the company concerning the utilization of investors’ money has reduced.

Liquidity Ratio

The second important ratio measured concerning the financial performance of Bonmarche Limited is the liquidity ratio. It helps to determine the capability of Bonmarche Limited to pay off the short-term liabilities of the business. Liquidity is the capability of the company to turn assets into cash rapidly. Two key liquidity ratios measured are discussed below.

Quick Ratio: Quick ratio is also termed as acid test ratio. It evaluates the capability of Bonmarche Limited to pay for the current liabilities by using quick assets, which comprise cash, cash equivalents, short-run investments and account receivables (Ganga & et al., 2015). However, inventory is excluded from quick assets.

From the above graph, it can be observed that the quick ratio of Bonmarche Limited was 0.38 in the year 2016, which has reduced to about 0.19 in the year 2018. This indicates that the company has not enough quick assets to pay off the current liabilities. It can pay only 19% of its current liabilities by using its quick assets. Thus, it can be stated that Bonmarche Limited’s capability fort quickly translating the assets into cash has reduced and hence its liquidity position is also reduced.

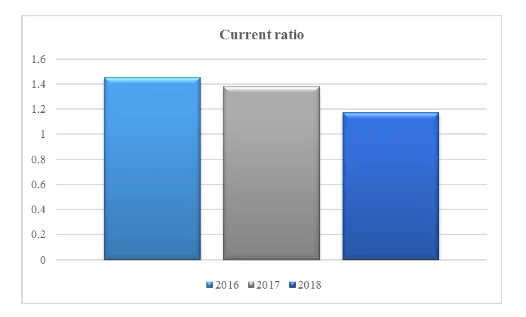

Current Ratio: The current ratio is another liquidity ratio, which evaluates the capability of Bonmarche Limited to pay the short run dues by using current assets. Apart from cash, cash equivalents, short-run investments and account receivables, current assets also consider the inventory.

From the above graph, it can be observed that the current ratio of Bonmarche Limited was about 1.45 in 2016, which has decreased to about 1.17 in the year 2018. This specifies that Bonmarche Limited has 1.17 times more current assets in comparison with the current liabilities. Therefore, it can pay off all its current dues by using current assets. However, the decreasing trend of this ratio indicates that the financial health of the company is declining as the liquidity performance in both ratios have reduced.

Cash Flow per Share

Cash flow per share is another financial ratio that evaluates the financial strength of Bonmarche Limited. It evaluates the level of cash generated by the company.

From the analysis, it can be observed that the cash flow per share of Bonmarche Limited was 21.21 in the year 2016, which was reduced to 17.89 in the year 2018. This specifies that with share worth £100, the company produces net cash of £17.89. The lowering trend of this ratio specifies the financial health of the company is weakening.

Three Strategic Decisions Bonmarche Limited should take

Financial planning

It is seen that the company does not possess any formal system of planning which has led to financial issues. It is thus highly essential for Bonmarche Limited to make a formal financial planning system that forecasts revenues, capital needs and costs and acknowledges the limits for the budgets of expenses yearly (Candy & Gordon, 2011). The company should also extract the important messages which assist the managers in making effective decisions in business. The books of accounts like Income statements and balance sheets should be maintained regularly to know the progress of the business. There is also needed to make forecast planning wherein the company should include trend analysis, regression models and computer simulation models (Bryson, 2011). The forecasting planning helps in management to confront the long-term decision-making implementation and strengthen the long-term competitive position of the company.

Low-Cost Leadership Strategy

Bonmarche Limited is seen to have declined in its business performance due to the larger number of competitors (Candy & Gordon, 2011). It is thus essential for the company to attain a competitive advantage by providing the products and services at lower prices which is lesser than that of the rivals. The competitive advantage would be increased when the firm will be able to attain higher profits as compared to rivals by selling the products as the market prices (Hubbard and Beamish, 2011). The Economic factors which withstand lower cost leadership strategy possess higher economies of scale, changing the degree of vertical integration and benefits of the higher experience curve. This decision would permit the company to enter the new market and create entry barriers for the industry.

Differentiation Strategy

Bonmarche Limited is facing a major decline in business performance and profitability which might be due to similar products and services it provides to its customers. It is thus essential for the company to apply differentiation strategy which will permit the firms to provide unique products and services and differentiate its products from its competitors (Bryson, 2011). It assists the company in creating the barriers to enter new business for new entrants and demand for products would be minimum price elastic. The application of this strategy would help the company to earn profits above the average rates and increases the reputation of the company (Hubbard and Beamish, 2011). Moreover, the company will also increase its reputation for the creation of innovative and higher-quality products which even assist in making long term relationships of customers with the business.

Conclusion

From the analysis of financial performance, it can be stated that the company is going through tough stages, as the performance has reduced within three years. Its key ratio such as profitability ratio and liquidity ratio has demonstrated downward trends, which indicates the financial health of the company is becoming weak and therefore, the company is in a risky situation. Apart from that, the economic condition and market of apparel have also contributed to the poor financial performance of Bonmarche Limited. To enhance performance, the company will require to reduce operational expenditures. Furthermore, it also requires enhancing the competitive positioning of the company by enhancing product variety and improving product designs. It will help to enhance the sales of the company. With the increased trend of females towards fashion products, proper marketing and financing strategies of Bonmarche Limited can help to enhance the financial performance of the company shortly.

References

Bryson, J., 2011. Strategic Planning for Public and Non-profit Organizations: A Guide to Strengthening and Sustaining Organizational Achievement. 4th ed. San Francisco, Jossey-Bass, pp.150-152.

Candy, V. and Gordon, J., 2011. The Historical Development of Strategic Planning Theories. International Journal of Management & Information Systems (IJMIS), Vol. No. 15, No. 4, pp.71-90.

Ganga, M. & et. al., 2015. Evaluation of Financial Performance. International Journal of Scientific and Research Publications, Vol. 5, No. 4, pp. 1-7.

Hubbard, G. and Beamish, P., 2011. Strategic management. 1st ed. Frenchs Forest, N.S.W.: Pearson Australia, pp.3-4.

Tracy, A., 2012. Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the Planet. RatioAnalysis.net.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts