Global Capital Flows and Financial Markets

Introduction

From 1980’s until the present time, one of the most significant economic transformations in developed countries has been Financialisation. After the Fordism era, advanced economies had transformed their growth model from virtuous cycle to vicious model, which average wage compromising but maintaining the productivity and consumption trend, which increased (Inequality for all 2013). Also influence of Nixon revolution and OPEC Oil shock, OPEC member countries’ unexpected surpluses capital flowed to US financial market and this increased Federal Reserve Bank’s interest rate, promising the highest return to the foreign investors. The trend of foreign capital flow is present to financial markets in US maintaining until now.

Without concern about US Government and Financial authority’s global hegemonic, positioning to global reserve currency issuing country, US and UK economy were requested to create new capital accumulation frames to observe the high return and also react to their challenged global position in the global manufacturing industry by former competitors, West Germany and Japan, and other former colonies, Korea, Taiwan, Singapore……so on, that newly reformed export-driven economy system after World War second() . In Macro level, it is arguable that many aspects were single causes of appearance of Financialisation transformation in leading economy, US, UK, and other Anglo-American county group. But nowadays, it is obvious that the Financialisation is spreading to not only advanced but also to developing countries partially ( ). In academic circles, depending on perspectives, there are several different explanations about the causes of Financialisation transformation by heterodox economy schools based on the economic environment in late 1970’s.

Keynesian lies poor production performance or rise of reinter as a cause of the transformation. Estein (2005) explain economic concentration in financial industry occurred because manufacturing industry could not bring enough result. And Crotty (1990) and Pollin (2007) described reinter has depressing effect on the real sector by investment fund and lower return. However, Marxian schools use historical perspective and their critical theory of capitalism to explain Financilisation. After Sweezy’s warning in ‘Monthely Review’ in 1997, tendency of profit decline has been used as a theoretical frame to explain appearance of financilisation (Brenner 2003, 2006, Harman, 2010 and Callinicos, 2010). Also Lapavitsas (2011) introduced another historical approach in Financialisation. For instance, Arrighi (1994) described Financialisation as an autumn of matured capital hegemony. Also there are system theory perspectives to bring Marxian economic analyst, According to Johnna (2006,) French Regulation school illustrate as a new form of finance-led growth model (Aglietta 1998; Aglietta & Breton 2001; Boyer 2000a, 2000b). And Brithish Social Accountant lies examination of coupon pool capitalism (Erturk 2003, Frind et al 2000, 2002) The Financialisation trend also transformed Australian economy from 1980’s. Australia, member of Anglo-American economy group, adapted the Neo Liberal trend, Financialisation, in same period compare with other advanced member countries ()

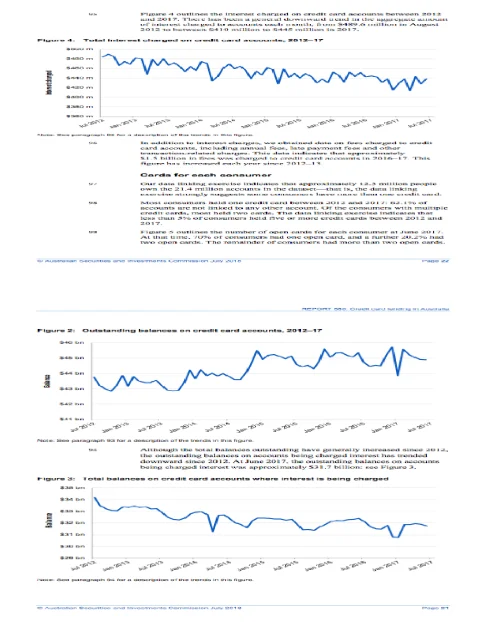

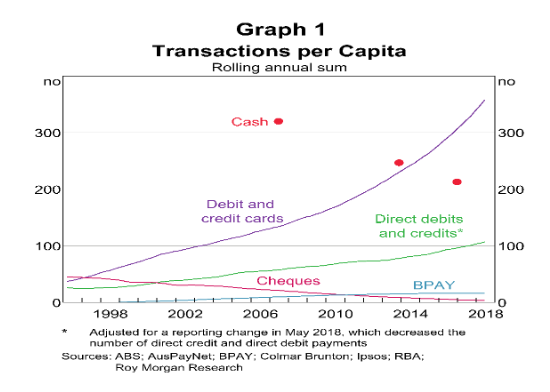

In microeconomic level, following the Costas classification ( ) Australian social reserve has been changed. Free education became a personal responsibility, house markets have been assumed that the average price are bubbled because of market base policy rather then providing public housing program, it became a compulsion to save retirement fundof private corporations, private health insurance reforms increased complaints ( ) and side effects of substituted disposable income, by credit card usage, causing significant indebtedness rate, 18% of economically active population classified as a bad debtor, is a regular reporting matter in government report ( ) This thesis would design to research economic and social effects of Australian credit card usage in Australian House hold consumption. Because among, the usage of credit card , as a consumer loan based input in economy has obviously been increasing like below Reserve Bank of Australia graph.

The growth of indebtedness level, caused by credit card, have been issuedat many times in Australian mass media and official Government authority’s report. For example, Australian Securities and Investment Commission (ASIC) report 580 lies that one out of six Australian consumers (18%) are struggling with credit card debts. Outstanding balances of total credit card debts are AUD $ 45 billion, including credit card interests of AUD $ 31.7 million.

Furthermore, theoretically, it is debatable whether credit card usage will be explained in mainstream consumption theories as a reasonable temporary income source in Milton Freedman’s permanent income hypothesis or it would be proper solution in Liquidity constrain hypothesis? Finally, numerical discovery of the total amount which would be payable to the credit card interest would be a good positive empirical evidence to claim economic efficiency. And also in fairness of system participation, statistical research about number of population to suffer going to bankruptcy and among of securities would be foundation of criticized the Australian credit card system.

General History of Financialisation in Australian Household Economy

For narrowing history of Australian Household (HH) Financilisation process, it is reasonable to start with understanding former Goat Whitlam’s social welfare reformation program that occurred in 1960’s. Whitlam government increased investment of ‘public housing program’till 5.1 percentages in 1974 (Whitlam 1985). The Whitlam government extended to a number of financial beneficiaries who were provided by Australian University Commission, which had been established in 1959 and was only providing funds for the advanced technological college, to all tertiary students in 1965 (McDougall 2015). Also the Whitlam government started a system of Commonwealth- Financed health insurance for all Australians. The welfare state was maintaining after two decades, even during Fraser Liberal government period, Base on this economic environment, Australian economy transformed to Neo-liberal system in early 1990’s. Ironically, Australian Neo liberal economic reform seeded with the Whitlam Labor government. Treasury Paul Keating under the Whitlam government provided the warning regarding the possibility that Australia economy was becoming a ‘Banana Republic’ in 1986 (Beeson & Firth 1998). Paul Kelly (1997) lies that Paul Keating mentioned; “key institutional structures of Australia’s unique historic compromise, particularly arbitration, protection, and a reliance on commodity exports” have to be changed to internationally competitive Neo-liberal economic structure. Beeson and Firth (1998) continue that the policy initiate the agenda was Garnaut Report (1981). And also another source to suggest to reform base on ‘competition policy’ centered was Hilmer report (1993). Hilmer report concluded that Australia’ had no choice but to improve its ‘international competitiveness’ and become ‘more innovative and more flexible’ (Hilmer 1993). The main assumption of the Hilmer report was a competition would be generated better economic result. And also Hilmer report suggested that for education of corporate and individual for implementation of the policies, it is request that establish National Competition Council (NCC). Karpin Repost (1995) extends the argument and provided blueprint to the Neo-Liberal economic reforms during the Keating Labor government and the period of Howard Liberal Government . The Karpin Report heritages the neo-liberal agenda and extend it until individuals attitude level like ‘Australia’s population, be they employees or managers need to be enterprising in the broadest sense of the word, not only in business but also in social community based organizations and even in their own personal lives ’ (Beeson and Firth 1998). After 20 years Australian social welfare period (from Whitlam Government in 1972 to end of Bob Hawke Labor Government until 1991), Australian society and economy were reformed by Neo-liberal agenda from the Paul Keating Labor Governments. This chapter would briefly outline history of financilisation transformation in five social reserves, which are privatized Health system, student loan, house loan, superannuation, and credit card usage for understand general history of Australian Household Financilisation.

Continue your exploration of Capital Structure Dilemma with our related content.

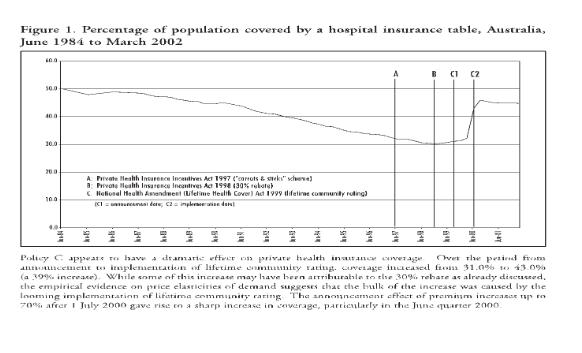

Privatized Health system Australian HH

Australian private health insurance was introduce in 1997. Before publicly funded universal health care systems, Australian National Health Insurance Scheme (Medicare), covered basic health insurance system in the country. Medicare was introduced in 1984 by Whitlam government as a part of social welfare program. However, after 13 years, John Howard’s Liberal coalition government introduced private insurance programs. Overall, according to Judy and Christine (2002) when compared with another Health system in Anglo-American countries, none of these countries’ governments, such as the United Kingdom (U.K.), New Zealand (NZ), Canada and Australia, has gone to the same extent of marketisation of health care programs and governance systems as in the U.S. However, from 1995 OECD figures of public health expenditure (PHE) Many strategic figures prove that Australian strategic health governance system (ASHGS) is well functioning, even Australian health system is most privatized system in the group; Australia (66.7 percent PHE) after the U.S. (46.2 percent PHE). And the U.K. system is the least privatized (84.3 percent PHE) (Donato & Scotton, 1999). Donato and Scotton (1999)have asserted that Australian spend more money than other counties; “Americans spend 13 percent of total per capita income on health, while Canadians spend 10.4 percent, Australians 8 percent, and both New Zealanders and the British 6.4 percent” (Donato and Scotton, 1999).

However, results are critical on birth and infant mortality per 100 living births and infant mortality perspective. Canada has the highest rate of male life expectancy at birth (75.3 years) with Australia is next (75 years) the U.K. (74.3 years), NZ (73.8 years) are following, and the U.S. last (72.5 years). For females, Australia is the highest (80.9 years), Canada (80 years). The U.K. is following (79.7) and NZ and the U.S. (both with 79.2 years) For, Australia has the best outcome infant mortality per 100 live births (0.57), Canada and the U.K. (both 0.60), N.Z. (0.70) with the U.S. last (0.80). (Donato and Scotton 1999). It means privatized health system does not provided significant result even individual’s responsibility is higher. Also, from James (2002) population that covered by private health insurance declined steady. It cause three policies change which are The Private Health Insurance Incentives Scheme (PHIIS), The 30% Rebate, and Lifetime Community Rating (James 2002). James (2002) mentioned that more deep research would be required but it is obvious that the inefficient private health system is not popular. Thus, it is necessary to implement the three policies for giving incentive to recover the population to covering private insurance.

Student loan Australian HH

According to Bruce and Ryan (2002), from 1973 to 1986, Australian Universities were not funded by the direct contribution of the students since Australian University Commission financed all higher education students (McDougall 2015). But, the trend changed with establishment of the Institution of Higher Education administration on charge (HEAC), in 1986 small fee of $ 250, only compensated three percentage of teaching cost, had been charged because still taxpayers supported the lest of the high education costs. In 1987 John Dawkins introduced different approach, ‘user pays Higher education system’ (Bruce and Ryan 2002). Suggestion of his report has been receipted because first Australian Labor government abolished University fee in 1973. Secondly, it was not matched with Labor party statement that stated ‘ All education should be free of charge’. And finally, income contingent scheme had no similar case internationally. However, in 1988, Warn committee recommended that all undergraduate students should pay uniform charges, timing and level of payment depending on income. This became a policy that entitled the students to pay A$ 2,250 per year. It was possible to pay ‘ up-front’ or defer the payment until graduation, charging was based on income contingent base in 1998. This High Education Contribution Scheme (HECS)was unique in internationally (Bruce and Ryan 2002). Nowadays, income treasure of the repayment starts from A$ 51,957 per annum in tax system (Australian Government-Australian Taxation Office 2019).

It is evident that within the income contingent scheme, if the income of any graduate could not be compared with the certain benchmark thresholds of remittance levels, the Anglo-American system would not be liable to have the obligation to remit the payment on an immediate basis. Especially, compared to US student loan repayment schemes it seems that Australian system is more generous to students. But, from the perspective of the loan provider, Income contingent scheme might be more secured to them from student loan default because the loan itself would be maintained until payback whole among and it is better strategy do not force too much to pay back until graduate earn in certain level of income. Also the fact that graduate would be damaged their consumption power is not different. Friedman (1955) has explained that conventional student loan has a two risk compare with income contingent loan, which are first, there is a lack of collateral: there is nothing for a bank to sell if a student defaults and, again unlike home loans, students can emigrate, leaving no forwarding address. In addition,there is asymmetric information: students are better informed than lenders about whether they aspire to careers in say financial markets or the arts (Barr….el 2017) .

Home loan Australian HH

Except researching about special home loan like Defense Service Homes Insurance (DSHI), Defense Home Ownership Assistance Scheme (DHOAS), Defense Service Homes Scheme (DSH), and Defense Home Owners Scheme (DHOS) for Australian military service person (Australian Government. Department of Veterans Affair. 2019 and also microeconomic, home loan is the most speculative financial instrument concerned with related house market bubble in openness of international investment environment in Australian economy, not only loan payment itself. Volatility would increase because over 80 percentage of Australian household assets formed by house ( ). The ownership would be a good second income source when expectation of increase house price is high. Historically, the common form of home loan, before establishing the Mortgage Finances Association of Australia (MFAA) in 1980 which is national body for home loan service, was oriented towards building society. However, due to unstable banking systems until the establishment of Reserve Bank of Australia in 1960, there had taken place previous permanent building society collapse in 1889 (Home Loan Expert 2015).

From 1960 to 1980, Australian financial market was strictly regulated for security purpose. At that time, as a government body, House Loan Insurance Corporation (HLIC) had been established for obtaining home loan at reasonable interest (Home Loan Expert 2015). However, Australia was not exception of Neoliberal economic revolution. Due to the trend, after 3 years of establishment of MFAA, foreign bank accessed Australian residential lending market. And furthermore, from 1989, Bank arrowed that developed many different home loan types by themselves (Home Loan Expert 2015) However, from 1990 to 1995, Australian economy had faced economic recession. But, during this period, residential lending increased from 30 percentages to 46 percentages, also introducing new loans such as home equity loans and low doc loans for self-employed citizens. This privatized trend caused the establishment of many government controlled regulated financial markets after the period, such as Australian Prudential Regulation Authority (APRA) in 1998, Australian Securities and Investment Commission (ASIC) in 2001. And importantly, after influence of 2008, Global Financial Crisis (GFC) Reserve Bank of Australia introduced strike lending polices for investment loan in 2014 (Home Loan Expert 2015).

Without due respect, the issue of Financialisation in the Australian home loan sectors has two facts. First one is affordability of Australian youth, purchasing first home, which is statistically hard because of price increase, caused by asset market bubble that related with neoliberal economic policy- market base supply policy rather then public house project-. Market base house supply would show its limitation of policy implementation such as house price bubble: 1972~1974, 1979~1981, 1987~1989, and 1986~2003 (Abelson…el 2005). Another element of the asset market bubble might be a direct, mainly Chinese foreign investment which is manipulating inner economy in general or indirect foreign investment like immigrants who bring wealth from outside of Australian economy and participate in the market. Second aspect is reduction of household consumption power. Even if there is no house price manipulation, still mortgage will be basically causing reduced household saving and in the end, HH would be spending lesser amounts. And importantly, private home loan service would shift HH wealth from public, which is Government, to private financial corporation, which are many banks. As a result, value cycle between public, government, to HH would transform to HH to private corporations and there would be no economic cycle, because Banks return is uncertain in the private mortgage program during the long HH repayment period depend on programs.

Superannuation. Australian HH

Before 1976, Australian retirement fund was set up by negotiation between each of the industries and union movements or industrial unions. The negotiation set up under the industrial awards which have been handed down by Fair Work Commission or state industrial relations commission (Fair Work Commission. 2018). In 1983, change of the superannuation agreement came between Bob Hawke labor government and the trade unions. In the agreement, ‘Prices and Income Accord’, which signed prime minister and treasury Paul Keating, lied that first 3 percentage of employee’s income will be paid by the employer for funding, and the amount would be increased. In 1997, under Paul Keating government, superannuation became a compulsory employer contribution scheme, preparing affordable retirement fund for aging society with tree pillars, which are arguable in critique of Financilsation perspective. According to Australian Retirement Income Strategic Issues Paper in Australian Future Tax System (2015), the three pillars are, first, the compulsory employer contribution, secondly, further contribution by superannuation and other investments, and finally, if insufficient, contribution to the government funded aged pension schemes which could be tested as the means of financial assistance programmes. The tree pillars are funding plan for future benefit. Mainly, the rate of employer contribution, superannuation guarantee (SG) are arguable, because according to Section 9 in Superannuation Guarantee Act 1992, government has a plan to increase until 12 percentage in 2025 (Australian Government. ATO. 2019) However, controversial part of the superannuation funding is ‘other investment’ in second pillars, relating to the superannuation fund industry. Under the Superannuation Industry Act 1993, 500 superannuation funds are operating as a form of trust (safa 2019). Those funds are not government bodies . It is an issue because of the character of trust, which separate ownership and capital executive. And furthermore, from 2015, employees have a power to ask employer to put contribution for certain fund. And it is possible to change the fund.

It is a retirement system that government bodies: The Australian Prudential Regulation Authority (APRA), The Australian Securities and Investments Commission (ASIC), The Australian Taxation Office (ATO), and The Superannuation Complaints Tribunal (SCT), are regulating but the funding is done by the private superannuation industry: 500 funds. Employees would join by their multi-fold choices of funds. It is reasonable that Superannuation system is another type of private investment project funding by Australian working class wage. Problematic points of the system are level of individual’s financial literacy for planning retirement and lack of legal obligation to disclose information about funds. According to Julie Agnew’s empirical research (2013), the level of financial literacy is high to certain groups: younger individuals, women, those with less education, and those who are not employed or not in the labor force. According to Superannuation Industry Supervision Act 1993, it is possible to borrow from bank to leveraging investment for residential real estates, so called SMSF property investment. It is criticized by possibility of economic recession. However, except anonymity of the fund management, the basic financial structure of Australian Superannuation should be criticized. Because, it is based on the acquisition of the income from the account of someone else that the retiree would bereceiving. For example, the source of real estate investment is logically the mortgage of the new house market participator , which means the deposition of the young worker’s future expected mortgage payment is the economic source of superannuation investment gain. It would make the economy to boom but basically never create new value.

Credit card Australian HH

Australian credit card has been started from credit card services of Australian Merchant Bank, which was named as Bankcard. It was the first credit card that was launched in 1974. Until the shrinkage of the market share in 2006, Bankcard was main credit card company that dominated Australian credit card market in the peak of 1984. Foreign international credit card companies like Visa and Master card signed co-branch agreement with the Bankcard in 1980. From Reserve Bank of Australia Payment Board Annual report (2018), Credit card transaction per capita has been increased.

Australian credit card industry has been extended. Merchant banks extended their business partners not only involving banks but also airplane company like Qantas or supermarket for example Woolworth (credit card compare 2019). However, the controversial issue in credit card is obviously datedness, having been caused by credit card debt. Australian Securities and Investments Commission (ASIC) Report 580, ‘Credit Card lending in Australia’ lies that one out of six Australian consumers (18%) are struggling with credit card debts. Outstanding balances of total credit card debts are AUD $ 45 billion, including credit card interests of AUD $ 31.7 million. ASIC warned that enticing credit card offers — notably balancing transfers from one card to another — were "a debt trap" with 550,000 people in arrears and 930,000 with persistent debts as of June 2017 (ASIC Report 580. 2018).

Due to credit card mechanism that forces users to pay card interest to issuing banks and store to pay bill to merchant bank for every transaction, although usage is increasing, total Australian HH consumption power would be reduced by an amount of total card interest payment even without default. Simply, in accounting perspective, the credit card mechanism designed to remit payment concerning the addition of principle amount as well as the interest charged on such an amount for the performed consumption, however, it could only perform the addition to the principle amount because of merchant bank’s interest charge for service. It is reasonable to assume that increase of the transaction; also interest payment would be increase. Also individual’s behavior perspective, it is hard to controlled to less spend and save enough that concerned Duesnberry and Labison’s research (Duesenberry. 1949 and Laibson 1994).

Conclusion

History of Australian HH Financialisation was a history of privatized social reserve transformation. The privatization caused the increase in theLiability side of HH balance sheet (home loan, student loan, and credit card interest payable) and even there were small increments of HH assets side (health insurance and superannuation)- Ellis (2007) lies that “household wealth increases by around 70 to 90 cents for every extra dollar in compulsory pension accounts, with the effect most pronounced for financially constrained households”. However, increasing house price, mainly causing by foreign investment, would psychologically be encouraging to taking more consumer loan with higher confidence, future expectation. However, it is obvious that the debt payment would be not only leveraging consumption but also deceasing consumption power in a long term respectively.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts