SEGRO plc: Leading Urban Warehousing

Introduction

An integral role is played by SEGRO plc warehouses located across the major cities in Europe and its transport corridors, in facilitating effective and efficient service of customers. Demand for high quality warehouse spaces and this is particularly in urban areas has significantly been influenced by changes in the habits of consumers and also changes in technology. To benefit from this demand, the company has positioned its portfolio, while at the same time being fully aware of spontaneity of change.

Methods of Estimating the Cost of Capital

For SEGRO plc, the cost of capital would be the rate at which the organisation would raise capital so that it can invest in different projects (Kaplan, 2015). There are seven different methods through which the cost of capital for SEGRO plc can be calculated and they involve calculations of; the cost of debt capital, cost of preference capital, cost of equity capital, cost of retained earnings, quasi-capital, the weighted average cost of capital and the marginal cost of capital.

Cost of Debt Capital

The rate of interest or the total cost that an organisation pays when raising debt capital is the cost of debt capital (Brotherson et al., 2015). The formula for calculating the cost of debt is as outlined below:

1. When the issued debt is at par

KD = [(1-T)*R]*100

Whereby,

KD = Cost of debt

T = Tax rate

R = Rate of interest on debt capital

KD = Cost of debt capital

2. Debt issued at a discount or at a premium

KD = [1/NP*(1-T)*100]

Where,

NP = Net proceeds of debt

3. Cost of redeemable debt:

KD = [{I (1-T) *H (P-NP/N)*(1-T}/(P-H NP/2)]*100

Where,

N = Numbers of years of maturity

P = Redeemable value of debt

Looking for further insights on Unilever Plc Dividend Strategy? Click here.

Cost of Preference Capital

This is the sum of the number of expenses that are incurred and dividends paid when raising preference shares. Because dividend is not considered as an expense but rather an appropriation of profit, the dividend that is normally paid on preference shares is never deducted from tax.

Formulae for calculating the cost of preference capital:

1. Cost of redeemable preference shares:

KP = [{D+F/N (1-T) + RP/N} / {P+NP/2}] *100

Here,

KP = Cost of preference share

D = Annual preference dividend

F = Expenses which include discount, brokerage and underwriting commission

N = Number of years to maturity

RP = Redemption premium

P = Redeemable value of preference shares

NP = Net proceeds of preference shares

2. Cost of irredeemable preference shares

KP = (D/NP) * 100

Cost of Equity Capital

According to Botosan (1997), in deciding the rate of dividend to be paid on equity capital, the risk factor plays an important role. There are seven approaches that can be used to establish the cost of equity for SEGRO plc and they include: the dividend approach, Gordon Model, Earning Price Ratio Approach, Dividend Price plus Growth Approach, Realized Yield Approach, Capital Asset Price Model, and Bond Yield plus Risk Premium Approach (Dhaliwal et al., 2015).

Using the Dividend-Price Approach

KE = (Dividend per share / Market price per share) * 100

KE = Cost of equity capital

Earning Price Ratio Approach

KE = E/MP

Whereby,

E = Earnings per share

MP = Market Price

Dividend Price plus Growth Approach

KE = [(D/MP) + GJ*100

Where,

D = Expected dividend per share, at the end of the period

G = Growth rate in expected individuals

Realised Yield Approach

KE = [{(D-P)/p} – 1] * 100

Where,

P = Price at the end of the period,

P = Price per share today

Capital Asset Price Model (CAPM)

E= R1 + β {E (R2) – R1

E = Expected rate of return on asset

β = Beta coefficient of assets

R1 = Risk-free rate of return

E (R2) = Expected return from the market portfolio

To calculate the beta value,

β = PIM (SD1) (SDM) / SD2M

β = Beta of the stock

PIM = Correlation coefficient that exists between the returns on stock, 1 and the returns on market portfolio, M.

SD1 = Standard deviation of returns on assets

SDM = Standard deviation of returns on the market port

Bond Yields plus Risk Premium Approach

Cost of equity capital = Returns on long-term bonds + Risk Premium

Gordon Model

P = E (1-b) / K – br

Where,

P = Price per share at the beginning of the year

E = Earnings per share at the end of the year

b = Fraction of retained earnings

K = Rate of return required by shareholders.

r = Rate of return earned on investments that have been made by an organisation

Cost of Retained Earnings

These are the profit reserves of an organisation which are not distributed as dividend. They are normally kept for purposes of financing the short-term and long-term projects of an organisation. There are different approaches for calculating the cost of earnings and they include, the KE = KR Approach and the Soloman Ezra Approach (Miller-Nobles, Mattison, and Matsumura, 2016). The KE = KR Approach assumes that in the event an organisation distributes the profits it earns as dividends, then this dividend would be invested by shareholders in other projects. The Soloman Erza Approach includes in it two different options that are viable for an organisation that are either to invest its earnings in its other projects or retain them so as to meet future uncertainties.

Weighted Average Cost of Capital

This is normally determined by multiplying each source of capitals cost with its respective proportion in the total capital (Frank and Shen, 2016).

Weighted Average Cost of Capital = (KE *E) + (KP *P) + (KD *D) + (KR * R)

Whereby,

E = Proportion of equity capital in the capital structure

P = Proportion of preference capital in the capital structure

D = Proportion of debt capital in the capital structure

R = Proportion of retained earnings in the capital structure

Marginal Cost of Capital

This is the cost of the additional capital that an organisation requires to finance investment proposals.

Marginal Cost of Capital = KE {E/ (E+D+P+R)} + KD {D/E (E+D+P+R)} + KP (P/ (E +D + PR)} + KR {R/ (E+D+P+R)}

An Estimate of the Cost of Capital for SEGRO Equity Providers

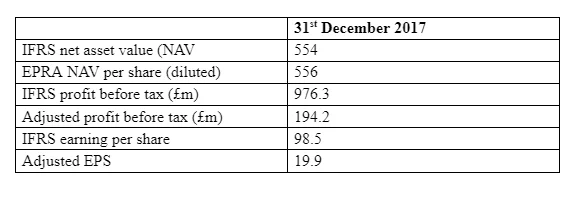

The earnings-price ratio approach will be used in calculating the capital estimate for SEGRO equity providers.

Earning Price Ratio Approach

KE = E/MP

E = Earnings per share

MP = Market price

E = 98.5 pence

MP = 615.40 GBX

98.5 * 615.4 = 60,616.9

KE = 60,616.9

Business Valuation Methods

Profit Multiplier

Here, the value of SEGRO would be calculated by multiplying its profit. Let's say for example, that in a given year, the company's net profit is $1,000,000 and 4 is used as the multiplier, the businesses value would then be $1,000,000 * 4 = 4,000,000. From the viewpoint of a willing buyer, this would imply that if the business was to continue making profits at the same level, it would roughly get $1,000,000 each year from an investment of $4,000,000 which is a 25% return. As such, the company would get the full return on the investment four years later. The profit multiplier method is also referred to as the P/E ratio (Price to Earnings ratio), with the price being the company`s value and the earnings being the profit generated by the company. 3, 4 and occasionally 5 are the commonly applied profit multiples for small companies (Trugman, 2016). For larger publicly traded companies, the common P/E multiples applicable range from 7 to 12. The multiple used obviously has a large effect on a company` valuation. It is always wise to make further corrections in a profit multiplier calculation for some companies like Earnings before Interest and Tax. EBIT is the adjusted profit made by a company without the effect of interest and tax. Most of the times, this calculation is normally used whenever businesses are sold or valued based on any surplus or debts removed from the balance. It gives a demonstration of the businesses earnings with zero effects on the stability of surplus cash balance or debts. In 2017, SEGRO made a profit of £956.3 million. If seven was to be used as the multiplier, the value of SEGRO would be £956.3 million * 7, which gives £ 6694.1 million. This implies that if this business is to continue making profits at this rate, from an investment of £6694.1 million, it would get a profit of £956.3 million each year.

Use of Comparables

This method of valuation involves looking into another company considered as comparable that was put up for sale recently or other similar businesses whose purchasing value is known. For example, typically, home and office security companies are known to trade at a double of the monitoring value, and accounting firms trade at one-time gross recurring fees. This method is however ineffective because it leads to an apples-to-banana comparison. A comparison between a company and 500 counterparts whose fortune is similar would definitely lead to disappointments (Hermoza and Molina, 2017). Some of SEGRO plc.’s competitors are Goodman plc, GLP, REALTERM GLOBAL plc and the redwood group.

Discounted Cash Flow Method

There exists some similarity between this method and the profit multiplier method. The Discounted cash flow method is normally based on projections of a few year future projections in and out of a business. The main difference that exists between the profit multiplier method and the discounted cash flow method is that the latter method takes inflation into account when calculating the present value. Present value is the value of today of money that will be collected in the future. So as to calculate a discounted cash flow valuation, it is necessary to estimate the expenditures that go out of a business and the cash revenues that get into a business (Olbrich, Quill and Rapp, 2015). Subtracting the expenses from the profit gives the net cash flow of each year. So as to get the net present value of the future profit, it is necessary to apply a discount rate to the figures for each year. Potential buyers could decide to compare the business against other choices of investment that are in their hands, each with their own different levels of return and risk.

To decide the DCF value the following procedures are followed;

Forecast period determination. This is the time period during which yearly cash flows for individuals are incorporated into the formula for calculating DCF.

Determining each year’s cash flow

Determination of the current value.

Determination of the continuing value.

Determination of the equity value.

Formula

DCF = [CF1/ (1+r)1] + [CF2/ (1+r)2] + … + [CFn / (1+r)n]

CF = Cash flow

r – Discounted rate (WACC)

Asset Valuation

The total market value of all the assets held by a company like; machinery, equipment, properties and computers makes up a company`s net asset value, subtracting any liabilities like finance, leases, debts and any other equipment's or money owed (Masari, Gianfrate, and Zanetti, 2014). Basically, if a company sold off all its assets and consequently paid its debts, it would be left with the net asset value or book value. In the event that a company has a larger number of assets or its capabilities of generating long-term revenue are limited, applying asset valuation becomes more realistic. It is possible to calculate an assets book value by subtracting any subtractions from its original price. A business has to arrive at its assets market value so as to reach the net asset valuation.

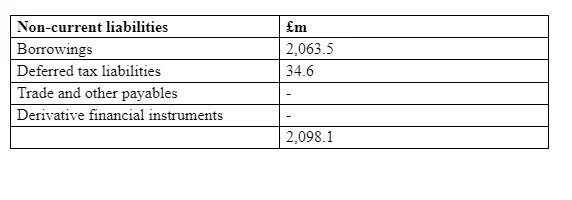

SEGRO`S Assets

SEGRO`S Liabilities

Assets – Liabilities

£7935.1 million - £2,350.9 million = £5584.2 million

Basically, if a SEGRO plc sold off all its assets and consequently paid its debts, it would be left with £5584.2 million.

SEGRO` s Capital Structure

Financial Highlights

SEGRO plc was able to maintain a capital structure that was both efficient and resilient in 2017. Throughout the whole of 2017, the company was able to significantly restructure its capital position. Its borrowings costs and efficiency have been improved through refinancing secured and expansive legacy debt and its capital structure has been strengthened from raising £ 573 million new equity in the March Rights Issue. These have provided the company with a quite extensive capacity to invest in opportunities for acquisition and development without necessarily having to overstretch the balance sheet. From 31st December 2017, there was an increase in the company`s net debt including its share of the joint to £2.6 billion from £2.4 billion (SEGRO Annual Report & Accounts 2017/2018). This movement is reflective of a net capital investment of £200 million that has been offset by the early receipt of cash proceeds from disposals that have been completed and retained earnings which are as a result of a relatively high take-up of the scrip dividend. The company’s look-through loan to value ratio (LTV) generally remained stable at 29% which was largely as a result of the net investment activity during the period offset by a further improvement in the value of assets. This by itself is very consistent with the company`s aim to have an LTV ratio that is close to 30% than its 40% through-cycle target. Over the years, the company has succeeded in creating a portfolio whose quality is high of modern, well-located warehouse assets, positioned to benefit from enduring occupier demand across a wide range of sectors and more specifically, so as to further capitalise on those opportunities that have been created by the e-commerce revolution that sweeps across numerous markets. High-quality portfolio combined with the company`s strong customer focus has been pivotal in driving strong operational, portfolio and financial metrics. In line with a previous guidance in 2016 that the interim dividend was to be set up at one-third of the total dividends of the previous year, a declaration has been made by the board to increase the interim dividend by 0.3 pence per share to 5.55 pence. In 2018, the board is expected to offer a scrip dividend option for the 2018 interim dividend which will give shareholders the opportunity of choosing whether to receive the dividend in new shares or cash. In 2017, 38% of the total dividend was paid out in new shares which equals to £ 37 million of cash that has been retained on the balance sheet and 6.3 million new shares to be issued.

References

Botosan, C.A, 1997, ‘Disclosure level and the cost of equity capital,’ Accounting Review, 1(1997), pp.323-349.

Brotherson, W.T., Eades, K.M., Harris, R.S., and Higgins, R.C, 2015, 'Best Practices' in Estimating the Cost of Capital: An Update.

Dhaliwal, D., Judd, J.S., Serfling, M., and Shaikh, S, 2016, ‘Customer concentration risk and the cost of equity capital,’ Journal of Accounting and Economics, 61(1), pp.23-48.

Masari, M., Gianfrate, G. and Zanetti, L, 2014, The Valuation of Financial Companies: Tools and Techniques to Value Banks, Insurance Companies, and Other Financial Institutions. London: John Wiley & Sons.

Olbrich, M., Quill, T., and Rapp, D.J, 2015. ‘Business valuation inspired by the Austrian School,’ Journal of Business Valuation and Economic Loss Analysis, 10(1), pp.1-43.

Trugman, 2016. Understanding business valuation: A practical guide to valuing small to medium-sized businesses. London: John Wiley & Sons.

Watson, D. and Head, A, 2010, Corporate finance: principles and practice. England: Pearson Education.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts