Strategic Planning for Successful Mergers and Acquisitions

Executive summary

Business change management and leadership are effective practice to run the organisational activities efficiently and expand the fir in achieving future success. In the recent years, the organisations get into the agreement of merger and acquisition for successful expansion of the business across the world to utilise the organisational resources and establish the brand efficiently. The study aims at analysing the problems of merger and acquisition as well as identifying the strategic planning of successful merger and acquisition, so that the organisation can expand their business in Scotland and run their business activities strategically. The study also helps to develop effective recommendations for successful merger where the organisation can merge with another company in the same industry to expand their business in Scotland in the post-Brexit era. the recommended strategic planning such as staffing through training and development, giving incentives and rewards to manage change and managing cultural diversity, developing organisational culture with harmony and freedom to work, continuous motivation and encouraging people’s creativity as well as organisational structure and strategy are important for the organisation to merge with another company and expand the operations in Scotland. If you need further assistance with your business dissertation, feel free to seek business dissertation help.

Introduction

Merger and acquisition are two terms where merger means combination of two companies and the term acquisition refers to on company take over another company. In the recent era of globalisation, the multinational corporate firms choose the strategic planning of merger and acquisition in order to expand their business internationally where two or more firms try to conduct their business operational activities jointly (Al-Ali et al., 2017). The aim of the report is to analyse the problem of merger and acquisition as well as the change management practice where the firms try to develop effective strategic planning to manage change in the organisational context. The study also provides a scope to recommend some suitable solutions for understanding the tactics through which the corporate firm can successfully change the business by merger and acquisition for successful expansion of the business. In this regard, the organisation tries to expand their business in Scotland in the post-Brexit era where the corporate firm aims at merger and acquisition strategy in order o utilise the organisational resources jointly with other same company and use the market base so that it is possible for the organisation to manage change and get into the agreement of merger and acquisition.

Evaluating the problems related to merger and acquisition

There are many factors that influence the business to go into merger and acquisition in the market in order to expand their business efficiently by utilising the organisational resources and capabilities of both the firms in the market. Joint infrastructure and utilisation of the resources are the major benefits of the strategy of merger and acquisition and in this regard it would be effective for the organisation to enter into Scotland and run their business in the country efficiently. In this regard, the factors such as strategic fit, brand values, market share and branding are effective to influence the organisation for getting into the tactic of merger and acquisition (Choromides, 2018). The major aim of the organisation is to expand the business in Scotland in the post-Brexit era and for this objective, it is beneficial for the firm to get into the merger and acquisition agreement, so that they can have successful bonding and they would have the scope to expand the business successfully. in this regard, the major issues of merger and acquisition are such as cultural differences, different organisational practice and strategies and diversify aims and objectives as well as there are other issues such as different views among the shareholder and other stakeholders such as managers and employees, different leadership style, face loss, misunderstanding about the distribution of profitability and integration risk. During the merger and acquisition, the leaders face different challenges such as differences in leadership style and difference views for which mismanagement and misunderstanding happens among the leaders of different organisations. For taking over other companies or for developing joint agreement for merger, it is necessary for the leaders to develop clear understanding cooperatively (Hussain et al., 2018). Due to cultural diversity and different knowledge management and rewards technique, the organisations face challenges in managing merger and acquisition in the market. According to VUCA model, the major issues during merger and acquisition are volatility, uncertainty, complexity and ambiguity, for which the business leaders face issues for successful merger and acquisition.

As per the VUCA model, the volatility of business activities is one of the major issues, during merger and acquisition where for example price of the products may fluctuates and business performance may also be fluctuating in different market condition and in this regard it becomes difficult for the leaders to handle the volatility of the business. Apart from that, uncertainty is another major problem in case of merger and acquisition, where due to lack of information search and poor knowledge of the leaders and the strategic management team, uncertainty may hamper the business negatively (Attah, Obera and Isaac, 2017). Market uncertainty and lack of proper knowledge about the market condition further hamper the business activities in long run. There are complexities in doing the business through merger and acquisition where both the leaders face challenges due to complexities in business environment, cultural diversity, differentiation in knowledge of the employees, different views of the leaders and diversify organisational practice and culture (Man and Cai, 2018). These factors further raise the issue of business complexities, where it becomes difficult for the firms to get into the agreement of merger and acquisition (Tang, 2019). Lastly, ambiguity is another major challenge faced by the leaders where the leaders and the managers face risks in change management during merger and acquisition, and in this regard the people are not clear about the organisational practice and aims and it leads to difficult situation for the leaders to manage the change through merger and acquisition.

Models of merger and acquisition

The model of five stages of Mergers and acquisitions refers to the systematic way to executive the business through merging and in this regard the development of corporate strategy is followed by company’s futures. The next step is involved with the negotiation and structuring and the post acquisition phase is related to auditing and organisational learning. Hereby, the strategic planning of developing corporate strategy, organising the acquisition, dealing with the organisational structure, posit acquisition integration through improving cooperation and company audit are the major strategic planning as per the model through which it is possible for the firms to expand the business through merging where skill management, corporate strategy and organisational structure are beneficial to run the operational activities of the firm in globe run (Li et al., 2016).

In addition to this, Hostile takeover process is another model of merger and acquisition which indicates position of a target company by acquirer which is made of tender offer, open market or through proxy fight. It offers the tender at the premium price of the company which is higher than the market values and in this regard it is the decision of the shareholders to accept the tender or not.

Theories of merger and acquisition

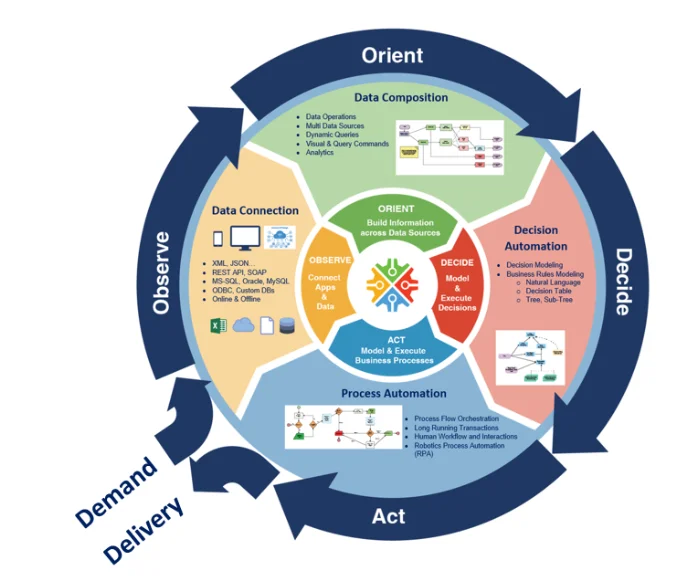

ODDA loop informs effective business decision and management strategy during merger and acquisition, where the firm may follow the loop and the factors of the loops stands for observe, orient, decide and act. the ODDA loop is effective for the merger and acquisition business where the organisations can develop effectives strategic planning after analysing the current business position, market condition and the existing rules and organisational resources, so that it s possible for the organisation to develop effective strategic planning for successful merger. observing the business is necessary, where data collection about the market demand, organisational performance and financial growth as well as customer’s values and online and offline data are necessary for the business to develop effective strategic planning for successful merger and acquisition, where the leaders of the organisations try to analyse the external and internal business environment by evaluating market growth and customer demand and firm’s capabilities to establish the bard successfully (Dumas and Beinecke, 2018). After that, orient is essential, where data composition is important for the organisations to get into the agreement of merger. Deciding the best policies and practice is effective after that, where the organisations make decision for the successful merger and after that act though implementing the planning will provide a scope to the organisations to get into the agreement of merger.

In addition to this, the differential efficiency theory of merger and acquisition is also effective, where the acquisition enhances efficiency of the business. Both the firms under merger and acquisition can utilise the organisational resources and capabilities to maximise their efficiency and in this regard the merging is one of the best strategy for joint operational activities where both the firm try to develop effective tactics to perform effectively and productively in the market (Brueller, Carmeli and Markman, 2018). Moreover, the information and signalling theory is also beneficial where the announcement of merger and acquisition negotiation may covey all the necessary information and signals the organisations about the market condition and growth. The cash flows activities are managed through information and signalling where both the firms try to share important information and convey the vision of the organisation so that it is possible to develop future values of the business. Additionally, Hubris hypothesis theory refers the practice look into the target of the firm and fulfils the personal motives and economic gains. In this regard the personal motives of merger and acquisition can be fulfilled through effective strategic tactics where both the firms try to understand each other’s values and negotiate properly to develop common strategy to achieve future organisational success (Burnes, Hughes and By, 2018).

Strategies of successful merger and acquisition for business growth

There is effective strategic planning for successful merger and acquisition where the business firms can develop joint strategic planning for the benefits of the organisations in long run. in this regard McKinsey’s 7s model is effective to develop the strategic planning for successful merger and acquisition and it refers to the strategies of organisational system, structure, style, staffs, skills and shared values. organisational system in this regard need to be developed properly where both the leaders try to negotiate and develop suitable organisational culture with harmony and freedom so that the employees can work efficiently (Joyce, 2016). The organisational structure is also necessary for develop merger and in this regard, the hierarchical structure with senior colleagues and management team are effective to support the junior staff members and employees to achieve future success. In this regard cooperative structure ad communicative management style is effective to manage the employees of both the firms and expand the business efficiently (Greve and Man Zhang, 2017). The major transformational leadership with high communication and cooperation are mandatory in this regard during merger where the leaders of both the firm can enhance internal communication and improve operation among the staff embers for improving their productivity. High communication and cooperation are effective this regard to improve leader’s involvement in the workplace where the leader and managers can direct and support the workplace for leading them towards achieving future success.

Apart from that staff, skill and strategy are also effective for the organisations so that they can expand their business in Scotland through merger and acquisition. In this regard, staffing is necessary for change management and getting into the strategy of merger and acquisition. In this regard, for successful change management in merger and acquisition, it is necessary for the leader to restructure the salary and introduce performance related pay and incentives to motivate the employees. Continuous motivation and encouraging their creativity are effective for successful staffing strategy where the firms can develop effective merger and acquisition to expand their business in Scotland in the post-Brexit era (Risberg and Gottlieb, 2019). In addition to this, skill management or knowledge management are beneficial for the organisations to develop diverse culture of managing skill in the organisational workplace. In this regard, for knowledge management, the organisations needs to develop proper strategy where it is necessary to improve organisational culture, manage the workplace activities and improve the business strategy for successful growth. In this regard, the strategic planning of product diversification and pricing strategy of the business are effective for the organisation to enter into the Scotland market and expand the business successfully. There are other strategy such as promotional practice, advertising and improving organisational infrastructure and technological advancement, which help the organisation to manage merger and expand the business successfully.

Lewin’s change model in this regard is beneficial to manage the change strategy of merger and acquisition and in this regard there are three stage of unfreeze, change and refreeze through which it is possible for the organisation to manage change practice at the organisational workplace and establish the brand through successful merger (Edwards, Raheem and Dampson, 2017). The unfreeze stage refers to the elders try to determine the needs and preferences of the organisation and ensure strong support, both financial and human resource so that it is possible to manage the changes (Sinatra, Singh and von Krogh, 2016). Creating the needs for changes is necessary in the workplace and manages and understands the doubts and concern of the health care professionals are also necessary. In the second stage, there is change where the change leader communicates with the staff and dispels rumours as well as empowers the actions and involves the people in the process (Jaques, 2017). In the third stage of refreeze, it is essential to develop change culture, develop the ways to sustain the change and provide continuous support and training to all the staff members for celebrating the success in near future.

In this regard, the organisational leaders need to share the entire necessary information about merger and discuss over the benefits of the merger in near future (Issah, 2018). The employee’s performance rewards and salary must be restructured well in order to motivate them and lead them toward achieving future success. For such change of merger, it is also necessary to build strong bonding at the workplace and empower all the staff in the organisational decision making practice, so that the staff members can share their opinion and contribute positively to expand the business through merger (Mutali, 2017). Cooperative learning, sharing information and experience and partnership working practice are hereby beneficial for the organisations under merger strategy to achieve future success by appropriate change management practice and ensuring more creativity and technological innovation of the business. there are other effective strategic planning to manage merger which are developing effective strategic planning together, high communication and cooperation, negotiation practice and improving mutual trust, managing cultural diversity, developing organisational culture and skill management which are also effective for the organisations to manage the organisational activities in the market (Jaques, 2017). Hereby, the strategic planning of managing merger are effective for the organisations to get into the agreement of merger and expand the business in long run where the business firms can establish their activities in Scotland and run the operations in the market sustainably. The further recommendations will be discussed well through which it is possible to develop the effective strategic tactics for the organisation to have successful merger with another company in same industry to expand their business in Scotland.

Conclusion

It can be concluded that, merger and acquisition is one of the effective strategic planning for the organisations to get into merger agreement and develop the firm successfully in the international market. The strategy of merger is beneficial for the business expansion where the organisation can gather more in depth knowledge and understanding about merger and acquisition and analyse the business environment for successful branding. Through merger, the organisations are able to expand their business in Scotland in the post-Brexit era and secure future suitable development. In this regard, further recommendation will be suggested so that the organisation can establish the brand in Scotland by effective merger and acquisition.

Recommendations

The merger and acquisition is effective for the businesses, where the organisations can develop effective strategic planning or successful merger. In this regard the organisation needs to have negotiation practice to improve mutual understanding and in this regard group meeting with the freedom to share the valid information and business environment is necessary. The organisation needs to develop teamwork and negotiate properly for profit maximisation and brand values creation. the leader of both the firm need to be supportive and directive where the leaders can direct the eta member to adopt the change process and improve their performance in long run. In addition to this, the leaders must focus on building communication by implementing Information and Communication Technology (ICT) at the workplace, so that the employees of both the firms can be engaged with each other and develop effective teamwork at the workplace. In this regard, open discussion and training program must be developed where the employees can take active part in the group discussion and general meeting as well as they can have the opportunity to take part in the training program for improving the knowledge and technical skill. For managing change to the organisations, it is necessary to have effective knowledge management practice and the strategy of developing on-the job training and off-the job training are effective for the employees to improve their productivity and contribute positively in the organisational workplace. In this regard, incentives for teamwork and partnership working practice must be provided to the employees as well as the human resource management team of both the firms must focus on restructuring the salary and giving them performance related pay to motivate the staff and lead them towards the organisational success through the strategy of merger.

In addition to this, the organisational leader needs to managing cultural diversity at the workplace, as there are a huge employee base from different cultural value, language and beliefs. In this regard, cultural training program and induction process are effective to introduce the employees and teach them about the organisational practice. In this regard organisational culture is also playing crucial role in managing change during merger and in this regard, the leaders of both the organisations need to develop suitable organisational culture to deliver quality workplace where the staff can work efficiently. The leaders should manage transparency and accountability at the workplace and encourage the employee’s creativity are necessary to motivate them in long run. Sharing the valid information and the reason and benefits of change through merger strategy with all the employees is necessary for the organisations to manage change during merging with another organisation in Scotland. Additionally, the leaders need to develop all the necessary agreement of merging and legal rules of the merging firms need to be managed properly so that mutual trust and respect can be developed properly. For managing resistance to change in the organisation, the leaders need to be cooperative and empower all the staff of both firms in the organisational decision making practice and this strategy further helps the managers to encourage the staff and direct and support them properly towards achieving the organisational success, where the firm can expand the business in Scotland through merging with another firm.

Take a deeper dive into Strategic Planning and Change Management in the Era of Globalization with our additional resources.

Reference List

Al-Ali, A.A., Singh, S.K., Al-Nahyan, M. and Sohal, A.S., 2017. Change management through leadership: the mediating role of organizational culture. International Journal of Organizational Analysis.

Attah, Y.E., Obera, V.A. and Isaac, S., 2017. Effective leadership and change management for sustainable development in Nigeria. International Journal of Public Administration and Management Research (IJPAMR), 4(2), pp.37-42.

Brueller, N.N., Carmeli, A. and Markman, G.D., 2018. Linking merger and acquisition strategies to postmerger integration: a configurational perspective of human resource management. Journal of Management, 44(5), pp.1793-1818.

Burnes, B., Hughes, M. and By, R.T., 2018. Reimagining organisational change leadership. Leadership, 14(2), pp.141-158.

Choromides, C., 2018. Leadership and change management: A cross-cultural perspective. International Journal of Entrepreneurial Behavior & Research.

Dumas, C. and Beinecke, R.H., 2018. Change leadership in the 21st century. Journal of Organizational Change Management.

Edwards, A.K., Raheem, K. and Dampson, D.G., 2017. Strategic thinking and strategic leadership for change: Lessons for technical universities in Ghana. MOJEM: Malaysian Online Journal of Educational Management, 6(1), pp.53-67.

Firk, S., Maybuechen, F., Oehmichen, J. and Wolff, M., 2019. Value-based Management and Merger & Acquisition Returns: A Multi-level Contingency Model. European Accounting Review, 28(3), pp.451-482.

Greve, H.R. and Man Zhang, C., 2017. Institutional logics and power sources: Merger and acquisition decisions. Academy of Management Journal, 60(2), pp.671-694.

Hussain, S.T., Lei, S., Akram, T., Haider, M.J., Hussain, S.H. and Ali, M., 2018. Kurt Lewin's change model: A critical review of the role of leadership and employee involvement in organizational change. Journal of Innovation & Knowledge, 3(3), pp.123-127.

Issah, M., 2018. Change Leadership: The Role of Emotional Intelligence. SAGE Open, 8(3), p.2158244018800910.

Jaques, E., 2017. Requisite organization: A total system for effective managerial organization and managerial leadership for the 21st century. London: Routledge.

Jaques, E., 2017. Requisite organization: A total system for effective managerial organization and managerial leadership for the 21st century. London: Routledge.

Joyce, P., 2016. Strategic leadership in the public sector. London: Routledge.

Kolev, K.D. and Haleblian, J.J., 2018. When firms learn from prior acquisition experience. Journal of Organization Design, 7(1), p.8.

Li, M., Liu, W., Han, Y. and Zhang, P., 2016. Linking empowering leadership and change-oriented organizational citizenship behavior. Journal of Organizational Change Management.

Man, K.S. and Cai, J.S., 2018. Preparing Leadership, Innovation and Change for 21st Century: Lessons from National Proffesional Bodies. INTI Journal, 1(11), pp.1-14.

Marshall, S., 2019. Strategic leadership of change in higher education. London: Routledge.

Mutali, E., 2017. Strategic leadership and change management at Equity bank. International Academic Journal of Human Resource and Business Administration, 2(4), pp.49-67.

Risberg, A. and Gottlieb, S.S., 2019. Workplace Diversity and Gender in Merger and Acquisition Research. In Advances in Mergers and Acquisitions (pp. 51-63). Emerald Group Publishing.

Schell, W.J., 2019. Leadership and change management. In Traffic Safety Culture: Definition, Foundation, and Application (pp. 191-218). Emerald Publishing Limited.

Sinatra, A., Singh, H. and von Krogh, G. eds., 2016. The management of corporate acquisitions: International perspectives. Berlin: Springer.

Tang, K.N., 2019. Leadership and Change Management. Berlin: Springer.

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts