Understanding the Dynamics of Financial Markets

Background

Any profitable entity needs financial capital; some of the capital can be supplied directly from the savings of the company, while some capital could be supplied from external sources. Therefore, for firms to raise more funds externally, there should enter the capital market. The financial market can be perceived like any other market, where sellers and buyers interact either physically or electronically to establish the terms of trade on various items. The effect of such dealing is always an equilibrium price and quantity being traded on. In short, the financial/capital market is where securities/ equities are being traded, and firms are allowed to sell their securities to raise funds. For students who are seeking finance dissertation help, understanding the dynamics of the financial market is very critical. The key players in any financial market include individual households, companies, national and federal governments and foreign entities. There are various financial markets, which the paper shall highlight in brief. The first is the money market; this where firms trade securities that have a maturity life span of one year. Such securities are known to be rationally safe and do not have high returns. Another type of capital market is the primary market; this includes firms issuing new securities to the public. In such a set-up, the firm will only receive the proceeds of its sales after the broker has deducted his or her share. The Public Offering market is a straightforward example of a primary market. The last category is the secondary market; this where the prevailing securities are actively operated among investors. The firm is not in any way directly involved in the trade of securities at this level and does not receive anything in return. The New York Stock Exchange is an excellent example of a secondary market. Another typical example of a secondary market is the Over-the-Counter Market (OTC) (Johnson and Pfeiffer, 2016, p. 71).

The main aim of financial markets is to establish an open and controlled scheme for entities to derive vast quantities of capital. Such objectives are attained via the equity and bond markets. The same markets also give room for firms to offset their current risks. They offset these risks with merchandises, foreign exchange investments agreements, among other byproducts. Because the public can access these markets, they are likely to offer a transparent platform of setting prices on every stock trading. They also reflect all the available knowledge on most of the stocks traded. It naturally, reduces the expenses incurred when obtaining information because it is already merged into the price. The scope and magnitude of the financial market provide sufficient liquidity. In short, traders can unload assets whenever they need to raise sufficient cash. The size also decreases the cost of doing business, and subsequently, companies do not have to search more to find a willing buyer for their shares.

Looking for further insights on Understanding Market Risk with VaR? Click here.

Capital allocation within the domestic economy

The domestic market takes a vital position in mobilizing private capital to finance national development. Through giving companies the capability to borrow in the domestic sphere in local currencies, the domestic economy can also decrease the cases of currency mismatch between borrowers, and ultimately reducing the systematic risks associated with the process. Besides, government bond markets establish various systems that manage macroeconomics and fiscal risks and offer essential pricing benchmarks. Chen (2016) argued that the domestic capital economy could pose significant risks to the real economy, for instance, because of activities such as marketing herding and the boom and bust cycles. Therefore, the government should help in regulating market volatility and encourage local players in the equity market to undertake long term investments.

National capitals are also essential sources of constant, sustainable capital and reinforce the private sector linked with employment and fiscal development. Harford, Wang and Zhang (2017, p. 1490) stated that in the underdeveloped markets, the capital allocation is slightly low, which leads to illiquidity, and heightened costs of transactions, among other inefficiencies. Santioni, Schiantarelli, and Strahan (2017) Advises that in such a case, development financial institutions can aid in fostering tougher capital markets via local bond issuances, fractional credit securities and risk-sharing. Consequently, such inefficiencies can help in limiting the price discovery and discourage an investor not to diversify. Besides, weak economies tend to struggle when allocating capital proficient and channel funds to save with the maximum profits to capital.

Local firms directly recompense premiums for capital, which reduces investment, development and the creation of employment, while at the same time, foreign investors are discouraged by the heightened costs and more risks. Efficient and developed local capital markets such as the United Kingdom, USA and Germany can address these issues while at the same time assist the private sector in mitigating the effects of capital-flow volatility, decrease the dependence on overseas debt and improve its resilience to a financial crisis. Advanced capital market also permits local investors such as insurance companies, pension reserves and investment firms to admission long-term venture sources apart from the administration debt and the credits (Kannan and Arockiam 2016, p. 435). Besides, the domestic capital market improves the value and pliability of fiscal intermediation in any economy, especially in markets that have frail banking frameworks. Besides, they enhance the value and elasticity of monetary intermediation in any market, especially in economies that have a weak banking system and help in addressing infrastructure shortages and blockages by marshalling the home-grown currency funds in standings that better reflect infrastructure scheme cash flows in comparison to the short-term outmoded bank loans.

Looking for further insights on Multifaceted Perception? Click here.

Gertner, Scharfstein, and Stein (1994, p.1211) advocated for various interventions that can be used to improve the domestic market to achieve better results. These interventions include; increasing the liquidity market. Increasing the domestic liquidity comprises of a range of market players who can swiftly sell and buy assets at a stable price. Such a framework creates efficiency and transparency through price detection and peril extenuation as potential shareholders in liquid markets can quickly sell their possessions in secondary markets in place of holding them to maturity. Issuances in developing markets assist in expanding the stakeholders base, a necessity for enhanced liquidity. Diversification; vibrant local capital markets, resourcefully allot capital from wide-ranging and the several pool of fonts to a correspondingly varied set of investments. Such allocations are as a result of a matching of saving and venture whose maturities range from both short terms to long-term.

More extended periods; an essential factor to a firm's success is the access to long-term finances, especially when developing infrastructure projects. Improving a company's capacity and future potential needs long term financing that can equally help the firm to spread the costs over the life of the project, which essentially help the firm to keep its debt burdens at a manageable level and lowers the costs of the final product. Accurate pricing of long-term tenors depends on the enhanced transparency that is only provided by deeper capital markets via mechanisms such as extending benchmark yield curves. The last intervention is on subsequent issuers (Koethenbuerger and Stimmelmayr 2016, p. 580). The amount and diversity of subsequent issuers is an essential quantity of the influence and sustainability of a bank's interference. Effective intrusions are likely to reduce evidence gaps and validate the viability of new matters. Such developments also complement and strengthen market institutions.

The development of domestic bond issuance needs significant technical assistance and cooperation between both the private sector and the government to establish a relevant regulatory and systematic framework. Such combined forces that emphasize on macroeconomic stability, a vibrant banking system, regulatory changes that improve market discipline and competition and of course institutional systems that will support the rule of law, the implementation of contracts and overall transparency. Murphy (2017, p. 15) detailed that there is an array of frameworks that can spur the development of the private sector through the domestic capital markets. Various institutions, approach this broad and complicated issue in several ways, but the ultimate aim is to reduce uncertainty, lower borrowing costs and stimulate the overall growth of the industry.

Due to globalization and easy access to information, global markets have grown to become a fundamental part of the stock market. The global markets have been proven to be equally beneficial to both shareholders and investors. Borrowers have the advantage of an increased supply of funds available at their disposal and a lesser cost of capital. At the same time, this market broadens the array of investment prospects, which allows investors to establish collections of transnational investments that diversify their imminent risks.

From a borrower’s viewpoint, the domestic market offers a limited pool of investors since these investors can only be the residents of a particular country. In short, market liquidity is also constrained (Véron and Wolff, 2016, p. 141). A good example is the case of China Mobile, which successfully overcame its financial constraints that were due to the comparatively small and illiquid Hong Kong Capital market. By selling its securities to the global market, the company was able to raise $8.2 billion by selling its bonds in different markets such as the New York stock exchange. Up to date, China mobile still lists its equity on the New York Stock Exchange, besides listing the same in the Hong Kong Stock exchange. Through tapping into the international market, the business was capable of raising more capital than it was initially planned and subsequently reduced its cost of capital (Mota, and Coutinho dos Santos 2018). The scenario is an indicator and a proof that the global market gives firms access to a more abundant supply of funds.

In terms of market liquidity; the most critical limitation of the restricted liquidity of an entirely domestic capital market is that the cost of capital is mostly developed as compared to the international market. Because of the limited pool of investors in domestic markets means that borrowers ought to pay more so that they can encourage the investors to loan them cash. The large pool of stakeholders that firms can access in the global market, in turn, leads to borrowers paying less in terms of the cost of capital, majorly because of increased supply (Harford, Wang. and Zhang 2017 p. 1493). Since there is access to a larger pool of investors, firms not only borrow at a lower cost, but they also have access to more capital as compared to the domestic markets.

The only problem is that global markets are hugely affected by different dynamics that the domestic market can prevent in some cases. For example, when the United Kingdom announced its Brexit plans, the London Stock Market fell drastically due to panics in the UK market and the unknown effects of the move. Investors that had invested in these stocks at that time were faced with losses (Musibau, Yusuf, and Gold 2019). Besides, the foreign capitals that had offered their securities for exchange in that market, and to lower the prices of their equities, which meant that these companies are likely to fetch lower capitals in the market than previously anticipated.

Lastly, most investors tend to shy away from investing in the global markets, this majorly due to the fear of the unknown. Most investors tend to be heavily biased on investing in firms located in their home countries. It can be because foreign markets present unseen challenges such as currency exchange, different governmental policies and different investment patterns. Pasricha, Falagiarda, Bijsterbosch, and Aizenman (2018, p. 55) conducted a study that revealed that most depositors do not hold distant financial assets in their respective collections. The researchers found that in the United States of America, Investors had 95% of their investments in the domestic markets, while in Japan, 98% of the capital investments were held by Japanese, while the same trend was also reported in the United Kingdom. The occurrence has been referred to as home bias, various ideologies have been formulated in a bid to solve this puzzle, but none has been able to identify and solve the problem correctly. Probably a common explanation has been the information asymmetry between the domestic and the global market. Therefore, investors are likely to invest in markets which they are familiar with and have sufficient information about, as compared to newer markets.

In the past two decades, Thailand has successfully developed from a low-income state that relied on agriculture and produced essential commodities to its current state where is classified as a middle-income country with a diversified economy that has balanced both agriculture, industrialization and trade. At the same time, the company has developed the necessary expertise in various fields such as mining, transport, and bureaucratic frameworks that have facilitated the precedented economic growth.

Thailand began integrating into the world economy in the early 1990s; this is much later as compared to developed countries that stated the process in the 15th century. The country joined the world market as a major rice exporter to other parts of the world, especially to the United Kingdom. The current progress in the Thai economy started in the late 1950s, and since then most leaders have adopted the modernization mentality to help their economic progress to advanced levels (Kimura and Chang 2017, p. 35). The transformation from agriculture to industrialization might, as a result, the low productivity experienced in agriculture in recent times, low human development index, rampant poverty and weak social institutions. Kelly, Seubsman, Dixon, Banwell, and Sleigh (2017), argued that the recent development in Thailand is not progressive instead it is predatory; this is due to the fact that in the last five decades, the state is majorly controlled by the elites, military and groups with vested interests whose sole aim is to gain more from the state at the expense of their citizens, who do not have enough access to healthcare, education, and health and sanitation amenities. As much as the economy is progressing, the political, bureaucratic, and governance system in Thailand still resembles that of an underdeveloped economy (Prakasam 2016, p. 51). The government has taken substantial foreign debts that are yet to be paid but has so not benefitted the citizens. Even the increased government revenue from international trade and industrialization is yet to be enjoyed by the citizens at a grassroots level.

Critical evaluation of challenges that Thailand faces due to industrialization and trade policies.

Thailand presents a unique situation in that the country has a weak institution and incoherent policies that cannot protect the citizens of the country. The most important policies, such as the land reforms, and income distribution, have always been improved and implemented to help citizens, but in a somehow different direction, which has rendered the policies ineffectual. The country majorly faces these problems because of the rising value of land, and therefore corrupt individual want loopholes to continue grabbing public land, and therefore they frustrate the efforts to implement sound policies because they are sure that such measures will burr their efforts. Besides, the increased government revenue from trade and industrialization has promoted most officials to be interested in how to gain more from this budget (Sa-Nguanmanasak and Khampirat 2019). These factors are also directly linked with the unlimited power of bureau that could have led to arrogance, overconfidence and anti-democratic inclinations that could lead to social conflicts. Any public demonstration is controlled as much as possible or prohibited so that the country can remain 'peaceful' to attract more foreign investors and traders (Simpson 2015, p. 183). Despite the improved trade and industrialization, the country has proved to be weaker in terms of protecting itself from the interests of specific individuals who pursue their interests at the expense of the citizens.

Besides, greedy political elites due to more wealth in the country, the country has a massive pool of unskilled labor and has turned to export-oriented strategies. Specifically, more price competition in electronic products from the developed world has further dwindled, the emerging industries in Thailand. The same has also been experienced in the textile and fashion industry. In the absence of highly skilled labourer, and investors needed to enable Thai companies to compete with more advanced economies, then the current trend might soon end up to a painful downfall (Charoenloet 2015.). Instead of addressing the challenges that could arise for competition by using micro-economics policies and structural frameworks to enhance industrialization, and upgrade skills by reducing unemployment, Thailand has chosen to protect its industries by using barrier tariffs and protectionism to its local industries. Such policies are not only retrogressive but have also hampered the competitiveness of Thai products in the international markets.

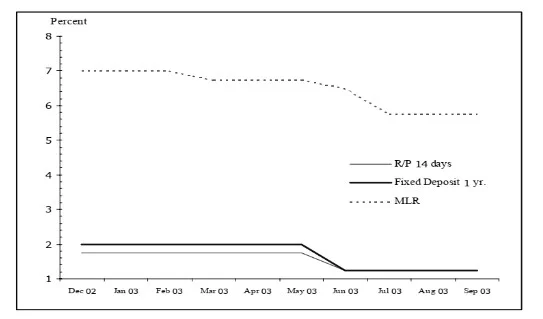

The interest rates in Thailand have continued to decrease in the last decade, this is majorly due to the government intervention in market. Besides, the movement of interest rates were mainly under huge pressure of high excess liquidity in domestic money market and low interest rates in the international market. Therefore, financial institutions had to reduce both lending and deposit rates. In 2003 the Bank of Thailand made another downward adjustment of its policy rate. The bank reduced both the lending and deposit rates. The domestic constrains in the economy pushed most investors to the global equity market. This was experienced in form of increased percentage of US investments in Thailand by Thai nationals as shown in the figure below.

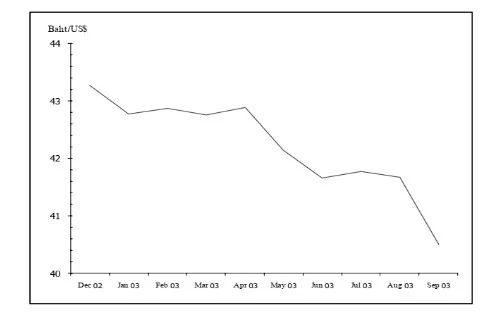

In reference to other currencies the Thai currency has been strengthened against the dollar ever since 2002. At the end of 2003 the rate was closed at 39.98 Baht/US in comparison to 43.15 Baht/US at the end of 2002. The strong economic performance in Thailand, the increase of the SET and the subsequent weakening of the US dollar were among the factors that led to the appreciation of the Thai currency. It is likely that the Thai currency will continue with the same performance in the market, especially due to the fact that the country enjoys economies of scale in Asia, which further boosts economic development and industrial development.

In 2009, the Thai currency weakened due to increased national debt and inflation that led to reduced industrial activities and development. The period was characterized by high rates of unemployment. Therefore, Thailand presents a typical case of a developing economy that is struggling to develop various sectors that will drive industrialization.

Conclusion

One of the defining factors of any market, whether the capital market or the financial markets in recent times has remained to globalization. Globalization has facilitated access to the global markets, which is beneficial to both investors who are interested in the capital market, and those who are also interested in foreign investments. From the capital market point of view, it is clear that both domestic and global markets have their advantages and shortcomings. As for the domestic market, the government has the obligation of regulating it, to ensure that it benefits everyone (both the sellers and the buyers). In the case of international markets, there are no regulations, and therefore, companies and buyers are guided by the rule of demand and supply.

In the case of Thailand, it is evident that sustainable development policies ought to be followed by a comprehensive policy that will back up the same process. If development projects are conducted without proper systems, frameworks and the goodwill of the people, the result can be catastrophic in terms of imminent failure and waste of public money.

References

- Charoenloet, V., 2015. Industrialization, globalization and labour force participation in Thailand. Journal of the Asia Pacific Economy, 20(1), pp.130-142.

- Chen, I.J., 2016. Corporate governance and the efficiency of internal capital markets. Review of Pacific Basin Financial Markets and Policies, 19(02), p.1650013.

- Gertner, R.H., Scharfstein, D.S. and Stein, J.C., 1994. Internal versus external capital markets. The Quarterly Journal of Economics, 109(4), pp.1211-1230.

- Harford, J., Wang, C. and Zhang, K., 2017. Foreign cash: Taxes, internal capital markets, and agency problems. The Review of Financial Studies, 30(5), pp.1490-1538.

- Harford, J., Wang, C. and Zhang, K., 2017. Foreign cash: Taxes, internal capital markets, and agency problems. The Review of Financial Studies, 30(5), pp.1490-1538.

- Johnson, N.B. and Pfeiffer, T., 2016. Capital budgeting and divisional performance measurement. Foundations and Trends® in Accounting, 10(1), pp.1-100.

- Kannan, V. and Arockiam, J.J., 2016. Impact Created by Foreign Institutional Investors and Domestic Institutional Investors on Indian Capital Market. International Journal of Engineering and Management Research (IJEMR), 6(3), pp.435-438.

- Kelly, M., Seubsman, S.A., Dixon, J., Banwell, C. and Sleigh, A., 2017. Integrating Food and Nutrition Security in a Middle‐Income, Globalized, Food‐Exporting Nation: Thailand's Food Policy Challenge. World Food Policy, 3(2-1), pp.5-31.

- Kimura, F. and Chang, M.S., 2017. Industrialization and poverty reduction in East Asia: Internal labour movements matter. Journal of Asian Economics, 48, pp.23-37.

- Koethenbuerger, M. and Stimmelmayr, M., 2016. Taxing multinationals in the presence of internal capital markets. Journal of Public Economics, 138, pp.58-71.

- Mota, J.H. and Coutinho dos Santos, M.J., 2018. Does Internal Capital Market Membership Matter for Capital Allocation? Theory and Evidence from the Euro Area. Theory and Evidence from the Euro Area (December 27, 2018).

- Murphy, F., 2017. How does the US taxation of foreign earnings affect internal capital markets: Evidence from TIPRA 2005. University of Connecticut School of Business Research Paper, (17-12).

- Musibau, H.O., Yusuf, A.H. and Gold, KL, 2019. Endogenous specification of foreign capital inflows, human capital development and economic growth: A study of pool mean group — International Journal of Social Economics, 46(3), pp.454-472.

- Pasricha, G.K., Falagiarda, M., Bijsterbosch, M. and Aizenman, J., 2018. Domestic and multilateral effects of capital controls in emerging markets. Journal of International Economics, 115, pp.48-58.

- Prakasam, S., 2016. Social Security Status of Urban Informal Workers in Thailand, Bangkok-Lessons for India. Political Economy Journal of India, 25(1-2), p.51.

- Sa-Nguanmanasak, T. and Khampirat, B., 2019. Comparing Employability Skills of Technical and Vocational Education Students of Thailand and Malaysia: A Case Study of International Industrial Work-Integrated Learning. Journal of Technical Education and Training, 11(3).

- Santioni, R., Schiantarelli, F. and Strahan, P.E., 2017. Internal capital markets in times of crisis: The benefit of group affiliation in Italy (No. w23541). National Bureau of Economic Research.

- Simpson, A., 2015. 10 Democracy and environmental governance in Thailand. Environmental Challenges and Governance: Diverse Perspectives from Asia, p.183.

- Véron, N. and Wolff, G.B., 2016. Capital Markets Union: a vision for the long term. Journal of Financial Regulation, 2(1), pp.130-153.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts