Global UAS Market Overview

Introduction

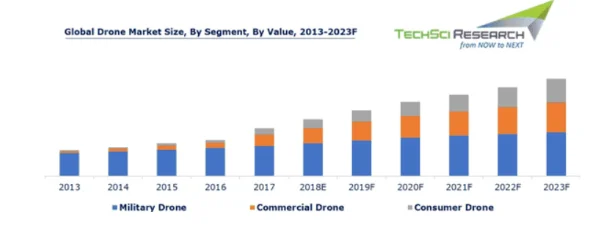

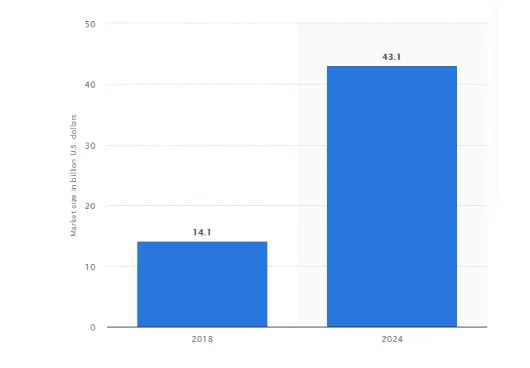

The unmanned aircraft systems (UAS), commonly known as drones, have significantly risen in popularity over the last ten years and it is expected to surpass $141 billion by 2023 (see figure 1). This technology has matured to an extent that it has enabled the capacity to become a key asset in military organisations enabling the market to expand significantly during the last 10 years. On the other hand, the civil and commercial market for UAS is in its initial phases with considerable unrealised potential in a wide number of applications where the available technology offers the opportunity to replace the existing solutions and potentially to be applied in new areas where there is no existing solution. According to Kovalev et al. (2019), the civil and commercial sector of the world UAS market as well as markets of separate countries is still being formed thus characterised by immature concentration. The commercial UAS market will start maturing between 2022 and 2025, a stage that will witness large-scale application of drones for commercial purposes as well as the expansion of their functionality (Kovalev et al, 2019). It is also in this phase that the participants in the UAS commercial market will find solutions for new problems while the manufacturers will develop technologies to maximise the efficiency of drones. Despite the fact that drones are in the primary concentration stage in the commercial market, drones are being touted as the solution for everything from expanding the range of news coverage, delivering packages to the consumers’ doors, finding lost hikers, and delivering medication to remote sites among other functions. In this background, the aim of this paper is to analyse the UAS market particularly focusing on the global market as well as the US and the Australian UAS market. The paper will also focus on the key players in the UAS industry and the level of competition in these markets. The paper will further explore the share units sold for both commercial and military uses.

2.1 UAV market size and future predictions

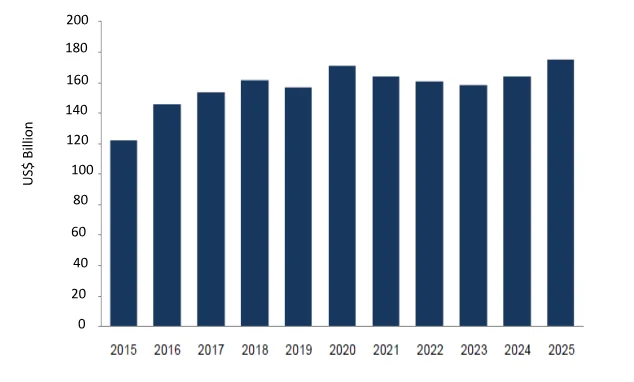

The global UAS market is expected to show positive growth between 2015 and 2025. According to Global Market Insights (2018), UAVs are the next generation of aerial platforms being increasingly deployed by defence ministries across the globe a factor that is significantly influencing the growth of the UAVs market. Drones are commonly used in performing ISR missions, multiplying forces, recognising targets, assessing damages, and in electronic warfare. Therefore, defence ministries across the globe are investing in drones for military purposes with an aim of reducing troop casualties. In particular, VTOL and mini UAVs are capable of performing ISR missions and are affordable thus increasing their demand in among various defence ministries across the world. The global market for UAVs in 2015 was estimated at approximately US$60 million and is expected to be valued at US$160 billion by 2025 due to a 12% CAGR (see figure 2).

2.2 Global UAV Market: Analysis by Region

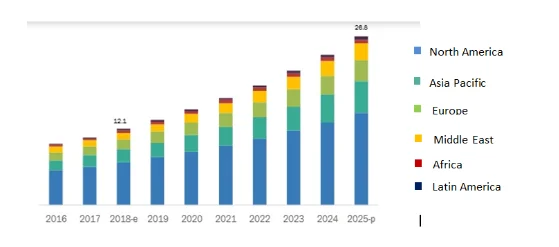

The global military drone market is regionally segregated into Latin America, Europe, Middle East and Africa, Asia Pacific, and North America. Out of these regions, North America is the largest market and it is expected to lead in terms of military UAV/ drone market revenue in the coming years (Global Market Insights 2018). Figure 3gives an overview of the UAV market by region.

2.2.1 North America market share and the driver

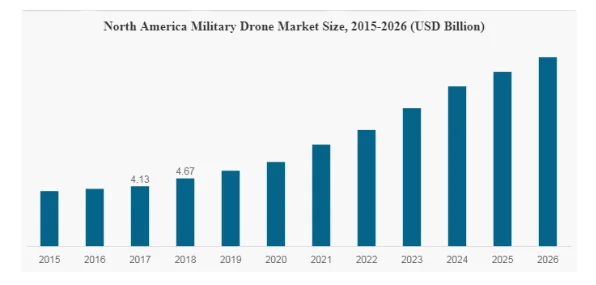

In 2018, the North America region held a share of $4.67 billion (see figure 4). The growth of the North America drone market can be attributed to increasing research and development activities to develop new drones which have higher efficiency. In addition, joint ventures by industry giants and rising investments in developing technologically has resulted in advanced UAS for supporting numerous military applications which further accelerates growth in the region. Still, some countries such as US and Canada are adopting military UAS for border and maritime surveillance, which has further driven the growth of the market in the region (Global Market Insights 2018).

2.2.2 Factors influencing the growth of UAV market in other regions

Despite North America being the largest UAS market in the world, the Asia Pacific region is expected to experience the highest CAGR given the exponentially growing demand for military drones in India, Japan, and China (Global market Insights 2019). The Middle East and Africa region remains the smallest UAS market but is expected to experience considerable growth as Israel has emerged the largest exporter of drones for military use while Turkey is increasingly deploying UAS and their sub-systems (Fortune Business Insights 2020). In addition, South Africa is adopting UAS for surveillance activities while Mexico has increasing adopted military drones to monitor forest fires. This increasing usage of UAS in different regions will lead to growth of the military UAS market.

3. The Military UAV Market

3.1 Overview of the military UAV market

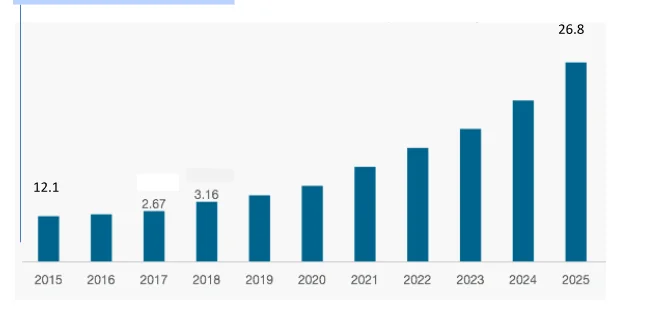

The military UAV market as of 2015 was valued at $12.1 billion and it is expected to be valued at $26.8 billion in 2025 due to a 12% CAGR between 2018 and 2025 (European Commission 2018). The global military drone market is gain traction from the increasing demand from the defence sector which possesses a high surveillance capability. Today, military drones are equipped with several state-of-the-art technologies such as artificial intelligence, cloud computing-based services, and multi-sensor data fusion for UAV navigation which have significantly influenced the adoption of drones in the military market. Figure 5 shows the 2015 2025 military UAV market value.

3.2 Key Players in the military UAV market

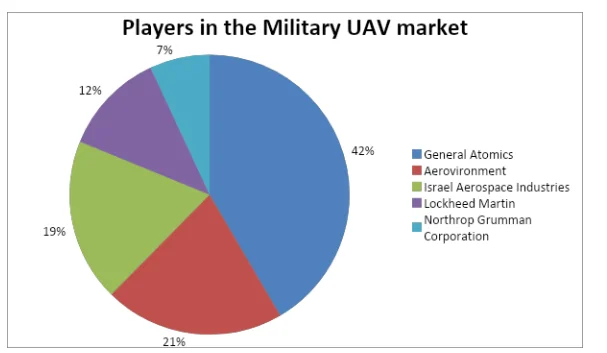

The key players in the global military UAS market are Aero Vironment Inc. (U.S.), General Atomics Aeronautical Systems Inc. (U.S.), Israel Aerospace Industries Ltd. (Israel), Lockheed Martin (U.S.), Northrop Grumman Corporation (U.S.), AAI Corporation – Textron Systems (U.S.), Aeryon Labs Inc. (Canada), American Dynamics (U.S.), BAE Systems (U.K), and Boeing (U.S.), and Boeing (U.S.) (Markets and Markets 2019). In 2019, General Atomics was the leading player in this industry with revenue of $2.1 billion (Global market Insights 2019). General Atomics products are operational in the US air force and are being significantly adopted in other countries such as Pakistan, Afghanistan, Libya, Iraq, Yemen, and Syria, which is promoting growth in market share (Market Research Future 2020). In addition, the company has a wide range of products offerings ranging from sensor systems, UAV platforms, and ground control stations; this diversification has promoted the growth in market share (Market Research Future 2020). The company generates most of its revenue from the US with the sale of its Predator and Sky Guardian drones as prime revenue pockets. Figure 6 summarises the market share for the major players in the military UAV market.

3.3 Adoption of military UAV by Countries

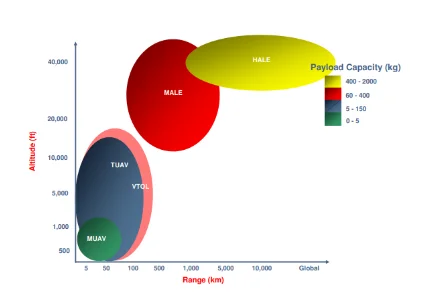

The US and Israel pioneered the adoption of AUVs for military applications and they still make significant investment in UAVs (see figure 7). The European States on the other hand begun to deploy the UAV technology in the mid-1990s and in these early stages, the application of the drone technology proved problematic due to factors such as immature technology, unfavourable weather conditions, deception, and lack of better understanding in how to best utilise the UAS. However, the drone technology begun to experience growth in 2003; according to Markets and Markets (2018), the number of UAS deployed globally rose from 1000 to 5000 systems between 2004 and 2008. The main consumer of UAS has been the US whose budget and need for drones has always been higher than any other region or country in the world (Global Market Insights 2018). While the US is set to remain the larger markets for the UAS in the military field, Europe is growth at a considerably faster rate (Global market Insights 2019). In the US and Europe, the UAS market can be segmented into MUAV, VTOL, TUAV, MALE and HALE segments with HALE being the largest segment (see figure 8). With this segmentation, the drone technology has quickly growth and has been able to replace manned aircraft thus offering new organic surveillance capability to the Land Forces. The emergence of hand-launched UAS has contributed to increased use of UAS in different countries in Europe, which could otherwise not have been achieved (Fortune Business Insights 2020). Australia has experimented and used UAS severally in military operations but it has not proved to be a strong market. Nonetheless, Australia is expected to procure Tactical UAS and mini-UAS in the medium term, which will considerably impact on its market strength.

4. The Commercial UAS Market

4.1 An Overview of the Commercial UAV market size

The global commercial UAV market size was valued at $5.80 billion, with an estimated 274.6 thousands units sold in 2018 (Fortune Business Insights 2020). The commercial UAV market is projected to register a CAGR of 56.5% between 2014 and 2025 (see figure 9). UAVs are increasingly being applied in different sectors such as agriculture, energy, and entertainment and are ultimately expected to positively impact the market growth. While UAS were initially viewed as military devices, they have significantly been used in commercial sectors due to their ability to perform hazardous tasks such as inspecting utility pipelines with higher cost-effectiveness and precision as compared to the conventional methods (Fortune Business Insights 2020). In the past few years, leading global technology giants have demonstrated the utilisation of UAS in delivering goods from warehouses to customers, which is likely to have a significant impact of the market size. The introduction of the commercial drone delivery services is projected to facilitate different forms of cargo transportation capabilities such as the transportation of temperature-sensitive goods and emergency medications.

4.2 Factors influencing the growth of the commercial UAV market

Drone manufacturers and UAS providers across the world are developing custom-made industry-specific solutions, which are aimed at helping business to effectively address the needs of their customers (Global market Insights 2019). Advancements in the UAS technologies have enabled manufacturers to produce wide range of models in different weights, sizes, and shapes that are capable to carrying different sensor payloads, which make them useful across different application bases. Further, there has been an increase in UAV venture funding and technological developments such as 3D mapping and drone delivery. These factors are expected to significantly contribute to the growth of the commercial UAV market. Nonetheless, there have been several safety and security concerns, UAS traffic management issues, and scarcity of trained pilots, which are among the factors that are negatively affecting the commercial UAV market.

4.3 Key Players in the Commercial UAV market

The major players in the commercial UAV market include DJI, Parrot Drones SAS, Xiaomi, AeroVironment Inc., 3D Robotics, INSITU, EHANG, Yuneec, and Aeryon Labs. Figure 10 provides an overview of the market share of the major companies in the commercial drones sector.

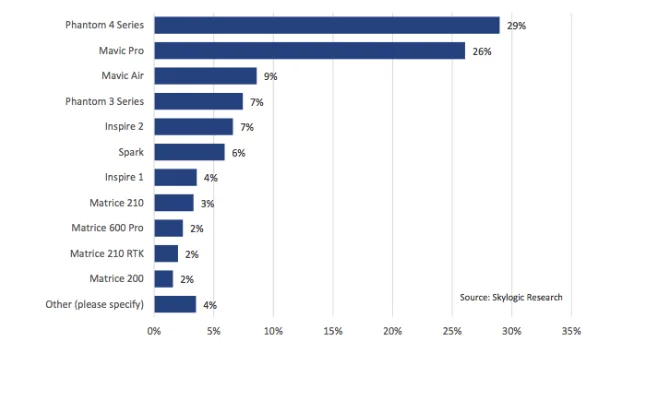

4.3.1 The Success of DJI

DJI’s success is attributable to its Phantom and Mavic Pro drones, which are often used for aerial photography, being the most purchased (see figure 11) (FAA 2019). These drones are offered at lower prices (between $500 and $1000), which has driven their demand. In the North American market, DJI accounted for 66% of the drones sold in the price category of $1000 and $2000 and 67% in the price range of $2000 and $4000 in 2017 (Fortune Business Insights 2020). Across all the price ranges, DJI was able to sell 50% of the drones sold in the North American market although the company is not a dominant seller of drones under $500 because there are hundreds of companies competing to produce these toys (Global market Insights 2019). Other main competitors are Parrot Drones and Yuneec with a market share of 7% each. Despite its success story in the commercial drones sector, DJI stopped manufacturing drones in 2016 to focus on software. However, DJI continues to be a good drone seller: for example, the company accounted for 36% of North American consumer drones seller in 2017 (Fortune Business Insights 2020), as it continues to aggressively cut prices. However, it faces stiff competition from Parrot and 3D Robotics. In 2018, DJI, Parrot and 3D Robotics accounted for more than half of the units sold in the commercial UAV market with having a share of 57.18%, Parrot 8.11%, and 3D Robotics 5%.

4.4 Commercial Drones Market Analysis by Country

Commercial drones are quite popular in the US (see figure 12). By March 2020, the US had 1,563,263 registered drones of which 441,709 were commercial (FAA 2019). The adoption of commercial drones is expected to growth exponentially; according to FAA (2019), the commercial drone market could triple in size by 2023 with approximately 823,000 drones flying at that time. Currently, several companies in the US such as Amazon, Walmart, Google and 7-Eleven have experimented delivering their products to consumers using drones while Baltimore Hospital has successfully used a drone to deliver an organ to a patient. With drones becoming operationally more efficient and safe, the US expects the commercial drones market to growth exponentially over the next few years. On the other hand, the Asia-Pacific region is at the heart of the commercial drone market growth, which implies that Australia is likely to benefit from the growth of the market. By 2019, Australia alone has over 1200 drone operators who have been rapidly developing technologies and services that support the larger drone ecosystem (FAA 2019). Currently, Australia has emerged a hub for Beyond Visual Line Of Sight (BVLOS) testing.

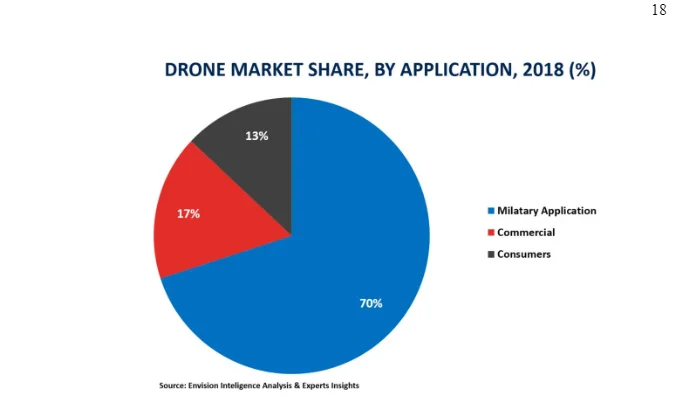

Generally, the commercial UAS market is yet to mature: for example, this market represented about 6% of the total drone market share which is approximately 158,900 to 168339 units as of 2018 while the military drone market still accounts for more than 60% of all the revenues in the drone market (FAA 2019). Nonetheless, the commercial UAS market has a great deal of potential given that large distributors and delivery services are adopting the use of drones in deliveries (see figure 13)

The global UAS market has experienced significant growth over the years and is expected to continue growing. Traditionally drones were used for military purposes but the last decade has seen growth in the commercial drone market. North America is the largest UAV market and US continues to be a major consumer and producer of UAS both for military and commercial purposes. The Australian drone market is also expanding and drones in this country are used for both military and commercial purposes. Nonetheless, the commercial UAS market is yet to mature while the military UAV market is in its mature stages.

5. References

Kovalev, I.V., Voroshilova, A.A. and Karaseva, M.V., 2019, December. Analysis of the current situation and development trend of the international cargo UAS market. In Journal of Physics: Conference Series (Vol. 1399, No. 5, p. 055095). IOP Publishing.

- 24/7 Customer Support

- 100% Customer Satisfaction

- No Privacy Violation

- Quick Services

- Subject Experts