Analyzing Financial Performance

- 19 Pages

- Published On: 08-11-2023

Part 1

Introduction

In the current economic climate, it is crucial for businesses to thoroughly assess their financial accounts because doing so will enable them to accurately assess the performance of their organisation. Also, accurate evaluation of the financial statements helps businesses make investment decisions (Fernie & Ebooks Corporation, 2005). Ratio analysis is a crucial tool in a manager's toolbox for this aim. With ratio analysis, businesses are able to assess their own performance as well as that of their competitors in the market or with their own historical performance (Fernie & Ebooks Corporation, 2005). By using different ratios to the financial accounts of the corporation, the current work assesses the financial health of retail behemoth Tesco. For better analysis of Tesco’s financial performance, the company’s financial health will be compared with another industry giant Sainsbury. If you are seeking business dissertation help, understanding such financial assessments can be invaluable.

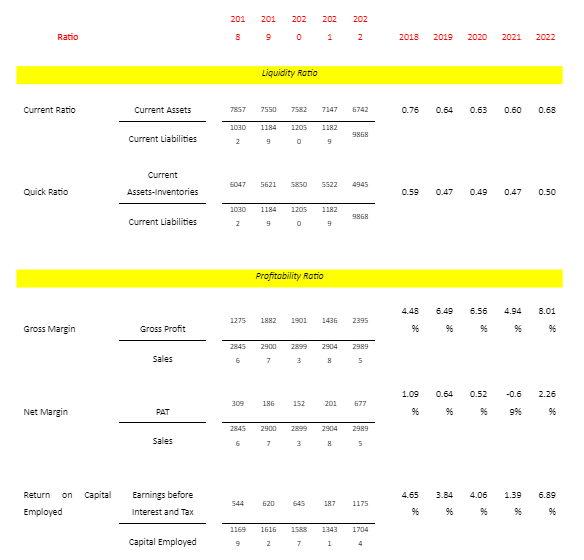

Profitability Ratios

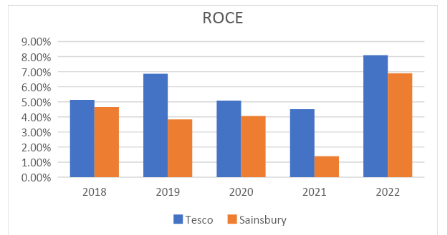

Return on Capital Employed

It determines company’s profitability and capital efficiency. It shows, how effectively the company has employed its capital for generating profit. A higher return on capital is desired by every company.

As per the analysis, ROCE for Tesco was increased in 2019 as compared to 2018, but there was subsequent decline in 2020 and 2021. This can be due to the fact that it was pandemic time and most of stores were operating with limited capabilities. However, once the pandemic was over, the company was again able to improve its ROCE which was reported approx. 8% in 2022. On the other hand, ROCE for Sainsbury was less than Tesco over the years and were following the same trend as of its competitor. Better ROCE for Tesco shows that it has effectively utilized its capital for generating better profit margins as compared to Sainsbury.

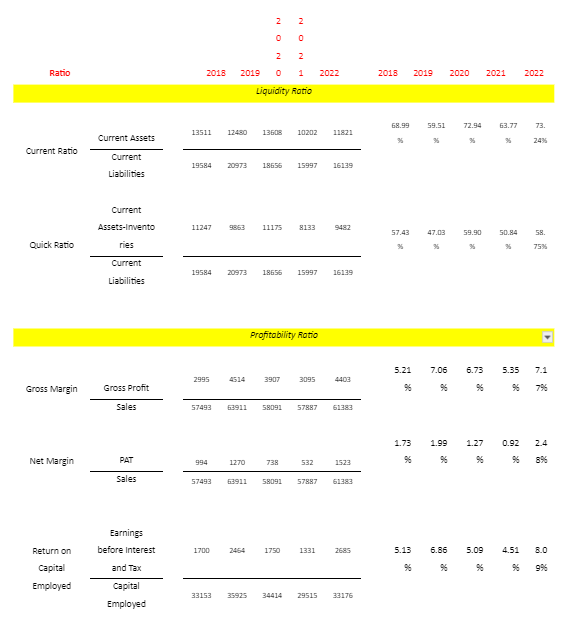

Gross Profit

Gross profits for both Tesco and Sainsbury were more or less at par over the five years. The pandemic had its effect on both the company’s profitability as during COVID times the gross profit for the company declined. However, as compared to Tesco, Sainsbury was able to reap better profit margins post COVID.

Net Profit

Although, gross profit margins for both the companies were similar, but there is a difference in their net profit margins. Net profit margin for Tesco was also much better than Sainsbury, showing its better operation efficiency. As expected, pandemic did affect both companies net profit, but it was much affected for Sainsbury. This shows that Sainsbury failed to achieve operational efficiencies and it was expending higher amounts on operational expenses and other overheads.

Liquidity Ratios

Current Ratio

It reveals whether the company has the liquid or current assets to cover its immediate obligations. The ideal current ratio for a corporation is roughly 2. This demonstrates that the business has access to sufficient short-term capital to cover its immediate obligations. In the given case, the current ratio for both the companies is much less than 2 for all the five years. In fact, it was less than 1 for both the companies over the years. This shows that both Tesco and Sainsbury do not have enough liquidity to meet their short-term obligations. In fact, it shows that current liabilities for both the companies are much higher as compared to their current assets. It is not a good sign for both the players as they will be not able to meet any unforeseen situation in the near future.

Acid Test

The company's ability to pay its short-term debts with liquid cash and without using shares is shown by the quick ratio. The ideal current ratio for a corporation is close to 1. This demonstrates that the business has access to sufficient short-term capital to cover its immediate obligations. In present case, like current ratio, the quick ratio is also poor for both the companies. This shows their inability to meet their daily operations as they have limited or no liquidity to their daily or short-term obligations.

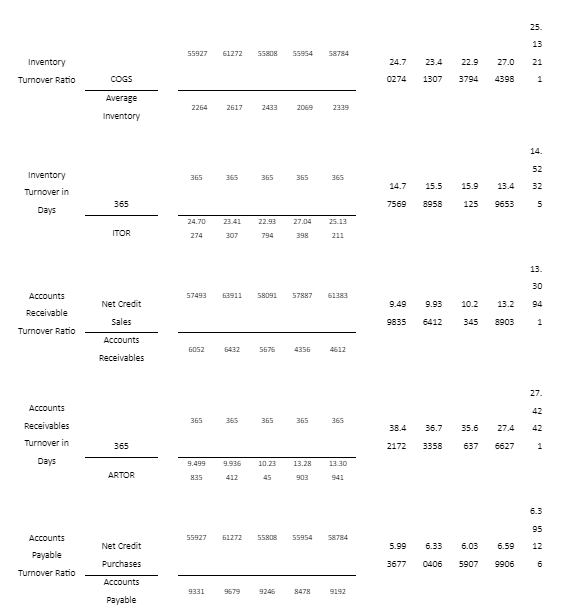

Efficiency Ratios

Inventory Turnover

Inventory turnover ratio tells how quickly the company is able to convert its stock into cash. A lower number is always preferable by the company as it helps them to generate quick profits. In present case, Tesco reported lower inventory turnover days as compared to Sainsbury. It shows that Tesco is able to sell its products in lesser days than Sainsbury. Thus, it indicates that Tesco is able to make quick profits than Sainsbury.

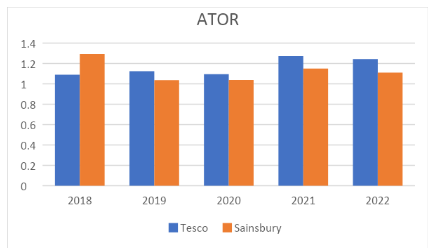

Net Asset Turnover

Asset turnover ratio tells company’s ability in generating cash/profits through its assets. Every company should employ its assets in such a way that it can generate multiple times sales from them. Then only the company will be able to reap higher profits. In present case, in 2018, this ratio was higher for Sainsbury, but in the following years Tesco surpassed Sainsbury and reported better asset turnover ratio. However, in both the cases, the asset turnover ratio is not very good. This shows that both the companies have failed in effectively utilising their assets in generating profits.

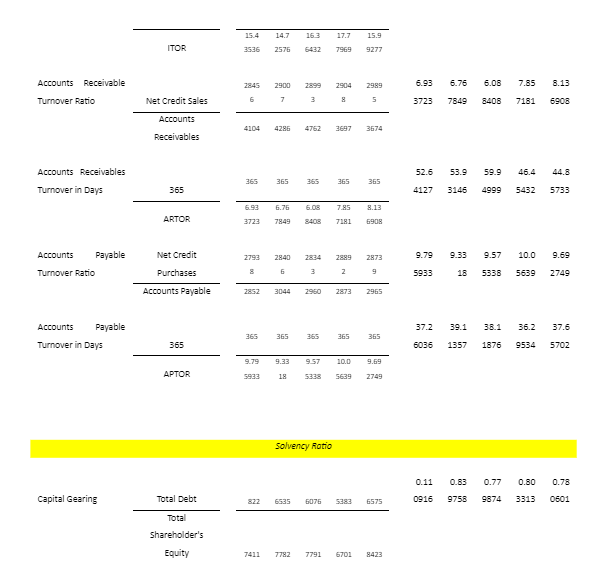

Trade Receivable Collection Period

The ratio of accounts receivable reveals how effectively a company collects money from its customers. Receivable turnover ratio should be as low as possible for a strong business. The company will have sufficient working capital on hand if its ratio of accounts receivable to total assets is low. However, if it is really high, the business would experience cash flow issues and will need to rely on debt financing. In present case, this ratio is much lower for Tesco as compared to Sainsbury, showing better efficiencies of the company in maintaining sufficient working capital. Moreover, in the last five years, Tesco is able to lower down this ratio every year, which again shows its better efficiency. On the other hand, Sainsbury needs to significantly work on this so as to maintain adequate working capital.

Trade Payable Payment Period

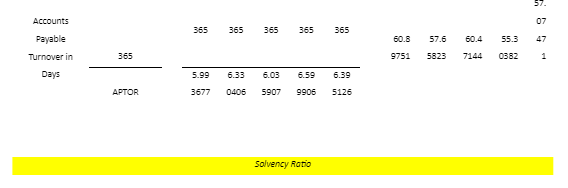

Every company expects that its payable days should be higher than receivable days so that it can maintain its working capital. If receivable days will be less than payable days, company will receive cash before it has to pay to its creditors. It means, the company will also have cash in hand to meet its obligations, otherwise it has to rely of debt financing. In present case, the receivable days of Tesco are less than its payable days, shows that company will not have cash crunch situation and it will have liquidity to meet its obligations. However, in case of Sainsbury the situation looks poor as its payable days are lower than the receivable. This clearly shows its inadequate working capital and because of which it has to rely of debt financing to meet its daily operations.

Investment Ratios

Dividends Yield

As per the analysis, the dividend yield for Sainsbury in 2022 is much better than Tesco and shows that it delivers better returns to its investors.

Earnings Per Share (EPS)

EPS tells about the corporate profitability of the company and is a good measure to price the stock. In the present case, Sainsbury maintains a better EPS as compared to Tesco and shows its better profitability. However, this number can be misleading as it does not guarantee future performance and also it can be influenced by how the company reports earnings and expenses.

Price/Earnings Ratio

As per data analysis, Tesco maintain a good PE ratio. Although it was reduced in 2021, but the company was able to regain it in 2022.

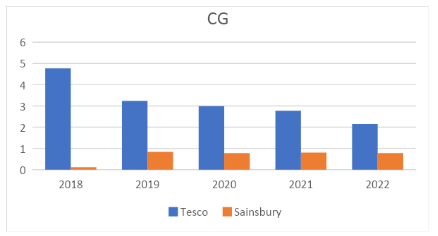

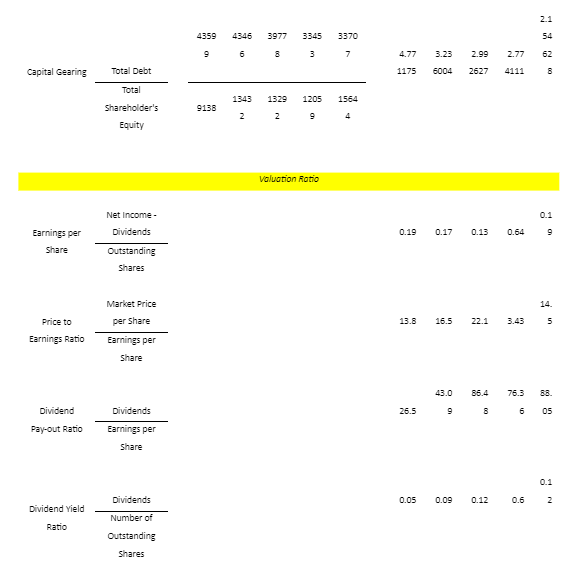

Capital Gearing

This ratio talks about the riskiness of the stock. Any company will higher debt amount as compared to its equity is considered as a risky stock. In the present case, Tesco looks more risky stock as the company has higher debt as compared to equity. On the other hand, Sainsbury maintains much less debt and thus it makes it less risky stock.

Conclusion

From the above financial analysis of Tesco and Sainsbury it can be concluded that both Tesco and Sainsbury were affected by the Pandemic. COVID-19 had its impact on the company’s performance as their performance degraded during those times. However, due to better credit management policies and efficient asset utilisation, Tesco was able to overcome the pandemic situation well in time. However, Sainsbury is still struggling to compete with the industry leader.

Dig deeper into Analyzing Disciplinary Issues and Leadership Values in The Royal Brunei Police Force with our selection of articles.

Recommendations

Based on financial analysis of Tesco and Sainsbury it is recommended that both the companies have to work on maintaining adequate current assets so that they can meet their short-term obligations. Poor current ratio and quick ratio shows that both the companies do not have adequate cash to meet their obligations and because of which many a times they have to rely on debt financing. For this purpose, they need to further stringent their credit management policies, so they never have cash crunch.

Part 2

Discuss this statement “Stock Markets do not create value” in terms of capital gains and losses made by stock market trading.

Contrary to what you might see on TV, stock markets are not the heart of capitalism. These are merely instruments that make it easier to buy and sell shares. The main focus of today's stock markets is speculation regarding the share values in the future, which is highly unrelated to actual investment or what is happening in the real economy of products and services. It's time for investors, like pension funds, to rebuild a long-term relationship with companies through a new investment structure (Koller et. al. 2010).

When created in the public interest, stock exchanges served a very specific public purpose: they provided a market for investors to sell their shares in those firms after they had raised capital from a sizable group of investors. A liquid market's promise reduced the cost of such equity to business, boosting economic growth and, at least theoretically, shared wealth.

Yet today's stock markets see far more activity than just capital formation. Undoubtedly, successful stock offerings give venture capitalists a way to reinvest funds raised in private markets into brand-new, cutting-edge start-ups. But the activity on the stock market is now dominated by short-term stock speculation, which has grown like a cancer into a large industry with little intrinsic value. This is made possible by the faster information flow (Anantharaman, 2020).

In his most recent letter to shareholders, Jamie Dimon, CEO of JPMorgan Bank, extols the virtues of liquid capital markets as one of the US's greatest assets. But the majority of those who praise market liquidity are typically just self-interested speculators. Furthermore, recent events have demonstrated that the tremendous global instability caused by our highly liquid markets—which led the world in this regard—has serious and long-lasting ramifications. Nonetheless, our short-term financial capitalism, which if allowed unchecked would undoubtedly bring about an economic, social, and ecological collapse, continues to be steadfastly based on this trader mindset.

Our stock capital markets are now unusable due to a combination of six factors:

- The privatisation of stock exchanges, which stripped them of their public purpose mandate and replaced it with a singular focus on increasing trading volume with a preference for high-frequency traders (computers programmed to trade).

- The rapid acceleration of trade volume generated by the unconstrained technological arms race in processing power and the acceptance of technology-driven information flow, which at key moments can be immensely destabilising.

- The mistaken rise of "shareholder wealth maximisation" in our business schools, boardrooms, and corporate finance departments on Wall Street (at the expense of all other stakeholder interests) (Merterns et. al. 2020).

- The well-intentioned but equally misguided practise of using stock-based incentives, and stock options in particular, as the primary means of senior management compensation, which encourages them to prioritise only short-term results at the expense of the long-term wellbeing of the company, the people, and the environment.

- The conflict of interest between true investors, such as pension funds, whose time horizon should be measured in decades, and middlemen with a short-term emphasis.

- The inability of regulators to implement structural changes, such as a financial transactions tax and other measures that would punish excessive speculation and encourage long-term profitable investment, in order to challenge the trader-driven paradigm (Elsaber, 2018).

Real investors don't have to confine themselves to this seriously flawed system; they can develop direct connections with businesses through negotiated, creative partnerships that are mutually beneficial and truly aligned with both parties' long-term objectives, including the balancing of financial, environmental, social, and governance imperatives.

References

- Anantharaman, T. S. 2020. Taxmann's Stock Market Wisdom – Lessons from a Lifetime in Capital Markets | 2020 Edition. Taxmann Publications Private Limited.

- Bhowmik, K. S. and Saha, D., 2013. Sources of Finance. Financial Institution of the Marginalized India Studies in Business and Economics. pp61-71.

- Bravo, G. M., 2007. Prior Ratio analysis procedure to improve data envelopment analysis for performance measurement. The Journal of the Operational Research Society. 58(9). pp. 1214-1222.

- Brigham, F. E. and Ehrhardt, C. M., 2011. Financial Management: Theory and Practice. 8th ed. Cengage Learning.

- Broadbent, M. and Cullen, J., 2012. Managing Financial Resources. Routledge.

- Correia, C. et. al., 2012. Financial Management. 6th ed. Juta and Company Ltd.

- Elsaber, K. 2018. Value Creation of Private Equity: An Empirical Analysis. GRIN Verlag.

- Fernie, J. and Ebooks Corporation. (2005). International retailing. Bradford: Emerald Group Publishing.

- James, J., Leavel, H. W. and Mainam, B., 2002. Financial planning, managers, and college students. Managerial Finance. 28(7). pp. 35-42.

- Jin, J., Yu, Z. and Mi, C., 2011. Commercial bank credit risk management based on grey incidence analysis. Grey Systems: Theory and Application. 2(3). pp.385-394.

- Kastantin, T. J., 2005. Beyond earnings management: Using ratios to predict Enron's collapse. Managerial Finance. 31(9). pp.35–51.

- Keller, A. 2011. Finance & Financial Management: Managing Financial Resources. GRIN Verlag.

- Koller, T. et. al. 2010. The Four Cornerstones of Corporate Finance. Wieley.

- Merterns, D. et. al. 2020. The Routledge International Handbook of Financialization. Taylor & Francis.

Appendix

Table 1Tesco Ratio Calculation

Table 2: Sainsbury Ratio Analysis

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts