Financial Assessment of a New Investment Proposal at Claude

ASSESSMENT OF NEW INVESTMENT PROPOSAL FOR TECHNOLOGICAL EXPANSION OF CLAUDE PLC

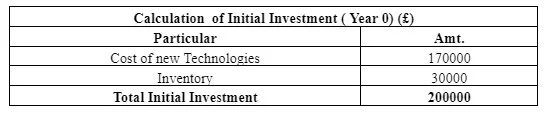

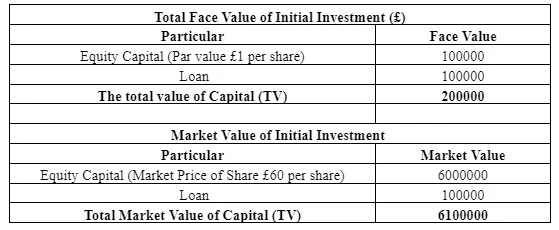

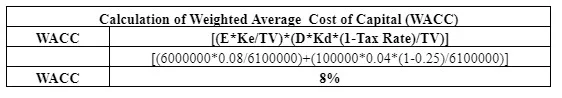

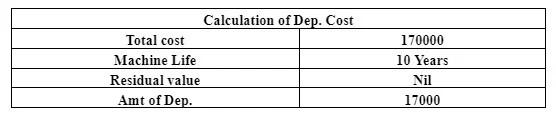

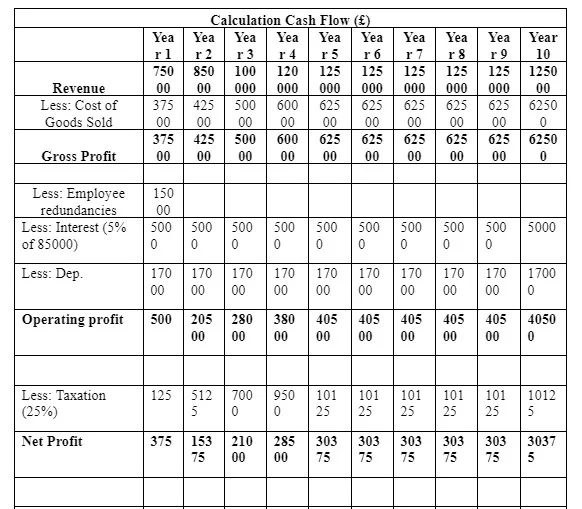

As per the case, the management of Claude Plc has considered a new investment proposal for advancement in existing technologies and systems, focusing on finance dissertation help. The total cost of the initial investment is £200000 that includes the cost of new technologies is £170000 and cost of inventory is £30000. The selected project will be funded by 50% of debt and 50% of equity capital. Therefore, an assessment of the reliability of the project is carried out through a Weighted Average Cost of Capital (WACC), Net Present Value (NPV) and Payback Period.

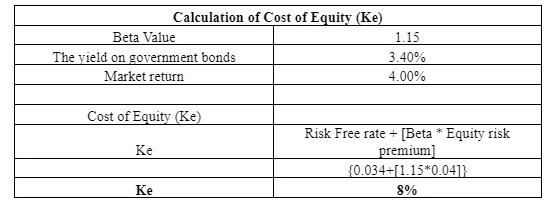

Cost of Equity

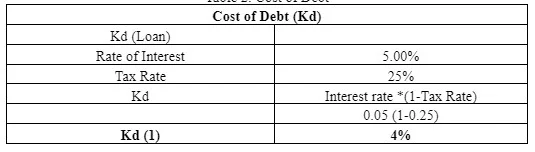

Cost of Debt

Calculation of WACC

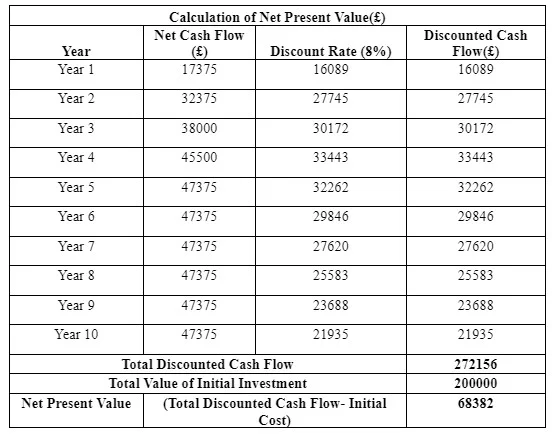

Calculation of Net Present Value

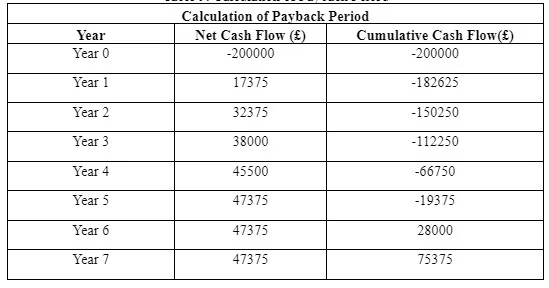

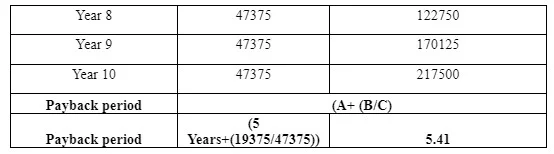

Payback Period

As per the above assessment, the proposed investment project of Claude Plc offers the positive net present value (NPV) of £68382 at 8% discount rate. The discount rate is linked with WACC that has been calculated with reference to market value proposed capital structure in which business considers the equal proportion of debt and equity capital. In addition to that organisation can recover the whole initial investment in 5.41 years. Therefore, this project seems appropriate for the company.

EVALUATING THE IMPACT OF CLAUDE PLC’S PROPOSED INVESTMENTS ON THE COMPANY’S FINANCIAL CONDITION AND SHAREHOLDER VALUE

Claude Plc is looking to expand its efficiency with the acquisition of the latest technologies. In this context of corporate finance, an investment decision must be evaluated by two key elements such as risk and return. In the proposed project of Claude Plc, management has recorded positive cash flow with positive net present value. Furthermore, an organisation can recover the whole initial investment within 5.34 years. Therefore, positive cash flow and net present value offer an additional source of business profit at low risk (Ehrhardt and Brigham, 2016). This new project will enhance the profit value of the organisation in a positive manner, and it will recover the whole initial investment in just 5.34 years as compared to 10 years expected life of a new system. This information provides assurance about the safety of investment with appropriate profitability to shareholders. Therefore, an investor could find more returns on their investment.

Continue your exploration of Proposal for Partnership and Business Expansion with our related content.

EVALUATING THE IMPACT OF CLAUDE PLC’S PROPOSED FINANCING ARRANGEMENTS ON THE COMPANY’S FINANCIAL CONDITION AND SHAREHOLDER VALUE

In the proposed project of technological, the management of Claude Plc has considered two different sources of finance, such as debt and equity. In this process, the organisation has proposed to execute the right issue to existing shareholders at the par value of £1 per share to attain 50% of total funding requirements. Furthermore, the company has proposed to issue a new series of 10-year loan notes at 5% interest rate to attain remaining funding needs. This decision leads a positive impact on the financial condition of the firm and shareholder value because debt sources facilitate funds at a low cost that support manager in the reduction of capital expenditure (Fracassi, 2016). On the other hand, the proposed process of right issues is going to take place at par value and the market price per share is £60. Therefore, the shareholder could find the capital gain from the right issues.

CONCLUSION

As per the above assessment, the proposed investment project of Claude Plc will offer a significant return at low risk. This is because positive net present value and low payback period provide assurance to the management of safety of investment with appropriate profitability. In the present case, the organisation has proposed the approach of right issues to attain 50% of funding requirements for the project. This strategy will offer capital gain and additional returns to existing shareholders due to higher market prices that would support management to attain the target of maximisation shareholder’s wealth that can be termed as an important element stakeholder theory.

Reference

Ehrhardt, M. C., and Brigham, E. F. (2016). Corporate finance: A focused approach. Cengage learning.

Fracassi, C. (2016). Corporate finance policies and social networks. Management Science, 63(8), 2420-2438.

Dig deeper into Financial Analysis for Managers with our selection of articles.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts