Exploring Management Accounting Systems

Introduction:

Management accounting system has been a critical part of the financial structure of the organization. There are various techniques through which the process of the management accounting can be processed which will be discussed in the upcoming parts and also learn how the system of the management accounting works with an example for the beneficiary of the accountant and the management. The data that is obtained from the management accounting is robust and the techniques are unique in nature to the other financial method. The various uses of the planning tools will also be addressed and in response to how TSR Pvt Ltd can use it for dealing with its financial problems.

LO1 Demonstrate an Understanding of Management Accounting Systems (P1, P2, and M1 & D1).

Management accounting works on the basic fundamental of financial accounting but in a different approach. Management accounting can be described as the analysis of how the price of the product can be adjusted to attract more customers, the number of units that the customer needs to sell in order to be profitable. Moreover, it also analyzes the returns to the employees in the manner of bonus and incentive is also calculated. Management accounting is a process of where the organization determines show the management is functioning and how the various other processes affect the business. It also helps the creditors and the shareholders to get more information about the management (Nitzl, 2016).It is important for the accountant for the preparation of the management report because it will help the management take a more robust managerial decision and help to understand the operation of the organization and the various effects of the decisions. It also can help TSR to determine its yearly business target and plan accordingly (P1). The process of the management will get better with respect to the decision process and also provide better service to the customers as they will be able to provide more quality service. The most important aspect is that it increases the businesses efficiency and helps in determining the performance of the management (Cooper, Ezzamel and Qu, 2017). The most important aspect in relation to the major difference in the management accounting and financial accounting is that the management accounting system helps in the addressing of the various costs related and internal matter of the company and is not for the outsiders as it is internal and confidential. Whereas, financial accounting is basically a statement of how the business is working and how the assets and liabilities of the company are dealt with the financial year (M1).

Of the various type of Management Accounting Systems, Cost Accounting is used to determine the variable cost of the products and understand how the cost will affect the profitability of the company. The analysis of the accurate cost is important as it will affect the company directly and its profitability. It also helps the company for the cost control process and the inventory valuation. Mainly there are two types of cost accounting systems, which includes the Job Order Costing and the Process Costing. The companies which produce unique products or take special orders, such as the producers of niche furniture, is most appropriate to use Job Order Costing as they have separate manufacturing cost for each product. A company where there are multiple departments, such as in oil refineries, where the cost flow from one department to the other is most appropriate to use Process Costing (Kaplan and Atkinson, 2015). However in a few cases some companies have to use the combination of both the costing, and that is known as the hybrid costing. However, the cost allocation is also done in two ways. In traditional costing system, a single overhead cost of the products is calculated and then they are applied to each of the departments, whereas in activity-based costing, first the activity rate is calculated and then they are applied to the overhead cost of each product, according to their activity usage. On the other hand, the Inventory Management system helps to determine the way the goods are transferred from the manufacturer and to the warehouse to the various point of sales accordingly (Cooper, Ezzamel and Qu, 2017). The Job Costing System is a structural way of determining the cost of the product on the per unit basis. It basically segregates the different products on the basis of the different cost of them. In the Job Costing System, one needs information about the three most important things for an organization. In order to do so, it has to track the Direct Labour of the organization, along with its Direct Materials and Overhead (Richards, 2017). The cost of the material is added up when they are sent for use, and of some are returned back then they are subtracted later on. In the case of direct labor, all the labor information can be collected using the internet in any other way so that they can be applied appropriately. Allocation methodology is used to track the overhead.

Finally, Price Optimization is the use of different price and check how the consumers respond to them and how it affects the profitability of the company. The company needs to determine the perfect price in which the consumer accepts it and gains maximum profit.While making a decision about the pricing of a product the company must understand the value customers have on that particular product (Alptekinoğlu and Semple, 2016). Along with that, they must know the cost of its competitors and then make competitive price accordingly. Finally, it should handle its cost effectively, and set price after keeping a reasonable margin on top. The management accounting will analyze the financial data and prudence a favorable report to the management for taking sound managerial decision for the organization. The financial data must be accurate and should be up to date for a report from the management accounting to be accurate and be able to take a strategically plan for the management(Chenhall and Moers, 2015). The analysis of the variable costs, fixed cost and the use of the data to create diversification are important for the management to take. This is only done when the management gets the financial data in s structured way and provides relevant data for the management.

The Budget report is created to understand the difference in the actual performance of the company in respect to the budgeted performance and later it is evaluated by the company to plan the cost accordingly (Chenhall and Moers, 2015). The performance report addresses the activity of an individual and evaluates it on the basis of the budget and the standard difference. The job cost report helps in understanding the expenses which have been incurred on particular aspect. In this regard, TSR Pvt ltd can incorporate job costing method in order to prevent issues associated management accounting system (P2, D1).

LO2 Apply Range of Management Accounting Techniques (P3, and M2 & D2).

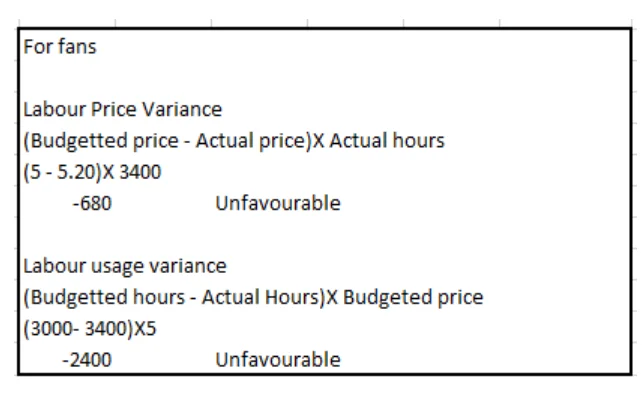

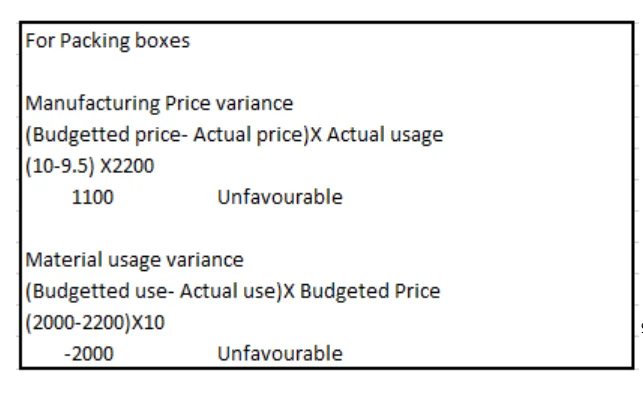

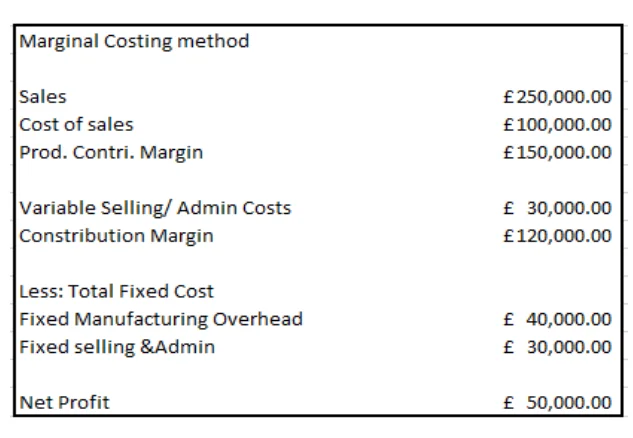

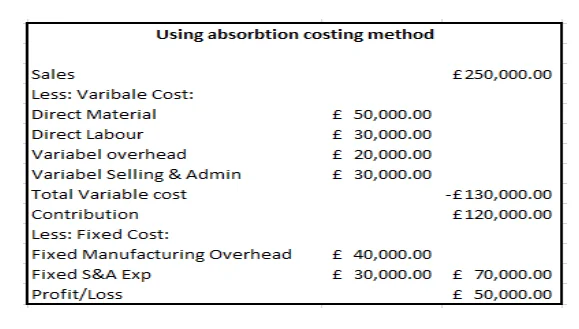

The cost in accounting can be described as the sum or the amount that the company has to incur in order to produce a new product and to sell it accordingly. Whereas, the cost analysis can be described as the way of measuring the relationship between the cost and the output relationship which are in actual correlated. The analysis helps in determining the productivity with respect to the cost of the product (Otley, 2016). There is the different type of cost that business incurs, which are the fixed cost which does not change with the change in production, whereas the variable cost changes with a number of products produced. There are also away of differentiating the cost where it is used directly by the business which is known as a direct cost and indirect cost which are not used directly by the business (P3). The cost volume profit of the company is used to determine how the volume and the cost of the product affect the organizational income in respect to operation. Flexible budgeting is the way of budgeting where it adjusts and changes with the change of the units produced and the activity. Cost variance can be described in the difference between the cost that was budgeted and the cost that was actually incurred (Jbarah, 2018).The marginal costing method can be described as the method where the costs that were actually incurred is taken into consideration and also when the units are produced individually. Whereas, in the method of the absorption costing all the cost incurred during the production are applied to all the units.

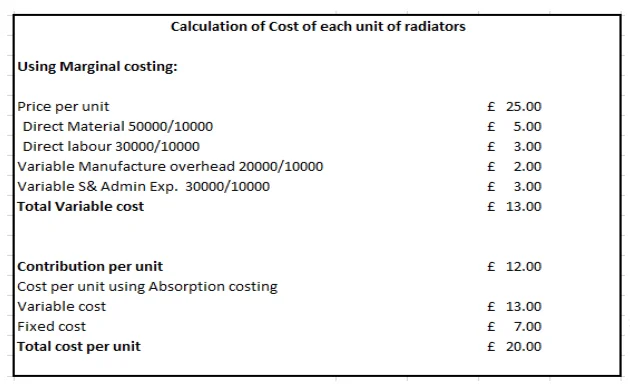

The production of a product basically takes into consideration the two costs which are the fixed and the variable costs. The fixed cost as discussed earlier can be described as the one where the cost is fixed and it does not change accordingly with the change of the product but on the other hand the variable cost is the cost which the organization incurs in the production process when there is production. The variable cost changes accordingly with the change in the units produced (Jermias, 2017). The use of the cost allocation can be described as the method where the costs are addressed into the costobject which is done by identifying, assigning and aggregating accordingly to the organizational need. The normal costing can be described as the process where the actual data is used for the development of the cost of the product in accordingly where the manufacturing cost and the overhead costs are not taken into consideration, whereas, in the process of the standard costing all the costs are taken into consideration and are mapped accordingly for the product. In the method of the activity based costing, the cost is simultaneously allocated to the different overheads in which they belong accordingly (Sokolov, Elsukova and Sadykova, 2016). Finally, the role of the cost is very important for the price setting of the product as it affects the behavior of the product in the market. The market demand and the competition need to be taken into consideration when the cost is set for a product. Any mean of overstatement or underestimation must be avoided in the process. Inventory cost, on the other hand, can be described as the cost which is related to the managing and storing of the inventory. The different type of inventory cost is the carrying cost, the cost of running short and the ordering cost of the product (Hopper and Bui, 2016). The inventory cost can be reduced by evaluating the SKUs, keeping the level of the inventory up-to-date and finally to track the movement of the inventory to reorder and it will increase the profitability of the company. The cost variance can be described as the variance in the cost which is budgeted and actual. Overhead cost is the cost that is important for the going concern of the business but does not directly affect the business activity. The estimated overhead costingof TSR Pvt Ltd and its others expenses of the business are represented below through costing analysis and preparation of income statement (M2).

Inventory cost, on the other hand, can be described as the cost which is related to the managing and storing of the inventory. The different type of inventory cost is the carrying cost, the cost of running short and the ordering cost of the product (Hopper and Bui, 2016). The inventory cost can be reduced by evaluating the SKUs, keeping the level of the inventory up-to-date and finally to track the movement of the inventory to reorder and it will increase the profitability of the company. The cost variance can be described as the variance in the cost which is budgeted and actual. Overhead cost is the cost that is important for the going concern of the business but does not directly affect the business activity. The estimated overhead costingof TSR Pvt Ltd and its others expenses of the business are represented below through costing analysis and preparation of income statement (M2).

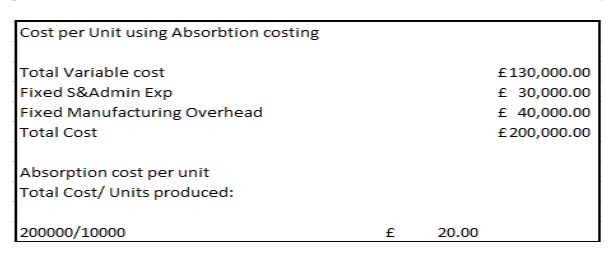

The total cost per unit was £ 20.

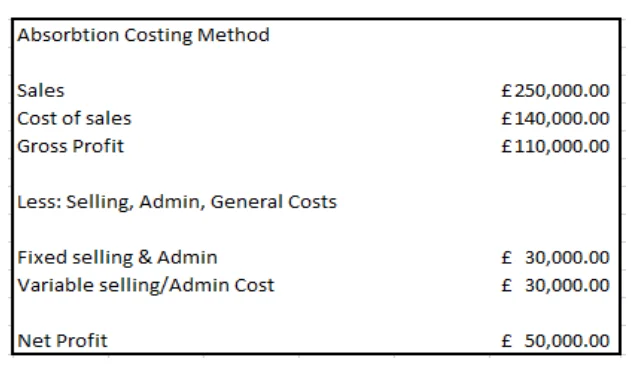

Under the marginal costing method, the net profit was 50000 and was the same under the absorption method.

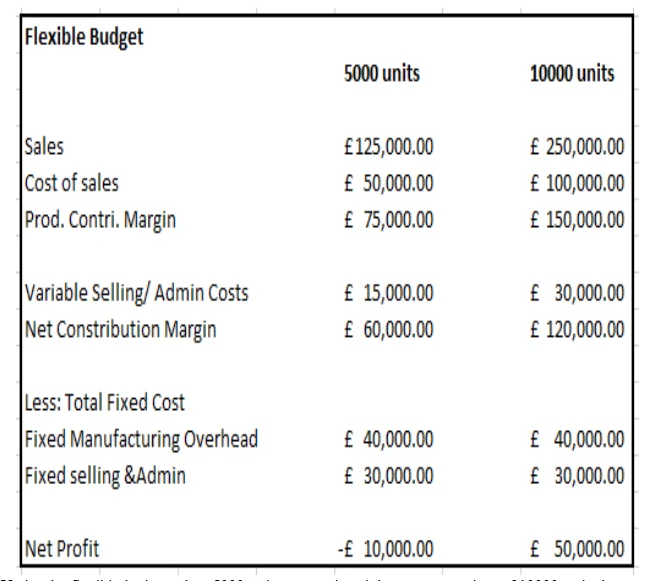

Under the flexible budget when 5000 units are produced there was a net loss of 10000 and when there was a production of 10000 units there was a profit of 50000.

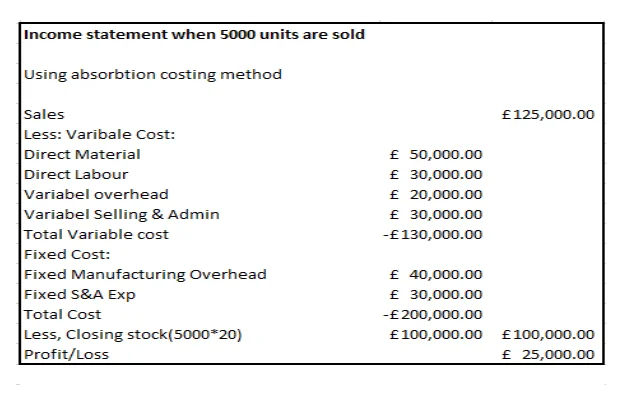

There was a profit of 25000 when income statement was prepared for 5000 units (D1).

Under the absorption method, the profit was 50000.

LO3 Explain the Use of Planning Tools Used in Management Accounting (P4 and M3 & D3)

Certain advantages and disadvantages can be noticed while dealing with the planning tools of budgetary control. It has been observed that budgetary planning tools are used for maximizing the level of profits in the organization. In addition to this, such tools are also helpful for measuring the performance strategy of TSR Pvt Ltd. It also helps in identifying the negative impacts of budgetary control in the process of management accounting. It also assists the organization by reducing the budgetary costs. On the other hand, the planning tools of the budgetary control face a certain affecting issue that negatively impacts the organization’s financial structure (Kerzner and Kerzner, 2017)(P4). Budgeting plays an important role in planning issues. It has been noticed that strategic planning is done for understanding its application in the process of budget forecasting. Different planning tools are used for managing the budget forecasting and for this process; there is a need for implementing some strategies. For forecasting of budget, ecological, monetary as well as social investigation needed to be done. On the other hand, there is also a need for creating connections between sectoral and spatial issues. Apart from this, planning should also be done for understanding the need in the future. Innovative strategies can also be implemented in this process (Cascetta et al., 2015). In addition to this, it is also useful in forecasting the cash flow level and the issues that are related to financial control. The trainee management accountant needs to identify the areas of difficulty in the planning tools. Thus, in this manner, TSR Pvt Ltd will be able to prepare and forecast the budgets accordingly with the help of the management accounting trainee (M3). Planning tools will be effective enough for solving the financial problems that are leading in the organization. For identifying the financial problems, PEST analysis, Porter’s Five Forces and SWOT analysis are done.

SWOT Analysis

With the help of the SWOT analysis, the management will be able to understand its strengths, weaknesses and opportunities and threats that are leading in the structure. For understanding the strengths and opportunities, they must analyze which products or services are successful and find out the assets and competitive advantages. How it can change its operations according to the latest trends and how it is going to impact the business will give a clear view of its opportunities (Bull et al., 2016). It can overcome its weaknesses by bridging the gaps and understanding the places where it needs improvement. Similarly recognizing new technologies or trends which can be threats to the business will help it to take preventive measures.

PEST Analysis

On the other hand, PEST analysis will be helpful enough for identifying the political, economic, social and technological issues that may give rise to the financial problems in the organization. PEST Analysis also helps an organization to get a clear view of the threats in advance which it may have to face in the future. Based on this analysis they can find out the opportunities which they can work on in the present and go with the flow (Whitehead, 2017). Also, the company gets an understanding about which project have a chance to fail and does not have to depend on assumptions while entering a new country, or market or a region. The political analysis gives a clear perception of the laws and legislation of the new country, while the economic one gives the economic condition and the unemployment rate of the same. Social factors make it understand the religious view and lifestyle choices of the citizens, while the technological one gives the view of available infrastructure and educations institutions.

Porter’s Five Forces Analysis

However, Porter’ Five Forces is used for analyzing the competitive factors and the rivalry issues that are affecting the organizations’ structure. It will help in finding other competitors in the market of the industry, which is helpful to understand the intensity of competition they may face. If new companies are entering the market then knowing their potential is of utmost importance similar to the substitute products they may bring in the future (Anton, 2015). To grow and be stable in the market the company must have an assumption of the power of the suppliers as well as the customers, which is done with the help of Porter’s Five Forces Analysis. In this way, the trainee management accountant will be able to analyze the financial position of the company or the organization. After identification, the planning tools and the costing systems will be used for solving the financial problems that are raised in the organization. This will be helpful enough for bringing success in the structure of the organization. Thus, planning tools of the management accounting will be effective enough to enhance competitive advantages for the development of TSR Pvt Ltd (D3).

LO4 Compare Ways in Which Organizations Could Use Management Accounting to Respond to Financial Problems (P5 and M4 & D3)

Different financial problems can be identified in the management accounting process. While identifying such problems, benchmarks, budgetary targets and key performance indicators are used. With the help of benchmarking, this company will be able to find out the level of best performance standard it can reach in the eye of its competitors or other industries. First, it needs to find out areas where it lacks performance and make a list, then shortlist the most important one and find ways to solve it by analysis its competitors (Ramón, Ruiz and Sirvent, 2018). The budgetary target will enable it to make an estimation of the amount of money to be needed for the operation of the company and other expenses, in order to stay within the limit. Some of the key performance indicators are the cost of goods sold, cost, profit, LOB Revenue vs Target, LOB Expenses vs Budget, sales by region, number of customers, etc. It has been observed that the organization is thinking of adapting the management accounting process for responding to financial problems. For this purpose, financial governance strategy is needed for the role of monitoring. The way by which a company collects data, and then manage and monitor it and finally controls all this financial information is known as the financial governance of the company. Finance governance plays a great role in this by responding to financial problems. This helps in identifying the ways of preventing problems related to finance. It helps the organization to close the financial processes faster and by speeding up the whole process, which gives a clear ownership to the company and also accountability (Bratton, 2018). It can also identify different risk of the organization and produce complaint regulatory report along with disclosures. It makes the models, budget, plans and forecasts accurate. On the other hand, the trainee management accountant needs to focus on the negative issues related to finance. For overcoming these, different accounting skills needed to be focused upon.

Communication skills needed to be improved and on the other hand, there is also a need for having numerical and analytical abilities (Maskell, Baggaley and Grasso, 2016). In addition to this, there is also a need for having some knowledge about the business or the organization structure. However, the trainee management accountant should have the ability to work in the form of the team in the organization. Following this management accounting skills, the organization will be able to overcome the financial problems that are arising in their financial structure. In this manner, different efficient strategies and methods will be used for bringing success by diminishing the problems of TSR Pvt Ltd (P5). An effective management accountant must have certain characteristics, such as collaboration with all which means he must be a good team player and earn trust of subordinates as well as the senior officials. Commercial awareness is highly important because he must have knowledge and business skills to understand how an organization works as a whole. With good ethics and high level of transparency, the accountant will be able to build a good foundation in the organization and encourage others to follow his footsteps be setting an example (Lees, 2017). Gathering accurate data and on time delivery of that information to the right person needs insight which he must be able to deliver. He must be up to speed with latest technologies, not just MS Excel but different automated tools which include reporting tools such as Cognos, TM1and ERP systems such as Sage, Oracle, and SAP etc. It has been noticed that the organizations use the tools of the management accounting for identifying and overcoming the financial problems. On the other hand, it can be noticed that the financial problems needed to be identified for obtaining success in the organizational structure. Management accounting skills will be helpful enough as with this, the company will be able to deal with the analytical abilities (Epstein, 2018). These capabilities will be helpful for measuring the performance of the business or analyzing the cash flow statement. On the other hand, technical processes will also be used for identifying the accurate cost estimation during the time of forecasting. The trainee management accountant needs to gain some knowledge about business fundamentals. In addition to this, there is also a need for improving communication as well as interpersonal skills.

In this way, the company will be able to understand the affecting factors that are coming in the path of the financial development of the organizations. Moreover, it can be said that these strategies and systems are quite helpful for bringing efficiency in the organization. In addition, it is also helpful for creating a well-established financial position in the structure of the organization. In this manner, the management accountant will be capable enough to reduce the problematic factors of the financial aspects for TSR Pvt Ltd. and it will also help the firm to ensure its sustainable business operations for long future (M4).

Conclusion

Management accounting plays a vital role in the organization. Different tools and techniques are used in this process. For overcoming these above discussed financial issues of management accounting’s Pvt ltd needs an effective skilled enough, financial accountant, who can make better financial decisions for TSR Pvt Ltd and can lead the organization towards success.

References

Alptekinoğlu, A. and Semple, J.H., 2016. The exponomial choice model: A new alternative for assortment and price optimization. Operations Research, 64(1), pp.79-93.

Anton, R., 2015. An Integrated Strategy Framework (ISF) for Combining Porter's 5-Forces, Diamond, PESTEL, and SWOT Analysis.

Bratton, W.W., 2018. Collected Lectures and Talks on Corporate Law, Legal Theory, History, Finance, and Governance. Seattle UL Rev., 42, p.755.

Bull, J.W., Jobstvogt, N., Böhnke-Henrichs, A., Mascarenhas, A., Sitas, N., Baulcomb, C., Lambini, C.K., Rawlins, M., Baral, H., Zähringer, J. and Carter-Silk, E., 2016. Strengths, Weaknesses, Opportunities and Threats: A SWOT analysis of the ecosystem services framework. Ecosystem services, 17, pp.99-111.

Cascetta, E., Carteni, A., Pagliara, F. and Montanino, M., 2015. A new look at planning and designing transportation systems: A decision-making model based on cognitive rationality, stakeholder engagement and quantitative methods. Transport policy, 38, pp.27-39.

Cooper, D.J., Ezzamel, M. and Qu, S.Q., 2017. Popularizing a management accounting idea: The case of the balanced scorecard. Contemporary Accounting Research, 34(2), pp.991-1025.

Hopper, T. and Bui, B., 2016. Has management accounting research been critical?. Management Accounting Research, 31, pp.10-30.

Jbarah, S.S., 2018. The Impact of Strategic Management Accounting Techniques in Taking Investment Decisions in the Jordanian Industrial Companies. International Business Research, 11(1), pp.145-156.

Lees, G., 2017. The management accountant as risk manager. The Routledge Companion to Accounting and Risk.

Nitzl, C., 2016. The use of partial least squares structural equation modelling (PLS-SEM) in management accounting research: Directions for future theory development. Journal of Accounting Literature, 37, pp.19-35.

Richards, G., 2017. Warehouse management: a complete guide to improving efficiency and minimizing costs in the modern warehouse. Kogan Page Publishers.

Sokolov, A., Elsukova, T. and Sadykova, A., 2016, March. Management of financial results of the organization by using management accounting techniques. In Proceedings of Economics and Finance Conferences (No. 3205778). International Institute of Social and Economic Sciences.

Whitehead, J., 2017. Prioritizing sustainability indicators: Using materiality analysis to guide sustainability assessment and strategy. Business Strategy and the Environment, 26(3), pp.399-412.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts