Discusses The Dividend Irrelevancy

Dividend Irrelevancy Theory

The dividend irrelevancy theory was advanced by Miller and Modigliani who suggest that in those perfect worlds without bankruptcy costs and taxes, the dividend policy is not relevant (Kaur and Saraf, 2014). They further propose that a company`s dividend policy has zero effect on the prices of stocks or the capital structure of a company. They argue that if an investor gets a dividend that exceeds his expectations, then he is in a position to re-invest in the stock of the company with the additional cash flow (Ang and Ciccone, 2009). For students exploring finance dissertation help, understanding these theories provides a foundational insight into dividend policy and its implications in financial markets.

In the case that the dividend expected is too small, the investor then has the option of selling a part of his shares and further replicating the same cash flow he would get had the dividend been what he expected. In both scenarios, because investors are in a position to create their own cash flow, they become irrelevant to the dividend policy of a company. Investors only tend to care about returns that are high. It is possible for them to have that return by selling a part of their shares or even re-investing. In the case that the market conditions are perfect, the investors care less if the return is from appreciation of stock price or from dividends (Bhattacharyya and Morrill, 2015).

So that this theory can work, a certain mind frame is needed from investors and it is only possible to achieve this in a perfect world. The assumptions in this theory include; (Priya and Mohanasundari, 2016) Taxes are non-existent, both corporate income taxes and personal income taxes. There are no transaction or flotation costs in existence whenever a company issues a stock. Dividend policy has no effect on a company once a company has made decisions on its capital budgeting. Information about the future prospects of a firm is usually available to both the investors in a company and also the manager of a company. Any other information is usually readily available to all investors. The impact of leverage on a company`s cost of capital is zero.

In reality however, none of these assumptions are really true. Certainly, taxes are for each and every one of us. When dealing with issuances, companies have to deal with flotation costs. Even though information is readily available to each and every person, the sophistication and tools with which institutional investors can analyse securities is far much better than what retail investors can use. The information which a manager of a company can have is far much superior to what an institutional investor can ever have and this is despite the sophistication of the tools in the possession of the institutional investor. According to Miller and Modigliani, it is only the ability of a company to earn money and the potential risks in the activity have an impact on a company`s value. Even though their conclusions might stand true in theory, in the practical world, they do not stand true (Jabbouri and Attar, 2018).

In the event that the directors of a company hold the view that putting the profits of a business to work and as such making the business even more valuable, then the company does not need to pay dividends. Dividend stocks also have their risks because profits can be volatile and yields do not always grow. Interest rates effect on dividend stock is complicated. The Berkshire Hathaway company owned by Warren Buffet does not pay dividends (Kim, 2018). The company which has grown to be famous mainly through acquisition of other businesses performing well mainly in Canada and USA most of which actually pay dividends.

Dividend Relevancy Theory

In the case that the value of a firm is affected by dividend policy, it is considered to be relevant. In a scenario like this, a change in the dividend pay-out ratio of a firm is usually followed by a change in its market value. An optimum pay-out ratio must exist whenever the dividend is relevant. The ratio that gives the highest market value per share is known as the optimum pay-out ratio (Lee et al., 2015). According to Professor James E Walter, the value of a firm is always almost affected by the choice of the dividend pay-out ratio. Professor Walters work explores the significance of the relationship between the cost of capital and the internal rate of return in determination of the optimum dividend policy capable of maximising the shareholders wealth (Baker and Weigand, 2015).

A firm is able to retain its entire investment by utilising its retained earnings. The cost of capital and the internal rate of return of a firm remains constant. The earnings of a firm are either re-invested internally or paid out as dividends. A firm’s dividends and earnings will never change. The infinite life of a firm is very long.

Walter advanced a formula which can be used in the calculation of price per share which is as follows;

P = D/k + {r*(E-D)/k}/k

P = Market price per share

D = Dividend per share

E = Earnings per share

r = Internal Rate of Return

k = Cost of capital

According to the dividend relevancy theory, the relationship that exists between the internal rate of return of a company and its cost of capital determines the optimum dividend policy.

In general firms pay out dividends and also have a positive view of the dividend payments. Different investors like and expect to receive dividend income on their investment. Investors may adversely rate those firms that fail to pay out dividends and as such affecting the share`s market value. Because the uncertainty of investors is reduced by current cash dividends, investors discount the earnings of a frim at rates that are lower and as such placing a value that is higher on the shares. If paying out of dividends does not happen, the shareholders uncertainty increases, raising the rate required even higher and as such resulting to a lower market value of the share and even the firms value. A share`s market price increases if only the firm pays out dividends, otherwise, it is bound to fail. As such, it is necessary for a firm to pay out dividends to shareholders so as to fulfil their expectations so as to increase or maintain the share`s market price.

Over a five year period that ended in 2010, for example, IBM was able to generate $56 Billion to its shareholders in share repurchases and dividends. It`s quite hard to imagine that a company like IBM would be in a position to reinvest such a huge amount of money over that time I its own business and this is especially because it was already spending $6 billion year in year out on R&D and up to $1 billion on adverts and promotional materials (IBM, 2018).

Comparison and contrast of the dividend relevancy and dividend irrelevancy theories

While the dividend relevancy theory opines that dividend has an impact on a firm’s value, the dividend irrelevancy theory argues that the paid amount of dividend does not affect a firm’s valuation in any way. The logic put behind the dividend relevancy theory is that generally, investors are usually risk-averse and they often prefer current dividend and as such attach lesser importance to capital gains and future dividends. On the other hand, the dividend irrelevancy theory suggests that in financial markets that are perfect, the distribution of dividends does not affect the value of a firm in any way. Both theories are concerned with the financial policies related to firms.

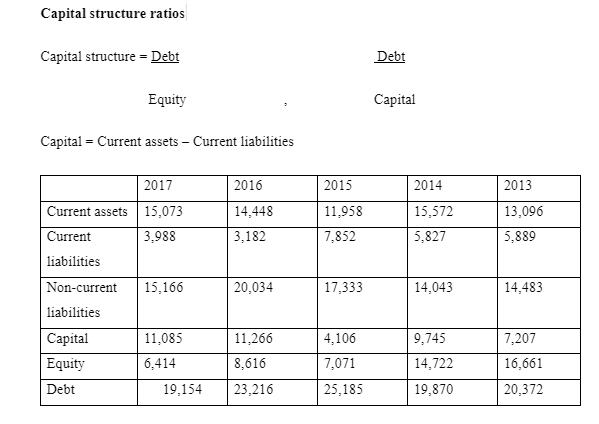

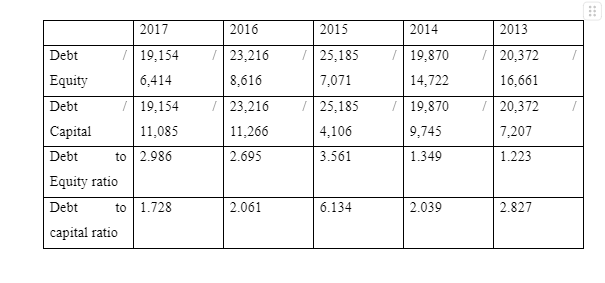

Capital structure

Capital structure refers to the amount of equity and/or debt that a firm employs to finance its assets and also to fund its operations. Typically, the structure is usually expressed as a debt-to-capital ratio or a debt-to-equity ratio (Robb and Robinson, 2014). Capital from debts and equity is used to fund business` operations, acquisitions, expenditures and other different forms of investments. There exists trade-offs that firms have to make whenever making decisions whether to raise equity or debt and managers are usually required to balance the two so as to come up with the optimal capital structure.

Often, a firm’s optimal capital structure is defined as the proportion of debt and equity that results in the lowest weighted average cost of capital (WACC) of a firm. So as to optimise the structure, a firm is usually required to make a decision whether it needs more debt or equity and further whether it can issue whichever it so requires. The new capital that is usually acquired is usually used to invest in new assets and can even be used to repurchase debt/equity that is outstanding as a form of recapitalisation (Korajczyk et al., 2015).

The Tesco group of companies was selected. Tesco is a British multinational company general merchandise and retailer whose headquarters are found in Welwyn Garden City, Hertfordshire, England, and United Kingdom. In the world, measured by gross revenues, it is the third largest retailer. Measured by revenues, it is the ninth largest retailer in the world. The company has shops in seven different countries across Europe and Asia. In the UK, it is the market leader of groceries with a market share of around 28.4% (Tesco, 2014). It is also the market leader in Ireland, Thailand and Hungary.

Continue your exploration of Digitalization of the Supply Chain in Relation to the Era with our related content.

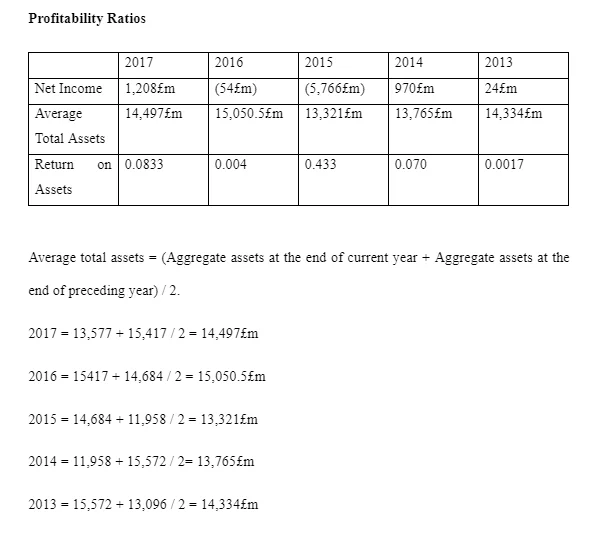

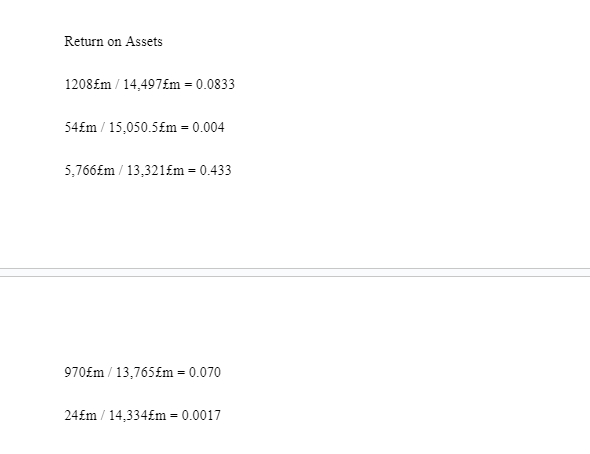

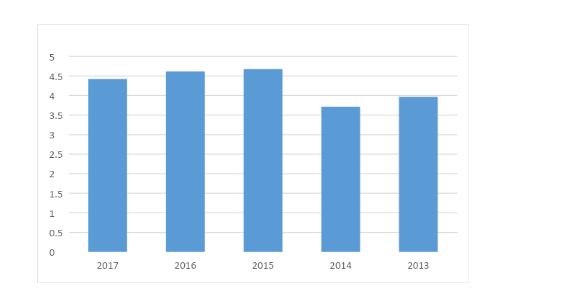

The ROA ratio is a measure of how effective a company is in converting the money used in the purchase of assets into profits and net income. High ratios are normally favourable to investors because this is a sign that the company is effective in the management of its assets in the production of greater amounts of income. Since 2013, TESCO plc. has managed to maintain a positive ROA ratio which is an indication of an upward profit trend. In the last five years, the company had the most positive ROA in 2015.

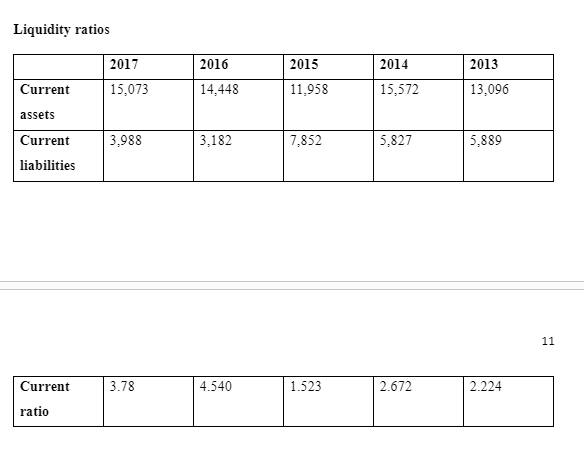

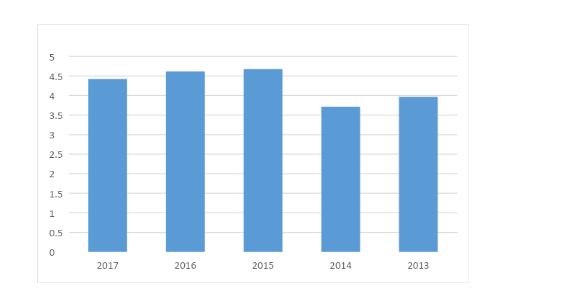

This ratio helps creditors and investors to get an understanding of the ease with which a company can be able to pay off its current liabilities. The ratio expresses the current debt of a company in terms of its current assets. As such TESCO plc.’s current ratio of 3.78 in 2017 indicates that the company has 3.78 times more current assets than current liabilities. In 2016, the company had a current ratio of 4.540 which is an indication that in 2016, the company was more able to make current debt payments in an easier way compared to 2017. This ratio also provides some insight on a company`s overall debt burden. In the case that a company is weighted down with a current debt, there is a high possibility that its cash flow would suffer.

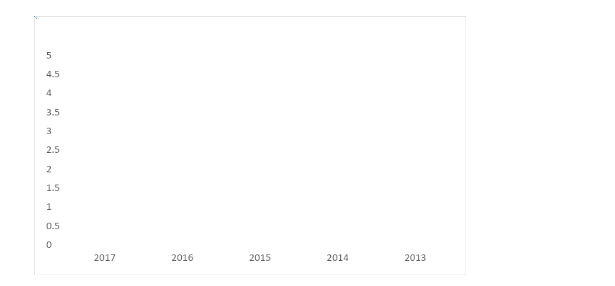

This ratio is a measure of how efficient a company is in utilising its assets in the generation of sales and as such a high ratio is always favourable. A higher turnover ratio is an indication that a company is more efficient in the utilisation of its assets. A lower ratio is an indication that the company is not utilising its assets efficiently.

From the above graph, it is evident that TESCO plc.’s asset turnover ratio faced a drop in 2016, but then picked up in 2017. The drop in 2016 would most likely have been as a result of production or management problems. The company`s efficiency ratio of 3.95 in 2017 is an indication that in the same year, the company generated 3.95 dollars of sales from every dollar that was invested in assets.

This ratio measures current assets as a percentage of current liabilities and as such, high ratios are usually more favourable. TESCO plc.’s working capital ratio of 3.78 in 2017 is an indication that the company is very well able of paying off its current liabilities and even after paying will be left with some current assets and a positive working capital. Changes that would have an impact on the Working Capital Ratio include an increase of the current assets which would also increase the WCR, a decrease in current assets which would lead to a decline in the WCR, a decline in current liabilities which would lead to an increase in WCR. Over the past five years, TESCO plc.’s WCR has always been positive, which is a clear indication that the company has always been able to meet its short term obligations and bills with its liquid assets.

Risks faced by TESCO plc

The group faces risks that are related to fluctuations in foreign exchange rates and interest, the availability of funds to meet business needs and the risk of counterparties to financial transactions defaulting. Credit risks come about from customer deposits, cash and cash equivalents, financial deposits and instruments with financial institutions and banks and trade and other receivables. The interest rate risk is an ever present risk that the value of an investment will change as a result of a change in the spread between two different rates and in any other interest rate relationship. Changes like this usually have an adverse effect on securities and it is possible to reduce them by hedging or diversifying. Mostly, the interest rate risk affects the value of bonds in a more direct way than stocks. As such, it is a major risk to all holders of bonds.

Optimal capital mix

The chief goal of any corporate finance department should be to come up with the optimal capital structure that would bring about the lowest WACC and the companies maximum value.

The capital Mix that would be the most appropriate for TESCO plc.

An optimal capital mix would require using enough equity so as to be able to able to mitigate the risks of being in a position whereby the company would not be able to pay its debts – taking into account the variability of the cash flow of a business.

Debts cost is usually not as expensive as equity because it is not as risky. The required return that would be required to compensate debt investors is usually less compared to the return that would be required to compensate equity investors. This is largely due to the fact that payments of interest usually have a higher priority over dividends and in the event of liquidation, holders of debts receive priority. When compared to equity, debt is cheaper and this is because companies get tax relief on interest, while it is only after tax income that dividends are paid out. There is however a limit to the amount of debt that a company is allowed to have and this is because, high amounts of debts bring about increments in the payment of interest and earnings volatility and even the risk of bankruptcy. An increment of the financial risk to shareholders like this would require returns that are even greater to compensate the shareholders which would lead to an increment in the WACC and further lower the market value of a business.

References

- Ang, J.S. and Ciccone, S.J., 2009. Dividend irrelevance theory. Dividends and Dividend Policy, pp.95-113.

- Baker, H.K. and Weigand, R., 2015. Corporate dividend policy revisited. Managerial Finance, 41(2), pp.126-144.

- Bhattacharyya, N. and Morrill, C.K., 2015. Capital Structure: Theory and Evidence. IBM. (2018). Direct deposit of dividends. [Online] Available at:

- Jabbouri, I. and Attar, A.E., 2018. The dividend paradox: a literature review. International Journal of Markets and Business Systems, 3(3), pp.197-221.

- Kaur, P.R. and Saraf, D.P., 2014. The Study of Dividend Policy: A Review of Irrelevance Theory. International Journal of Innovatory Research in Science and Management, pp.1-12. Kim, T. (2018). Warren Buffett’s Berkshire Hathaway will make about $700 million annually on Apple’s dividend alone. [Online] CNBC. Available at:

- Korajczyk, R.A., Levy, A., Chaplinsky, W.T.S., Clayton, M., Daniel, K., Hennessy, C., Hodrick, L. and Petersen, J.D.L.M., 2015. 2002, Capital structure choice: Macroeconomic conditions and financial constraints. In Journal of Financial economics. Lee, C.F., Gupta, M.C., Chen, H.Y. and Lee, A.C., 2015. Optimal pay-out ratio under uncertainty and the flexibility hypothesis: theory and empirical evidence.

- In Handbook of Financial Econometrics and Statistics (pp. 2135-2176). Springer, New York, NY. Priya, P.V. and Mohanasundari, M., 2016. Dividend Policy and Its Impact on Firm Value: A Review of Theories and Empirical Evidence. Journal of Management Sciences and Technology, 3 (3). Robb, A.M. and Robinson, D.T., 2014. The capital structure decisions of new firms. The Review of Financial Studies, 27(1), pp.153-179. Tesco, P.L.C., 2014. Annual Report and Financial Statements 2014. Zugriff am, 15, p.2014.

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts