Commonwealth Bank Strategic Foray Into India

Introduction

Commonwealth Bank wasestablished in 22 December 1911 as a Government bank, It has 1,100 + branches, 4,300 + ATMs servicing worldwide motto is ‘’CommBank Can’’. Commonwealth bank is recognisedfor its well-known reputed bank in the Australian market with a well-established network and a strong customer base, it is one of the reliable brands in Australia, often cited in discussions about marketing dissertation help due to its effective strategies and customer engagement practices.

There was strong economic growth in Indian banking throughout the 5 years period which came next (Austrade, 2016). India's middle class is expanding, which enhances growth opportunities in banking due to an increase in subsequent disposable incomes (DFAT, 2016).

The report is helpful to discuss the commonwealth bank that expands their business in India and it is important to conduct situational analysis in India so that it is possible to understand the environment in the international market and recommend some suitable suggestions for market entry strategy, positioning the business in the international market and developing marketing mix strategy.

Political/Legal

India is a democracy where thereare significant changes in the political environment in the recent years after the election of PM Modi of the BJP (DFAT, 2016). leadership change has crucial impacts in India where the PM focuses more on agriculture and small business as well as he is concerned about the investment on the employment in the country (DFAT, 2016).

Economic

While analysing the macro environment factors in India, it is necessary to evaluate the economic growth where there is significant growth in the industries in India and potential growth rate and social development influences the foreign investors to invest more in the country for establishing the business in future (Fletcher & Crawford, 2014). For example, there is high growth in e-commerce sector in India which further enhances the development of other industries such as banking, commerce as wellas fashion industries (Hubbard, Rice & Galvin, 2015). As there is high growth and it can be expected that in future, there will be more growth and development, the Australian companies can expand their business in India for utilising the economic growth in India for successful business establishment.

Definition of the Market

The Commonwealth Bank operates in the banking industry where the customers are loyal and open minded for future investment in the bank. the market in India is suitable for the Commonwealth Bank where it is possible for the bank to expand their business in India and establish their business in the market for retaining the customers in the country and serve better banking and financial services to the customers by improving the organisational resources and capabilities (Fletcher & Crawford, 2014).

Market Size and Outlook

As per the information published by the IMF globally the market size in the finance sector is over $77.6 trillion.

There is more than 5.5% growth rate year on yearin the Asian countries (IMF 2017).

Market Characteristics

The middle-classfamilies are growing rapidly in India and this is the reason of increasing urban lifestyle where the people are more interested in investment and in this regard, the Commonwealth Bank targets the market mainly the middle-class families for huge investment for insurance and finance (DFA 2016). There is lack of trust in the local financial institutions in India and the people know that there is high debt which influence them to invest more for future. The investment planning of the Commonwealth Bank in this regard are efficient to target the customers in India and improve investment.

Target Market

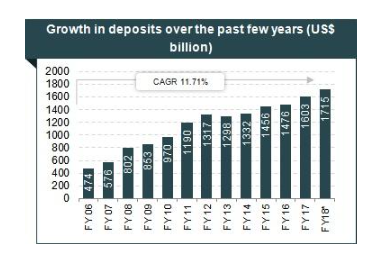

The Indian banking sector is growingrapidly, and it can be seen that, there is huge investment in India in the past few years and it is increasing. In 2016, there was $1476 billion investment and in 2017, it was $1603 billion. In 2018, there is approximately $1715 billion investment in the Indian banking sector and it can be expected that the amount of investment is increasing rapidly in near future (IBISWorld, 2016). There are high competitions in the banking market in the USA due to huge numbers of competitors entering the market, targeting niche areas and driving local competition.

There is strong presence of independent business in the country and it further provides an opportunity to the Commonwealth Bank to establish their business in India and strengthen customer’s base further by providing efficient service and good financial investment planning.

International Competition

There is high competition in the international banking and finance market due to high presence of efficient banking institutions who are able to serve the customers with better investments planning and efficient services as per the client’srequirements. As India is growing rapidly in the recent years and banking and investment sector shows high growth, it will be effective for the Commonwealth Bank to establish their business in the country for expanding their brands across the international markets.

The competition for substitute products in the banking and finance market is also moderate as there are many investment planning through which the people in India can invest for securing their future and gaining higher return on investment. It is hereby essential for the Commonwealth Bank to establish the business through developing effective investment planning that would further attract the customers in India.

Organisational Analysis

The Commonwealth Bank started their journey since the year of 2000 and they try to establish the business in the international banking and finance market through expanding theirbranches and retaining more loyal customers for future. The Commonwealth Bank is successful in developing their position in the USA and it now targets the Indian market to expand their business internationally so that it is possible to improve their reputation and strengthen their customer’s base.

SWOT Analysis

SWOT analysis is useful in this context to understand the internal environment of the Commonwealth Bank which further helps to understand the strengths and weaknesses of the bank as well as identify the market opportunities and threats in the Indian banking and finance market.

Strengths

There are various brands which are owned by Commonwealth Bank. This provides greater opportunity to widen services offered and in turn aid sustainability especially in a volatile climate. Commonwealth Bank is operating in several countries such as New Zealand, Fiji, USA and United Kingdom. This expanse strengthens the brand name and hence trust by clients. It is a largest Australian Listed Company on ASX, giving it greater stability and sustainability.

Bank has got strong revenue also is generating effective amount of profit in its field

There are various services which are provided by Bank such as Insurance, Consumer

Banking, Corporate Banking, Global Wealth Management, Private Equity, Mortgages

and Credit Cards

The Indian market is one of the largest and fastest growing in the world, so this is a

positive aspect and provides plenty of scope for success.

Opportunities

Commonwealth Bank is planning to enter into the new market which will create a huge

scope for the growth of the organisation. It needs to consider addressing the need for

digital/electronic banking to remain competitive.

Commonwealth Bank has taken the initiative of introducing “One Commonbank” which

will assist in building strong relationships with customers in the Indian market. Building

on this approach may assist to consolidate an upward trend in the number of customers.

The Asian market will provide a huge scope for growth for the bank having the effect of

a more sustainable future.

Addressing the need for accessing worldwide financial channels in order to maintain connectiveness

with more than the local market. An improved system of licensing will aid with this aim. This

would also enable the Bank to support Australian businesses and customers’ internationals banking

needs

Hedge from risk Well-regulated banking sector provides some stability for decision making. Diversifying options for services increase scope for meeting the needs of a greater number of clients. Open to FDI Being the fourth largest economy in world there is scope to secure both local and international markets.

and mean the bank is unsustainable. Uncertain environmental conditions and electrical issues.

Global Wealth Management, Private Equity, Mortgages and Credit Cards The Indian market is one of the largest and fastest growing in the world, so this is a positive aspect and provides plenty of scope for success.

Opportunities

Commonwealth Bank is planning to enter into the new market which will create a huge scope for the growth of the organisation. It needs to consider addressing the need for digital/electronic banking to remain competitive. Commonwealth Bank has taken the initiative of introducing “One Commonbank” which will assist in building strong relationships with customers in the Indian market. Building on this approach may assist to consolidate an upward trend in the number of customers. The Asian market will provide a huge scope for growth for the bank having the effect of

Weaknesses

Recent various controversies involving the Commonwealth Bank has affected its goodwill among the target customers available in the market worldwide. Resolving and addressing these issues are necessary to regain trust and sustainability in the future. Loan impairment expenses are seen by the Bank as an immense concern for it. Minimising this aspect provides better opportunities for growth. Financial strength ratings of the bank are not effective which again affects its growth in the target market in which it is dealing Lack of knowledge of the rural areas is a negative aspect attached with the bank. Seeking information of the needs of these customers is vital to secure this cohort as customers.

Threats

Policies of the government of India are the biggest threat for Commonwealth Bank. The political instability creates uncertainty about future stability for the Bank. A change of government could create doubt for the Bank. People of India has the mentality of trusting the Indian Banks which again could affect the growth of Commonwealth Bank in the target market Competition in the Banking Sector of India is increasing which could affect the progress of Commonwealth Bank in the target market. This in turn could create a downward spiral and mean the bank is unsustainable. Uncertain environmental conditions and electrical issues. Lack of infrastructure in rural areas inhibits opportunities for a fuller banking experience for country customers

Implications of SWOT Analysis

The SWOT analysis is beneficial to understand the internal environment of the bank and from the above-mentioned SWOT analysis, it can be stated that, there are positive factors that influence the Commonwealth Bank to enter in the Indian market for successful establishment of the bank. Growing support from the Indian Government is also beneficial for the bank to expand their branches across India. Moreover, the social development of the country as well as economic growth ae helpful for theCommonwealth Bank to increase their reputation and develop effective strategy of word-of-mouth through the tourists and social networks which will be a major opportunity to establish the business strategically(Ashraf, Narongsak, & Auh, 2014). Well regulated banking market industry as well as growth in Asian banking and finance industry are also the opportunity which influences the Commonwealth Bank to flourish in the Indian market by reducing the threats of political instability, uncertainty and high competition. High reputation of the commonwealth bank, strong infrastructure and efficient services such as Insurance, Consumer, Banking, Corporate Banking, Global Wealth Management, Private Equity, Mortgages and Credit Cards are the success factors for the bank to establish their business successfully(Fletcher &Crawford, 2014).

Objectives

The objectives of the Commonwealth Bank and the mission statement can be achieved within 12 months through applying own strengths of the bank and utilising the market opportunities in the Indian banking sector which is the fastest growing industry.

Mission

Commonwealth Bank focuses onquality servicewhich is for everyone and the mission of the bank is to deliver quality and efficient service to all the clients of their business.

Business objectives

The key objectives for Commonwealth Bank to achieve in the new market of India are:

Successful market entry

Online advertising search, display, social and delivering 3 blog posts per week to business communities.

Recommended Strategy

The Commonwealth Bank is efficient to develop effective strategic planning for successful market entry in the Indian banking market. The main strategy of the bank is focus strategy where the organisation focuses on the niche market mainly the middle class people where it is possible to target them and retain them for long run investment. The bank focuses on unique products and services in the banking and finance industry which helps the organisation to target the people in India and offers the best possible banking products and services to them (Fletcher & Crawford, 2014).

Market Entry Strategy

In order to access new market like India, the Commonwealth Bank needs to focus on effective market entry strategy so that it is easy to enter into the new international market like India which has high growth rate in the banking and finance sector (Fletcher &Crawford, 2014). The selection of the right entry mode is difficult in international marketing and it is necessary for the bank to develop effective planning for successful entry (Baena, 2012). Commonwealth Bank needs to utilise their resources and capabilities for successful entry while developing the planning by considering increased susceptibility to external forces and management structure (Laufs & Schwens, 2014). The following discusses potential and preferred market entry options for Commonwealth Bank.

Option 1 - Entering a Joint Venture

Joint venture is one of the effective strategies for successful market entry where it is possible for the Commonwealth Bank to establish joint venture with a local financial institution to enter into the Indian banking market. The benefits of such strategy are that the Commonwealth Bank needs less capital and resource commitment in this context where the bank also can utilise the access of the market and customers of the local institutions. The market share and the ability to leverage local expertise and contacts will likely increase through joint venture (Fletcher & Crawford, 2014).Strong relationship with the business head and cooperation are also other advantages of such joint venture through which the Commonwealth Bank can expand their business in the Indian banking sector.

Option 2 - Franchising

Franchising is also another effective strategic planning for successful expansion of the business where the businesses can expand their branches in a cost effective manner. There is lower capital requirements and lower risk if the business expands their branches through franchising and the Commonwealth Bank is a reputed firm which can focus on this tactic of franchising to enter into the Indian banking and finance industry.

Segmentation, Targeting and Positioning Strategies

Segmentation, targeting and positioning strategic planning are helpful for the companies for successful establishment of the brand and it also enhances the performance of the companies in the new international markets (Fletcher &Crawford, 2014). The Commonwealth Bank may successfully conductsegmentation by segmenting the new market, determining the right segments to target and developing the best way to position their offering to those chosen targets (Fletcher &Crawford, 2014).

Segmentation

Within the broader market of India, there are various criteria that Commonwealth Bank could use in its segmentation approach that includes demographic, behavioural. lifestyle, ethnicity-based and linguistic bases (Fletcher &Crawford, 2014). The main aim of segmenting the market is to categorise the potential customers in India with their comparable needs and buying behaviour into segments.The bank mainly considers the segment who are middle class and prefer quality products and services as the bank has the capability to deliver high quality product to the customers according to their needs and preferences.

Targeting

By reviewing the market segmentation above and determining the Commonwealth Bank’s position as a niche specialist in the market, it is now essential to identify and choose those segments which are beneficial for the bank in near future.The business of commonwealth bank has effective resources and capabilities to deliver best services to these segments and gain competitive advantage (Laufs & Schwens, 2014).

Positioning

The Commonwealth Bank needs to focus on positing the company in the Indian banking industry through developing effective marketing mix strategicplanning so that the company can acknowledge the taste and preferences of the customers and serve them in a better and efficient way.

Marketing Mix Strategy

The marketing mix strategic planning is important for the institutions to enter into a new international market and make successful positioning in the country (Kotler & Keller, 2012). For targeting the right customers and promoting the brand in the market, the strategies of marketing mix are unbeneficial as it provides an opportunity to the company to establish the brand successfully and the marketing mix strategies includes product, price, promotion, place, people, process and physical evidence.

As Commonwealth Bank provides efficient services that are established, the business will take service-based approach to develop the right marketing mix program for delivering their existing products and services to the identified target segments (Fletcher & Crawford, 2014).

Services and Products

Products and services of the company should be unique during international expansion of the organisation so that it is possible to target the customers and retain them for long run. In this regard, the Commonwealth Bank needs to design their financial products that would match the needs and preferences of the customers. Moreover, the bank needs to deliver high quality service to manage the customer’s queries through providing 24*7 services by utilising latest updatedtechnology.

Price is also another important factor under the marketing mix strategic planning where the bank can attract the customers in the Indian market (Fletcher & Crawford, 2014). Firstly, price needs to be set at similar or less than perceived value which will help the bank to retain more customers in India (Fletcher &Craw ford, 2014).

Expansion of suppliers across the country as well as strengthen distribution channel in the country are important for the bank so that it can serve the customers in a better way (Fletcher & Crawford, 2014).

The 'people' is a significant factor in the marketing mix because it is difficult to serve the best quality service to the customers without efficient manpower (Kushwaha &Agrawal, 2015). In this regard, the bank needs to provide proper training to the staff members for performance management as well as encourage them for performing better through motivation, providing rewards ad incentives and flexible working culture in the workplace.

Physical Evidence and Process

The tangible part of the services, physical evidence is also important for successful expansion of the companythat includes the facilities, equipment and Information and communication technology(Ivy, 2008). The Commonwealth Bank needs to increase the internal resources, human resources and implement Information and Communication Technology for delivering efficient services to the customers.

Promotion

Promotion is another effective technique to promote the company in the new international markets (Powers &Loy ka, 2010).To become successful, the Commonwealth Bank’s promotional activity will need to meet the customer preferencesof the new market (Jain, Haley, Voola,& Wickham, 2012). As suggested by Hulonan, Katsikeas & Robson (2011), The promotional strategy for the commonwealth bank would be the social media advertisement which promotes the products of the institutions across India where people can get proper information through social media. Word-of-mouth and e-mail marketing as well as televisionadvertisement are also some of the promotional strategies through which the bank can and tehri business across the Indian market.

The process is also important were the Commonwealth Bank needs to develop their internal portals and system as well as company’s website to serve the customers in a better way.

Economic Evaluation

Table 2 outlines the financial viability of the proposed plan which includes expected revenues, and costs for recommended market entry and marketing mix strategies.

Proposed Budget and Performance against Objectives

The estimated cost for the bank is 15000 million dollar which is required for establishing the banking service, promoting the services across the country through social media and implementing the updated technology. The office set up costs approximately 12000 million dollar where it can be estimated that there will be 55000 million dollar revenue of the bank as the bank is reputed across the globe. Hereby, the estimated profit after 12 months will be around 28000 million dollars.

Implementation and Control

The organisation can control the strategic planning through hiring an efficient manager who is expert in marketing. Investing in technology and upgrading the operating system of the banking portal are also under the implementation planning through which the company can execute the marketing planning. Efficient upfront mangers and staff members are able to control the marketing mix strategy and expand the bank through establishing physical store and developing efficient banking service for the customers.

Goals

The goal of the Commonwealth Bank is successfully expanding the business in India through developing marketing mix strategic planning.

The strategic planning of 7 P's (Product/Service, Price/Value, Place/Distribution, People, Process, Physical Evidence and Promotion or communication plan) of the Commonwealth Bank can be discussed below:

Dig deeper into Consumer Behaviour Change and Marketing Strategy with our selection of articles.

Conclusion

It can be concluded that, through developing effective products and services andsettingaffordable price, the companyCommonwealth Bank can expand their business in India as it has the capability to utilise its resources and capabilities. The Indian banking industry is growing rapidly,and it will be beneficial for the Commonwealth Bank to expand their business and establish it in the international banking market and gain highly competitive advantage.

Looking for further insights on Commonwealth Bank Strategic Foray Into India? Click here.

Continue your exploration of Case study of Zara Company with our related content.

References:

- Central intelligence Agency (n.d). The World Factbook: India. Retrieved from:

- DFAT. (2016).India country brief Retrieved August 7, 2016, from Department of Foreign Affairs and Trade:

- eMarketer. (2018, October 23). Internet Users in India Prefer Mobile Access and Social Media. Retrieved August 14, 2018, from eMarketer:

- Commonwealth Bank. (2018). Home. Retrieved September 10, 2018, from Commonwealth Bank:

- Fletcher, R., & Crawford, H. (2014).International Marketing: an Asia-Pacific Focus.Frenchs Forest: Pearson Australia.

- Hooley, G., Piercy, N. F., & Nicoulaud, B. (2012). Marketing Strategy &Competitive Positioning.

- Harlow: Pearson Education Limited.

- Hubbard, G., Rice, J., & Galvin, P. (2015). Strategic Management: Thinking, Analysis, Action.Melbourne: Pearson.

- Ivy, J. (2008). A new higher education marketing mix: the 7Ps for MBA marketing. International Journal of Educational Management, 288-299.

- Kotler, P. (2011). Reinventing marketing to manage the environmentalimperative. Journal of Marketing, 132-135.

- Kushwaha, G. S., & Agrawal, S. R. (2015). An Indian customer s ur rounding 7P's of service marketing. Journ al of Retailing and Consumer Services, 85-95.

- Porter, M. E. (1996). What Is Strategy? Harvard Business Review, 61-78.

- Powers, T. L., & Loyka, J. J. (2010). Adapta tion of marketing mix elements in international markets. Journal of Global Marketing, 65-79.

- The World Bank.(2018).IndiaOverview. Retrieved September 15, 2018, from The World Bank:

- Trip Advisor. (2016). India: Tippin9 &Etiquette. Retrieved October 7, 2016, from Trip Avisorhttps

- Warnier, V., & Weppe, X. (2013). Extending resource-based theory:Mana9ement Decision, 1359- 1379.

- X-Rates. (2018, September 10). CurrencyCalculator.Retrieved SEPT 10, 2018, from X-Rates:

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts