Strategic Management

- 15 Pages

- Published On: 30-11-2023

INTRODUCTION

This study focuses on strategies that are utilized by Tesla Inc for the development of business and the CEO of the company, Elon Musk considers the development of a business plan in the future (Wayland, and Kolodny, 2020). This study will analyse the company’s mission, vision and values as well as analyze the business environment with the help of Porter’s Five Forces along with the discussion based on competitive strategy of strategic positioning. Moreover the report will evaluate the strategic changes. For students seeking business dissertation help, understanding Tesla's strategic decisions and competitive positioning can provide valuable insights into modern business strategies.

ANALYSIS OF STRATEGY AND BUSINESS ENVIRONMENT

Strategic business development is considered to be one of the developments for business and it forms the highest priority for acquiring ideal consumers for the company. It is necessary for the creation and focusing on the approach for the betterment of the company's performance (Whittington et al., 2020). For better strategic decision making and implementation of the plan and policies, clear statements of mission and vision and values are helpful for the company and staff members to manage the resources accordingly and professionally achieve the goals. The mission and vision statements of Tesla are as follows:

Mission:

The mission of the organization is to accelerate the world's transition to sustainable energy. The statement suggests that the organization is focusing on the opportunities of utilizing renewable energy that will help to improve the environmental conditions.

Vision:

The vision of the company is to create the most compelling car company of the 21st century by driving the world's transitions to electric vehicles. By focusing on this vision that management is specifically designing and manufacturing the electric vehicles that support in making use of renewable energy.

Core values:

Following are the core values of Tesla:

- Always be learning

- Respect and encourage people

- Respect the environment

- No forecast is perfect, but try anyway

- Always do the best and look for the best technology to overcome challenges

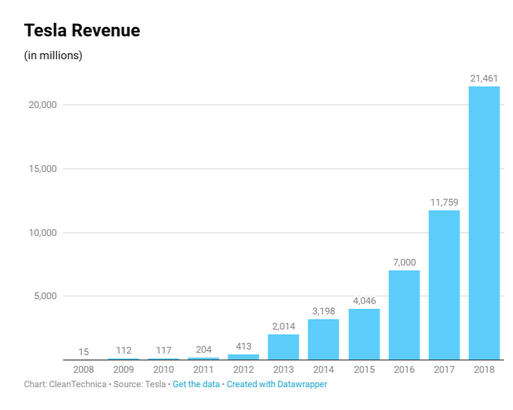

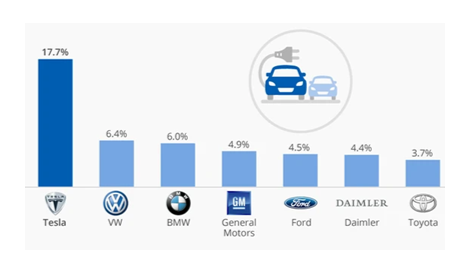

Market share and profit

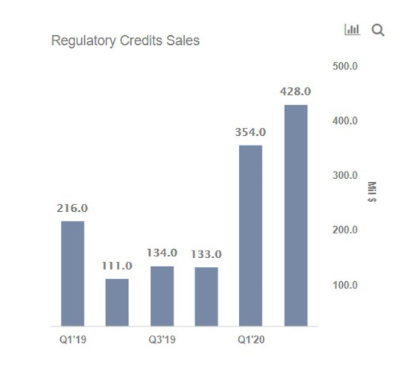

The company is making significant efforts to improve the business by considering the needs and expectations of the target customers globally and developing the actions plan to meet the objectives (Zhang, Garrett, and Liang, 2015). According to the analysis, the current revenue and profit of Tesla are $8.8 billion and the market share is grown up to 25% at $433.88 in extended trade. The management is working on improvement in manufacturing capabilities and aimed to deliver 840.000 to 1 million vehicles this year. The $394.5 billion market capitalization has made the company one of the largest among the global automaker companies. In addition to this, the revenue of the company rose to a record $8.77 billion from $6.30 billion this year and it is expected to grow. The profit of the company has grown by 76% and the net income of the company is $331 million or $876 million excluding stock-based compensations (Revenue and record of Tesla, 2020). However, the outbreak of Covid-19 has affected the sales of the company but the management has increased the manufacturing and maintaining the new standards to gain a competitive advantage.

UNDERSTANDING OF BUSINESS ENVIRONMENT

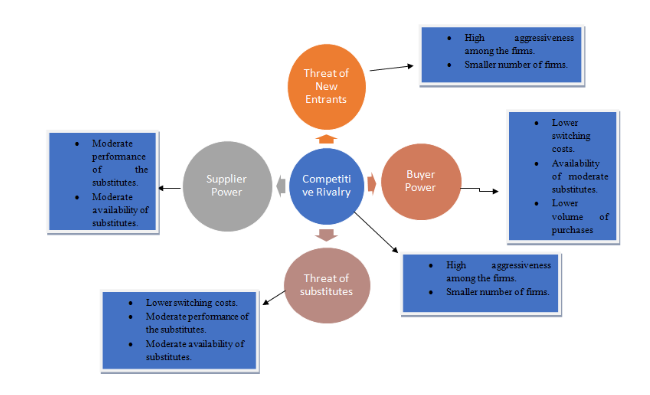

Porter’s Five Force analysis

The Tesla management is using an effective model of business development and planning of the strategies to manage the barriers and achieve the vision and mission objectives. The approach of continuous improvement in market research and capabilities using the technology is helping the management to maintain sustainability. The analysis of the business environment of the company using Porter’s Five Force analysis can be helpful to gain critical information related to the effectiveness of the business strategy of Tesla:

Competitive Rivalry

Tesla Inc. is operating the business in a highly competitive market. The major competitors of Tesla in the global market are involving Ford, Volkswagen and General Motors and new entrain from China like NIO and Xpeng (Long, et al., 2019). These companies are giving tough competition to Tesla and pushing the organization to change the business strategy to gain a competitive advantage. The external factor that intensifies the responsibilities of the strong force of competitive rivalry includes:

- High aggressiveness among the firms.

- The smaller number of firms.

- Changes in the expectation of customer considering the market segments

According to the analysis, the presence of a smaller number of firms that is currently operating in the automotive industry limits the overall effect of competition on Tesla Inc (Liu, 2021). However, the company has an aggressive nature concerning innovation and promotion of the products but high manufacturing cost and lack of infrastructure for charging are affecting business.

Bargaining power of the Buyers

The demand for electric vehicles is high and many leading companies are designing and developing low-cost vehicles for all types of customers. This kind of approach is increasing the bargaining power of the customer. However the quality of Tesla battery, automotive and solar panel is good and attracting customers (Davies, and Gutsche, 2016). The major factors that are influencing the bargaining power of customers in the global market and shaping the business strategy of a company involved

- Lower switching costs.

- Availability of moderate substitutes.

- Lower volume of purchases.

A lower switching cost reduces the number of barriers for Tesla Inc's customers for purchasing the cars from its other providers. The lesser availability of substitutes also limits the bargaining power of the customers of Tesla Inc. Thus, it implies the bargaining powers of the buyers are moderate in nature.

Bargaining power of the Suppliers

For managing the business in the manufacturing industry the role of suppliers is important as they offer quality material as per the demand of the company. Tesla Inc. is dependent on the suppliers and trying to maintain the constrictive relationship with the existing suppliers and looking for new suppliers for expanding the business in leading global markets (Dans, 2019). Following are the key factors that are influencing the bargaining power of suppliers:

- Moderate forward integration.

- Moderate supplier’s size.

- Moderate level of supply.

The leading competitor in this industry is offering a good amount for suppliers for offering the material that is a major issue for Tesla in the coming time that will increase the bargaining power of the suppliers which will directly influence the cost of the production and affect the profitability (Chen, and Perez, 2018).

Threat of Substitutes

Tesla Inc. is facing issue related to the introduction of substitute products and services in the automotive industry and the management needs to identify the approach of the new substitute products and services to make the changes in the existing strategy. Following are the key factors that have a significant impact due to the entry of substitute products:

- Lower switching costs.

- Moderate performance of the substitutes.

- Moderate availability of substitutes.

For example, the local companies in the overseas markets are offering low-cost products and services compare to Tesla. The products of Ford in EV segments are low cost and affordable for all type of customers. Apart from this, the fully driverless technique of Tesla is not successful in the market like Brazil, India and China as there is huge traffic and people are not following the rules and regulations (Birk, 2015). Therefore company have to make changes in the design and dependence on technology for driving.

The threat of New Entrants

A new entrant impacts the environment of the industry and also helps in determining the performance of Tesla Inc. The force of a new entrant is identified as a weak force due to:

- Brand development needs high cost.

- High economies of scale.

The business of Tesla Inc. is huge as thus it becomes difficult to develop such a high-cost brand by the new entrants. Thus, it implies that the threat of new entrants has a weak force for the company. The organization is offering more funds for brand development and promotion of the products and service that is helping to gain the competitive advantage and meet the business goals by overcoming the issues related to substitute and high cost (Bilbeisi, and Kesse, 2017). Moreover, the organization is working on the development of low-cost vehicles for minimizing the impact of external factors.

EVOLUTION AND COMPETITIVE ADVANTAGE

Competitive strategic positioning

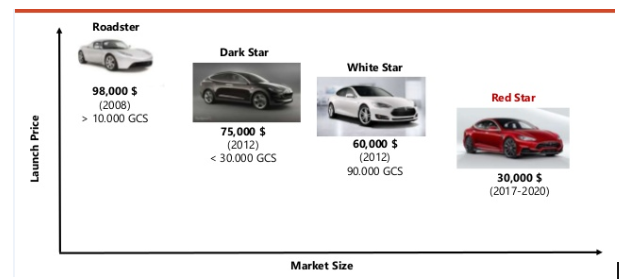

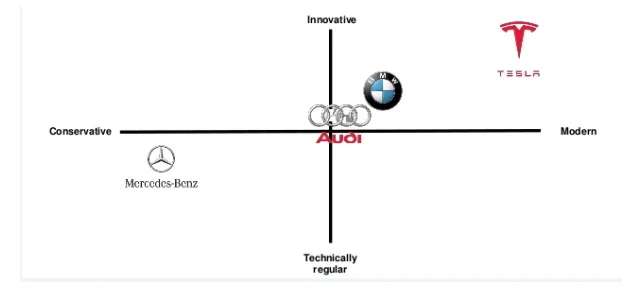

According to the analysis, the Tesla management is using the differentiation strategy for managing the business and gaining a competitive advantage. The analysis of external factors has suggested that the company is facing issues related to the competition, new entry and substitute products. To overcome the issues, the organization must make changes in the existing approach of business. The proper analysis of the available resources and strategic changes is useful for the organization to address the strategic changes and gain a competitive advantage over Ford, General Motors and Volkswagen (Lang, Reber, and Aldori, 2021). The strategic changes that Tesla management could make in the existing approach involve the implementation of the strategic positioning model.

The strategic positioning model of value creation is helping the management to maintain the differentiation market action and open up the new market segments by producing high-end products and services. By using this strategy the Tesla management will find competitive advantage by contracting with new suppliers for the new market who can deliver required material on demand and maintaining the quality. Contracting with them will support minimizing the cost and increase the profitability of the organization. Hybrid cars will be more cost-effective for the corporation, lowering manufacturing costs and raising profits. Tesla's products become more attractive in this respect as green energy costs fall, as their business expands in lockstep with the popularity of renewable energy solutions (Thomas, and Maine, 2019). In reaction to the rapid speed of technological change, Tesla can enhance the capabilities of its products.

The business strategy of Tesla is focusing on the differentiations to play long term by focusing on the environmental issues that influence the business of the automobile industry. The electronic automobile automation approach of the organization is supporting the organization to develop a distinctive image in the market and helping to increase the market share and profitability with attractive growth. The business model of Tesla is based on direct sales and services not franchise dealership (Teece, 2018). The organization is developing products that can be run through renewable energy sources and help to maintain the environment clean and protected.

Evaluation

By using this strategic positioning, the management will be able to create new opportunities considering the gaps in the target markets like the development of dual-mode cars like manual operation and fully automated. This kind of approach will be helpful for value proposition and managing the resources to meet the expectation of the customer and develop the products better then value provided by the competitors. For example, this kind of changes will be helpful for Tesla to compete with the substitute products and services. The offering of better safety and standards products in this industry will increase the demand in the new market segments. Moreover, the world is facing environmental issues and encouraging the use of renewable energy sources to protect the environment (Stringham, Miller, and Clark, 2015).

Therefore, the implementation of the value proposition strategy model will be helpful for Tesla management to maintain the competitive advantage using the strengths and making the necessary changes in the strategy and product offering. The sustainable approach of developing and managing the business is playing a vital role in the success of the company in the global market. The major issue for the company is the development of charging stations at different locations to increase the sales of electric vehicles (Perkins, and Murmann, 2018). Moreover, the high prices of the products and services are also helping the management to ensure customers that company is offering the value through products and services.

CONCLUSION

From the study, it has been carried out that strategic management and planning is playing a critical role in business improvement and maintaining growth in the market. The report has provided an analysis of the business strategy of Tesla and discussed the factors that are having a direct or indirect impact on the sales and profitability of the company. The report has suggested strategic changes like the use of the Blue ocean theory to gain a competitive advantage.

Continue your exploration of Strategic Knowledge Management with our related content.

REFERENCES

Bilbeisi, K. M., and Kesse, M. 2017. Tesla: A successful entrepreneurship strategy. Morrow, GA: Clayton State University.

Birk, D. 2015. Evaluation of the Marketing Strategy of Tesla Motors Inc. Munich, Germany: GRIN Verlag.

Chen, Y., and Perez, Y. 2018. Business model design: lessons learned from Tesla Motors. In Towards a Sustainable Economy (pp. 53-69). Springer, Cham.

Dans, E. 2019. The Secret Of Tesla’s Success Is Not Selling Cars: It’s Being Able To Anticipate The Future. Forbes. Retrieved from https://www.forbes.com/sites/enriquedans/2019/09/09/the-secret-of-teslas-success-is-not-selling-cars-its-being-able-to-anticipate-thefuture/

Davies, I. A., and Gutsche, S. 2016. Consumer motivations for mainstream “ethical” consumption. European Journal of Marketing, 50(7/8), 1326-1347.

Lang, J. W., Reber, B., and Aldori, H. 2021. How Tesla created advantages in the ev automotive paradigm, through an integrated business model of value capture and value creation. Business & Management Studies: An International Journal, 9(1), 385-404.

Liu, S. (2021). Competition and Valuation: A Case Study of Tesla Motors. In IOP Conference Series: Earth and Environmental Science (Vol. 692, No. 2, p. 022103). IOP Publishing.

Long, Z., Axsen, J., Miller, I., and Kormos, C. 2019. What does Tesla mean to car buyers? Exploring the role of automotive brand in perceptions of battery electric vehicles. Transportation Research Part A: Policy and Practice, 129, 185-204.

Perkins, G., and Murmann, J. P. 2018. What does the success of Tesla mean for the future dynamics in the global automobile sector?. Management and Organization Review, 14(3), 471-480.

Revenue and record of Tesla, 2020 Retrieved from < https://economictimes.indiatimes.com/markets/stocks/news/tesla-sets-revenue-record-makes-profit-thanks-to-pollution-credit-sales-to-rivals/articleshow/78808645.cms?from=mdr> on 18th May 2021

Teece, D. J. 2018. Tesla and the reshaping of the auto industry. Management and Organization Review, 14(3), 501-512.

Thomas, V. J., and Maine, E. 2019. Market entry strategies for electric vehicle start-ups in the automotive industry–Lessons from Tesla Motors. Journal of Cleaner Production, 235, 653-663.

Wayland, H., and Kolodny, L. 2020. Tesla’s market cap tops the 9 largest automakers combined — Experts disagree about if that can last. Retrieved from https://www.cnbc.com/2020/12/14/tesla-valuation-more-than-nine-largest-carmakers-combined-why.html

Whittington, R., Regner, P., Angwin, D., Johnson, G. and Scholes, K. 2020. Exploring Corporate Strategy: text and cases, 12 Edition, Harlow: Pearson Education Ltd

Zhang, H., Garrett, T., and Liang, X. 2015. The effects of innovation-oriented mission statements on innovation performance and non-financial business performance. Asian Journal of Technology Innovation, 23(2), 157-171.

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts