Strategic Management of Tesla Motors

Executive Summary

Tesla Motors Inc. is a multinational corporation that develops, produces, and sells automobiles and automotive components. The company unveiled the Roadster and Model S, two vehicles that have garnered a lot of attention in the automotive industry. Tesla Motors has a board of directors and various committee members who assist in the smooth operation of the company. Tesla is a firm that is socially responsible, ethical, and environmentally sensitive. It creates automobiles that do not damage the environment. It also produces non-toxic batteries that may be easily recycled. Tesla Motors is a well-known company whose products are in high demand all around the world. Tesla has unique qualities that it uses to obtain a competitive advantage over its competitors. Tesla also has a strong organizational framework that allows it to accomplish administrative tasks effectively by integrating employees. Tesla's leadership style is quite effective. It motivates everyone to work tirelessly to attain the company's goals. To achieve its goal and vision, Tesla also adopts strategy and strategic planning. It evaluates the effectiveness of its organization by comparing its performance to the company's goals. On the other hand, it needs to improve its control and editing systems because they are lacking elsewhere, and seeking msc dissertation help can provide an edge. Surprisingly there are more tests, skill activities, group discussion, and personal interviews where many bloom out but are not selected (Fotiadou, 2021).

Introduction

Strategy formulation is a decision-making and planning process ultimately leading to the creation of an effective strategy to help the business achieve its objectives (Amason, 2011). Strategists use this approach to set goals and make strategic judgments. It brings the strategic and operational structures together and provides a complete framework for allocating resources across units and periods.

Company description

Tesla aspires to expedite the shift to renewable energy around the world. In 2008, Tesla unveiled the Tesla Roadster, the company's first elevated and fuel-efficient electric automobile. Elon Musk claims that Tesla Motors will assist in the transformation from a mine-and-consume petroleum economy to a solar economy (Maurer & Nelson, 2007). Tesla will also join the top end of the market, according to Musk, where buyers are willing to pay extra, and then rush the market to larger unit capacity and lower pricing as rapidly as feasible (Higgins, 2021). Tesla's marketing plan, on the other hand, is a larger distinction of attracting both expensive and low-priced buyers in the automotive sector. Tesla differentiates itself from the competition by growing its research and improving investment annually to establish a completely different ecosystem to optimize return on the economic level, based on that coherent plan. The purpose of this research is to look into Tesla Motors Ltd.'s strategy implementation.

Findings

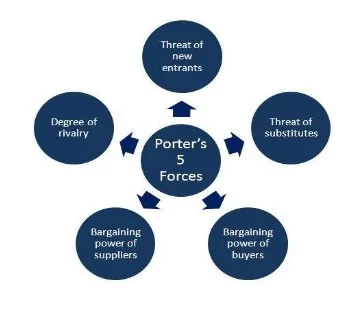

An overview of the Porter's Five Forces model

The Porter Five Forces model is built on the principle that a marketing strategy must address opportunities and challenges in an organization's external environment (Perera, 2020). Strategic planning should start with understanding trends in industrial structures. Porter established five competitive factors, which affect the entire sector, and all markets influence the industry's competitiveness, and thus its profitability and attractiveness (Porter, 2017).

A strong business plan should change these competitive factors in such a way that the company's position improves. Porter's model aids in the examination of industrial driving power. Managers can select how to influence or apply particular areas of their field based on the information revealed in the Five Forces Analysis. Microeconomics underpins these five forces. Supply and demand, related items, and alternatives, the relationship between production capacity and production costs, and market structures like monopoly, oligopoly, or total competition are all examined. If the market, for instance, is dominated by a few large suppliers instead of a separate supply chain, the power to negotiate with suppliers is likely to be higher (National Research Council, 2000).

Criticism of Porter's Five-Force Model

Porter's Five Competitive Forces paradigm has been panned. Its primary flaw stems from the historical circumstances in which it was created. Aside from that, there are several typical criticisms. The following considerations detract from the model's worth:

Porter's Five Forces approach, for starters, is based on microeconomics (Daidj, 2014). Fundamental notions are applied to a completely new market. As a result, this fundamental premise also applies to the Five Forces paradigm. In the economic sense, many real-world sectors are not perfect marketplaces. For example, they may be manipulated or there may be a knowledge gap among market participants. The regulations, in particular, limit the model's functionality. There is not much competition in the workplace in a heavily regulated sector. As a result, their investigation will yield only a few details.

Second, the model works best when looking at simple market structures (Mahajam, 2016). In complex industries with various relationships, product groups, manufactured products, components, and intermediates, comprehensive description and examination of all five factors become more challenging. However, if some aspects of these industries receive insufficient attention, major energy shortages may result.

Third, the approach emphasizes the concept of competitiveness. It is assumed that businesses are attempting to obtain a competitive advantage over other market competitors, rather than suppliers or customers. It is less acceptable to evaluate interdependent marketplaces with this focus. Fourth, Porter's Five Forces model does not account for the current market's strengths. It resides in stable market structures. This is not the case in today's unpredictable markets.

This model, in general, has significant limitations in today's industry, since it is unable to account for new business models and market dynamics. Porter's model is valuable not only because it allows managers to think about the status of their business in a systematic, easy-to-understand manner, but also because it serves as a starting point for additional investigation (Porter, 2017).

Analysis of Tesla Motors Inc. Company

Situation Analysis-Electric vehicles

In recent years, a new generation of cars has arisen, powered by an electric motor train and battery storage batteries. Among these autos are modernized electric hybrids, plug-in hybrids, and battery-powered electric automobiles (Mintzer, 2008). Gas-powered hybrids, such as the Toyota Prius from before 2004, run on gasoline and batteries but are not regarded as true 'electric' vehicles since they lack a 'plug-in' charging function. Plug-in hybrids, like the Chevrolet Volt, are partially reliant on ordinary gasoline but are meant to be recharged using the electrical grid.

Growth and expansion analysis

Mercedes-Benz just revealed that in the first half of 2021, it sold 590,999 passenger cars, up 22.3 percent (Reclamation, 2007). This demonstrates Tesla's expanding power, which is frequently associated with Mercedes, BMW, and Audi as a high-end product. In the fourth quarter of 2020, Audi sold 505,583 vehicles, a new high. The BMW Group has set a new record, with 636,606 units sold in the first quarter, the most in history. BMW, MINI, and Rolls-Royce are among them. When it comes to the BMW model, it has sold 560,543 units per quarter worldwide, practically evenly split between its two main competitors, Mercedes and Audi.

Tesla sold 185,000 automobiles during the first half of 2021. The increase in the price of Mercedes sold has proven, in my opinion, which Tesla sales may double or triple without reaching that level, implying that there is still an opportunity for Tesla growth, especially given that Tesla cars are more expensive than Mercedes automobiles. Any doubts regarding the necessity for Tesla customers should vanish or be proven unfounded when Tesla climbs the ranks of Mercedes-Benz (Graham, 2021). It may take a bit of time for hearsay to reach that level, but given how quickly Tesla's sales have risen, it is difficult to see this as a serious worry.

It is worth remembering that Tesla does have a lot of room for expansion. India, Brazil, South Africa, and several Arab World and Eu nations are just a few of the notable areas where Tesla should be able to sell a significant number of Model 3 and Model Y vehicles, especially as new automobile manufacturers are built (Texas can supply South America, Berlin can offer much better Europe). It currently does not sell in those places due to high demand in established markets.

With its present technology and reputation, it is difficult to imagine Tesla failing to match or outperform premium-class rivals like BMW, Mercedes-Benz, and Audi in the next years (Marcouse, 2017). In a negative scenario, half a million sales in 2025 and quarter sales in 2030 are possible. That is a terrible prediction in comparison to Tesla's ambitions and fan expectations, but as a real estate agent, you believe Tesla is battling with total autonomy and trying to grow its market offerings outside of its current services.

Performance and market structure

The following are the essential ingredients: - To begin with, Tesla's business model is built around direct sales and service rather than retail sales. Second, the distribution of charging stations is a top priority for Tesla's commercial plan. This could be a big impediment to the purchase of huge numbers of electric automobiles. Third, Tesla's business model has evolved to include energy and real estate plans in real estate transactions (Tansel, 2016). Tesla has tried a novel approach to market stabilization. Rather than focusing on creating a less-priced car that can be mass-produced and marketed, it has chosen a different path, focusing on creating an attractive car that will drive demand for electric vehicles. Elon Musk, the company's CEO, stated that their initial product would be expensive regardless of its appearance, so they chose to develop a sports car because it appeared to have a high chance of competing with other sorts of vehicles of fuel.

The Tesla Roadster is the world's first and most competitive electric luxury automobile, according to Tesla. Before completing manufacturing in January 2012, the business sold roughly 2,500 Roadsters, a level that would not have precluded any GM interruption. Tesla's business strategy was enhanced as it built its brand, manufactured, and released its prototype car. Tesla's model is predicated on a three-pronged strategy for selling, fixing, and charging its electric automobiles (Tansel, 2016).

Tesla, unlike other automobile companies that sell through franchised dealerships, sells directly to people (Twomey et al., 2016). It has created a global dealership and gallery network, particularly in urban locations. Tesla believes that by owning a sales channel, it will be able to benefit from the rapid development of its product. More importantly, it improves client satisfaction. Tesla's showrooms, unlike automotive dealerships, are free of conflicts of interest. Tesla's staff and service professionals are the only ones who matter to customers.

By the end of 2021, Tesla will have 438 locations worldwide, including display rooms, Service Plus facilities (a combination of sales and service centers), and service facilities. Tesla also used online marketing, allowing customers to personalize and purchase Tesla vehicles. Tesla has also developed a network of "supercharger channels" where Tesla drivers can charge their cars for up to 30 minutes free. The goal is to accelerate electric vehicle adoption by making them less expensive and easier to maintain.

Market competition

Tesla has several traditional automobile manufacturers as competitors, including Ford and Honda. The organization has been able to succeed by concentrating on high-end electric automobiles (EVs). However, there is a lot of rivalry in the market for electric and self-driving automobiles presently. Tesla is also active in offering services to other automobile businesses that are working toward these aims, such as selling its battery tech to them (Musk et al., 2021).

Tesla makes money from two main sources: car sales and research and development (National Research Council, 1992). Automobile sales account for a substantial amount of the company's revenue. Tesla eventually saw significant growth after years of breakeven operations. In the second quarter of 2021, Tesla surpassed Wall Street salary predictions, making $ 1.1 billion (GAAP) in sales, more than tripling its first-quarter revenue of $ 438 million. In the second quarter of 2020, Tesla barely made $ 100 million. Using adjusted statistics, Tesla reported $ 1.6 billion in the second half of 2021, up from $ 1.1 billion in the first half and $ 451 million in the second half of 2020. (Non-GAAP)

Five Power Related Porters on Tesla market performance

The threat of new entrants

Because the threat of entry is low, there is a high risk of new entrants. Tesla's competitors include EVs startups, gasoline-powered autos, and traditional automakers making the conversion to electric vehicles (Pigato, 2020). Nio, BYD, XPeng, and Li Auto are among the Chinese companies in charge of EV implementation. Because of their access to a massive consumer market, well-established supply chain, and government support, they have a higher chance of competing. Traditional automobile manufacturers and corporations that migrate to electric cars are owned by the US and European companies. Ford Motor Company introduced the electric Mustang, and General Motors introduced the electric Hummer. By 2035, all of these vehicles will be electric. Tesla, on the other hand, is a forerunner in the mass manufacture of electric vehicles. It takes advantage of economies of scale to lower costs and make them more accessible to everyone (Grant, 2016).

First, broadening new knowledge to develop diversified products and offerings, second, being a global leader in impartial technologies and applications, third, using Space X and other affiliates to provide integration services, and finally, improving production quality to improve cost, reliability, and delivery, Tesla raised the entry barrier and reduced the threat of new entrants (Porter, 2017).

Power to negotiate providers

Because of the supply chain network, it is possible to bargain with high-end providers. The - mobility sector is still in its infancy. The majority of Tesla's automobile parts are now sourced from German manufacturers. Tesla manufacturing will be harmed by any disturbance to the German economy, such as the closure of COVID-19 and power shortages (UNCTAD, 2020). As a result, Tesla created Giga plants in the United States, Asia, and Europe to weaken suppliers' bargaining position. The strategy will cut transportation costs and eliminate supply chain disruption due to COVID-19 by shortening the supply chain network and bringing production and market closer together.

Tesla lowered supplier bargaining capacity by minimizing the supply chain system by building Giga factories, separating suppliers to avoid shortfalls and production issues, and leveraging technology to reduce supplier negotiation potential, improve tight contact, and improve cost governance and manufacturing capability.

The power of consumer negotiations

Tesla splits its products into high-end marketplaces at outrageous pricing, limiting consumer bargaining power. Due to heavy competition in the low-end market, Tesla competes in the premium sector. Dividing, which provides products and services that no one else can, is a major source of long-term rivalry in the high-end market. The electric vehicle manufacturer is currently at the forefront of technology in terms of speed, safety, battery life, and automatic driving systems (Thornton, 2021).

By splitting products into popular categories, like larger SUVs, by offering a new subscription model rather than rental or general financing, increasing automated cars capabilities, reliability, and global security, and providing unique services that others no longer offer, Tesla reduces consumer bargaining power.

Threat of substitutes

Tesla controls 1.2 percent of the total vehicle market and 14.55 percent of the worldwide electric car industry, posing a serious threat to the status quo. Beginners flood the markets, and major automobile manufacturers have a strong consumer base. Nevertheless, product reliability is a significant source of Tesla's competitive edge. Elon Musk, Tesla's CEO, has a devoted following. Tesla's free marketing strategy includes his controversial appearance on social media and mainstream media (Neumann, 2020). No commercials are claiming that buying from Tesla is the best decision to make. Meanwhile, big automakers like Ford, GM, BMW, Volkswagen, and Mercedes-Benz spend billions of dollars on marketing efforts to get their current models included in magazines, television, radio, and social media.

Tesla serves as a deterrent of inductees by boosting its product through effective marketing rather than traditional advertising, competing in high-end markets and charging exorbitant costs, and expanding company-owned showrooms and stores into a cooperative technology hub so customers can experience the latest technology (Netexplo, 2019).

Industrial rivalry among competitors

The competition amongst rivals in the automotive industry is fierce, beginning with newcomers, conventional automobile makers, and significant electric vehicle producers. Tesla's market penetration and profit growth are limited by competitors' price and segmentation initiatives. The desirability of electric vehicles is harmed by oil price variations, geopolitics, and changes in government policy. Longevity, battery life, infrastructure, and chip constraints are still common industry issues that make it difficult for an electric automobile to contend with an IC engine (Porter, 2008).

Product diversity, location, pricing, and promotions are a primary source of competitive advantage in a successful sector, but Tesla diminishes industry depth and competitiveness. Tesla's competitive edge is built on innovation, support processes, and intellectual property. To optimize earnings, supply series, direct integration, and continual improvement will lower unit costs. Product value and accessibility will improve with the presence of a solid communication platform.

Implications of the five-pot power industry and competitive analysis at Tesla

Tesla, in summary, has a low entrance barrier, a high power provider negotiating power, a low consumer based on agreed, a strong operator threat, and fierce competition. Tesla, on the other hand, has a competitive advantage in a stable business. Product discovery is accelerated by ongoing news stories on social media, traditional outlets, and the investment community, especially for young people. High stock estimates indicate that the company expects future inflows and outflows to be driven by the expansion of its product line (Grant, Contemporary Strategy Analysis, 2022). When a company maintains on track as a leader in technical innovation, supply chain efficiency, and operational efficiencies, higher equity thrives. The overall low market share in the automobile industry shows great future expansion and development potential.

The company is structured as a flexible technological firm with a solid operational structure, giving it a competitive advantage in responding to challenges and opportunities. By owning a subsidiary like Space X, Tesla can find and enter game-changing possibilities.

Conclusion

The market for electric car batteries is about to grow, thanks to a slew of diverse market factors. Tesla is confronted with many difficult questions in this regard. Should their primary goal be to create the Tesla brand as a market for high-end, low-volume electric automobiles, as opposed to BMW or Mercedes' market positions in the traditional car industry? If that is the case, what is the most effective marketing plan for accomplishing that goal?

The focus above should be Tesla's priority, based on the existing market research and statistics (Maurer et al., 2016). This idea is supported by Tesla's business model, available resources, and existing marketing initiatives. Furthermore, the competition study reveals that a big number of automakers are positioned in the BEV plug-in hybrid and mixed market customer categories. Several of these companies are far larger than Tesla and will benefit from significant scale economies,' marketing, and production advantages.

Some other alternative Tesla might consider is to continue to extend the Tesla brand into the luxury-car market category as planned, but to sell the company to a major automaker that will be better able to advertise the product to a larger market section of consumers. Tesla, on the other hand, should be mindful of this strategy. When Jaguar 'cuts' it is brand by launching the X-type in the hopes of reaching a larger market, it loses a lot of status and market dominance as a luxury car (Linde, 2010).

In terms of marketing, Tesla should continue to work on increasing brand awareness, lowering costs, streamlining its structure, and constructing an 'Apple-like' marketing/distribution infrastructure. Tesla is poised to redefine the car-buying experience - particularly the BEV 22 M.E Mangram shopping experience - in the same way, that Apple has revolutionized computer shopping (Kotler et al., 2016). When comparing 'Apples to Apple,' it may be determined that the governor of Tesla Inc. is not fully dressed, but rather 'dressed to kill.'

Tesla marketing strategy recommendations

Continue to develop new goods - Tesla should continue to push the boundaries of design and innovation.

While traditional car competitors are likely to split their development efforts across a complicated network of gasoline, electric, and hybrid vehicles, Tesla should always focus on producing a small range of memorable products of excellent quality.

Provide surprises- This type of secrecy can also benefit Tesla, as technology-related news often generates a lot of attention and important word-of-mouth work (Tansel, 2016).

References

(UNCTAD), U. N. (2020). World Investment Report 2020: International Production Beyond the Pandemic. New York: United Nations, 2020.

Amason, A. (2011). Strategic Management: From Theory to Practice. New York: Routledge, 2011.

Daidj, N. (2014). Developing Strategic Business Models and Competitive Advantage in the Digital Sector. IGI Global, 2014.

David P. Twomey, Marianne M. Jennings, Stephanie M Greene. (2016). Business Law: Principles for Today's Commercial Environment. Cengage Learning, 2016.

Graham, J. D. (2021). The Global Rise of the Modern Plug-In Electric Vehicle: Public Policy, Innovation, and Strategy. Northampton: Edward Elgar Publishing, 2021.

Grant, R. M. (2016). Tesla is a pioneer in the mass production of electric vehicles. It uses the economy of scale to reduce costs and make them more widely available to everyone. United Kingdom: John Wiley & Sons, 2016.

Continue your exploration of Strategic Management of Microsoft with our related content.

Grant, R. M. (2022). Contemporary Strategy Analysis. John Wiley & Sons, Limited, 2022.

Higgins, T. (2021). Power Play: Elon Musk, Tesla, and the Bet of the Century. Silicon Valley: Ebury Publishing, 2021.

Higgins, T. (2021). Power Play: Tesla, Elon Musk, and the Bet of the Century. San Francisco: Knopf Doubleday Publishing Group, 2021.

Hoffman, A. N. (2011). Tesla Motors, Inc: The First U.S. Car Company IPO Since 1956. Rotterdam: Rotterdam School of Management, Erasmus University, 2011.

J P Mahajan, Anupama Mahajan & Management Principles And Applications. (2016). Deepika Dewan. New Delhi: Vikas Publishing House.

Jeffrey H. Dyer, Paul Godfrey, Robert Jensen, David Bryce. (2021). Strategic Management. Hoboken: John Wiley & Sons, 2021.

Linde, A. (2010). Electric Cars – The Future is Now! England: Veloce Publishing Ltd, 2010.

Marcouse, I. (2017). Edexcel GCSE (9-1) Business, Second Edition. Hodder Education, 2017.

Markus Maurer, J. Christian Gerdes, Barbara Lenz, Hermann Winner. (2016). Autonomous Driving: Technical, Legal, and Social Aspects. Berlin: Springer, 2016.

Miria Pigato, T. W. (2020). Technology Transfer and Innovation for Low-Carbon Development. World Bank Publications, 2020.

National Research Council, Commission on Engineering and Technical Systems, Board on Manufacturing and Engineering Design, Committee on Supply Chain Integration. (2000). Surviving Supply Chain Integration: Strategies for Small Manufacturers. Washington D.C: National Academies Press, 2000.

National Research Council, D. o. (1992). Automotive Fuel Economy: How Far Can We Go? Washington: National Academies Press, 1992.

Netexplo. (2019). Smart cities: shaping the society of 2030. Paris: UNESCO Publishing.

Neumann, S. (2020). Tesla, Inc. and the World's Transition to Electric Vehicles. Risks, Strengths, Opportunities, and Strategic Recommendations. GRIN Verlag, 2020.

Perera, R. (2020). Understanding Porter’s Five Forces Analysis. Nerdynaut, 2020.

Philip Kotler, Hermawan Kartajaya, Iwan Setiawan. (2016). Marketing 4.0: Moving from Traditional to Digital. Indonesia: Wiley, 2016.

Porter, M. E. (2008). Competitive Advantage: Creating and Sustaining Superior Performance. Simon and Schuster, 2008.

Porter, M. E. (2017). Competitive Strategy: Techniques for Analyzing Industries and Competitors. Bangalore: CreateSpace Independent Publishing Platform, 2017.

Porter, M. E. (2017). Competitive Strategy: Techniques for Analyzing Industries and Competitors. CreateSpace Independent Publishing Platform, 2017.

Porter, M. E. (2017). Competitive Strategy: Techniques for Analyzing Industries and Competitors. Harvard: CreateSpace Independent Publishing Platform, 2017.

Reclamation, U. S. (2007). Sale of Electric Power: Hearings Before the Committee on Irrigation and Reclamation, House of Representatives, Seventy-ninth Congress, Second Session, on H.R.

5124, a Bill Relating to the Sale of Electric Power and Lease of Power Privileges Under the Recl. Washington: U.S. Government Printing Office, 1946.

Rich Mintzer, E. P. (2008). Start Your Own Automobile Detailing Business. Entrepreneur Press, 2008.

Tansel, A. K. (2016). Analysis of Tesla Motors' Marketing Communications Strategy: Marketing Report. GRIN Publishing, 2016.

Tansel, A. K. (2016). Analysis of Tesla Motors’ Marketing Communications Strategy: Marketing Report. London: GRIN Verlag, 2016.

Tansel, A. K. (2016). Marketing Report on "Tesla Motors": Marketing Audit, Segmentation & Targeting Analysis and Analysis of Product/Brand Strategy and Positioning. London: GRIN Verlag, 2016.

Tracy Maurer, Tracy Nelson Maurer. (2007). Tesla Roadster. Rourke Pub., 2007.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts