Optimal Tariff Theory and its Implications

If a country is a primary buyer or importer of a commodity from many competing suppliers, then she can shift the economic burden of an import tariff from domestic customers to foreign suppliers, a concept that is explored in the economics dissertation help. This is in general the optimal tariff theory argues. However this could lead to further retaliation by country as the final outcome is not easy to predict. This theory is based on principals that optimum welfare should b reached.

(i) Covered interest arbitrage is a trading strategy where an investor capitalizes on the interest rate differences between two countries by using a forward contract to cover exchange rate risk. Calculation of the scenario given in question is as follows

By applying formula:

0.94/0.96 X 1.04

= 1.0183, This looks lover than the offered interest rate of 6% or 1.06 in UK

Dig deeper into Implications with our selection of articles.

Now applying assumptions

Borrow 1 Million at 6%

Purchase 1,063,830 C$

Invest at 4% for a year , the investor will receive 1,106,383 in one years time

Sell 1,106,383 at forward rate for 1,062,128

Repay loan with interest 1,000,000 + 60,000 = 1,060,000

Arbitrage profit = 2,128

However, there is profitability if a UK firm engages in arbitrage, but due to very low profits this transaction does not look feasible.

(ii) The forward rate of C$ might be affected as the investors will look forward to create more profits, when investing the currency, therefore, by applying above assumptions the forward rate might be increase so, the investors could benefit from covered interest arbitrage transaction.

Internal economies of scale means, that the cost of producing an item decreased as the size of your business expands. It measures the company’s efficiency of production, which is obtained as the company increases its output when the average cost per products decreases.

It is good for a firm to produce the same good in more than one production facility as it decreases could decrease the transportation costs for delivering goods to different areas. The company could also avail bulk buying discounts on raw materials and might also reduce its material in transit cost too. If the company is starting another production facility keeping in mind the reduction in variable costs, this decision might increase the overall profitability of the company in this long run

Internalization is a process where a corporate tends to process or develop something internally. It means that when a transaction in incurred within the organization rather than open market, then it is internalization. Following are the four reasons for internalization.

Investment if made is made within the corporation or group companies, so that any profit arising from investment is retained in the business, rather than offered to outside market.

Some semi products used to in manufacturing are developed internally, through self or group companies, resulting in lowering of costs of goods manufactured.

Internalization increases the company’s image in the market

Adoption of internalizations gives independence from the local market business cycles.

If Tmaclo Corp. estimates are accurate for producing stereos at the cost of one-third, the cost of producing them in UK. It is definitely a sensible strategy to adopt. However the company should keep calculate the cost of capital required, to do business in Germany, there might be some heavy fixed cost associated with establishing a new business in a new country, which may be raised from banks or financial institutions on high interest rates, if this is the case this may decrease the net profit of Tmaclo Corp.

Debt-intensive capital structure

Some MNCs favour debt-intensive capital structure because the operational structure of the company is consisted of debt financing. It means the funds are borrowed from lenders for the consideration of interest. Debts financing is for a foreseeable future and any profits made are retained within the company, as the lender of finance only charges interest of the amount invested. Further it also saves tax as an interest expenses is charged in arriving any profit before tax.

Equity-intensive capital structure

Some MNCs, however favour equity-intensive capital structure because they are of the opinion that the interest expense in case of debt-financing reduces the profitability of the company, thus reducing earnings per share and ultimately affecting the share price on the traded market. Equity capital structure is not for a foreseeable future, but remains for infinite period, as the shares once sold by sponsor’s remains in the hands of investors.

Managers of wholly-owned subsidiaries are more likely to satisfy the shareholders of the MNCs because the share holders are the ultimate owners of the company. Being the ultimate owner they have complete legal control over operations, products and processes of the company. The managers, tends to satisfy them as they will only be rewarded by them and not by any other stakeholders.

The cost of capital is calculated as follows:

Every firm measures risk before financing in a foreign currency, degree of risk aversion means additional margin is required to take additional risk, firm adopt hedging arrangement, and buy financial instruments, build commercial contracts in order to reduce the risk associated. However trading in local currency does not constitute any risks that are generally associated with foreign currency.

The meaning of a break-even point in terms of exchange rate change when financing in a foreign currency means that it indicates the firm regarding the value or amount by which a low interest rate currency must appreciate to make its financing cost the same as a domestic currency.

If Kanaacln Co. borrows yen and simultaneously purchases yen one year forward, then Kanaacln Co. will pay a forward premium that will offset the interest rate differential. If interest rate parity exists as indicated (1.02/1.05 – 1 = 2.9%), the forward premium is about 2.9%.

The effective financing rate would be: (1 + 2%)(1 + 2.9%) – 1 = about 5%

As the expected effective financing rate is 5%, Kanaacln Co. should therefore finance with GBP rather than Japanese yen, since the expected cost of financing with GBP is lower.

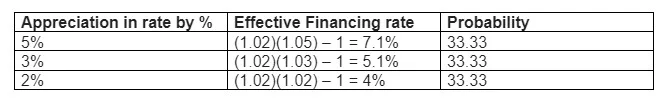

If, we assume that Japanese yen will appreciate by either, 5 percent, 3 percent, or 2 percent, and with equal probability of each occurrence the following results will be obtained:

By applying the above scenario and calculating the probability, there is about a 67% chance that financing with Japanese yen will be less costly than financing with GBP. The choice of financing with yen or GBP in this case is depends on the degree of risk aversion the company chooses.

References

- Vohra and Bagri (2003). Futures And Options. 2nd ed. Tata McGraw-Hill Education.

- Parameswaran (n.d). Futures and Options: Concepts and Applications. Tata McGraw-Hill Education.

- Duarte, J. (2006). Futures & Options For Dummies. John Wiley & Sons.

Continue your exploration of Navigating the Maze: Personal Finance Management in a Modern World with our related content.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts