Governance And Performance Of Barclays Bank

INTRODUCTION

Corporate governance is an important aspect of operations of business organisations. It has a direct and profound impact on the operations of companies. Due to this reason, it is imperative for firms to use proper methods and strategies for corporate governance (Naceur and Omran, 2011). Essentially it can be defined as a tool through which functions and operations of a firm can be monitored. This aspect has become extremely popular in the banking industry in recent some years, particularly for those who are seeking business dissertation help. The marketplaces have become extremely volatile and unpredictable, due to which there is a need to determine effective ways through which bank’s performance can be monitored efficiently and effectively (Aebi, Sabato and Schmid, 2012). Corporate governance is considered as a very useful method in this regard. Through this study, the researcher will explore the relationship between corporate governance and performance of banking organisations.

The banking industry is known to be one of the most volatile marketplaces (Grove, Victoravich and Xu, 2011). It has become imperative for these organisations that they use a number of different ways and methods to ensure that such characteristics of the industry are managed properly. Through this study, the researcher will try to thoroughly explore the importance and corporate governance’s utility in the banking industry. It is a well-known fact that the banking industry gets affected by a large variety of factors and forces. One of them is corporate governance. It has a crucial role to play in how banks function and perform. Thus by conducting this research, the scholar will be able to identify ways in which corporate governance influences the bank performance and also suggest ways that can help in using this aspect properly and effectively. In this study, the researcher will focus on corporate governance practices adopted by Barclays Bank, UK. The main reason behind selecting this bank is that it is one of the largest banks in the country. By assessing its corporate governance policies, the researcher will be able to assess the relation between its performance and corporate governance thoroughly. This way the researcher can also evaluate different aspects of the banking industry in the UK.

The aim of the current study is “To Assess the Relationship between Corporate Governance and Performance of Barclays Bank, UK”. Through this study, the researcher will attempt to explore different ways in which corporate governance influences the operations and performance of banking organisations. In order to achieve this aim, the following objectives will have to be fulfilled:

Continue your exploration of Sentiment Analysis in Corporate Legitimacy with our related content.

- To evaluate factors that affect bank performance.

- To assess the role of corporate governance in improving bank performance.

- To evaluate the relationship between Barclays banks’ performance and corporate

- To suggest ways to improve the performance of Barclays banks through effective corporate governance.

In order to fulfil the aim and objectives of this study, the researcher will have to provide answers to the following research questions:

- What are the factors that have an impact on the performance of banks?

- What is the role of corporate governance in bank performance?

- What is the relationship between corporate governance and Barclay’s banks’ performance?

- How can corporate governance help in improving the performance of Barclays bank?

Continue your journey with our comprehensive guide to Corporate Governance in Associated British Foods.

LITERATURE REVIEW

This is an important chapter of any research investigation. Through this study, the researcher aims at exploring the area of corporate governance policies adopted by Barclays bank and its relationship with the bank’s performance. Many studies have been conducted on similar topics in the past, but the current one is different because it takes into view the Barclays bank’s performance and the impact of corporate governance. In the following paragraphs, different aspects of corporate governance and bank performance have been evaluated and analysed extensively.

The banking industry is considered as one of the most volatile and unpredictable marketplaces. Over the years this sector has grown at an exponential rate. In this sense, it can be said that there are a large number of factors and aspects that influence the performance of banks (Kolapo, Ayeni and Oke, 2012). One of the key factors is that of risks. In recent some years, it has been observed that the risks involved in the banking sector have increased by a great margin. They have increased so rapidly that if these firms do not use a proper technique to identify and evaluate them, then their very existence can be jeopardised. There are many risks that banking organisations have to face or experience on a regular basis and these then affect its performance. The main risk is that of economic uncertainty. The economic environment can be characterised as highly unstable due to various events such as terrorism, inflation, etc. Due to this reason risks for banks have increased. If the economy is affected, then the banking sector will also be affected in a similar manner. Berger and Bouwman (2013) cite the example of the financial crisis of 2007-08. It was considered as one of the worst times for economies and thus the banking organisations.

Aebi, Sabato and Schmid (2012) determined that size is also a very crucial factor that affects the performance of the banks. A smaller organisation can sustain risks and uncertainties very easily in comparison to its big counterparts. The bigger the bank is, the riskier its operations will be; therefore its performance will also be affected in a similar manner. On this basis, it can be said that banks need to manage their size in relation to their risk mitigation capabilities. If they fail to do so, then there are chances that its performance will be affected in an adverse manner. Naceur and Omran (2011) also stated that competition is a very prominent factor that has an influence on the performance of banking organisations. In recent some years, the level of competition in the banking industry has increased by a great margin. There are a number of organisations that operate in the market space. Erkens, Hung and Matos, (2012) argued that although the number of customers for banking organisations also have increased but not in proportion of ‘mushrooming’ of the banks. This means that there are more banks than there are customers. Due to this reason, many of these organisations are not able to operate effectively.

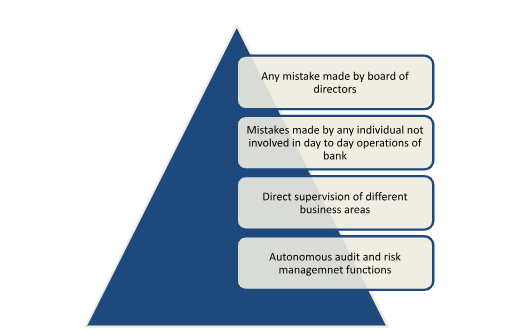

Corporate governance essentially is a tool that enables companies to keep a check on their operations and ensure that their functions are legal and have the minimum negative impact on society. In recent some years the concept of corporate governance has gained a lot of ‘traction and momentum’, as opined by Grove, Victoravich and Xu (2011). It now plays a very central role in, the banking sector. One of the main functions of corporate governance in banking is to supervise the actions of the organisation. This way confidence can be provided to the numerous stakeholders. The following figure provides an understanding of aspects that are necessary for good corporate governance practices.

The Basel Committee in 1999 recommended four main areas that should be included in the corporate governance structure of any banking organisation (Erkens, Hung and Matos, 2012). They have been shown in Figure 2. Through these measures, the function of corporate governance can be made an integral part of the business operations of banks, and they can function in a better and more effective manner as well. One of the main reasons that explain the importance and necessity of corporate governance in banking is globalisation. The industry can be characterised as hyper-competitive in nature due to the presence of numerous organisations and enterprises. Thus there are chances that these firms might engage in using unethical techniques to meet the competition, improve their performance and sustain in the market. This can negatively affect the stakeholders such as customers, government, etc. This can be controlled to a great extent by the corporate governance function. Herein Berger, Imbierowicz and Rauch (2016) stated that corporate governance keeps a check on operations and functions of a banking organisation and ensures that it is not part of such activities that might have a negative impact on the society and the stakeholders. Furtado (2017) argued that functions of a bank are less transparent than that of other business firms. Due to this reason, stakeholders cannot gain complete access to information about the bank’s functions. This creates chances for these firms to engage in unethical practices. This is now controlled through a properly defined and developed corporate governance structure which is independent of the bank’s organisational structure. Such autonomy helps in the effective use of this function.

There are a number of areas and aspects that are of great importance for the banking industry. One of them is the function of corporate governance. It is an aspect that has a significant impact on operations of such firms and their ability to not only achieve their objectives but also to satisfy the numerous stakeholders. As stated by Karaibrahimoğlu (2010) corporate governance is a function of utmost importance to banks. Therefore, it is imperative for these organisations to determine ways in which they can effectively measure and monitor the use of this function. According to Harjoto and Jo (2011), the role of the board of directors is crucial in measuring corporate governance. It is a group of individuals who have the decision making power and dictate terms of operations for the firms. By analysing decisions taken by these people can help in understanding and measuring the effectiveness of corporate governance function. Apart from this Giroud and Mueller (2011) suggests that fulfilment of rights of the shareholders is also an effective way of measuring corporate governance. Aspects such as employee welfare, transparency of information and decisions are some of the ways that help in measuring the effectiveness of corporate governance.

RESEARCH METHODOLOGY

In this part, the researcher has discussed some of the tools and methods that would be used in conducting this study. The chapter of research methodology holds significant importance for an investigation. By thoroughly developing this chapter, the researcher can understand the way in which the study can be carried out efficiently and effectively.

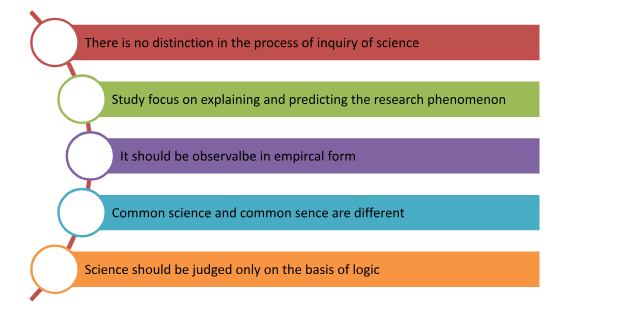

It can be defined as the belief about the way in which data about a research topic should be collected, analysed and used (Knobe and Nichols, 2013). It is an essential part of any research study. In this investigation, the researcher will use positivism philosophy. Positivist researchers believe that ‘factual’ knowledge can be gained only through observations including measurements. Through the use of this philosophy in the current study the researcher will be able to explore the relationship between corporate governance and bank performance thoroughly. Essentially the research design here will be quantitative. There are five main principles of positivism. They have been shown in Figure 3.

In this study, the researcher will use the inductive approach. It is also known as inductive reasoning. Essentially it involves a search for pattern and development of explanation or theories (Sultan and Yin Wong, 2013). The main reason for selection of this approach is that it would enable the researcher to focus on the process of data collection and its analysis. Herein the process of data collection will focus on exploring the phenomenon of corporate governance and its relationship with the performance of banking organisations. Moreover, the results obtained here can be generalised and thus can be applied to almost every entity in the banking sector.

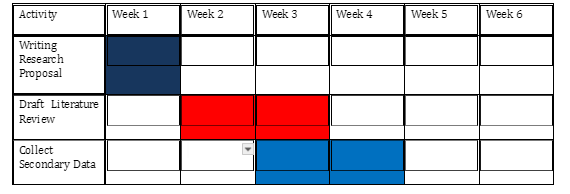

In this study, the researcher will collect and use only secondary data. This will be done primarily due to the fact that the scholar aims at evaluating the findings of past studies and on exploring the relationship between corporate governance and bank performance. Through the use of this technique of data collection, the researcher will be able to analyse the subject matter thoroughly and extensively (Robinson, McCarthy and Smyth, 2010). Moreover, there have been several studies in the past that have explored this subject area.

A quantitative approach for data analysis will be used in the current study. Through such methodology, the researcher will be able to explore and analyse the subject matter thoroughly. The main reason behind the selection of this technique for data analysis is that it will help the researcher in evaluating the data sets in an extensive manner (Simmons, Nelson and Simonsohn, 2011). Herein the researcher will use statistical tools and SPSS software to analyse the data. In this study variables such as ROE, ROA in terms of performance of Barclays Bank and Size of the board of directors, bank size, etc. for bank performance will be taken into consideration.

REFERENCES

- Aebi, V., Sabato, G. and Schmid, M., 2012. Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking & Finance, 36(12), pp.3213-3226.

- Berger, A.N. and Bouwman, C.H., 2013. How does capital affect bank performance during financial crises?. Journal of Financial Economics, 109(1), pp.146-176.

- Berger, A.N., Imbierowicz, B. and Rauch, C., 2016. The roles of corporate governance in bank failures during the recent financial crisis. Journal of Money, Credit and Banking, 48(4), pp.729-770.

- Erkens, D.H., Hung, M. and Matos, P., 2012. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. Journal of Corporate Finance, 18(2), pp.389-411.

- Giroud, X. and Mueller, H.M., 2011. Corporate governance, product market competition, and equity prices. The Journal of Finance, 66(2), pp.563-600.

- Grove, H., Victoravich, L.M. and Xu, P., 2011. Corporate governance and performance in the wake of the financial crisis: Evidence from US commercial banks. Corporate Governance: An International Review, 19(5), pp.418-436.

- Harjoto, M.A. and Jo, H., 2011. Corporate governance and CSR nexus. Journal of Business Ethics, 100(1), pp.45-67.

- Karaibrahimoğlu, Y.Z., 2010. Corporate social responsibility in times of financial crisis. African Journal of Business Management, 4(4), pp.382-389.

- Kolapo, T.F., Ayeni, R.K. and Oke, M.O., 2012. CREDIT RISK AND COMMERCIAL BANKS'PERFORMANCE IN NIGERIA: A PANEL MODEL APPROACH. Australian journal of business and management research, 2(2), p.31.

- Naceur, S.B. and Omran, M., 2011. The effects of bank regulations, competition, and financial reforms on banks' performance. Emerging markets review, 12(1), pp.1-20.

- Robinson, M.D., McCarthy, D.J. and Smyth, G.K., 2010. edgeR: a Bioconductor package for differential expression analysis of digital gene expression data. Bioinformatics, 26(1), pp.139-140.

- Simmons, J.P., Nelson, L.D. and Simonsohn, U., 2011. False-positive psychology: Undisclosed flexibility in data collection and analysis allows presenting anything as significant. Psychological science, 22(11), pp.1359-1366.

- Sultan, P. and Yin Wong, H., 2013. Antecedents and consequences of service quality in a higher education context: a qualitative research approach. Quality assurance in education, 21(1), pp.70-95.

- Furtado, R., 2017. All About Corporate Governance In The Banking Sector. [Online]. Available through:

Take a deeper dive into Fraud in UK Financial Organizations with our additional resources.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts