Investment Strategies for CFOs

Kings Bars

All rational investors want to invest in securities (or projects) that are expected to yield a return greater than their cost of capital. For the chief financial officer (CFO) of a company, the procedure for determining where to invest is a three-step process. The first step is finding the expected return on the securities (or projects) in which the firm may be interested. The second step is the determination of the firm's cost of capital. The final step is selecting those securities (or projects) whose expected return is greater than the firm's cost of capital. In reality neither of the first two steps precedes the other as the CFO may calculate the firm's cost of capital on an annual, a semi-annual, or even a quarterly basis, depending on changes in the capital markets. The calculated cost of capital may then be compared to the expected returns of the various securities and capital projects available.

History of Kings Bars

Kings Bars (KB) was founded in 1976 by David as a manufacturer of quality chocolate candy. As with most food companies established in the United Kingdom in that period, KB started as a modest manufacturer of a single product that was sold locally. Later, if successful, those firms expanded their sales efforts to regional, national, and sometimes even to international areas. Kings Bars was one of the successful companies. David's first product was a chocolate bar that sold for twenty pence. The bar, known as the Kings Bar, soon became famous for its quality and fine taste. David expanded production to meet the rising demand for the Kings Bar, but growth never exceeded cash available to pay for the expansion. Two of the basic tenets on which David founded and ran KB were to make a quality chocolate bar and not to go into debt. These tenets were considered almost sacrosanct, and David believed they were the reasons for his success while many other food companies failed. By 1996, when David turned the reins of his company over to his son, Harry, KB had grown into a respected and well-known £2.5-million regional chocolate firm. It had survived intense competition, according to David, because the firm still produced a quality product and, above all, had no debt. Harry followed the principles laid down by his father, and in the next 10 years KB grew to a national firm with £125 million in sales. Although KB had purchased a confectionery candy firm, over 90 percent of the sales were from chocolate candy. Significantly only 5 percent of the firm's capital structure was in long-term debt, the debt needed to purchase the confectionery candy firm. In 2010, when Harry's son Barry became president of KB, the family still owned all the shares of the firm and the board of directors was made up entirely of family members. However, in 2012 the company was forced into going public because of two circumstances. The first was the need to raise cash to pay estate taxes following the death of Harry. The second came from the increasing awareness that the firm needed to modernise its plants to compete with other food companies, which were slowly taking market share from KB with better quality candy products and higher profits from their automated, modern equipment.

By the early 2015 the firm had completed its modernisation, improving the quality of its products and reducing operating expenses. However, the firm was totally dependent on the chocolate and confectionery business and its managers were beginning to realise that diversification into other lines of the food business might be necessary for KB to survive in the increasingly competitive business environment. In addition, some family members were beginning to question the financial practices of the firm and the effects those practices had on the share price. They noticed that throughout the 1990s, many of the old-line family food businesses were purchased by larger publicly held firms run by managers who were not majority shareholders of the firm. More importantly they noticed that the returns on the shares sold seemed much higher than the returns they were receiving from their shares. During the early 2010s, KB did expand into the pasta business through the purchase of three familyowned firms and by 2015 had an 18 percent market share of the £0.5 billion UK pasta business. The purchase of these businesses was financed through two bond issues. Long-term debt, however, was never more than 20 percent of total assets.

Peter Wood

Peter Wood, the chief financial officer (CFO) of KB, was hired in 2010 with specific instructions to improve the return on the financial resources of the firm. Wood's background included four years as the cash manager of a large corporation with sales in excess of £9 billion. He was a graduate of an MBA programme that is nationally known for its emphasis on financial management. Wood saw the job as CFO of KB as an outstanding opportunity to affect the financial decision making of a firm in transition from family ownership to one that was becoming a multibillion pound, publicly held firm. This Monday morning, Wood had just walked into his office at 7:40 am to find a note stuck on his computer's monitor to call Barry, the CEO of Kings Bars. Barry, however, was making a real effort to bring KB into the modern era, insisting that many of the top executives attend financial seminars sponsored by the Top Business School. Wood had suggested the seminars to Barry as a vehicle to help these executives understand some of the changes he thought were necessary to improve Kings Bars' financial performance. Wood called Barry, who asked him to come up to his office. In the next 30 minutes Wood learned that KB was considering the purchase of Bartoni Foods, a pasta producer with annual sales in excess of £130 million, for £100 million. Before a decision could be made, Barry wanted the answers to three financial questions from Wood. First, what was the expected return from this proposed purchase? Second, what was Kings Bars' cost of capital? Finally, what was Wood's recommendation on how the purchase could be financed?

Financial Information

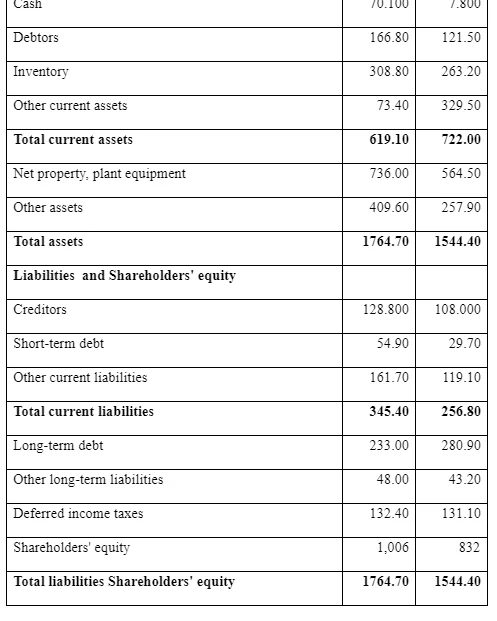

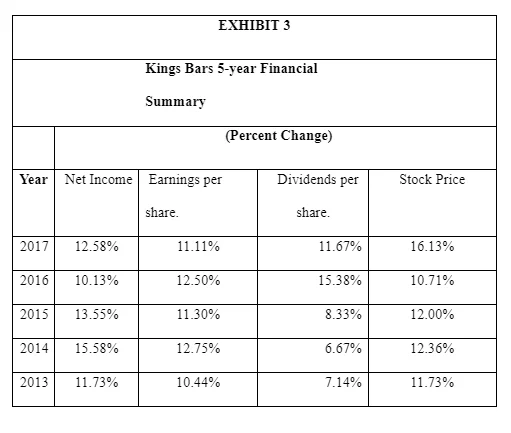

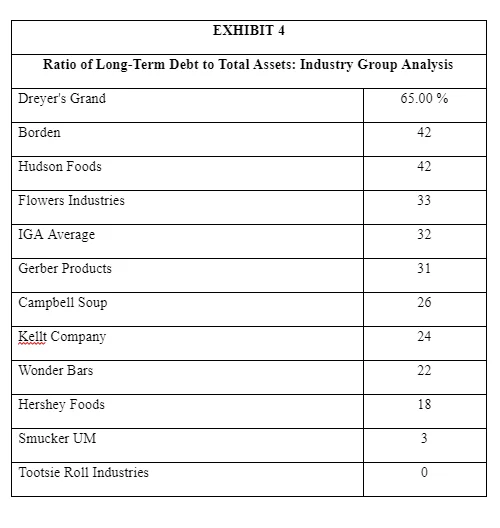

Wood reviewed the KB financial data. (See Exhibits 1 and 2.) The average outstanding balance of short-term, interest-bearing debt in 2017 was £76,132,000 and the weighted average interest rate was 8.2 percent. Domestic borrowing under lines of credit and commercial paper was used to fund seasonal working capital requirements and provide interim financing for business acquisitions. Maximum short-term borrowings at any month were £372,400,000. KB had two long-term, AA+ rated bonds outstanding. The first was a 6.25 percent sinking fund debenture due in 12 years. This debenture is traded on the London Stock Exchange priced at £95.0 which results in yield to maturity of 6.87 percent per annum. Of the original £150 million issue, £133 million is still outstanding. The second issue was for £100 million and had a coupon interest rate of 7.46 percent. The entire issue was sold in 2012 in a private placement to two life insurance companies, and the issue will mature in 2043. Wood then called KB's investment banker and learned that the banker was highly confident that Kings Bars could issue up to £100 million of new debt at the current return on KB's outstanding long-term debt. Like many other family-controlled but publicly held businesses, KB has two classes of ordinary shares: Ordinary Shares and Class B shares. The Ordinary Shares have one vote per share and the Class B shares (held or controlled by family members) have 10 votes per share. However, the Ordinary Shares, voting separately as a class, are entitled to elect one-sixth of the board of directors. With respect to dividend rights, the ordinary shares are entitled to cash dividends that are 10 percent higher than those declared and paid on the Class B Shares. There are a total of 75 million shares of ordinary shares and 10 million of Class B Shares outstanding. The current price of both the ordinary shares and Class B Shares is £36 and their beta is 0.95. The ordinary shares and Class B Shares generally vote together without regard to class on matters submitted to shareholders. The growth rate of net income, earnings per share, dividends, and ordinary share prices are given in Exhibit 3 and have averaged about 12.5 percent a year over the last five years. Some of this growth rate is the result of an aggressive repurchase of the firm's ordinary shares. Over the past three years the firm has repurchased over 5 million ordinary shares. Finally, Wood looked up the capitalization ratio for other firms in the food industry. (See Exhibit 4.) As he expected, Kings Bar had a much lower debt ratio than almost all other companies in the industry group. Wood wrote down the additional information that he thought he needed before starting to work. The current Treasury bill rate was 4.0 percent and the return on the FT all share index has averaged 12 percent over the past 5 years. The current corporate tax rate is 20 percent. The beta for Bartoni Food was 1.1 with debt accounting for 20 percent of the market value of the firm’s capital. The yield to maturity for the debt was 7 percent per annum, slightly higher than that for the Kings Bars.

Questions requiring answers:

1. What is Kings Bar's capital structure? List all the assumptions made underlying your calculations providing the rationale based on capital structure theories and practices.

Kings Bar's capital structure is made up of 26.45% debt and 73.55% equity

Assumptions

The real interest rate from the bench mark rates from various benchmark rates across the states as shown by the company data.

The rates from the start of the project otherwise called the contraction phase are at the peak, leverage from 9.5% and a constant deviation of 0.5% on the lower and upper side of the fixed rate.

The rates for the investment are shown need to be stable and in consistent with the market conditions.

There are deaf of the inflation rates which lead to the dilution of the rates rendering the investor in oblivion of the future.

2. What is Kings Bar's before-tax cost of long-term debt and cost of equity? List all the assumptions made underlying your calculations providing the rationale based on capital market theories and practices. Use the Dividend Growth Model (DGM) and the Capital Asset Pricing Model (CAPM) in calculating the cost of equity.

Solution

Assumptions:

The initial capital out lay is the cost of equity for the firm since there unrelated variables

The firm has limited asset to equity ratio, an indication that the variables do not hold for CAPM.

3. Calculate the cost of capital for Kings Bar using weighted average cost of capital of debt and equity, and Miller and Modigliani proposition incorporating corporate tax. Explain, which of the cost of equities calculated in question 2 (using the DGM or the CAPM) is used. Why the capital asset pricing model is not used to estimate the firm’s cost of capital directly?

Solution

The cost of equities in question two above has employed DGM. The DGM is satisfying as well as the IRR. The LTV is also in favor of the project developer’s projection schedule. It is also not favorable on his side if the firm in regard to the market conditions change in the period of operation. Capital Asset Pricing Model is not employed in the as an estimate method for the cost of capital since it puts into place risk free rate of return which in the cash flows in place does not hold. There is also an aspect of failure to address real rates of interest and instead employs market risks that only feature in the case of market values. The cap rates come in existent and it is through such that the project is likely to experience a sink. The expansion phase in accordance to the benchmark rates from the investor and that of the auditor in comparison to the market.

4. If Kings Bar uses book value rather than market value to determine its capital structure, explain the impact of the cost of capital on its capital budgeting decisions?

The lender of the property however, is favored in some sectors of the project but not that fully as

Book value estimates are rough estimates away from the market conditions.

The lender stands to lose some finances of close to 17.3% off the initial investment if the developer runs the project for over three years.

Book value would also affect the financial decisions in that the value is an approximate of the project cost estimates unlike the use of market value that employs real cost of products taking into consideration the inflation rates and other emerging trends on the market.

5. Why using the book value or the market value of the firm's capital in the determination of the cost of capital is considered superior? Explain.

It is considered superior since it gives room for upward adjustment and there no underlying accumulating or rather accruals on the loan.

It also employs the use of debt coverage ratios for instance

The Debt Service Coverage= NOI/ Annual debt service

The ratio is important in ensuring that the property has all the required cash flows for the coverage of the loan from the lender.

It also provided the safety margin on behalf of the developer.

6. Wood apparently believes that Kings Bar's cost of capital can be used as the hurdle rate for the required return to evaluate the acquisition of Bartoni Foods. Under what conditions, if any, is this appropriate?

The investment meets the investment criteria and the application of the same criteria can be used in any investment portfolio that may come in line with the same approach. This is way in consideration of the ever strong demand as well as the increasing tight market conditions working against the investor’s expectations. There is the low vacancy rates followed by the ever robust increase in the growth rates but all the mentioned from the onset have a bearing on the overall cap rates hence the project is a go zone for King Bar

7. How can the firm raise £100 million for the acquisition without changing the present capital structure?

Solution

The firm can attain the £100 by doing the repurchase of its shares and securities by bidding at a lower price than the market price and repurchasing them in bulk. The use of LTV ratio would also lower than the reference which is 80% but the lender is not at much risk courtesy of the base lending rates from other financial firms as stipulated by the King Bar firm scheduling table for the lending rates. The third value appraisal inn our case is not required to be determined it the lender is responsible of the insurance charges.

8. Assume that the expected net income of Kings Bar in 2018 is £220 million, how would you suggest that the firm finance the acquisition? Explain the advantages and disadvantages of share repurchase instead of cash dividend payments.

Solutions

My suggestions for finance acquisitions are that the firm ploughs back its profits as a first priority and secondly the firm need to seek finances from the hiring of its assets and recommend that the firm need not accept any idea about seeking bank loans since they attract higher interest rates.

Advantages

Share repurchase saves the firm extra costs of restocking

It also ensure that the firm ploughs back on its profits depending on the repurchase price of the shares

It also mitigates risks of losses and devaluation of properties and equities

Disadvantages

Attracts small interest yield to the firm

Comprises of high risks of rebound as repurchase may be done at a below par price than the initial price

Can easily make the firm run short of cash and cash equivalents

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts