Study Analysis Barclays Plc Recruitment Process

Introduction

This report purposes to provide a deeper insight on the issue of recruitment process, based on an employer’s perspective. In this regard, the report will discover its findings, based on scenario A, which involves a case study that entails similarities with Barclays Plc. This report will start by providing Barclays’ organisational background, and identification of skill gap. In this part, the report will provide a brief history of Barclays Plc, and also provide an analysis of the labour problem causes will as well be analysed, which will consequently contribute towards the rationale for producing a new role. Following this, this report will bring forth the approach for recruitment, which will aim at solving the problem, whilst understanding of the skill gap, outlined in scenario A. This report will then provide a conclusion, which will summarise the report content, by synthesising the main argument and summarizing the key findings in the report. Finally, under the appendix, this report will articulate the human resource solution by purposing to create a job profile or rather, person specification, based on the details of the recruitment initiative used in the scenario. Notably, the new role will be suitable for the proposed new role. For those seeking HRM dissertation help, this analysis will offer valuable insights into effective recruitment strategies and addressing skill gaps within organisations.

Barclays Plc was founded in the year 1896, and by 1918, it was regarded as one of the largest banks in the UK. Evidently, Barclays Plc has its primary operations in the UK, US, Africa, as well as Europe. Notably, it is growing its presence in Asian countries (Barclays, 2019). It is significant to note that presently, Barclays plc is one of the world’s leading financial institutions with over 100 years of experience. Its headquarters is located in the UK. Barclays Bank has a significant strategy of increasing its growth potential by engaging in continued diversification of its business activities either in different geographies, in its customers or products (Barclays Plc, 2019). By 2018, it was recorded that Barclays had employed 79,900 employees in all the countries, where it holds banking licenses.

Generally, the banking industry engages in banking activities, which include providing savings, loans, mortgages, as well as related financial services to businesses, and also consumers. In this regard, the primary responsibility of Barclays bank is progressing, lending, investing, as well as protecting money belonging to approximately 3 million individuals (customers) across the globe and precisely, in 50 different countries (Bloomberg, 2018). In addition, Barclays provides, current accounts, as well as savings for products and various branded mortgages, it provides general insurance, and unsecured loans, and finally of great importance is the fact that the company offers money transmission services to businesses (small, as well as medium sized).

Significant to note is the fact that Barclays plc has had key developments, others happening within its sector and thus affecting its operations, whilst others directly affects its operations. Notably, in 1967, the company became the first bank that introduced the cash machine referred to as Automated Teller Machine (ATM) (Bloomberg, 2019). This invention issued £10 maximum cash delivered, in an instance where a customer inserted a paper (printed) which was obtained from the cashier. Moreover, in 1999, the company purposed to launch online banking, which took its course and by the year 2008, it purposed to also introduce the first contactless system of payment that used debit, as well as credit cards. In addition, by 2012, Barclays plc introduced mobile banking when smartphones could be used in making transfers, as well as pay bills (Barclays Plc, 2019).

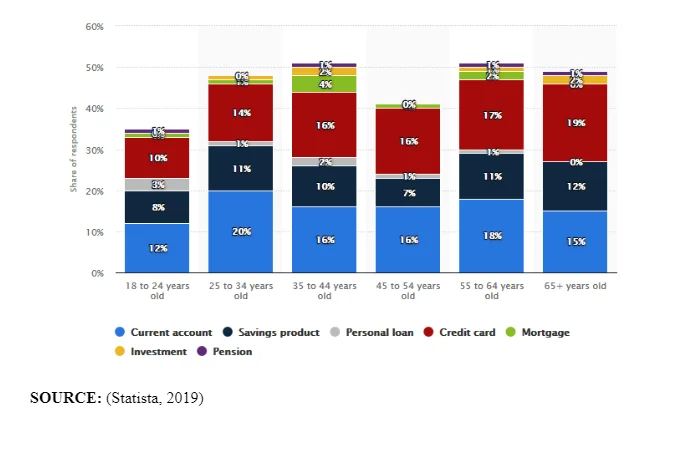

Barclays bank also made key developments, following government regulations, in that it was the first bank in the UK to gain an approval for its established ring-fencing scheme, following the response in 2011 towards the financial crisis in 2008. Based on the reforms that were established, all the banks in the UK took more than 25 billion as deposits from small businesses, as well as individuals, and this required them to separate their activities involving deposit-taking from their banking activities that involved riskier investment (Barclays, 2019). The ring-fenced scheme should be legally, as well as operationally distinct from other banking groups. Another development is that there are different customers using Barclays products, and this differs by age, owing to the fact that the consumption behaviour of consumers differs, based on their ages. The figure below (figure 1) illustrates the 2015 findings of the entire share of consumers who use the financial products of Barclays in the UK by age. About 20% of all the respondents aged 25-34, noted that they had Barclays bank’s current account (Statista, 2019).

The New York regulator fined Barclays with $15m, for claims that the chief executive had tried to unmask the whistleblower. Stanley had held the top position since 2015 at Barclays bank, and he notified the board that he thought unmasking a whistleblower was a legal action (Cassin, 2018). As such, he was reprimanded publicly. However, the bank allowed him to keep job as the company’s CEO. Notably, whistleblowers are essential in uncovering and also addressing wrongdoings, which are regarded as intentional (The Guardian, 2018). A thorough investigation conducted by the DFS’s uncovered actions, which exposed Barclays to risk, and as well created an atmosphere whereby, employees might have doubts on whether it was safe escalating issues related to the concerns of Barclays. In addition, an investigation conducted by the New York state department found out that Barclays had shortcomings in its governance, controls, as well as corporate culture (Noto, 2018).

The second issue noted in the case study is that Barclays decided to offer $2bn as settlement for a long-running US case regarding the sale of toxic mortgage products in the run-up to the 2008 financial crisis (The Guardian, 2018). This settlement had followed a 3year investigation, owing to the allegations that Barclays has caused billion dollar losses to its investors through the involvement of a fraudulent scheme (selling Residential Mortgage-Backed Securities in 2005-2007). As such, allegations were that Barclays had misled the investors and this was regarded as a violation of the Recovery and Enforcement Act of 1989, which relates to wire, brand fraud and postal, and other misconduct. Barclays, as well as its executives, acknowledged the harm that the company caused to its investors, as well as the national economy (Chapman, 2018).

The third issue noted in the case study is that Barclays has been slow towards addressing reported cases, where fraudsters have tricked its customers into accessing their online accounts. In this regard, aggrieved customers have raised complaints, both online and to the banking regulators, noting that the bank does not have a robust system that can check the set-up on new accounts (The Guardian, 2016). It is significant to note that criminals do operate multiple accounts, which are provided by high street banks, with the purpose of deceiving victims and making them transfer money online to their fraud accounts. This is the case in Barclays, and in most instances, the fraudsters pretend to be a trusted party or the victim’s solicitor. For instance, Andy Eggleston had made a complaint to Barclay’s bank regulator when a fraudster deceived his personal assistant and made her transfer a total of £19,000 to a fraud designated account (Murray, 2017). Andy raised a complaint to Barclays bank, but he was told that owing to the fact that he was not their customer, no report could be made. Another case is when fishers from London were deceived by online fraudsters into transferring £25,000 into their Barclays bank account, making them believe that the account was their legitimate builder’s account. Noteworthy, Barclays is under growing pressure, as they are required to explain the reasons why many customers are being conned thousands of pounds online (Collinson, 2016).

Based on the issues raised in this case, study, it is significant to note that Barclays plc experiences constant and prevalent fraud cases, thus implying that there is a skill gap in this sector. In this regard, the bank’s HR director should be obligated to provide advice, sought on a suitable new role in the organization, which could assist in fighting the aforementioned fraudulent cases. Noteworthy, based on the findings on the cases study, it is evident that Barclays bank lacks a fraud risk manager, who would aid in steering the company in a more compliant direction.

Organizations use the recruitment wheel in assessing their current recruitment strategies, and as such, applicants need to follow the simple instructions, score themselves on the wheel spokes and thus, set forth a clear action on how they plan to improve in areas where they have not scored perfectly (Banfield and Kay, 2012). Based on the post required by Barclays bank on the position of fraud risk manager, it is significant for the company to engage in advertising. Advertising is a vital aspect of the recruitment process, and its purpose is to reach a large section of the audience, composed of qualified individuals for the position. The advertisement process is determined by the HRM department of Barclays bank, and this involves making decisions, in order to ensure that the advertisement wordings do not exclude the possible recruits (Porter et al., 2007). In order to get the suitable candidates for the job position, the advertisement should purpose to attract, interest, and also communicate to the suitable candidates, discourage candidates that are unsuitable for the position, portray the organization’s positive image, adhere to the legislation relating to discrimination and should as well purpose to provide clear instructions on what is required of the candidates (Bingham, 2016).

In line with the above mentioned, the content of the advertisement should meet a specific criteria, in order to enhance its effectiveness (Rees and French, 2013). In this regard, the advertisement checklist should entail the job title, the employer, job location, job role, as well as timescale, job role responsibilities, outline profile of the required ideal candidate, requirement of qualifications and experience, salary guide, organizational description, as well as contact details (Pilbeam and Corbridge, 2010). In addition, Barclays should purpose on including details of its employee recognition schemes, or rather, the benefit programs that the company has, owing to the fact that employees are increasingly valuing them, and in turn, they aid in attracting the right candidates for the role.

Notably, the advertisement approach provided above is appropriate for the position of a fraud risk manager at Barclays bank. Firstly, because it will be regarded as a senior position in the company, which then implies that only appropriate and suitable candidates will be required to apply for the role (Edenborough, 2005; cited in Rees and Porter, 2015). The above advertisement approach purposes to attract the right target audience for the job. Moreover, the labour market conditions have made employees to prefer working in organizations where they are well-treated (Burnes, 2014). On the other hand, employers need to consider that employees consider these factors, thus it is required of them to take them into considerations. In this regard, the Barclays need to elaborate on its employee recognition schemes, or rather, the benefit programs that the candidates would benefit from if selected (Rayner and Adam-Smith, 2009). Overall, it is evident that the above recruitment approach would attract the right candidates with the right attributes for Barclays Plc.

Conclusion

This report makes it clear that Barclays bank suits all the issues in the case study, and it has been noted that the company has had constant and prevalent fraud cases, thus implying that there is a skill gap in this sector. The identified skill gap that can aid in fighting the fraudulent cases, needs the company to employ a fraud risk manager. However, an appropriate candidate can only be gotten when the company engages in significant recruitment approach, whereby, a suitable advertisement is used. The advertisement needs to meet all the criteria, which can meet the requirements of a suitable candidate.

Dig deeper into Stress and conflicts at work places with our selection of articles.

References

- Banfield, P. and Kay, R. (2012). Introduction to Human Resource Management, 2nd ed. Oxford: Oxford University Press.

- Barclays Plc. (2019). Profile: Barclays PLC (BCS.N). Retrieved [online] from

- Barclays. (2019). Who we are. Retrieved [online] from [accessed on 13th Feb, 2019].

- Bingham, C. (2016). Employment Relations, Fairness and Trust in the Workplace. London: Sage Publishing.

- Burnes B. (2014). Managing Change, 6th ed. London: Financial Times Press. Cassin, R.L. (2018). New York regulator fines Barclays $15 million for whistleblower program flaws. Retrieved [online] from

- Chapman, B. (2018). Barclays to pay $2bn settlement over US fraud case dating back to financial crisis. Retrieved [online] from

- Edenborough, R. (2005). Assessment methods in recruitment, selection, and performance. London: Kogan Page.

- Noto, A. (2018). Barclays has been fined $15 million by New York regulators after the bank's CEO, Jes Staley, tried to unmask a whistleblower. Retrieved [online] from

- Pilbeam, S. and Corbridge, M. (2010). People resourcing and talent planning: HRM in practice. Harlow: Financial Times Prentice Hall.

- Porter, C. Bingham, C. and Simmonds, D. (2007). Exploring Human Resource Management. Maidenhead: McGraw Hill Education.

- Rayner, C. and Adam-Smith, D. (2009). Managing and Leading People, 2nd ed. Maidenhead: McGraw Hill Education. Rees, G. and French, R. (2013). Leading, Managing and Developing People, 4th ed. Maidenhead: McGraw Hill Education.

- Rees, W. D. and Porter, C. (2015). The Skills of Management and Leadership. London: Palgrave Macmillan. Statista. (2019). United Kingdom: Which, if any, of the products listed do you have from Barclays? Retrieved [online] from

- The Guardian. (2016). Is Barclays doing enough to protect its customers? Retrieved [online] from

- The Guardian. (2018). Barclays agrees to pay $2bn to settle US fraud case. Retrieved [online]

- The Guardian. (2018). Barclays hit with $15m fine over attempts to unmask whistle blower. Retrieved

A fraud risk manager will pro-actively manage risks related to fraud at Barclays banks within its global retail, as well as commercial banking by embedding and also implementing the bank’s risk control policies, as well as frameworks (Prospects.com, 2019). Moreover, a fraud risk manager will manage fraud-related loses that are within the bank’s budget, and will compile fraud reporting standards, in line with the fraud risk development, capability of the fraud management, as well as fraud investigation. Finally, it will be of importance that the fraud risk manager pro-actively manages fraud reduction, prevention, as well as training initiatives across the globe (Prospects.com, 2018).

The ideal candidate for the position of a fraud risk manager should hold a bachelor’s degree or even fraud-supervisory experience A minimum of five years of experience Leadership skills Strong analytical skills Experience in online fraud threats, as well as controls Have fraud techniques, which includes advanced, transaction, as well as plastic fraud Have an understanding of tools, and techniques for preventing fraud, which is presently used in the fraud industry Excellent presentation, as well as communication skills Working knowledge related to risk management, and its processes Report writing skills Have a deep understanding of types of fraud, especially in the financial service sector, and in market trends (Prospects.com, 2019).

The job description and persona specification are a perfect match for the proposed role of fraud risk manager, owing to the fact that a candidate fitting the aforementioned, can be able to fight fraudulent issues within the organization, and would as well been able to solve the issues, which Barclays had faced, relating to fraud in the past, as provided in the case study. However, based on the job description, an addition should be made, whereby, the job role should ensure that cases of fraud are reported to appropriate departments. On the other hand, whilst considering the person specification, an additional specification should be made, to include candidates who have a broad knowledge, as well as understanding of the regulatory/compliance environment.

What Makes Us Unique

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts