Strategic Insights into GSK

Introduction

The report aims to identify and address the strategic and financial issues of Glaxo SmithKline (GSK) plc. especially in the area of biomedical science dissertation help. To determine the current strategic points of the company, the report conducts a critical investigation of the value drivers of GSK using Porter’s Value chain analysis approach. Additionally, the report also covers analyzing the internal and external strategic issues associated with the possession of GSK. In this context, a critical investigation of the problems has been examined using SWOT and PESTLE analysis frameworks. At the same time, the report also conducts vital research of the financial position of GSK to identify the critical issues regarding the fact that how much returns have GSK been making over the last 5 years and how it compares with its competitors. In this regard, the report conducts a comparative analysis concerning the financial performance of GSK and its arch-rival Unilever. The assessment includes comparison by conducting ratio analysis of both the organization by covering their financial performance or position since last five years in the global market. In this process, the evaluation encompasses analyzing of different accounting ratios of both GSK and Unilever. Following the comparative analysis of different financial ratios, the report justifies how GSK is doing good/bad in comparison to the financial position of Unilever.

Identifying and Evaluating Strategic Issues

A clear understanding of the strategic issues is one of the most effective practices as it helps to understand the strategic competitiveness of the firms in comparison to other rivals within a market (Colicchia et al., 2011). About the current business performance of GSK, a critical investigation of strategic issues can help to understand the strategic position of the organization. The strategic issues of the company have been examined using relevant theoretical frameworks or approaches.

Analyzing Value Drivers

The value driver analysis process for examining GSK’s strategic position has been performed using Porter’s Value Chain analysis model. According to the model, the value chain framework includes two broader segments of activities of a firm, such as Primary Activities and Supportive activities of an organization.

Porter’s Value Chain Model

Primary Activities

Inbound Logistics: The inbound logistics of GSK mainly includes retrieving raw materials, storing inputs, and internally distributing materials and other components directly to the production units. The company upholds a robust supply chain management division responsible for handling sourcing efficiently, storing, and distribution activities (GSK, 2021). Simultaneously, the SCM division of the company maintains solid environmental guidelines that enable the company to minimize its impacts on the natural ecosystem (Cholicchia et al., 2011). The process of ‘green procurement and utilizing eco-friendly products and equipment and promoting environmental conservation practices are few among the critical activities of GSK’s inbound logistics processes. Simultaneously, GSK also promotes its ethical values throughout its supply chain to protect the interests of its patients globally (GSK 2021).

Operations: the operational process of GSK includes three broader segments of business such as research, developing, and manufacturing innovative pharmaceutical products, vaccines, and different other healthcare products. The business operations currently involve 40 new healthcare medicines and 18 vaccines in development (GSK, 2021). GSK substantially increases its operational efficiency through its extensive network of manufacturing units and research and development (R&D) centers located across 36 countries globally. The company operates its leading R&D divisions currently located in the US, UK, China, Spain, and Belgium.

Outbound Logistics: Till 2016, GSK used to undertake its direct distribution process. However, the company increased its strategic capabilities in global logistics contracts through its partnership with Kuehne and Nigel (Kuehne Nagel, 2016). The primary aim of the association is to extend the performance level of the supply chain through the integration of an efficient logistic approach involving land, air, and sea services in distribution processes. According to the logistics plan of the company for 2030, it has been recognized that GSK is committed to reshaping its supply chain through increasing its efficiency as well as solving a range of complexities in its supply processes using an artificial intelligence system. The company has gradually started its logistics operations to successfully its logistics vision for 2030 (GSK, 2021).

Sales and Marketing: The primary role of sales and marketing is to commercialize the range of vaccines, pharmaceutical, and consumer healthcare products across the potential markets. The main objective of the sales and marketing strategies of the company is to drive improvement in business and delivering more excellent value to customers. The marketing activities of the organizations involve communicating with the government, regulatory and health authority in each active region globally; during the pandemic of COVID-19, the strategy of utilizing tracking tools to understand search priority and needs of the customers, which increased the search efficiency of the company by 15% to 20% (Rogers, 2020). Nevertheless, the seamless use of technology, especially AI, in communicating or interacting with the customers also played a critical role for GSK to strengthen its marketing performance globally.

Services: GSK nurtures its long-term value of delivering good health and well-being across different parts of the globe. Despite its wide range of pharmaceutical and healthcare products, the company is well known for its quality and value-based services to its large group of stakeholders, namely, patients, community members, environment, along with the investors, suppliers, and employees of the organization. The company provides a range of community-based events and programs to promote the health and wellbeing of people. Nevertheless, the company also conducts awareness campaigns to conserve the natural environment (GSK, 2021).

Evaluating Strategic Possession

The evaluation of the strategic position of GSK has been examined in both internal and external strategic processes of the company. The interior strategic possessions of the have been analyzed using the SWOT analysis tool. On the other hand, the PESTLE analysis conducted in this report refers to the external strategic control of GSK.

Support Activities

Procurement: GSK’s procurement process ensures to deliver that the market suppliers are treated with utmost values. The strategy helps GSK to gain the significant attraction of both local and global suppliers. Also, expanding benefits delivered to GSK and making buying process simpler for workers are a few of the powerful procurement tactics used by GSK.

Human Resource Management: The HRM division and its wide range of functions have long played a critical role for GSK. The company is headed by Dame Emma Walmsley, who is responsible for complying with the long-standing HRM values of the organization. The company incorporates a robust set of HRM principles and policies that encourage transparency and equality of employees within the workplace. Moreover, engaging employees in decision-making and promoting individuals based on their performance and increasing wages and compensation are few significant factors that enhance the operational efficiency of GSK.

SWOT Analysis

Strengths: The increasing volume of annual sales and strong distribution network or channel can be considered a significant strength of GSK (GSK, 2021). Additionally, robust performance in R&D in terms of developing innovative and most influential pharmaceutical and healthcare products is also a core element that drives GSK to lead globally (LinchPinseo, 2021). Additionally, practical focus on controlling operating cost and resilience towards dealing with uncertain market risk factors are also considered a few of the significant drivers of GSK.

Weaknesses: GSK has been witnessing to deal with allegations concerning its fraudulent practices associated with price and unlawful promotion of prescribed drugs. Additionally, less or minimum focus on marketing and promotional activities is also a significant weakness for GSK in the current competitive industry of pharmaceutical and healthcare products (Walters, 2021).

Opportunities: The outbreak of COVID-19 can drive GSK to obtain significant opportunities in the R&D division of the company to produce a wide range of pharmaceutical and healthcare products. Nevertheless, increasing growth in HIV cases globally can also drive opportunities for GSK (GSK, 2021).

Threats: The increasing pace of competition in producing generic drugs and changing and rising customer expectations can create a significant obstacle for GSK. Changing the legal system, especially in the pricing of medicines in many global markets, and the government’s policies on manufacturing vaccines can further generate threats for the company to grow and maintain its competitive position (LinchPinseo, 2021).

PESTLE Analysis

Political: Possible changes in international trade regulations, as well as changes in competitive policies and regulatory actions (mainly in China), can drive a significant challenge for GSK to manufacture and market its pharmaceutical and healthcare products. On the other hand, political stability in other global markets can increase substantial opportunities (Deloitte, 2021).

Economic: Budding pressure in the manufacturing and distributing of healthcare and pharmaceutical products can be a significant challenge for GSK (Walters, 2021). However, shifting focus on profitability and continuous growth in the global healthcare product industry due to the outbreak of COVID-19 can drive significant opportunities for GSK.

Socio-cultural: Increasing number of aging populations in the global population index can be a significant factor for GSK to thrive in its growth (UN, 2021). Nevertheless, the use of advanced technological tools such as social media in marketing and promotion, as well as integrating AI in improving customer experience, can deliver significant growth opportunities for GSK.

Technological: The integration of business analytics and AI in predicting customers’ needs and expectations can help GSK strengthen its sales across global markets. Nevertheless, increasing the size of online sales of pharmaceutical and healthcare products can further shift growth for GSK in the future (The Regulatory Review (TRR, 2020).

Legal: International law regarding protecting products from infringement becomes a significant opportunity for GSK in global markets. At the same time, the company also compliant with meeting policy requirements associated with employees’ health and safety, environmental conservation, and most obviously of its medicine and healthcare product manufacturing processes (Transparency International, 2016). In this context, GSK’s continuous focus on protecting products with solid patents and copyright of its pharmaceutical and healthcare medicines can help the company avert possible risks.

Environmental: the sustainable strategy of “net zero emissions across all operations by 2030” of the CEO can be a significant move for GSK to become an environment champion in the global pharmaceutical product manufacturing industry. Nevertheless, the company’s continuous focus on encouraging 100% renewable electricity by 2025 and its objective of eco-friendly packaging can help GSK mitigate a range of environmental-related allegations against the company.

Accounting Ratios

Profitability Ratios

Gross Margin Ratio

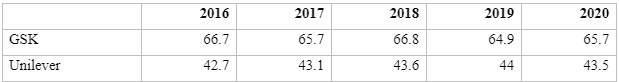

The following table demonstrates the gross margin ratio of GSK and Unilever for five years.

From the data, it can be observed that the gross profit margin of GSK was 66.7% in 2016, which has become 65.7% in 2020. In comparison, its competitor Unilever has a gross profit margin of 43.5% in 2020. This indicates that every £100 GSK is making £65.7 profit before paying other indirect business expenditures. Furthermore, the value indicates that the core activities of GSK are profitable, and the company is efficiently using the materials and resources to sell products (Arnold, 2013).

Operating Margin Ratio

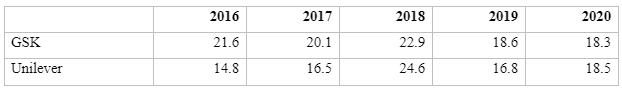

The following table demonstrates the operating margin ratio of GSK and Unilever for five years.

The operating margin ratio of GSK is observed to be 21.6% in 2016, which has reduced to 18.3% in 2020. In comparison, the operating margin ratio of Unilever was 18.5% in 2020. This indicates that with sales of £100, only £18.6 remains to cover all non-operational expenses. The lowering trend of the operating ratio suggests that the company’s operational strengths are reducing.

Net Margin Ratio

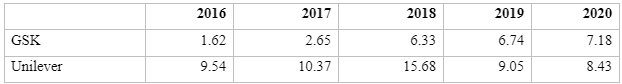

The following table demonstrates the net margin ratio of GSK and Unilever for five years.

From the above table, it can be observed that the net margin ratio of GSK was 3.27% in 2016, which has increased significantly to 16.86% in 2020. In contrast, the net margin ratio of its competitor Unilever is observed to be 11% in 2020. This indicates that with £100, GSK is earning a profit of £16.86 after paying all the expenditures. The increasing trend of this ratio specifies that the company’s capability in turning sales to profit has increased. Hence, the company is efficiently managing the business and making more profit from its sales (Arnold, 2013).

Return on Assets (ROA) Ratio

The following table illustrates the ROA ratio of GSK and Unilever for five years.

The ROA ratio of GSK is observed to be 1.62% in the year 2016, which has increased to 7.18% in 2020. Its close competitor Unilever has a ROA ratio of 8.43 in 2020. This value specifies that with £100 of investment in assets, GSK is making a profit of £7.18. The higher trend, in this case, indicates that the company’s ability to manage the assets to generate net income has increased, i.e., the company is effectively converting the investment utilized for purchasing the assets through earning profit.

Return on Equity (ROE) Ratio

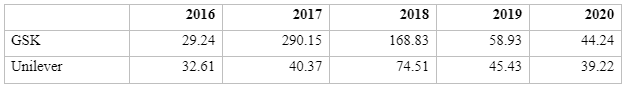

The following table demonstrates the ROE ratio of GSK and Unilever for five years.

The Roe ratio of GSK is 29.24% in 2016, which has increased to 44.24% in 2020. On the other hand, in Unilever, the ROE ratio was 32.61% in 2016 and became 39.22% in 2020. This value specifies with £100 of ordinary investors’ equity, GSK is earning a net income of £44.24. The increasing trend stipulates that the company’s ability to using the investors’ equity has increased. The management of the company is efficient in utilizing equity financing to operate the business and to earn a profit (Arnold, 2013).

Liquidity Ratios

Current Ratio

The current ratio of GSK and Unilever for five years is demonstrated in the following table.

The current ratio of GSK is observed to be 0.88 in the year 2016, which has turned into 0.91 in 2020. Its competitor Unilever has a current ratio of 0.68 in 2016, which has increased to 0.78 in 2020. This value specifies that GSK has sufficient existing assets to pay 91% of its current liabilities. This shows the company is not leveraged and less risky. The increasing trend indicates that the liquidity position of GSK has increased, and the company can more easily pay the current dues (Sekhar, 2018).

Quick Ratio

Following is the quick ratio of GSK and Unilever for five years.

The quick ratio of GSK was 0.56 in 2016, which has become 0.58 in 2020 compared to 0.55 in 2020. This indicates GSK can pay off only 58% of its current dues by using its quick assets. It is a false indication for shareholders and creditors as the company has insufficient quick assets to pay all the short-run debts.

Leverage Financial Ratios

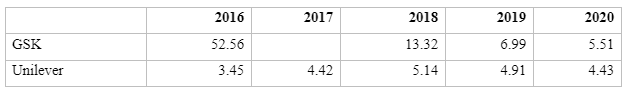

Debt Ratio

Following is the debt ratio of GSK and Unilever for five years.

From the table, it can be observed that the debt ratio of GSK was 52.56 in 2016, which has reduced to 5.51 in 2020. Concerning Unilever, the debt ratio was 4.43 in 2020. This indicates that the company has more debts than assets. However, the lowering trend of this ratio means that the financial leverage is reducing. Still, the company has high financial risk.

Debt to Equity Ratio

The following table demonstrates the debt to equity ratio of GSK and Unilever for five years.

The debt/equity ratio of GSK is observed to be 13.04 in the year 2016, which has reduced to 1.61 in 2020. In contrast, Unilever has a debt/equity ratio of 1.47 in 2020. This indicates GSK has more debts than equity, i.e., the company is mainly financed by debt, which is considered risky. However, the lowering trend of this ratio specifies that the company is using more shareholder financing and reducing the use of credit or financing in recent times (Sekhar, 2018).

Efficiency Ratio

Asset Turnover Ratio

The following table demonstrates the asset turnover ratio for GSK and Unilever for five years.

The asset turnover ratio of GSK was observed to be 0.5 in the year 2016, which has reduced to 0.43 in 2020, in contrast to 0.77 for Unilever in 2020. This indicates that for every pound in assets, GSK is earning only £0.43. Thus, it can be stated that GSK is not much efficient with its utilization of assets. This can be due to specific problems in management (Sekhar, 2018).

Risk

Beta

To understand the risk of a stock, Beta value is considered. It is a measurement of share volatility concerning the overall financial market (Mcclure, 2020). Following is the beta for five years average for GSK and Unilever.

The five-year average beta value for GSK is 0.68. Since the value is less than 1, this indicates that the company's stock is less volatile in the extensive financial market. Therefore, the share of GSK has low risk. However, the average five years beta value of Unilever is 0.43, which is less than GSK. Thus, Unilever’s stock is regarded as less risky than GSK.

Conclusion

From the analysis, it can be stated that GSK has demonstrated strong financial performance. It has improved the net profit margin ratio within the five years, which specifies that the company’s capability in managing the expenses in business has enhanced. The company can transform a sufficient amount of sales into net profit, which is a good indication of financial performance. It has demonstrated better understanding in comparison with its close competition Unilever in terms of profitability. GSK has better ROA and ROE, specifying that the company uses its assets and equity effectively to earn a net profit. However, concerning liquidity GSK’s current ratio and quick ratio is unfavourable as it has lower existing and quick assets in comparison with current liabilities. This can generate a short-run liquidity problem while paying the debts. However, GSK is slowly improving its liquidity performance.

In comparison with Unilever, GSK has demonstrated better liquidity performance within five years. GSK is highly leveraged as it has more debt than the assets; this indicates a sufficient amount of debt is funded by the support. Furthermore, the company also has more obligations than equity, specifying the company’s operation is mainly financed by debt. This indicates the poor financial health of GSK. GSK has also demonstrated poor financial health in comparison with its competitor Unilever. However, the company is improving its financial health condition by reducing the level of debt and increasing more equity financing. GSK is also considered to be less risky in the stock market, as it has experienced a low level of volatility. This makes GSK an overall financially viable company, having a solid financial position.

Reference

Arnold, G., 2013. Essentials of Corporate Financial Management. Pearson Education Limited.

Colicchia, C., Melacini, M., & Perotti, S. (2011). Benchmarking supply chain sustainability: insights from a field study. Benchmarking: an international journal.

Deloitte. (2021). The bigger picture. Deloitte. [Online] Available from https://www2.deloitte.com/uk/en/pages/life-sciences-and-healthcare/articles/eu-regulatory-changes-impact-global-life-sciences-industry.html [Accessed March 25, 2021].

GlaxoSmithKline Pharmaceuticals Limited, 2020. Annual Report 2019-20. [Online] available at: https://india-pharma.gsk.com/media/899991/gsk-annual-report-2020.pdf [Accessed 25 March 2021].

GSK (20201). Pharmaceuticals. GlaxoSmithKline. [Online] Available from https://www.gsk.com/en-gb/about-us/pharmaceuticals/ [Accessed March 25, 2021].

GSK (2021) Sales and Marketing. GSK. [Online] Available from https://uk.gsk.com/en-gb/careers/areas-of-opportunity/sales-and-marketing/ [Accessed March 25, 2021].

GSK. (2021). About Us. (2021). [Online] Available from https://www.gsk.com/en-gb/about-us/ [Accessed March 5, 2021].

GSK. (2021). Environmental Stewardship. GSK. [Online] Available from https://www.gsk.com/en-gb/responsibility/environment/environmental-stewardship/ [Accessed March 25, 2021].

GSK. (2021). Ethical conduct and supply chain. GSK. [Online] Available from https://uk.gsk.com/en-gb/responsibility/our-behaviour/ethical-conduct-and-supply-chain/ [Accessed March 25, 2021].

GSK. (2021). Our locations. [Online] Available from https://uk.gsk.com/en-gb/careers/our-locations/ [Accessed March 25, 2021].

Kuehne Nagel. (2016). Kuehne Nagel and GlaxoSmithKline (GSK) sign long term global logistics partnership contract. [Online] Available from https://newsroom.kuehne-nagel.com/kuehne--nagel-and-glaxosmithkline-gsk-sign-long-term-global-logistics-partnership-contract/ [Accessed March 25, 2021].

LinchPinseo. (2021). Pharmaceutical Industry Challenges to Solve in 2021. [Online] Available from https://linchpinseo.com/common-challenges-facing-the-pharmaceutical-industry-to-solve-in-2020/[Accessed March 25, 2021].

Mcclure, B., 2020. What Beta Means When Considering a Stock's Risk? [Online] available at: https://www.investopedia.com/investing/beta-know-risk/ [Accessed 25 March 2021].

Morningstar, Inc., 2021. GlaxoSmithKline PLC ADR GSK. [Online] available at: https://financials.morningstar.com/ratios/r.html?t=0P000002FO&culture=en&platform=sal [Accessed 25 March 2021].

Morningstar, Inc., 2021. Unilever PLC ULVR. [Online] available at: https://financials.morningstar.com/ratios/r.html?t=0P00007P0W&culture=en&platform=sal [Accessed 25 March 2021].

Porter, M. E. (2001). The value chain and competitive advantage. Understanding business processes, 2, 50-66.

Rogers, C. (2020) How GSK reorganised its brand portfolio in response to Covid-19. MarketingWeek. [Online] Available from https://www.marketingweek.com/gsk-marketing-covid-19/ [Accessed March 25, 2021].

Sekhar, C., 2018. Financial Ratio Analysis. Chandra Sekhar.

The Regulatory Review (TRR). (2020, Oct 17). Regulating prescription drug costs. The Regulatory Review. [Online] Available from https://www.theregreview.org/2020/10/17/saturday-seminar-regulating-prescription-drug-costs/ [Accessed March 25, 2021].

Transparency International. (2016). Corruption in the Pharmaceutical Sector: Diagnosing the Challenges. [Online] Available from https://www.transparency.org.uk/sites/default/files/pdf/publications/29-06-2016-Corruption_In_The_Pharmaceutical_Sector_Web-2.pdf [Accessed March 25, 2021].

Unilever, 2020. Unilever Annual Report and Accounts 2020. [Online] available at: https://www.unilever.com/Images/annual-report-and-accounts-2020_tcm244-559824_en.pdf [Accessed 25 March 2021].

United Nations (UN). (2021). Ageing. UN. [Online] Available from https://www.un.org/en/sections/issues-depth/ageing/ [Accessed March 25, 2021].

Walters, C. (2021). Depleting resources adding pressure to healthcare. PwC. [Online] Available from https://www.pwc.com/gx/en/industries/healthcare/emerging-trends-pwc-healthcare/depleting-resources.html [Accessed March 25, 2021].

Looking for further insights on Small and Medium-Sized Enterprises (SMEs) and Funding Issues in Glasgow? Click here.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts