Unilever Plc Dividend Strategy

Question 1 Dividend Policy

a) The size of the annual dividend to return to its stakeholder

Unilever Plc is one of the most profitable brands in the UK that offers a variety of personal care and consumer goods in different countries. A vast product range supports the firm in the attainment of the distinct needs of consumers associated with different demographics (Madura, 2020). Therefore, the organization maintains stable growth in revenue and profit margin that leaves a significant impact on the dividend policy. According to the dividend policy of the company, Unilever Plc announces its dividend in every quarter. The dividend size of Unilever is aligned with the profit margin along with the underlying profit percentage. The profit margin determines the net profit percentage of the company. The approach of underlying earnings seems a great approach that represents the underlying profit attributes to shareholders. Therefore, shareholders could perceive the amount of dividends. In 2019, the proportion of underlying earnings to shareholders was 5.4% and dividend recognized during the year was near to 3.5%. Therefore, the profitability of the company plays a key role in determining the dividend size (Unilever Annual Report and Accounts 2019, 2019). The distribution of profit has been performed at 5% per year on the paid-up nominal capital of 31/9p of the ordinary shares. Secondly, the company follows the previous rate, the rate of 6% per year at the deferred stock and remaining balance has been distributed as a dividend on the ordinary share. In addition to that, the dividend payout ratio is being identified as a great tool to determine the size of dividends with reference to returns to shareholders. It shows the relationship between the earnings per share and dividend payout per share in a year. The assessment of the financial data of Unilever Plc has found that the profit margin of Unilever Plc is 10.82%, and the dividend payout ratio is 75.82%. The return on equity is 46.35% and return on assets is 9.85% Therefore, stable growth in revenue and high value of net earnings has been termed as key drivers that influence the size of dividends (The Unilever Group (ULVR.L), 2020). In addition to that, Unilever Plc offers both options like cash and stock dividend in which shareholders can consider either cash payment or stock payment option that may have a substantial impact on the perception of consumers. This approach plays a critical role in maximizing the wealth of the company and also builds the trust of shareholders.

b) Key practical issues in determining the size of the dividend

An organization considers several variables while deciding the size of the dividend. Some of these critical variables are listed below:

Ownership structure: It is considered as the most critical element that influences the dividend payout. In this context, a company with a higher promoter holder will mainly consider low dividend payout because management feels that it may cause a reduction in the value of the stock (Banerjee, 2015). On the other hand, high institutional ownership considers a high dividend payout for assessing better control over the managers.

Age of corporation: A newly established company is mainly focused on retaining a major proportion of its earnings to finance future business expansion projects. Therefore, a conservative approach is adopted by the new firm to enhance the value reserves in which the reduction in dividend payout plays an important role.

Leverage: It plays a key role in determining the size of the dividend. This is because a company with more leverage in its capital structure will influence management for more payment of interest (Andreou, Louca and Panayides, 2014). Therefore, firms offer a low dividend payout due to the high value of interest.

Future financial requirements: The decision of dividend payout is significantly aligned with future business requirements or investment opportunities. This is because the requirements of additional capital influence management to increase the amount of retained. Therefore, an organization with various profitable investment opportunities can justify the high value of retained earnings or low payment of dividends.

Profitability: In the context of the contemporary business environment, the profitability of a company has been identified as the key driver of dividend-related decisions. The high proportion of net profit indicates that the company has an appropriate capacity to pay higher dividends (Chandra, 2017). On the other hand, a conservative dividend policy is adopted by companies when organizations have recorded less profit.

Take a deeper dive into Treatment Access And Support with our additional resources.

Liquidity: It may have a direct impact on the size of the dividend. In some cases, companies have generated high net profit, but the majority of the profit is blocked in the working or other liquid assets. It shows that the company is facing some liquidity issue that results in the reduction in the size of the dividend (Jabbouri, 2016). On the other hand, the high dividend payment could be carried out by a firm when a firm has good retained earnings along with the sound liquidity.

Profit trends: In the context of dividend declaration, the profit margins in different periods are significantly aligned with economic fluctuations. If an organization maintains a stable rate of earnings in both positive and negative market condition, then the high-value dividend is provided by the firm (Baker and Weigand, 2015). On the contrary, the company increases its reserves during the emergence of inefficiencies in dealing with market-based ups and downs.

c) Calculating the effect of different options of dividend payment

As per the case, Squeezeco is looking to decide its next dividend. In this context, the company has considered three dividend options that include payment of cash dividend, a 5% scrip dividend, and share repurchase (Kaźmierska-Jóźwiak, 2015). Therefore, the assessment of each option with reference to the viewpoint of investor that hold 1250 shares is carried out below:

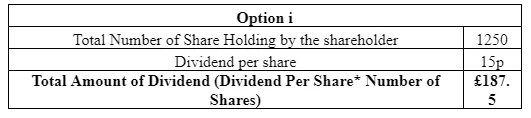

i. A cash dividend payment of 15p per share

The above calculation determines that if the Squeezeco considers the option of the cash dividend payment of 15p per share, then the wealth of the shareholder would be increased by £187.5 on its total holding.

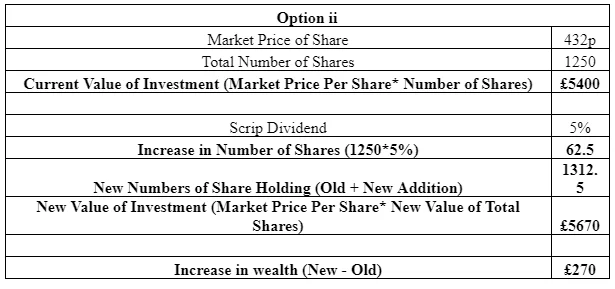

ii. A 5% scrip dividend

The above calculation shows the implications of the dividend decision on the total wealth of the firm when the organization will offer 5% scrip dividend. This option will increase the shareholding of the organization by 62.5 shares, and the monetary value of total shareholding would reach £5670 as compared to £5400. The total addition to wealth would be near to £270.

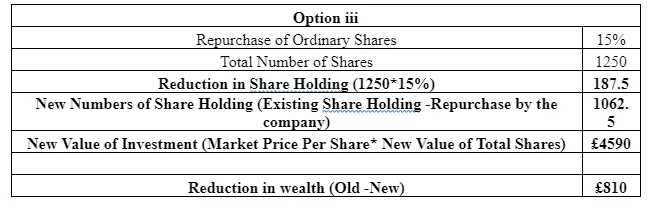

iii. A repurchase of 15 % of the ordinary share capital at the current market price

The evaluation of the option of stock repurchase will reduce the wealth of shareholders. This is because the business entity will repurchase the shares at the current market value rather than the payment of dividends. In the present case of Squeezeco, the company is looking for the repurchase of 15% of ordinary share capital. In this context, an individual with a shareholding of 1250 shares would find a reduction in the wealth of £810 because the company is going to repurchase 15% of his total shareholding.

d) Critically analyzing the decision related to the investment opportunity of £70m in a project with a positive net present value.

If an organization finds an investment opportunity of £70m with a positive net present value, then the management of a particular organization should have to consider several other variables and decisions for checking the reliability of investment opportunities (Huang and Zhang, 2015). In the context, Setiawan and et al. (2016) asserted that the selection of sources of finance is being termed as an important aspect of investment decisions that may have a significant impact on the capital structure of the company. Therefore, the management needs to consider multiple sources of capital that could support the organization in lowering the weighted average cost of capital and increasing the net present value. The investigation of Jacob and Michaely (2017) stated that the payback period and project life cycle could influence the profitability and managerial expenditures of different investment proposals. This thing influences the project manager of £70m project in analyzing the risk factors that would be aligned with the payback period and project life cycle even after the positive net present value. In addition to that, the approach of the internal rate of return (IRR) would support the business entity in determining the minimum rate of return that a project would be provided through future cash inflow. This information assists the project planner to compare the cost of capital or discount rate with reference to IRR so as the business entity could estimate project profitability that can be considered as a key element to influence the investment decision.

Question 3

1. Assessment of economic feasibility the machine acquisition project of Lovewell Limited with different techniques of investment appraisal

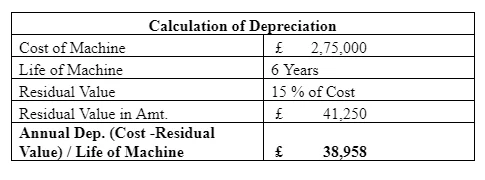

Lovewell Limited, a food manufacturer, is looking to acquire a new machine for £275,000. For checking the economic feasibility of the proposed investment plan, different techniques of investment appraisal are applied below:

a. The Payback Period

As per the above assessment, the payback period of the proposed investment project is near to 3.79 years that is significantly lower than the expected life of the machine. Therefore, the management of Lovewell Limited can consider the machine acquisition project.

b. The Accounting Rate of Return

The above calculation determines the accounting rate of return or profitability of the proposed machine acquisition plan. In the context, the accounting rate of return of the project of Lovewell Limited is 12.20%.

c. The Net Present Value

As per the above calculation, the net present value of the project of Lovewell Limited is £ 45,484. This positive net present value indicates that an organization would enhance its returns with the help of a new machine. This is because there is a positive NPV identified in the proposed investment project.

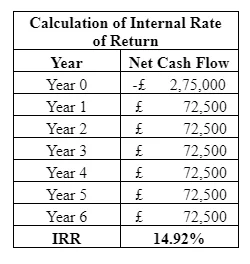

d. The Internal Rate of Return

In the context of the present case, the above calculation of the Internal Rate of Return determines that the selected machine acquisition project would facilitate the IRR of 14.92%. With reference to the cost of capital of 12%, the value of IRR is 14.92%, that is higher than the cost of capital. Therefore, the management of Lovewell Limited can consider the machine acquisition project. As per the above assessment, the management of Lovewell Limited should consider the machine acquisition project. This is because this project has recorded the positive net present value, low payback period, an efficient accounting rate of return along with optimum IRR. Therefore, the acquisition of a new machine would support Lovewell Limited in the attainment of organizational efficiency.

2. Critically evaluating the benefits and limitations of each of the different investment appraisal techniques.

In the process of project planning and investment appraisal, different techniques of investment appraisal help investors in analyzing the project profitability along with the reliability (Al-Mutairi, Naser and Saeid, 2018). In this regards, Imegi and Nwokoye (2015) asserted that the payback period seems a great approach for checking the reliability of the proposed investment plan. It determines the time duration in which the whole initial investment could be recovered. This method is simple to compute and also provides some information about the risk of investment. Moreover, it offers great support in measuring project liquidity. On the contrary, Champathed (2015) argued that the method of payback period could not provide any kind of concrete decision criteria to indicate whether the proposed investment plan increases the firm’s value. Moreover, this approach also ignores the time value of the investment. Scholars further argued that the evaluation of the payback period is mainly aligned with negative cumulative cash flow. It also ignores the cash flow beyond the payback duration that could limit the effectiveness of the payback period in the contemporary investment appraisal process. Apart from that, this model also ignores the risk of future cash flow. The investigation of Umair (2015) has determined that the approach of net present value has gained significant popularity within the investment appraisal process. This is because this model determines whether the available investment options will enhance the firm’s value or not. This is because this system considers the time value of money, so as a project manager would be to select the most suitable project from multiple options. Alkaraan (2017) criticized the reliability of the net present value method because this model requires a systematic evaluation of the cost of capital or discount rate through the project planner can calculate the net present value. Therefore, the high dependence of the discount rate could limit the usefulness of the net present value approach within the investment appraisal process. In the context of investment planning, the accounting rate of return helps project managers or investors for checking the project profitability (Neelakantam, 2015). This is because it determines the proportion of average earnings with reference to the total value of the initial investment. Alkaraan (2015) stated that the accounting rate of return has found very effective in evaluating the project profitability. This is because the calculation of the accounting rate of return is carried out by the average cash inflow during the lifecycle of the proposed investment plan. In addition to that, the calculation of ARR has found a very simple task, and it would not require any special information. On the other hand, Dyson and Berry (2014) argued that non-consideration of the time value of money could limit the usefulness of ARR in the contemporary project planning and investment appraisal process. Moreover, the consideration of an arbitrary benchmark cut off rate reduces the reliability of ARR. Gaweł, Rȩbiasz and Skalna (2017) asserted that the role of ARR is reduced within different aspects of investment appraisal because it is worked on the accounting of net income and book values and it does not consider market values and cash flows in checking the project profitability.

According to the investigation of Abor (2017), Internal rate of return (IRR) has found the most appropriate investment appraisal tools in evaluating the profitability of contemporary investment proposals. This is because it measures the role of an investment proposal for increasing the value of the firm. Moreover, the main success factor of IRR is the consideration of all cash flow along with time value. Therefore, it increases the reliability of investment decisions. Huang and Zhang (2015) stated that the comparison of IRR with the cost of capital supports project managers in assessing the project risks so as the project manager can restructure the expected rate of returns. On the other hand, Setiawan and et al. (2016) identified some drawbacks of the IRR model in which the dependency of IRR on the cost of capital could limit the effectiveness of the investment appraisal process. The author identified that this model would not provide appropriate support in the value maximization decision when this model is applied to compare mutually exclusive projects. In addition to that, the complexity of IRR calculation could reduce its usefulness in contemporary investment appraisal activities (Jacob and Michaely, 2017).

Dig deeper into Strategic Utilization of Management Accounting with our selection of articles.

Reference

Abor, J. Y. (2017). Evaluating Capital Investment Decisions: Capital Budgeting. In Entrepreneurial Finance for MSMEs (pp. 293-320). Palgrave Macmillan, Cham.

Al-Mutairi, A., Naser, K., and Saeid, M. (2018). Capital budgeting practices by non-financial companies listed on Kuwait Stock Exchange (KSE). Cogent Economics and Finance, 6(1), 1468232.

Andreou, P. C., Louca, C., and Panayides, P. M. (2014). Corporate governance, financial management decisions and firm performance: Evidence from the maritime industry. Transportation Research Part E: Logistics and Transportation Review, 63, 59-78.

Champathed, K. (2015). Capital budgeting practice of Thai firms. Information Management and Business Review, 7(1), 59-66.

Dyson, R. G., and Berry, R. H. (2014). Capital investment appraisal. Developments in Operational Research: Frontiers of Operational Research and Applied Systems Analysis, 59.

Gaweł, B., Rȩbiasz, B., and Skalna, I. (2017, September). Application of Probability and Possibility Theory in Investment Appraisal. In International Conference on Information Systems Architecture and Technology (pp. 47-56). Springer, Cham.

Jabbouri, I. (2016). Determinants of corporate dividend policy in emerging markets: Evidence from MENA stock markets. Research in International Business and Finance, 37, 283-298.

Jacob, M., and Michaely, R. (2017). Taxation and dividend policy: the muting effect of agency issues and shareholder conflicts. The Review of Financial Studies, 30(9), 3176-3222.

Neelakantam, T. (2015). Advancements in Capital Budgeting Evaluation Practices: A Conceptual Analysis. Samvad, 9, 6-14.

Umair, N. (2015). Review of Capital Budgeting Techniques and Firm Size. Research Journal of Finance and Accounting, 6(7), 106-112.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts