RAZ Corp's Competitive Simulation Review

PART 1

Introduction

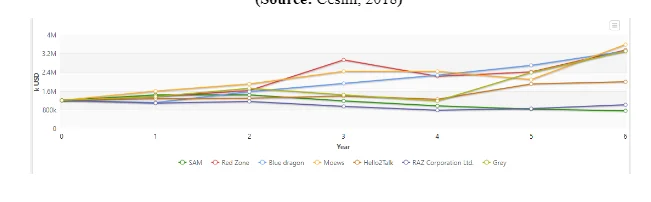

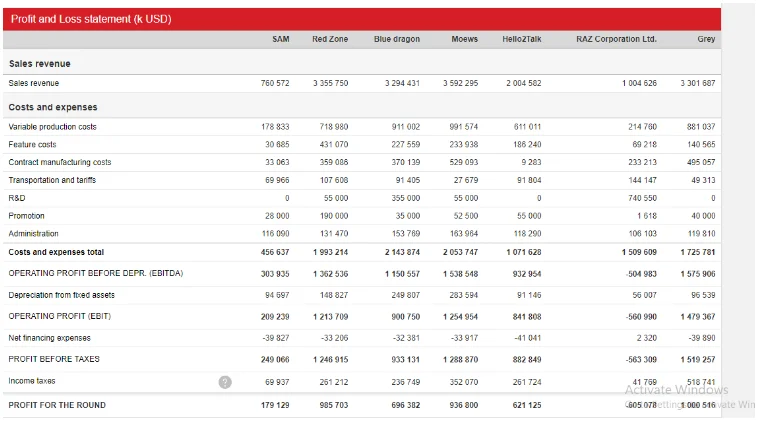

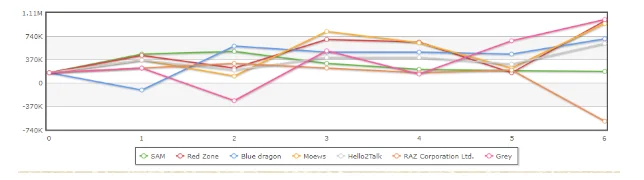

The purpose of the subsequent study has been led to the selection of the RAZ Corporation Ltd which operates as the manufacturing organisation of a range of different mobile handset phones as well as smartphones. In the simulation of Cesim Global operational challenge, the RAZ Corporation Ltd could be observed to manufacture mobile phone sets at USA and the sales market of the company is primarily situated at Europe. The RAZ Corporation Ltd has to compete with seven other simulated companies of SAM, Blue dragon, Moews, Hello2Talk, Red Zone and Grey within the mobile handset manufacturing industry. At the culmination of the round 6 of the simulation, the RAZ Corporation Ltd currently is situated at the 6th position concerning the extent of sales revenue. RAZ Corporation Ltd has suffered the loss extent of -605078$ at the culmination of the 6th round of operations. In this context, the primary concern for the company under consideration is the extensive liabilities of the RAZ Corporation Ltd which could be comprehended to be $536250 and this is only surpassed by the liabilities of Hello2Talk ($544375). This has been a direct outcome of the second highest long term loans of $510789, only second to that of the long term loans of the Blue Dragon ($1060789).

The External Environment

Global Market Share Development

The production capability of only the Tech 1 based products and poor strategic approaches culminated in the downfall of the efforts of the RAZ Corporation Ltd. RAZ Corporation Ltd should invest in the development of the production plants which could manufacture the Tech 2,3 and 4 based handsets which could as well diversify the revenue generation bases for the company.

Growing demand for Tech 3 and 4 in Europe

There has been consistent increment in the demand of technologically advanced devices at Europe and the emphasis is on the products belonging to the Tech 3 and 4 categories. The RAZ Corporation Ltd could achieve better sales revenue through undertaking of greater and more effective R&D through which better feature addition could be achieved in the existing products and in the future prospectus features as well (Darroch, Miles and Jardine, 2015).

Threats

High Competition

Currently, the RAZ Corporation Ltd is the second highest loss incurring organisation within the Cesim simulation scenario in terms of profit margin earning. The business scenario in the future rounds of the mobile handset manufacturing industry could not be forecasted to be of any positive nature in terms of having space for incorrect decisions. If the RAZ Corporation Ltd could not achieve any success to increase the sales and revenue margins then the company could be relegated to the position where it could not remain in effective competition and could become insolvent.

High debts

Europe has been experiencing consistent growth in the popularity of the Tech 3 and 4 products and the companies have been gradually investing in the process of introduction of the newer handsets in this regional market. However, the manufacturing of the Tech 2,3 and 4 products by the RAZ Corporation Ltd has been curtailed out of the effect of high long term loans ($510.789) of the company. The increasing of such debt has to be addressed or else the diversification of manufacturing could not be undertaken by the RAZ Corporation Ltd.

High Negative Return on sales

For the RAZ Corporation Ltd the key factor of concern could be outlined to be the consistent negative value on the return on sales since the company is incurring losses of more capital than which it could gain. The business strategies of the company has so far been affected by primarily lack of capacity to manufacture Tech 2,3 and 4 products and by erroneous business decisions as well. The capital which had been expended for development of the manufacturing plants at the USA and Asia have yielded little dividends since the 1.1k manufacturing units at Asia have not provided any manufactured product and the demand has also fluctuated significantly regarding the Tech 1 based products.

Porter’s five forces

Bargaining power of the suppliers

The cost of the manufactured product in comparative relativity with the overall cost of production and marketing is considerably high for the RAZ Corporation Ltd, however, the other competing organisations have exhibited relative reduction in the cost of the product in relative comparison with the overall cost of manufacturing and marketing. The element of product differentiation is relatively low since the end products of all of the operating organisations are similar and the range is also limited (Albrecht et al. 2015). The competition between the suppliers is intensive since the multiplicity of numbers of the suppliers provides the opportunity to the customers to acquire products from multiple sources (Davcik and Sharma, 2016).

Bargaining Power of Buyers

The Cesim simulation provides the fact that the bargaining power of the buyers has been considerably high. Buyers always prefer and appreciate the prices when these could be lower in comparative manners. At the primary rounds, the strategy of RAZ Corporations Ltd had been the process of skimming the global market segments through the charging of prices which had been higher. The product differentiation approaches have been persistently not adopted by the company under consideration given that the company only manufactures Tech 1 based products.

Competitive rivalry

The element of competitive rivalry is considerably high since all of the seven companies have similar access to the necessary resources to manufacture and sell the products. For the RAZ Corporation Ltd. it has been considerably difficult to gain any opportunity of expansion since it had to continuously contest with the other companies which had invested greater resources in the product promotion and differentiation processes. In this context, the company under consideration had to reduce the price extent on the Tech 1 products which had been sold, albeit in meagre numbers, to the Asian regions (Li, 2017).

Threat of substitutes

The threat of substitutes of existing products of RAZ Corporations Ltd regarding the prices and performance measures is high due to relatively low product differentiation. This has been amplified for the reason that the company under consideration only manufactures and sells products which are based on Tech 1.

Threat of new entry

For the RAZ Corporation Ltd, the company is primarily dependent upon the dividends received from the subsidiaries. The information regarding brand loyalty is not extensive concerning this research. The ability of the customers to switch costs is also high due to the fact of 7 different organisations having to compete within the same market sphere. The different companies have different measures of economies of scale and the existence of such economy of scale for the RAZ Corporations Ltd has been moderate since the total operating expenditure for the company has been 15,09,609 $. The cost advantage in absolute terms is non-existent in this regard. The legal and administrative barriers vary from national market to market. The propensity of retaliation from existing companies could be high since this industry is a hyper competitive one (Crespo, Suire and Vicente, 2015).

PEST Analysis

Political

The influence of political factors could involve differential policies of telecommunication and administrative directives regarding the tariff and customs barriers at different national market regions. Furthermore, the open market policy based operational policies and variations in the measures of governmental control over the telecommunication sectors in different countries of the three market spaces.

Social

According to Faccio and Zingales (2017) the social influences on the operational capability of RAZ Corporations Ltd could be understood to be the changing trends of the smartphone based application preferences of by the existing customers as well as the diverging perspectives of product preferences regarding the urban and rural hinterland based customers of the three different market zones.

Technological

The emerging technological applications such as more streamlined manufacturing automation, artificial intelligence based manufacturing and assembly systems and utilisation of voice based mail facilities within the manufactured handsets could be significant influences on the industry under consideration.

Economic

The incurrence of income tax remission of 41,769 $ and tariff duties of 1,44,147 $ and overall trade related expenditure of 15,09,609 $, the economic factor holds the most significant importance in delineation of the competitive position of the RAZ Corporations Ltd in relative comparison with the other 6 competing companies.

Giachetti and Marchi (2017) has stated that legal stipulations related to the business and manufacturing activities of RAZ Corporation Ltd. are reflective of the issues associated with market monopolies, governmental regulations and conformation to specifications of telecommunications and these constitute the legal influence factors for the company under consideration. Regulations related to import and export duties are also considered to be the legal influencing factors (Giachetti and Dagnino ,2014).

Internal Analysis

Strengths

Cost management

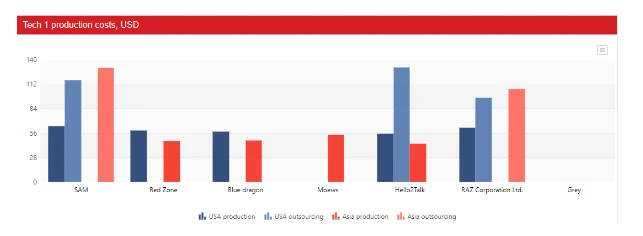

The second least extent of variable production costs comparatively ($214760). The second least extent of feature costs comparatively ($69218). The least amount of administration cost comparatively ($106103).

Gradual rise in the sales revenue in the 6th round

The sales revenue had increased from $844.73k in the 5th round of simulation to $1 million in the 6th round of the Cesim simulation.

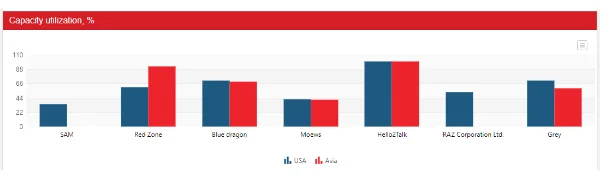

High capacity utilisation at USA

RAZ Corporation Ltd has been observed to have been successful in utilisation of the 53% of production capacity which it has at the USA. The company under consideration has 12 manufacturing plants at the USA.

Low offering price of Tech 1 at Asia

The Cesim simulation report has highlighted that the RAZ Corporation Ltd has been able to offer the Tech 1 products at relatively lower comparative prices at the Asian market region in RMB1.5 k where all of the other Tech 1 products of other companies have been offered in greater price ranges than that of the RAZ Corporations Ltd.

Weaknesses

Low global market share

The RAZ Corporation Ltd has only managed to generate only 10.1% of the global market share which is the second lowest of all of the 7 competing mobile phone set manufacturers and only SAM has a lower percentage share of the global market in the range of 5.3%.

Second lowest sales profit generation in the global market scenario

The RAZ Corporation Ltd has generated only the second lowest sales revenue ($ 1004.626) which is only second to the sales revenue of SAM ($ 760572).

Relatively high total costs of the Tech 1 products

The RAZ Corporation Ltd had generated $1509609 in terms of the total expenditure while the company only manufactures and offers the Tech 1 based products. The relatively high depreciation cost from fixed assets ($56.01k) could be outlined to be one of the major financial weaknesses of the company.

VRIO Analysis

The VRIO analysis is necessary for the evaluation of the resources and competitive advantages of the RAZ Corporation Ltd.

Valuable

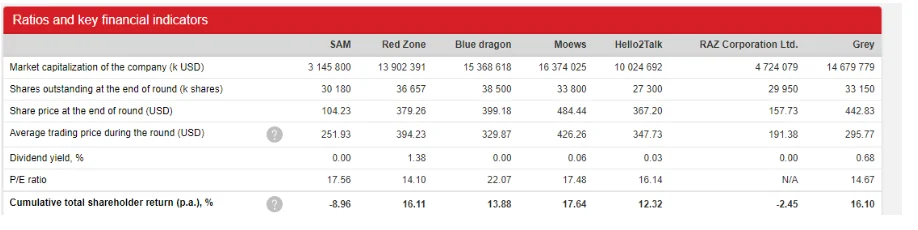

The availability of 4.67k units of production at the USA with 12 manufacturing plants is the most valuable aspect of RAZ Corporation Ltd, however, all of the other companies included in the Cesim simulation also have similar or more number of production plants situated at USA. The company under consideration has so far been unable to completely utilise the capacity of all the manufacturing plants and only 53% has been utilised. This is starkly in contrast with Hello2talk (100%), Blue Dragon (70%) and Red Zone (60%).

Rare

The capabilities and resources of the RAZ Corporations Ltd are not unique since other competing organisations have identical capabilities and resources as well. The utilisation of the available resources to obtain greater competitive advantage is necessary. RAZ Corporations Ltd had spent the least measure of resources and capital on the promotional efforts in comparison to the other companies. This has been the reason that the company under consideration had failed to gain any competitive advantage and sales volume generation increment and the product differentiation has been not achieved as well.

Imitability

1.The imitability is considerably high. 2. Competition is also high. 3. Tech 1 products are produced by all of the other competing organisations. 2. All of the included companies have access to the similar resources and product specifications. 3. The emphasis is on the utilisation of capacity to the fullest, on achievement of effective promotion and on the management of the strategic cost structure maintenance. 4. RAZ Corporations Ltd had incurred high expenses in net financing process.

Organization

The most prominent organisational feature for the RAZ Corporations Ltd is the negative cumulative return on the investments of the shareholders. Another aspect is the extremely low value of the share prices. Long term loans. Issues in the organisational processes management. High receivable and low capacity utilisation. Acute necessity to address the existing shortcomings. Necessity to diversify the product manufacturing ranges and the inclusion of tech 2,3 and 4 based products is paramount.

Marketing Expenditures

The marketing expenditure is related to the investments and expenditures associated with the marketing efforts of products, market research, development of the products, promoting the same, undertaking of sales and development of the necessary technology concerning the same. As could be outlined from the Cesim Global Challenge Simulation derived data, the RAZ Corporations Ltd, did not invest much capital in terms of undertaking extensive promotional activities. The competitors of the company under consideration had employed similar promotional strategies as well. On the contrary, the highest amount of promotional capital was invested by the Red Zone ($ 190000k) and the company achieved the highest and the most extensive competitive advantage as well as the necessary increment in the revenue from sales.

Learning and Experience effects

The necessity to take the advantage of the effects of learning is paramount for the RAZ Corporations Ltd so as to figure out the most effective manner of investing money in the process of marketing and differentiation of products. Learning through repetition is necessary to be performed so as to reduce the unit costs of the company (Bharadwaj, Fahy andVaradarajan, 2015). Experience effects could assist the RAZ Corporations Ltd in lowering the structure of costs as well as the unit costs in the systematic manner. However, the development of novel technological disciplines could offset the effects of experiences since these technological innovations could be utilised the competing companies to take away the competitive advantages, if gained in the course of time, by the RAZ Corporations Ltd.

Recommendations

Marketing Strategy

The data derived from the Cesim Global Challenge simulation has outlined that the company of RAZ Corporation Ltd has extensive issues concerning the marketing strategies. Development of adequate markets at both USA and Asia has been the problem and the low expenditure on the promotion of products has been curtailing the product differentiation aspect completely (Chirumalla, Oghazi and Parida, 2018).

Pull strategy

Customers have to be motivated for the selection of product brands in the most active manner. Brand loyalty formulation within the targeted customers could be achieved through the greater expenditure. The introduction of new Tech based products has to be expedited and aggressive promotion would have to be undertaken since in the future rounds could be highlight the increased demand of Tech 3 and 4 based products.

Price penetration strategy

The organisation of RAZ Corporation Ltd has already utilised the price premium strategy and this has been similar to the strategic applications of the competitors of the company under consideration (Cecere, Corrocher, and Battaglia, 2015). Thus, the recommended strategy could be that of price skimming.

Transnational Strategy

Necessity to adopt a strategy which could be effective in the transnational domain. This would have to be based on the introduction of Tech 2, 3 and 4. The sales of Tech 1 could be well advised to be discontinued since the RAZ Corporate Ltd had achieved little success in terms of selling the Tech 1 based products in sufficient numbers. The reason could be outlined to be the fast diminishing demand of the product and thus the company under consideration has to focus on the products which are experiencing large growth in the demand cycle.

The product offerings based recommendations for the next 3 years could be thus identified as the following:

USA – Tech 2 (Premium) and Tech 4 (Mid-range) Europe – Tech 2 (Premium) and Tech 4 (Mid-range) Asia – Tech 2 (Premium) and Tech 3 (Mid-range)

Smart objectives

Increment of the revenue earned from sales through the increment of the sales margin within Europe and USA in particular with special emphasis on the manufacturing of the Tech 3 and based products. Obtain greater market share at Europe and the USA. This could be performed through greater resource and effort investment on the sales promotion and through utilisation of advanced technology based product manufacturing such as Tech 3 and 4. Increment of the capacity utilisation of manufacturing plants and outsourcing processes at the USA up to 100% in the future rounds through the development of marketing and promotion of the products as well as the manufacturing of the technologically advanced products such as Tech 3 and Tech 4.

Part 2

Stakeholder report

External Stakeholders

Customers

Customers are the singular sources of revenue generation for the RAZ Corporations Ltd. The essential aspect is that the customers of RAZ Corporations Ltd could be provided the value for their invested money and would also have to be provided the quality of products which they expect and demand.

Creditors

Creditors provide the most valuable resource for RAZ Corporations Ltd in the form of financing which could fulfil the necessity of capital budgeting by the company and could assist the company to remit the long term loans. Remittance of interest to the creditors is also necessary.

Government

Governments impose the regulations and the supervisory directives on the business processes and this makes them the most significant external stakeholder (Bourne, 2016). The RAZ Corporations Ltd has to adhere to the governmental regulations concerning the payment of taxes and standardisation of the products, purchase of the licenses for the new products such the Tech 3 and 4 based ones and would have to comply to the labour laws as well.

Internal Stakeholder

Shareholders

The shareholders provide new capital to the companies for the purpose of undertaking new product development and manufacturing as well so that sales volume and revenue generation could be increased. Maximisation of the return on the investment is the key objective in this regard.

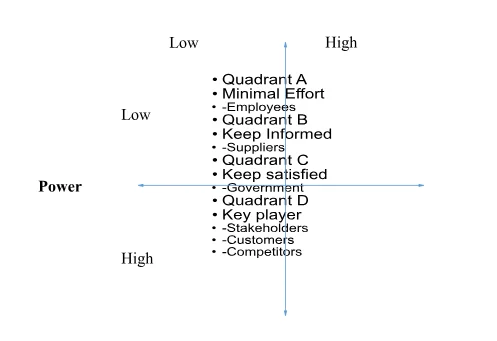

Stakeholders Mapping

Key players

Competitors

The RAZ Corporations Ltd and other competing companies have similar customer targets and similar interests. These are adding additional features to the products and the retaining and expanding market share. Thus the interest is high by the competitors. Similarly, the competitors have extensive power and the RAZ Corporations Ltd requires to work prudently to devise effective business strategies.

Customers

Customers of the company under consideration have both high power and high interest since they generate the demands for the manufactured handsets to be sold. The hyper competitive scenario could entail further trouble for the company if customer demands are not met.

Shareholders

Shareholders have an extensive and the most significant role in the maintenance of the company since they are often the financers of the company. Thus, they could be accorded both high power as well as high interest.

Keep satisfied

Government

The governments have absolute ability to influence and amend the business strategies of the RAZ Corporations Ltd and they have low interest as well as high power.

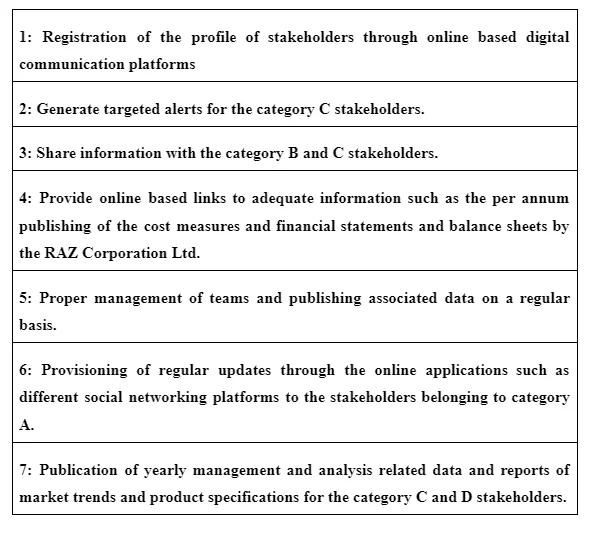

Stakeholder Management

Shareholders, Creditors and Customers are to be prioritised in this process

1. The dominant stakeholders are the Shareholders since the power and legitimacy of interest which they have could provide them with the ability to extensively influence the operations of RAZ Corporations Ltd. Sales revenue increment could take place for the company through maximisation of the investment from shareholders and this requires ensuring the payment of dividends to the shareholders on a timely basis. This is crucial since the company has been making negative profit. 2. The Creditor management would require to remit all of the existing long term loans with due interest added. 3. Customer management would require the consideration of views of customers and translation of such realisations into the policy based decisions. Strategic decisions could be only formulated after conducting effective market research to understand the demands and preferences of the customers and this could assist RAZ Corporations Ltd to formulate successful decisions.

Communication strategy

According to Zeng andHou (2018) the measures of management of stakeholders is necessary to be extensive and accurate. Bourne (2016) has observed that this process of management of stakeholders consummately depends upon establishment of the most effective digital communication process with the entire range of stakeholders. This digital communication plan could be comprehended to be inclusive of multiple elements which are described in the following:

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts