Financial Ratios Analysis Overview

Introduction

The success of an organisation is significantly influenced by its ability to manage business performance along with consideration of different tools for reporting of financial outcomes. This is because these tools are very effective in presenting business information to different stakeholders such as investors, suppliers, shareholders etc. Therefore, ratio analysis is identified as a great tool to present distinct information to management through which external stakeholders like investors of a company can compare financial performance (Atrill and McLaney, 2016). In this regards, in present work, Persimmon PLC has been selected as an organisation for carrying financial evaluation. This report calculates financial ratios of Persimmon PLC and also discusses the company’s financial reporting practices for taxation as per the IAS 12.

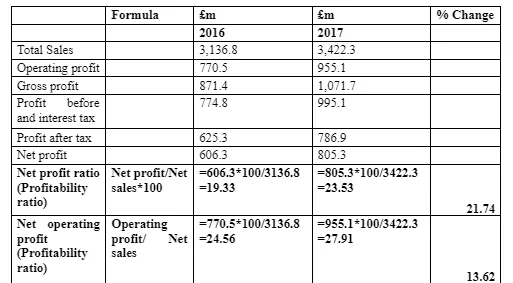

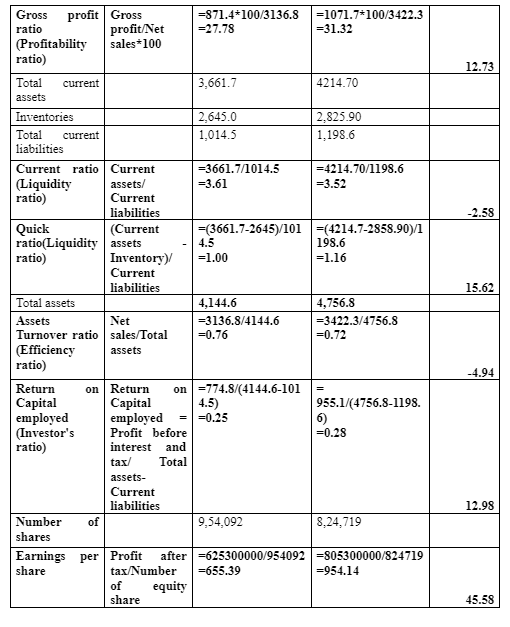

A) Calculating Ratios For Profitability, Liquidity, Efficiency And Gearing For The Years 2017 And 2016

Financial ratios play an important role in examining the financial performance of the company. Therefore, calculation of financial ratios of Persimmon PLC is carried out in below table through which an external investor can take appropriate investment decision by managing detailed comparison of financial performance of the company:

B) Analysing The Performance And Position Of Persimmon Based On The Above Ratios

For the present study, Persimmon PLC has selected as an organisation. It is a UK based household company which has started its business operations in 1972.

Profitability ratio

In the context of investment decision, the assessment of a company’s profitability is considered as the essential element of financial analysis. The evaluation of Persimmon PLC’s profitability has determined that the company has gained an appropriate profit in 2017 during the situation of slow market growth. In this regards, the net profit of the household company is £805.3m which is 23.53% of the total revenue of the organisation. In 2016, the net profit of the firm was £606.3m that was 19.33% of total sales. This information indicates that the company has recorded positive growth in profit during the period of economic downturn. As per the annual report, it has addressed that PLC is focusing on such locations where the demand of household is high (Melville, 2015). In this context, it has addressed that organisation has done good business in Mansfield and company is legally completing 373 new homes in 2017 that has played important for increasing company’s revenue which is enhanced to £3,422.3m in 2017 with reference to £3,136.8m of 2016. Therefore, the strategy of Persimmon PLC is focused towards such market where the high demand of homes has been identified. In addition to that gross profit margin of household, the organisation is also growing with similar trends as compared to net profit. The mentioned company has recorded the 31.32% gross profit margin in the period of 2017 which is showing significant growth (Persimmon PLC Annual Report 2017, 2017). Were IFRS 15 applied to the years ended 31 December 2017 and 2016 both revenue and cost of sales would have been increased by £175.5m and £176.8m respectively. Reported profit from operations would have remained at £955.1m for 2017 and £770.5m for 2016.

The assessment of operating profit has determined that the mentioned company has kept operating profit margin in acceptance level which is respectively 24.56% and 27.91% for the period of 2016 and 2017. The reason behind the increase in operating profit is that the business entity has gained significant expertise for improving operational efficiency. For reducing the cost of different operation, Persimmon PLC has established its plant in Harworth for brick production that has started production of concrete bricks in November 2017. This plant has a significant capacity of producing 80 million bricks each year, so the management is able to meet two-thirds of the total Group’s current requirements by this brick manufacturing plant (Helfert, 2011). This approach has been found very effective for reducing cost operation related to delay in the production process and will ensure availability of brick which is termed as a key material component of construction. This thing ensures an appropriate supply of material and has lowered the cost of operation as compared to previous years. All these factors have led to a positive impact on return on capital employed which is 0.28 in 2017 and has shown growth trends with reference to previous years.

Liquidity ratio

By adopting a verity of aggressive business strategies, Persimmon PLC has maintained the current ratio at 3.52 in 2017. In the context of liquidity ratio, some negative growth was addressed because the value of total current liabilities is significantly enhanced to £1,198.6m in 2017 with reference to £1,014.5m in 2016. However, the company has recorded current assets during the period of 2016 and 2017 as £3,661.7m and £4214.70m respectively. Therefore, it has addressed that value of current assets is not increased in 2017 like an increase in the value of current liabilities. However, Persimmon PLC has maintained good liquidity position in both years which is significantly higher than ideal 2:1 current ratio. This thing indicates that the business entity has maintained appropriate control over the requirement of working capital (Fridson and Alvarez, 2011). In the total current assets, the amount of inventory has significantly high in both years. In this regards, the business entity has kept the total inventory of 2,645.0 and 2,825.90 for the period of 2017 and 2018 that significantly influenced the liquidity position.

Moreover, it has been addressed that ensuring surplus capital is termed as a most important feature of the Group’s strategy in which mentioned organisation has maintained disciplined approach for managing the capital employed in the business with proper consideration of mitigating financial risk. Furthermore, the evaluation of annual report has determined that the Persimmon PLC’s working capital cycle and reinvestment strategy is mainly focused to a systematic risk assessment process that supports management for ensuring liquidity generation which would be beyond to core requirement of the firm. In addition to that quick ratio of Persimmon PLC has shown positive growth trends and recorded 1.16 in 2017.

Further evaluation has determined that increment in inventories not follows similar incremental trends which are identified in growth in total current assets. The value of inventories was respectively £2,645m and £2,825.9m during the period of 2016 and 2017, and a quick ratio of 2016 was 1. By reducing the level of inventories, the company has reduced inventory management related expenditures. In addition to that Persimmon PLC’s has adopted distinct strategies for managing the waste along with its recycling. According to the financial report of Persimmon PLC, it has been addressed that 92% of total waste has been recycled by the company in 2017. This strategy plays an important role for reducing the cost of manufacturing and also reduced the cost of material because management has used recycled material in the development of homes in different areas, so the requirement of maintaining a large amount of inventories is also reduced (McKinney, 2015). The reduction in requirement of inventories or different material will lead positive impact on the availability of working capital and liquidity position of the firm.

Efficiency ratio

For evaluating the efficiency of the firm, assets turnover ratio has been considered as a great tool. The assessment of financial data of 2017 has found the increment in total assets, but the downturn is identified in assets turnover ratio which is 0.72 in 2017. The main reason behind the reduction in an organisation’s efficiency is that a total sale of the firm is not increased to a similar way to total assets. The main cause behind the increase in total assets is that the Group has acquired 17,301 plots of new land during the period of 2017. All the plots are located across 84 separate locations in the UK.

Furthermore, 8,296 plots have been converted towards the strategic land portfolio within 28 locations. In this process, Persimmon PLC and its own land bank are working together for increasing group’s strategic portfolio along with total assets of a business entity (Wang, Dou and Jia, 2016). This land acquisition provides significant assistance in a future project of the organisation in different locations. Therefore, overall assets turnover ratio shows negative trends from 0.76 in 2016 to 0.72 in 2017. It can be stated that the increase in the value of total assets lead significant impact on the efficiency of the firm because the revenue of the firm is not growing in a similar way to total assets of the business entity.

Earnings per share ratio

The earning per share is identified as an important gearing ratio and has found very attractive figures in the context of Persimmon PLC because the firm is offering 954.14 EPS in 2017. This figure is much better than EPS of 655.39 in 2016. The reason behind increment in earning per share is that company’s profit after tax is a growing positive manner which is respectively £625.3m and £786.9m for the period of 2016 and 2017. The main reason behind the significant increase in profit after tax is that the overall revenue of the company has increased year on year with an average growth rate of 9% to £3.42bn as per annual report of Persimmon PLC. Further investigation has determined that the new home sales are increased by 872 additional homes and appropriate waste recycling strategy has played an important role for reducing the cost of operations (Finkler, Smith, Calabrese and Purtell, 2016).

C) Evaluating Persimmon’s Reporting Of Taxation With Reference To Ias 12 Taxation And The Conceptual Framework

Discussing the requirements of IAS 12

In the context of finance, IAS 12 has been addressed as a great tool to manage taxation. This concept has found very effective in recognition of such kind of asset or liability that could be recovered or settled. It means the recovery or settlement of a certain amount of tax may be raised in the form of future tax consequences which are going to address at the same time as the asset or liability. In this regards, IAS 12 determines some accounting standards through companies like Persimmon PLC should keep systematic accounts for the tax consequences of transactions along with some other events which are similar to previously mentioned transactions (Wang, Dou and Jia, 2016). In addition to that this approach supports an organisation for carrying out accounting of temporary differences which are addressed during the accounting of assets, liabilities, profits along with the tax equivalents.

Furthermore, it plays an important role in determining the tax base (Kim, Kim and Qian, 2018). This is because the tax base of an item is playing a critical role in determining the amount of any kind of temporary difference which has been appeared. In the context of Persimmon PLC, this approach supports management in order to effectively represent the amount which is going to be recorded in tax based balance sheet related to asset or liability so as IAS 12 provides the systematic guidelines for handling different aspects of differed tax.

Providing examples from Persimmon of compliance with IAS 12

According to the annual report of Persimmon PLC, it has addressed that management has considered IAS 12 for managing differed tax liability. With reference to IAS 12, partial provisions are addressed. In addition to that certain deferred tax assets and liabilities have been offset. The annual report of the company has addressed that the Group has recognised deferred tax liabilities of £11.5m related to retirement benefit assets of £67.7m in 2017 which has been identified as a liabilities of £4.0m in 2016 based on retirement benefits assets of £23.3m. Furthermore, the company has charged £3.8m of tax liability in profit and loss statement in 2017 related to retirement benefits. In addition to that, the amount of £3.7m has been charged in comprehensive income for handling retirement benefits (Crowther, 2018). Apart from that, some traction is also addressed as assets of the company of company in taxation in which amount of £2.9m credited in profit and loss statement related to Share-based obligation and £15.1m directly taken into equity.

Furthermore, some other temporary differences are also addressed, and these differences are reported or charged in the form of partial provision with an amount of £1.0m. As per the reporting standards of IAS 12, Persimmon PLC has also carried out accounting of difference based on the accelerated tax depreciation. In this regards, the additional amount of £0.2m related to Accelerated tax depreciation has been credited to profit and loss account in order to determine future tax requirements. The total difference of the amount of £1.9m is settled related to Accelerated Tax Depreciation during the period of 2017 with reference to the partial provision of IAS 12.

Explaining the specific causes of deferred tax shown by Persimmon

For handling differences based on future tax requirement, the management of Persimmon PLC has adopted IAS 12 for carrying out proper reporting of tax in different accounts. The main reason for showing differed tax is that the business entity has addressed a significant difference in tax liability related to a retirement benefit. In this regards, the total tax liability is £11.5m on the asset of £67.7m. By showing this difference, the management of Persimmon PLC tries to reduce the liabilities of the company by transferring liabilities in profit and loss of account as expenditure on the company. In addition to that, some portion of retirement benefit related tax liabilities is charged as other comprehensive income (Kim, Kim and Qian, 2018).

Furthermore, IAS 12 has found very effective to manage multiple differences related to taxation settlement. In the context of Persimmon PLC, the organisation has shown different causes such as accelerated tax depreciation, retirement benefit obligation, share-based payment and other temporary differences which are settled by the company in the form of future tax liabilities. Consideration of deferred tax accounting as per the IAS 12 influences authorities of Persimmon PLC for managing the difference in accounting assets and liabilities related with reference to future tax requirement (Wang, Dou and Jia, 2016). It helps an organisation for carrying out financial reporting as per the legal norms.

CONCLUSION

As per the above assessment, it has been concluded that Persimmon PLC has addressed positive trends in the profitability of the company. In this context, different financial ratios have determined that business entity has maintained good profit as result of very aggressive business strategy in which organisation is focusing for increasing the sales by identifying such market where the demand of household is high as compare to other market. This information is found very effective for external investors for taking investment decision because Persimmon PLC has maintained appropriate profitability. This report has addressed that business has focused on the production of bricks with company’s own plant along with recycling of waste for reuse that plays an important role for reducing cost operations so as overall profitability is increased as per the current market trends. Apart from that IAS 12 has played an important role in managing deferred tax liabilities and handling of differences in different assets and liabilities such as retirement benefits.

REFERENCE

Atrill, P. and McLaney, E. (2016) Accounting and Finance for Non-Accounting Specialists (10th edition), Pearson,

Crowther, D. (2018). A Social Critique of Corporate Reporting: A Semiotic Analysis of Corporate Financial and Environmental Reporting: A Semiotic Analysis of Corporate Financial and Environmental Reporting. Routledge.

Finkler, S.A., Smith, D.L., Calabrese, T.D. and Purtell, R.M. (2016). Financial management for public, health, and not-for-profit organizations. CQ Press.

Fridson, M and Alvarez, F. (2011) Financial Statement Analysis, a practitioner’s guide, Wiley.

Helfert, E. (2011) Financial Analysis tools and techniques: a guide for managers, McGraw-Hill.

Kim, K. H., Kim, M. and Qian, C. (2018). Effects of corporate social responsibility on corporate financial performance: A competitive-action perspective. Journal of Management, 44(3), 1097-1118.

McKinney, J. B. (2015). Effective financial management in public and nonprofit agencies. ABC-CLIO.

Wang, Q., Dou, J. and Jia, S. (2016). A meta-analytic review of corporate social responsibility and corporate financial performance: The moderating effect of contextual factors. Business & Society, 55(8), 1083-1121.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts