Vodafone's Global Impact in Telecommunications

Overview

In the telecommunication sector, Vodafone is one of the leading organizations that offering the reliable and fastest services for the customers of 21 countries. The organization is serving more than 300 million customers across the globe. Vodafone is listed among the leading companies on the London Stock exchange and constituent of FTSE 100 (Vodafone, 2022). Moreover, the organization is offering employment to more than 105,000 people. The present report is an attempt to value the company. Vodafone is selected because, firstly it’s a multinational company operating in 21 countries and has a huge cash reserve. The company has seen improvement in its profitability and per share and has strong liquidity as compared to its competitors. This makes the stock less risky. Thus, purpose of valuing this stock is to determine whether in the near future, this stock is a good option to buy in one’s portfolio or not as the company has experienced fluctuations in its liquidity and analysts believe that its shares have overstated market value.

Company Profile

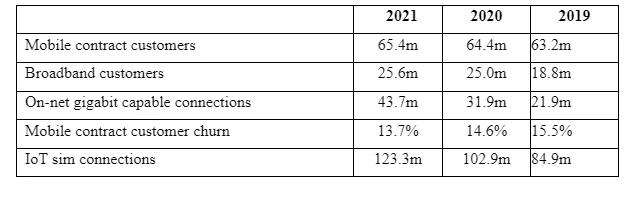

Vodafone is one of the leading organization that offering the communication and internet services across the world and serving customers based on the needs and trends of the business of particular location. The management is offering services for both private and public sector customers and providing the services options related to the internet, data sharing and communication that supported by the dedicated global network. According to financial analysis of the organization, it has been carried out that Vodafone is the largest mobile and fixed network operator in Europe with 113 million mobile connections (Vodafone, 2022). The organization is providing largest and fastest 5G services in 244 cities of the 12 countries. Apart from this, the fixed line services of the organization are including the broadband, television and voice. Additionally, the organization is offering the services related to the Internet of Things (IoT) and security and insurance.

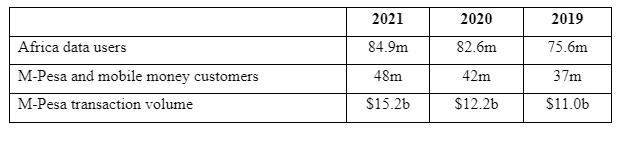

According to reports, Vodafone is leading services provider in Africa region as company is having more than 179 million customers in 9 countries and offering the financial services in 7 countries (Watson and Head, 2019). The M-Pesa is online payment transfer platform of the organization that helping to send and receive money from anywhere and anytime.

Telecommunication Sector Analysis

The telecommunication industry is one of the prominent sectors that is generating more than $1.1 trillion income and supporting the global economy. By considering the growth of the telecommunication sector, it is expected to grow by $1.5 trillion by 2025. Apart from this, the industry is offering job for 12 million people contributing more than $500 billion in the public sector through consumer and operator taxes. According to analysis, the global telecom market is estimated value was $1667 billion in 2020 and growth rate was 5.4% from 2021 to 2028 (S&P Rating 2022). As the demand of the high speed broadband services and internet is increasing the telecommunication organization are expecting improvement in the corporate and residential connections. In the current scenario, the demand of the internet and mobile data traffic is increased after the outbreak of Covid-19 due to remote working and educations (Spiteri, 2020).

In addition to this, the improvement in the standards of Internet of Things (IoT) services and devices has increased the interest of the leading organizations to manage the services accordingly. The numbers of connection of IoT expected to grow up to 50 billion by 2028. As per the analysis, there are 5.3 billion mobile users in the world that is 67%of the global population and 60% of those are using the smartphones. These phones are helping the users to watch the videos on demand and gaming (Reilly and Brown, 2012). Apart from this, the global demand of corporate sectors is also increased as leading and growing businesses are using the internet based tools and technologies for marketing, customer relationship and keeping the record of the data. The market analysis has suggested that in the coming decade, the 5G services are set to make the mobile network speed up to 100x faster and have 1000x capacity of managing the services. The corporate and industries are giving preference to the advance tools and services options considering the digital market and coming demand of the services. The telecommunication sector is planning to invest more than $600 billion over the next four years for upgrading the network and increasing the coverage of 5G network. However, the improvement in the environment betterment and use of the sustainable practices related to the business has the significant impact on the core business objectives of the organizations (Skeldon, 2020). The organizations are trying to manage the operations as per the new guidelines and looking for the support from the government to maintaining the higher efficiency level.

Financial Analysis

The financial analysis is providing the information related to the wealth of the Vodafone in last five years. The ratios were compared with the industry average.

Take a deeper dive into Vodafone Global Performance with our additional resources.

Profitability

According to analysis, the revenue of the organization was decreased from 2017 to 2021. However, the organization has maintained the increased in gross profit and generated the profit after the losses in 2019 and 2020 (Vodafone 2021).

According to the analysis, the gross and net profit of Vodafone has been increased as company has made more profit and net income by sales. The major factor that has contributed in the profitability of the organization is improvement in selling prices and maintaining the better efficiency using the digital tools and technologies for production and supply of the services. As per the evaluation, the improvement in the net profit of the organization was €536 million. However, the losses of organization in 2019 and 2020 were estimated around €7,644 million and €455 million respectively (Vodafone 2019).

Liquidity

According to analysis of liquidity ratio, it has been carried out that liquidity of Vodafone was decreased by 33.86% and liquid assets of 34.66% which is higher than the current liabilities of 32.37% in 2017 to 2020. Moreover, the decrees in cash and cash equipments were of €3,014 that has affected the current assets of the organization (Vodafone 2018). However, Vodafone has the strong liquidity those competitors which rose by 67.66% from 2017 to 2021.

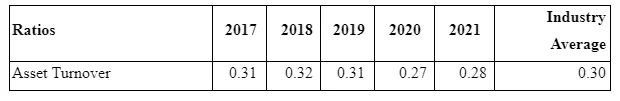

Efficiency

According to the analysis, it can be considered that lower sales were managed from the total assets available for the organization. However, the management of Vodafone has developed the measures for improving the utilization of the resources to improve the sales. Apart from this, the pandemic situation has created the pressure among the organization to manage the services as lower roaming revenue was generated in this time which has led the organization to lower turnover (Yahoo Finance 2022). However, the small organizations have generated higher revenue by making better utilization of the resources that has helped in increasing the sales in the local market.

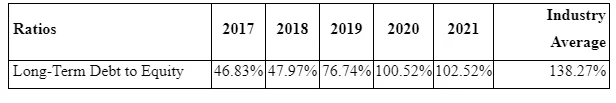

Gearing

The improvement in long-term equity is indicating the higher financial risk for the organization as the organization unable to pay the long-term debt on time that could lead the Vodafone to bankruptcy. The borrowing of the organization increased by 71.63% from 2017 to 2021 and decreased in equity of 21.69% (Mark Beech 2020).

Investor Ratio

As per the analysis, it has been considered that improvement in the profitability is helping Vodafone to increase the level of earnings per share. This ratio is improved due to strong profitability and less dividends of 34.97% (Investing FTSE 100, 2022). The pandemic has a negative impact on the profitability and influencing the decisions of the investors to offer fund for the organization.

Forecasting

The information related to the key variable for making the forecasting are presented in Appendix A that are based on the following changes:

Revenue: According to financial analysis of the Vodafone, it has been carried out that revenue of company is decreasing after the pandemic and people are giving preference to the IoT devices for managing the communication and internet connection. Therefore, it is expected to improvement of 20% per annum as the management of Vodafone is focusing on the sales of the IoT devices (Investing, 2022).

Operating expenses: By the analysis of financial document of Vodafone, it has been considered that company is making efforts for digital transformation and maintaining the higher efficiency for minimizing the expenses and looking forward to reduction in operating expenses by 15% annually (GSMA, 2022).

Capital Expenditure:

As per the analysis, the PPE/sales of Vodafone were increased from 2017 to 2021 caused by the more acquisitions (Grand View Research, 2022). The management is trying to lower it but lack of effective management of the assets is affecting the process.

Depreciation:

According to analysis, the depreciation pattern is influenced by the direct proportion of PPE and the average Deprecation/PPE is 35.78% for Vodafone.

Changes in working capital:

As per the analysis, the receivable sales were stable for the organization for 5 year and average figure of the working capital is 24.21%. However, the fluctuation in the CCE/Sales is having a direct impact on the performance of Vodafone. Moreover, the cash from the operating activities was increased by 32.63% due to improvement in the profitability (Gov.uk, 2022).

Other assets:

Other assets of Vodafone were increased due to acquisitions of European Liberty Global Assets.

Valuation of Vodafone

For the valuation of the organization, the assets valuation method was used that help to understand the financial position of the organization. The statements of financial data were used for gaining the in-depth information related to value of the organization:

Risk-free rate of return: The risk-free return for organization was estimated around 1.82% in 30 years government bonds.

Beta: The present beta value of Vodafone is 0.75 and it will remain stable.

Share outstanding: The share outstanding of Vodafone would be 28,816,836,778 (Corporate Information, 2022)

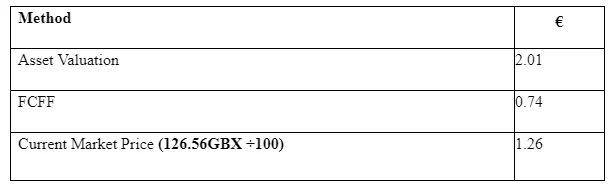

Comparisons of intrinsic value with market value

According to current market analysis, the market prices of Vodafone are higher than the intrinsic value of the company based on the FCFF valuation. However, the replacement value of this tangible and non-tangible asset can be significantly different but the improvement and talent at workplace can add more value to Vodafone and support to gain a competitive advantage. The consideration of forecast will be useful for analyzing the values and issues that could influence the business process of the organization (Berk and DeMarzo, 2020). The indicators of FCFF might differ due to changes in the economic conditions and lack of management in pandemic situation that has influenced the market prices and demand or supply of the shares.

Recommendations

By considering the financial wealth and value of Vodafone in last five years, it has been recommended to the investors to buy the share of company. Following are the major strengths and weakness of company that could support the investors to make the decisions:

Strengths and weakness: The digital transformation that has been made by the organization is having a significant impact on the financial wellbeing of the organization. The strong revenue and profitability is also helping the organization to maintain the trust of the investors. However, the level of competition is high in the global market that could influence the sales and profitability of the organization as small and local organizations are attracting the customers by offering the effective and low cost services (ACCA F5, 2019). Apart from this, Vodafone is offering higher earnings for the investors per share considering the competition that is having a significant impact on the decision making of the investors.

Value and Risk: The market price of Vodafone is higher than intrinsic value and indicates it overvalued. The fluctuation in economic conditions is having a significant impact on the business operations and planning of Vodafone to improve the prices of the share and maintain the higher efficiency (Penman, 2013). In addition to this, improvement in the taxes and use of the technological tools has also increased the operating cost of Vodafone to maintain the efficiency.

References

ACCA F5 (2019) Study Text: Performance Management. 12th ed. London: BPP Learning Media Limited.

Begović, V.S., Momčilović, M. and Jovin, S. (2013) ‘Advantages and limitations of the discounted cash flow to firm valuation.’ Škola Biznisa, 1, 38-47.

Corporate Information (2022) Vodafone group public limited company [Online]. Available at: CorporateInformation.com - Financial Information on 46,000 Companies Worldwide [Accessed 8 August 2022]

Grand View Research (2022) Telecom Services Market Size, Share & Trends Analysis Report By Service Type (Mobile Data Services, Machine-To-Machine Services), By Transmission (Wireline, Wireless), By End-use, By Region, And Segment Forecasts, 2021 – 2028 [Online] Available at: Global Telecom Services Market Size Report, 20212028 (grandviewresearch.com) [Accessed8th August 2022].

GSMA (2022) The Mobile Economy 2022 [Online]. Available at: The Mobile Economy 2022 (gsma.com) [Accessed8th August 2022].

Lynch, R. (2015) Strategic Management. 7th ed. London: Pearson.

Mark Beech (2020) COVID-19 Pushes Up Internet Use 70% And Streaming More Than 12%, First Figures Reveal [Online]. Available at: COVID-19 Pushes Up Internet Use 70% And Streaming More Than 12%, First Figures Reveal (forbes.com) [Accessed 8th August 2022].

Paul Skeldon (2020) 5G mobile subscriptions to reach 2.8bn and 55% coverage rate by 2025 [Online]. Available at: 5G mobile subscriptions to reach 2.8bn and 55% coverage rate by 2025 | Platforms & Technology (telemediaonline.co.uk) [Accessed8th August 2022].

Penman, H.S. (2013) Financial Statement Analysis and Security Valuation. 5th ed. New York: McGraw-Hill Irwin.

Pike, R., Neale, B. and Linsley, P. (2015) Corporate Finance and Investment: Decisions and Strategies. 8th ed. London: Pearson.

Reilly, K. F. and Brown, C. K. (2012) Investment Analysis & Portfolio Management. 10th ed. Mason: South-Western Cengage Learning.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts